What Are Income Tax Rates Like In My State

Individual income taxes are among the most significant sources of state tax revenue, accounting for 37 percent of all collections. Theyre also one of the most visible tax types to most individuals. Thats because taxpayers are actively responsible for filing their income taxes, in contrast to the indirect payment of sales and excise taxes.

Forty-three states levy individual income taxes. Forty-one tax wage and salary income, while two statesNew Hampshire and Tennesseeexclusively tax dividend and interest income. Seven states levy no income tax at all.

How Is Tax Liability Calculated

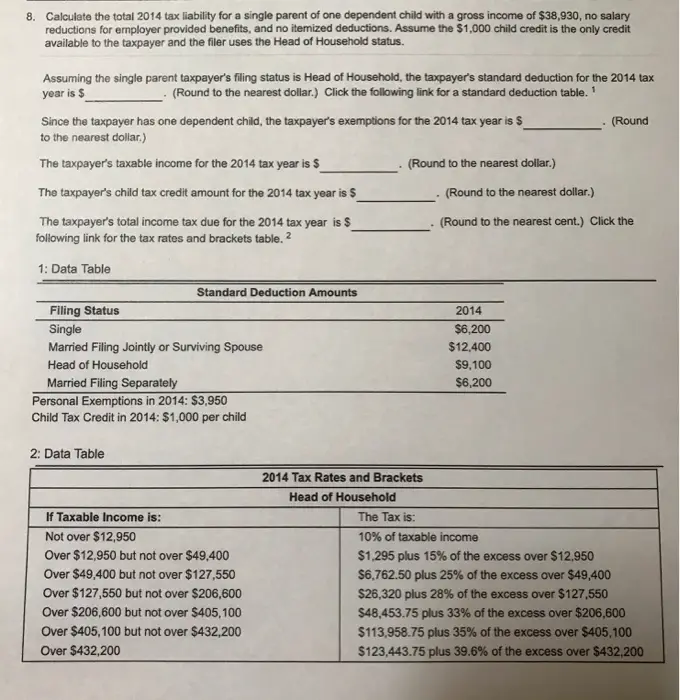

Now, lets put all the pieces together. Taking each of the concepts outlined abovemarginal tax rates and brackets, refundable and nonrefundable credits, and standard and itemized deductionshere is an example of how a taxpayers overall liability might be calculated.

Nate is an engineer and earns $75,000. Emily teaches 7th grade and earns $50,000. The couple has two children, ages 7 and 9. In Scenario 1 they rent a townhouse and have no itemized deductions. In Scenario 2, they own their own home and pay $16,000 annually in mortgage interest. They pay a combined $10,000 in property taxes and state income taxes and contribute $2,000 to their church and various charities.

Lets compare their tax liability in the two scenarios:

Federal Income Tax Return Calculator

Estimate how much you’ll owe in federal taxes, using your income, deductions and credits all in just a few steps with our tax calculator.

How we got here

The United States taxes income progressively, meaning that how much you make will place you within one of seven federal tax brackets:

