What Are The Federal Tax Brackets For Tax Year 2021

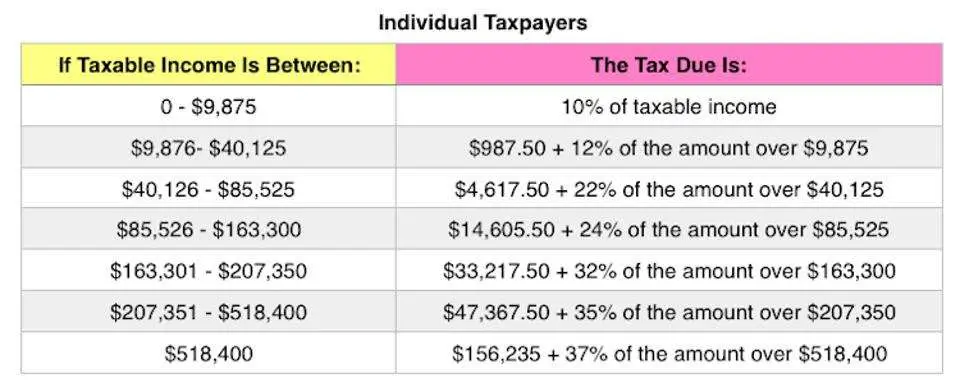

The top tax rate remains 37% for individual single taxpayers with incomes greater than $523,600 . Below are the other brackets:

- 35%, for incomes over $209,425

- 32%, for incomes over $164,925

- 24%, for incomes over $86,375

- 22%, for incomes over $40,525

- 12%, for incomes over $9,950

The lowest rate is 10% for incomes of single individuals with incomes of $9,950 or less .

Contribution Exceptionnelle Sur Les Hauts Revenus

In addition to the basic rates of income tax those fortunate few with a taxable income of upwards of 250,000 pa are liable for a special tax called contribution exceptionnelle sur les hauts revenus.

This tax is at the rate of 3% on income up to 500,000, and at the rate of 4% on income above 500,000.

The tax is imposed on net income, after determination of the tax liability under the standard scale rates.

Ways To Get Into A Lower Tax Bracket

You can lower your income into another tax bracket by using tax deductions such as charitable donations or deducting property taxes and the mortgage interest paid on a home loan and property taxes. Deductions can lower how much of your income is ultimately taxed.

Tax credits, such as the earned income tax credit, or child tax credit, can also put you into a lower tax bracket. They allow for a dollar-for-dollar reduction on the amount of taxes you owe.

Read Also: Is Doordash Money Taxed

What Is A Tax Bracket

A tax bracket refers to a range of incomes subject to a certain income tax rate. Tax brackets result in a progressive tax system, in which taxation progressively increases as an individuals income grows. Low incomes fall into tax brackets with relatively low income tax rates, while higher earnings fall into brackets with higher rates.

How Federal Tax Brackets Work

Tax brackets are not as intuitive as they seem because most taxpayers have to look at more than one bracket to know their effective tax rate.

Instead of looking at what tax bracket you fall in based on your income, determine how many individual tax brackets you overlap based on your gross income.

Figuring that out is easier in practice:

- Example one: Say youre a single individual who earned $40,000 of taxable income in the 2021 tax year. Technically, youd be aligned in the 12% tax bracket, but your income wouldnt be levied a 12% rate across the board. Instead, you would follow the tax bracket up on the scale, paying 10% on the first $9,950 of your income and then 12% on the next chunk of your income between $9,951 and $40,525. Because you dont make above $40,525, none of your income would be hit at the 22% rate.

That often amounts into Americans being charged a rate thats smaller than their individual federal income tax bracket, known as their effective tax rate.

- Example two: Say youre a single individual in 2021 who earned $70,000 of taxable income. You would pay 10% on the first $9,950 of your earnings then 12% on the chunk of earnings from $9,951 to $40,525 , then 22% on the remaining income

- Your total tax bill would be $11,148.50. Divide that by your earnings of $70,000 and you get an effective tax rate of roughly 16%, which is lower than the 22% bracket youre in.

Recommended Reading: Does Doordash Tax You

How Much Do You Get Back In Taxes For A Child In 2020

There are multipletax breaks for parents, including the child tax credit. For 2020, the child tax credit is worth a maximum of $2,000 per qualifying child. Up to $1,400 of that amount is refundable meaning if the credit reduces your tax bill to zero, you could receive the difference back as a refund. Tax reform expanded the credit to also include a $500 nonrefundable credit for qualifying dependents who arent children, and boosted the phase-out limits to an AGI of more than $400,000 for taxpayers who are married filing jointly and $200,000 for everyone else. The higher limits mean that more people could qualify for the credit.

