Closing Costs On A Rental Property

Closing costs and settlement fees are not deductible on a primary or secondary home, but the rules for rental properties are different. Why? The IRS considers rental income taxable on your annual return. This gives you more flexibility to claim deductions for rental property expenses.

The following rental property expenses that are deductible include:

Improve A Rental Property

If you own a rental property, you may want to use your cash-out refinance money to repair or enhance the property. You may be able to deduct the expenses of a repair or improvement from your taxes.

You may be able to claim a deduction for a rental property because the IRS considers money you earn from a rental property as personal income. Further, you may be able to deduct interest, insurance and closing costs paid on a rental property from your income taxes as business expenses.

Documentation Needed To Claim Mortgage Interest As A Tax Deduction For An Owner

Related Articles

The IRS allows you to deduct up to 100 percent of the interest you paid on your mortgage each year, even if you bought your home using owner financing. Know the rules and secure the appropriate documentation to file with your tax return to claim mortgage interest as a tax deduction on your owner-financed home.

Tip

Owner financing differs from traditional financing offered by institutional lenders because you make your mortgage payments to the previous owner of the home, not a mortgage company. An owner who provides financing must file certain documentation with the IRS as a traditional lender would.

Also Check: How To Get The Most Out Of Taxes

Do You Have To Pay Any Taxes After A Cash Out Refinance

Real estate investors are always looking for ways to put money to work.

With the way home prices have been rising over the last few years, an investor may have a surprising amount of equity in a home. Doing a cash out refinance is one way to turn accrued equity into cash to reinvest.

But one of the questions that frequently comes up is whether money from a cash out refinance is taxed.

In this article, well explain how a cash out refinance works, whether or not a cash out refinance is a taxable event, and some ways an investor can put funds from a cash out refi to work.

Key takeaways

- A cash out refinance is a strategy used to turn accrued equity in property into cash without selling.

- Since a cash out refinance is more like a loan, the IRS does not consider money from a cash out refi to be income or a capital gain.

- Doing a cash out refinance may have an impact on the amount of cash flow and net income generated by the refinanced property.

- Two ways to put money from a cash out refi to work are by making improvements to add value and increase rental income, and by using the funds for the down payment on another rental property.

Tax Deductible Refinancing Costs

There are two main areas of tax deductions that can be claimed when you are refinancing your investment property

However, its important to note that you may not receive the refund for these costs immediately. Youll need to budget as this money could take a long time to be returned to you.

These borrowing costs can be claimed on tax, incrementally, over the first five years of property ownership. But if you sell or refinance the property within that time period, you should be able to claim the remaining tax deductions straight away .

You May Like: How Do I Track My Taxes

When You Refinance Your House Is The Cash Back Taxed

You can tap into the equity youve built in your home with a cash-out refinance. With a cash-out refinance, you borrow more than you owe on your current mortgage and receive the excess in cash. However, though youre still using your home as collateral, that doesnt mean that you can automatically continue to claim all the interest you pay as part of the mortgage interest deduction.

Additional Requirements To Be Eligible To Deduct Mortgage Points

- The mortgage is for your primary residence

- Points have to be a percentage of your mortgage total

- Points must be normal in your area

- The points must not be excessive in your area

- You have to use the cash accounting method when filing taxes

- The points cannot be used for items that are normally standalone fees

- You cannot be paying for your points with borrowed funds

- You have to itemize your points clearly

In the event that you are unable to deduct points this tax year, you may be able to deduct them over the life of the loan.

You May Like: Does Doordash Withhold Taxes

Also Check: How To File Ca State Taxes For Free

How Do Tax Laws Affect Cash

Its important that we go over exactly how cash-out refinances work before we look at how the IRS views the money you get from this transaction. Basically, you replace your existing mortgage with a loan that has a higher principal balance. Your lender then gives you the difference in cash. You can use the money from a cash-out refinance for almost anything. Many homeowners use it to consolidate debt or make home improvements.

Lets look at an example. Say you have $100,000 left on your mortgage loan and you want to do $30,000 worth of repairs. Your lender might offer a new loan worth $130,000 at 4% APR. You take the refinance and your lender gives you $30,000 in cash a few days after closing. You then pay back your new mortgage loan over time, just like your old loan.

One of the first questions that homeowners have when they take a cash-out refinance is whether they need to report it as income when they file their taxes.

As you can see, the cash you get from this kind of refinance isnt free money. Its a form of debt that you must pay interest on over time. The IRS doesnt view the money you take from a cash-out refinance as income instead, its considered an additional loan. You dont need to include the cash from your refinance as income when you file your taxes.

Protect whats precious

Deducting The Interest On Your Loan

One area that you may want to be careful when it comes to refinancing and taxes is the interestthat you pay on the loan. This is when the reason for the refinance will play a role in what you owe. Typically, you can write off the interest on a loan when you buy a home. You may even write off the interest on a second mortgage if it was used to buy the home.

