What Can Slow Down Your Refund

- Your return was selected for additional review. As refund fraud resulting from identify theft has become more widespread, were taking extra steps to review all individual income tax returns we receive to be sure refunds go to the rightful owners. Additional safeguards can mean that it takes us longer to process your refund. However, our goal is to stop fraudulent refunds before theyre issued, not to slow down your refund. Learn more about our refund review process and what we’re doing to protect taxpayers.

- Missing information or documents. If we send you a letter requesting more information, please respond quickly so we can continue processing your return.

- Errors on your return. We found a math error in your return or have to make another adjustment. If the adjustment causes a different refund amount than you were expecting, we will send you a letter to explain the adjustment.

- Problems with direct deposit. If you requested direct deposit, but the account number was entered incorrectly, your bank won’t be able to process the deposit. When this happens, your bank notifies us, and we will manually re-issue your refund as a check. This process could take up to 2 weeks between the time we receive notification from the bank and when you receive the check.

How Can I Update My Address/ E

Login to the income tax e-filing portal, go to My Profile Settings, then proceed to Update Contact Details. Update the required details of Address/ E-mail ID/ Mobile Number and then click on Submit. The requisition might take some time to update your profile. Hence, wait for at least 15 days before reapplying for an update.

How To Use The Income Tax Departments E

You May Like: Where Is My Agi On My Tax Return

How Can I Check The Status Of My Refund

You can check the status of your refund online by using our Wheres My Refund? web service. In order to view status information, you will be prompted to enter the social security number listed on your tax return along with the exact amount of your refund shown on line 34 of Form D-400, Individual Income Tax Return.

Recommended Reading: Are Donations To St Jude Tax Deductible

What Is The Phone Number For The Irs

Phone support from the IRS is currently very limited. If you have questions about payments that affect the economy, call 8009199835. Where is my refund? Are you waiting for a refund? The IRS gives more than 9 out of 10 refunds in less than 21 days. 4 weeks after sending the paper declaration. Where is my refund? They invite you to contact us.

Recommended Reading: How Do I File An Extension On My Taxes

How Long Do Tax Refunds Take

Your tax refund speed depends on how you filed and how you requested your refund.

If you filed electronically, your refund will usually come faster because your states department of revenue can automatically check your tax return and process your refund. Paper tax returns usually have to be processed by hand, and when everyone is filing at the same time, it takes a while to get through them all.

Similarly, a direct deposit refund goes faster because the computers can automatically send it to your bank account. Paper checks have to be printed, put in envelopes, and then sent through the mail system.

If you filed electronically, you can usually expect your tax refund to be approved in 1-3 weeks. Direct deposits usually come 2-3 business days later, while a paper refund check can take an additional 2-3 weeks.

If you filed by mail, it often takes 4-8 weeks for your state to process your individual income tax return and approve your refund. After that, add 2-3 days business days for direct deposit and 2-3 weeks for paper checks.

Can I Call The Irs If Im Waiting On My Refund

Its best to locate your tax transcript or try to track your refund using the Wheres My Refund tool . The IRS says that you can expect a delay if you mailed a paper tax return or had to respond to the IRS about your electronically filed tax return. The IRS makes it clear not to file a second return.

The IRS says not to call the agency because it has limited live assistance. The agency is juggling the tax return backlog, delayed stimulus checks and child tax credit payments. Even though the chances of speaking with someone are slim, you can still try. Heres the best number to call: 1-800-829-1040.

Read Also: What Is Tax In Texas

What If My Refund Was Lost Stolen Or Destroyed

Generally, you can file an online claim for a replacement check if it’s been more than 28 days from the date we mailed your refund. Where’s My Refund? will give you detailed information about filing a claim if this situation applies to you.

For more information, check our Tax Season Refund Frequently Asked Questions.

I Still Dont Have My Refund What Should I Do Next

If you have waited the maximum number of weeks it should take to process a refund, we encourage you to check the status of your return or refund online one more time before contacting the Department.