Single filers

|

$995 plus 12% of the amount over $9,950 |

|

|

$4,664 plus 22% of the amount over $40,525 |

|

|

$14,751 plus 24% of the amount over $86,375 |

|

|

$33,603 plus 32% of the amount over $164,925 |

|

|

$47,843 plus 35% of the amount over $209,425 |

|

|

$157,804.25 plus 37% of the amount over $523,600 |

|

$1,990 plus 12% of the amount over $19,900 |

|

|

$9,328 plus 22% of the amount over $81,050 |

|

|

$29,502 plus 24% of the amount over $172,750 |

|

|

$67,206 plus 32% of the amount over $329,850 |

|

|

$95,686 plus 35% of the amount over $418,850 |

|

|

$168,993.50 plus 37% of the amount over $628,300 |

|

$995 plus 12% of the amount over $9,950 |

|

|

$4,664 plus 22% of the amount over $40,525 |

|

|

$14,751 plus 24% of the amount over $86,375 |

|

|

$33,603 plus 32% of the amount over $164,925 |

|

|

$47,843 plus 35% of the amount over $209,425 |

|

|

$84,496.75 plus 37% of the amount over $314,150 |

Head of household

|

$1,420 plus 12% of the amount over $14,200 |

||

|

$6,220 plus 22% of the amount over $54,200 |

||

|

$13,293 plus 24% of the amount over $86,350 |

||

|

$32,145 plus 32% of the amount over $164,900 |

||

|

$46,385 plus 35% of the amount over $209,400 |

||

|

$523,601 or more |

$156,355 plus 37% of the amount over $523,600 |

Don’t Miss: How To Calculate Tax In California

Arrive At Your Net Tax Liability

If your taxable income is more than Rs.5 lakhs, add the health and education cess of 4% to your tax to see the final amount payable. High income earners will pay surcharge as under: –

|

Total income in Rs. |

|

|

Exceeds 5,000,000 but lesser than 10,000,000 |

|

|

Exceeds 10,000,000 but lesser than 20,000,000 |

|

|

Exceeds 20,000,000 but lesser than 50,000,000 |

*Subject to marginal relief. Surcharge is computed on tax plus cess.

How To Figure Out Your Tax Rate If Youre A C Corp

The Tax Cuts and Jobs Act greatly simplified tax calculations for C corporations by replacing the graduated corporate tax rate schedule that included eight different tax rate brackets with a flat 21% tax rate.

In other words, if you own a C corporation, no matter how much taxable income your business has, your income tax rate will be 21%.

Read Also: How To Do Your Tax Return Online

Small Business Tax Liability

Small businesses are usually run as either proprietorship businesses, partnership firms, or small companies. Proprietorship businesses are run by an individual person who has the

the sole responsibility for the business, whereas partnership firms are run by two or more people and operate as per the Indian Partnership Act, 1932. Partnerships can be of different types, such as limited liability partnerships . These small businesses tend to operate under special tax provisions.

The corporate tax rate for companies depends upon their net profits. For example, if a company has a turnover of less than 250 crores, then the tax rate is 25%. For companies with a turnover above 250 crores, the corporate tax rate is 30%. Nonprofit organisations which are established for charitable purposes are free from the payment of corporate tax. This is due to the role they play in supplementing the gaps in the government’s welfare and development delivery systems. The exemptions granted to NPOs, however, are subject to various conditions and regulations.

You can incur short-term liabilities from normal business operationsreport tax liabilities with other current debts on your small business balance sheet. Your business can incur tax liabilities from any taxable events, which means a transaction resulting in tax liability. This includes earning taxable income, issuing salaries, and making sales.

Definition And Examples Of Tax Liability

Your federal tax liability is the amount of money you owe to the U.S. government in a given year. It’s based on the rules set by the Internal Revenue Service .

Preparing and filing your income tax return will tell you your tax liability for the tax year for which you’re filing. Anything that remains unpaid from previous years should be added to what you owe on that return. This ascertains your total tax liability. It’s included in your tax liability if you entered into an installment agreement with the IRS to pay off last years tax debt and you havent yet made the final payment on that agreement.

You can find your tax liability for the year on lines 37 and 38 of the 2021 IRS Form 1040. Appropriately, line 37 says, “Amount you owe. Line 38 is dedicated to any penalty you might also owe for making your estimated tax payments late.

Technically, line 24 is your total liability for the tax year. But the IRS probably already has some of that money, either through tax withholding from your paychecks or because you’ve made quarterly estimated payments. It’s line 37 that you have to concern yourself with because the IRS still wants that balance.

You May Like: How Much Tax Is Taken Out Of Social Security

Three Deduct Any Allowances Due To Arrive At The Amount On Which Income Tax Is Charged

Deduct from the amounts of the components left after Step two any allowances to which the taxpayer is entitled for the tax year… See section 25 for further provision about the deduction of those allowances.

Step three is where the personal allowance is deducted. Further information here.

Again Section 25 tells us that this should be done in the way which will result in the greatest reduction in the clients income tax liability , and again the allowance must be deducted from components rather than from the total net income figure to achieve this. See the worked example later in the article.

