How Is Sales Tax Collected

Sales tax is collected by retailers when goods and services are sold to the final user. Sales taxes are not imposed when materials that will be used to manufacture a product are sold to a manufacturer. When the manufacturer sells their products to a retailer, no taxes are imposed. It is only when the product is sold to the final customer that the taxes are charged. If the sale is not made to the final end user, no sales tax is collect. A few states have made exemptions to this rule, like charging contractors sales tax on materials.

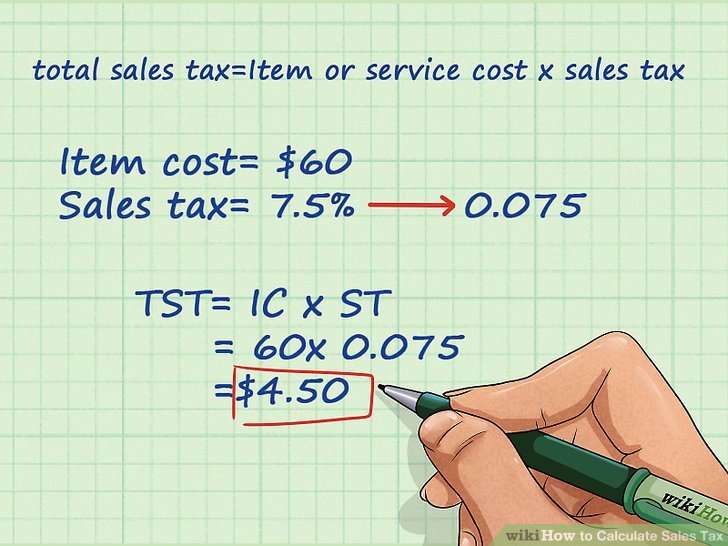

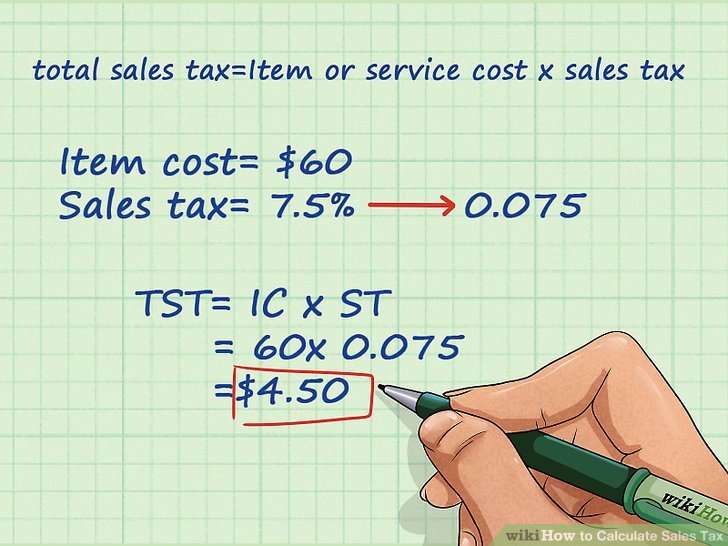

There are two ways that companies can add sales tax to their products. Most companies add sales tax to the price of their products. To calculate the amount of sales tax, multiply the sales tax percentage by the total amount of the sale.

Example #1

A customer purchases $150.00 worth of taxable products from Jeffs Geek-O-Rama on 2/15. The sales tax rate in the state the store resides is 6%. Calculate the amount of tax and the total amount the customer paid.

First lets calculate the tax. The sales tax is 6% of the total purchase, which in this case is $150.00.

$150.00 X .06 = $9

That is the total tax on the transaction. This must be added to the purchase price so the total cash collected is $159.00, but only $150 belongs to Jeff. The other $9 belongs to the state and should be remitted to the state when the next sales tax return is filed.

Example #2

Is What You Are Selling Taxable

Most âtangibleâ property in the U.S. is taxable. This includes items you can touch and feel like furniture, coffee cups and books. Since sales tax is governed at the state level, some states have decided not to tax necessities like groceries, clothing or textbooks. Check with your stateâs taxing authority to find out if the products you sell are taxable.

