How To File A California Sales Tax Return

Once youve collected sales tax, youre required to remit it to the CDTFA by a certain date. The CDTFA will then distribute it to state and local tax agencies where appropriate.

Filing a California sales tax return is a two-step process comprised of submitting the required sales data and remitting the collected tax dollars to CDTFA. The filing process forces you to detail your total sales in the state, the amount of sales tax collected, and the location of each sale.

Filing sales tax online is generally recommended, but businesses may also submit the State, Local, and District Sales and Use Tax Return paper form . This form replaces the CABOE-401-A2. Taxpayers can file and pay returns online through the California Taxpayers Services Portal.

How To Calculate California Sales Tax On A Car

To calculate the sales tax on your vehicle, find the total sales tax fee for the city. The minimum is 7.25%. Multiply the vehicle price by the sales tax fee.

For example, imagine you are purchasing a vehicle for $20,000 with the state sales tax of 7.25%. $20,000 X .0725 = $1,450. $1,450 is how much you would need to pay in sales tax for the vehicle, regardless of if it was used, purchased with trade-in credit, or included an incentive.

Remember that the total amount you pay for a car not only includes sales tax, but also registration, and dealership fees.

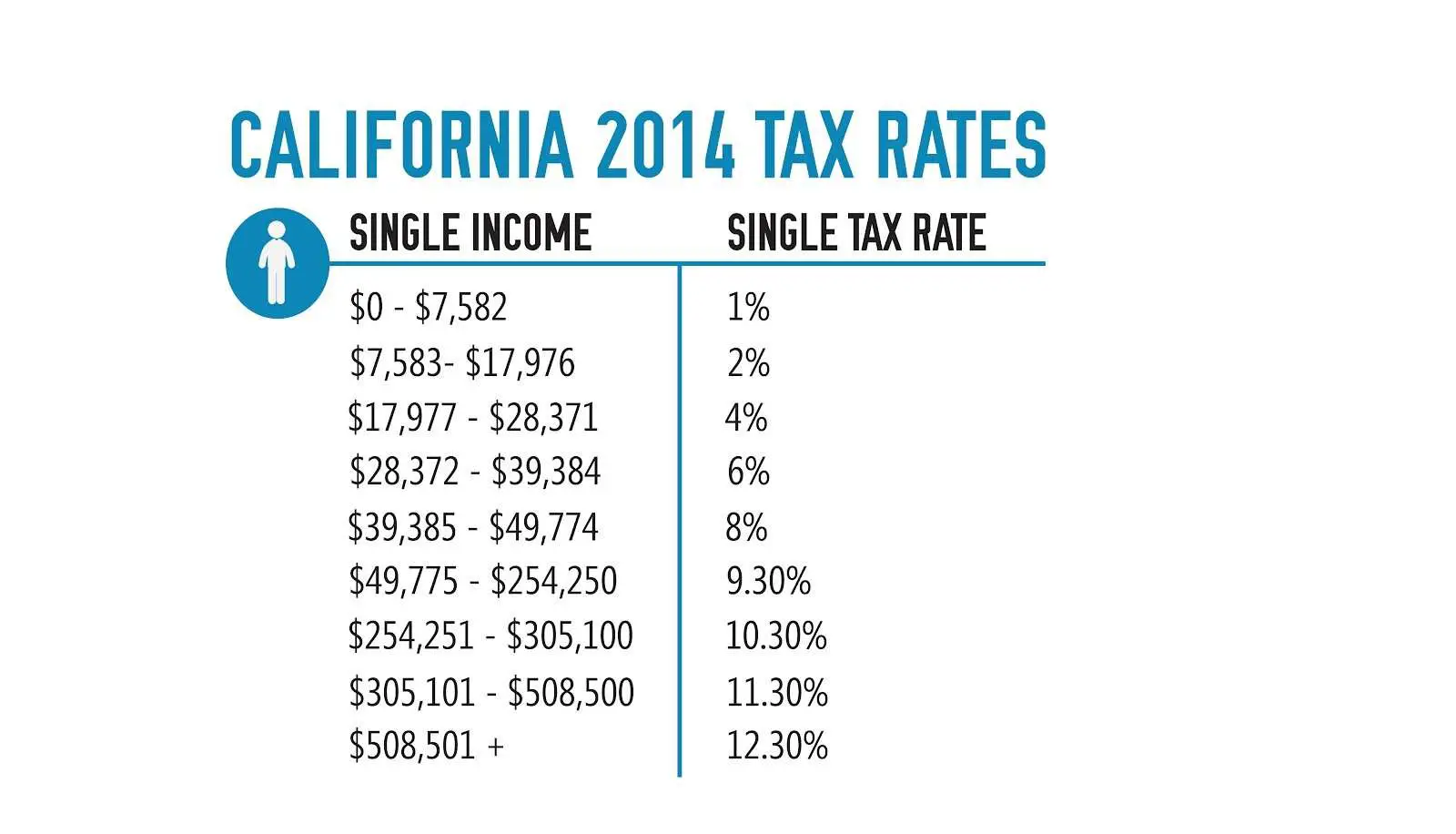

Determining Your 2020 California Income Tax Rates

California taxpayers are subject to nice progress marginal tax rate brackets. The tax brackets in California range from a low of just 1% to a high of 12.3%. Being a progressive state with a progressive income tax system, there is an additional 1% tax on incomes above $599,013, if you file as single. This is a Mental Health Services surtax that isn’t included in the marginal tax rate schedule.

AAPL , Airbnb, or even SpaceX with substantial stock options.

I am a huge fan of tax planning and tax loss harvesting. Employing tax-saving strategies are imperative for a resident of California with “high” incomes. I am putting quotes around high because you get hit with a 9.3% capital gains tax at just $58,635 of income, if you are single. Thats hardly enough income to call yourself “rich.”

Your federal taxes are paid to the IRS, while your California taxes are paid to the Franchise Tax … Board.

Federal Capital Gains Tax Brackets

Single

- 0 percent: $0 to $39,375

- 15 percent: $39,376 to $434,550

- 20 percent: $434,551 or more

- 0 percent: $0 to $39,375

