Payroll Taxes: Where To Start

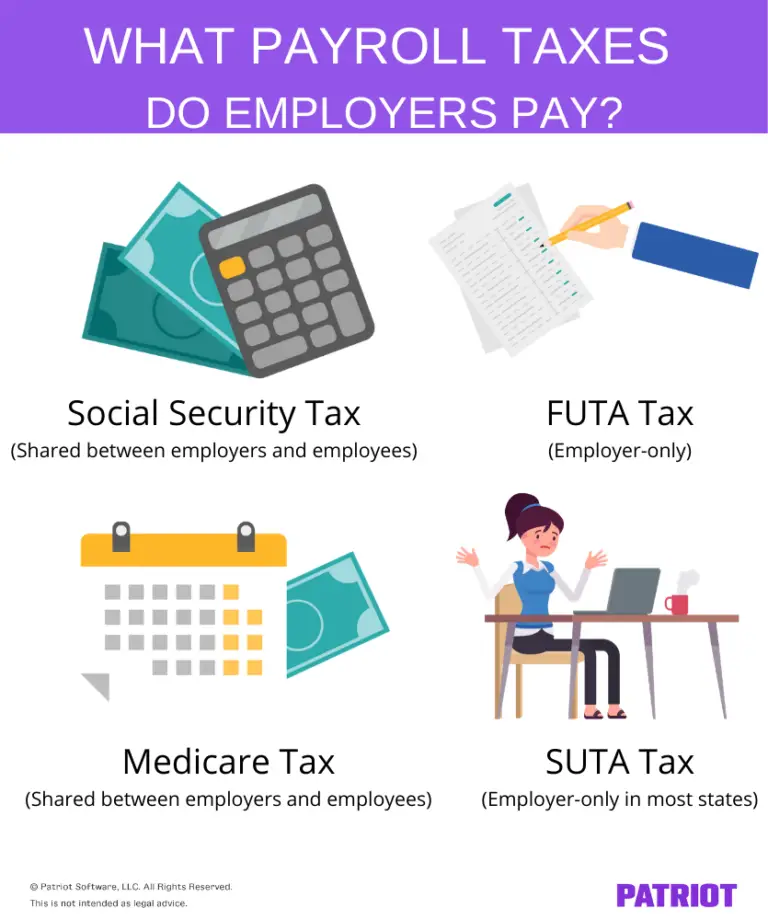

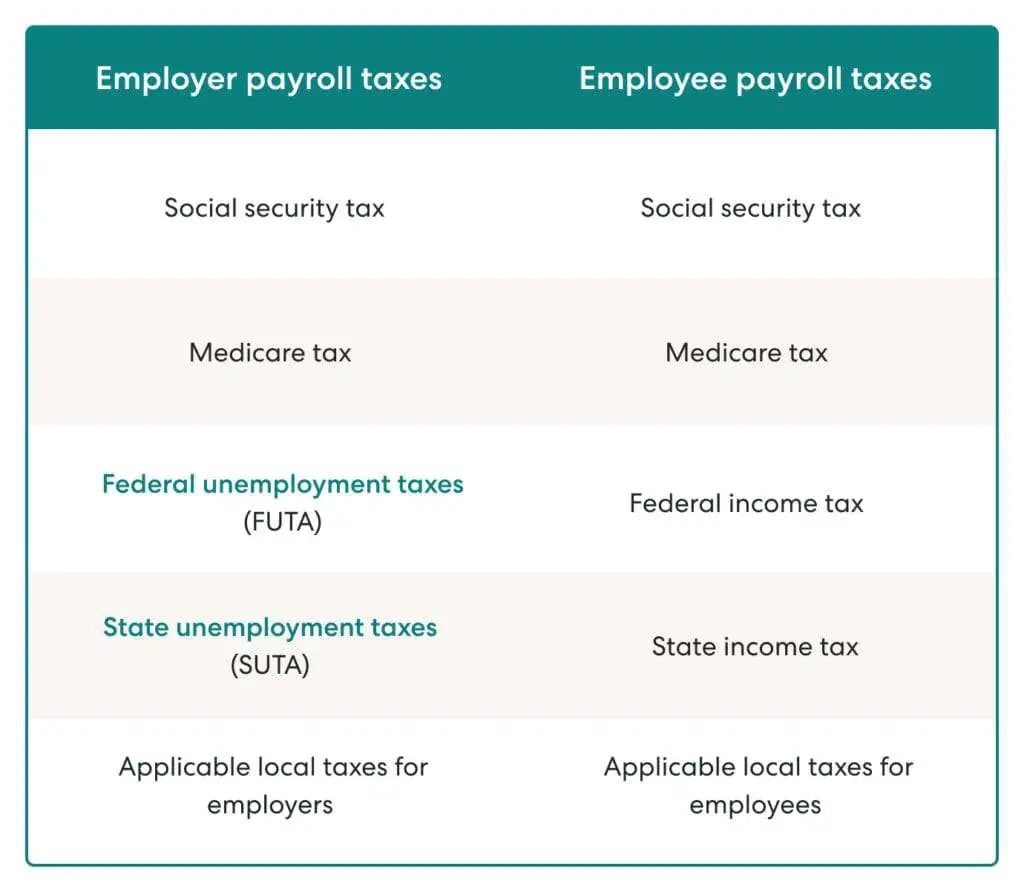

Now that you know what payroll taxes are, where do you start? As a small business owner, there are numerous taxes you are responsible for paying. Some taxes for small business owners include:

- Employers arent the only ones responsible for paying taxes, either. Employees also have to contribute their fair share, including payroll taxes and federal and state income taxes.

Once I’ve Calculated My Business Employment Taxes How Do I Submit Them

Payroll taxes must be deposited electronically through the Federal Electronic Tax Payment System, or EFTPS. Small employers who are permitted to pay their employment tax when filing their annual employer tax return can opt to use EFTPS.

For state employment taxes, check with your state to determine how to deposit employment taxes.

Calculation Of Tax For The Pay Period

For Option 2, you calculate the tax on the projected income for the year, and then find the tax amount that is proportional to the number of pay periods that have occurred . Compare the result to the tax deducted in the year-to-date. The difference is the tax payable on the current income.

Continuing the above example, if the total federal and provincial or territorial tax on $25,380.95 is $3,560.17, the proportional year-to-date tax is $2,875.52 . If the total tax deducted year-to-date is $2,736.40 the tax on the current income of $500 is $139.12 . The tax values used in this example are fictitious.

