If You Are Getting A Refund:

This is one of the great little secrets about the federal tax law. If you have a refund coming from the IRSas about three out of four taxpayers do every yearthen there is no penalty for failing to file your tax return by the deadline, even if you dont ask for an extension. However, this might not be the case for state taxes.

Thats not to say there arent very good reasons for filing on time. Even if you have a refund coming, consider the following:

- You cant get your money back until you file, so you should file as soon as you can to get your money as soon as possible.

- The statute of limitations for the IRS to audit your return wont start until you actually file your return. So, the sooner you file, the sooner the clock starts ticking.

- Some tax elections must be made by the due date, even if you have a refund coming. This applies to a very tiny percentage of taxpayers.

Who Should Use Turbotax

Whether youâre an experienced tax preparer or have little knowledge of tax law beyond knowing you need to file, TurboTax makes tax filing easy by walking you through the process with interview-style questions and options for live, on-screen support when needed.

TurboTax, a product of the financial, accounting, and tax-preparation software provider Intuit, is one of the most popular tax-filing options out there. Its popularity partly stems from its name recognition but also from the companyâs focus on design and offering users plenty of features.

How To File Federal & State Tax Returns Free

There are several reasons that I think TurboTax is the best. Firstly, their program called Absolute Zero. In other words, they charge $0 federal, $0 state, and $0 to file. While federal is often free, if youve wondered how to file state taxes free. Then heres your answer. This applies to simple returns. Secondly, you get the same quality walk-through which guides you through the process. Thirdly, their expert error checking and advice forums. And lastly, when you E-File with TurboTax, youll get your return faster.

