Plus How We’re Supporting A Children’s Charity

While its exciting to prepare for holiday celebrations with your friends and family, the festive season is also a time to stop and reflect on the joys and blessings of our lives and share this with those in need. If you are planning to make a donation to a registered charity there are some opportunities to claim tax relief that you should be aware of before making a decision on how you would like to donate.

How Long Can You Claim Back For

If you forget to or were unaware you could claim tax relief you have four years to submit a claim for tax overpayment relief to HMRC. Thats four years after the end of the tax year your claim relates to.

For example, currently its the 2017/2018 tax year and it ends 5 April 2018, so you could claim as far back as the 2013/2014 tax year which ended 5 April 2014.

How Much Of A Donation Is Tax Deductible

Generally, you can deduct all your charitable contributions for the year as long as they do not exceed 20% of AGI. However, in some limited cases, you can deduct contributions up to 60% of your AGI. You can find your AGI on Form 1040, line 11.

It is a good idea to speak with a tax professional to determine the amount you can claim.

Recommended Reading: How To Get Maximum Tax Refund

What Do I Need In Order To Claim A Charitable Contribution Deduction

Once you’ve decided to give to charity, consider these steps if you plan to take your charitable deduction:

- Make sure the non-profit organization is a 501 public charity or private foundation.

- Keep a record of the contribution .

- If it’s a non-cash donation, in some instances you must obtain a qualified appraisal to substantiate the value of the deduction you’re claiming.

- With your paperwork ready, itemize your deductions and file your tax return.

Which Organizations Can You Give Back To

Ideally, you should give back to an organization that needs your support. Experts advise not to make your decision to donate to a cause based on your ability to get a tax deduction. Support an organization with a mission you believe in, or one in which you believe your customers support.

If you are seeking a tax deduction, start with the IRSs definition of a charitable donation its a little complicated. The way the IRS treats a charitable contribution varies according to:

- The recipient organizations.

- What you donated .

- Whether the donor was an individual, business, or corporate donor.

- How much was donated .

There are different standards and ceilings for each of these variables, so lets take a deeper look at each factor.

To claim a charitable contribution deduction, the recipient organization must be registered as a tax-exempt organization as defined by Section 501 of the Internal Revenue Code. You can search for an organization’s eligibility to receive tax-deductible charitable contributions using the IRSs Tax Exempt Organization Search Tool. Note that the limit you are able to deduct applies to all donations you make throughout the year, no matter how many organizations you donate to.

With those caveats out of the way, heres how much you can deduct in charitable contributions.

Ideally, you should give back to an organization that needs your support.

Don’t Miss: Do I Pay Taxes On Roth Ira Gains

How To Claim Tax Deductible Donations On Your Tax Return

-

In general, itemize at tax time. When you file your tax return every year, you’ll need to itemize your deductions in order to claim tax deductible donations to charity. That means filling out Schedule A along with the rest of your tax return.

-

Weigh the costs and benefits ahead of time. Itemizing can take more time than if you just take the standard deduction, and it may require more expensive tax software or create a higher bill from your tax preparer. Plus, if your standard deduction is more than the sum of your itemized deductions, it might be worth it to abandon itemizing and take the standard deduction instead. If you abandon itemizing, however, you abandon taking the deduction for what you donated.

Here are the standard deduction amounts by filing status. Again, if your standard deduction is more than the sum of your itemized deductions, it might be worth it to skip itemizing and take the standard deduction instead.

|

Filing status |

|---|

How Much Can I Donate In One Year

Whilst you are allowed to donate as much as you wish, there are a few points that should be considered regarding how much tax relief youll be eligible to receive.

Charitable donations can reduce your tax liability to zero but will not create a negative liability. Therefore, if you donate to charity when your tax liability is already zero, the Tax Authority will not refund to you part of the donations made.

Your total donations during the tax year must be at least ILS 190 for you to be eligible to make a tax relief claim.

There is an upper limit to how much charitable donations individuals can claim relief on: Donations up to 30% of your taxable income, and Total donations not more than ILS 9,350,000

Tip if you donate too much in one year, you can use the unclaimed relief for up to three years following the tax year.

Recommended Reading: How To Know How Much Taxes You Owe

Having Taxiety We Have The Answers

Its no secret taxes can be a challenge to understand. If preparing for this years tax season gives you TAXiety, dont hesitate schedule an appointment with your local Liberty Tax Practitioner. Let the tax pros at Liberty Tax be your tax resource.

Ready to tackle your taxes? You can start your return by downloading our app from the Apple App or stores or utilizing our virtual tax pro.

What About Online Fundraising And Charitable Tax Deductions

In the age of crowdfunding, it has never been easier to support your favorite charity. Technology has changed the way people all over the world help others. Lending a digital hand to those in need is now effortless, and finding best charities to donate to takes no time at all.

The top charity fundraising sites have done an incredible job of simplifying the giving process for donors and organizers alike. Reputable sites now offer fundraising platforms and issue tax-deductible receipts for donations made to certified charity fundraisers. They also give donors a way to easily track their donations in one place.