Also Check: When Will Taxes Start Being Accepted 2021

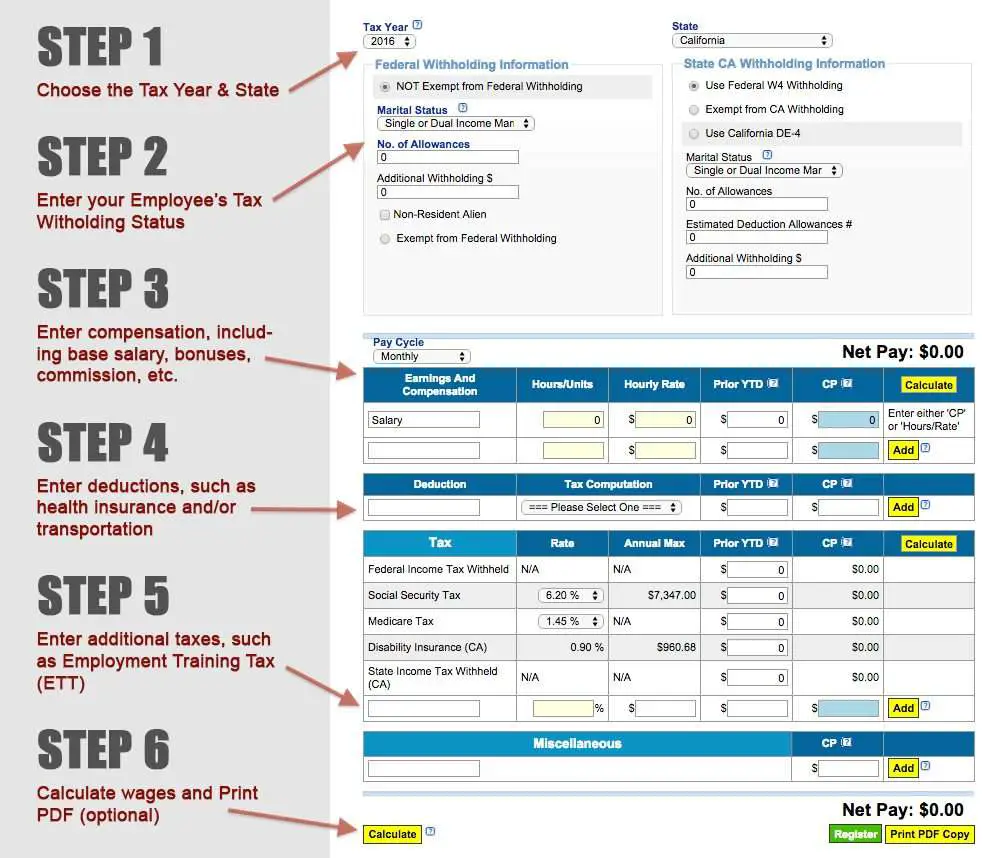

Helpful Payroll Tools To Get Payroll Done

Whether youre running payroll manually or working with a service provider, youre not in this alone. ADP offers a host of tools that can help both you and your employees manage payroll-related finances:

- If you offer stock options or employee discounts, this must be reported to the government.

- Payroll fraud Updates to employee bank accounts and Forms W-4 should be done in person, instead of email, to prevent payroll phishing scams.

Formula To Calculate Annual Taxable Income

A = Annual taxable income = HD F1 If the result is negative, T = L.

Only for employees paid by commission:

A = I1 F* F2* F5A U1* HD F1 E If the result is negative, T = L. * Estimated deduction amounts for the year. For registered retirement savings plan contributions included in F, you will need to find out from your employee paid by commission the estimated or expected annual deduction. We recommend that you caution employees not to exceed their RRSP contribution limit for the year.

P = The number of pay periods in the year:

Weekly

P = 12P = 10, 13, 22, or any other number of pay periods for the year

F2 = In situations where a garnishment or a similar order of a court or competent tribunal states that the alimony or maintenance payment cannot be more than a certain percentage of the employees net salary , more calculations may be required, as follows:

F1 = If the F1 amount is implemented after the first pay period in the year, F1 must be adjusted using the following formula: / PR

Only for employees in Quebec: F5Q = C ×

Recommended Reading: How Much Does It Cost To File Taxes

Calculate State And Local Tax

You next calculate any state taxes Aaron may be responsible for. Since Aaron lives and works in New Mexico, he must pay state tax. However, if Aaron lived in Alaska, Florida, Nevada, South Dakota, Texas, Washington State, or Wyoming, there would be no state income tax deducted from his check.

New Mexicos Wage Withholding table lets you know how much tax to withhold. Image source: Author

The New Mexico Wage Withholding table shows that youll need to deduct $64.67 plus an additional 4.9% of the additional amount over $2,183, which you can calculate as follows:

$2,500 – $2,183 = $317

Maintain Complete And Organized Payroll Records

