Reaching The Irs Online

Be Prepared To Identify Yourself And Your Accounts

When you’re ready to call, you’ll want to have some basic info and forms on hand to help the conversation go smoothly. First, you’ll need to be able to identify yourself.

“I’m sure this sounds silly, but you’ll need to have your name, date of birth, and your social security number ready,” Oware says.

If you’re , say an elderly parent, you’ll need to have proof of power of attorney showing you have the permission and authority to do so before getting information about that individual’s account.

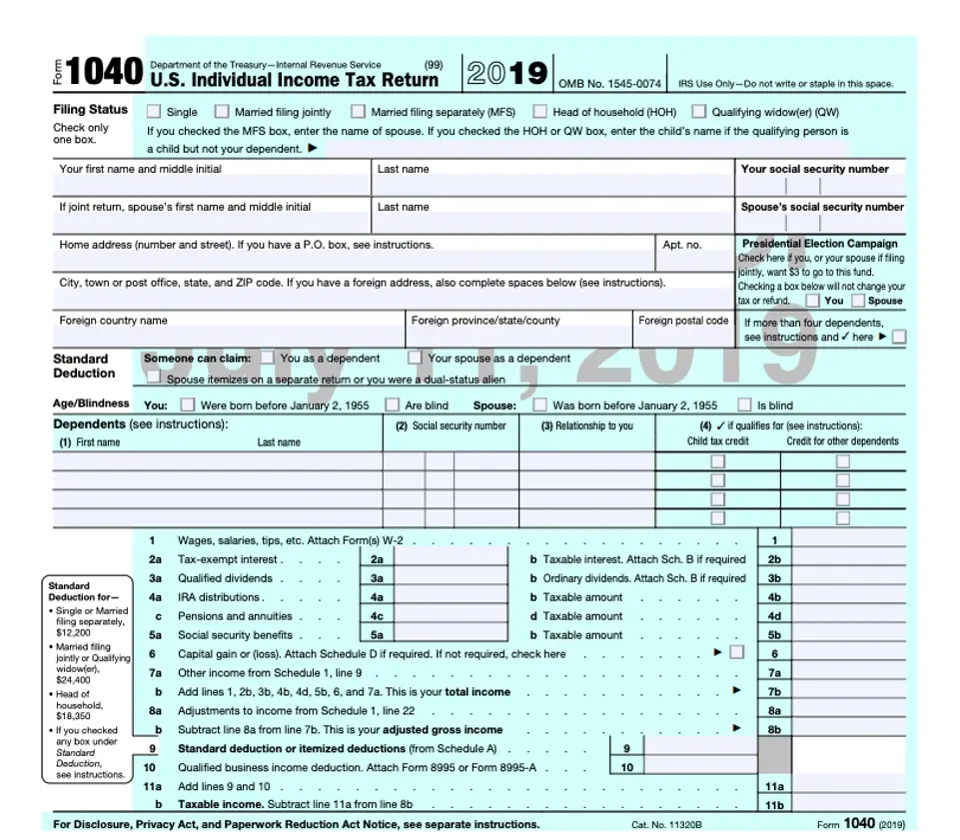

Once you’ve identified yourself, it’s down to the nitty-gritty. You should have the following forms on hand in a pinch:

- Your completed tax return

- Your EIN or Tax Payer Identification number

- Proof of past payments if you’ve made quarterly payments or put money toward a debt to the IRS

“The better prepared you are, the more efficient the phone call will be,” McCreary says.

Ken Griffin Says Three

Billionaire hedge fund manager Ken Griffin has filed a lawsuit against the Internal Revenue Service alleging that someone at the agency illegally leaked his tax returns to the news site ProPublica last year.

Griffin, the founder and CEO of Citadel, accused the IRS and the Treasury Department of breaching privacy laws after ProPublica published tax information of billionaires including Tesla CEO Elon Musk, Amazon founder Jeff Bezos and real estate mogul Stephen Ross.