You May Like: How To Get Doordash Tax Form

Recommended Reading: How To Pay Nc Taxes Online

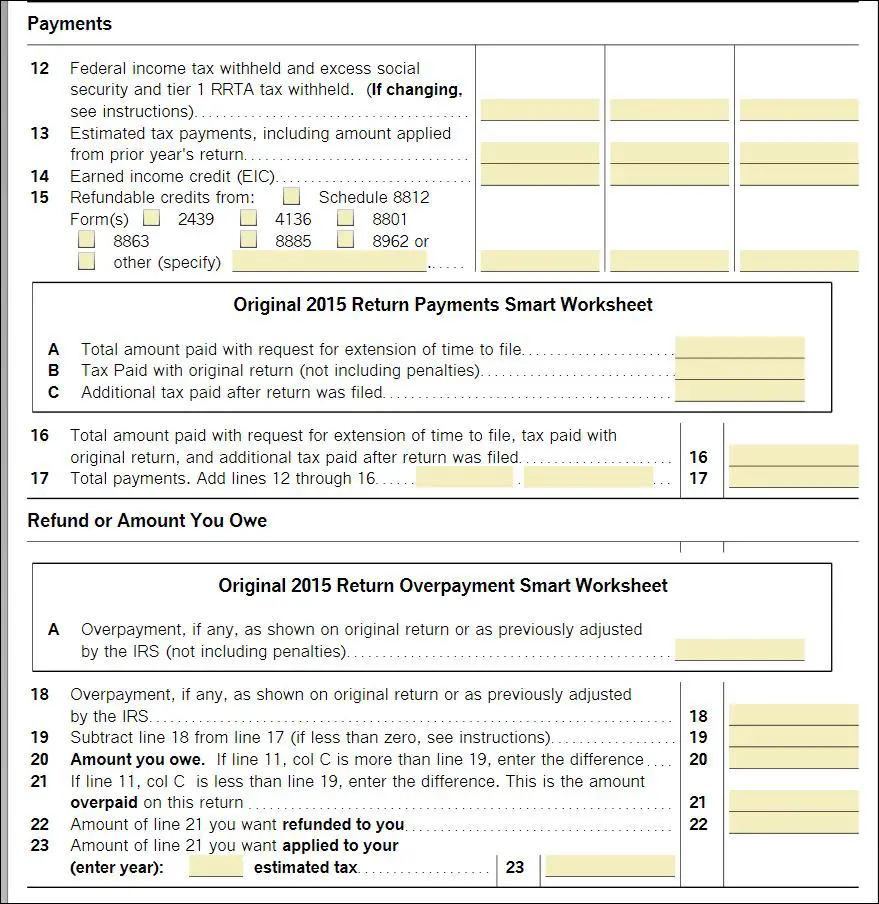

Estimated Quarterly Tax Payments

The U.S. operates as a pay-as-you-go tax system, meaning that you have to make income tax payments throughout the year. If you complete your LLC taxes using the default tax status , you will need to make estimated income tax payments. These tax payments are due four different times a year: April, June, September, and January of the following year.

You can make estimated tax payments using Form 1040-ES or online using IRS Direct Pay or the Electronic Federal Tax Payment System . Dont forget to keep track of your payments made, as youll need to report them on your tax return.

Can I File My Taxes Online For Free If Im A Non

Yes. TurboTax makes it easy to file your Candian tax return as a non-resident. In fact, if youre a non-resident you can use any of the TurboTax Online products, including TurboTax Free. For more info, read about How Residency Status Impacts Your Tax Return

With more than 20 years experience helping Canadians file their taxes confidently and get all the money they deserve, TurboTax products, including TurboTax Free, are available at www.turbotax.ca.

Recommended Reading: How Old Do You Have To Be To File Taxes

Irs Free File Available Until October 17 Midnight Eastern Time

Welcome to IRS Free File, where you can electronically prepare and file your federal individual income tax return for free using tax preparation and filing software. Let IRS Free File do the hard work for you.

IRS Free File lets you prepare and file your federal income tax online using guided tax preparation, at an IRS partner site or Free File Fillable Forms. It’s safe, easy and no cost to you for a federal return.

To receive a free federal tax return, you must select an IRS Free File provider from the Browse All Offers page or from your Online Lookup Tool results. Once you click your desired IRS Free File provider, you will leave the IRS.gov website and land on the IRS Free File providers website. Then, you must create an account at the IRS Free File providers website accessed via IRS.gov to prepare and file your return. Please note that an account created at the same providers commercial tax preparation website does NOT work with IRS Free File: you MUST access the providers Free File site as instructed above.

How To Form An Llc

Like corporations, LLCs are governed by state law. Youll need to draft articles of organization in the state where your company is headquartered, file them with the appropriate state office , and pay a filing fee.

Most states make the process easy. They usually have a preprinted form where you just fill in the blanks to provide your companys information, or they have a sample form to follow.

For LLCs with more than one member, youll also need to draw up an operating agreement. Items in this document should include: The rights and responsibilities of the LLC members what percentage of the business each member owns how the business will be managed how members will make decisions on major issues what the procedures are for adding new members and what tax treatment the LLC chooses.

Once youve established an LLC, you may have to pay annual registration fees to the state.

Also Check: How To Check State Tax Refund

Who Qualifies For Free File

If your adjusted gross income was $73,000 or less in 2021, you can use free tax software to prepare and electronically file your tax return, according to IRS instructions online for the 2021 tax season. If you earned more, you can use Free File forms.

See IRS.gov/freefile to research options.

Roughly 70% of taxpayers, based on income, qualify for some software services offered. But only a small fraction of those who qualify actually use Free File.

More than 4.2 million taxpayers used one of the free online partner products that are part of Free File in 2020, according to data from the IRS. That is excluding the millions of nonfilers who used the system to claim Economic Impact Payments.

For fiscal year 2020, the IRS processed more than 150 million individual electronically filed returns.

Why has Free File participation been so historically low even after an uptick in 2020? Is it because taxpayers don’t know about the heavily hyped Free File? Or did taxpayers go online and end up being directed somewhere else for tax services?

We’re not talking about a new program. It has been about 20 years since the IRS first entered into a special agreement to encourage tax software companies to provide free tax return software to a certain percentage of U.S. taxpayers. But in exchange, the bargain included getting the IRS to agree that it would not compete with these companies by providing its own software to taxpayers.

