How To Calculate Taxes Taken Out Of A Paycheck

Calculations, however, are just one piece of the larger paycheck picture.

Tennessee Median Household Income

| 2010 | $41,461 |

You won’t pay any state income tax earned in Tennessee. You also won’t have to pay any local income taxes, regardless of which city you reside in.

Prior to 2021, Tennessee levied a flat tax on income earned from interest and dividends. This was called the “Hall Income Tax” after Sen. Frank Hall, the senator who sponsored it in 1929. At its peak, this tax rate used to be 6%, but a bill signed in 2016 by Governor Bill Haslam set the Hall Income Tax on a track to get repealed by 2021. The tax rate was lowered by 1% each year, meaning it was 1% in 2020, 2% in 2019, 3% in 2018 and so on. So as of Jan. 1, 2021, the Hall Income Tax is fully repealed, meaning Tennessee now has no income taxes of any kind.

While you won’t feel a significant impact from a traditional state income tax in Tennessee, the downside is that Tennessee sales tax rates deal a tough hit to taxpayers’ cash flows during the year. Tennessee residents pay the highest overall sales tax nationwide, with rates ranging from 8.50% to 9.75% depending on where you live. This doesn’t affect your paycheck, but your wallet will feel it whenever you make a purchase.

A financial advisor in Tennessee can help you understand how taxes fit into your overall financial goals. Financial advisors can also help with investing and financial plans, including retirement, homeownership, insurance and more, to make sure you are preparing for the future.

Bottom Line On Tax Returns

An accurate income tax return estimator can keep you from banking on a refund thats bigger in your mind than the real refund that hits your bank account. It can also give you a heads-up if youre likely to owe money. Unless youre a tax accountant or someone who follows tax law changes closely, its easy to be surprised by changes in your refund from year to year. Use the tool ahead of time so you arent already spending money you may never see. You can also run the numbers through a tax refund calculator earlier in the year to see if you want or need to make any changes to the tax withholdings from your paycheck.

You May Like: When Do Non Profits File Taxes

The Federal Income Tax

The federal personal income tax that is administered by the Internal Revenue Service is the largest source of revenue for the U.S. federal government. Nearly all working Americans are required to file a tax return with the IRS each year and most pay taxes throughout the year in the form of payroll taxes that are withheld from their paychecks.

Income taxes in the U.S. are calculated based on tax rates that range from 10% to 37%. Taxpayers can lower their tax burden and the amount of taxes they owe by claiming deductions and credits. Below, well take a closer look at the most important IRS tax rules to help you understand how your taxes are calculated.

Adjust Gross Pay For Social Security Wages

Now that you have gross wages, we can take a closer look. Before you calculate FICA withholding and income tax withholding, you must remove some types of payments to employees.

The types of payments not included from Social Security wages may be different from the types of pay excluded from federal income tax.

For example, if you hire your child to work in your business, you must take out the amount of their pay when you calculate Social Security withholding but don’t take it out when calculating federal income tax withholding.

Here’s another example: Your contributions to a tax-deferred retirement plan plan should not be included in calculations for both federal income tax or Social Security tax.

IRS Publication 15 has a complete list of payments to employees and whether they are included in Social Security wages or subject to federal income tax withholding.