How To Stay In A Lower Tax Bracket

You can reduce your tax bill with tax deductions and tax credits. Another way to reduce your taxable income, and thus stay in a lower tax bracket, is with pre-tax deductions.

A pre-tax deduction is money your employer deducts from your wages before withholding money for income and payroll taxes. Some common deductions are:

- Contributions to a 401 plan

- Contributions to a Flexible Spending Account

Returning to the example above, lets say you decide to participate in your employers 401 plan and contribute $1,500 per year to your account. Now, your taxable income is $39,000 contribution + $1,700 in other income $12,500 standard deduction). You remain in the 12% tax bracket while saving for retirement. Its a win-win.

For 2020, you can contribute up to $19,500 to a 401 plan. If youre age 50 or above, you can contribute an additional $6,500 in catch-up contributions, for a total of $26,000. In 2021, the contribution limit will remain at $19,500, or $26,000 if youre age 50 or older.

If youre self-employed or dont have access to a 401 plan at work, you can still reduce your taxable income while saving for retirement by contributing to a Traditional IRA or through a broker or robo-advisor like SoFi Invest. These contributions reduce your AGI because they are above-the-line deductions .

For 2020, you can contribute up to $6,000 to a Traditional IRA . The contribution limits are the same for 2021.

Recommended Reading: Property Tax Protest Harris County

Convert Assets To Roth Accounts

Lets say youre usually in the 22% tax bracket. This year you might have a unique situation where youll only be in the 10% tax bracket for a year.

You can use this opportunity to convert traditional retirement account assets into a Roth retirement account.

Now:

Youll have to pay income tax on the conversion based on the marginal income tax rate each dollar of the conversion falls in.

However, if you only convert enough assets to keep yourself in a lower tax bracket, you pay less in income taxes now. Then, you can withdraw the money tax-free later when youre in a higher tax bracket.

Consult a professional before you do this. It can be complicated. Once you convert assets, you may not be able to hit an undo button if you make a mistake.

Did Tax Tables Change For 2021

Yes. Each year, the IRS adjusts the tax brackets to account for inflation. Below are the income thresholds for tax year 2021.

The top tax rate remains 37% for individual single taxpayers with incomes greater than $523,600 . Below are the other rates:

- 35%, for incomes over $209,425

- 32%, for incomes over $164,925

- 24%, for incomes over $86,375

- 22%, for incomes over $40,525

- 12%, for incomes over $9,950

The lowest rate is 10% for incomes of single individuals with incomes of $9,950 or less .

Don’t Miss: How To Find Your Employer’s Ein

Why Knowing Your Tax Bracket In Retirement Matters

Knowing what your tax bracket is in retirement is important because it can help you better plan for your taxes.

In some cases, you may be able to use your knowledge to lower your overall tax liability in one year or over multiple years.

For instance, funds taken out of Roth accounts in retirement are generally tax-free. These could include Roth IRA and Roth 401 funds.

On the other hand, you may have to pay taxes on money withdrawn from tax-deferred accounts. These could include traditional IRAs, 401s and other workplace retirement plans.

Taxable investment accounts may also be required to pay taxes depending on the assets you sell.

When To Use Marginal Vs Effective Tax Rates

So when is it proper to use marginal tax rates, and when should effective tax rates be used?

Effective tax rates are used to measure a person’s total tax obligation relative to his/her income accordingly, it is a useful tool to compare the relative tax obligations amongst several people. For example, in the recent tax reform debates during the election, there was discussion about the effective tax rate of Governor Romney, or Warren Buffett the effective tax rate was a measure of the portion of various peoples’ incomes that are consumed by their tax obligations, to evaluate which of those people have a greater or lesser relative tax burden. Notably, though, the measure is still a relative measure even if Warren Buffett’s effective tax rate is lower than his secretary, his total tax liability – the total amount of taxes he actually pays – is still far larger, as his tax obligations are measured in the millions, many times the amount of his secretary’s that are measured in the thousands. Nonetheless, the fundamental usefulness of effective tax rates is to compare across people and the portion of each person’s income that is consumed by taxes. Effective tax rates can also be useful to simply understand the portion of an individual’s overall income that is consumed by taxes – for instance, in determining an ‘average’ tax rate to apply during retirement.

Recommended Reading: Do You Pay Taxes On Doordash

Heres How Tax Brackets Work

As anyone who has ever filed income taxes can tell you, you have to know which tax bracket youâre in before you can make even an educated guess of what you might owe Uncle Sam.