An essential piece of the payroll puzzle is maintaining accurate and organized records. At some point, the IRS may audit you and investigate to ensure that all of your employees are working legally and that youre adhering to labor and payroll laws.

If this happens, its important that you have the necessary records and that they are neatly filed away. You should keep the following information on file for each employee from the time theyre hired until 34 years after their termination or resignation from your company:

- Name and job title

- Form W-4 or W-9

Also Check: How To Make Tax Payments

Problem #: Not Keeping Payroll Records For At Least 3 Years

Messy, incomplete, or missing payroll records are unacceptable to the IRS.

The FLSA mandates that employers must keep employee records for a minimum of 3 years after the individual stops working with the company. These records must include payroll information like wages, run dates, and hours worked.

Solution: Develop a recordkeeping system that works for you, whether it’s paper or digital, and dont stray from it. Organize employee files in a way that feels intuitive to you, and set aside time during the first month of each year to cull any unnecessary files.

How To Do Payroll Yourself Faq

Yes, you can run payroll yourself by hand. The easiest way to run payroll yourself is with a payroll calculator, spreadsheet software, and a free payroll template with pre-filled cell formulas.

No, you dont necessarily need a payroll service to do payroll. If you have no more than 25 employees, are confident in your ability to stay on top of tax deadlines, and have thorough organizational skills, you can likely do your own payroll.

Even if you have only one employee, payroll software from providers like Gusto and SurePayroll can dramatically simplify your life. An online payroll service will calculate paycheck amounts, deposit them directly into your employees bank account, and draw up tax forms for you to submit on time.

Plus, free payroll software performs the same tasks you do when you run payroll manuallythey just do it faster, with more automation, and usually with a tax calculation guarantee that ensures your tax deductions are correct. Payroll software can save you money in the form of costly payroll mistakesbut perhaps more importantly, it can help you save the time youd otherwise spend running payroll.