In most cases, services are not taxable, though some states have changed that in recent years. If you are a service provider, such as a graphic designer or plumber, double check with your state to ensure that you arenât required to collect sales tax.

More Excel And Finance Resources

Thank you for reading CFIs guide to the Excel sales tax decalculator. If you want to become an Excel power user please check out our Excel ResourcesExcel ResourcesLearn Excel online with 100’s of free Excel tutorials, resources, guides & cheat sheets! CFI’s resources are the best way to learn Excel on your own terms. to learn all the most important functions, formulas, shortcuts, tips, and tricks.

- Debt scheduleDebt ScheduleA debt schedule lays out all of the debt a business has in a schedule based on its maturity and interest rate. In financial modeling, interest expense flows

- List of Excel formulasExcel Formulas Cheat SheetCFI’s Excel formulas cheat sheet will give you all the most important formulas to perform financial analysis and modeling in Excel spreadsheets. If you want to become a master of Excel financial analysis and an expert on building financial models then you’ve come to the right place.

- Excel templatesTemplatesFree business templates to use in your personal or professional life. Templates include Excel, Word, and PowerPoint. These can be used for transactions,

- Finance career resourcesCareersSearch CFI’s career resources library. We’ve compiled the most important career resources for any job in corporate finance. From interview prep to resumes and job descriptions, we’ve got you covered to land your dream job. Explore guides, templates, and a wide range of free resources and tools

Also Check: Taxes For Doordash

When Do You Need To Calculate Sales Tax

Maybe youre getting ready to make a big purchase and you want to calculate exactly how much youll be paying out of pocket.

But the most common reason youd need to calculate sales tax is because you are a retailer making a sale. You have obligations to your customers and to the state to charge the right amount of sales tax every time. And in that case, TaxJar has your back!

How Much Taxes Are Taken Out Of A $1000 Check

Paycheck Deductions for $1,000 Paycheck

For a single taxpayer, a $1,000 biweekly check means an annual gross income of $26,000. If a taxpayer claims one withholding allowance, $4,150 will be withheld per year for federal income taxes. The amount withheld per paycheck is $4,150 divided by 26 paychecks, or $159.62.

Also Check: Ccao Certified Final 2020 Assessed Value

Calculating Sales Tax During A Tax Holiday

This example shows how to calculate the sales tax amount and the total amount a customer owes for purchases made during a sales tax holiday. Some of the customer’s items are taxable because they do not qualify for the sales tax exception, while other items are non-taxable because of the exception. The customer is purchasing new clothes, shoes, a backpack and school supplies, tissues and cleaning wipes, a laptop and makeup. The following list shows the store’s total sales amount for each of these categories:

-

Clothes: $155.95

-

Tissues and cleaning wipes: $12.26

-

Laptop: $400.00

-

Makeup: $35.00

The store is in Nashville, Tennessee. The cashier knows the state sales tax rate is 7% and Davidson County’s sale tax rate is 2.25%. They also know that clothing, shoes and school supplies that cost $100 or less per item and computers that cost less than $1,500 are tax-free during the sales tax holiday. The cashier uses this information to make the following calculations:

-

*Sales price for tax-exempt goods: $735.95 *

-

*Sales price for taxable good: $47.26 *

-

*Sales tax amount: $4.37 *

-

*Total amount the customer owes: $787.58 *

What Are Sales Tax Holidays

Sales tax holidays are short-term periods in which consumers are exempt from paying sales taxes. These holidays usually exist to provide additional savings that encourage consumers to make purchases for back-to-school shopping or hurricane preparedness during a specific time. The length of a sales tax holiday also varies, but it is often a day, weekend or one week.

Not every state has a sales tax holiday. States that have a sales tax holiday usually identify specific items and a maximum sales price for each item that qualifies for the sales tax exemption.