The Post has sought comment from the Treasury Department, which has vowed to investigate the leak.

ProPublica titled The Secret IRS Files last year examining thousands of tax returns belonging to the wealthiest Americans.

The site reported that between 2013 and 2018, Griffin, whose net worth is estimated by Forbes to be $31.9 billion, reported an average annual income of almost $1.7 billion, but paid a tax rate of just 29.2% far lower than the top marginal income tax rate of nearly 40%.

ProPublica found that other moguls worth billions managed to avoid income tax entirely for years by claiming substantial losses in their businesses.

The IRS made these unlawful disclosures knowingly, or at the very least negligently or with gross negligence, Griffins lawsuit, which was filed in Miami federal court on Tuesday, states.

Griffin is seeking $1,000 for each act of unauthorized disclosure as well as unspecified damages.

ProPublica has not specified precisely how it obtained the information.

Don’t Miss: Is Life Insurance Tax Deductible

Respond Rapidly For Faster Refund

All income tax returns go through fraud detection reviews and accuracy checks before we issue any refunds. We might send you letters asking for more information.

- Fraud Detection: The Tax Commission uses a variety of methods to validate your identity and tax return to detect and combat tax identity theft. To help protect taxpayer information and keep taxpayer dollars from going to criminals, we might send you:

- An Identity Verification letter that asks you to take a short online quiz, provide copies of documents to verify your identity, or state that you didnt file a return.

- A PIN letter that asks you to verify online whether you or someone you authorized filed the tax return we received.

When Preparing To Contact The Irs Be Sure To Have The Following Information Available

When Calling About Your Own Account

- Social Security cards and birth dates for those who were on the return you are calling about

- An Individual Taxpayer Identification Number letter if you dont have a Social Security number

- Filing status Single, Head of Household, Married Filing Joint or Married Filing Separate

- Your prior-year tax return

- A copy of the tax return youre calling about

- Any letters or notices sent to you by the IRS

When Calling About Someone Elses Account

- Verbal or written authorization to discuss the account

- The ability to verify the taxpayers name, SSN/ITIN, tax period, form

- IRS PTIN or PIN if you are a third-party designee

- A current, completed, and signed Form 8821, Tax Information Authorization or a completed and signed Form 2848, Power of Attorney and Declaration of Representative

What Does the IRS Help With?

The IRS can assist with concerns such as

Filing requirements/ status/ dependents/ exemptions

|

Department of the Treasury Internal Revenue Service Fresno, CA 93888-0045 |

For certain types of debts, the IRS has the authority to garnish your tax refund.

Common reasons that the IRS will garnish your refund include

- You owe money for back taxes

- You defaulted on a federal student loan

- You owe money for child support

- You filed a joint return and your spouse has outstanding debt

Recommended Reading: How To Get Copies Of Old Tax Returns

We Received Your Return And May Require Further Review This May Result In Your New York State Return Taking Longer To Process Than Your Federal Return No Further Information Is Available At This Time

Once we receive your return and begin to process it, our automated processing system scans it for any errors or signs of fraud. Depending on the result of that scan, we may need to manually review it. This status may update to processing again, or you may receive a request for additional information. Your return may remain in this stage for an extended period of time to allow us to review. Once your return goes back to the processing stage, we may select it for additional review before completing processing.

Expect High Call Volumes

Once you call, make yourself comfortable. “During filing season, the IRS notes that phone service wait times can average 15 minutes or more,” McCreary says. You can shorten your wait time by calling later in the week and early in the mornings, McCreary says. The IRS reports that Mondays have the highest call volume, and things get hectic after 10 a.m. You’ll also see an uptick in wait time around April 15 as everyone scrambles to file.

