Australia Tax Rates For 2020 2021

| Australian Income Tax |

|---|

| $90,001 to $126,000 | $1,080 minus 3 cents for every dollar of the amount above $90,000 |

These are the tax rates for Australian residents and do not apply to other taxpayers in the country . The rates and reductions that apply to you will depend on your circumstances. For the sake of simplicity, our Australia tax calculator assumes that you are a single Australian resident with no dependents.

Usage Of The Payroll Calculator

Please note that the calculator on this site is for informative purposes only and is not intended to replace professional advice.

If you want to use the tax calculator instead, .

Six: Calculate Social Security And Medicare Deductions

You must withhold FICA taxes from employee paychecks.;

Be sure you are using the correct amount of gross pay for this calculation. This article on Social Security wages explains what wages to take out for this calculation.

The calculation for FICA withholding is simple.

| FICA Taxes – Who Pays What? | |

|---|---|

| FICA Taxes | Employee Pays |

| 0.9% on gross pay over $200,000 | 0% |

Withhold half of the total from the employee’s paycheck.

For the employee above, with $1,500 in weekly pay, the calculation is $1,500 x 7.65% for a total of $114.75.

Be careful not to deduct too much Social Security tax;from high-income employees, since Social Security is capped each year, with the maximum amount being set by the Social;Security Administration.

You will also need to consider the additional Medicare tax deduction due by higher-income employees, which begins when the employee reaches a $200,000 in earnings for the year. The additional tax is 0.9% of the gross pay based on the employee’s W-4 status. No additional tax is due from the employer.;

Most states impose income taxes on employee salaries and wages.; You will have to do some research to determine the amounts of these deductions and how to send them to the appropriate state/local taxing authority.;

Your responsibilities as an employer for deducting, paying, and reporting these taxes are discussed in this article.

You May Like: How To Get My Income Tax Return Copy Online

What Are The Details Required When E

Following details are required to e-filing income tax return:

How To Calculate Payroll For Tipped Employees

Forgetting or neglecting to report cash tips doesnt relieve your employee of the responsibility of paying taxes on them. Since tax evasion probably isnt on anyones mind, keeping tax reporting on tips as easy as possible is a win-win for everyone so you can withhold the right amount of taxes from their hourly or salaried base wages. To keep things simple for you as the business owner, we recommend using a tax tip calculator like this one to make sure youve got your withholdings correctly calculated. You can also find restaurant payroll software that makes it easier to automate the process, including submitting all tax filings.

You May Like: How To Read My Tax Return

Income Tax Deductions & Exemptions

Deductions under the income tax act

Income tax act allows individuals to take certain deductions from the salary. However, only a few sections are eligible for tax deductions. These are covered in chapter VI-A of the Act. These are discussed below:

Deductions under Section 80C

Applicability: Individual & HUF

Maximum Limit: INR 1,50,000 in a financial year provided investments are made in certain financial instruments.

Instruments covered: Public Provident Fund , Employees Provident Fund, the premium paid towards life insurance policies, principal repayment of a home loan, investment in National Savings Certificate, investment in Equity Linked Savings Scheme , children tuition expenses, etc. Also, it includes car loans used for commercial purposes for self employed individuals.

Deductions under Section 80CCC

Applicability: Individual

Maximum limit & coverage: INR 1,50,000 per financial year if the amount is invested in keeping in force any annuity plan of a life insurance company.

Deductions under Section 80CCD

Applicability: Individual

Maximum limit & coverage: Contribution to National Pension Scheme is allowed as a deduction from gross total income. The maximum deduction available in the case of salaried employees is 10% of the salary and for self-employed individuals, up to 20% of the gross total income. Also, the National Pension Scheme is one of the popular retirement planning instruments.

The maximum limit is INR 1,50,000 in a given financial year.

Expect Regular Raises And Performance Reviews

Corporate policies are all over the map, in terms of who gets raises and when. Small scale employers, for example, may rely on informal guidelines to manage human resources, so regularly scheduled reviews and pay incentives may not be in-place. Even multinational organizations are rethinking annual reviews, prompting proactive moves from employees seeking maximum take-home pay.