Also Check: How To Calculate Federal Income Tax Withholding Percentage Method

Formula To Calculate Qpp Contributions For Employees Who Were Transferred By Their Employer To Quebec From A Location Outside Quebec During The Year Only For Employees Paid By Commission

C = The lesser of: $4,038.40 × 0.0640 × If the result is negative, C = $0. * No rounding required for this factor.

Note:

For these formulas, round the resulting amount to the nearest $0.01.

Each employer needs to deduct CPP contributions based on the employees pensionable income, without regard to any other earnings the employee may have had with another employer in the same year. Accordingly, you must use the maximum above even if the employee works for you less than 12 months. Similarly, you are not entitled to a refund of the employers share of CPP if the employee works for you less than 12 months.

For payments where the employee receives remuneration such as a bonus, retroactive pay increase, vacation pay when vacation is not taken, or accumulated overtime pay, and the payment is not included with the regular remuneration for the current pay period, you should introduce a code or use the factor B with the record. Also do this if a non-periodic payment is made and no regular remuneration is paid in the pay period. You do this to avoid allowing the basic exemption for the pay period in the formula described above.

The basic exemption amount used to determine the employees contributions for the pay period has to stay the same throughout the year, regardless of whether an employee has worked in each week of the pay period.

How Do Employers Use Gross Wages For Payroll Processing

Calculating an employees gross wages is the first step in running payroll. From there, employers generally:

*Note: most unemployment tax is paid by the employer, but there are other taxes, such as state disability or paid family and medical leave tax, which require employee contributions. Additional deductions may apply depending on state and local requirements.

Also Check: Do You Have To Report Roth Ira On Taxes

What Are Your Payroll Tax Responsibilities

From the discussion so far, it should be clear that the laws and rules around payroll tax differ substantially in different countries. This complexity means that any business operating across international borders and hiring workers needs to carefully consider how to implement global payroll, and any applicable taxes across their operations.

Sometimes this will need to be managed as part of a shadow payroll. This means ensuring tax compliance in one country , while paying the worker in another country.

Another possibility is for an organization to set up separate legal entities in each country that they operate in, and run a separate payroll in that country through that entity.

A third option is to engage a Global Employment Organization : They hire workers in-country through an employer of record solution and ensure that all essential employment taxes are withheld and remitted to tax authorities as required.

A GEO can be particularly beneficial when operating across many different countries, states, provinces or territories: The GEO will ensure that, in each jurisdiction the business operates in, there is full compliance with employment and payroll taxes.

Note, one additional advantage of engaging a GEO when dealing with international employment taxes is that, as employer of record with the tax authorities, they take on the compliance risk and liability for employment and payroll tax filing .

Accounting For Payroll Liabilities And Expenses

The accrual method of accounting, which balances revenue received with expenses incurred, should be used by all businesses. Regardless of when the costs are paid in cash, the accrual method tracks payroll expenses in the month they are incurred. A more accurate representation of company profit is provided by the matching concept.

Read Also: How To File Taxes On Turbotax For Free

Take Care Of Deductions

In addition to withholding for payroll taxes, calculating your employees paycheck also means taking out any applicable deductions.

There are voluntary pre and post-tax deductions like health insurance premiums, 401 plans, or health savings account contributions. Some employees also have involuntary deductions that may need to be considered for items like child support or wage garnishments .

Be careful here, because pre-tax deductions like 401 are taken out of gross income in Step 1, which means that the tax withholding calculation in Step 2 will be lower. Post-tax deductions are taken out after Step 2. Pre-tax deductions will save the employee more taxes.

How To Do Payroll With An Accountant In 4 Steps

Once your company starts to grow, the DIY payroll accounting strategy you started out with may no longer be viable. Especially if youre hoping to play a more active role in daily operations and client-side projects. Likewise, if compliance, efficiency, and data security are important to you, hiring an accountant or third-party payroll company may be the best option for you.

Hiring a professional accountant or an outsourced payroll service is the easiest solution, but often the most costly. You will delegate mostif not allof the payroll responsibilities to an accounting professional. Just be sure that your accountant has all the information they need to complete payroll on schedule.

Tip: Work with a local accountant if you value flexibility and access to advice.

Also Check: How Much Does Filing Taxes Cost

How To Do Payroll Using Professional Services

As your small business grows and you hire more employees, DIY payroll may become too difficult and time consuming. Or, you may decide that your efforts would be better spent on improving your products and services instead of administrative tasks. At that point, it makes sense to outsource payroll.

