What Happens If My Family Size Or Income Changes During The Year

Life-changing events can impact your tax credit eligibility by either increasing or decreasing the amount that you are allowed to claim. Events that can affect your premium tax credits may include:

- Change in your household income

- Gaining or losing health insurance coverage

Since the marketplace determines your tax credit, it is important to report changes immediately so your health plan eligibility can be updated. And if you’re currently using the advance premium tax credit, then it is particularly important to report any life changes to the marketplace as soon as possible.

If you wait to report such changes, there may be discrepancies between what you paid and what you should pay. In this case, if you used more advance premium tax credits than you are allowed, you may have to pay back money when filing your federal income tax return. On the other hand, if you used less than allowed, you may get an added refund. This is known as “reconciling” your advance premium tax credits.

How To Claim The Tax Credit

To claim the ACA tax credit, attach Form 8941, Credit for Small Employer Health Insurance Premiums, to your annual business tax return . Form 8941 helps you calculate the amount of the tax credit you can receive.

The premium tax credit is only available for two consecutive years. If your tax credit is more than the amount of taxes you owe, you can carry the unused amount back to previous tax years or forward to the next year.

Nonprofit organizations can receive a refundable tax credit. This means that nonprofit, tax-exempt organizations can receive cash for unused credit.

What Is The Health Insurance Tax Credit

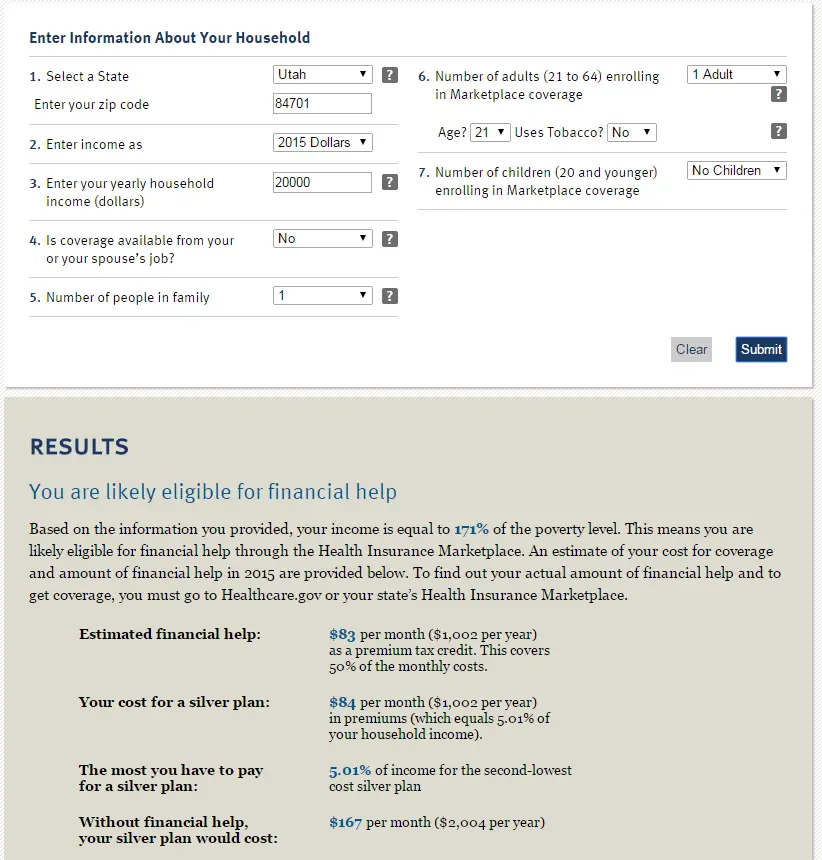

The Health Insurance Tax Credit is a refundable tax credit available to certain individuals and families who purchase health insurance through the Health Insurance Marketplace. The credit is based on the cost of the health insurance premium and the number of persons covered by the policy. To be eligible for the credit, taxpayers must meet certain income and coverage requirements.

