Who Uses A Schedule K

A Schedule K-1 is required for partners in a general partnership, limited partnership, LLP, LLC members, and shareholders of S corporations. Single-owner LLC’s don’t use a Schedule K-1 to report the business income they use a Schedule C-Profit or Loss from Business.

Partners and shareholders of S corporations must file a Schedule K-1 to report income, losses, dividend receipts, and capital gains. The partnership Schedule K-1 is used to show income distribution to members in a multiple-member LLC, which is taxed as a partnership.

Overview: What Is The Schedule K

The K-1 tax form is a supplementary form that assists owners of small businesses in filing their personal taxes. The form reports the income and other information about the business and you use it to complete your personal return.

The form is only applicable to pass-through entities. General partnerships and S corporations are the two business entities that pass income through to owners to be reported on the personal return.

You may want to bookmark the Schedule K-1 instructions page on the IRS website, because the form changes each year.

K-1s are also used for trusts and estates. You may have experience with them if you have ever been left money in someones will. The numbers are reported in the same schedule of the personal return.

Who Has To File A K

All partnerships must file K-1 tax forms for each partner as part of their tax returns. Additionally, the partners must include a K-1 tax form with their individual tax return whether they are a partner in a general partnership, limited partnership, limited liability partnership or an LLC taxed as a partnership. You must also file a Schedule K-1 if youre a shareholder in an S corporation.

Partners must file Schedule K-1 forms because partnerships are taxed as pass-through entities. In this structure, a companys profits and losses pass through the partnership to all of the partners without being taxed. Schedule K-1 quantifies this profit or loss, and perhaps more importantly, it clarifies how much of your partnerships loss or income you should include in your personal tax returns.

You May Like: What’s The Last Day To File Taxes 2021

What If You Don’t Issue A Schedule K

The IRS is strict about issuing this form. Companies that do not issue Schedule K-1 forms face stiff penalties:

- They receive large fines for every month each partner or shareholder is late.

- Pass-through incomes incur a heavy fine for each K-1 that is not issued on time.

If you need more information or help with an S corporation K-1, you can post your legal need on UpCounsel’s marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved

State Laws For Inheritances

Finally, theres one last caveat here. Schedule K-1 is a federal form. Your state might have its own way of treating inheritances.

Although the IRS doesnt tax inheritances just the income they produce some states do both. Pennsylvania, New Jersey, Maryland, Iowa, Kentucky and Nebraska all had an inheritance tax as of November 2020.

Each of these states has its own unique rules, but most do not tax surviving spouses and some dont tax the children of a decedent, either. At least, they dont impose an inheritance tax on these individuals. Income taxes could be another matter, so always check with a tax professional to determine where you stand at the state level.

References

Read Also: What Paperwork Do I Need To File Taxes

How To Read K1 Forms

The first thing you need to do when reading a k1 tax form is to identify the taxpayer.

The taxpayer is the person who owns the business or activity that generated the income on which the tax is being paid.

Next, you need to identify the partners. The partners are the people who share in the profits or losses of the business or activity.

Also, you need to determine the tax basis of the partnership. The tax basis is the amount of money the partners have invested in the business or activity.

After identifying the taxpayer and the partners, you need to look at the income statement. The income statement shows the total income of the business or activity. It also shows the expenses of the business or activity.

The next thing you need to do is to look at the balance sheet.

- The balance sheet shows the assets and liabilities of the business or activity.

- The assets are the things that the business or activity owns. The liabilities are the things that the business or activity owes.

- The balance sheet will also show you the equity of the business or activity.

- Equity is the difference between assets and liabilities.

After you have looked at the income and balance sheets, you need to look at the cash flow statement.

The cash flow statement shows the money that is coming in and going out of the business or activity.

The cash flow statement will show you how much money the business or activity has left after paying all of its expenses.

Its Time To Present Your K

Now you know about filing a K1 tax form and what you need to present it alongside your personal tax returns if youre part of a transferring entity.

And even though there are different K-1 forms, all the information you need to complete them is in your business tax return and your financial statements.

Finally, dont forget to attach your tax form to your individual statement and look for tax advice from an expert for your paying income tax.

Read Also: Where To File Taxes Online

Completing Schedule B Of The Irs Form 1065 On Page 3

Similar to Schedule B on page 2, page 3 asks specific questions that require you to answer yes or no. Some of the wide range of topics covered by these questions are:

- Partnership property

- Foreign partners within the partnership

- Tax obligations with regard to forms like 1099, 1042, 5471, etc.