Recommended Reading: How To File State Taxes By Mail

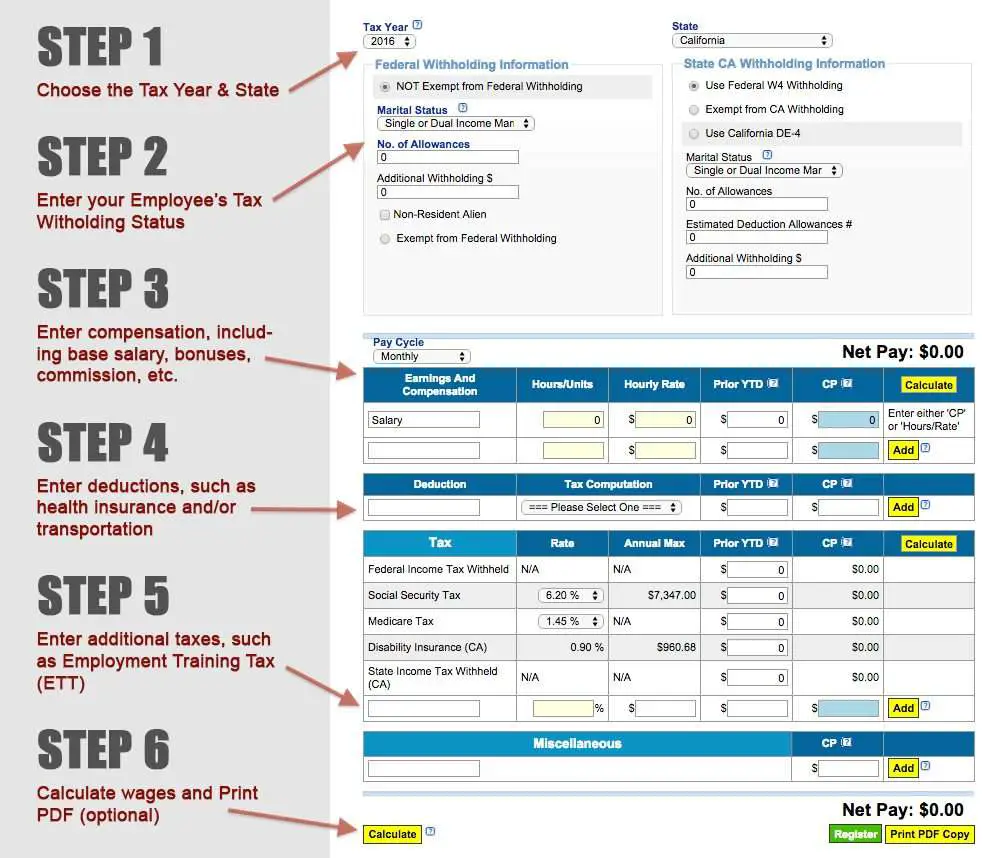

How To Calculate Payroll Taxes: Step

If youre a small business owner trying to figure out how to calculate payroll, youre not alone. Over six million small businesses in the U.S. are in the same boat as you. They all have fires to put out, employees to pay, futures to plan, and little to no time to grapple with the IRS tax code.

The good news is that although the tax code may seem complicated, once you figure out what tax filings are required and learn how to do the math, the process is fairly straightforward. With that being said, calculating payroll taxes correctly is critical not only to your employees but also to your accountant and Uncle Sam. Thats why we decided to write this in-depth guide on how to calculate payroll taxes, step by step.

You should be able to find all the answers to your payroll questions here, but if you hit a wall or simply want to take payroll taxes off of your to-do list, we also offer a simple payroll service that does the heavy lifting for you.

Penalty For Underpayment Of Estimated Tax

If you didnt pay enough tax throughout the year, either through withholding or by making estimated tax payments, you may have to pay a penalty for underpayment of estimated tax. Generally, most taxpayers will avoid this penalty if they owe less than $1,000 in tax after subtracting their withholdings and credits, or if they paid at least 90% of the tax for the current year, or 100% of the tax shown on the return for the prior year, whichever is smaller. There are special rules for farmers, fishermen, and certain higher income taxpayers. Please refer to Publication 505, Tax Withholding and Estimated Tax, for additional information.

However, if your income is received unevenly during the year, you may be able to avoid or lower the penalty by annualizing your income and making unequal payments. Use Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts , to see if you owe a penalty for underpaying your estimated tax. Please refer to the Form 1040 and 1040-SR Instructions or Form 1120 Instructions PDF, for where to report the estimated tax penalty on your return.

The penalty may also be waived if:

Also Check: Do You Pay Sales Tax On Out Of State Purchases

Calculate Employee Tax Withholdings

Once you know an employees gross pay and the number of allowances from their W-4, you can start figuring out how much you need to withhold to cover their taxes. In most states, youll need to withhold for both federal and state taxes and FICA taxes from each paycheck.

In our example, we will look at a Florida employee who claims a single marital status and two dependents on their W-4. The employee earns a $50,000 annual salary and is paid twice per month . Her gross pay per period is $2,083.33.

How Rental Income Is Taxed

by G. Brian Davis | Last updated Sep 6, 2022 | Personal Finance, Real Estate Investing, Spark Blog |

Real estate investments can offer some huge tax breaks if used wisely. In fact, some investors opt for real estate specifically for the tax breaks!

But how is rental income taxed? What other taxes do landlords and real estate investors pay? How can you avoid the worst of these taxes?

Leave your watch calculator at the door, and well break down rental property taxes in laymans terms.