When annual raises are not a standard part of an employment arrangement, management and staff work together finding added value for workers. Company-provided lunches, paid time off and other coveted perks are used to augment earnings when raises are on hold. And though these feel-good measures do result in savings and increased take-home pay, incremental salary raises should also be included, as part of a reasonable compensation package.

Read Also: What Form Do I Need To File My Taxes Late

How Do I Determine Which Percentage To Elect

Every employee must consider;the facts of their own situation and adjust their election accordingly.

If you want to keep your withholding approximately the same as last year, use last year’s;federal Form W-2, or your last pay stub, to calculate which withholding percentage to elect. ;For example, if box 1 of federal Form W-2 shows $40,000 in wages and box 17 shows $1,000 in state income tax withheld, divide box 17 by box 1 to determine your percentage .; To keep your withholding the same as last year, choose a withholding percentage of 1.8% and withhold an additional $10.77 per biweekly pay period . ;Be sure to take into account any amount already withheld for this year.

If you want to withhold more, choose one of the higher percentages or choose to have an additional amount withheld.

Note:;Underwithholding can result you owing tax and/or underpayment penalties when you le your Arizona return at the end of the year.

How Is Tds Calculated On Salary

TDS or Tax Deducted at Source is the amount which is deducted from an individuals income by a company on behalf of the Income Tax department and later deposited to the Income Tax department. TDS can be calculated by following these steps.

- Calculate monthly gross income. This includes basic, allowances, and perquisites received in a month.

- The next step is to calculate the tax exemption under Section 10 of The Income Tax Act.

- Deduct the tax exemption from gross income.

- Since the above is the monthly income, multiply it by 12 to calculate the yearly taxable income.

- The next step is to add all other incomes and deduct losses. For example, incomes like rental income, interest income, and losses in trading or transacting.

- Calculate investments that fall under Chapter VI-A of The Income Tax Act. An example of investments eligible for deductions under 80C is Public Provident Fund , Equity Linked Savings Scheme , Fixed Deposits , ULIPs SSY, Senior Citizen Savings Scheme;, car loan taken for business purpose etc. This amount has to be deducted from gross income.

- Now the resulting figure is the total taxable income. The tax slabs according to age and income have to be applied to calculate taxes or TDS on the income.

You May Like: How Do I File Colorado State Taxes

Income From Capital Gains

Capital Gains are classified as Short Term Capital Gains and Long Term Capital Gains . Income from Capital Gains can become tedious to compute at times. The number of transactions and complexity sum up to the effort required to calculate the income. Total sales of all capital assets come under this category.

Enhance Credentials To Raise Pay Scale Prospects

Corporate purse strings are tied to job requirements and experience, but training and other credentials also impact earning power. Within corporate America, for example, advanced degrees qualify applicants for higher-paying jobs than the ones available to high school and baccalaureate graduates.

Even though education quality in the United States lags behind other industrialized countries, the degree to which college education influences pay rates is substantial. In the U.S., workers with college degrees are paid nearly 75% more than their contemporaries with high school diplomas. Mobility is stagnant for those without credentials, so education is essential for maximizing income. In many cases, employers committed to personnel growth are willing to share the cost of training and education, whether through MBA programs or certifications enhancing job preparedness.