- 15 percent: $39,376 to $244,425

- 20 percent: $$244,426 or more

Capital Gains Taxes in California are sky high.

California state tax rates and tax brackets

California Tax Brackets for Single Taxpayers

Taxable IncomeRate

Don’t Miss: How Much Is Sales Tax In Illinois

California Capital Gains Tax On Real Estate

One distinction in the California tax code is that there is a built-in exclusion for Real Estate owners that hold the property as a primary residence.;

The criteria that the owner needs to adhere to is that they may only possess one home dedicated as a primary residence, the owners live on the property for 2-years in a 5-year window, and the sale of the home nets less than $250,000.;

Even with this exclusion, any property sold that nets more than $250,000 will be taxed for every dollar above the threshold.;

According to the Franchise Tax Board of California, the California capital gains tax rate in 2021 allows for that exclusion if an owner meets the following criteria:

- Reside in the property for 2-years within 5-years of selling

- Properties are defined as any of the following:;

- House

Where To Send Your California Tax Return

| Income Tax Returns Franchise Tax Board |

You can save time and money by electronically filing your California income tax directly with the . Benefits of e-Filing your California tax return include instant submission, error checking, and faster refund response times. Most tax preparers can electronically file your return for you, or you can do it yourself using free or paid income tax software, like the examples listed below.

California’s free eFile program allows all California taxpayers to instantly file their income tax return over the internet. California provides several free resources for eFile users, including ReadyReturn , and CalFile, a free software program offered by the Franchise Tax Board. In addition, California supports e-filing your return through a variety of third-party software packages.

The benefits of e-filing your California tax return include speedy refund delivery , scheduling tax payments, and instant filing confirmation. If you have questions about the eFile program, contact the California Franchise Tax Board toll-free at 1-800-852-5711.

To e-file your California and Federal income tax returns, you need a piece of tax software that is certified for eFile by the IRS. While most in-depth tax software charges a fee, there are several free options available through the states, and simple versions are also offered free of charge by most tax software companies.