Please note that our tax examiners do not have information about the status of your refund beyond what is available to you from our website. Although the Department is always available to answer your questions and concerns, calling us will not speed up the process. If you would still like to contact the Department, you may reach us at:

Phone: 828-2865 or .

Our staff is working hard to process your return. Our precautions may increase processing time, and we would like to ask for your patience as we strive to provide the protection you have come to expect and deserve.

We appreciate your patience and welcome your feedback to help us continue to improve our services.

Don’t Miss: Is It Hard To Do Your Own Taxes

Estimate Your Federal Tax Refund With The Last Pay Stub Of The Year

When workers receive their last pay stub of the tax year, they are likely wondering if they will receive a tax refund for the year and, if so, by how much. Most taxpayers know completing their income tax return is complex and challenging even with all the information they need, such as W-2 forms and receipts for other income and eligible deductions. However, even without this information, a taxpayer can make an educated guess as to whether they will receive a tax refund or not, including the amount, by using the information on their last pay stub.

Recommended Reading: Why Would My Taxes Be Rejected

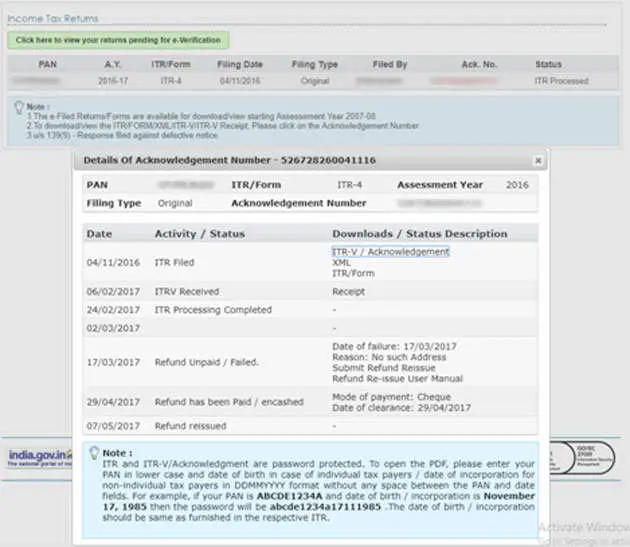

How To File A Refund Re

Only the pre-validated bank account will be refunded. After receiving communication from CPC, taxpayers can file a service request in the e-Filing portal if their refund is denied. Here are steps to follow to file the request-

- Select New Request as the Request Type and Refund Reissue as the Request Category. Click the Submit button.

- PAN, Return Type, Assessment Year , Acknowledgement No, Communication Reference Number, Reason for Refund Failure, and Response are among the details displayed.

- Choose the bank account to which the tax refund will be credited and press the Continue button. Bank Account Number, IFSC, Bank Name, and Account Type are displayed for the taxpayer to cross-check.

- If the details are correct, click Ok in the popup, and the e-Verification options appear in the dialogue box. Select the appropriate e-Verification mode, To proceed with the request submission, generate and enter an Electronic Verification Code /Aadhaar OTP.

- A success message will be displayed, confirming the submission of the Refund Re-issue request.