You May Like: Where Can I Get Taxes Done For Free

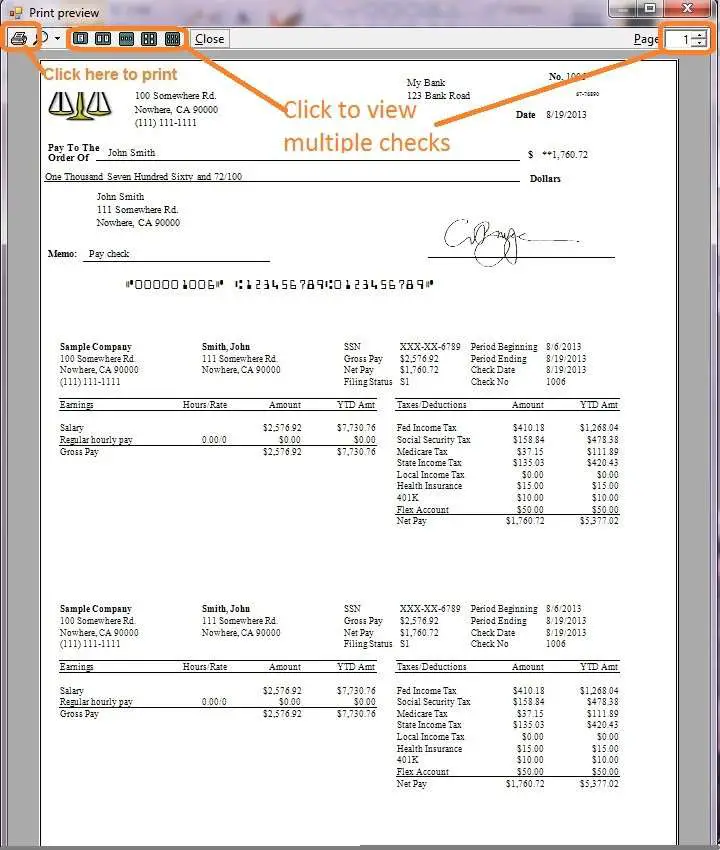

An Example Of An Employee Pay Stub

;In the case of the employee above, the weekly pay stub would look like this:;

| Employee Pay Stub |

|---|

;You must make deposits with the IRS of the taxes withheld from employee pay for federal income taxes and FICA taxes and the amounts you owe as an employer. Specifically, after each payroll, you must

- Pay the federal income tax withholding from all employees;

- Pay the FICA tax withholding from all employees, and;

- Pay your half of the FICA tax for all employees.;

Depending on the size of your payroll, you must make deposits monthly or semi-weekly.;

You must also file a quarterly report on Form 941 showing the amounts you owe and how much you have paid.;

If you have many employees or don’t have the staff to handle payroll processing, you might want to consider a payroll processing service;to handle paychecks, payments to the IRS, and year-end reports on Form W-2.

Calculating Your Net Paycheck

Want to know what your paycheck will look like before you take a job? There is a way to figure out exactly how much youll have left after FICA, federal taxes, state taxes, and any other applicable;deductions;are removed. You need a few pieces of information in order to calculate your take-home pay:

- The amount of your gross pay.;If you earn a fixed salary, this is easy to figure out. Just divide the annual amount by the number of periods each year. If you are paid hourly, multiply that rate by 40 hours to determine your weekly pay.

- Your number of personal exemptions.;When you start a new job, you fill out a;W-4;form to tell your employer how much to withhold from your check.

- Your tax filing status.;There are standard federal and state tax deductions that vary depending on whether you are single, married filing jointly, married filing separately, head of household, or a surviving spouse.

- Other payroll deductions.;This category could include contributions to a 401 retirement plan, health insurance, life insurance, or a flexible spending account for medical expenses. It also may include union dues or any other garnishments that are taken from your wages. It helps to categorize these according to pre-tax and after-tax contributions, to deduct them from either your gross salary or after-tax calculation.

Read Also: How To Register For Tax Id

Pursue Active Real Estate Ventures

Depending upon who weighs-in, real estate investing is either a hands-off, passive pursuit, or an active way to put money to work. The distinction lies with each investor, who makes his or her choices about property administration. Are you a do-it-yourself owner, with handy skills suited for maintaining properties? Or is your schedule full, beyond the responsibilities of daily property management? Answering these and other questions helps determine whether or not you are ready to take-on rental responsibilities and other challenges of income property ownership.

Property management companies assist properties owners, covering needs like unit rental, repair and maintenance, as well as rent collections. The services are not free, but using professional managers enables passive real estate investing. Profits are reduced too, when paid to professional management companies, so careful analysis shows whether or not property ownership is financially prudent.

How Your Texas Paycheck Works

Your hourly wage or annual salary can’t give a perfect indication of how much you’ll see in your paychecks each year because your employer also withholds taxes from your pay. You and your employer will each contribute 6.2% of your earnings for Social Security taxes and 1.45% of your earnings for Medicare taxes. These taxes together are called FICA taxes.

No matter which state you call home, you have to pay FICA taxes. Income you earn that’s in excess of $200,000 , $250,000 or $125,000 is also subject to a 0.9% Medicare surtax. Your employer will not match this surtax, though.