Don’t Miss: Where Can I Find My Agi On My Tax Return

California Median Household Income

| 2010 | $57,708 |

So what makes Californias payroll system different from the systems you might have encountered in other states? For one thing, taxes here are considerably higher. The state has nine income tax brackets and the system is progressive. So if your income is on the low side, you’ll pay a lower tax rate than you likely would in a flat tax state. Californias notoriously high top marginal tax rate of 13.3%, which is the highest in the country, only applies to income above $1 million for single filers and $2 million for joint filers.

While the income taxes in California are high, the property tax rates are fortunately below the national average. If you are thinking about using a mortgage to buy a home in California, check out our guide to California mortgage rates.

California also does not have any cities that charge their own income taxes. However, sales tax in California does vary by city and county. This wont affect your paycheck, but it might affect your overall budget.

California is one of the few states to require deductions for disability insurance. This may seem like a drag, but having disability insurance is a good idea to protect yourself and your family from any loss of earnings you might suffer in the event of a short- or long-term disability.

Are Capital Gains Taxed In California

The short answer to whether capital gains are taxed in California is yes.;

This is because the tax rate including income and capital gains are higher than most other states and is one of the ways that California generates a bunch of its annual revenue.;

California treats capital gains as an income regardless of how long the asset was held. In contrast, federal capital gains tax will consider capital made from short-term and long-term investments differently.;

This means that the average investor holding an investment may be a more financially sound strategy than buy-and-sell investments such as stocks or flipping homes.;

A more prudent approach then is to buy and hold, whether its an investment vehicle such as a stock or Real Estate, rather than looking for a quick source of income in order to benefit from various exclusions available.

Don’t Miss: How To File Federal Taxes For Free

Sales Tax Filing Frequency

The CDTFA will assign you a filing frequency. Typically, this is determined by the size or sales volume of your business. State governments typically ask larger businesses to file more frequently. See the filing due dates section for more information.

California sales tax returns and payments must be remitted at the same time; both have the same due date.

Tax On Rebates & Dealer Incentives

Dealer or manufacturer incentives are common, and they encourage buyers to choose certain models. For example, a dealer may offer a $1,500 cash rebate on a $15,000 car, so the buyer would only pay $13,500 out of pocket.

Rebates and incentives do not change the sales tax for the car. In California, the sales tax is determined by the vehicle’s original price before incentives are applied. In the example above, the buyer must pay sales tax for the initial price of $15,000.

You May Like: Can I Use Bank Statements As Receipts For Taxes

Does Nevada Have Property Tax For Seniors

While there is no general property tax exemption for seniors, there are a number of specific programs from which some retirees may benefit. The exemptions available include a veterans exemption that is available to veterans who served in active duty during a recognized war period.

Californias Overall Tax Picture

California is generally considered to be a high-tax state, and the numbers bear that out. There is a progressive income tax with rates ranging from 1% to 13.3%, which are the same tax rates that apply to capital gains.

The Golden State also has a sales tax of 7.25%, the highest in the country. With local sales taxes added on, the sales tax rate in some municipalities can climb as high as 10.25%.

Property taxes in California cant exceed 1% by law. There is no estate tax or inheritance tax.

Recommended Reading: How Do I File Colorado State Taxes

How Property Taxes In California Work

California property taxes are based on the purchase price of the property. So when you buy a home, the assessed value is equal to the purchase price. From there, the assessed value increases every year according to the rate of inflation, which is the change in the California Consumer Price Index. Remember, there’s a 2% cap on these increases.

This means that, for homeowners who have been in their house for a long time, assessed value is often lower than market value. The same is true of homeowners in areas that have experienced rapid price growth in recent years, such as San Francisco and San Jose.

Homeowners in California can claim a $7,000 exemption on their primary residence. This reduces the assessed value by $7,000, saving you at least $70 per year. You only need to claim this exemption once, and its important to do so shortly after you buy.

If you’re considering buying a home in California with a mortgage, youll want to take a look at our guide on mortgage rates and getting a mortgage in the Golden State.

A financial advisor in California can help you understand how homeownership fits into your overall financial goals. Financial advisors can also help with investing and financial plans, including taxes, homeownership, retirement and more, to make sure you are preparing for the future.