Also Check: What Do Taxes Pay For

But Its Not All About Tax Relief

A contractor friend of ours is volunteering at GOSH and is selling Charity Christmas cards in aid of Radio Lollipop to support children in hospital.

Radio Lollipop is an international charity, which provides care, comfort, play and entertainment to children and young people in hospital. It is run entirely by volunteers who provide a play and interactive radio service for patients and their families to make their stay in hospital more fun.

They have 3 lovely designs drawn by children who have been patients at either Evelina London Childrens Hospital or Great Ormond Street Hospital. The price is £5 per pack this year, and each pack contains 12 cards with 4 of each design included. Every penny from every pack goes directly to the charity to buy games and arts & crafts for the children in the wards.

Please contact us at or call on 0207 078 0211 if you wish to support this amazing cause. We can post the cards to you or if you collect the cards from our office, we will donate the postage cost to Radio Lollipop as well!

Tis the seasonto win big! Were feeling the generous Christmas spirit and so have created an Advent Calendar with daily prizes for you to win!

How Much Can You Deduct

The amount of money that you can deduct on your taxes may not be equal to the total amount of your donations.

-

If you donate non-cash items, you can claim the fair market value of the items on your taxes.

-

If you donated a vehicle, your deduction depends on if the organization keeps the car or sells it at an auction. A Donors Guide to Vehicle Donation explains how your deduction is determined.

-

If you received a gift or ticket to an event, you can only deduct the amount that exceeds the value of the gift or ticket.

Note: Limits on cash and non-cash charitable donations have increased or been suspended. Learn more about charitable deductions in 2021.

Don’t Miss: How To File Taxes If Married But Living Separately

Selling Land Property Or Shares For A Charity

It is not uncommon for a charity to ask a donor to sell the gift on their behalf when offering them a gift of land, property, or shares. Donors may do it and still claim tax relief for the donation.

But, the donor must keep records of the gift as well as the request by the charity. If not, you may need to pay Capital Gains Tax on the donation.

Security Precautions To Take

While your business might have other peoples needs at heart, online scammers try to take advantage of peoples generosity.

Adrien Gendre, North American CEO at Vade Secure, believes businesses or individuals that donate to charity via gift card are at risk of being scammed. He said a scam thats on the rise is people or businesses being asked to purchase gift cards from nearby stores and provide the codes to scammers posing as charities. He says to avoid donations like this where almost nothing can be tracked.

Additionally, Gendre says to look out for well-designed email and website scams. If you receive an email soliciting donations that appears to be from a legitimate source, double-check the senders email address and accompanying website to ensure youre not being duped by a minor change to the web address.

Go on Google, type the brand, find the website from Google, and compare the URL, Gendre said when describing how to verify a websites legitimacy. Thats the easiest trick. Compare the two websites and URLs side by side to determine if the email sent to you is fake.

Its also important to understand the complexity of some scams. When it comes to email cons, studies suggest that scammers select days of the week to send phishing emails based on when peoples inboxes are busiest. Dont fall into a trap because youre hurried on a busy day.

Additional reporting by Andreas Rivera. Some source interviews were conducted for a previous version of this article.

You May Like: How Much Can You Earn Before You Owe Taxes

Choose A Charity With Similar Goals

Its not that difficult to find a public or private charity that aligns with your company and is known to use its money wisely. It takes some research, but your business should be able to support a charity that does good and is willing to accept your businesss generosity responsibly.

Fusaro-Pizzo suggests picking an organization that aligns with your brand. For example, a company with beach branding should get involved with organizations that advocate for clean water or ocean life.

Also, dont leave the selection of the charity completely up to the CEO of your company. Poll employees to find out what causes are near and dear to them. Although you may feel strongly about a charity, the rest of your team may not share the same sentiment.

Deductions Donations Of Non

When most people think of charitable giving, they picture money donations. However, donating goods and services is also very popular and very deductible.

Commonly, people will donate their unused clothes and household items to thrift stores. When deducting these donations, you must use the items fair market value typically, you will get this figure from the thrift store when they process your donation. For example, iIf you were to donate a vehicle with a fair market value exceeding $500, things get a little more complicated. There are two figures to choose from: the vehicles fair market value at the time of donation and the gross proceeds from the organizations sale of the vehicle. You must select the smaller of the two figures.

Taxpayers claiming more than $500 in non-cash contributions in a single year must file IRS Form 8283 alongside their tax return.

