Interest Is Compounded Daily

The Internal Revenue Service assesses interest on unpaid taxes starting on the due date. The IRS calculates the interest rate by calculating the federal short-term rate plus 3 percent, which is adjusted quarterly. This interest is compounded daily, and the total amount due on any given day is the total amount of interest owed plus the penalty. For tax debts of more than $1000, the penalty can reach 25 percent, but for smaller amounts, its often less.

The rate of interest on unpaid taxes is 4% per year for underpayments, 3% for overpayments, and 6% for corporate underpayments. The IRS adjusts these rates quarterly, so the rate you pay on April 1 may be higher than what you owe now. If you owe money to the IRS for more than four years, you can get in trouble by settling with them before the due date.

Calculating The Interest Amount Under Gl C 62c 32a

- Residential lots as defined in I.R.C. § 453

To calculate the required interest amount, multiply the amount of tax attributable to the payments received on installment obligations by the underpayment rate determined under M.G.L. c. 62C, § 32 as of the date of the sale compounded semi-annually, for the period beginning on the date of the sale and ending on the date payment was received.

Massachusetts follows federal rules, to the extent practicable, in determining the amount subject to the addition to tax under M.G.L. c. 62C, § 32A .

Fees For Guaranteed Installment Agreements

If youre able to repay your income tax balance of less than $10,000 within three years, you are eligible for a short-term payment plan. If you can repay in 120 days, you wont be charged a setup fee. Monthly payment options for a guaranteed installment agreement include:

- Direct debit payments to your bank accounts

- Check or money order

- Online or phone payments via the Electronic Federal Tax Payment System

Recommended Reading: When Can I File Taxes 2021

Does The Irs Ever Forgive Penalties

The IRS can remove or reduce some penalties if you acted in good faith and can show reasonable cause for why you werent able to meet your tax obligations. By law, the IRS cannot remove or reduce interest unless the penalty is removed or reduced.

The IRS determines reasonable cause after examining all the facts and circumstances in your situation. They say they will consider any reason which establishes that you used all ordinary business care and prudence to meet your Federal tax obligations but were nevertheless unable to do so.

The IRS will consider any of the following to be sound reasons for failing to file a tax return:

- Fire, casualty, natural disaster or other disturbances

- Inability to obtain records

- Death, serious illness, incapacitation or unavoidable absence of the taxpayer or a member of the taxpayers immediate family

- Other reason which establishes that you used all ordinary business care and prudence to meet your Federal tax obligations but were nevertheless unable to do so

- Note: A lack of funds, in and of itself, is not reasonable cause for failure to file or pay on time. However, the reasons for the lack of funds may meet reasonable cause criteria for the failure-to-pay penalty.

Facts the IRS will request to establish reasonable cause:

Common documents the IRS will request to establish reasonable cause:

Failure To Pay Penalty

If you fail to pay your taxes, the IRS will penalize you based on how long your overdue taxes remain unpaid. The penalty will be a percentage of the taxes you either didnt pay or didnt report on your return. The IRS charges 0.5% of your unpaid taxes for each month or part of a month that your taxes remain unpaid. The failure to pay penalty has a maximum charge of 25% of your unpaid taxes.

Be sure to pay your taxes within 10 days of the failure to pay notice. After 10 days, the penalty charge increases to 1%.

Read Also: How To Pay Virginia State Taxes

Unidentified Remittance Account Payments

When a payment is refunded from the unidentified remittance account, no interest is allowed.

When a payment from the unidentified account is correctly identified and applied to a tax module, it is treated the same as any other payment on the module. Normal underpayment and overpayment interest rules apply.

To ensure correct interest computations, always apply a payment from the unidentified remittance account using the payment received date.

Irs Penalty And Interest Calculator

If youre in a situation where youll need to pay your taxes late, youre likely wondering how much will the IRS charge on interest, and how much will the IRS charge for penalties.

The exact amount you will pay depends on multiple factors.

The three biggest factors that will determine how much you owe are:

Although the IRS treats every late payment penalty on a case-by-case basis, an IRS tax calculator can give you a pretty good indication of what youll owe in interest and penalties.