Read Also: Are 529 Plan Contributions Tax Deductible

How To Qualify For The Small Business Health Care Tax Credit

You must enroll your employees in a group health insurance plan via SHOP, and well explain that in detail shortly. Beyond that, your business will qualify for this income tax credit for health insurance if:

Note that you dont need to offer health insurance to part-time staff, and you dont need to offer it to spouses or dependents.

Premium Tax Credit Filing: Avoiding A Rejected Return

Be sure to attach Form 8962 to your return, if you, your spouse, or your dependent had ACA Marketplace coverage at some point in the year and received theAdvance Premium Tax Credit. Attaching the form can help you avoid your return being rejected when you e-file .

To help you complete Form 8962, the health insurance exchange will send you Form 1095-A. Cant find your Form 1095-A? You can get a copy from www.healthcare.gov or your states exchange portal if you received coverage from a state exchange.

If you dont believe you had Marketplace insurance, you can attach a statement to your e-filed return stating that you did not have Marketplace coverage.

Related Topics

Donating household goods to your favorite charity? Learn the ins and outs of deducting noncash charitable contributions on your taxes with the experts at H& R Block.

You May Like: How Much Should I Put Aside For Taxes 1099

How Do I Get The Health Insurance Tax Credit

If you had Marketplace health insurance in 2020, you may be able to claim the premium tax credit on your taxes. The premium tax credit is a government subsidy that helps eligible taxpayers pay for their Marketplace health insurance. You can claim the premium tax credit for yourself, your spouse, and any eligible dependent children.

To be eligible for the premium tax credit, you must:-Have household income below a certain level-Not be eligible for other types of health insurance coverage -Have filed a federal income tax return for the year in question

If your income changes during the year and it affects your eligibility for the premium tax credit, be sure to report these changes to the Marketplace as soon as possible so that your subsidies can be adjusted accordingly.

How Do I Get The Money From A Tax Credit

When you sign up for health insurance in a Marketplace, you’ll have a few choices for how you’d like to use the money from a tax credit.

- You can use it in advance. In this case, you don’t receive any money directly. Instead, the IRS sends a monthly payment to your insurance company to pay part of your premium. You pay the rest of the premium directly to your insurer.

- You can split the money between premiums and a tax refund. You choose how much of the credit you want to go toward your premium each month. You get the rest of the credit as a tax refund.

- You can pay all of the premium yourself and apply the tax credit to your taxes. When you file your taxes, you can subtract the full amount of your tax credit from the tax you owe. If you don’t owe any taxes, then you’ll get a bigger refund.

Read Also: Are Donations To Hillsdale College Tax Deductible

T2201 Disability Tax Credit Application Form

T2201

Disability Tax Credit T2201 Canada

Skip to content T2201 Disability Tax Credit Application Form We Help Canadians with Disabilities get the Money They Deserve The Disability Tax Credit is a non-refundable tax credit that helps people with disabilities or the people that support them by reducing the amount of income tax they pay. This tax credit is meant to help offset the cost of unavoidable expenses that come from living with a disability.

Before someone can be deemed eligible to receive the tax credit, they must first fill out the T2201 Disability Tax Credit form, which can be downloaded from the Government of Canadas website. Once the application is complete, it must be submitted to the Canada Revenue Agency for review. In your T2201 form, you must provide incontrovertible proof to the CRA that you are living with a severe or prolonged mental or physical disability that is keeping you out of the workforce.

Many Canadians choose to fill out the form themselves, but because the process is so demanding, their application ends up being denied. Without an experienced disability tax service company their corner, many applicants fail to convince the CRA that they have a severe or prolonged mental or physical disability. When applicants fill out their T2201 form without the requisite knowledge of what the CRA looks for in a Disability Tax Credit application, they submit a form that is incomplete or not persuasive.

t2201 disability tax credit form medical practitioners

Policy Options For Improving Financial Assistance

Several legislative proposals introduced in the previous Congress would significantly improve the ACAs subsidies, reducing both premiums and out-of-pocket costs for subsidized consumers. H.R. 5155, introduced by Representatives Frank Pallone, Richard Neal, and Bobby Scott , would significantly increase both premium tax credits and cost sharing assistance, lowering net premiums for subsidized ACA consumers to closer to Massachusetts levels. The bill would also extend subsidies to people above 400 percent of the poverty line.

