Record All Business Deductions

The more you track tax deductions and the more organized you are, the better youâll be during tax season. Remember, you are responsible for paying both sides of the self-employment tax. When you know your expenses and accurately track them, you will understand what tax deductions you can get and can maximize them. Simply follow the Schedule C instructions to claim your tax deductions.

Note: Itâs critical to separate business expenses from personal ones, as you donât want to merge the two accidentally. If you want to do all of that automatically, try Bonsais freelancer 1099 expense tracking software. Our tax software can help you organize all of your expenses and save you money on your tax bill at the push of a button.

You May Like: How To Figure Out Tax Deductions From Paycheck

Publications And Subscriptions Deduction

The cost of specialized magazines, journals, and books directly related to your business is tax deductible as supplies and materials.

A daily newspaper, for example, would not be specific enough to be considered a business expense. A subscription to Nations Restaurant News would be tax deductible if you are a restaurant owner, and Nathan Myhrvolds several-hundred-dollar Modernist Cuisine boxed set would be a legitimate book purchase for a self-employed, high-end personal chef.

Contributions To Employee Pension Or Retirement Plans

If you make contributions you make to your employees retirement plans , Keogh plans, profit sharing plans), then these contributions are tax-deductible. Make sure to deduct contributions to your own retirement on form 1040 Line 28).

For more detail on what expenses require and allow, check out the IRS guidelines for the Schedule C Form. The best bet is to find a tax preparer who specializes in self-employment taxes to help you maximize all of these deductions and keep as much of your earnings as possible.

Disclaimer: The information contained in this Guide is not offered as legal or tax advice. The U.S. federal income tax discussion included in this Guide is for general information purposes only and is not a complete analysis or discussion of all potential tax consequences that may be relevant to a particular individual. In light of the foregoing, each individual should consult with and seek advice from such individuals own tax advisor with respect to the tax consequences discussed herein. Any information contained in this Guide is not intended to be used, and cannot be used, for purposes of avoiding penalties imposed under the U.S. Internal Revenue Code of 1986, as amended.

Also Check: How To Pay Fica Taxes

Does Getting A 1099

Getting a 1099-K does not mean that your payment transactions are taxable. You may receive a 1099-K if your non-business payments exceed the minimum reporting thresholds.

For example, you might receive a 1099-K for a peer payment paying you back for dinner or taking credit card payments at a garage sale where you sold your personal items for less than you paid for them. These are not taxable events.

Your reportable payment transactions could also have been hobby income instead of business income.

The purpose of 1099-K is to help the IRS find business income from payers who traditionally didnt have to issue a 1099-NEC or were bad at following the requirements. Since the payment processor doesnt always know what payment card transactions are for, non-taxable payments can end up on a 1099-K.

How To Calculate The Home Office Deduction

You have two choices for calculating your home office deductionthe standard method or the simplified optionand you dont have to use the same method every year. The standard method requires you to calculate your actual home office expenses and keep detailed records in the event of an audit.

The simplified option lets you multiply an IRS-determined rate by your home office square footage. To use the simplified option, your home office must not be larger than 300 square feet, and you cannot deduct depreciation or home-related itemized deductions.

The simplified option is a clear choice if youre pressed for time or cant pull together good records of your deductible home office expenses. However, because the simplified option is calculated as $5 per square foot, with a maximum of 300 square feet, the most that youll be able to deduct is $1,500.

If you want to maximize your home office deduction, youll want to calculate the deduction using both the regular and simplified methods to find out which one will give you the greater benefit. If you choose the regular method, calculate the deduction using IRS Form 8829, Expenses for Business Use of Your Home.