Common Forms To Gather

One of the first things to do is gather all of the forms youll need to file your tax return. Consider starting a folder for your tax return at the beginning of a tax year. Then, put any important tax information you receive in that folder until youre ready to file your tax returns.

Most of these forms will show up after the end of a tax year in January or early February. However, some forms may show up even later. Its important to wait until you receive all of the forms youre expecting before you file your tax return or you may leave out an important item.

Common forms to look out for include:

Forms may be mailed to you or you may be able to access them online. If you havent received your W-2, check with your employer, online, or even with the IRS. TurboTax tax software can import your W-2 electronically and even notify you when your W-2 is available to begin your tax return.

Check your tax information from last year to see if you received the same forms this year. If youre missing something, check to see if you no longer need that information. For instance, you may no longer receive a Form 1099-INT if you closed your bank account that issued it last year.

Additionally, you may experience new situations in a tax year that you havent experienced before. Youll have to make sure you think through the year to determine if there are any new forms you may receive so you can keep an eye out for them.

Also Check: What Is The Tax In Tennessee

Why Isn’t Turbotax Part Of Irs Free File Anymore

TurboTax announced in a blog post last July that it was not renewing its role with IRS Free File due to its limitations and “conflicting demands from those outside the program” that leave it unable to continue participating while still delivering “all of the benefits that can help consumers make more money, save more, and invest for the future.”

However, the company vowed not to give up on free tax filing options. TurboTax said it processed 17 million free tax filings last season of that, only 3 million came through the Free File program.

“Moving forward, Intuit is committed to continuing to offer free tax preparation while accelerating innovation to address all of consumers financial problems,” it added.

It’s worth noting that TurboTax came under fire a few years ago for using code that hid its Free File page from Google results, as reported by ProPublica. It later changed the code.

How Do I Buy T2 Returns

This FAQ applies to the TurboTax Business Incorporated edition for tax year 2021. To purchase additional returns for a prior tax year, visit Where can I purchase additional returns for previous years?

TurboTax Business Incorporated allows you to print and/or internet file one corporate return to federal and provincial authorities. To file or print additional returns, youll need an authorization code for each return. To obtain the necessary codes to do so, you have to purchase additional returns for $249.99.

Important: Before purchasing your print authorization code, confirm that the business number, legal name of corporation, and year-end are correct.

You May Like: Do You Have To Pay Taxes On Insurance Payouts

Can I Import Tax Forms

Online tax software has streamlined the ability to prepare your tax return by having you input your unique tax information through intuitive question and answer prompts, on-screen guidance, access to a tax professional, and convenient e-filing with the IRS.

Tax software allows you to import your tax information directly onto your return without needing to handle physical forms or manually enter the data.

You can import tax forms like:

- W-2 from your employer

- 1099-B, 1099-DIV, 1099-OID, 1099-INT or 1099-R forms from brokerages where you invest or institutions where you bank

- 1099-NEC forms from companies you work for as a self-employed person

- 1099-MISC forms for non-employment related payments or income

TurboTax Tip: When selecting the financial institution for importing your tax forms, be sure to select the right company from the list. For example, several participating partners’ names may start with First National Bank. Select your specific bank to ensure your details can be found.

Can I Share Turbotax With A Friend

Yes, you can share it with a friend, with some conditions.

When you purchase the TurboTax software , it says that it comes with 5 free federal e-files. This is actually an IRS rule, not a TurboTax one. The IRS only allows you to prepare and electronically file up to five federal and state tax returns.

You can, however, prepare an unlimited number of returns and print them out to mail in.

When you buy TurboTax, youre allowed to install it on any computer you own. When you do, you can prepare the returns of you and your immediate family. Ive seen families do this a lot where a parent does their returns as well as their children, often when theyre in college.

In that way, you can share TurboTax with someone else when you buy the software but you are limited to five e-files. E-filing is the fastest way to get a tax refund.

If youre using the online version, you can only do one return.

Read Also: Are Health Insurance Premiums Tax Deductible For Retirees

What If I Have More Than 2251 Transactions

Currently, TurboTax Online can only import up to 2,251 crypto transactions via its cryptocurrency import.