Legislation introduced by Senator Elizabeth Warren would make similar changes. Other proposals would make more limited but targeted improvements, for example lowering premiums for young adults . All of these proposals would advance the goals of expanding coverage and making premiums and out-of-pocket costs more affordable for those who are already insured.

| Appendix Table: Non-Elderly Uninsured, by Income, 2017 |

|---|

| State |

Recommended Reading: How To File An Oregon Tax Extension

The Small Business Health Care Tax Credit

The Small Business Health Care Tax Credit exists to help offset the costs of group health insurance plans for employees. For small business owners, this federal income tax credit can be worth up to 50% of your yearly investment in group health insurance for employees. Non-profit organizations can get an income tax credit up to 35% of their investment in group health insurance.

Small business owners have a lot on their plate. A huge part of your success relies on employee retention, human resources issues, and your ability to navigate income taxes.

Consider this unbiased article your Ultimate Guide to the Small Business Health Care Tax Credit. Its aimed at entrepreneurs and new small business owners, but any human resources manager or more experienced business owner will find it enlightening.

Well start with the most practical information, like how to qualify for this small employer income tax credit, and how to claim it on your taxes. Then well explore the history of Affordable Care Act

You can jump to:

Lets begin with a better understanding of how this valuable income tax credit works.

Health Coverage & Your Federal Taxes

- If you had Marketplace coverage at any point during 2021, youâll use your Form 1095-A to “reconcile” your 2021 premium tax credits when you file your taxes.

- If you got excess advance payments of the premium tax credit

A tax credit you can take in advance to lower your monthly health insurance payment . When you apply for coverage in the Health Insurance Marketplace®, you estimate your expected income for the year. If you qualify for a premium tax credit based on your estimate, you can use any amount of the credit in advance to lower your premium.

for 2021, youâll have to report the excess APTC on your 2021 tax return or file Form 8962, Premium Tax Credit .

- If youâre claiming a net Premium Tax Credit for 2021, including if you got an increase in premium tax credits when you reconciled and filed, you still need to include Form 8962.

- If you submitted your 2021 tax return electronically but it was rejected for a missing Form 8962, see how to fix it and correctly file electronically.

- Visit IRS.gov for more information on filing your 2021 taxes with excess APTC.

You May Like: When Should I Get My Taxes

How To Claim The Small Business Health Care Tax Credit At Tax Time

Per the IRS, youll fileform 8941 when filing your business income taxes to claim the Tax Credit.

Thanks to the magic of the internet, many small business owners use tax preparation services like TurboTax, H& R Block, FreeTaxUSA and the like. They should include this form for small organizations. But you should do your due diligence as a business owner. Double-check that your return includes this form.

If you use a professional Certified Public Accountant , remind them of your small employer status and the Small Business Health Care Tax Credit. CPAs are only human, after all, and they get busy at tax time. It would be an expensive mistake to forget this healthcare tax credit for small employers.

See If You Qualify For Savings

Enrolling in a Small Business Health Options Program plan is generally the only way for a small business or non-profit to claim the Small Business Health Care Tax Credit. To qualify for the tax credit, all of the following must apply:

- You have fewer than 25 full-time equivalent employees

- Your average employee salary is about $56,000 per year or less

- You pay at least 50% of your full-time employees’ premium costs

- You offer SHOP coverage to all of your full-time employees.

IMPORTANT

The IRS has released guidance on qualifying for the Small Business Health Care Tax Credit that may apply to small employers in areas with no available SHOP plans. Learn more.

Recommended Reading: Can I Claim Child Care On My Taxes

Is A Tax Credit A Refund

Refundable tax credits are called refundable because if you qualify for a refundable credit and the amount of the credit is larger than the tax you owe, you will receive a refund for the difference. For example, if you owe $800 in taxes and qualify for a $1,000 refundable credit, you would receive a $200 refund.

How The Small Business Health Insurance Tax Credit Works

The health insurance tax credit is available to small businesses that pay at least half the cost of single coverage for their employees. If your business and your plan meet the qualifications, you can get a credit of up to 50% of the health insurance premiums you paid for employees, but not for yourself as the business owner.