Ner With A Trusted Tax Accountant At Eco

Calculating a businesss tax liability can be complicated and time-consuming. For many business owners, it is beneficial to employ the help of a tax professional. Eco-Tax, Inc. offers several services, including tax planning services. When you work with Eco-Tax you will have a dedicated accountant who will be your trusted advisor in preparing and filing your year-end business and personal income tax returns. Your accountant will ensure that you take advantage of every tax benefit and reduce your taxes.

Eco-Tax also offers secure online filings. Eco-Taxs secure online portal is easy, convenient, safe, and provides you 24/7 access to all of your documents. You will also get unlimited consultations with Eco-Tax. Eco-Taxs advisors goal is to help you achieve the financial success you deserve.

When you employ the help of an Eco-Tax advisor they prepare all of your year-end business and personal tax returns. In addition to handling your year-end tax returns, you will also receive quarterly projections for your estimated tax payments from that quarter, automatic reminders for important tax deadlines, and timely notifications of any important tax updates.

With several different tax planning and preparation bundles available, Eco-Tax can help you calculate your tax liability no matter you and your businesss individual needs.

Recommended Reading: What Do I Need To Bring To Tax Preparer

What’s The Difference Between Estate Tax And Inheritance Tax

Estate tax is based on a percentage of the net value of an estate. Inheritance tax is based on the value of a single bequest. The estate pays the estate tax, while the beneficiary is responsible for paying the inheritance tax. Some people provide in their wills that the estate should pay any inheritance taxes on behalf of beneficiaries, too.

What Is State Income Tax Liability

State income tax liability is specifically how much you owe in taxes to the state government. Each year taxpayers earn income and depending on your state, you may owe a state income tax on what you earned.

Research your state’s income tax laws and income tax rate. These details will be different for every state. For example, Utah’s income tax rate is 4.95%, so taxpayers in Utah will owe 4.95% of their earned income to the state government in state income tax.

Read Also: Can We File Taxes Now

How To Figure Out The Tax Rate For C Corporations

Under the Tax Cuts and Jobs Act, its become much more straightforward for C corporations to make tax calculations. Instead of worrying about the corporate tax rate schedule and its eight different tax brackets, C corporations only have to pay a flat 21% tax rate.

It essentially means that a C corporation will have to pay an income tax rate of 21%, no matter the amount of taxable business income it earns.

Divide Into Quarterly Payments

Now that you know that your yearly tax liability is estimated to be $3,205, you can divide that by four to make your estimated tax payments, which would come out to $801.25 for each quarter.

If your business operates close to margin, meaning your income and expenses are fairly even, you may end up with no tax liability at all.

Recommended Reading: How Much Is Federal Inheritance Tax

How Do You Take 20% Off A Price

First, convert the percentage discount to a decimal. A 20 percent discount is 0.20 in decimal format. Secondly, multiply the decimal discount by the price of the item to determine the savings in dollars. For example, if the original price of the item equals $24, you would multiply 0.2 by $24 to get $4.80.

Income Tax Payable Vs Deferred Income Tax Liability

On a general note, income tax payable and deferred income tax liability are similar in the sense that they are financial accountabilities that are indicated on a companys balance sheet. However, they are distinctly different items from an accounting point of view because income tax payable is a tax that is yet to be paid.

It remains on the balance sheet because, probably the tax period is still to come. For example, if a business tax for the coming tax period is recognized to be $1,500, then the balance sheet will reflect a tax payable amount of $1,500, which needs to be paid by its due date.

Deferred income tax liability, on the other hand, is an unpaid tax liability upon which payment is deferred until a future tax year. Such a liability arises as a result of differences between tax accounting and standard accounting principles or practices. This sometimes appears as confusing, however, it is as simple as the fact that for example, in the United States the accounting required by the IRS is not identical to the accounting practices delineated by the Generally Accepted Accounting Principles .

Read Also: How To Claim Child Care On Taxes

How Is Nexus Determined

Nexus is determined by the amount of revenue from sales to customers in Colorado and using sales from the previous and current calendar years. You have a nexus if you have met the following condition:

- Your revenue from sales to customers was $100,000 or greater in the previous or current calendar year.

