Difference Between Take Home Salary And Ctc

Your job may entitle you to some benefits in the form of food coupons or a cab service apart from your salary. The total cost to the company is the sum of all the benefits offered plus your salary.

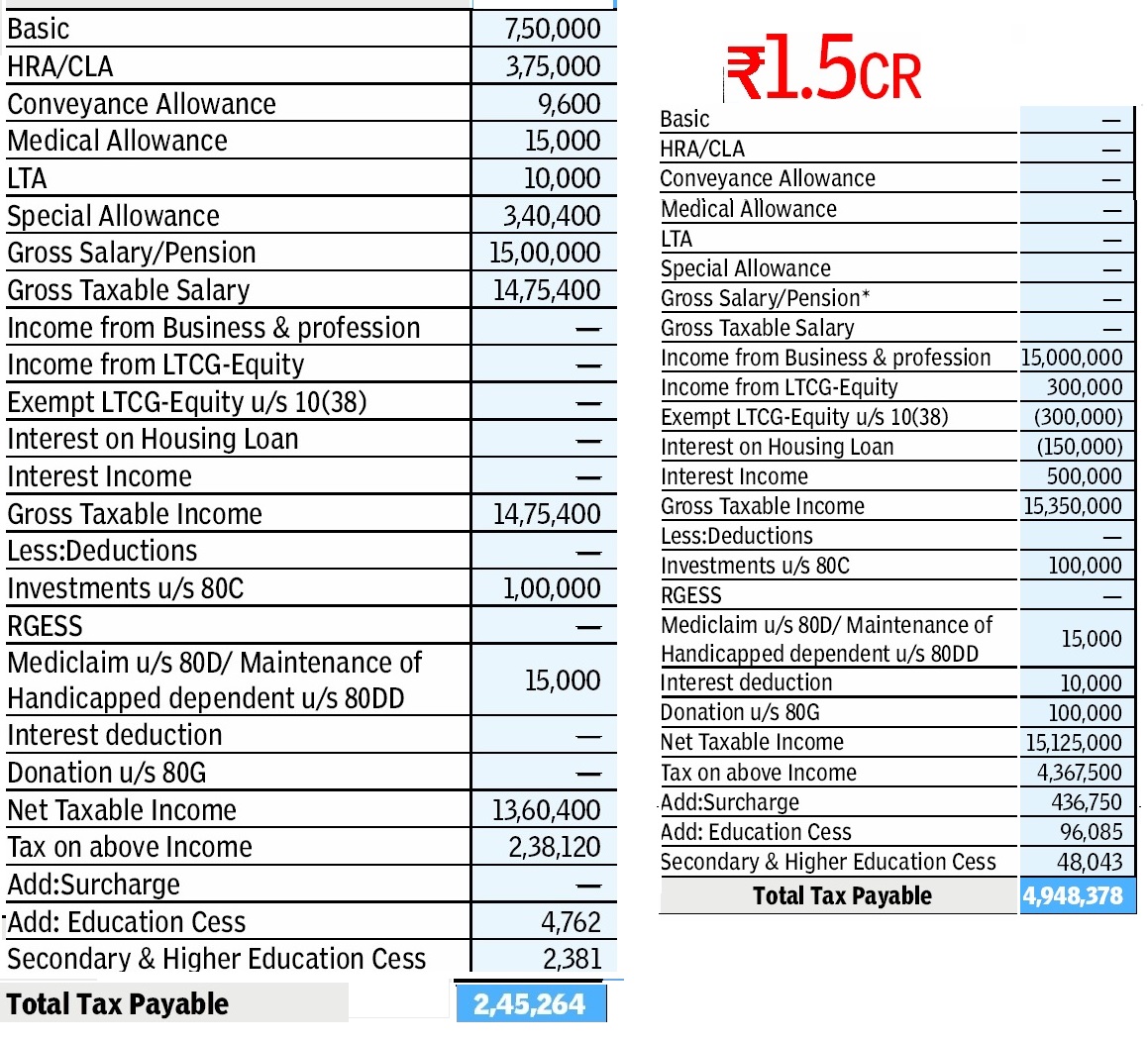

Below is an example of components of your CTC that is on your offer letter.