To be eligible for the small business health insurance tax credit, you must:

- Have fewer than 25 full-time equivalent employees

- Have average wages that are lower than $56,00

- Pay these premiums using an IRS-qualified arrangement generally an arrangement that requires you to pay a uniform percentage of the premium cost for each enrolled employees health insurance coverage

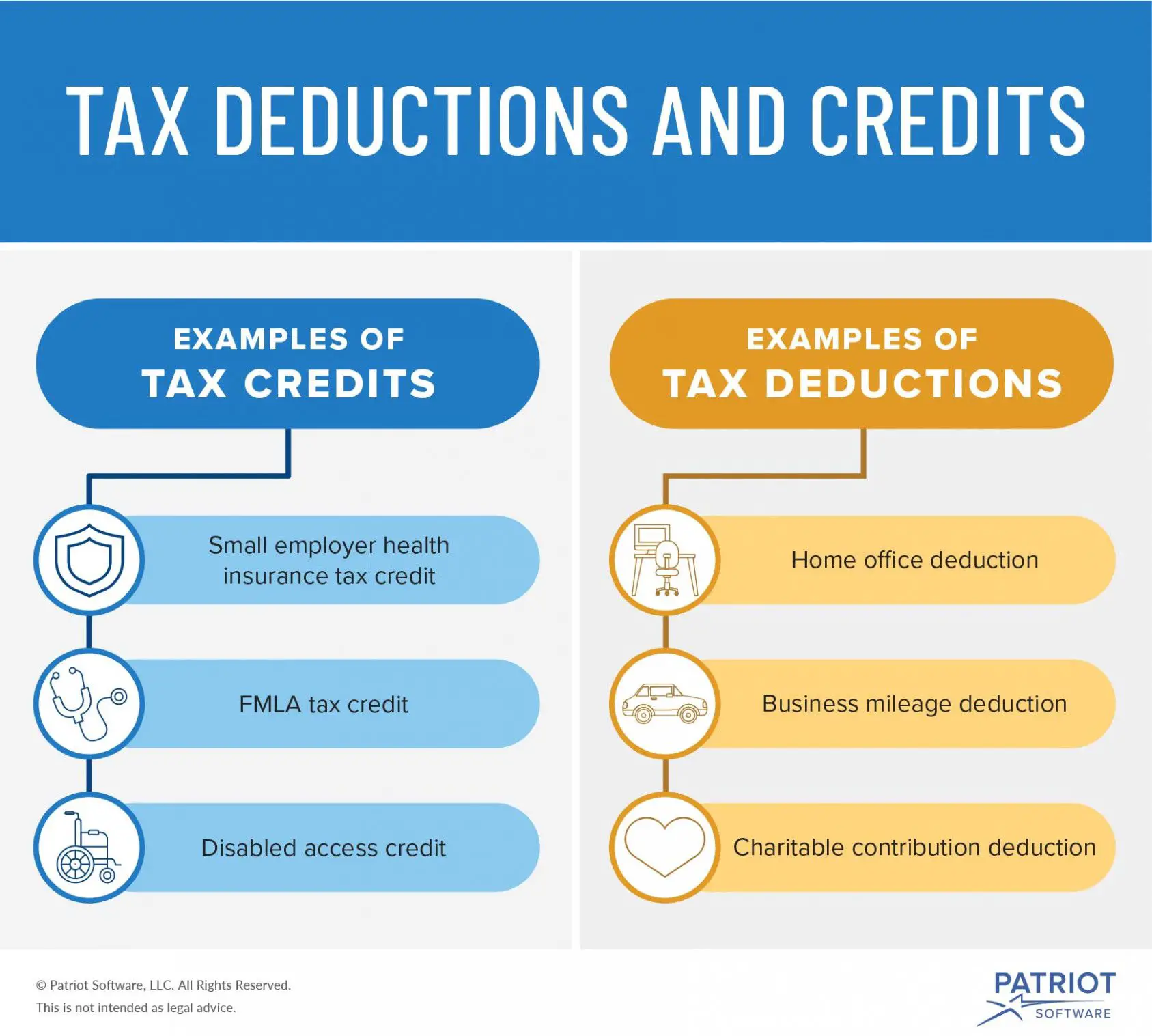

If you are self-employed and your business was profitable during the year, you can get a tax deduction for yourself, your spouse, and your dependents. A tax deduction differs from a tax credit in that a deduction reduces your taxable income thus, the value of the deduction depends on the taxpayers marginal tax rate, which rises with income. A self-employed health insurance deduction is available for the costs of medical insurance, dental insurance, and long-term care policies. You can deduct these costs up to the total of your self-employment gross income.

Recommended Reading: How Do I Get My Taxes From Last Year

Review: Your Deductible Vs Out

To understand how a catastrophic plan works, itâs important to review a couple of key health insurance concepts: your deductible vs your out-of-pocket maximum.

Just about every health insurance plan has a deductible. Thatâs the amount of money you need to spend on your health expenses before your insurance starts paying for anything. A higher deductible means you will have more out-of-pocket expenses before insurance starts sharing costs with you.

Recession-proof your money. Get the free ebook.

Get the all-new ebook from Easy Money by Policygenius: 50 money moves to make in a recession.

Get your copy

The out-of-pocket maximum, also called the out-of-pocket limit, is the most you will ever have to pay, in a given year, on health services that your insurance covers. Once you spend enough to hit that limit, your insurance will cover 100% of the rest of your health expenses for the year. The highest possible out-of-pocket limit for 2020 is $8,150.

Catastrophic health insurance plans have a deductible that is the same as your out-of-pocket limit. The tradeoff is catastrophic plans have lower monthly premiums â the amount you pay each month in order to keep your insurance policy active â compared to most health insurance plans since you could be on the hook to pay some health costs yourself.

Read Also: Burger King Health Insurance

What If I Dont Qualify For A Premium Tax Credit Or Csr

The IRS allows you to deduct certain medical expenses exceeding 7.5% of your adjusted gross income .

Deductible medical expenses may include but arent limited to the following:

