Summary Of The Years Digit

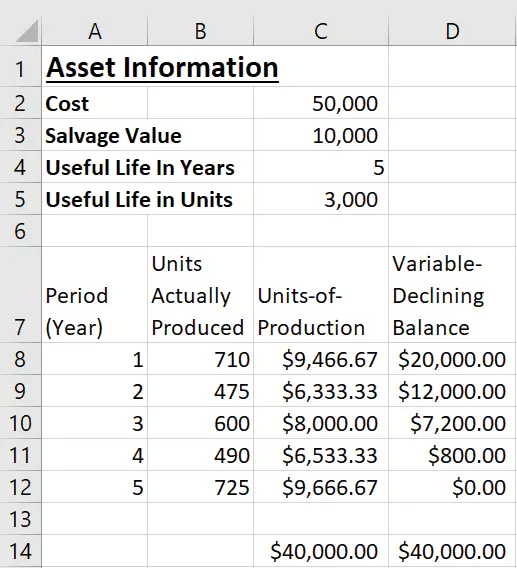

With this method, the propertys expected lifespan is included. Every year, its divided by the amount starting with a more significant number through its first year.

- While a straight-line basis is the most commonly used process of calculating your depreciation tax under the GAAP, its a pretty straightforward approach in calculating depreciation with fewer errors, consistent methodology, and changes well from the companys prepared tax return statements.

- The process reflects property consumption over time and measuring it by removing its salvage value over the propertys original cost when purchased. The assets useful life splits the amount.

- Salvage value pertains to the cost of a building when its not useful anymore.

How To Calculate The Depreciation Tax Shield

Under U.S. GAAP, depreciation reduces the book value of a companys property, plant, and equipment over its estimated useful life.

Depreciation expense is an accrual accounting concept meant to match the timing of the fixed assets purchases i.e. capital expenditures with the cash flows generated from those assets over a period of time.

The real cash outflow stemming from capital expenditures has already occurred, however in U.S. GAAP accounting, the expense is recorded and spread across multiple periods.

The recognition of depreciation causes a reduction to the pre-tax income for each period, thereby effectively creating a tax benefit.

Those tax savings represent the depreciation tax shield, which reduces the tax owed by a company for book purposes.

How To Calculate Depreciable Assets

Learn how to calculate depreciable assets and what straight-line depreciation is and the steps involved in calculating it, and review an example calculation.

Everything you buy for your business has a cost attached to it, and you can deduct those costs from your taxes. Large items, such as vehicles, buildings, and equipment, are expected to last for years, so when you deduct the purchase cost from your income taxes, you do it over the course of several years. This is the idea of depreciation.

Also Check: How To File School District Taxes In Ohio

Depreciation Expense Vs Accumulated Depreciation

Depreciation expense is the amount you deduct on your tax return. Since itâs an expense, you record it as a debit.

Accumulated depreciation is the total amount youâve subtracted from the value of the asset. Accumulated depreciation is known as a âcontra accountâ because it has a balance that is opposite of the normal balance for that account classification. The purchase price minus accumulated depreciation is your book value of the asset. Since itâs used to reduce the value of the asset, accumulated depreciation is a credit.

Further reading:Debits and Credits, A Visual Guide

Important Points To Remember :

For any questions, you may reach us at Discussion Forum

The author of the above article Shruti Jain.

Disclaimer:The article or blog or post in this website is based on the writers personal views and interpretation of Act. The writer does not accept any liabilities for any loss or damage of any kind arising out of information and for any actions taken in reliance thereon. Also, www.babatax.com and its members do not accept any liability, obligation or responsibility for authors article and understanding of user.

For Advertising with us-

You May Like: How To Do Taxes Online For Free

Depreciation As Per Income Tax Act

Depreciation Is Not An Option

The Internal Revenue Code and all accompanying regulations and rulings relate to the depreciation “allowed or allowable,” not the amount that you may wish to claim or actually report on a tax return. The IRS has made it clear: depreciation is not an option if available, you must claim it. While this point may seem silly on the surface, there are at least two real instances in which the issue arises. Consider a business with a low profit for the year, before depreciation is deducted. Why not save our depreciation deduction for a later year when it can do some good? Even though we might find ourselves in a situation like this, we must claim the depreciation deduction. If we don’t, when we sell the asset, we must compute the depreciation allowable, not the depreciation actually claimed, to compute any gain on the sale of the asset. Secondly, consider the tax practitioner who never depreciated a depreciable asset. When sold, the amount of depreciation that was allowed must again be used to compute gain on the sale.