You have several options in this regard work with a payroll service provider, outsource your entire HR department with a professional employer organization or hire an accountant. Of the three, payroll service providers tend to be the most cost effective and offer a host of benefits, including accuracy, compliance support and data security.

Posting Journal Entries For Payroll Liabilities

Below you will see three common payroll journal entries that businesses should post:

- Accrued Payroll: Payroll expenses are recorded by debiting accrued wages and crediting wages payable.

- Pay Accrued Payroll in Cash: Payroll accrual results in a debit to wages payable and a credit to cash when workers are paid in cash.

- Pay Income Taxes withheld: A liability for the amount withheld is recorded by the business when taxes are withheld. When the withheld taxes are paid, a debit is made to the Tax Liability Account and a credit is made to the cash account.

Although payroll liabilities are the same for all businesses, the chart of accounts for payroll liabilities may use account names that are unique to the company. For example, a business might create subaccounts to manage payroll by the department. Adjustments are frequently made to payroll accounts before financial statements are generated by accountants. Using technology and creating a documented plan will help you process payroll accurately while saving time.

You May Like: How To Apply For State Tax Extension

Social Security And Medicare Taxes

An employer generally must withhold social security and Medicare taxes from employees’ wages and pay the employer share of these taxes.

Social security and Medicare taxes have different rates and only the social security tax has a wage base limit. The wage base limit is the maximum wage subject to the tax for the year. Determine the amount of withholding for social security and Medicare taxes by multiplying each payment by the employee tax rate.

For the current year social security wage base limit and social security and Medicare tax rates refer to Publication 15, , Employer’s Tax Guide.

Overview: What Are Payroll Taxes

If you have an employee — even just one — you need to pay payroll tax. Payroll tax is divided into two types: those that you are solely responsible for, and others that you collect from your employees to remit to the correct government entity.

In this guide, we explain what payroll taxes are, what forms you need in order to calculate taxes properly, and finally, a step-by-step guide to calculating payroll taxes for your employees.

You May Like: Are Federal Tax Returns Delayed

Federal Income And Fica Tax Deposit Schedules

Businesses can deposit income taxes either monthly or semi-weekly. You must decide on a tax-filing schedule before the calendar year starts. The type of deposit schedule you can choose depends on information you provide on IRS Form 941, which you use to report income taxes and submit your half of your employees FICA taxes.

If youve just launched your business and have never filed Form 941 before, youll automatically start out on a monthly tax-filing schedule. And as for how to deposit your employees taxes, the federal government requires you to use its electronic federal tax payment system to file income taxes.

Keep Payroll Records And Make Any Necessary Corrections

As you process payroll, its important to keep records of your transactions for tax and compliance purposes. If an employee disputes payment or the IRS needs some kind of documentation down the line, you need to have records at the ready. Especially in the case of an employee disputing a paycheck, its important to maintain records, including year-to-date payment, so you can sort out any issues that arise.

Recommended Reading: What Happens When You File Taxes Late

Calculating Employee Payroll Taxes In 5 Steps

Once your employees are set up , youre ready to figure out the wages the employee has earned and the amount of taxes that need to be withheld. And, if necessary, making deductions for things like health insurance, retirement benefits, or garnishments, as well as adding back expense reimbursements.

In technical terms, this is called going from gross pay to net pay.

If youre trying to figure out a specific step, feel free to skip to the one youre looking for:

- Step 1: Figure out gross pay

- Step 2: Calculate employee tax withholdings

Obtain The Necessary Paperwork

Before a payroll professional can help you, you must provide all of the forms and paperwork they need. Some information they will need to do their job includes:

- Employee information. When hiring a new accountant, verify that all employee tax withholding and personal information is correct so they can send out accurate W-2s and 1099-MISCs at the end of the year. You should also include details about worker classification, hire dates, and any wage garnishment orders.

- Company information. Provide your payroll specialist with your FEIN and state tax ID if applicable. They will need this to file your taxes for you. You should also notify them if your company must adhere to any specific state or federal tax regulations.

- Form I-9: You must complete this employment eligibility verification and authorization form on or before a new hires first day

- Form W-4: The federal employee withholding certificate determines how much federal income tax to withhold from each paycheck by taking personal information like jobs, dependents, and filing status into account.

- State withholding form: If you own a business in a U.S. state that isnt Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, or Wyoming, your employees may need to submit a state withholding certificate. This is essentially a W-4 at a state level.

You may need to update these documents manually if employee circumstances change.

Also Check: How To Calculate How Much Tax You Owe