Income Taxes And Form W

As we previously mentioned, in addition to the specific payroll taxes related to FUTA, SUTA, and FICA, income taxes are also calculated and withheld from payroll for most employees .

The employer should calculate and withhold proper income taxes based on the withholding status declared by the employeebut ultimately, correct payment of income taxes is the individual employees responsibility and any under or overpayment of taxes will be theirs to resolve when they file their tax return.

It is best practice to have all employees complete Form W4, which declares their amount of withholding, and revisit their withholding status on an annual basis . Federal and state income taxes are calculated based on the employee’s W-4 form.The IRS, in turn, provides the income tax calculation based on those declarations. The employee can include more in withholdings than is required by the IRS. State taxes are determined in much the same way. Every individual state’s tax board provides a calculating formula for tax withheld.

State And Local Payroll Tax

Employers are also responsible for paying state and local payroll tax on behalf of employees. As with federal payroll tax, part of this tax is employer paid and part is employee paid. Keep in mind that âemployee paidâ just means that you, the employer, withhold a certain amount from your employeeâs paycheck and then remit it as part of your payroll taxes.

In addition to state payroll tax , employers are also responsible for remitting state income tax on behalf of their employees. Have all your SUTA questions answered in just a 3 minute read.

State and local payroll taxes are governed at the state and local level, and every stateâs payroll tax rules are different. The Federation of Tax Administrators published a list of each stateâs taxing authority. You can find out more about payroll tax in your state and local area there.

What Should You Do With Your Paycheck Stub

Pay stubs are used to verify payment accuracy and may be necessary when settling wage/hour disputes. For this reason, employees may want to save their pay stubs, but arent required to do so. Employers, however, must keep payroll records for the specific lengths of time mandated by federal and state governments.

Recommended Reading: How To Get Tax Exempt Status

California Personal Income Tax

PIT is a tax on the income of California residents and on income that nonresidents get within California. The EDD administers the reporting, collection, and enforcement of PIT wage withholding. The Franchise Tax Board and the EDD administer the California PIT program for the Governor to provide resources needed for California public services, such as schools, public parks, roads, health, and human services.

California PIT is withheld from employees pay based on the Employees Withholding Allowance Certificate on file with their employer. There is no taxable wage limit. Refer to the PIT withholding schedule. The withholding rate is based on the employee’s Form W-4 or DE 4. There is no maximum tax.

For assistance, contact the Taxpayer Assistance Center at 1-888-745-3886 or visit your local Employment Tax Office.

How To Get More Information About These California State Payroll Tax Calculations

If you are still worried about getting it right, do not worry. There is more support available. California offers in-person payroll tax seminars to walk you through the process, and you can find a current schedule here.

If you want more specialized assistance, or if you are dealing with an especially complex payroll tax issue, it may be worth your time to consult with a tax professional or an attorney trained in tax law. Their familiarity with all the rules and regulations means that they know the ins and outs of payroll taxes for businesses of all sizes.

A one-on-one consultation gives them the chance to offer you personal guidance and total peace of mind that you are meeting all the payroll tax requirements for the state of California.

Other Issues Concerning California State Payroll Taxes

California has some other tricky rules for state payroll taxes:

California Payroll Tax Pitfalls and Penalties

The greatest pitfall in dealing with federal and state income taxes can be attempting to handle them yourself as a business owner. The larger your business, the more complicated payroll taxes become.

If you only have a couple of employees or are experienced with the California payroll tax provisions, you may be able to take care of it yourself or pay an accountant, but at a certain point, you may require the services of a tax attorney to advise you about the details of tax law or to help you resolve penalties.

California Payroll Tax Penalty Resolution

Recommended Reading: Is Past Year Tax Legit

What Are Payroll Taxes

Payroll taxes are taxes based on salaries, wages, commissions and tips an employee makes. They are withheld from their paychecks by their employer, who then pays them to the government. Payroll taxes are used to fund social insurance programs like Social Security and Medicare and show up as FICA and MedFICA on pay stubs.

Its important not to confuse federal payroll taxes with federal and state income taxes, even though both are taken out of an employees pay. The difference between these two taxes is that payroll taxes fund specific social programs, while income taxes go to the U.S. Treasurys general funds. Additionally, every worker pays a flat payroll tax rate, while income taxes vary based on an employees earnings.