Recommended Reading: When Can You File Your Taxes 2021

How To File Income Tax Returns

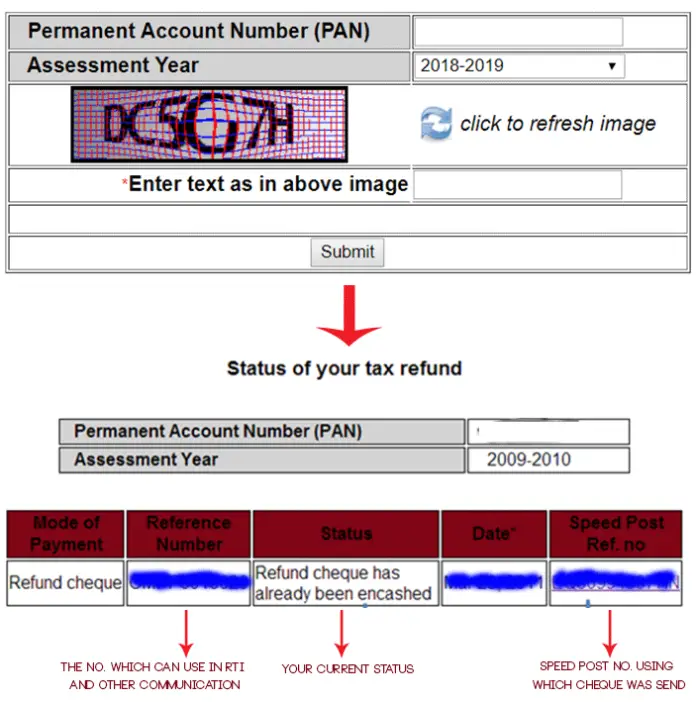

If you have filed your income tax return and are expecting a refund, you can check the status of your refund by following these steps:

If you have not received your refund after a reasonable amount of time, you can contact the Income Tax Departments customer care center for assistance.

Its important to note that the Income Tax Department may take some time to process your refund, especially if you have made any errors in your ITR or if there are any discrepancies in your tax records. Its a good idea to keep track of your refund status so that you know when to expect your refund.

Know How To Check Income Tax Refund Status

Blog»Know How to Check Income Tax Refund Status

The income tax department offers us an online facility for tracking the status of refunds. You can do this by filling in details in the income tax refund form through the Income Tax departments website. also do this on the TIN NSDL website. Your PAN number and assessment year should be accurate to check the status of your IT return. You are eligible for an income tax refund if you pay more than the actual amount of tax liability for the financial year. Income tax refund status can be viewed 10 days after the department sends the refund. Read on for a step-by-step guide that will provide information on how to check income tax refund status

Don’t Miss: When Are Tax Returns Due This Year

Income Tax Refund How To File A Refund Re

For a variety of reasons, an income tax refund scheduled to be paid in a specific assessment year may fail to be credited to your bank account. You can only file a refund re-issue request on the income tax e-filing portal if the income tax department fails to credit your refund after processing your ITR. here is how to file a income tax refund re-issue request.

How New Jersey Processes Income Tax Refunds

Beginning in January, we process Individual Income Tax returns daily. Processing includes:

Generally, we process returns filed using computer software faster than returns filed by paper. Electronic returns typically take a minimum of 4 weeks to process.

Processing of paper tax returns typically takes a minimum of 12 weeks.

We process most returns through our automated system. However, staff members do look at some returns manually to see whether the taxpayer filed income, deductions, and credits correctly.

In some cases, they will send a filer a letter asking for more information. In such cases, we cannot send a refund until the filer responds with the requested information.

Returns that require manual processing may take longer regardless of whether the return was filed electronically or by paper.

To mitigate the spread of COVID-19, staffing is extremely limited and may delay the timeframe to review refund requests.

Please allow additional time for processing and review of refunds.

