Deductions And Adjustments Worksheet

If you have substantial deductions and credits youre going to claim, you may be eligible to claim more allowances than you qualify for based on the personal allowances worksheet. For example, if you have a substantial mortgage interest deduction, charitable donations or education tax credits, you can use the deductions and adjustments worksheet to see if you can claim extra. This worksheet estimates how much lower your income tax liability will be because of the deductions and converts that amount to the number of allowances you should claim to approximate your tax withholding. To complete the form, you need to estimate all of your deductions and credits.

Will I Get A 2020 Tax Refund

Typically, you receive a tax refund after filing your federal tax return if you pay more tax during the year than you actually owe. This most commonly occurs if too much is withheld from your paychecks. Another scenario that could create a refund is if you receive a refundable tax credit that is larger than the amount you owe. Life events, tax law changes, and many other factors change your taxes from year to year. Use the refund calculator to find out if you can expect a refund for 2020 .

Dont Miss: Can You File Missouri State Taxes Online

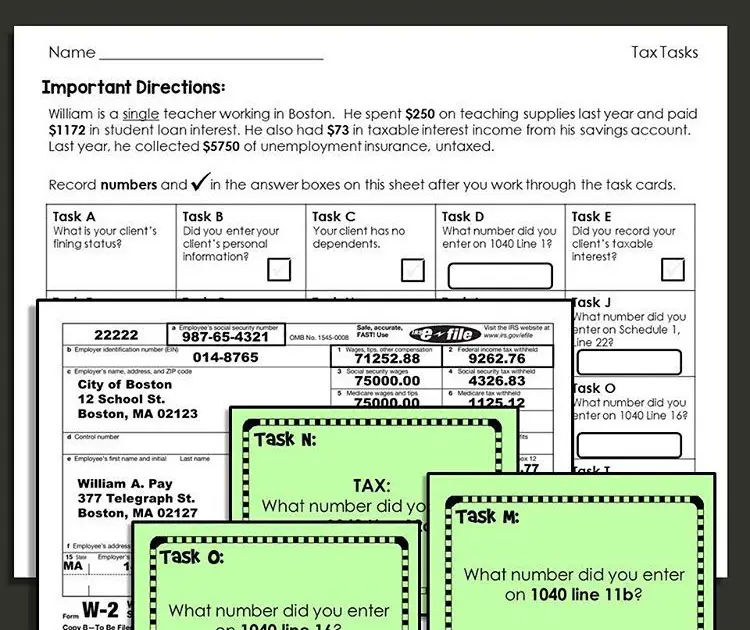

Sign Up For Electronic W2

Its safe and convenient. Your W-2 cant get lost, stolen, or misplaced and you can download/print at any time. The deadline for requesting an electronic W-2 for the 2021 tax information is .

- Go to UCPath online and click on Employee Actions > Income and Taxes > Enroll to Receive Online W-2. If the current status says CONSENT RECEIVED, no action is required you are already signed up for the electronic statement.

- Once signed up, all notifications pertaining to your W-2/W-2c will be sent to your preferred email address on file in the UCPath system make sure it is correct.

- UC does not send actual W-2 statements to employees by email or text. You SHOULD NOT open any attachments or click on any email links that claim to give access to your W-2! If you receive an email or text that has a link or an attachment for viewing your W-2, it is a phishing scam designed to gain access to your private information. All employees must sign in to UCPath to view/print their electronic W-2.

- Find more information on UCnet.

If you chose paper delivery of your W-2 it will be mailed on or before January 31. It will be identical to the version available online. Your W-2 is available online whether you opt-in or opt-out of electronic delivery

Recommended Reading: Plasma Donation Taxable

Recommended Reading: What Does Tax Credit Mean

What The Calculator Doesnt Do: Include Tax Credits

Most tax credits are based on your particular circumstances. For example, maybe you:

- Saved for retirement

We would have to ask a lot more questions to accurately forecast your tax credits. To make this calculator quick and easy to use, weâve chosen not to include them in our results.

How to check which tax credits you qualify forIf youâre not sure whether these credits apply to you, you can check by looking at your tax return from last year. The second page of your Form 1040 will list the credits you received for the year:

To find more information about the amounts listed on line 31, look at your Schedule 3, which should be included with your tax return.

If you were eligible for a tax credit last year, youâll often be eligible again this year .

âWhat happens if youâre eligible for tax credits

Being eligible for tax credits could mean that, if you make the estimated payments recommended by the calculator, youâll end up overpaying in taxes.

If that happens, youâll get the extra money back in a refund.

Changes To Irs Form W

Prior to the enactment in 2017 of the federal Tax Cuts and Jobs Act , most withholding allowances were based on personal exemptions, including those for the employee, spouse and any dependents. The TCJA made significant changes to tax rates, deductions, tax credits and withholding calculations, and changed the value of personal exemptions to zero.