Where Can You Find Information On Your California State Refund

You can check your refund status on the California Franchise Tax Board website. You’ll need your Social Security number, ZIP code, exact refund amount, and the numbers in your mailing address. It typically takes three weeks to receive a refund if you e-filed and three months if you mailed in your return.

Also Check: How To File Past Years Taxes

Triggering California Sales Tax Nexus

The need to collect sales tax in California is predicated on having a significant connection with the state. This is a concept known as nexus. Nexus is a Latin word that means “to bind or tie,” and its the deciding factor for whether the state has the legal authority to require your business to collect, file, and remit sales tax.

How The Capital Gains Tax Is Calculated In California

In general, to determine your capital gains tax in California, you can use a simple formula that helps you calculate your gross tax rate.;

To determine your taxes related to capital gains, use this simple formula:

Don’t Miss: Do Your Own Taxes Online

Overview Of California Taxes

California has the highest top marginal income tax rate in the country. Its a high-tax state in general, which affects the paychecks Californians earn. The Golden States income tax system is progressive, which means wealthy filers pay a higher marginal tax rate on their income. Cities in California levy their own sales taxes, but do not charge their own local income taxes.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

- Our Tax Expert

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

Determining Your Responsibility To Pay Sales Tax

Also Check: Where Can I Get My Taxes Done By Aarp

Accurately Calculating Your Taxable Income Is Important

As you prepare to file your California and federal income tax returns, it is important to be certain that you are accurately reporting your taxable income and fully paying what you owe. Failing to report income from all sources, taking deductions for which you are ineligible, and otherwise evading your state and federal tax obligations whether intentionally or unintentionally can have severe consequences.

Using tax software or hiring a certified public accountant to prepare your taxes can help you avoid mistakes. However, as the taxpayer, you are the one who is ultimately responsible for ensuring that you meet your state and federal income tax obligations.

How To Use A California Car Sales Tax Calculator

If you’re a California resident or you’re looking to purchase a vehicle in the state, you should be aware of its sales tax on cars. There is a flat sales tax rate in California, but you’ll pay a different sales tax rate depending on the county you purchase your vehicle.

If you’re a California resident or you’re looking to purchase a vehicle in the state, you should be aware of its sales tax on cars. There is a flat sales tax rate in California, but you’ll pay a different sales tax rate depending on the county you purchase your vehicle. Using the California car sales tax calculator can help you figure out exactly how much a new vehicle will cost, so there won’t be any surprises when you see what you actually owe.

Don’t Miss: When Is Sales Tax Due

How To Register For A California Seller’s Permit

You can register for a California sellers permit online through the CDTFA. To apply, youll need to provide the CDTFA with certain information about your business, including but not limited to:

- Business name, address, and contact information

- Federal EIN number

- Date business activities began or will begin

- Projected monthly sales

Wise Is The Cheaper Faster Way To Send Money Abroad

Exporting or importing goods from abroad to sell in the US? Want to pay your sales tax via direct debit?

With Wise for Business, you can get a better deal for paying supplier invoices and buying goods overseas. Well always give you the same rate you see on Google, combined with our low, upfront fee so youll never have to worry about getting an unfair exchange rate.

That means you spend less on currency conversion, and have more to invest in growing your business.

Set up recurring direct debits from your Wise account, where payments will be automatically taken out on schedule. So it’s not only money you’ll be saving with Wise, but time as well.

You May Like: What Is The Sales Tax In Arkansas

How Do You Calculate California Car Sales Tax

You need to add the sum of all taxes and fees to know the total amount you’ll pay when buying a vehicle in California. You must include insurance as part of your calculation. Insurance rates vary based on a car’s power as well as other factors.

Speak with your insurance company to gain a better understanding of your car’s insurance premium. Ask the representative of the insurance company for tips on how to save on your monthly premiums. You might see a decrease in the amount you pay in sales taxes if you purchase an energy-efficient vehicle.

Use the state of California’s Department of Motor Vehicles website to help you calculate the state’s car tax. You’re encouraged to search by the zip code or by the county you reside in, per CarsDirect. You need to select the type of car you purchased and its selling price to help you make your calculation.