Recommended Reading: How To Pay My Federal Taxes

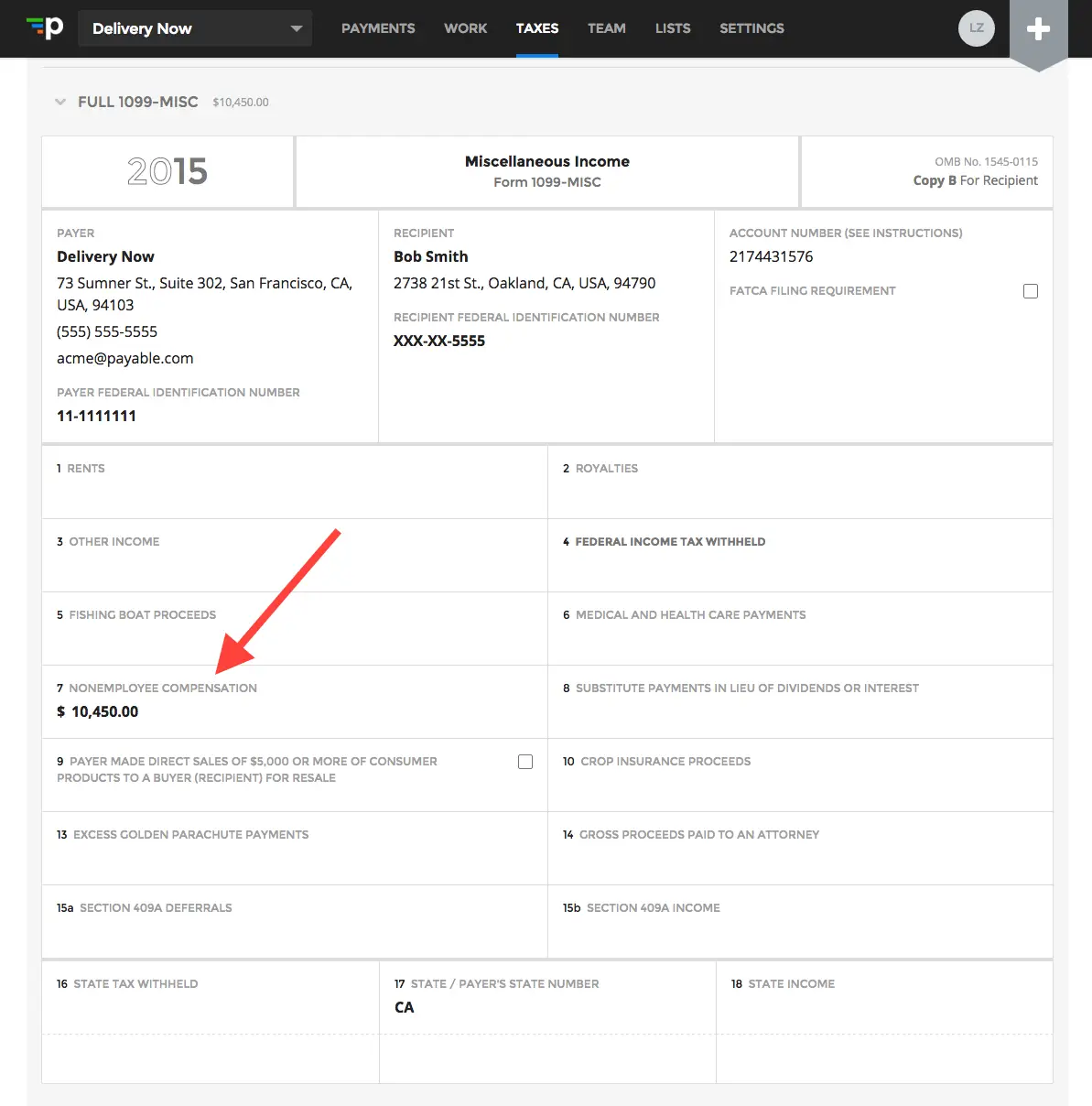

How To File Taxes With Irs Form 1099

OVERVIEW

If you receive tax form 1099-NEC for services you provide to a client as an independent contractor and the annual payments you receive total $400 or more, you’ll need to file your taxes a little differently than a taxpayer who only receives regular employment income reported on a W-2.

Apple Podcasts | Spotify | iHeartRadio

|

Key Takeaways When you provide $600 or more in services to a business, that client is usually required to report your earnings by issuing Form 1099-NEC. When you receive form 1099-NEC, it typically means you are self-employed and claim your income and deductions on your Schedule C, which you use to calculate your net profits from self-employment. As a self-employed person, you’re required to report all of your self-employment income. If the amount you receive from your self-employed work totals $400 or more, you will likely need to pay self-employment taxes using Schedule SE. |

One of the most common reasons youd receive tax form 1099-NEC is if you’re self-employed and did work as an independent contractor during the previous year. The IRS refers to this as nonemployee compensation.

The process of filing your taxes with Form 1099-NEC is a little different than if you only had income reported on a W-2. Here’s some tips to help you file.