If you have more than 2,251 transactions, CryptoTrader.Tax will automatically consolidate your TurboTax Online file by asset type so that you can still import your transactions and still file your taxes with TurboTax.

When e-filing a consolidated 8949, you need to take one additional step and mail in your complete 8949 to the IRS. For detailed instructions on mailing, checkout this step-by-step guide.

Not Free No Help When The Irs Sends A Letter And Still Waiting For Refund Four Months Later

I used the TurboTax app to file my refund in early February. The app was relatively easy to use, but it did get old going in circles sometimes. Unfortunately, the free option really is not usable. If you have to file state taxes like just about everyone, then you will have to pay $40 per state. If youre a college student in another state like me, that means two states so $80. Of course, no student discount. Honestly, that was not too bad since I was supposed to get a lot back.Unfortunately, that was not what happened. I did get some from one the state returns, but that was it. The IRS sent a letter for a health insurance form that didnt even apply to me. If you want help with that, guess what? It will cost you even more money! At that point, I wasnt paying TurboTax any more so I went off on my own. Eventually I got it figured out, but not without massive disruption to my school work. None of that help was thanks to TurboTax which sends you to FAQs that dont really apply.They have online discussions which appear to have many people with the same problem. This program is made to look easy- and it is at first- but the headache it causes later is not worth it. Never had trouble like this with H& R Block so I think Ill go back to them next year. Whatever you do, dont use TurboTax. It is seriously not worth it. Still waiting for that federal tax refund BTW.

Read Also: When Will My Tax Return Come

Read Also: How To Pay City Taxes

Customers Who Viewed This Item Also Viewed

Find answers in product info, Q& As, reviews

Your question might be answered by sellers, manufacturers, or customers who bought this product.

Please make sure that you are posting in the form of a question.

Please enter a question.

- Product Dimensions :5.5 x 0.19 x 7.5 inches 2.25 Ounces

- Item model number :5100237

- Date First Available :October 24, 2021

- Manufacturer :Intuit, Inc.

What Are Turbotaxs Different Products

TurboTax offers four different products, Basic, Deluxe, Premier and Self-Employed, to choose from depending on the complexity of your return and how much human help you want.

Each tier offers two additional levels of expert help: TurboTax Live and TurboTax Live Full Service . Live assistance is an optional category that allows you to regularly consult with an expert who will review your return. Full Service has an expert completely prepare and file your return for you. With those added offerings, that means you technically have a total of 12 options.

Dont Miss: 1040paytax

Recommended Reading: When Are Income Tax Returns Due

There Are 2 Ways To Prepare And File Your Taxes

Americans have two basic options when it comes to filing their taxes:

1. Do it yourself with tax software or through the IRS website. The IRS does not charge to file taxes. If youre well-versed in tax law you can or request the paper forms in the mail. However, the IRS encourages online filing and directs taxpayers with incomes under $72,000 to its free filing portal, which lists 10 qualified tax preparers that offer free services .

For people with incomes north of $72,000, you can still find free filing options if you have straightforward income. A more complex situation like self-employment or complicated investments means youll likely have to pay an online tax preparer, which can range from $25 to $100 or more for federal and state filing.

2. Hire a tax preparer to do it for you. The only professionals qualified to help you are tax lawyers, CPAs, and enrolled IRS agents. You can search for appropriately credentialed preparers at taxprepareregistry.com.

Preparers generally start at around $100 and vary depending on where you live and how complex your taxes are, and accountants might very well charge at least twice that, with similar variations in price according to location and complexity. According to a survey from the National Association of Tax Professionals, the average charge for preparing and filing a tax return is $216.

You May Like: How To Register For Tax Id

Create A Sprintax Account

Sprintax will save your information so you can log in and out without starting over. If you use Sprintax in future years, your information will carry over.

To obtain the access code, which will be made available after all the tax-related documents from the University have been created, click General Services in myStatus and choose Sprintax Access Code. Submit the attestation. You will receive an automated email that contains the access code.

You May Like: Who Qualifies For California Earned Income Tax Credit