Recommended Reading: Protesting Harris County Property Tax

New York City Sales Tax Calculator

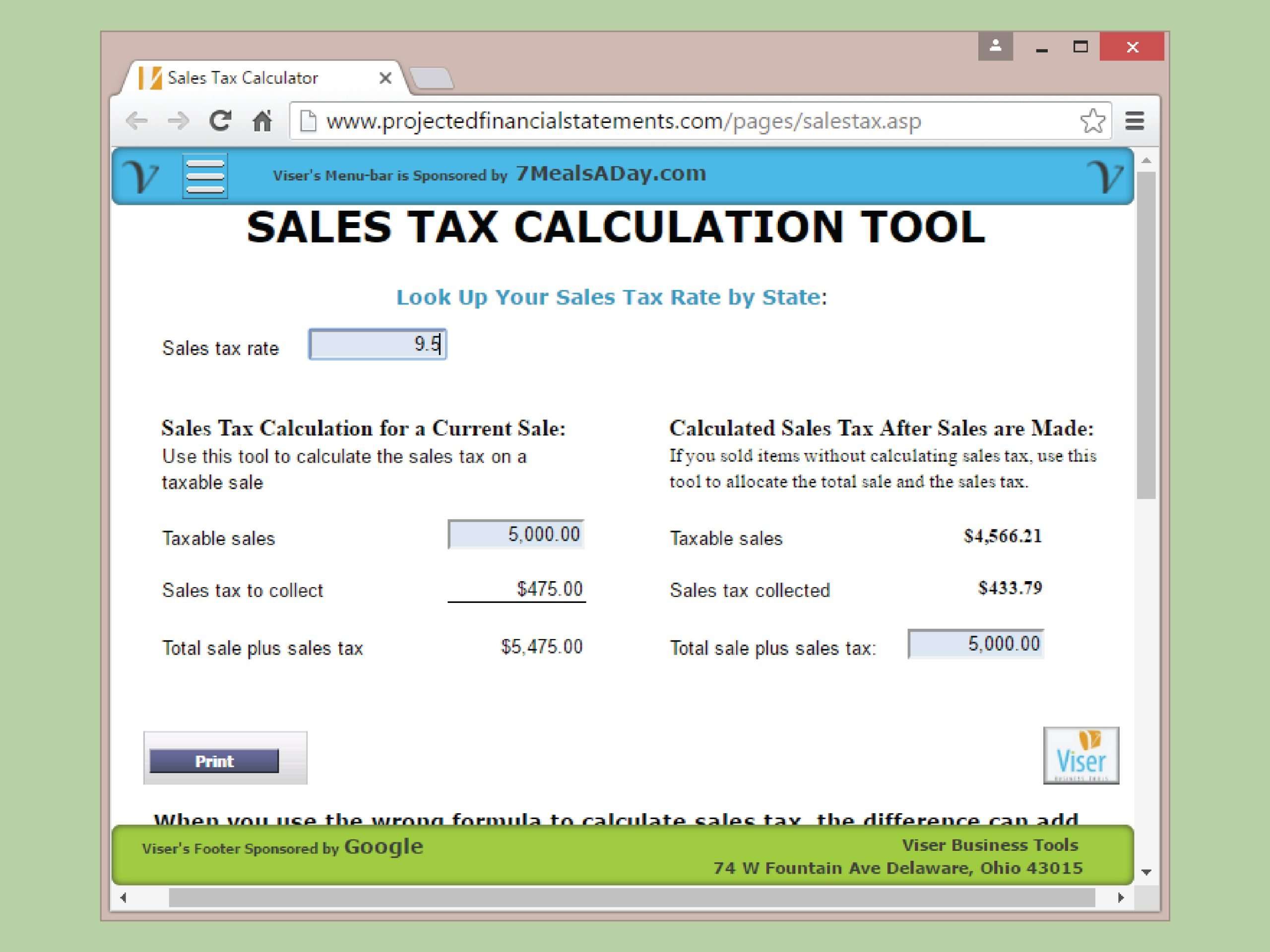

Invoicing clients or selling to customers and need to know how much sales tax to charge? Use our simple sales tax calculator to work out how much sales tax you should charge your clients. Input the amount and the sales tax rate, select whether to include or exclude sales tax, and the calculator will do the rest. If you dont know the rate, download the free lookup tool on this page to find the right combined NYC rate.