As of January 1, 2020, IRS Form W-4 has been revised to reflect changes resulting from the TCJA where the withholding calculation is no longer tied to the number of personal exemptions claimed.

The TCJA did not impact Massachusetts laws regarding exemptions. To accurately determine the correct amount of Massachusetts withholding, employers will rely on Massachusetts Form M-4.

New employees are expected to complete both Form W-4 and Form M-4 for employers. It is not necessary for current employees to resubmit the federal Form W-4 unless they choose to adjust their withholding amounts. Employees who choose to make adjustments will submit both Form W-4 and Form M-4 to the employer.

Also Check: Do Your Own Taxes Online

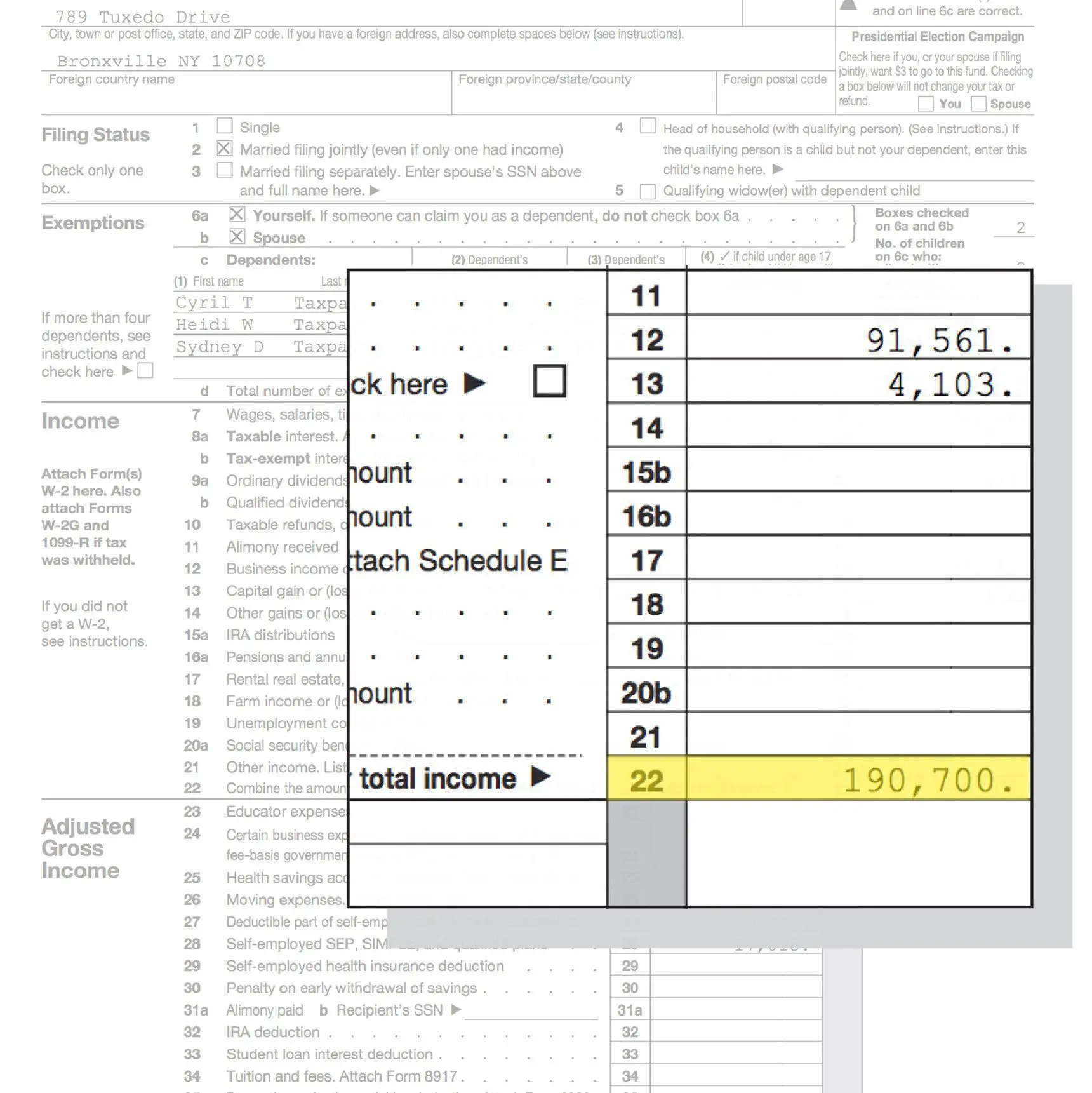

How To Calculate Agi From W

Do you want to claim your deductions and credits that are available on your tax return? To claim credits you first need to know your Adjusted Gross Income .

