If You Owe More Than You Can Pay

If you cannot pay what you owe, you can request an additional 60-120 days to pay your account in full through the Online Payment Agreement application or by calling 800-829-1040 no user fee will be charged. If you need more time to pay, you can request an installment agreement or you may qualify for an offer in compromise.

Get Your T1 Personal Income Tax Return

This is your tax form and as a new Canadian who is filing taxes for the first time, you must do so on paper rather than online. Go here and select the province or territory which you were a resident of as of December 31. Remember your tax year is previous to the year you actually file. For example, you filed your 2019 taxes in 2020.

Next click on the following links and download them:

- Federal Income and Benefit Guide

- Income Tax and Benefit Return

- Worksheet for the return

- Print the PDF forms seeing you will have to mail your first tax return to CRA in paper format

- You may have to download and print some of the Schedules listed next depending on your financial and personal situation.

You can also just click the button Order the 2019 Income Tax package when you first open the above link, before you click on a specific province or territory.

You can also order a copy of your tax package from the CRA by calling the following number:

1 855 3303305.

Recommended Reading: Will I Get Any Money Back From My Taxes

Save The Right Paperwork All Year Long

Stay on top of tax-related paperwork throughout the year it will make your life easier during tax season. You might want to keep receipts for things like charitable donations, work-related expenses and medical bills, or other items from step 4. You may also want to keep statements from student loans or investments and any grants or fellowships. Having these handy and organized can help you determine whether to itemize and make the process easier. You should keep your paperwork after you file, too. The IRS recommends keeping records for at least three years.

Recommended Reading: How Much Is Tax In Florida

Protect Yourself From Tax

Tax ID theft occurs when someone steals your personal information to file a tax return using your personal data. Usually, the fraudulent tax filer will use your Social Security number to file your return in order to collect a refund. To protect yourself from tax ID theft, you can obtain a six-digit Identity Protection PIN from the IRS. IP PINs are known only to you and the IRS so the IRS is able to confirm your identity when you file your return. Learn more about how the IP PIN works and how to apply.

Can I File My Tax Returns Via Mail

Yes, there are many different ways to file your federal tax return. If you want to post it to the IRS you can.

However, if you want to post your tax return you need to make sure you have the correct address and that you are posting it well in advance of the deadline.

We also recommend that you get proof of postage and pay to have the forms tracked so you know when they arrive.

We also recommend that you photocopy all your forms so that you dont have to start from scratch if they get lost in the mail.

Recommended Reading: Where To Send My Federal Tax Return

Free Federal Tax Filing Services

The IRS offers free services to help you with your federal tax return. Free File is a service available through the IRS that offers free federal tax preparation and e-file options for all taxpayers. Free File is available in English and Spanish. To learn more about Free File and your free filing options, visit www.irs.gov/uac/free-file-do-your-federal-taxes-for-free.

You May Like: Are Unemployment Benefits Delayed On Holidays

Mail As Early As Possible

Firstly, We recommend that you prepare and mail your tax documents as soon as possible. By preparing your tax documents today you can ensure that you receive your tax refund without delay.

As you will be mailing your documents to the IRS from outside America, delivery times may take longer than what you would expect if you were mailing from within the US. This is why its a good idea to file your documents as soon as possible to ensure they reach the tax office on time. Give yourself plenty of time to locate everything you will need in order to prepare your documents.

You May Like: Does Washington Have Income Tax

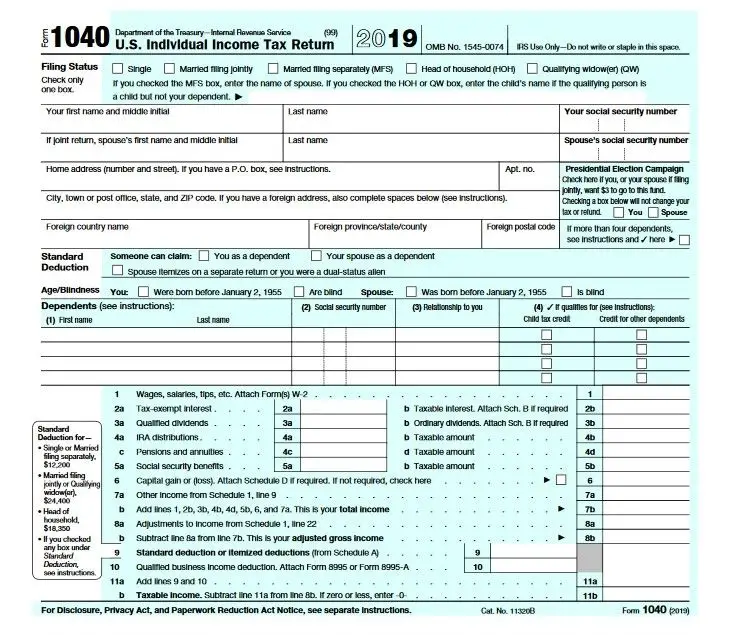

What Is My Filing Status

Your filing status can affect your standard deduction, eligibility for certain credits, tax liability, and filing requirements. If you are eligible to use more than one filing status, you may determine the one that saves you the most in taxes using the IRS service, What Is My Filing Status?.