Don’t Miss: Can I File Taxes Late On Turbotax

New Formula Needed To Calculate Interest Rate On Unpaid Taxes

GGD-81-20Skip to Highlights

The recent volatility in market interest rates prompted GAO to review the interest rate that the Internal Revenue Service assesses on delinquent taxes and pays on overpayments.

| Status | ||

|---|---|---|

| Congress should amend the Internal Revenue Code to establish semiannual adjustments of the IRS interest rate, stating it to two decimal places, as a practical means of maintaining the rate in line with government borrowing rates. Also, changes should be limited to .025 percent or more. | Closed< label class=”status-code-label”> Closed< /label> < p class=”status-code-description”> < /p> | Please call 202/512-6100 for additional information. |

| Congress should amend IRC Code to require IRS to establish the IRS interest rate at an appropriate government borrowing rate plus a factor for administrative expenses. | Closed< label class=”status-code-label”> Closed< /label> < p class=”status-code-description”> < /p> | Please call 202/512-6100 for additional information. |

Interest Rates By Category

| Interest Categories | |

|---|---|

| Non-Corporate overpayment | 5% |

| GATT | 2.5% |

| Internal Revenue Code 6603 Deposit | 2% |

| Non-Corporate Overpayment | 3% |

| GATT | 0.5% |

| IRC 6603 Deposit | 0% |

| Non-Corporate Overpayment | 3% |

| GATT | 0.5% |

| IRC 6603 Deposit | 0% |

| Non-Corporate Overpayment | 5% |

| GATT | 2.5% |

| IRC 6603 Deposit | 2% |

| Non-Corporate Overpayment | 5% |

| GATT | 2.5% |

| IRC 6603 Deposit | 2% |

| Non-Corporate Overpayment | 4% |

| GATT | 1.5% |

| IRC 6603 Deposit | 1% |

- 1st Quarter Rates Internal Revenue Bulletin: 2016-51

Don’t Miss: How Much Is New Jersey Sales Tax

Overpayment Interest Due On Unpaid Tax

If you made an overpayment of your tax, the following applies:

- The rate for underpayments of tax remains at the federal short-term rate:

Exception to Compounded Interest for Underpayment of Estimated Tax

Penalties for underpayment of estimated income tax is now calculated with simple interest instead of daily compounding.

The assessment of interest isnt discretionary and the Commissioner doesnt have the authority to abate interest accrued on unpaid tax.

Advantages Of Working With A Polston Tax Lawyer

Being unable to pay the taxes you owe to the IRS is stressful and it can be hard to choose which option is best to settle your balance. For many taxpayers, an installment agreement is an attractive option. With an installment agreement, you can pay your unpaid taxes in smaller amounts each month, making the payment more affordable. If youre interested in getting an installment agreement, Polston Tax can help.

You owe it to yourself to speak to a Polston tax attorney who can apprise you fully of your tax rights and sort out debt repayment options available to you. They can also investigate your tax cases details and negotiate directly with the IRS to get the best outcome for your situation.

Contact us at Polston Tax today to pay off your unpaid taxes and get your life back on track.

You May Like: How Much Is Walmart Tax Service

How To Dispute Insufficient Interest Paid

If you think we underpaid interest owed to you on refunds or credits you’re eligible for, you can file an informal claim or complete and send Form 843PDF for us to consider allowing additional overpayment interest. Make sure to include your own computation and reason for making the request for additional interest on Line 7 .

Your request must be received within six years of the date of the scheduled overpayment.

Claims For Refund Of Overpaid Underpayment Interest

The statutory period of limitations for filing a claim for refund of overpaid underpayment interest is two years from the date of the payment or three years from the time the return was filed, whichever is later. See IRM 25.6.1.10.2.7, Claims for Credit or Refund-General Time Period for Submitting a Claim. The amount of credit or refund may not exceed the portion of the tax paid within the period immediately preceding the filing of the claim equal to 3 years plus the period of any extension of time for filing the return. Prepaid credits are considered paid on the return due date for this purpose. See IRC 6511.