Broadly your CTC will include:

a. Salary received each month.

b. Retirement benefits such as PF and gratuity.

c. Non-monetary benefits such as an office cab service, medical insurance paid for by the company, or free meals at the office, a phone provided to you and bills reimbursed by your company.

Your take-home salary will include:

a. Gross salary received each month.

b. Minus allowable exemptions such as HRA, LTA, etc.

c. Minus income taxes payable .

Which States Have No Income Tax

Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming do not collect state income taxes. New Hampshire doesnt tax earned wages, but it does tax income earned from interest and dividends. At the end of 2023, New Hampshire will begin phasing out these taxes, and all personal income in the state will be tax free by 2027.

California Alcohol Cigarette And Gas Taxes

Products that face separate tax rates include alcoholic beverages, tobacco products and gasoline. For alcohol and cigarettes, rates are assessed based on the quantity of the product purchased. Wine, for example, faces a rate of 20 cents per gallon. For regular gasoline, there is a 51.10 cent per gallon excise tax.

Recommended Reading: How Much Taxes Deducted From Paycheck Md

Choosing Standard Or Itemized Deductions

Once you know your AGI, you have the opportunity to lower your taxable income even more by subtracting either the standard deduction or your itemized deductionswhichever is greater.

When to consider the standard deduction

If your financial situation is straightforward, the standard deduction might be the best and simplest choice. The standard deduction for 2014 is $6,200 for single filers, $12,400 for married filing jointly and $9,100 for head of household.

When to consider itemizing deductions

If you pay a lot in state income taxes, have a mortgage on your home, give a lot to charity, have paid extensive medical bills or manage a lot of investments, you might be better off taking the extra time to itemize your deductions.

Examples of legitimate itemized deductions:

- State and local income taxes

- Specified medical and dental expenses that exceed 10 percent of your AGI , including limited amount of premiums paid for long-term care policies

- Mortgage interest on first and secondary residences , plus interest on home equity loans

- Charitable contributions to tax-exempt organizations

- Casualty and theft losses

- Investment interest expense

- Miscellaneous expenses, including impairment-related expenses for persons with disabilities and gambling losses to the extent of gambling winnings

- In addition, the following can be itemized if the cumulative total is more than 2 percent of your AGI:

- Business expenses not paid by your employer

Four: Apply Your Personal Exemptions

There’s one more step to determine taxable income for the 2017 tax year — the personal exemption.

The personal exemption is disappearing after the 2017 tax year as part of the Tax Cuts and Jobs Act, but for 2017 returns, each taxpayer and their dependents are entitled to a $4,050 personal exemption .

So, in our example, this single filer would subtract a personal exemption of $4,050, finally arriving at their taxable income of $58,450.

Of course, if you’re reading this in preparation for your 2018 tax return , ignore this section.

Recommended Reading: Can I File My Taxes For Free

Three: Apply Deductions To Find Your Taxable Income

Next comes tax deductions. Now, Americans have two choices. They can add up all of the tax deductions to which they’re entitled, or they can choose to take the standard deduction.

For the 2017 tax year , the standard deduction is $6,350 for single filers, and $12,700 for married couples filing jointly. For the 2018 tax year, the standard deduction is increasing to $12,000 and $24,000 for single and joint filers, respectively.

You can choose to take your corresponding standard deduction, or take all of your actual tax deductions, whichever is higher. Mortgage interest, charitable contributions, state and local taxes, and certain medical expenses are some of the most common ones, but there are many other possible deductions.

The majority of Americans use the standard deduction, but it’s often a good idea to calculate your taxes using both methods to see which is most advantageous.

For example, let’s say that in our hypothetical example with an AGI of $70,000 in 2017, this taxpayer is single and has the following deductions:

- $5,000 in mortgage insurance

- $1,500 in charitable contributions

- $1,000 in state income taxes

This adds up to $7,500, higher than the $6,350 standard deduction for 2017. So, they would use the higher figure, resulting in $62,500 in remaining income.

Don’t Use This Tool If:

- You have a pension but not a job. Estimate your tax withholding with the new Form W-4P.

- You have nonresident alien status. Use Notice 1392, Supplemental Form W-4 Instructions for Nonresident Aliens.

- Your tax situation is complex. This includes alternative minimum tax, long-term capital gains or qualified dividends. See Publication 505, Tax Withholding and Estimated Tax.