Itâs pretty easy to figure out your tax bracket because itâs based on your income, but itâs trickier to calculate how much youâll actually owe because of the way the U.S. tax system works. Weâll explain how to do that in a moment. But first, here are the tax brackets for 2022, represented as the percentage of tax youâd pay on each portion of your income .

How Does The Cpp Work

You will contribute towards the CPP from your employment earnings from age 18 to 70. The CPP Investment Board then invests CPP funds. Once you retire, you will then receive a monthly retirement pension that is equal to a certain percentage of your lifetime average earnings.

The base CPP benefit provides a monthly pension of up to 25% of your contributory earnings for the best 40 years of earnings. With changes enhancing CPP contributions, the monthly pension amount can rise to up to 33.33% of your contributory earnings. This pension amount counts as income, and so you must pay income tax on your CPP benefit.

The earliest that you can receive your retirement pension is when you turn 60 years of age. If you have a disability, you may receive the CPP disability benefit if you are under the age of 65, or the CPP post-retirement disability benefit if you have already started to receive your CPP retirement pension.

If you start receiving your pension between 60 and before you turn 65, your pension amount will be permanently reduced at a rate of 0.6% for every month before age 65, for a maximum reduction of 36%.

Every month after age 65 permanently increases your pension amount by 0.7%, up to a maximum of 42% when you turn 70.

Read Also: Taxes For Door Dash

How Are Dividends Taxed In Canada

There are two types of dividends in Canada: “Eligible Dividends” and “Other Than Eligible Dividends”. Corporations will designate their dividends as either âeligibleâ or âother than eligibleâ for tax purposes.

Dividends are paid out of a corporation’s after-tax profits. This means that tax has already been paid on the dividend amount. However, not all corporations have the same tax rate.

Canadian Controlled Private Corporation are eligible for the small business deduction, which reduces their corporate income tax rate. Dividends paid out by them are “other than eligible”. Since a lower amount of tax has already been paid on them, you will receive a smaller tax credit rate.

Public corporations are not eligible for the small business deduction, and so their dividends are designated as eligible dividends. As a higher tax rate applies to these public corporations, your dividend tax credit amount will be larger.

A dividend gross-up multiples your actual dividend amount by a certain multiplier, which attempts to replicate what the dividend-paying corporation had to earn in order to pay out the dividend after taxes.

Progressive Vs Flat Tax Rates

You might have heard common arguments about progressive tax rates versus flat tax rates. Some states use a flat tax for state income taxes, so its good to understand the difference

With a flat tax, everyone pays the same tax rate regardless of their income. If you live on an income below $30,000 per year, you would pay the same percentage of your income in taxes as someone who makes $300,000 per year . If the flat tax rate is 5%, for example, 5% of your income would go to taxes at all income levels.

Under a progressive tax system, which we use for Federal taxes, those with a higher income pay a higher percentage of their income. This system taxes new income at a higher rate but doesnt go back and raise your tax rate on income earned earlier in the year.

Recommended Reading: How Much Does Doordash Take In Taxes

Tax Brackets Filing Jointly Vs Single

The biggest difference in how youâre placed in a tax bracket is whether you are single or have other people to consider.

If you are an individual with no dependents or spouse, the lowest of the seven tax brackets goes from a yearly income range of $0 to $9700. That bracket pays a tax rate of 10%. The highest of the tax brackets is for anyone making more than $510,300 a year in taxable income anything above that is taxed at a rate of 37%.

For married people jointly filing their taxes, the income range is usually doubled. For example, whereas the lowest tax bracket for single people is $0-$9,700, for joint married couples itâs $0-$19,400. At the highest end of it, though, that tapers off income over $612,350 gets taxed at 37%.

Recommended Reading: How To Look Up Employer Tax Id Number

How Do You Know Your Tax Bracket And Tax Rate

Tax Bracket Rates 2021 If youre currently employed in Canada, you may be paying taxes less than those of Americans. The last ten years has seen a significant decrease on Canadian tax rates and this could be due to the current economic conditions in Canada following the downturn of the collapse of the real estate market for homes in Canada. In the current economic climate, there are a lot more workers and, consequently, there are greater deductions for income of Canadian citizens. Although this might seem like something that is worth it for those who are eligible, the vast majority of people will not be able to take the benefit and have to accept higher tax rates.