Also Check: What Does Locality Mean On Taxes

Interest Rate Without An Installment Agreement When You Dont File On Time

If you owe taxes and didnt file a tax return or pay the amount due in time, youll receive an IRS notice and interest will be charged on the balance due.

This is compounded daily at an interest rate equal to the federal short-term rate plus 3 percentage points, which is currently approximately 5%. Additionally, the IRS will charge penalties for late filings.

Need Help With Tax Penalties & Interest

to help you with any tax penalties or interest questions or concerns. Here at Sheppard Law Offices, we can speak to the IRS on your behalf to work out a settlement that is within your monthly budget.

Contact Sheppard Law Offices and Attorney Kenneth L. Sheppard, Jr. to discuss your particular situation. Call today to schedule your free free consultation consultation at .

Ohios Trusted and Experienced Bankruptcy and Tax Attorneys, Family & Divorce Attorneys, and Estate Planning Lawyers.

Read Also: How Are Roth Iras Taxed

How To Calculate Irs Interest On Unpaid Taxes

If you are wondering how to calculate IRS interest on unpaid taxes, read this article. This article will tell you the exact formula to use. To calculate interest, enter the tax amount, excluding any penalties. Then, choose the payment date, usually the 15th of April, as the date when you expect to pay the full amount due. Each tax quarter, the IRS releases short-term interest rates.

What Is The Interest Rate On Irs Installment Agreements

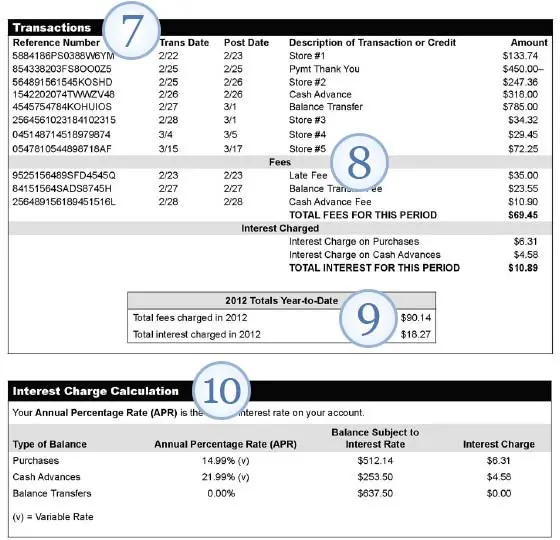

Taxpayers who owe taxes to the IRS usually end up owing more than just taxes. When you are unable to pay the amount of income tax owed by the due date, interest and late payment penalties are then added on top of the original tax balance.

The best way to stop the interest and penalties from building up is to pay off your unpaid taxes. Many people who cant pay the balance in full immediately will take out an installment agreement with the IRS. This reduces the amount of interest and penalties that accrue and breaks the taxes owed down into affordable minimum monthly payments. The interest rate applied to overdue tax payments differs substantially when you have an installment agreement in place with the IRS.

Also Check: How To Find Out Tax Identification Number

Types Of Irs Penalties

There are a number of different types of IRS penalties you can be charged for. The more you understand what types of penalties exist, the better you can navigate them when faced with one, or avoid them altogether.

The IRS charges penalties for numerous reasons, the most common being if you dont:

- File your tax return on time

- Pay any tax you owe on time and in the right way

- Prepare an accurate return

- Provide accurate information

IRS Failure to File Penalty

The Failure to File Penalty applies if you dont file your tax return by the due date. The penalty is a percentage of the taxes you didnt pay on time.

The penalty is calculated based on how late you file your tax return and the amount of unpaid tax as of the original due date.

Your unpaid tax is the total tax required to be shown on your return minus amounts paid through withholding, estimated tax payments, and allowed refundable credits.

The Failure to File Penalty is calculated in the following way:

IRS Failure to Pay Penalty

The Failure to Pay Penalty applies to taxpayers who dont pay the tax reported on their tax return by the due date or approved extended due date. The accessed penalty is a percentage of the taxes that were not paid.

The IRS calculates the Failure to Pay Penalty based on how long the overdue taxes remain unpaid. Unpaid tax is the total tax required to be shown on a return minus amounts paid through withholding, estimated tax payments, and allowed refundable credits.