When you take out the cash-out refinance, though, things are a little different. You arent taking money to buy a home. Now the IRS wants to know what you did with the money. Did you take it out to reinvest it back in the home? Maybe you added on a room or redid the homes flooring. If thats the case, you can typically write off the interest on the cash-out refinance. But, if you use the funds to consolidate debt, take a vacation, or any other reason that doesnt pertain to your home, you may not be able to write the interest off that you pay.

Don’t Miss: What Tax Forms Do I Need

Second Mortgage Tax Implications

Suppose you opt for a second mortgage ) instead of a cash-out refinance. Are you still able to deduct mortgage interest?

Once again, that depends on what you use the funds for. If you buy or significantly improve a home, you probably can. But, if you borrow for other purposes you almost certainly wont.

The IRSs Publication 936 Home Mortgage Interest Deduction gives full details.

Is A Cash Out Refinance Taxable

Since a home isnt actually being sold with a cash out refinance, the IRS doesnt consider the cash generated as income or as a capital gain. A cash out refinance is more similar to taking out a loan, because in order to pull cash out of a home with a refi the mortgage balance and loan payments increase.

The following example illustrates how the monthly principal and interest payments on a mortgage might change with a cash out refinance, assuming that the interest rate remains the same:

| Before cash out refi | |

| $716 | $954 |

A cash out refinance isnt a taxable event. However, refinancing a rental property to pull cash out does have an impact on the financial performance of an investment and on the pre-tax income the property generates.

You May Like: How Much Is Sales Tax In Louisiana

Filing Your Taxes When You Have No Income

Home \ Blog \ Taxes \ Filing Your Taxes When You Have No Income

Join millions of Canadians who have already trusted Loans Canada

Did you lose your job? Are you on maternity or paternity leave? Are you in-between jobs? Have decided to go back to school in order to further your career once you get back into the workforce? Or have you decided to take an extended sabbatical in order to refresh and take a breather from the everyday hustle and bustle of work-life?

Whatever your reason for not working, you may be wondering whether or not its still necessary to file a tax return. You might think theres absolutely no reason to do so, especially since you did not make any money and therefore have nothing to pay income taxes against. In a sense, you may be right. You technically dont have to file your income taxes if you have no income to claim, but only if other circumstances dont apply.

Settlement Fees Not Deductible

You “settle” or “close” your mortgage refinancing when you sign all the paperwork to officially take out the new loan and pay off the old one. A number of fees and charges may be applied at settlement. These closing costs can add up to hundreds or thousands of dollars and may include such things as:

These costs are generally not deductible in a mortgage refinance if they’re for your residence.

You May Like: How To Buy Tax Lien Properties In California

How Much Mortgage Interest Is Tax

You can deduct all your mortgage interest up to $750,000 per property if you used the loan to purchase your home or substantially improve it. Any such improvements must increase its value.

But you wont be able to deduct mortgage interest on any portion of your loan that youve used for other purposes.

So, if you got a cash-out refinance and spent the money on debt consolidation, starting a business, funding a wedding or vacation, or any other purpose that doesnt involve home improvements, you wont be able to deduct that interest.

How Do You Qualify For A Cash

To get a cash-out refinance loan, you’ll need to have enough equity in your home. In most cases, a lender will consider you for a cash-out refinance if you have equity of at least 20%.

To figure out whether you qualify, a lender will look at the loan-to-value ratio. This ratio is calculated by dividing the amount you owe on your mortgage by the value of your home. So, if the mortgage balance is $160,000 and the value of your home is $200,000, the loan-to-value ratio is 80%. An 80% ratio translates into 20% equity, which would meet the equity requirements of most cash-out lenders.

Read Also: How To File My Own Taxes For Free

What Do Mortgage Lenders Look For On Your Tax Returns

When you apply for a mortgage, your lender is likely to ask you to provide financial documentation, which may include 1 to 2 years worth of tax returns. Youre probably wondering exactly how those tax returns can affect your mortgage application. Well break it down for you.

Why do mortgage lenders request tax returns?

Your tax returns, along with the other financial documents. in your mortgage application, are used to determine how much you can afford to spend on your home loan every month. Because a mortgage commits you to years of payments, lenders want to make sure your loan is affordable to you both now and years down the road.

To help calculate your income, mortgage lenders typically need:

- 1 to 2 years of personal tax returns

- 1 to 2 years of business tax returns

Depending on your unique financial picture, we might ask for additional paperwork. For example, if you have any real estate investments, you may need to submit your Schedule E paperwork for the past 2 years. If youre self-employed, you may have to provide copies of your Profit and Loss statements. On the other hand, if youre not required to submit tax returns, lenders may be able to use your tax transcripts instead. If you are self-employed, a business owner, or earn income through other sources , youre more likely to be asked for your tax returns along with additional paperwork. Heres a guide to what documents lenders might need for your specific situation.

