How Do I Calculate Sales Tax Backwards

How to Calculate Sales Tax Backwards From Total

How Often Should You File

How often you need to file depends upon the total amount of sales tax your business collects.

- Annual filing: If your business collects less than $100.00 in sales tax per month then your business should file returns on an annual basis.

- Quarterly filing: If your business collects between $100.00 and $1200.00 in sales tax per month then your business should file returns on a quarterly basis.

- Monthly filing: If your business collects more than $1200.00 in sales tax per month then your business should file returns on a monthly basis.

Note: California requires you to file a sales tax return even if you have no sales tax to report.

Keep In Mind For 2022 And Beyond

The definition of a retailer engaged in business in a tax district means that you:

- Ship or deliver the merchandise into the district using your own vehicle

- Maintain, occupy, or use any type of office, sales floor, warehouse, or other space within the district, even if it is a temporary space, you are doing business indirectly or through an agent

- Have a representative of any kind making sales or deliveries, installing or assembling personal property, or taking orders within the district

- Receive revenue from the rental or lease of tangible personal property located in the district

- Sell or lease vehicles or undocumented vessels, which will be registered within the district

As long as you are engaged in business within the district, you are responsible for reporting and paying district taxes as well as state taxes. The requirement also applies to multiple business locations.

You are liable for the sales tax amount in force in the district where you have a retail presence and conduct principal negotiations for sales within that district.

For use tax, there is a single exception to payment or collection: if you ship or deliver merchandise outside of a district to a purchasers principal residence address or business address unless the merchandise is a vehicle, vessel, or aircraft.

The caveat is that you must accept, in good faith, a properly executed declaration under the penalty of perjury to be relieved of this obligation.

Some things that are not taxable:

Read Also: How Do I Find What My Property Taxes Are

Assessment Of The Sales And Use Tax On Purchases

The sales and use tax rate is determined by the point of delivery or the ship to address. The California vendors will charge sales tax on the purchase of tangible personal properties based on the ship to address. Since out-of-state vendors often do not collect sales tax on invoicing, it is the Universitys responsibility to accrue use tax on the purchase of taxable tangible personal properties based on the ship to address.

What Sales Are Subject To Sales Tax

Nearly all states in the U.S. charge sales tax on items sold, California is no different in that regard. Sales taxes go into the general fund to help pay for education, health care, public pensions, and other programs. Sales taxes can also be collected for special programs or specific areas of the state.

You May Like: How Much Is Tax In Alabama

Sales And Use Tax Review

Currently, the base tax rate for the state sales tax is 7.5 percent. Local jurisdictions may add onto that. This tax is imposed on all California retailers and applies to all retail sales of merchandise within the state. All retailers must have a sellers permit and pay sales tax to the California California Department of Tax and Fee Administration.

Retailers are allowed to collect the sales tax from customers but are not required to do so. Most retailers do. In all cases, they are liable for sales tax on anything they sell, whether the tax is collected from customers or not.

Use tax is levied on consumers of merchandise used, consumed or stored in the State of California. It does not matter where it was purchased. If you buy something from an online source that is not registered to collect California sales tax or else does not collect it, you are on the hook for paying the tax, which is the same rate as the sales tax.

Use tax is also imposed on leased merchandise such as cars, boats and planes. If you make a purchase in a foreign country and hand-carry it through U.S. customs into California, you must pay the use tax.

Sales and use taxes are mutually exclusive. You cannot be required to pay both sales tax and use tax for the same merchandise.

What Does The Exemption Credit Of California Offer

California, like many other states, offers an exemption credit. This means that California businesses that pay taxes in the state and have a certain amount of sales over a set amount in the past year are allowed to take their tax liability down to zero.

They are then allowed to subtract any taxes paid during the calendar year from their total obligation, which gives them an overall refund. If you are an employer who is exempt from paying the corporate tax, then a credit will be issued for the amount of your taxes paid in the previous year. This credit must be applied against the following years tax liability.

California provides an exemption from business tax for all new businesses. There is no limit to the number of new businesses this exemption may be claimed by, which means that any business starting up in California can enjoy this exemption credit.

The state also offers a phase-in period during which the first Dollars 5,000 of income generated from operations are exempt from taxation until a maximum of Dollars 25,000 of income is generated. Furthermore, California allows its licensed contractors who perform services on a temporary basis not to pay business tax even if they are doing so only part-time and while they are not employing any workers.