Want to figure out what AGI is and how can you calculate it? Then keep reading to find out!

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSUREFOR MORE INFO. Which means if you click on any of the links, Ill receive a small commission.

How Can I Claim Tax Credits

Tax credits directly reduce how much you owe the IRS. They’re either refundable or non-refundable. If the amount of a refundable credit is more than the tax you owe, the IRS will send you the difference. If your claimed credits are non-refundable, the government doesn’t send you the extra if your credits are more than what you owe.

You can claim most tax credits on Schedule 3 of the 2021 Form 1040. These include:

- The foreign tax credit

- The credit for child and dependent care expenses

- Education credits

- The retirement savings contribution credit

- Residential energy credits

- The net premium tax credit

Claiming some of these credits requires filing additional forms. Each line clearly states which form you need to use.

Some credits are claimed directly on Form 1040 rather than on a separate schedule or worksheet. These include:

You May Like: Why Do I Owe Taxes If I Claim 0

Tips For Calculating Adjusted Gross Income

If you want to calculate your adjusted gross income then these handy tips may be useful to you.

File with Ease from Home Today!

Monitoring Your Refund Status

Once youve submitted your return, the waiting begins. This can be excruciating if you need the money. If you submitted electronically, you should have already received a notification that your return was submitted and approved. After 24 hours have passed, you can start watching the IRSs Wheres My Refund? page, which generally updates every night.

To get started with Wheres My Refund? youll need your Social Security number, filing status and the exact amount of your refund. Once you have a notification that your refund has been processed, you can log into your bank account, provided you chose direct deposit, and wait until it appears as pending. If you sent your return by postal mail, your wait will be considerably longer. The IRS directs you to begin checking the Wheres My Refund? page four weeks after you put it in the mail.

For electronic filers, if 21 days pass and your refund still isnt in your account, call the IRS to check on it. There may be questions about your return. Paper filers will need to wait six weeks to pick up the phone. You should also make a phone call if you get a message to call when you check your status on the Wheres My Refund? page.

Don’t Miss: How Can I Check My Income Tax Refund Status

State And Local Income Taxes

Many states, as well as some cities and counties, have their own income taxes. These are collected in addition to the federal income tax. States that have a state income tax require that you file a separate state tax return, as they have their own rules. If you’re curious about a particular states tax system and rules, visit one of our state tax pages.

How To Figure Out Your Short

Capital gains tax can apply to short-term or long-term capital gain. This section will break down the differences between short-term and long-term capital gain taxes to help you figure out how these terms apply to your assets and affect your tax rate.

Short-Term Capital Gains Taxes

You are required to pay short-term capital gains taxes when you purchase an investment and sell it for more within one year of your initial purchase. In other words, you need to pay short-term capital gains taxes whenever you sell an investment after not much time. In general, short-term capital gains tax rates can be more than the tax rates for long-term capital gains to help incentivize investors to hold onto their investments for longer periods.

Your income tax rate, which is based on your household income, determines how much you are allowed to be taxed on short-term capital gains. You will have to add your short-term capital gains to your income before determining your tax rate rather than determining your tax rate with just your income. The increased taxable income due to short-term capital gains could transition you to a higher tax bracket, which you should consider before deciding whether to sell an investment and realize your gains.

Long-Term Capital Gains Taxes

On the opposite end of the spectrum, long-term capital gains tax applies to paying taxes on profits for investments. Youve held those investments for over one year in this case.

Recommended Reading: Do Your Taxes Online Free

Also Check: How Much Of Paycheck Goes To Taxes

Penalty For Failure To Pay Or Underpayment Of Estimated Tax

Revised Statute 47:118authorizes a penalty for failure to pay or underpayment of estimated income tax. The penalty is 12 percent annually of the underpayment amount for the period of the underpayment.

Determination of the Underpayment Amount

Determination of the Underpayment PeriodThe underpayment period is from the date the installment was required to be paid to whichever of the following dates is earlier:

Notification of Underpayment of Estimated Tax Penalty

File An Amended Return

If you receive your W-2 after you file your return, you can easily amend your return with the more up-to-date information by filing a Form 1040X, Amended U.S. Individual Income Tax Return. If you underpaid taxes, there may be a small penalty. However, you will not be penalized for filing a late return if you use Form 4852 and file your return by the deadline.

You May Like: When Do My Taxes Have To Be Done

Line 712 Part Iv Tax Payable

Dividends subject to Part IV tax

The following types of dividends are subject to Part IV tax:

- taxable dividends from corporations that are deductible under section 112 when you calculate taxable income

- taxable dividends from foreign affiliates that are deductible under paragraphs 113, , , or , or subsection 113 when you calculate taxable income

Taxable dividends received are only subject to Part IV tax if the corporation receives them while it is a private or subject corporation. Taxable dividends received from a non-connected corporation are subject to Part IV tax.