The Differences Between Irs Payroll Tax Vs California Payroll Tax

Description. Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy eirmod tempor invidunt ut labore et

The Differences Between IRS Payroll Tax vs. California Payroll Tax

Payroll taxes, whether under the IRS or the State of California, are treated differently by the different agencies because of a variety of different factors. If you have employees, payroll taxes are a fact of life. Some taxes are withheld from your employees wages, some you must pay yourself.

Before diving into the topic of California payroll tax audits though, we briefly wanted to discuss how things are handled differently at the federal and state level. After all, for the purposes of understanding how California payroll tax audits work, it is important for us to define exactly what being in compliance means. In a nutshell, remaining in compliance means understanding how and when payroll taxes are calculated, filed, and paid.

In this first chapter, we are going to address the federal model, which the Internal Revenue Service administers payroll taxes as part of its responsibilities. Later, we will contrast the California payroll tax system before moving on to our main topic of California payroll tax audits.

Brief Overview of IRS Payroll Tax System

The IRS administers the Internal Revenue Code, which means it is in charge of income and payroll taxes for the entire nation. Included in the payroll tax are payments for the federal unemployment tax, also known as FUTA.

IRS Payroll Taxes

Also Check: Can You Change Your Taxes After Filing

Additional California Payroll Tax Resources:

Our calculator is here to help, but of course, you can never learn enough, especially when it comes to payroll taxes. Here are some additional resources and contact information to help you run California payroll:

State of California Employment Development Department : 333-4606 | E-Services for Business | Register Online

Franchise Tax Board : 852-5711

Being a California employer isnt always easy. If you want to take some of the administrative burdens off your shoulders, there are a number of terrific payroll software companies that can do all the heavy lifting for you.

Payroll Tax Income Tax And Independent Contractors

Rather than hiring employees, many businesses value the flexibility of hiring independent contractors and/or freelancers. There is no requirement to withhold income or payroll taxes on behalf of independent contractors. Independent contractors are not employees, and their status is usually considered to be âself employmentâ. This means they are not technically âon the payrollâ .

Independent contractors pay their own taxes and file their own tax returns. Note, as well as income tax, in some jurisdictions this includes compulsory self employment tax .

In addition, independent contractors are often required to register for, and pay turnover taxes, often called âVATâ or âGoods & Services Taxâ. They may also be required to make separate workersâ compensation contributions or pension contributions.

Some businesses may consider it a benefit of engaging independent contractors that they do not have to deal with taxes and compulsory contributions relating to employment. However, it is essential that any business engaging independent contractors is not âmisclassifyingâ individuals who are really employees, as independent contractors.

Where workers have been correctly classified and a business seeks to engage independent contractors it is worth considering a contractor management outsourcing solution.

For more information on paying international contractors see our guide on How to Pay International Contractors.

Read Also: What Does Locality Mean On Taxes

Why Is It Important To Have Accurate Paychecks

Having accurate paychecks isnt just important for employees. Its an essential part of operating your business legally. Fail to pay employees fairly under federal, state, or local laws, and you may find yourself facing thousands of dollars in fines. Underpaying employee overtime is one of the most common labor law violations businesses commit. If you live in California, New York, or Texas, where local laws go beyond federal requirements, youll want to be especially diligent.

Payroll Taxes: Where To Start

Now that you know what payroll taxes are, where do you start? As a small business owner, there are numerous taxes you are responsible for paying. Some taxes for small business owners include:

- Payroll taxes

- Property taxes

- Dividend taxes

Employers arent the only ones responsible for paying taxes, either. Employees also have to contribute their fair share, including payroll taxes and federal and state income taxes.

Don’t Miss: What Is California State Tax Rate

If You Need Help With Your Taxes Contact Our Office Today

The best way to determine your tax liability as a California business owner is to consult with an experienced California tax attorney. These attorneys are familiar with both state and federal tax codes, as well as any changes that have been made to either set of rules.

At RJS Law, our attorneys understand how stressful paying taxes can be. We simplify the process for you as much as possible and are proud to serve Beverly Hills, San Diego, and Orange County. To set up a free consultation, contact us today.