Now, question 25 asks if the partnership is electing out of the centralized partnership audit regime under 6221 . If the answer to this question is yes, then you will have to complete Schedule B-2. However, if the answer is no, you will need to fill in the Designation of the Partnership Representative below.

The last question of Schedule B asks if you are attaching Form 8996 to certify as a Qualified Opportunity Fund. If the answer to this is yes, you mention so while also adding the amount from that form in this section.

S For Completing Form 1065

Begin completing Form 1065 by including general information about the partnership, including its Employer ID Number and its business code .

- Lines 1a-8: Enter different types of partnership income to get total income for the year on Line 8.

- Lines 9-22: Enter all types of deductions next. If some deductions arent listed, you can include them on an attached statement, entering the total deductions on Line 21, and total ordinary business income on line 22.

- Lines 23-30: Enter interest and other adjustments, taxes, and payments on adjustments on lines 23-26 to get a total balance due on line 27.

Schedule B is a section that requires information about the type of partnership or limited liability company. A domestic partnership is one formed in the U.S. a foreign partnership is one formed outside U.S. federal or state law. It also includes questions about stock ownership, dealings with foreign financial institutions, and other situations.

The Schedule K section is the calculation of the different types of income, deductions, credits, foreign transactions, and other information to be divided between partners and reported on each partners Schedule K-1.

Schedule L breaks down the partnerships balance sheet at the beginning and end of the year, for different types of assets, liabilities, and partner ownership accounts.

You May Like: When Do I Have To Do My Taxes By

Who Has To File It

If youâre part of a:

- LLC that has elected to be taxed as a partnership

You need to do at least two things during tax season:

File your own individual Schedule K-1

Not sure whether youâre in a partnership? Here are some telltale signs:

- You co-own a business with one or more other person, but that business isnât incorporated.

- Youâve signed a partnership agreement and registered the partnership with the state.

- Your company is an LLC and has not decided to be taxed as a corporation this year.

There are actually two more forms that the IRS calls âSchedule K-1â:

Although these forms are similar, in this guide weâll focus exclusively on Schedule K-1 of Form 1065, to be filed by partnerships.

Perfect For Independent Contractors And Small Businesses

TurboTax Self-Employed searches over 500 tax deductions to get you every dollar you deserve.

Uncover industry-specific deductions, get unlimited tax advice, & an expert final review with TurboTax Live Self-Employed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Also Check: Where Do I Mail My Federal Tax Payment

How To File Schedule K

Even though the process is similar to filing other tax forms, it depends on the type of business and the type of tax forms used. One must pay attention to using the correct type of tax form and attach it to the personal tax return. One can submit the documents electronically or through a qualified accountant.

If someone does their own taxes, the address they should use depends on the state they reside in and the type of business they own. The address for filing the different kinds of tax forms is as follows.

Reasons One Would Receive A Schedule K

A person receiving a schedule K-1 form needs to report it in the tax seasonTax SeasonThe term tax season refers to a short period in a tax year during which the individuals prepare and file tax returns of the previous tax year.read more since the income received is taxable income. The Internal Revenue Service must have already been notified in this case.

A person receives the K-1 form for one of the following reasons.

- If they are the beneficiary of a trust or estate

Depending on the reason someone receives this tax form, its information will vary.

Don’t Miss: How Long To Keep Tax Records

What Is The K

Schedule K-1 is due on an annual basis. It is due on the 15th day of the 3rd month after each tax year.

- For example, if a partnership follows the calendar year, the due date for Schedule K-1 would be March 15, 2020.

If the due date falls on a Saturday, Sunday or legal holiday, the due date will be the next business day.

People also ask:

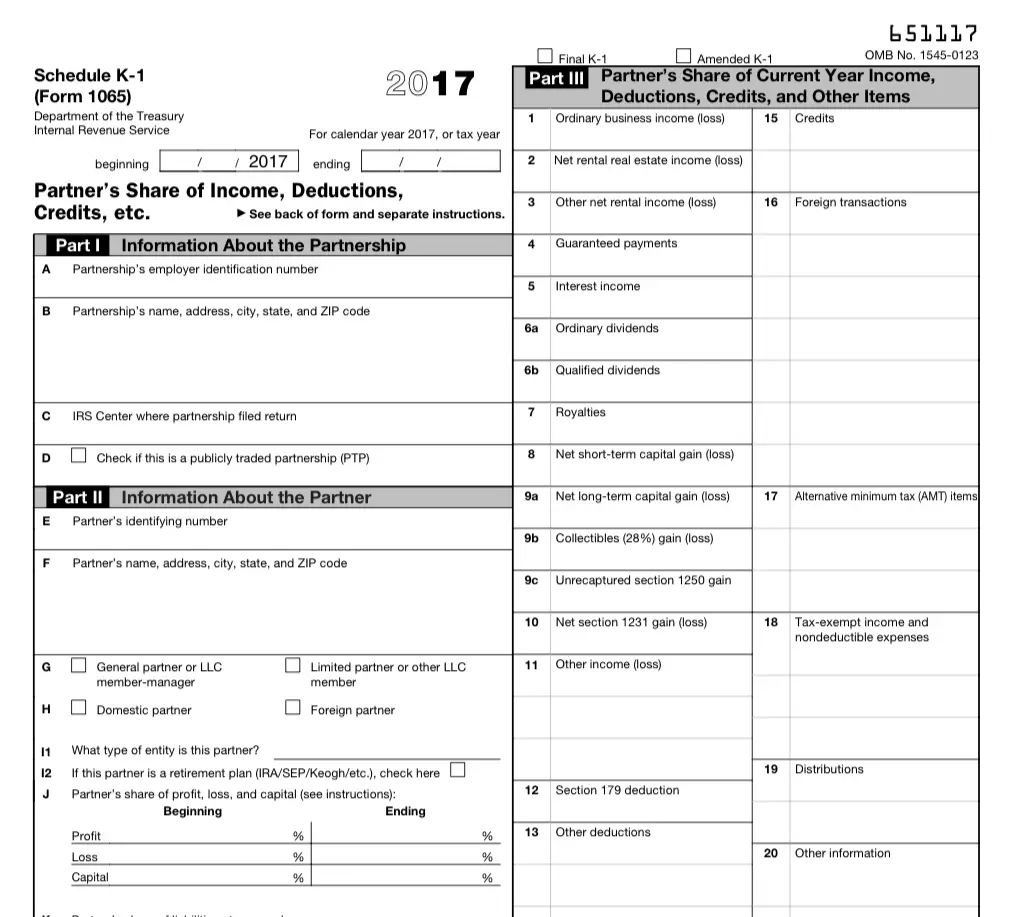

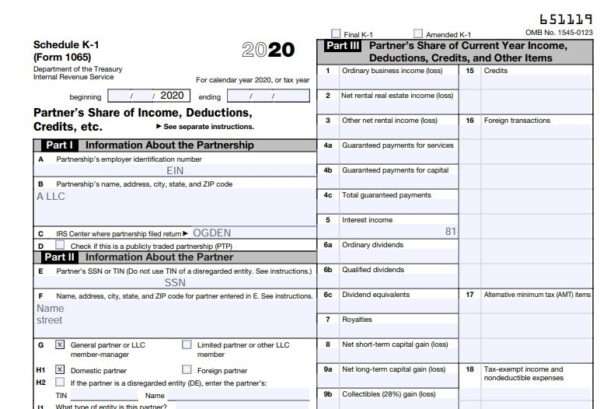

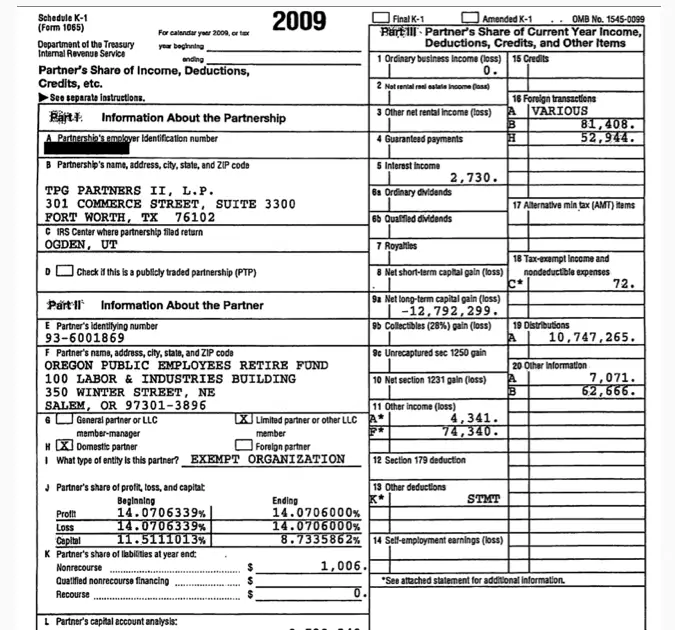

Complete Parts I And Ii Of The Form

In parts I and II, letters AK only need to be completed once and then can carry over from year to year unless there is a change in ownership. Each of these items feature administrative information that you can find in the entity documents you filed with your state, if you dont it remember off the top of your head.