Who Issues Form 1099

Third-party network transactions are reported by the third-party payment processor. The business making the payments does not report this income to the IRS.

The Form 1099-NEC IRS instructions clearly say that a business that pays its vendors through a payment settlement entity that reports on 1099-K should not issue a 1099-NEC. Despite this, some tax professionals are fraudulently pressuring clients into issuing 1099-NECs when they shouldnt to increase their tax preparation fees.

Recommended Reading: How To Do Taxes On Paper

Phone And Internet Bills

As a self-employed worker, you can take a tax deduction for whatever percentage of your phone and internet usage is for business purposes.

If you rent an office space with its own internet connection and pay for a second phone line just for your business communications, you can deduct the entire cost of both services.

However, if you have a home office or use your personal cell phone number for work, you can only deduct the business portion of the related expenses. Unfortunately, it can be particularly difficult to calculate that split for your phone and internet costs.

Determine If The Worker Is An Employee Or Independent Contractor

Companies must thoroughly understand the relationship between themselves and their workers are they employees or independent contractors? The answer isnt always cut and dried, which is why the IRS provides specific guidelines for worker classification.

In general, if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done, then the person performing the work is an independent contractor. To determine this degree of control, the IRS considers three common law rules:

Also Check: How To Calculate Gas For Taxes

What Happens If I Dont Amend My Tax Return

The IRS gets a Form 1099-G from the state unemployment office showing what they paid you. If you dont include that income on your tax return, the IRS computers will automatically flag your return.

The IRS will calculate the additional amount you owe and send you a bill. It will usually take several weeks or months to do so. In addition to the extra taxes, you will owe interest and penalties from when your tax return was due until you pay in full.

Also Check: Are Taxes Due By Midnight May 17

The Home Office Deduction

If you work from your home or use part of it in your business, then self-employment tax deductions like this one could get you a break on the cost of keeping the lights on.

What you can deduct: A portion of your mortgage or rent property taxes the cost of utilities, repairs and maintenance and similar expenses. Generally, this deduction is only available to the self-employed employees typically cannot take the home office deduction.

How it works: Calculate the percentage of your home’s square footage that you use, in the IRS words, exclusively and regularly for business-related activities. That percentage of your mortgage or rent, for example, becomes deductible. So if your home office takes up 10% of your house’s square footage, 10% of those housing expenses for the year may be deductible. IRS Publication 587 outlines a lot of scenarios, but note that only expenses directly related to the part of your home you use for business say, fixing a busted window in your home office are usually fully deductible.

What else you can do: Choose the simplified option, which lets you deduct $5 per square foot of home used for business, up to 300 square feet thats about a 17-by-17-foot space. You wont have to keep as many records, but you might end up with a lower deduction, so consider calculating it both ways before filing.

» MORE: Home office tax deductions for small-business owners

Don’t Miss: How Do You Owe Taxes

Why Is The Amount On My Form 1099

The amount of refund shown on your Form 1099-G could be different from the amount of refund you received for any of the following reasons:

-

You reported consumer use tax on your D-400

-

You made a contribution to the NC Nongame and Endangered Wildlife Fund, the NC Education Endowment Fund, or the NC Breast and Cervical Cancer Control Program

-

You chose to apply a portion of your overpayment toward the following years estimated tax

-

A portion of your overpayment was offset to a prior tax year or external agency having a claim against your refund

-

You received interest which is reported separately on a Form 1099-INT

Car And Truck Expenses

For some 1099 contractors, vehicle expenses can be a valuable source of deductions. If your car or truck is in your business name and used 100% for business use, then itâs fully deductible.

If the vehicle is in your personal name and used partly for personal, partly for business use, there are two ways to calculate the deduction:

Track your actual car expenses, including gas, maintenance, insurance and depreciation and deduct a percentage based on the number of business miles you drive.

Deduct a standard rate on each âbusinessâ mile driven for the year. For the second half of 2022, the standard mileage rate is 62.5 cents per mile driven for business use, up from 58.5 cents per mile in the first half of the year.

No matter which method you choose, youâll need to keep track of how many business and personal miles you drive. You can do this using a log kept in your carâs glove compartment, or use an app like MileIQ or TripLog.

Further reading:The Five Best Mileage Tracker Apps

If you used five or more vehicles in your business, you must use the actual expense method.