How To Calculate 2020 California State Income Tax By Using State Income Tax Table

| 1. Find your income exemptions2. Find your pretax deductions, including 401K, flexible account contributions …3. Find your gross income 4. Check the 2020;California state tax rate and the rules to calculate state income tax5. Calculate your state income tax step by step6. If you want to simplify payroll tax calculations, you can download ezPaycheck payroll software, which can calculate federal tax, state tax, Medicare tax, Social Security Tax and other taxes for you automatically. You can try it free for 30 days, with no obligation and no credt card needed.Learn more about the |

Recommended Reading: How To Correct State Tax Return

How Much Does The Employer Pay For California Payroll Tax

The rate for California payroll tax is the sum of the four individual payroll tax rates combined. The rate for each individual tax is uniquethe Employment Development Department has a handy website that breaks down the actual percentages based on income, which you can access hereand some are paid by employers and some are paid by employees. Heres a breakdown of who pays which tax and what the rates are:

Input Any Additional Pay The Employee Receives

If the employee is salaried, you will only see two fields: bonus and commission. Fill in those amounts, if applicable.

If the employee is hourly, you should see four fields: overtime worked, bonus, commission, and salary. This is your opportunity to add in any additional pay they should receive this pay period. If the employee earned overtime, input in the number of overtime hours they worked. One thing to keep in mind for California employees is that this calculator does not account for double-time pay. The tool calculates overtime pay using time and a half.

Recommended Reading: How Much Does H&r Block Cost To File Taxes

Who Pays State Unemployment Taxes

State unemployment taxes are usually paid solely by the employer and are calculated based on an employees wages.

Employees in Alaska, New Jersey, and Pennsylvania are subject to state unemployment tax withholding as well. If you employ workers in any of these three states, you will be required to withhold the tax from their wages and remit these funds directly to the state.

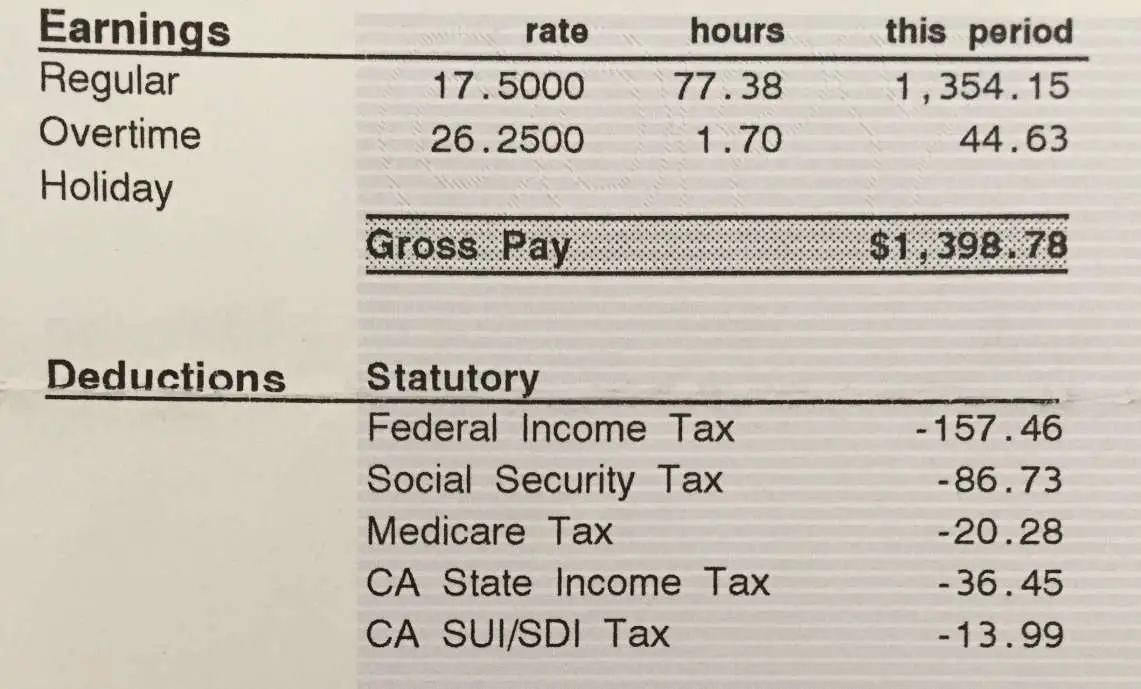

How Your Paycheck Works: Deductions

Federal income tax and FICA tax withholding are mandatory, so theres no way around them unless your earnings are very low. However, theyre not the only factors that count when calculating your paycheck. There are also deductions to consider.