There are several different types of tax bracket 2021 in Canada One of them are the Federal Income Tax. This is the lowest tax bracket in Canada and it is applied to the taxable earnings of an individual or business. Taxation on corporate income is a tax that corporations pay. the tax bracket applicable to corporations is the 15 percent tax bracket. The amount individuals pay in tax each year to the federal government is then transferred to their neighborhood Social Development Canada office for processing. After the tax is processed, the money that was deducted is sent directly to the person.

Recommended Reading: Taxes Grieved

How Much Of Social Security Will Be Taxable By 2021

Social Security is a program that allows people to receive a pension when they retire. The government takes out money from peoples paychecks and uses it to pay for the pensions of old-age workers. In 2019, employers will have to start taking out taxes from the Social Security payments that their employees make before sending them over to the Social Security Administration.

This will increase the amount of money that the government has access to, which could mean increased funding for programs like Medicare and Medicaid. The tax deductions in the United States will be changing by 2021.

Some people may be disappointed to learn that they will have to pay more in taxes as they near retirement, while others may rejoice because they wont get hit with a large tax bill at the time of filing their 1040s.

Every year, the Social Security Administration releases a new estimate of how much of your Social Security benefits will be taxed. The percentage of your benefits that will be taxable, by law, is currently set to 75 percent. However, they predict that the number will be 70 percent by 2021. This is because the IN estimates a slower growth rate in wages and salaries than it had predicted previously.

In 2018, the Social Security tax was twelve point four percent of wages. However, in 2020, the tax rate will jump to fifteen point three percent and then in 2021 it will be sixteen point five percent.

How Do You Calculate Income Tax

It is an important part of estimating taxable income to estimate tax bills. Tax deductions are subtracted from gross income to estimate taxable income. We will need taxable income before we can leave. To determine tax liability, we apply the appropriate tax bracket after calculating taxability for the taxpayer.

Also Check: Door Dash 1099

Irs Tax Bracket Rate For Single Head Of Household Married Couples Filing Jointly

Lets look at some of the main tax brackets for each major filing group. Youll get a rough idea of which tax bracket youre likely to fall into. Take note that your tax bracket is defined by your adjusted gross income, rather than your salary on its own.

With recent changes under the Tax Cuts and Jobs Act , five of the seven tax brackets have changed.

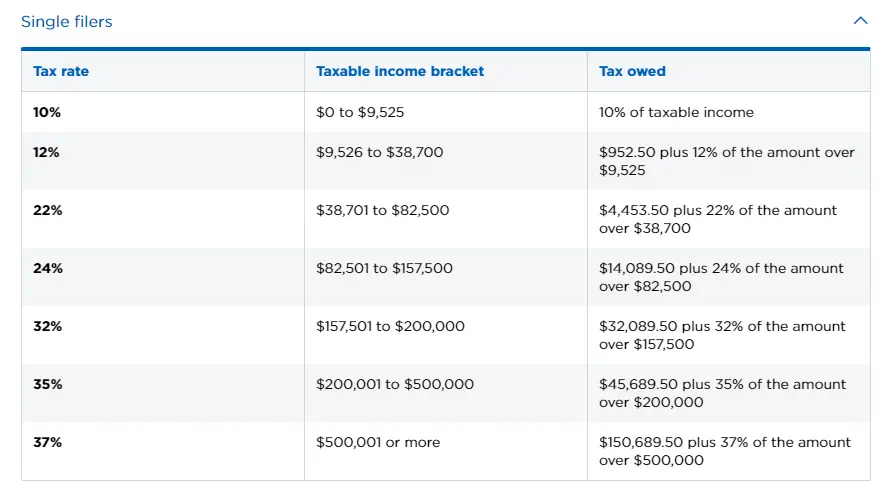

If you are a single taxpayer, the IRS tax brackets for the upcoming tax filing season are as follows:

- $9,525 or under means youll be taxed at 12%.

- Up to $38,700, and youll be taxed at a rate of $952.50, in addition to a 12% tax rate of your income that falls solely in this threshold.

- Up to $82,500, and youll see a tax rate of 22%. This is $4,453 on top of this.

- Up to $157,500 is a rate of 24%. But thats $14,089.50, on top of that.

- Anything up to $200,000 is a rate of 32%, plus $32,089.50.

Top rate taxpayers who go over $200,000 will enter the final two brackets, which are 35% and 37%, respectively. If you earn more than $500,000, expect to pay a tremendous amount in addition. For these taxpayers, we recommend they seek specialized advice.

For married couples filing jointly, the tax brackets are the same, but the amounts differ. can earn around double that of a single taxpayer and continue to remain in the same tax bracket.

For example, the lowest tax bracket has a range of between $0 and $19,050, which is more than double what a single taxpayer is entitled to.

But what about a head of household?