You can streamline your call by contacting the correct office off the bat, McCreary says. Some common departments include:

- Individual tax helpline: 800-829-1040

- To order tax forms: 800-829-3676

- International Taxpayer Service Call Center: 267-941-1000

You May Like: How Soon Can I File My 2020 Taxes

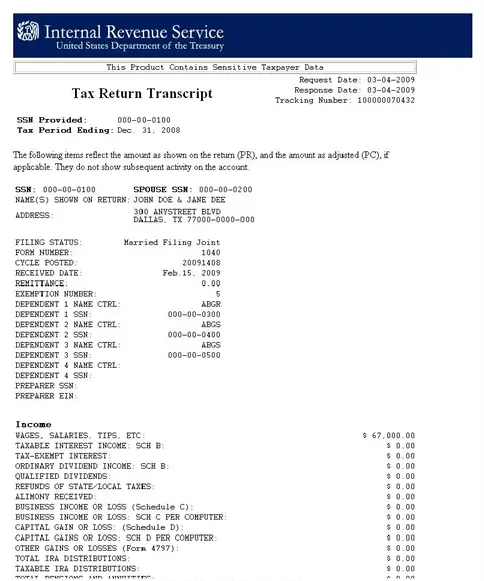

Copies Of Actual Tax Returns

Certified tax transcripts are acceptable to many, if not most, financial institutions as proof of your filing. However, on some occasions, a third party may request a copy of your actual tax return rather than a computer printout detailing the information you reported. Or, you may simply prefer to have such a photocopy for your records. In either case, the IRS can provide a copy to you for the past few years of filings.

Tip

The IRS makes copies of tax returns available for anywhere from the past three to the past 10 years, depending on the type of information requested. In general, the tax account transcript covers the longest time period.

You May Like: Do I Have To Pay Taxes On My Unemployment

What To Do If You Owe Back Taxes

Nationally Recognized Tax Resolution Attorney – Providing Innovative Solutions to IRS Tax Dilemmas

Paying taxes is a fact of life, but when the amount is excessive, you may not have the funds to pay in full. Making a mistake on your taxes can be costly as well, and if you plug in the wrong numbers, the IRS will surely come calling.

Whether you owe money to the IRS due to an innocent oversight, a lack of funds, or something else, ignoring the problem will not make it go away.

Once you owe money to the IRS, the clock is ticking, and all the while penalties and compounded interest will be piling up. So what should you do if you owe back taxes? Here are some critical steps to take.

Recommended Reading: Are Debt Settlement Fees Tax Deductible

What You Need To Know About Irs Phone Scams

Generally, the IRS does not call taxpayers there are exceptions to this rule, but typically, by the time the IRS calls, you should have received several letters or notices from the IRS.

Unfortunately, scam artists frequently call people, say they’re from the IRS, and then demand payment. To protect yourself, you must know the signs of an IRS phone scam. If any of the following occur, the person on the phone is probably a scammer:

- Demanding immediate payment of your tax debt.

- Requiring payment over the phone, especially in the form of a prepaid debit card, gift card, or wire transfer.

- Threatening to call the police or immigration officials.

How The Treasury Offset Program Works

Here’s how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then TOP will send the entire amount to the other government agency. If you owe less, TOP will send the agency the amount you owed, and then send you the remaining balance.

Here’s an example: you were going to receive a $1,500 federal tax refund. But you are delinquent on a student loan and have $1,000 outstanding. TOP will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.

Recommended Reading: Do I Owe Nc State Taxes

When To Contact The Irs

1. IRS Audit

One of the most common reasons why tax filers contact the IRS is due to receiving a dreaded IRS audit letter. If you receive one, try not to panic as most tax issues are simple to fix. Before you contact the IRS, start by finding out what section of your tax return the government wants to audit. Once you know what the auditor is questioning, you can start gathering the requested information. An audit doesn’t always indicate a problem. You may be getting audited for one of the following reasons:

Random selection and computer screening

This type of IRS audit is selected based solely on a statistical formula. The IRS compares your tax return against “norms” for similar returns. The IRS develops these “norms” from audits of a statistically valid random sample of returns.

Related examinations

The IRS may select your returns when they involve issues or transactions with other taxpayers, such as business partners or investors, whose returns were selected for an audit.