The exemption credit is a tax credit that offers a certain amount of money to a business in California. This credit is available to any company with net income of less than Dollars 3 million and has fewer than 50 employees.

You May Like: What Is The Agi On Taxes

How To File And Pay Sales Tax In California

Insofar filing and paying sales tax in California is considered, three things need to be kept in mind while you do this:

First things first. How do you think you will file a sales tax return if you have no idea about the sales tax that you owe? You cant! Youve got to understand the sales tax report in your state for that purpose.

Once done, the next thing you have to do is file your sales tax with the help of the following:

What Is Subject To State Tax

Sales and use taxes are collected on the retail sale or use of tangible personal property within the State of California.

Sales tax is imposed on items such as:

- Toys

- Furniture

- Giftware

Some services require sales tax to be collected as well, but it can get tricky. If the service is inseparable from the sale of a physical product, that service may be taxed as well. It includes services such as machine or equipment set-up, fabrication, or assembly.

Installation and repair, on the other hand, are not taxable but installation and set-up sound like the same type of services. Construction is another service where it can be debated whether sales tax applies.

If you think that is complicated, shipping and handling are worse. California has unusually complex rules surrounding shipping which can be tax-exempt, partially taxable, or fully taxable depending on the situation.

If you do not keep accurate records of your shipping costs, include delivery charges in the cost of the product, or deliver it using your own vehicle instead of a common carrier, the shipping charges may be fully taxable and you, as the seller, are stuck for it.

When it comes to drop shipping and tax nexus, more complications set in.

Recommended Reading: How To Pay Nc Taxes Online

How Do I File California Sales And Use Tax Returns

Filing can be done online or via mail. You can use BOEs free online filing option or you can choose to use a third-party service to file with any provider that has successfully completed the BOE acceptance testing and is authorized to receive returns and payment information. If filing online, you may pay through the Electronic Funds Transfer program , ACH Debit, ACH Credit through your own financial institution or make your payment separately.

The EFT payment program is mandatory if you have a California Sellers Permit and average $10,000 in monthly payment or more, or you have a Special Taxes and Fees account and average monthly tax or fee payments of $20,000 or more. Other sellers can select this as a voluntary option.

Finally, there is a prepayment sales tax rate for motor vehicle fuel, diesel fuel, and aircraft jet fuel.

How To Calculate Sales Tax In California

The sales tax rate ranges from 0% to 16% depending on the state and the type of good or service, and all states differ in their enforcement of sales tax.

U.S. Sales Tax.

| Max Tax Rate with Local/City Sale Tax |

|---|

| California |

| 0% |

What is the lowest sales tax in California?

- California: Sales Tax Handbook. 2019 List of California Local Sales Tax Rates. Lowest sales tax Highest sales tax California Sales Tax: 6.00%. Average Sales Tax : 8.371%. California has state sales tax of 6.00%, and allows local governments to collect a local option sales tax of up to 3.50%.

You May Like: Where Can I Pay My Property Taxes

Certain Kinds Of Food Taxation

As you may have guessed, the top necessity of life is food. However, the exemptions can appear complicated because the CDTFA looks at a variety of items that may not seem to be food but are related in a way that allows tax exemption.

For example, most food products for human consumption are easily recognized but where and how they are sold impacts the exemption. Food that falls under the following conditions is considered taxable:

- Sold in a heated condition

- Served as meals

- Consumed on or at a sellers facilities

- Is ordinarily sold for consumption on or near the sellers parking facility, or

- Is sold for consumption where there is an admission charge

However, there is an exception. Hot bakery items or hot beverages such as coffee sold for a separate price are still tax exempt.

The justification for the tax exemption on food products sold through a vending machine is just as convoluted. The vending machine operator is considered the consumer of any food products retailing for 15 cents or less and food products sold through bulk vending machines for 25 cents or less.

Wait, there is more: for sales of cold food products, hot coffee, hot tea and hot chocolate through a vending machine for more than 15 cents, 67 percent of the receipts are tax exempt. The rest is fully taxed.

Other necessities of life include health-related products, services, and meals as well as some utilities like gas, water and electricity.