Don’t Miss: How Much Can You Inherit Without Paying Taxes In 2020

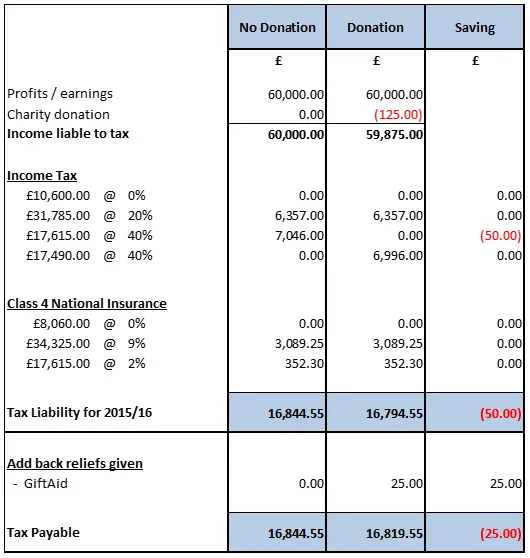

Tax Relief On Charitable Donations

As an individual, you may qualify for tax relief when you donate to a charity in the United Kingdom. Tax relief on charity donations can occur through schemes like Gift Aid, Payroll Giving, or when gifted in a will.

The information in this guide also explains where tax relief goes after donating to a charity. Learn the importance of keeping proper tax records after making a charitable donation.

Individuals can make tax free donations to charitable organisations and to community amateur sports clubs .

The tax portion may go to the charity itself or to the donor. The way tax relief works would depend on how the donation take place, such as by:

- A donation made through the Gift Aid scheme

- Donating an amount direct from wages or from a pension through a scheme

- Donating land, property, or shares

- Leaving gifts to charity in a will

Note: The same rules also relate to sole traders and to partnerships. But, a different set of rules apply to .

You cannot use a Payroll Giving scheme to make a donation to a community amateur sports club . It must be registered as a CASC with HM Revenue and Customs to get tax relief when you donate to a sports club.

Note: You can check an updated A to Z list of community amateur sports clubs registered with HMRC.

As a general rule, you would be able to take the donations off your . But, you would need to keep accurate records of any donations that you make to charity .

You Must Get A Qualified Appraisal

To qualify for a tax deduction for artworks worth more than $5,000, the donor must obtain a qualified appraisal. The Pension Protection Act of 2006 redefined the qualifications for acceptable appraisers, requiring that they have certifications, experience and have completed formal professional-level coursework.Once an appraisal report has been acquired, a donor must attach IRS Form 8283 to his or her personal income tax return to claim the deduction. This form includes a summary of the appraisal, the signature of the appraiser, a signature from the charity acknowledging the gift, and a statement by the appraiser that he is qualified to perform this kind of appraisal. For works of art valued at more than $20,000, the full appraisal report must accompany the form.

Read Also: Where Do You Go To File Taxes

Donating To Charity In Your Will

If you decide to donate to charity in your Will then the value of these items will either be taken off the value of your estate before inheritance tax is calculated or actually reduce your inheritance tax rate if 10% or more of the value of your assets is left to charity.

To make sure your gifts to charity are legally included in your will you can read our legal guide, Making your will.

Donating to charity in your will is worth considering if you intend to support a particular charity even after your death. The rules on exactly what you can give away to charity to earn the lower tax rate can be quite complex.

We recommend that you Ask a lawyer who specialises in estate planning.

What Donors Can Do Next

Schwab Charitable has tools, information, and other resources available online to inform and guide donors as they plan their giving for 2022. Creating a strategic giving plan may be a good place to start.

The Schwab Charitable Giving Guide is a powerful tool designed to help donors plan and manage their giving, no matter where they are in their philanthropic journey. Donors may delve into any of 13 philanthropic topics and answer guiding questions that will help inform their plan.

For additional resources related to the strategies in this article, donors may review the following information:

Recommended Reading: How To Fill Out Tax Form 8962

How Does The Pease Limitation Affect My Tax Deduction

The Tax Cut and Jobs Act of 2017 removed the Pease limitation from the tax code. The Pease limitation was an overall reduction on itemized deductions for higher-income taxpayers. The rule reduced the value of a taxpayers itemized deductions by 3% of adjusted gross income over a certain threshold. The 3% reduction continued until it phased out 80% of the value of the taxpayers itemized deductions.

Politics And Charitable Contributions Don’t Mix

Joining the political process of our democracy through monetary support does not help reduce your taxable income via charitable donations, much to the disappointment of patriotic donors. They don’t count as a miscellaneous deduction, either. Your tax bill will not be lowered after giving money to:

- Candidates or committees working on their behalf

- Advertising for a candidate or their political party

- Campaign fund-raising events such as dinners and luncheons

Also Check: Where Can I Mail My Tax Return

Donate Straight From Wages Or Pension

Some employers, companies, and personal pension providers run a Payroll Giving scheme. If so, you should be able to donate straight from your pension or wages. It would mean the donation takes place before they deduct tax from the income. Your employer or pension provider can confirm if they run a Payroll Giving scheme.

The amount of tax relief you can get would depend on the you pay. Thus, to make a donation of £1, you would actually pay:

The rates of Income Tax in Scotland affect the amount of tax relief you can get on charity donations if you live in Scotland. Thus, to make a donation of £1, you would actually pay:

Note: The rules of Payroll Giving schemes do not allow donations to a community amateur sports clubs via this method.