- More

Dont Miss: Chase Recast Mortgage

Closing Costs You Can Deduct In The Year Theyre Paid

Origination fees or points paid on a purchase. The IRS considers mortgage points to be charges paid to take out a mortgage. They may include origination fees or discount points, and represent a percentage of your loan amount. For these costs to be tax-deductible in the same year theyre paid, you have to meet all of the following conditions.

Points paid on a home improvement cash-out refinance. If you took out a new home loan for home improvements, the refinance points may be deductible. Youll have to document that all of the cash was used for renovations and show that the points meet the first six requirements listed above.

Mortgage insurance. Lenders may require mortgage insurance to cover the extra risk of offering a loan with a down payment of less than 20%. If you bought a home before or during 2021, private mortgage insurance premiums are deductible.

Also Check: Will The Irs Extend The Tax Deadline For 2021

Restrictions On Refinancing Deductions

The IRSs objective is to collect taxes owed to the federal government, so these deductions obviously come with some limitations. In order to qualify for most of the tax deductions listed above, you must itemize your deductions rather than take the standard deduction.

To save the most money on your annual tax return, youll want to choose the deduction method thats most valuable to you. The 2019 standard deduction is:

- $12,200 for single filers

- $24,400 for married couples filing jointly

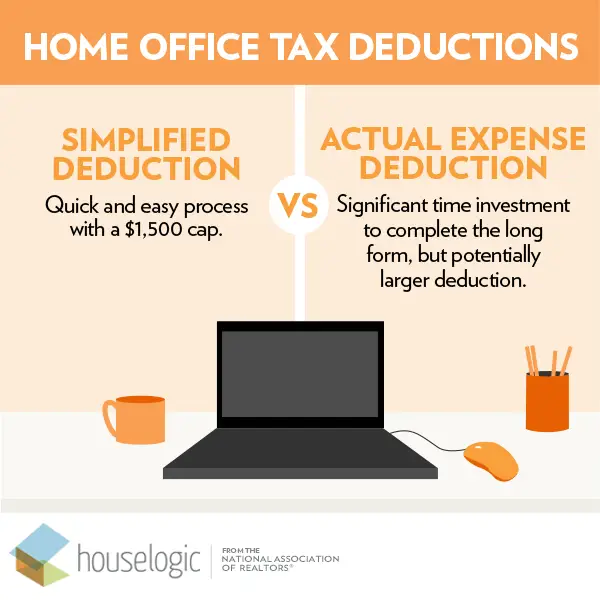

How Does A Tax Deduction Work

A tax deduction is an opportunity for taxpayers to indirectly reduce their tax bill by lowering their taxable income. There are two ways taxpayers can save with tax deductions:

- Standard deduction: A predetermined amount that eligible taxpayers can subtract from their taxable income.

- Itemized deductions: A list of deductions with differing values that eligible taxpayers can claim.

If you can claim multiple itemized deductions, the overall value of these deductions might outweigh the benefit of the standard deduction. However, the majority of taxpayers find that the standard deduction is the option with the most pay-off.

In 2019, the standard deduction raised to $12,200 for single filers and $24,400 for filers who are married and filing jointly. But in exchange for a higher standard deduction, the Tax Cuts and Jobs Act eliminated some tax deductions for homeowners and lessened the value of others. The reform placed additional restrictions on the mortgage interest deduction and removed the insurance deduction for most mortgage loans.

Also Check: Can You Pay Property Taxes Online

Refinancing When Owning Personally

If you own the property personally, there is no immediate tax implication when you refinance the property.

However, you need to pay attention to how you use the funds from refinancing.

In Canada, you are only allowed to deduct the interest on money borrowed for investment purposes. Like mortgage interest incurred to earn rental income is deductible.

But, if you use the funds to pay down your principal residence mortgage, the interest related to the refinanced money, i.e. $240K from our example above isnot tax deductible.

I generally tell my clients to use those funds to pay off the initial line of credit that they used to finance the purchase of the rental property. Or use it for a down payment on their next investment property. By continuing to use the funds for investment purposes, you can keep the entire mortgage interest expense tax deductible.

Cash flow at sale

After years of appreciation and refinancing, you may have taken a lot more out than what you have put in.

Say, you purchased the rental property for $250,000 a number of years ago with an initial mortgage of $200,000.

Youve refinanced the property a few times over the years and currently the mortgage has an outstanding balance of $500,000.

And you sold the property for $850K.

Your capital gain is $600K .

Assuming you pay the highest marginal tax rate of approximately 50%, the tax liability is around $150K.