Any premiums that you pay for employer-sponsored health insurance or other benefits will also come out of your paycheck. The same is true if you contribute to retirement accounts, like a 401, or a medical expense account, such as a health savings account . These accounts take pre-tax money so they also reduce your taxable income.

Your marital status, pay frequency, wages and more all contribute to the size of your paycheck. If you think too much or too little money is being withheld from your paycheck, you can file a fresh W-4 with your employer at any time during the year. When you do this, be sure to indicate how much extra income you want withheld so as to avoid a tax bill come April each year.

Don’t Miss: How Do Property Taxes Work In Texas

How Your California Paycheck Works

Your job probably pays you either an hourly wage or an annual salary. But unless youre getting paid under the table, your actual take-home pay will be lower than the hourly or annual wage listed on your job contract. The reason for this discrepancy between your salary and your take-home pay has to do with the tax withholdings from your wages that happen before your employer pays you. There may also be contributions toward insurance coverage, retirement funds, and other optional contributions, all of which can lower your final paycheck.

When calculating your take-home pay, the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. Your employer withholds a 6.2% Social Security tax and a 1.45% Medicare tax from your earnings after each pay period. If you earn over $200,000, youll also pay a 0.9% Medicare surtax. Your employer matches the 6.2% Social Security tax and the 1.45% Medicare tax in order to make up the full FICA taxes requirements. If you work for yourself, youll have to pay the self-employment tax, which is equal to the employee and employer portions of FICA taxes for a total of 15.3% of your pay.

These changes mainly apply to anyone adjusting their withholdings and those who got a new job following Jan. 1, 2020. For reference, employees hired before 2020 arent required to complete a new W-4. Finally, the tax return you file in April 2021 will contain any adjustments youve made to your withholdings in 2020.

How To Determine Gross Pay

For salaried employees, start with the person’s annual amount divided by the number of pay periods. For hourly employees, it’s the number of hours worked times the rate .

If you are not sure how to pay employees, read this article on the difference between salaried and hourly employees.

Here are examples of how gross pay for one payroll period is calculated for both salaried and hourly employees;if no overtime is included for that pay period:;

A salaried employee is paid an annual salary. Let’s say the annual salary is $30,000. That annual salary is divided by the number of pay periods;in the year to get the gross pay for one pay period. If you pay salaried employees twice a month, there are 24 pay periods in the year, and the gross pay for one pay period is $1,250 .;

An hourly employeeis paid at an hourly rate for the pay period. If an employee’s hourly rate is $12 and they worked 38 hours in the pay period, the employee’s gross pay for that paycheck is $456.00 .

Then include any overtime pay.;Next, you will need to calculate overtime for hourly workers and some salaried workers. Overtime pay must be added to regular pay to get gross pay.;

Recommended Reading: How Do I Get My Property Tax Statement

Maximize Earning From Overtime Work

– Guide Authored by Corin B. Arenas, published on October 8, 2019

Building a solid income is crucial for security. The earlieryou save, the stronger your financial safety net will be.

One practical way of increasing savings is to put in more work for more pay. In this section, youll learn more about overtime work, how to make the most out of extra hours, and managing your savings wisely.

Top Jobs That Let You Benefit from Overtime Pay

The U.S.Bureau of Labor Statistics states that the average American works overtimefor a little over 4 hours a week. Thats about 208 hours a year.

While some people think hourly jobs pay a lot less than salaried work, its not always true. There are fulltime hourly jobs that provide sizable salaries and benefits.

Employees who are paid by the hour, also called non-exempt employees, are not obligated to make managerial decisions. Their time of work is tracked, and they receive compensation for the excess hours. Their overtime rate is 1.5 times their regular hourly rate.

Hourly workers appreciate leaving work on time, allowingthem to do other important activities. Likewise, rendering extra hours effectivelyincreases their annual income.

Here are some of the top paying hourly jobs according to the U.S. Bureau of Labor Statistics National Occupational Employment and Wage Estimates :

| Occupation |

|---|

What does it take to qualify for these positions? Consider 5 of these jobs:

Industrial Machinery Mechanics

Mean wage per hour: $25.96