IRS Accuracy-Related Penalty

| $560 |

If You Owe Taxes The Way The Irs Charges Interest And Penalties May Seem Confusing Here’s What You Need To Know

Image source: 401kcalculator.org via Flickr.

If you pay your taxes late, the IRS can charge you interest on the unpaid balance, as well as assess a penalty based on how late you are. The exact amount you’ll have to pay depends on a few factors, such as whether or not you filed your tax return on time, how much you still owe, and what the current interest rate is. While the IRS treats each late payment on a case-by-case basis, here’s how you can get a good idea of what you’ll owe in interest and penalties.

How interest is calculatedOut of the two charges you can face, the interest is the more straightforward to calculate. The IRS interest rate is determined by the Federal short-term rate plus 3%. Since the Federal short-term interest rate has been close to 0% for some time now, the interest rate charged on late tax payments is 3% as of this writing .

Keep in mind that interest rates are widely predicted to start increasing in the not-too-distant future, so this can change over time.

Interest is computed on a daily basis, so each day you are late paying your taxes, you’ll owe 0.0082% of the balance.

So, if you owe the IRS $1,000 and you’re 90 days late, first calculate your daily interest charge, which would be about $0.082. Then, multiply it by 90 days to arrive at the total interest charge of $7.40.

Two kinds of penaltiesLate penalties can be a bit tougher to calculate, and depend on whether or not you’ve filed your return.

Also Check: How Much Is My Social Security Taxed

Fees For Long Term Installment Agreements

If you have a larger tax debt and require more time to repay it, you always need to set up a long-term payment plan. All balances that exceed $25,000 require direct debit withdrawal from your monthly account.

Low-income taxpayers might qualify for a reduced fee of $43 by filing Form 13844, the Application for Reduced User Fee For Installment Agreements. If you have questions about the fees that may apply to your situation, reach out to us at Polston. We can further advise you on the details of your installment agreement.

Special Rules For Determining Due Date Of Payments

Consider the following special rules for the due date of payments for Form 2290, Heavy Highway Vehicle Use Tax Return, jeopardy assessments, accumulated earnings tax, and penalties.

See IRM 20.2.10.3.10, Heavy Highway Vehicles, or IRM 21.7.8.4.2, Form 2290, Heavy Highway Vehicle Use Tax Return, for instructions for Form 2290. Beginning July 1, 2005, the installment privilege was eliminated. The installment payment line on Form 2290 was deleted. Tax must be paid in full with the filing of Form 2290. Otherwise, penalties and interest will accrue on the unpaid balance .

In the case of a jeopardy assessment, notice and demand for payment is issued immediately . The due date for payment of the assessment is the date of the notice and demand.

Don’t Miss: What Is The Penalty For Paying Taxes Late

Why Does The Irs Charge Penalties

If not having enough to cover your tax liability isnt stressful enough, the IRS shows little mercy when it comes to penalties. The dollar amount of your penalty depends on the type of penalty and the time it takes to pay it back. The IRS states that the purpose of penalties is to encourage voluntary compliance.

Interest On Penalties And Additions To Tax

The date from which interest will begin to accrue on an assessable penalty, including those referred to as an “addition to tax,” varies by penalty type. Some penalties begin to accrue interest on the date of notice and demand , while others accrue interest from the later of the return due date or extended return due date. See the table below for the appropriate interest start date for each penalty type.

Refer to section IRM 20.2.5.3 of archived IRM 20.2.5, dated July 25, 2017, for the appropriate interest start date on penalties assessed before July 18,1984, for guidance on the 50% interest component thatâs applicable to negligence and fraud penalties assessed on returns due after December 31,1981 and before January 1, 1989, and for penalties assessed on returns with due dates prior to January 1, 1990.

See the 20.1 family of IRMs , as well as Document 6209, Section 10, Penalties and Interest Provisions, for more information on each penalty.

The table below displays the interest beginning date for the most commonly encountered penalties.

Title

Read Also: How Much Tax Do You Pay On Social Security