- Payments to doctors, dentists, chiropractors, psychologists, etc.

- Payments for inpatient hospital care.

- Payments for insulin and for drugs that require a prescription.

- Payments for false teeth, prescription glasses, contact lenses, hearing aids, crutches, wheelchairs, etc.

- Payments for transportation primarily for and essential to medical care that qualify as medical expenses.

For a full list of deductible medical expenses, visit the IRS website.

You May Like: What’s The Sales Tax In Florida

How To Claim The Health Insurance Premium Tax Credit

As the first year of health insurance through the new health care exchanges winds down, another new challenge is just beginning. The upcoming tax season will be the first year to report, claim, and reconcile the new health insurance premium tax credit. It will be a new, and in some cases challenging, addition to your 2014 tax return.

How Does The Small Business Health Care Tax Credit Work

In a nutshell, small business owners report their companys expenses for group health insurance for employees at tax time. Depending on the size of your business and your average payroll per employee, you will receive a credit against the amount of federal income tax your business owes. That credit could be as much as 50% of your premium payments.

Don’t Miss: How Do Independent Contractors File Taxes

What If I Am Self

As a self-employed individual, you are in a unique situation. If your business has employees and you happen to be providing them with a health plan , then you can claim the premiums as long as they are considered to be a reasonable business expense. Your employees, on the other hand, cannot.If you do not have any employees, you may be eligible to deduct premiums that you pay for medical and dental insurance coverage for yourself, your spouse, and your dependents. Refer to the CRA website for more details.

How Do I Access The Premium Tax Credits

You may be wondering, does the premium tax credit work with any type of insurance? No to receive your premium tax credit, you must purchase health insurance through the federal marketplace, healthcare.gov, or your stateâs marketplace.

You can purchase a qualified health plan during your states open enrollment period. Otherwise, you can only get health coverage during a special enrollment period .

Most states have a website where you can view and compare policies, enroll in a plan, and receive the premium tax credit. A licensed health insurance broker is a great resource for help selecting a health plan. Look up your state marketplace here.

Also Check: What Is Tax Free Weekend