| Sorry your browser does not support inline frames. |

You May Like: How Do I File Taxes If I Work For Myself

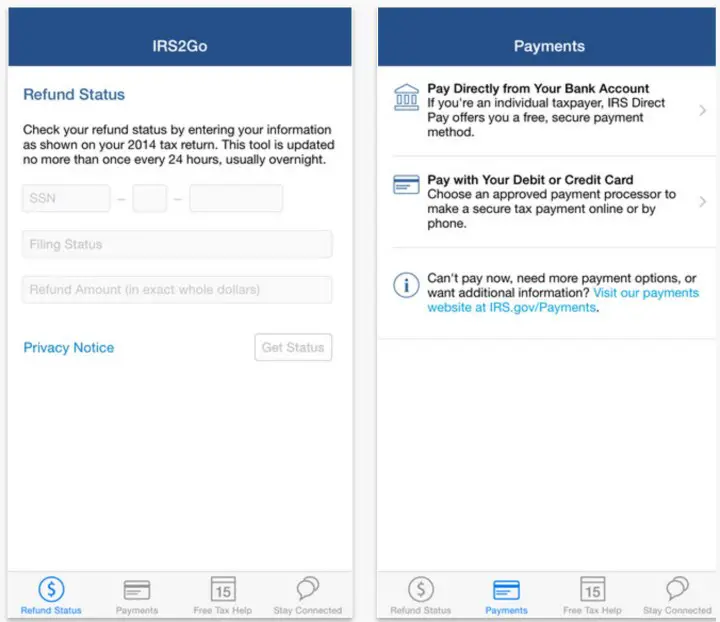

Heres How Taxpayers Can Check The Status Of Their Federal Tax Return

IRS Tax Tip 2021-70, May 19, 2021

The most convenient way to check on a tax refund is by using the Wheres My Refund? tool. Taxpayers can start checking their refund status within 24 hours after an e-filed return is received. The tool also provides a personalized refund date after the return is processed and a refund is approved.

Dont Miss: What Is Income Tax Return

We Have Received Your Return And It Is Being Processed No Further Information Is Available At This Time

This is a general processing status. Unless your return is selected for additional review, or we request additional information, this will be your status throughout processing until we schedule an issue date and update your status at that time. While your return is in this stage, our Call Center representatives have no further information available to assist you. As your refund status changes, this message will automatically update in our automated phone system, our online Check your refund status application, and in the account information available to our representatives.

Also Check: What States Do Not Have State Income Tax

How To Claim Income Tax Refund

A taxpayer can claim income tax refund as per Section 237 of Income Tax Act, 1961. Earlier, Form 30 was required to claim income tax refund. But with the advent of e-transfer of refunds, Form 30 is no longer required. It can now be simply claimed by filing the ITR and verifying the same, either physically or electronically within 120 days of filing. However, do ensure that the tax paid in excess is reflected in Form 26AS. In case the excess tax paid by you as per your ITR filing is not reflected in the annual tax statement, your refund claim may be rejected by the assessing officer.

How Can I Check My State Refund Status

You can check your refund status by visiting the website for your states department of revenue. Most states have a Wheres My Refund tool similar to the IRS.

If you filed online, it usually takes anywhere from 24 hours to a week for your tax return to show as received.

If you filed by mail, you may not see a refund status for 2-4 weeks or even longer. When you file by mail, your tax return has to go through the postal system first. Then it could spend a few days or weeks in your tax departments mailroom or warehouse before a worker updates it in the system as accepted.

If youre worried about making sure your paper tax return arrived, you may want to use a mailing option with tracking.

Read Also: Can I Pay My Pa State Taxes Online

Claiming A Vermont Refund

To claim a refund of Vermont withholding or estimated tax payments, you must file a Form IN-111, Vermont Income Tax Return. You have up to three years from the due date of the return, including extensions, to file a claim for overpayment of tax due.

If the information on your return does not match the information available to the Department, your refund may be delayed. The Department may be waiting for information from your employer or the IRS for data verification. If we need additional information from you before issuing your refund, we will contact you in writing with instructions on how to respond either online through myVTax or in writing.

For tips on how to avoid the filing errors which commonly delay refunds, see Where’s My Vermont Income Tax Refund?

If you have an unclaimed refund from other tax years, find out how to claim it.

If you chose direct deposit for your refund, you may see your refund a few days after your status has been updated to Weve released your refund. Your financial institution may have additional processing times. If you chose to receive your refund by check, then it may take a few weeks to receive your refund by mail.

Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

at 1-800-829-1040

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

Read Also: Can I File My Taxes Online Now

If You Do Not Have A Personal Tax Account

You need a Government Gateway user ID and password to set up a personal tax account. If you do not already have a user ID you can create one when you sign in for the first time.

Youll need your National Insurance number and 2 of the following:

- a valid UK passport

- a UK driving licence issued by the DVLA

- a payslip from the last 3 months or a P60 from your employer for the last tax year

- details of your tax credit claim

- details from your Self Assessment tax return

- information held on your credit record if you have one

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

- Federal taxes were withheld from your pay

and/or

- You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

Read Also: How Much Tax Is Taken Out Of Social Security