Sales Tax By States In 2021

To demonstrate the diversity of sales taxes in the United States, you can find more details about the applied sales taxes in U.S. states in the following table. Besides, you can check when the different states introduced the sales tax and if there is an exemption or reduced rate on sales of food.

| State |

|---|

Read Also: Doordash Payable 1099

Are Resellers Exempt From Sales Tax

Since the end-user of a taxable good or service pays the sales tax, people who purchase goods and intend to resell the product to the end-user are exempt from paying the sales tax. The reseller usually needs a resale certificate that proves their exemption to the businesses they are purchasing the goods from. The reseller then becomes responsible for collecting the sales tax from the end-user with the final sale of the product and passing it on to their state and local government.

Find The Total Sales Price For Taxable Goods And Services

When you calculate the sales tax amount for a single taxable item, the total sales price is the price listed on the product. When you calculate the amount of sales tax a customer owes for the purchase of several goods or services, add the listed sales price of each taxable item together to find the total taxable sales price.

Remember to keep non-taxable items out of this calculation and calculate their total sales price separately. Completing this step before you calculate the sales tax amount simplifies the number of calculations you need to make.

Read Also: Buying Tax Liens In California

How To Calculate Sales Tax For Your Online Store

One of the best ways to predict the profitability of your online store is to look at your pricing strategy. The price of any product is based on its associated costs, including the wholesale price, shipping costs, and sales tax. Your profit and income will be determined by these expenses if you set your retail price too low, you may end up with a smaller profit margin. Too high, and you may miss out on sales.

Some aspects of your pricing strategy, like wholesale costs, are easier to understand and identify. Other factors, like how to find the sales tax, can be a bit more stressful and complicated, especially for online businesses with a global reach. Thats because when calculating sales tax for your online store, there is rarely a one-size-fits-all-approach. Instead, you have to navigate city, county, state, and country regulations to understand your tax obligations.

In this article, well cover everything you need to know about sales tax. Youll learn what sales tax is and if you even need to charge sales tax. Then, well share a variety of different formulas to help you figure out how to calculate sales tax for your business.

Sales Tax In The United States

As mentioned before, most of the states in the U.S. apply a single-stage retail sales tax with different rates and scopes: there are 46 different sales taxes with distinct exclusions. As Schenk and Oldman pointed out, the relatively high diversity in the enacted tax law in various states have several economic implications:

- Business conducted on a nation-wide scale need to devote substantial resources to comply with many states and local sales taxes. It increases the complexity and administrative costs related to businesses.

- As most of the services are not subject of sales taxes, the total tax base is shrinking due to the expanding trend of electronic services and the increase in the sharing economy .

- Tax evasion is expanding as the current sales tax system inefficiently tax most cross-border and mail order shopping by consumers.

These issues become more relevant if we take into consideration the significant contribution of sales taxes to state revenues and the current transformation of the economy. It is not surprising then that recent studies have begun to address these problems and examine the possibility of a nation-wide introduced federal VAT or another consumption-based tax which may coexist with the state-level sales tax.

Read Also: Is Plasma Donation Money Taxable

What Is The Gst/hst Tax Credit In Alberta

The GST/HST credit is a quarterly payment given to low and moderate-income individuals to offset the sales taxes they pay. It is paid out four times per year on:

This tax-free credit starts at $299. There is an additional credit of $157 if a familys net income is more than $9,686. After $38,892 net income, the credit is gradually reduced until it disappears.

See the guide below for specifics in Alberta:

Simplifying Sales Tax For Your Online Store

Calculating sales tax on your own can quickly become a manual, burdensome process. Not only do you have to keep track of all your sales tax nexus locations and ensure youre charging the right amount, you also have to stay on top of ever-evolving tax regulations.

An easier way to manage sales tax is to use an automated sales tax solution. With an automated system, tax calculation for your business is hassle-freeall you need to do is select the states where you do business and the software takes care of the rest.

Wix Merchants can take advantage of an automated sales tax integration with Avalara, which automatically calculates sales tax for each location you sell to, so your customers always get real-time rates as they shop and check out. Theres no longer a need to rely on ZIP codes or rate tables because your sales tax rates are updated and calculated based on the most current rules worldwide. This automated system can reduce the time you spend on tax-related activities by 50% or more.

Log in to your Wix account.

From your Wix site dashboard, click Settings.

Select Store Tax.

Here are some guides to setting up your sales tax automations if you sell in home rule states or Canada.

Dont have your online store up and running yet? Create your eCommerce site and start selling today.