When you use this service, you will need your marital status and the percentage of the costs that your household members paid towards keeping up a home. If your spouse is deceased, you also need your spouses year of death.

Read Also: What Tax Bracket Are You In

What Is A 941 Form

Use Form 941, also titled Employers Quarterly Federal Tax Return, if youre an employer, to report income taxes, Social Security tax or Medicare tax withheld from employees paychecks and to pay the employers portion of Social Security or Medicare tax. Youll need to fill this out four times a year by these deadlines: April 30, July 31, Oct. 31 and Jan. 31.

Best for:Employers.

Read Also: How Much Do I Owe In Property Taxes

Give Yourself Time And Make Sure Youre Registered

Remember to give yourself enough time to do this ahead of the deadline, to allow for your UTR to be posted to you.

If this is your first time completing a tax return, you will need to register for Self Assessment and then HMRC will send you your UTR.

If you are completing a Self Assessment return because you are self-employed, then you will also need to register your self-employment with HMRC.

Requesting An Extension Of Time For Filing A Return

Revised Statute 47:103 allows a six-month extension of time to file the individual income tax return to be granted on request. The extension request must be made before the state tax filing due date, which is May 15th for calendar year filers or the 15th day of the fifth month after the close of a fiscal year.

The five options for requesting an extension are as follows:

An extension does not allow an extension of time to pay the tax due. Payments received after the return due date will be charged interest and late payment penalty.

Also Check: How Much Tax Is Taken Off Paycheck

How To Get My 1099 From Unemployment To File Taxes

Many taxpayers are unaware that the unemployment income they received is taxable, just like earned income. The key difference is that unemployment income is taxed at a lower rate. Also, thanks to the American Recovery and Reinvestment Act , the first $2,400 of unemployment income is untaxed. In any event, you should list your unemployment income should on your return. Your state unemployment office should send you the 1099-G form listing that amount, but there are ways to request the form in the mail.

Tips

-

If you have received unemployment income at any point during the year, you will be required to complete and return IRS Form 1099-G. This document will accurately summarize your unemployment compensation and ensure that you are taxed appropriately. You can collected Form 1099-G by calling your local unemployment office or contacting the IRS directly.

Federal Quarterly Estimated Tax Payments

Generally, the Internal Revenue Service requires you to make quarterly estimated tax payments for calendar year 2022 if both of the following apply:

- you expect to owe at least $1,000 in federal tax for 2022, after subtracting federal tax withholding and refundable credits, and

- you expect federal withholding and refundable credits to be less than the smaller of:

- 90% of the tax to be shown on your 2022 federal tax return, or

- 100% of the tax shown on your 2021 federal tax return .

To calculate your federal quarterly estimated tax payments, you must estimate your adjusted gross income, taxable income, taxes, deductions, and credits for the calendar year 2022. Form 1040-ES includes an Estimated Tax Worksheet to help you calculate your federal estimated tax payments.

Also Check: When Is Oklahoma State Taxes Due

Do You Even Have To File Taxes

Whether you have to file a tax return this year depends on your income, tax filing status, age and other factors. It also depends on whether someone else can claim you as a tax dependent.

Even if you dont have to file taxes, you might want to do it anyway: You might qualify for a tax break that could generate a refund. So give tax filing some serious consideration if:

-

You qualify for certain tax credits.

Why You Should E

Its generally better to e-file than it is to paper file. The IRS even advises people against paper filing unless they have to. Not only does it speed up the filing process on their end, its also more beneficial for consumers.

- Its safer. Your tax return has a lot of sensitive information on it information that could seriously harm you or your business if it falls into the wrong hands. When you e-file, its much harder for that to happen, since your information goes directly to the IRS computer system.

- You could get your tax refund quicker. If you want your tax refund as soon as possible, youre better off e-filing. According to the IRS, it might take up to eight weeks for you to receive your tax refund if you mailed your tax return. But if you e-filed, it could take as little as three weeks. It could take even less time if you receive it via direct deposit instead of a paper check, the IRS says.

- Theres less of a chance for mistakes. Theres also less of a chance the IRS will mess up something on your return if you e-file it. When you paper file, the IRS has to physically transfer your information into their online systems. Of course the IRS could still make mistakes, but it wont be because they had to take the extra time to transfer your information.