Los Angeles Sales Tax Calculator

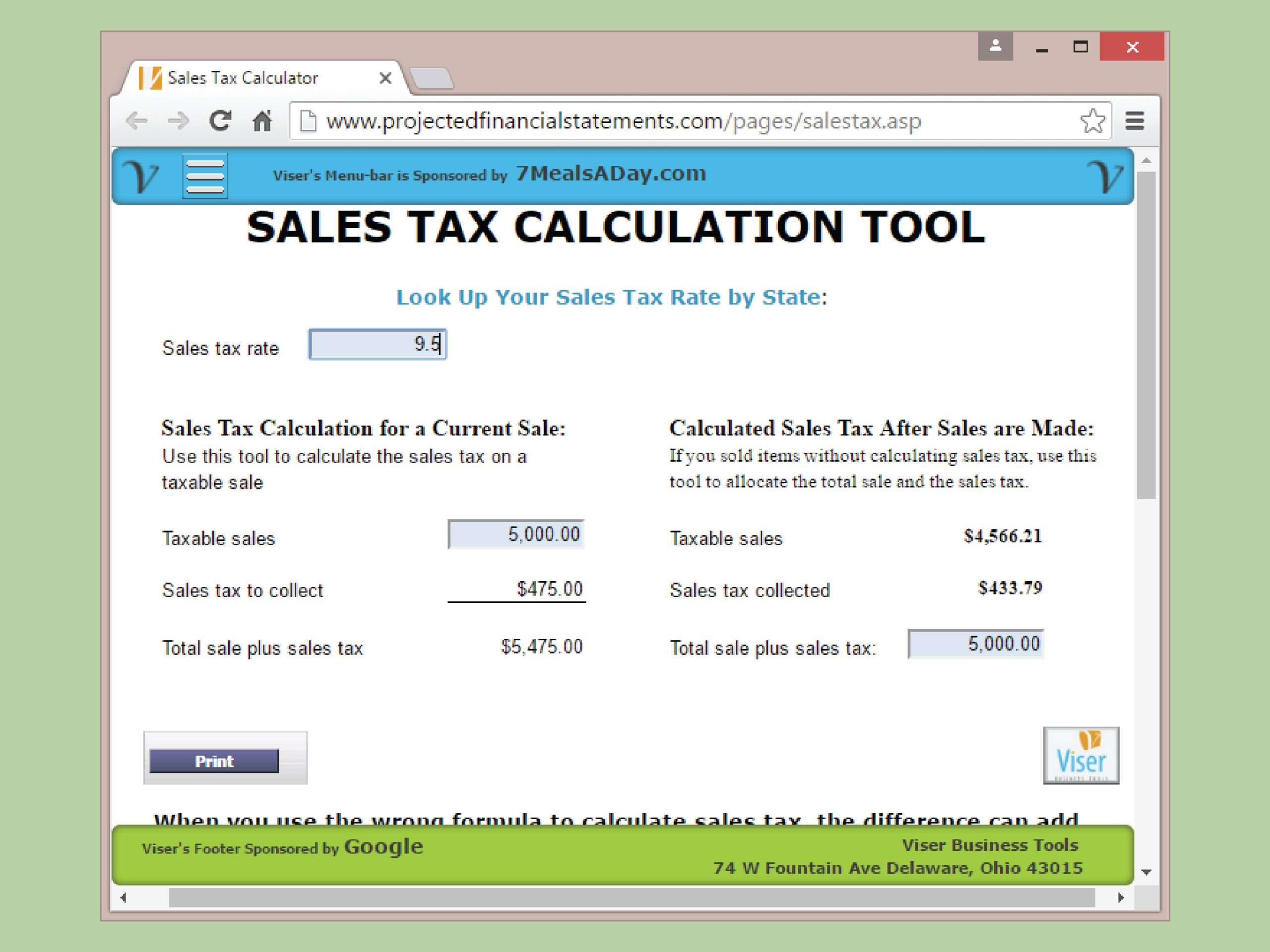

Invoicing clients or selling to customers and need to know how much sales tax to charge? Use our simple sales tax calculator to work out how much sales tax you should charge your clients. Input the amount and the sales tax rate, select whether to include or exclude sales tax, and the calculator will do the rest. If you dont know the rate, download the free lookup tool on this page to find the right combined Los Angeles rate.

Read Also: Can You Deduct Federal Income Taxes Paid

Complete A Partial Exemption Certificate For Manufacturing Research And Development Equipment

If your purchase is qualified, complete the required Partial Exemption Certificate for Manufacturing, Research and Development Equipment for all purchases from California and out-of-state vendors when placing your purchase order. Since out-of-state vendors do not collect sales tax on invoicing, it is the Universitys responsibility to accrue use tax on purchase of taxable tangible personal properties.