If you want to keep things simple, stick with the standard mileage rate since you arenât required to keep receipts every time you stop for gas or get an oil change. If you prefer, you can try calculating your deduction both ways and use the method that gives you the higher deduction.

Remember to add all business parking fees and tolls paid during the year, as these are deductible too.

Also Check: Do You Pay Taxes When You Sell Your House

How Much Taxes Do You Pay On A 1099

There is no set tax rate for Form 1099-K since your gross receipts could be different types of income.

For business income, youll pay income taxes plus self-employment tax. Hobby income is generally only subject to income tax.

If the reported income on Form 1099-K isnt taxable, you, of course, wont have to pay taxes.

Entering Multiple 1099 Forms

if you received 1099-MISC forms from several payers, you will need to enter each one separately in your tax software. If you have just one business, all 1099-MISC forms are collected and added to your business tax schedule for that business. If you have several businesses, be sure each 1099 form is connected to the right business.

Also Check: How Do I Find The Amount Of Property Taxes Paid

What Happens If I Dont Report 1099

If you dont report 1099-K income at all or have a lot of business deductions so your reported profit is much lower than your gross receipts, you could get a letter from the IRS.

Be prepared to show 1) proof of what the payments were for and 2) proof of the deductions you claimed.

This means you may need to keep records and receipts of non-business third-party network transactions. Some networks dont report personal payments on 1099-K, so if you have a lot of personal transactions, you may want to move to one of those payment services.

Its also a good idea not to make both business and personal third-party network transactions in the same account.

Phone And Internet Costs

Anyone from real estate agents and journalists to day care providers and jewelry makers could deduct part or all of their annual cell phone or internet bill.

What you can deduct: You can deduct your entire bill if you have a dedicated business cell phone or internet connection.

How it works: You must use your smartphone or internet service for business, and your employer if you have one must not reimburse you.

What else you can do: If you don’t have a dedicated line, you can deduct the percentage used for business.

You May Like: How Do Taxes On Cryptocurrency Work

Insurance Premiums And Retirement Accounts

If you have forms of professional or liability insurance that are relevant to your job, you may be able to claim those as business expenses.

Meanwhile, contractors who pay for their own health and dental insurance can claim these costs directly as a deduction. This also applies to any insurance costs you pay for your immediate family.

Finally, dont forget to deduct your contributions to any qualifying retirement accounts, like a SEP-IRA. Since you dont have someone managing a 401 for you theres no one to do this for you, and its certainly important to take care of.

How Strong Is A Verbal Agreement In Court

Most business professionals are wary of entering into contracts orally because they can difficult to enforce in the face of the law.

If an oral contract is brought in front of a court of law, there is increased risk of one party lying about the initial terms of the agreement. This is problematic for the court, as there’s no unbiased way to conclude the case often, this will result in the case being disregarded. Moreover, it can be difficult to outline contract defects if it’s not in writing.

That being said, there are plenty of situations where enforceable contracts do not need to be written or spoken, they’re simply implied. For instance, when you buy milk from a store, you give something in exchange for something else and enter into an implied contract, in this case – money is exchanged for goods.

Don’t Miss: How Much Is The First Time Home Buyers Tax Credit

No Withholding On 1099 Income

You may be wondering why there was no tax withholding on your 1099-NEC form. That’s because the payer didn’t withhold any taxes from your payments during the year. Employers are not required to withhold federal income taxes from non-employees, except in specific circumstances. Employers also do not withhold Social Security and Medicare taxes from non-employees.

What Are The Tax Form 1099

Starting with the 2022 tax year, you will receive a 1099-K if you have more than $600 in third-party payment network transactions through a single payment settlement entity.

There is no longer a minimum number of payment transactions to receive a 1099-K. If you have a single transaction thats $600 or more, you could get a 1099-K.

Up through the 2021 tax year, you would get a 1099-K if you received gross payments totaling $20,000 or more AND had more than 200 reportable payment transactions during the year.

It was very easy for someone to have $200,000 in gross payments but only 199 third-party network transactions and leave the income off of his income tax return. The IRS lowered the requirements for a third-party payment network to report payments to reduce potential tax evasion.

Read Also: How Much Is Property Tax In California

How To Include A 1099

The Balance / Britney Wilson

You received a Form 1099-NEC from someone who paid you for the work you did as an independent contractor. Now what? Two big questions here:

You must report the income on your personal tax return and you must pay both income tax and self-employment tax on this income.