Read Also: What Does It Mean When Your Tax Return Is Accepted

Soil And Water Conservation Structures

Section 175 of the Internal Revenue Code provides favorable treatment for recovery of the cost of building soil and water conservation structures. That section allows farmers and ranchers to deduct the entire amount of direct expenditures for soil and water conservation on land used in farming in the year they were spent. There are only three hitches:

An IRS regulation states, reasonably clearly, that all earthen structures are not depreciable and, therefore, may be deducted in the year of construction. In fact, if they are not expensed, they may not be depreciated and rather must be added to the basis of the land. On the other hand, if any masonry, concrete, tile, metal, or wood is used in the structure, the structure must be depreciated over the life established by SCS guidelines for the useful life of the structure.

Prime Cost Method And Formula For Depreciation

The Prime Cost method of depreciation values depreciation as a fixed amount for each year of the effective life of the asset.

For example, the prime cost depreciation rate for an asset expected to last 5 years is 20% of the original cost/value per year.

The formula for depreciation using the prime cost method is:

Assets cost X X .

Note: Days held is the number of days you owned the asset in the income year in which you had it installed ready for use. Days held can be 366 for a leap year.

Also Check: Do You Have Until Midnight To File My Taxes

Depreciation On Suvs Trucks And Other Heavy Vehicles

Up until now weâve been discussing depreciation as it relates to âpassenger vehicles.â A passenger vehicle is what most of us drive. Theyâre typically not designed to seat more than nine people and usually weigh less than 6,000 pounds.

In many cases, however, freelancers and self-employed people work jobs that require more heavy-duty autos. SUVs, pickup trucks, and other heavy-weight vehicles are categorized as âtransportation equipment.â Consequently youâre eligible to claim 100% of their cost under bonus depreciation and Section 179 expensing.

For instance, if you purchase a truck for $80,000, and it meets the transportation requirements, you can claim the full $80,000 in the first year.

To verify that your vehicle meets the transportation requirements, it must have a Gross Vehicle Weight Rating of above 6,000 pounds. Most manufacturers will note this on the vehicleâs label.

Similar to passenger vehicles, if the business use falls below 50%, youâll have to depreciate it using the straight-line method over its useful life — typically six years for heavy vehicles.

Calculating car depreciation is nobodyâs first choice for a Saturday afternoon, but taking the time to consider your options is worth every penny!

Sarah York, EA

Find write-offs.

How To Calculate Depreciation For Tax Purposes

Running a business requires additional knowledge when purchasing tangible assets that are owned by the company. The item can decrease its value over time. In some instances, the value of the asset goes down when you plan to resell it. Not getting the original price over the cost you paid for this asset is known as depreciation.

On a different perspective, tax depreciation requires you to spread the assets cost over the estimated lifespan and use. Calculating tax depreciation can be complicated without following the fundamental guidelines. In short, depreciation is the value of your businesss asset measure by life usage. But how to effectively and accurately apply it into your business.

Read Also: How To Contact Credit Karma Tax By Phone

Plant And Equipment Deduction Rules

For any plant and equipment assets costing $300 or less, the ATO allows you to claim their entire cost as an immediate tax deduction, assuming you mainly use them to help generate income but not to run a business.

Plant and equipment assets that cost more than $300 can be claimed according to their effective life. The effective life of a depreciating asset is how long it can be used to produce an income.

Plant and equipment assets found in the property will generally wear out more rapidly than the actual structure of the building. Therefore, the effective life of these depreciating assets is typically shorter.

So while you can claim capital works deductions over 40 years, you can only claim plant and equipment deductions over their effective life.

Each financial year, the Commissioner issues a Taxation Ruling in which he or she decides on the effective life for several different depreciating assets in various industries.

For example, a washing machine, which is subject to a fair amount of wear and tear, has an effective life of six years based on the Commissioners current ruling.

However, depending on the particular asset in question, the ATO allows you to work out its effective life yourself , based on factors such as the manufacturers specifications and the past experience people have had with similar assets.

How Is Tax Depreciation Calculated

Generally, tax authorities in the United States) provide comprehensive guides to taxpayers on the rules applicable to the depreciation of tangible assets.

For example, the Canada Revenue Service , a federal tax agency in Canada, provides the guide on the Capital Cost Allowance . Essentially, CCA is a tax deduction associated with the depreciation of assets under Canadian tax laws.

The CRA divides all the assets eligible for CCA claim into different classes. Each asset class comes with its own depreciation rate and calculation method. For example, rental buildings are classified under Class 1 and must be depreciated at a 4% rate.

In the United States, the IRS publishes a guide on property depreciation that is similar to that of the CRA. In the IRS guide, a taxpayer may find all necessary information about property depreciation, including what assets are eligible for depreciation claim, as well as the applicable depreciation rates and useful lives.