Daniel Clinton

Managing Editor, Wix eCommerce

Read Also: Home Improvement Cost Basis

How To Calculate Sales Tax With Our Online Sales Tax Calculator

As you can see, this is precisely the same as how you calculate percent increase… or if you want to find out the pre-tax price while using our calculator, simply input the gross price and the sales tax rate to perform the reverse sales tax calculation!

Besides, it’s quite likely that you’ll find our , and calculators handy as well, especially if your job is in any way related to sales.

Do All States Have Sales Tax

While most states have a sales tax, some states do not. These states are Alaska, Delaware, Montana, New Hampshire and Oregon. Businesses operating in these states only add sales tax to their customers’ purchases if they need to collect it for the city or county. Hawaii and New Mexico also don’t have a state sales tax, but they have general excise and gross receipts taxes similar to sales tax.

Recommended Reading: Mcl 206.707

Determine The Tax Rate

Determining the tax rate refers to identifying the total amount of tax you must charge. If, for example, your state has a three percent tax rate and your county and city each a one percent rate, the total tax rate applicable to any item sold in your city is five percent: 3 + 1 + 1 = 5.

However, determining the tax rate also refers to identifying the number you must use in your calculations. To transfer a percentage into a usable number for calculation purposes, you move the decimal point two spaces to the left. The decimal point is always located after the first number in the tax rate percentage. In the previous example, even though omitted, the decimal point is: 5.00, meaning that the tax percentage is 5.00 percent.

Moving the decimal point two spaces to the left may require you to add zeros before the first number . For example: 5.00 percent becomes .0500. For ease, you can remove the zeros at the end of the conversion, to have .05. This is the number that you will use to multiply the sale price by.

How To Find Original Price Before Tax

There are times when you may want to find out the original price of the items youve purchased before tax. Instead of using the reverse sales tax calculator, you can compute this manually. To find the original price of an item, you need this formula:

OP with sales tax =

But theres also another method to find an items original price. You can use this method to find the original price of an item after a discount or a decrease in percentage. Here are the steps:

- Subtract the discount rate from 100% to acquire the original prices percentage.

- Multiply the final price of the item by 100.

- Finally, divide the percentage value you acquired in the first step.

Read Also: How To Do Taxes For Doordash

Combined State And Local Sales Tax Rates

The high diversity of sales tax structures on a state level means that states have difference attractiveness for businesses. There are two key reasons behind it:

- higher rates and more complex taxation system raise the cost of production,

- as a response to higher sales tax rates consumers may reduce consumption or move their shopping to states where the tax burden is low.

An optimal sales tax is one that is applied to a broad base of goods and services with a low tax rate. Such a tax system can minimize the adverse impacts, especially the economic distortion, that occurs when consumers adjust their consumption behavior according to the tax differentials.

The below graph shows the ranking among states according to their Combined State and Local Sales Tax Rates in 2021 that gives you an overview of how attractive tax systems are over the United States.

How Much Taxes Do They Take Out Of A 900 Dollar Check

Your Federal Income Tax

You would be taxed 10 percent or $900, which averages out to $17.31 out of each weekly paycheck. Individuals who make up to $38,700 fall in the 12 percent tax bracket, while those making $82,500 per year have to pay 22 percent. There are also 24, 32, 35 and 37 percent tax brackets.

Also Check: Doordash How Much Should I Set Aside For Taxes

Identifying The Sale Price

An item’s sale price is what a customer is charged for its purchase. This means that it includes any discounts or other reductions. For example, an item costing $100.00 having no applicable reductions has a sale price of $100.00, but an item costing $100.00 on sale for fifty percent off is $50.00. You calculate this by multiplying the converted reduction percentage and then subtract the result from the price total. For example:

- 100 x .5 = 50

- 100 – 50 = 50

The result is the item’s sale price: $50.00. Another example: a $100.00 item is on sale for 15 percent off:

- Convert the percentage reduction: 15 = .15

- Multiply the price by the converted value: 100 x .15 = 15

- Subtract the result from the total price: 100 – 15 = 85

- The result is the item’s sale price including the discount: $85.00

This calculation is essential because it is the sale price including the discount that you use to calculate sales taxes.