2. Missing W-2

Missing tax forms such as a W-2 is another popular reason why filers contact the IRS. However, if you haven’t received your form by mid-February, there are a few options available to you, including contacting the IRS.

Contact your Employer. Ask your employer for a copy. Be sure they have your correct address.

Why You Would Need To Call The Irs

According to the IRS, the IRS website should be your first resource for help and information because of the sheer volume of calls. The IRS will not address the following issues on the phone:

- You have questions about tax law

- You have transcript requests

- You need IRS forms

- You want to check your refund status, but its been less than 21 days since you filed

- You have complaints about your taxes or tax-related issues

You may want to call the IRS and speak with an actual person if:

- You received a notice from the IRS

- You will miss a deadline set by the IRS and need to request more time. For example, extensions for paying off your tax balance, to send more information, or to respond to a notice from the IRS.

- Wheres My Refund? says you need to call

- You require the amount you need to pay off for tax purposes

- You have questions about your IRS payment plan

- You want to know the status of any IRS action

- You need to confirm that the IRS received your payment

- You lost, never received, or received an incorrect Form W-2 and/or Form 1099-R

You May Like: How Do I File My Taxes Electronically

Check Your Refund Status Online

Next, you’ll want to point your web browser to the IRS refund status tool. Click the link to “Check My Refund Status” at this page on the IRS website to access the tool.

You can also find your refund status using the free IRS2Go app, but the web page worked just fine for me and I didn’t have to download anything to make it work.

You’ll need to enter your Social Security number, select your filing status, and enter your refund amount from step 1 to get your result.

Lean On Your Tax Professional

If you worked with an enrolled agent or accountant to file your taxes, contact them to get further insight into your issue with the IRS. They may not be able to speed up delays in the IRS system, but they can help you decipher notices from the agency and call on your behalf if further information is needed.

If you havenât worked with a tax professional before and want extra help figuring out your situation, you might consider contacting one in your area. Expect to pay a fee for their services if youâre a new client, as the accountant or tax preparer will need time to get familiar with your situation before calling on your behalf.

You May Like: How To Pay Your State Taxes

The Main Way To Contact Irs Customer Service

The most common and most popular way to contact IRS customer service and reach a real human is to call the main phone number: 829-1040. Thats the primary IRS phone number listed on the IRS website, and it will get you to a live human eventually.

If that number sounds familiar, theres a reason. Look at the last four digits again. Ending the number in 1040, the digits associated with the most common individual tax filing form, is a clever touch and it might just help you remember the number in a pinch.

The primary phone number is connected to the IRS customer service center, which operates from 7 a.m. to 7 p.m. local time, in the words of the IRS itself. Since local time looks different from coast to coast, its safe to assume that this number will operate from 7 a.m. Eastern to 10 p.m. Eastern . Residents of Alaska and Hawaii are advised to follow Pacific time.

How To Avoid Irs Imposter Scams

There are things you can do to protect yourself from an IRS imposter scam.

Do:

- Beware if someone calls claiming to be from the IRS. The IRS will always contact you by mail before calling you about unpaid taxes.

- Ask the caller to provide their name, badge number, and callback number. Then call TIGTA at 1-800-366-4484 to find out if the caller is an IRS employee with a legitimate reason to contact you. If you confirm that the caller is from the IRS, call them back. Otherwise, report the scam call to TIGTA.

- Become familiar with what fraudulent IRS email messages look like. Review a sample IRS phishing email.

- Verify the number of the letter, form, or notice on the IRS website.

- Be suspicious of threats. The IRS wont threaten to have police arrest you for not paying a bill.

Dont:

- Dont give in to demands to pay money immediately. Be especially suspicious of demands to wire money or pay with a prepaid debit card.

- Dont trust the name or phone number on a caller ID display that shows IRS.Scammers often change the name that shows on caller ID using a technique called spoofing.

- Dont click on any links in email or text messages to verify your information.

Don’t Miss: What Is The Deadline For Filing Taxes In 2021