You May Like: When Will Irs Refund Unemployment Taxes

Overview Of Texas Taxes

Texas has no state income tax, which means your salary is only subject to federal income taxes if you live and work in Texas. There are no cities in Texas that impose a local income tax.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

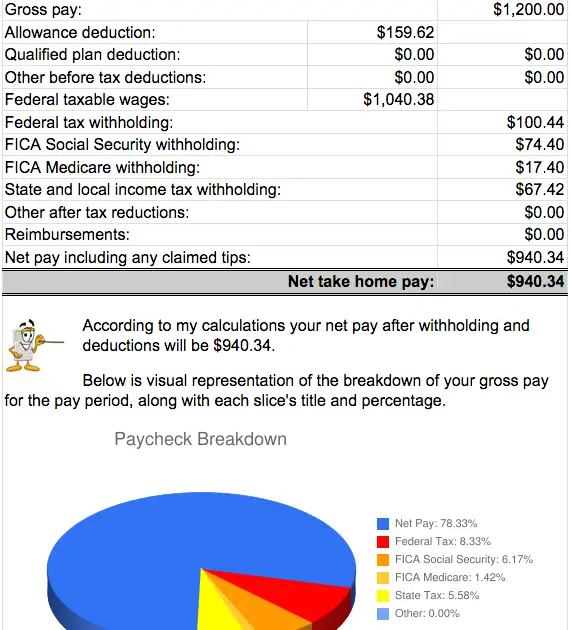

An Example Of An Employee Pay Stub

In the case of the employee above, the weekly pay stub would look like this:

| Employee Pay Stub |

|---|

You must make deposits with the IRS of the taxes withheld from employees’ pay for federal income taxes, FICA taxes, and the amounts you owe as an employer. Specifically, after each payroll, you must:

- Pay the federal income tax withholding from all employees

- Pay the FICA tax withholding from all employees, and

- Pay your half of the FICA tax for all employees.

Depending on the size of your payroll, you must make deposits monthly or semi-weekly.

You must also file a quarterly report on Form 941 showing the amounts you owe and how much you have paid.

If you have many employees or don’t have the staff to handle payroll processing, you might want to consider a payroll processing service to handle paychecks, payments to the IRS, and year-end reports on Form W-2.

Recommended Reading: Do You Have To Pay Taxes On Plasma Donations

Coronavirus Tax Relief For Self

Coronavirus Aid, Relief, and Economic Security Act permits self-employed individuals making estimated tax payments to defer the payment of 50% of the social security tax on net earnings from self-employment imposed for the period beginning on March 27, 2020 and ending December 31, 2020. This means that 50% of the social security tax imposed on net earnings from self-employment earned during the period beginning on March 27, 2020, and ending December 31, 2020, is not used to calculate the installments of estimated tax due. Please refer to Publication 505, Tax Withholding and Estimated TaxPDF, for additional information.

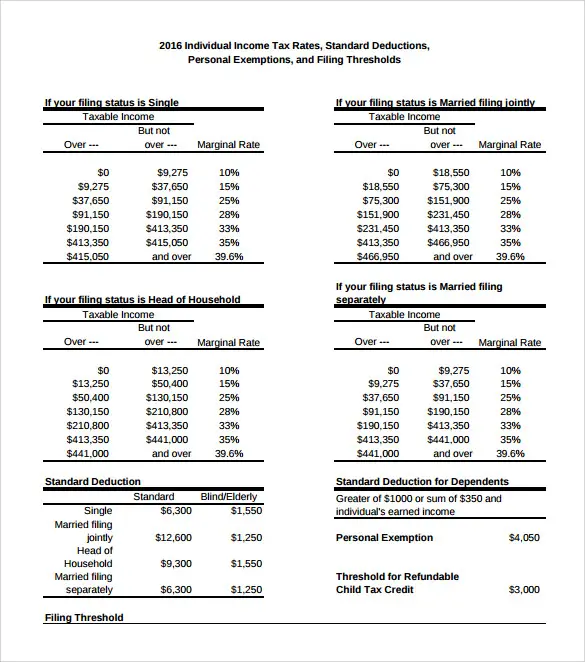

More About Tax Brackets

What Is My Tax Bracket?

The federal income tax system is progressive, which means different tax rates apply to different portions of your total income. Tax bracket refers to the highest tax rate charged on your income.

What Are Tax Tables?

Tax tables like the one above, help you understand the amount of tax you owe based on your filing status, income, and deductions and credits.

Tax brackets only apply to your taxable income. Your deductions and taxable income may drop you into a lower tax bracket or potentially a higher one.

Taxable Income vs. Nontaxable Income

Income comes in various forms, including wages, salaries, interest, tips and commissions. Nontaxable income wont be taxed, whether or not it is entered on your tax return.

File faster and easier with the free TurboTax app

- Limited interest and dividend income reported on a 1099-INT or 1099-DIV

- IRS standard deduction

- Earned Income Tax Credit

- Child tax credits

* More Important Details and Disclosures

Read Also: How Do You Calculate Tax

How To Calculate Your Tax Refund

Every year when you file your income taxes, three things can happen. You can learn that you owe the IRS money, that the IRS owes you money or that youre about even, having paid the right amount in taxes throughout the year. If the IRS owes you money it will come in the form of a tax refund. However, if you owe the IRS, youll have a bill to pay. SmartAsset’s tax return estimator can help you figure out how much money could be coming your way, or how much youre likely to owe.