Note that the depreciation expense recorded by a business on its financial statements may be different from the depreciation expense claimed on a tax return. The reason is that the methods applied to calculate depreciation expense for accounting and tax purposes do not always coincide. For example, accounting depreciation is commonly determined using the straight-line method, but tax depreciation is generally calculated via accumulated depreciation methods . As a result, the depreciation calculation methods can vary significantly.

Don’t Miss: How Many Years Of Taxes To Keep

Depreciation Calculator As Per Companies Act 2013

. While all the effort has been made to make this. Depreciated for the regular tax using the 200 declining balance method generally 3 5 7 or 10 year property under the modified accelerated cost recovery system MACRS. TaxAdda Private Limited CIN – U93000RJ2019PTC067547 GSTIN – 08AAHCT6764E1Z1.

When an asset loses value by an annual percentage it is known. ATO Depreciation Rates 2021. Depreciation asset cost salvage value useful life of asset.

You can claim a deduction for the decline in value of a depreciating asset over the effective life of the asset where the asset either. Straight Line Depreciation Method. The formula to calculate annual depreciation.

This depreciation calculator will determine the actual cash value of your Computers using a replacement value and a 4-year lifespan which equates to 004 annual. For laptops this is typically two years and for desktops typically four years. Section 179 deduction dollar limits.

Please resend the purchase document of the laptop along with the letter from the company stating that you use the laptop 100 for work purposes when sending the calculation. Find the depreciation rate for a business asset calculate depreciation for a business asset using either the diminishing value. MCGs Quantity Surveyors patented Tax Depreciation Calculator is the first calculator which provides representation of accurate estimates through actual real properties.

How To Calculate Depreciation On Computer Hardware A Cheat Sheet Techrepublic

Accelerating Depreciation With Section 179

The Section 179 deduction was introduced to incentivize business owners to purchase machinery and equipment. The election enables you to write off the entire cost of the purchase in the first year, rather than depreciating it over its useful life.

The 179 deduction extends to automobiles as well, with the only caveat being that the max write-off is limited to $18,200 for 2021.

Note that the 179 deduction canât be taken on vehicles used less than 50% for business.

Also Check: How Do I Pay My New York State Taxes

Which Property Is Depreciable

According to the IRS, you can depreciate a rental property if it meets all of these requirements:

- You own the property .

- You use the property in your business or as an income-producing activity.

- The property has a determinable useful life, meaning it’s something that wears out, decays, gets used up, becomes obsolete, or loses its value from natural causes.

- The property is expected to last for more than one year.

Even if the property meets all of the above requirements, it cannot be depreciated if you placed it in service and disposed of it in the same year.

Note that land isn’t considered depreciable since it never gets “used up.” And in general, you cannot depreciate the costs of clearing, planting, and landscaping, as those activities are considered part of the cost of the land and not the buildings.

Sinking Fund Or Depreciation Fund Method

Under this method, we transfer the amount of depreciation every year to the sinking fund A/c. We then invest this amount in Government securities along with the interest earned on these securities. Thus, we calculate depreciation after considering the element of interest.

Depreciation = x Present value of 1 at sinking fund tables for the given rate of interest.

Read Also: Do I Owe Property Taxes

How To Calculate Depreciation Recapture

The calculation involves the following steps:

Step 1: Calculate adjusted cost basis

Adjusted cost basis = Purchase price + Improvements

Step 2: Calculate gain from the sale

Realized gain = Selling price Adjusted cost basis

Step 3: Compare realized gain and the accumulated depreciation

If the realized gain < accumulated depreciation

Depreciation recapture = Realized gain

The realized gain is taxed as ordinary income

Tax = Realized gain * Depreciation recapture tax rate

If the realized gain > accumulated depreciation

Depreciation recapture = Accumulated depreciation

The accumulated depreciation is taxed as ordinary income, and the remaining amount in the realized gain is taxed as a capital gain.

What Assets Are Qualified For A Tax Depreciation

Understanding the rules on tax depreciation and its variations per jurisdiction is essential. The propertys eligibility for every claim may affect certain factors like your location or state rules. However, here are the critical factors for your business property to be eligible for potential depreciation claims.

- Asset ownership

Don’t Miss: What Is The Tax Bracket For 2021

If You Use The Actual Expense Method

This expense method allows you to claim your actual vehicle costs, such as gas, oil changes, repairs, insurance, and depreciation.

This method simplifies the recordkeeping requirement: you can track your auto expenses with all your other write-offs rather than maintaining a separate mileage log. And luckily, Keeper Tax makes this even easier by automatically tracking auto expenses through our app!

Make sure you carefully consider which method is most advantageous to you. If you claim mileage your first year, you can switch to actual car expenses the next year. But if you choose the actual method the first year, you’re locked in and can’t switch to mileage later on.

This is on a per-auto basis. So in theory, you could have two vehicles each using a different method. The only rule is that you canât alternate between methods on the same vehicle.