Read Also: When Are Taxes Being Sent Out

Expanded Penalty Waiver Available If 2018 Tax Withholding And Estimated Tax Payments Fell Short Refund Available For Those Who Already Paid 2018 Underpayment Penalty

The IRS lowered to 80 percent the threshold required for certain taxpayers to qualify for estimated tax penalty relief if their federal income tax withholding and estimated tax payments fell short of their total tax liability in 2018. In general, taxpayers must pay at least 90 percent of their tax bill during the year to avoid an underpayment penalty when they file. On January 16, 2019, the IRS lowered the underpayment threshold to 85 percent and on March 22, 2019, the IRS lowered it to 80 percent for tax year 2018.

This additional expanded penalty relief for tax year 2018 means that the IRS is waiving the estimated tax penalty for any taxpayer who paid at least 80 percent of their total tax liability during the year through federal income tax withholding, quarterly estimated tax payments or a combination of the two.

Taxpayers who have not filed yet should file electronically. The tax software was updated and uses the new underpayment threshold and will determine the amount of taxes owed and any penalties or waivers that apply. This penalty relief is also included in the revision of the instructions for Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts.

History Of Income Tax

The United States imposed the nations first income tax in 1862 to help finance the Civil War. After the war, the tax was repealed, but it was reinstated after passage of the Revenue Act of 1913. That same year, Form 1040 was introduced.

Most countries, including the U.S., employ a progressive income tax system in which higher-income earners pay a higher tax rate compared with their lower-income counterparts. The idea behind progressive tax is that those who earn high incomes can afford to pay more tax. In 2022, federal income tax rates range from 10% to 37%.

Read Also: Are You Taxed On Cryptocurrency Gains

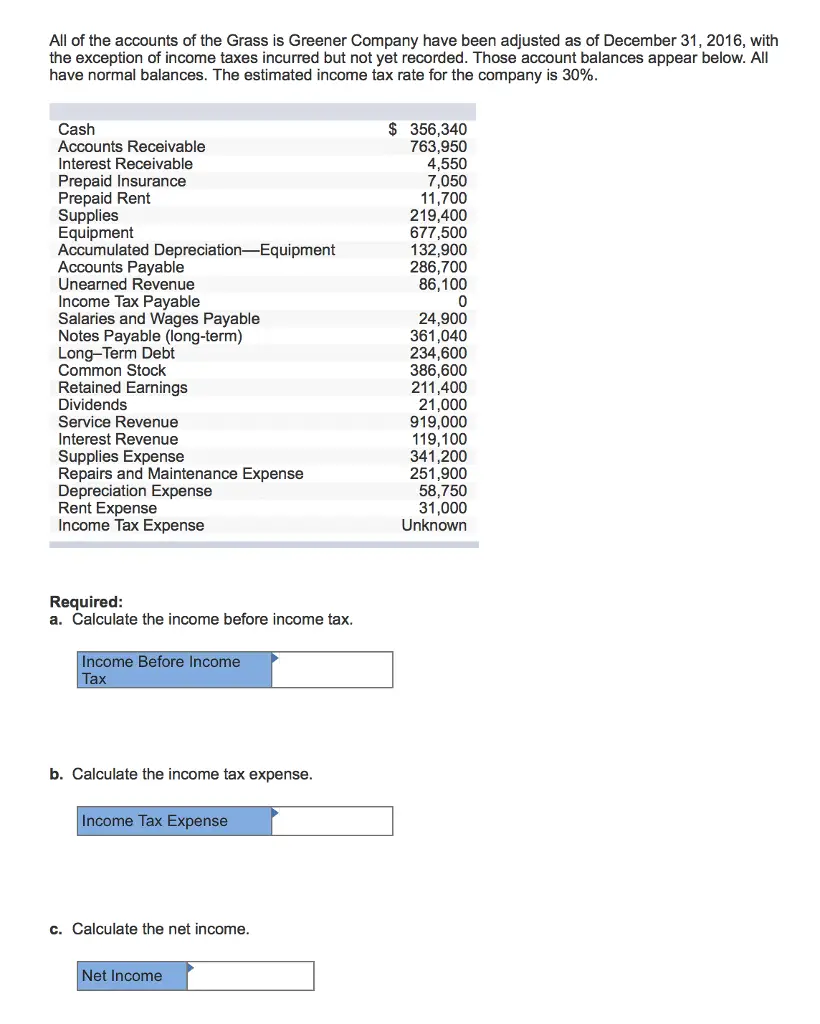

Are Income Tax Expenses Operating Expenses

No, they’re not. Operating tax expenses cover selling, general and administrative expenses, amortisation and depreciation. These don’t include taxes or investments in other companies and interest expenses.