Why would the IRS owe you a tax refund? There are several possible scenarios. You might have overpaid your estimated taxes or had too much withheld from your paycheck at work. You might also qualify for so many tax deductions and tax credits that you eliminate your tax liability and are eligible for a refund. A tax return calculator takes all this into account to show you whether you can expect a refund or not, and give you an estimate of how much to expect.

Why Is It Important To Have Accurate Paychecks

Having accurate paychecks isnt just important for employees. Its an essential part of operating your business legally. Fail to pay employees fairly under federal, state, or local laws, and you may find yourself facing thousands of dollars in fines. Underpaying employee overtime is one of the most common labor law violations businesses commit. If you live in California, New York, or Texas, where local laws go beyond federal requirements, youll want to be especially diligent.

Don’t Miss: How Much Is Georgia State Tax

Employers Federal Unemployment Tax Return

Some states may require that you fileunemployment taxes at various timesthroughout the year.

But the federal unemployment tax return is filed annually.

The due date for the Form 940 is January 31.

If you have deposited all of your FUTA taxon time however,you are given until February 10th to file.

As with all due dates, if the date falls on a Saturday,Sunday, or a federal holiday,you can file on the next business day.

As you’ve learned with employment taxes,FUTA tax also has rules on when you must deposit taxes.

If at the end of any calendar quarter you owe,but have not yet deposited, more than $500 in FUTA tax,you must deposit the FUTA tax by the last day of the firstmonth after the quarter ends.

If the accumulated tax at the end of anyof the first three quarters is $500 or less,you do not have to deposit the amount. Instead,you may carry it forward and add it to the liabilitycalculated in the next quarter to seeif you must make a deposit.

Remember all of this information is in IRS Publication 15.

How Much Is The Standard Deduction

Next, subtract your standard deduction. For taxpayers who are single or married filing separately, the standard deduction is $12,950 in 2022. For those who are married and filing jointly, the standard deduction is $25,900 in 2022. Heads of households have a standard deduction of $19,400 in 2022.

The standard deduction is higher for taxpayers who are age 65 or older, or who are blind.

The resulting number should be very close to your taxable income. This is the total that will be used to determine your federal and state tax brackets.

You May Like: What Is An Able Account For Taxes

Why Would A Refund Be A Bad Thing

Receiving a tax refund actually means you gave the IRS more from your paycheck than you had tomoney that you could otherwise have spent on bills, pleasure, retirement savings, or investments. The IRS held onto that extra money for you all year. It’s just returning it to you when you get a tax refundwithout interest. It would have served you better in a simple savings account.

Calculating Withholding: Percentage Method

If the employee’s wages are greaterthan the amount in the last wage bracket of the wage tables,or if you do not want to use the wage bracket tables,you can use the percentage method.

This method works for any number of withholdingallowances the employee claims on any amount of wages.

To calculate withholding by the percentage method,you will again use IRS Publication 15-T. Usingthe percentage method table,multiply 1 withholding allowance for yourpayroll period by the number of allowancesthe employee claims on the Form W-4.

Then subtract that amount from the employee’s wages.

Next find the amount to withhold from the tablesfor the percentage method of withholding.

Understanding wages for employment taxpurposes is not easy.

Remember to start with IRS Publication 15,to answer most of your questions relatedto compensation.

Read Also: How To Check Last Year Tax Return

How To Check Your Withholding

Use the IRS Withholding Estimator to estimate your income tax and compare it with your current withholding. Youll need your most recent pay stubs and income tax return.

The results from the calculator can help you figure out if you need to fill out a new Form W-4 for your employer. Or, the results may point out that you need to make an estimated tax payment to the IRS before the end of the year.

If you adjusted your withholding part way through 2021, the IRS recommends that you check your withholding amounts again. Do so in early 2022, before filing your federal tax return, to ensure the right amount is being withheld.

How You Can Affect Your Texas Paycheck

If you want to boost your paycheck rather than find tax-advantaged deductions from it, you can seek what are called supplemental wages. That includes overtime, bonuses, commissions, awards, prizes and retroactive salary increases. These supplemental wages would not be subject to taxation in Texas because the state lacks an income tax. However, they will be subject to federal income taxes.

The federal tax rate for supplemental wages depends on whether your employer rolls them in with your regular wages or disburses them separately. They can either be taxed at your regular rate, or at a flat rate of 22%. If your normal tax rate is higher than 22% you might want to ask your employer to identify your supplemental wages separately and tax them at that 22% rate.

You May Like: Do Dependents Need To File Taxes