Taxable dividends received from a connected corporation are subject to Part IV tax only when paying the dividends generates a dividend refund for the payer corporation.

The Part IV tax rate is 38 1/3%.

Definitions

A private corporation is a corporation that is:

- resident in Canada

- not controlled by one or more public corporations

- not controlled by one or more prescribed federal Crown corporations

- not controlled by any combination of prescribed federal Crown corporations and public corporations

ReferenceSubsection 89

Subject corporation

A subject corporation is a corporation, other than a private corporation, that is resident in Canada and is controlled by or for the benefit of either an individual other than a trust, or a related group of individuals other than trusts.

ReferenceSubsection 186

The following types of corporations are exempt from Part IV tax:

ReferenceSection 186.1

Request A State Copy Of Your W

If your employer withheld state taxes from your wages, you might be able to get a duplicate W-2 from your state revenue agency. The cost of a duplicate W-2 from the state might be less than ordering a copy of your entire tax return from the IRS. There may be drawbacks, however. For instance, duplicate W-2s from the California State Controllers Office are available for only up to the last four years.

References

You May Like: 1040paytax Customer Service

Read Also: How To Contact Credit Karma Tax By Phone

Withholding: How Its Calculated

At this point you may be thinking, OK. Well Im in the __% tax bracket, and its obvious that my employer is withholding way more than that!

Youre probably right. Thats because your employer isnt just withholding for federal income tax. Theyre also withholding for Social Security tax, Medicare tax, and state income tax.

The Social Security tax is calculated as 6.2% of your earnings, and the Medicare tax is calculated as 1.45% of your earnings. Before youve even begun to pay your income taxes, 7.65% of your income has been withheld.

Your refund is determined by comparing your total income tax to the amount that was withheld for federal income tax. Assuming that the amount withheld for federal income tax was greater than your income tax for the year, you will receive a refund for the difference.

EXAMPLE: Nicks total taxable income is $32,000. He is single. Using the tax table for single taxpayers, we can determine that his federal income tax is $3,641.

Over the course of the year, Nicks employer withheld a total of $8,500 from his pay, of which $4,000 went toward federal income tax. His refund will be $359 .

Work Out How Big Your Tax Refund Will Be When You Submit Your Return To Sars

INCOMEOTHER INCOMETAX PAIDTo get this refund you need to fill out your tax return 100% correctly.Please note that this is only an indicator of an estimated refund.TaxTim cannot be held liable for this refund not being received.Get SARS Tax Dates and Deadlines in your InboxDo your Tax Return in 20 minutes or less!TaxTim will help you:

Read Also: How To Pay Taxes Throughout The Year

Which Assets Qualify For Capital Gains Treatment

Capital gains taxes apply to what are known as capital assets. Examples of capital assets include:

- Real property used in your trade or business as rental property

Also excluded from capital gains treatment are certain self-created intangibles, such as:

- Literary, musical, or artistic compositions

- Letters, memoranda, or similar property

- A patent, invention, model, design , or secret formula

The Tax Cuts and Jobs Act, passed in December 2017, excludes patents, inventions, models, designs , and any secret formulas sold after Dec. 31, 2017, from being treated as capital assets for capital gain/capital loss tax purposes.

Also Check: What Is The Deadline For Filing Taxes In 2021

Federal Income Tax Brackets 2022

The taxable income rate for single filers earning up to $10,275 is 10 percent, and for joint married filers is 10 percent tax on income up to $20,550.

Income between $10,276 to $41,775 for single filers, and $20,551 to $83,550 for joint filers is taxed at 12 percent.

There is a 22 percent tax applied to income between $41,776 to $89,075 for single filers, and $83,551 to $178,150 for joint filers.

The tax rate for income earned between $89,076 to $170,050 for single tax filers and $178,151 to $340,100 for joint tax filers is 24 percent.

Income tax rates for earnings between $170,051 to $215,950 for single and $340,101 to $431,900 for joint filers is set at 32 percent.

There is a 35 percent tax rate applied to earnings between $170,051 to $215,950 for single filers and $340,101 to $431,900 for joint filers.

And, income earned over $539,900 for single tax filers and over $647,850 for joint filers is taxed at a 37 percent rate.

Recommended Reading: Can You Do Your Own Taxes Online

Stay On Top Of Tax Season Calculate Your W

Its not a good idea to keep waiting around until January to start backtracking and calculating your W2s.

Every time you earn, you can calculate the income from your paystub.

If the numbers on your pay stub and your W2 dont quite match up, then review your calculations and go back.

The great thing about using a pay stub generator is that its calculator is FREE!

You simply have to purchase and redeem it if youre happy with the result.