Section L is where it starts to get interesting.

The required information for Section L can be found on the front page and the Schedule M of the business tax return. Image source: Author

Current year net income is found on the front page of the business tax return. The other line items are on the Schedule M-2 on the partnership tax return.

The final two sections in Part II have to do with contributing property to the business as equity. If you have done that and the property had an unreported gain when contributed, check “yes” and declare the amount of the gain.

Also Check: How To Calculate Tax Expense

When Are Schedule K

Partnerships and S-corps must file tax returns to the IRS and Schedule K-1 forms to their owners by the 15th day of the third month after the end of the tax year. For companies on a calendar-year schedule, that means the filing deadline is March 15.

To request a six-month extension for filing the businesss tax return and Schedule K-1, file Form 7004, which can be done or electronically. You will automatically be granted the six-month extension unless the IRS notifies you otherwise.

| Entity type |

| The 15th day of the fourth month after the end of the tax year April 15 for calendar-year filers |

If you are the recipient of a Schedule K-1 form, you do not need to send this form to the IRS with your tax return. You should give this form to your tax preparer to help them complete your individual tax return.

What Is A Schedule K

OVERVIEW

The Schedule K-1 is slightly different depending on whether it comes from a trust, partnership or S corporation. Find out how to use this tax form to accurately report your information on your tax return.

The United States tax code allows certain types of entities to utilize pass-through taxation. This effectively shifts the income tax liability from the entity earning the income to those who have a beneficial interest in it. The Schedule K-1 is the form that reports the amounts that are passed through to each party that has an interest in the entity.

Read Also: How Long Does It Take For Tax Refund

Calculating How Much You’ll Owe

When youve completed your tax return and all is said and done, the income generated by your bequest will be included with all your other taxable income after you claim your own personal deductions and credits. Its therefore taxed at your marginal tax rate according to your tax bracket, just like all your other income.

But here’s a bit of a silver lining: Were the trust or estate to pay the income taxes on that $1,000, it would have been subject to a higher tax rate. More of your inheritance would have been lost to taxation. Because you personally pay a lower tax rate than what the estate or trust must pay, more of that $1,000 will stay in your pocket even though you have to report the income. There is no special K-1 tax rate.

Of course, if you inherit something like an investment account rather than cash, all income earned by it after you receive it assuming you dont immediately cash it in remains your responsibility. The estate or trust took a bow and backed out of the tax situation when it transferred the inheritance to you. Again, earnings generated would be taxed along with your other income according to your tax bracket going forward for as long as you keep the account intact.

When Should I Receive My Irs Schedule K

Schedule K-1 forms are notorious for arriving late. The IRS says they are due , but whether that means they need just to be issued by then, or to actually be in taxpayers’ hands by then, seems open to interpretation. Most authorities agree you should receive one by March 15, or the closest business day to that, though.

Read Also: How To File Late Taxes

What Is A K

Inheritances generally arent taxable, at least not at the federal level and not as income, but some exceptions do exist. In most cases, you can collect your gift from a deceased friend or relative and never concern yourself with reporting the event to the Internal Revenue Service. In other cases, however, your gift will kick off income, and this changes things.

Maybe its an investment that earns interest or produces dividends. The gift itself still isnt taxable, but its earnings are. Schedule K-1 tells you and the IRS that your inheritance has earned income and how much.

Contents Of Schedule K

The form itself is fairly simple, consisting of a single page with three parts. Part one records information about the estate or trust, including its name, employer identification number and the name and address of the fiduciary in charge of handling the disposition of the estate. Part two includes the beneficiarys name and address, along with a designation as a domestic or foreign resident.

The third part covers the beneficiarys share of current year income, deductions and credits. That includes all of the following:

- Interest income

- Other portfolio and nonbusiness income

- Ordinary business income

- Alternative minimum tax deductions

If you receive a completed Schedule K-1 you can then use it to complete your Form 1040 Individual Tax Return. This will allow you to report any income, deductions or credits associated with the inheritance of the assets.

You wouldnt, however, have to include a copy of this form when you file your tax return. That is, unless backup withholding is present in Box 13, Code B. The fiduciary will send a copy to the IRS on your behalf. But you would want to keep a copy of your Schedule K-1 on hand in case there are any questions raised later about the accuracy of income, deductions or credits being reported.

Recommended Reading: Who Has Free Tax Filing