Please note that none of the companies, institutions or organisations mentioned in this article are affiliated with Indeed.

Six: Apply Any Tax Credits

We’re not quite done yet. The last step is to apply any tax credits to which you are entitled. Unlike deductions, which reduce the amount of your income subject to tax, tax credits reduce the amount of tax you owe dollar-for-dollar.

There are many tax credits available, but some of the most common credits are:

- The Child and Dependent Care credit.

- The Retirement Savings Contributions Credit, or Savers Credit.

So, let’s say that in our example of a taxpayer who has calculated a 2017 federal income tax of $10,351.25, this individual qualifies for a Lifetime Learning Credit of $1,000. This would be subtracted from their tax bill, reducing it to $9,351.25.

Read Also: How Do I Find Out About My Tax Return

How To Track Your Tax Refund

Many taxpayers prefer to get their tax refund via direct deposit. When you fill out your income tax return youll be prompted to give your bank account details. That way, the IRS can put your refund money right in your account, and you wont have to wait for a check to arrive in the mail.

If you file your taxes early, you dont have to wait until after the tax deadline to get your tax refund. Depending on the complexity of your tax return, you could get your tax refund in just a couple of weeks. To get a timeline for when your refund will arrive, you can go to www.irs.gov/refunds. You can check the status of your refund within 24 hours after the IRS notifies you that it has received your e-filed tax return .

In a given tax year, you may want to know how big your refund will be so you can plan what to do with it. You may want to use it to boost your emergency fund, save for retirement or make an extra student loan or mortgage payment.

Income Tax Slab For Salaried Individuals

During the Union Budget 2020, the central government announced a new tax regime for the taxpayers. The new tax regime has relatively lower slab rates than its predecessor, and it eradicates most of the deductions available in the previous version.

This year, the income tax rates remain unchanged for taxpayers. Nevertheless, employees can choose between the new tax regime and the old one. The table provided below shows a brief comparison between the two tax systems.

* Rs. 50,000 deduction is only available in the old regime

Tax Rebate u/s 87A of the Income Tax Act, 1961 is the lower of Rs. 12,500 or the actual tax payable. It is only applicable to individuals with taxable income up to Rs. 5 lacs per annum.

You May Like: How To Do Taxes For Cryptocurrency

Bottom Line On Tax Returns

An accurate income tax return estimator can keep you from banking on a refund thats bigger in your mind than the real refund that hits your bank account. It can also give you a heads-up if youre likely to owe money. Unless youre a tax accountant or someone who follows tax law changes closely, its easy to be surprised by changes in your refund from year to year. Use the tool ahead of time so you arent already spending money you may never see. You can also run the numbers through a tax refund calculator earlier in the year to see if you want or need to make any changes to the tax withholdings from your paycheck.

How To Arrive At Your Tax Due

After you’ve figured out your taxable income, there are a few more steps to arriving at your actual tax due.

- Subtract any payments and/or credits from your taxes owed.

- On lines 75 and 76, you will determine whether you owe taxes or will receive a refund.

If you’re getting a big refund, you’re probably having too much withheld from your paycheck. In effect, this means you’re giving the government an interest-free loan. On the other hand, if you have too little withheld, you may be charged an underpayment penalty.

Also Check: Can I File Taxes Without My Spouse Present

How To Understand Income Tax Slabs

The Indian Income-tax works on the basis of a slab system and the tax is levied accordingly on individual taxpayers. Slab implies the different tax rates charged for different income ranges. In other words, the more your income, the more tax you have to pay. These income tax slabs are revised every year during the budget announcement. Again, These slab rates are segregated for different categories of taxpayers. As per the Income-tax of India, there are three categories of individual taxpayers such as:

- Individuals below 60 years of age including residents and non-residents

- Resident Senior citizens 60 to 80 years of age

- Resident Super senior citizens more than 80 years of age

New York Property Tax

Property taxes are assessed exclusively by counties and cities in New York State, which means that rates vary significantly from one place to the next. Effective rates – taxes as a percentage of actual value as opposed to assessed value – run from less than 0.7% to about 3.5%.