- The reason for completing the required Partial Exemption Certificate for purchases from California and out-of-state vendors is to:

- Comply with California sales and use tax law by providing the seller a timely partial exemption certificate

- Apply the correct sales tax code when processing payment

- Reduce audit risk, potential tax underpayment, interest, and penalties

- Control risk at front end

Note: Capital Accounting will apply the full use tax rate on your voucher if the partial exemption certificate is not completed and submitted in BearBuy.

Have the Principal Investigator or department financial manager certify and sign the Partial Exemption Certificate.

How Tax Is Calculated

The amount of tax charged on your order depends on many factors including the following:

- The identity of the seller

- The type of item or service purchased

- The time and location of fulfillment

- The shipment or delivery address of your order

The tax rate applied to your order will be the combined state and local rates of the address where your order is delivered to or fulfilled from. For example, if you live in a state that does not impose a sales tax, you may still see tax calculated on your order if shipped to another state. Moreover, the tax rates applied to your order may also be different for a variety of reasons, such as a shipment to a residential home versus a business address. Also, the total selling price of an item will generally include item-level shipping and handling charges, item level discounts, and gift wrapping charges. If applied at an order level, these charges, may be allocated to the individual items in an order.

If you are ordering from Amazon.com and shipping to a country outside of the US, you may be charged the applicable country tax rate.

Note:

- No tax is charged when purchasing gift cards however, purchases paid for with gift cards may be subject to tax.

- Textbooks rented from Warehouse Deals and shipped to destinations in Delaware are subject to tax.

Items sold on Amazon.com that are shipped to destinations in the following states and US territories may be subject to tax:

| Alabama |

Don’t Miss: How To Track My State Taxes

Determining Your Responsibility To Pay Sales Tax

When To File Taxes In California

When you register for sales tax, California will assign you a certain filing frequency. Youâll be asked to file and pay sales tax either monthly, quarterly, or annually.

Usually the frequency they choose is based on the amount of sales tax you collect from buyers in California. High-revenue businesses file more frequently than lower volume businesses, for example.

California sales tax returns are usually due on the last day of the month following the reporting period. If the due date falls on a weekend or holiday, then your sales tax filing is generally due the next business day.

Read Also: What Are My Taxes On My Property

Calculate General Sales Tax In California

It depends on where your home is located in CA as to what amount to use for CA general sales tax rate.

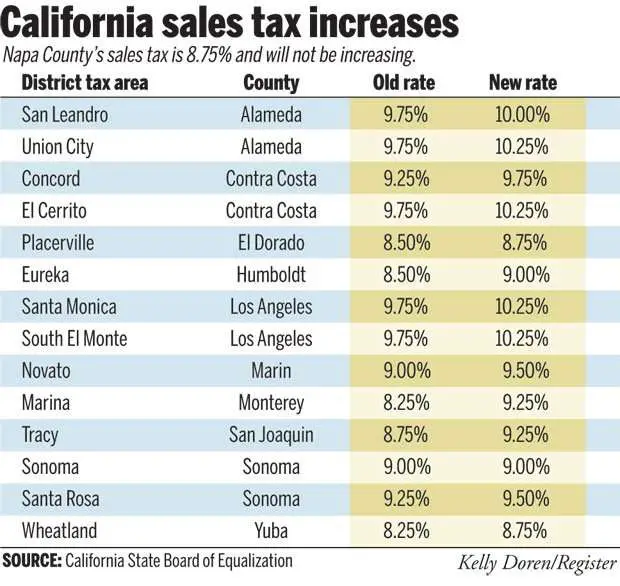

The California sales tax rate is currently 6.0%. However, California adds a mandatory local rate of 1.25% that increases the total state sales and use tax base to 7.25%. Depending on local municipalities, the total tax rate can be as high at 9.75%.

You can use this helpful state sales tax calculator link: to get your general state sales tax rate.

Please note that you will only be allowed to claim either a state income tax deduction or a state sales tax deduction as an itemized deduction on your federal income tax return. You will not be able to claim both.

Also, you can only claim the state sales tax or state income tax deduction for your home state. You cannot use the rate for a nonresident state even if you are required to file a nonresident state return in that other state.

Make Your Purchase In Bearbuy

Follow the California Partial Sales Tax Exemption job aid available on Supply Chain Management’s website to complete your purchase in BearBuy. You must attach the completed and approved Partial Exemption Certificate for every applicable product to your BearBuy cart.

Please ensure the chartstring for your purchase utilizes research function code 44 or 45.

Recommended Reading: How Much Do Rich People Pay In Taxes