For example, if you pay any amount toward your employer-sponsored health insurance coverage, that amount is deducted from your paycheck. When you enroll in your companys health plan, you can see the amount that is deducted from each paycheck. If you elect to contribute to a Health Savings Account or Flexible Spending Account to help with medical expenses, those contributions are deducted from your paychecks too.

Also deducted from your paychecks are any pre-tax retirement contributions you make. These are contributions that you make before any taxes are withheld from your paycheck. The most common pre-tax contributions are for retirement accounts such as a 401 or 403. So if you elect to save 10% of your income in your companys 401 plan, 10% of your pay will come out of each paycheck. If you increase your contributions, your paychecks will get smaller. However, making pre-tax contributions will also decrease the amount of your pay that is subject to income tax. The money also grows tax-free so that you only pay income tax when you withdraw it, at which point it has grown substantially.

You May Like: How To Buy Tax Lien Properties In California

California Payroll Taxes: Everything You Need To Know

The true cost of employees goes far beyond wages. Every new hire comes with tax obligations, and having a strong grasp on payroll taxes is something fundamental to your peace of mind as a business owner and employer.

Whether you are a household employer or taking care of a huge team, you need to understand how to compute taxable income, what to withhold, what to contribute, and how to file. Payroll taxes occur on both a federal and a state level, but today we will be taking a look at the specific issues around California payroll taxes.

What Are State Payroll Taxes

California has four state payroll taxes which are administered by the EDD:

- Unemployment Insurance and Employment Training Tax are employer contributions.

- State Disability Insurance and Personal Income Tax are withheld from employees wages.

Wages are generally subject to all four payroll taxes. However, some types of employment are not subject to payroll taxes and PIT withholding. For more information, refer to Types of Employment .

Most employers are tax-rated employers and pay UI taxes based on their UI rate. Nonprofit and public entity employers that choose another method are known as reimbursable employers. School employers can elect to participate in the School Employees Fund, which is a special reimbursable financing method.

Read Also: How To Calculate Payroll Tax Expense

Your Obligations To Employees

As an employer, you have three payroll obligations to employees:

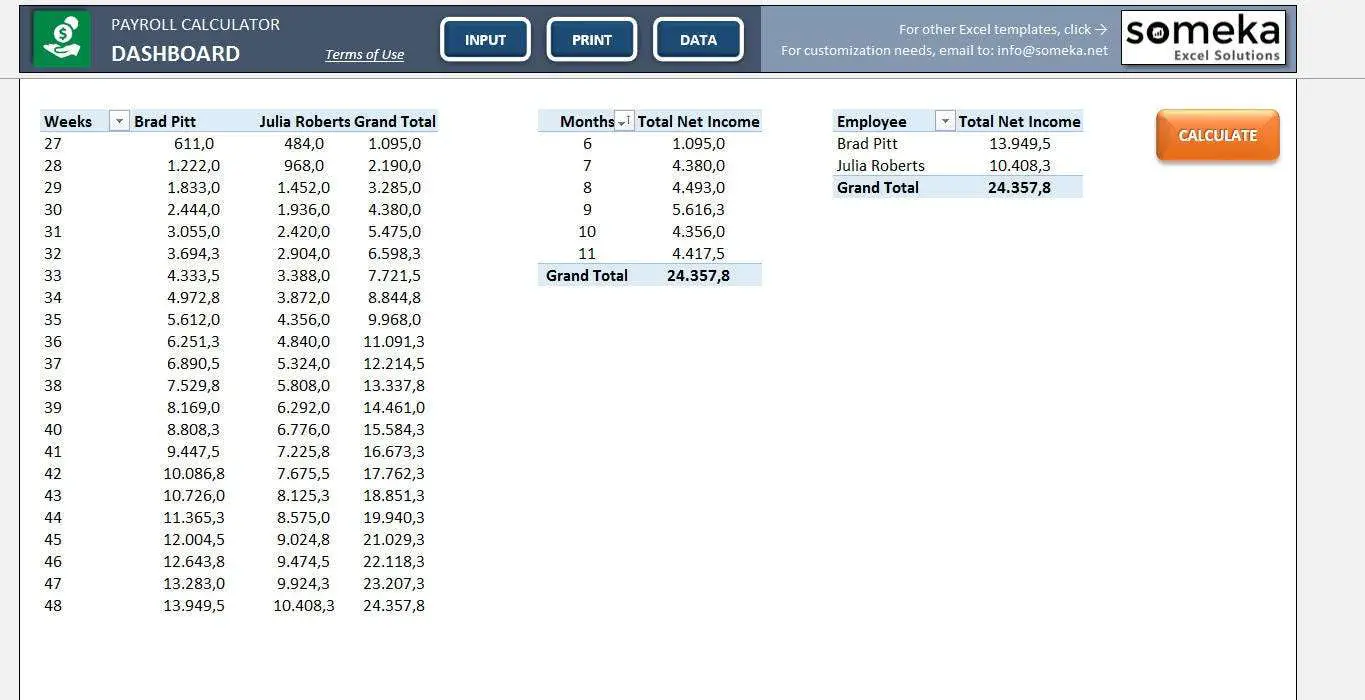

1) Paying Wages

Employees must be paid on a recurring schedule typically, businesses opt for either monthly or bi-weekly payments.

Wondering how to pay employee salaries? Some SMBs still use physical checks, but this requires manual tracking and entry into payroll systems. Many now opt for direct deposit, which sends wages directly to staff bank accounts. Setting up direct deposit requires you to create a business account with the bank of your choice and then collect employee banking data to ensure funds are sent to the correct accounts. You can choose transfer these funds manually each pay period from your online banking portal, use a payroll system that integrates this function or pay a third-party provider to complete this task.

2) Remitting Deductions

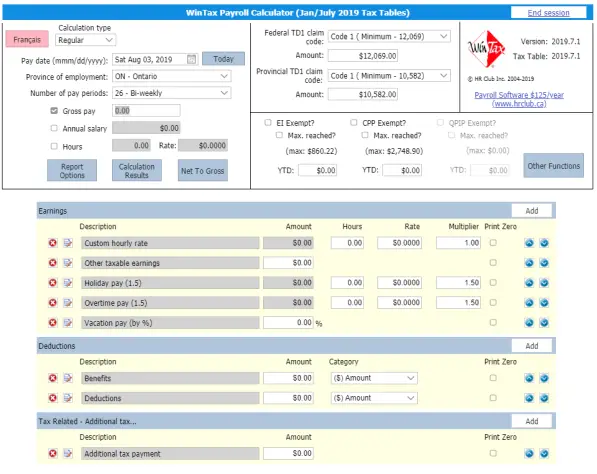

The Canadian Revenue Agency requires you to collect specific deductions from employee pay:

- Employment Insurance

3) Ensuring Compliance

In addition to paying staff on a recurring schedule, the CRA typically requires small businesses to remit all source deductions money taken from employee wages by the 15th of the month after staff are paid. You must also send T4 and T4A tax slips to employees by the last day of February of the calendar year following the deduction period. For example, T4 slips for the 2019 calendar year must be sent out by February 29th, 2020.

Do Not Include Dollar Signs Commas Decimal Points Or Negative Amount Such As

Use the 540 2EZ Tax Tables on the Tax Calculator Tables and Rates page. To find out how much personal income tax you will pay in California per paycheck use the California salary paycheck calculator. It will take between 2 and 10 minutes to use this calculator. The California Salary Calculator allows you to quickly calculate your salary after tax including California State Tax Federal State Tax Medicare Deductions Social Security Capital Gains and other income tax and salary deductions complete with supporting California state tax tables. The CA Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for single joint and head of household filing in CAS. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time. Free online income tax calculator to estimate US federal tax refund or owed amount for both salary earners and independent contractors. The 1099 tax rate consists of two parts. If you make 55000 a year living in the region of California USA you will be taxed 12070That means that your net pay will be 42930 per year or 3577 per month. Do not include dollar signs commas decimal points or negative amount such as -5000. Its a high-tax state in general which affects the paychecks Californians earn.

Also Check: How Much Money Is Taken Out Of Paycheck For Taxes