Don’t Miss: Why Do I Have To Pay Taxes This Year

What Is A 4506

Use Form 4506-T to request a transcript of previously filed tax returns free of charge. It contains most of the line items on your full return and is widely accepted by most lenders. Mortgage lenders and student loan lenders, for example, will often ask you to fill out this form to verify your income. With COVID-19 delaying processing of paper forms at the IRS, an easier and faster option is the IRS online Get Transcript tool.

Best for:People who need a transcript of their tax return free of charge.

Filing Your Tax Return Early

As soon as the tax year ends, you can complete your tax return at a time that suits you. HMRC accepts completed tax returns for the 2021 to 2022 tax year between 6 April 2022 and 31 January 2023.

In fact, almost 65,500 taxpayers submitted their tax returns on 6 April 2022. Some people like completing it early for their peace of mind and it helps them better manage their tax bills.

Read Also: How To File Us Taxes

Extension To File Your Tax Return

If you cant file your federal income tax return by the due date, you may be able to get a six-month extension from the Internal Revenue Service . This does not grant you more time to pay your taxes. To avoid possible penalties, estimate and pay the taxes you owe by the tax deadline of April 19, 2022, if you live in Maine or Massachusetts or April 18, 2022, for the rest of the country.

Federal Unemployment Programs End After This Weekend

Todays the first day you can file for your tax refund and experts say you should file early. But tax time is also causing some trouble.

Many of you who are collecting unemployment for the first time have encountered issues. WINK News walks you through getting the necessary documents.

Many of you are wondering where to get your 1099-G form. According to its weekly update, the Department of Economic Opportunity says it sent claimants their personalized form by mail or made it available on CONNECT back in January:

- The Department completed electronically processing 1099-G Tax Forms for all claimants on January 17, 2021. All claimants should have access to their 1099-G Tax Form in their CONNECT account.

- Claimants who opted to receive communication from the Department through U.S. Mail should have received their 1099-G tax form no later than January 31, 2021. 1099-G Forms were also made available in CONNECT for these claimants on January 17, 2021.

- If a claimant did not receive their 1099-G tax form by January 31, 2021, they received a 1099-G tax form by mistake, or their 1099-G tax form is incorrect, please for additional resources to obtain the form.

- The Department has created Frequently Asked Questions to provide more information about the 1099-G Tax Form.

But if you still havent been able to access it, there are a few options for you to get it now.

Read Also: When Can You Stop Filing Taxes

Youre Seeking Relief As An Injured Spouse

If your spouse owes certain kinds of debt such as past-due taxes, state debts, unpaid student loans or late child support payments and you file a joint federal tax return, the U.S. Department of the Treasury might be able to take some or all of your joint refund to pay that debt. Requesting injured spouse relief could help you keep the portion of your shared refund that is yours, while your spouses share goes toward paying their debts.

To apply for injured spouse relief you must complete and submit Form 8379. If you submit the form at the same time you file your joint return, you can e-file both together. However, if you already filed your federal return and it was accepted , youll have to mail it. And if youre submitting it with an amended tax return, both must be filed on paper.

Need Help Or Have Questions On Filing Your Income Tax And Benefit Return

If you have a modest income and a simple tax situation, volunteers at a free tax clinic may be able to complete your tax return. Free tax clinics are available in-person or virtually. Find out about the Community Volunteer Income Tax Program by going to canada.ca/taxes-help.

If you have a lower or fixed income, you may be eligible to use File my Return. This service will let you file your return by answering a series of short questions through a secure, dedicated, and automated telephone service. If you filed a paper return last year and are eligible to use File my Return, youll receive an invitation letter with the 2021 income tax package sent by the CRA. Starting February 21, 2022, you can use File my Return to quickly file your return by phone.

Also Check: How Can I Pay My Property Taxes Online

Send A Paper Return By Mail

If you are mailing someone elses paper return

If you prepare other peoples returns, mail each persons return in a separate envelope. However, if you file returns for more than one year for the same person, put them all in one envelope.

Read Also: How Much Taxes Come Out Of Paycheck

Deductions: Standard Or Itemized

Earlier, we discussed how tax deductions come in two forms: standard or itemized. The standard deduction is a fixed amount itemized deductions are complicated, but could reduce your tax bill more than the standard deduction. You can only take your deduction one way or the other, so you have to choose between taking the standard deduction or itemizing your deductions.

Which option you choose depends on your unique financial situation. The general rule is if the total of your itemized expenses is greater than the standard deduction , you should itemize your deductions. If the standard deduction is greater than your itemized expenses, you should take the standard deduction. Duh.

Most young people starting out in life dont have enough tax deductible expenses to warrant itemizing their deductions. Stick with the standard deduction until you have a mortgage and are filling giant trash bags full of clothes and leaving them on your doorstep for Prevent Blindness.

Recommended Reading: How To File Joint Taxes For The First Time