Surprisingly, the city with the lowest effective property tax rate is New York City, where property taxes paid total an average of just 0.88% of property value. The reason for that relatively low rate is that the taxable value of most residential property in New York City is equal to just 6% of the market value. That is, if your home is worth $500,000, you will only be charged taxes on $30,000 of that amount. Outside of New York City, however, rates are generally between 2% and 3%.

Regardless of city, if you are looking to refinance or purchase a property in New York with a mortgage, check out our guide to mortgages in New York. Weve got details on average mortgage rates and other information about getting a mortgage in the Empire State. You can also use our New York property tax calculator to find out what you would pay in property taxes in New York.

Read Also: Can You File An Amended Tax Return Online

Is A Pay Stub The Same As A Paycheck

Although paychecks and pay stubs are generally provided together, they are not one in the same. A paycheck is a directive to a financial institution that approves the transfer of funds from the employer to the employee. A pay stub, on the other hand, has no monetary value and is simply an explanatory document.

How To Calculate Your Tax Refund

Every year when you file your income taxes, three things can happen. You can learn that you owe the IRS money, that the IRS owes you money or that youre about even, having paid the right amount in taxes throughout the year. If the IRS owes you money it will come in the form of a tax refund. However, if you owe the IRS, youll have a bill to pay. SmartAsset’s tax return estimator can help you figure out how much money could be coming your way, or how much youre likely to owe.

Why would the IRS owe you a tax refund? There are several possible scenarios. You might have overpaid your estimated taxes or had too much withheld from your paycheck at work. You might also qualify for so many tax deductions and tax credits that you eliminate your tax liability and are eligible for a refund. A tax return calculator takes all this into account to show you whether you can expect a refund or not, and give you an estimate of how much to expect.

Also Check: Which Tax Program Gives The Biggest Refund

Determine Your Total Taxable Income

Your taxable income is the portion of your wages subject to government taxation. It may include salaries, tips, wages, bonuses, unearned income, investment income and assets you sold during the taxable year. Unearned income refers to lottery payments, strike benefits, disability and unemployment benefits and cancelled debts.

To determine your taxable income, subtract your expenses from your gross income to derive your business income. Next, subtract deductions from the business income. Deductions are tax credits you might benefit from based on age, company size and household status. You can also consult tax specialists, such as tax attorneys and certified public accountants , to calculate your taxable income.

Related:How to calculate net income

Apply The Income Tax Expense Formula

Once you have your total taxable income figure and the appropriate tax rate percentage, you can calculate your overall income tax expense. Input the appropriate numbers in this formula:

Taxable income x Tax rate = Income tax expense

For example, if your company had a total taxable income of $1 million and a tax rate of 20%, your income tax expense would be $200,000.

You May Like: Are Financial Advisor Fees Tax Deductible

First Step: Figure Out Your After

Income taxes are much easier to figure out on an annual basis, so let’s start there. The amount of federal income taxes withheld from your paycheck is based on three factors:

First, add your salary and any other income you expect to receive this year, such as rental income, dividends, interest, or self-employment income. Then subtract your applicable standard deduction amount or your itemized deduction amount — whichever is greater. Also remember to subtract any pre-tax contributions to retirement accounts you’ll be making or any health insurance premiums your employer pays.

| $25,900 | |

| Head of household | $19,400 |

|---|

This number is an estimate of your taxable income. From here, you can use the following tax table to figure out approximately how much federal income tax will be withheld from your paycheck.

Take the amount of your tax and divide by 12 to determine how much should be withheld per month. Also calculate your state taxes and any local taxes you may be subject to. Each state has a different tax rate . Here’s a link from TaxFoundation.org to help you find yours.

We’re not done with taxes quite yet. Social Security will take 6.2% of up to $160,200 of your salary, and Medicare will take another 1.45% and is applied to your entire salary, no matter how much it is.

From here, you’ll need to tally up the rest of your deductions, including :

An example

| SALARY |

|---|