If youre in doubt about whether youll have to remit taxes in Colorado, contact US State authorities or Local Tax professionals.

Dont Miss: What Documents Do I Need For My Taxes

How Does Sales Tax Apply To Amazon Vendors

In addition to reporting earnings to the IRS at the end of the year, most retailers, including Amazon sellers, must collect and submit sales taxes. Fulfillment by Amazon sales taxes varies depending on the transaction and where it occurred. The sales tax rate is determined by the state and city where the customer resides, as well as the location of the item being shipped from, and can range from 0% to 13%.

Don’t Miss: Where Do I Pay My Taxes

Tax Liability And Recordkeeping

Not paying attention to your tax liability can turn into a big deal. You need to know what your tax liability is. And, you must have the records to back it up. Records are necessary to determine your tax liability as well as act as proof if the IRS audits you.

Collect and set aside the correct amount of taxes. For example, withhold payroll taxes from employees each pay period, and place the withheld taxes in a separate bank account.

Keep track of your tax liability by tracking expenses and income in your accounting books for small business. Stay up to date on tax laws so you know how much your tax liability is. Maintain documents in your records, too.

Stay on top of your tax liability due dates. Familiarize yourself with your businesss tax depositing schedule, and mark down due dates in a calendar.

You need organized accounting records to track your tax liabilities. Patriots online accounting software makes it easy to manage your books and organize your records. Interested in a free trial? Get yours today!

This article has been updated from its original publication date of July 28, 2016.

What Is Federal Income Tax Liability

Federal income tax liability is specifically how much you owe in taxes to the federal government. Each year taxpayers earn income and owe taxes on that earned income. A percentage of your income tax goes toward the federal government.

How much you make annually will put you in a federal tax bracket. Your tax bracket will then give you a tax rate percentage for how much you’ll owe in taxes based on how much you made in a year. If your annual earned income is below a certain amount, then you’ll actually be exempt from owing federal income tax.

Recommended Reading: Are Tax Relief Companies Worth It

One Identify The Components Of Income Then Add Together To Arrive At Total Income

Identify the amounts of income on which the taxpayer is charged to income tax for the tax year. The sum of those amounts is total income. Each of those amounts is a component of total income.

What is meant by a component? These are all possible components of a clients total income.

- Employment income

|

Onshore and offshore bond gains and slices |

Top slicing information is available here

What Are Use Taxes And How Do They Differ From Sales Taxes

Sales taxes are a form of consumption tax levied on retail sales of goods and services. If you live in the U.S., you are likely familiar with the sales tax from seeing it printed at the bottom of store receipts.

Youre likely less familiar with the use tax, however.

Use tax is owed on out-of-state purchases for which a sales tax was not charged but would be if purchased in-state.

Whereas retailers collect sales tax from consumers, then remit that to state governments, its the responsibility of consumers themselves to keep track of and pay their use tax liability.

For example, if you live in Massachusetts, but cross the border to purchase an item of furniture in New Hampshire, which doesnt levy a sales tax, youre required to report and pay use tax on that item when filing your personal income tax return.

The use tax rate is equivalent to the sales tax rate that would be owed if the purchase occurred where the taxpayer lives.

Read Also: How Do I Pay My Arizona State Taxes

Penalty For Underpayment Of Estimated Tax

If you didnt pay enough tax throughout the year, either through withholding or by making estimated tax payments, you may have to pay a penalty for underpayment of estimated tax. Generally, most taxpayers will avoid this penalty if they owe less than $1,000 in tax after subtracting their withholdings and credits, or if they paid at least 90% of the tax for the current year, or 100% of the tax shown on the return for the prior year, whichever is smaller. There are special rules for farmers, fishermen, and certain higher income taxpayers. Please refer to Publication 505, Tax Withholding and Estimated Tax, for additional information.

However, if your income is received unevenly during the year, you may be able to avoid or lower the penalty by annualizing your income and making unequal payments. Use Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts , to see if you owe a penalty for underpaying your estimated tax. Please refer to the Form 1040 and 1040-SR Instructions or Form 1120 Instructions PDF, for where to report the estimated tax penalty on your return.

The penalty may also be waived if: