States That Dont Allow E

All states that charge a state income tax allow you to e-file your state tax return. However, some states dont allow you to e-file a state-only return they require you to e-file state and federal taxes together.

According to TaxSlayer, states that dont allow state-only filing online include:

- Alabama

Know The Dates For Filing

The IRS requires you to e-file your taxes by midnight on Monday, April 15 – aka Tax Day.

Ideally, you’ll want to file as early as possible. That way, you’ll get your refund faster and, if you’re concerned about tax fraud, filing early gets you ahead of potential tax fraudsters who may try to file fraudulent taxes using your name. Yes, there’s a remote chance of that happening, but why take a chance?

Free Electronic Filing For Individuals

The Arizona Department of Revenue will follow the Internal Revenue Service announcement regarding the start of the 2020 electronic filing season. Because Arizona electronic income tax returns are processed and accepted through the IRS first, Arizonas electronic filing system for individual income tax returns is dependent upon the IRS’ launch date. Remember, the starting point of the Arizona individual income tax return is the Federal Adjusted Gross Income. The Arizona Department of Revenue will begin processing electronic individual income tax returns beginning mid-February.

Taxpayers can begin filing individual income tax returns through Free File partners and individual income tax returns will be sent to the IRS starting mid-February. Tax software companies also are accepting tax filings in advance of the IRS’ launch date.

Please refer to the E-File Service page for details on the e-filing process.

Recommended Reading: How Can I Make Payments For My Taxes

Extension Filers: File Your Tax Return By October 15

Your extension of time to file is not an extension of time to pay your taxes. Pay the tax you owe as soon as possible to avoid future penalties and interest.

If you didn’t get a first and second Economic Impact Payment or got less than the full amounts, use Free File to claim the 2020 Recovery Rebate Credit.

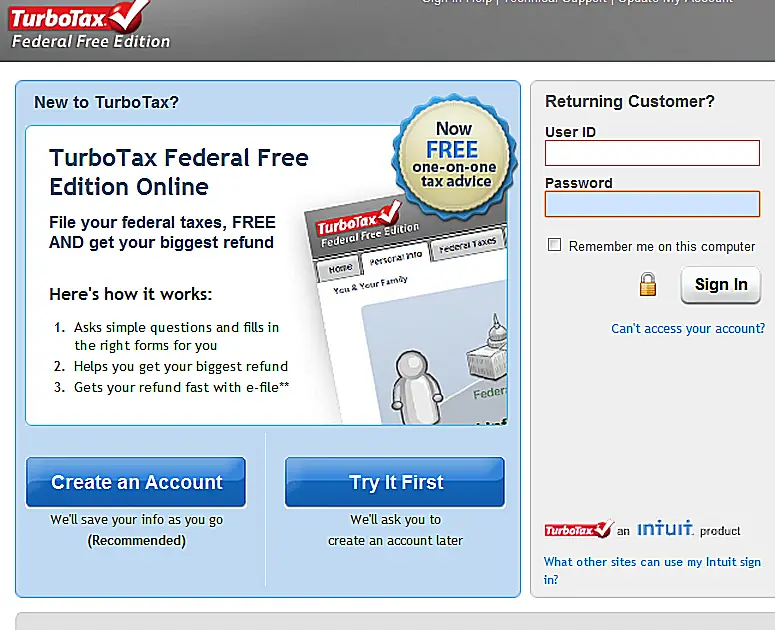

IRS Free File lets you prepare and file your federal income tax online for free. File at an IRS partner site with the IRS Free File Program or use Free File Fillable Forms. It’s safe, easy and no cost to you for a federal return.

To receive a free federal tax return, you must select an IRS Free File provider from the Browse All Offers page or your Online Lookup Tool results. Once you click your desired IRS Free File provider, you will leave the IRS.gov website and land on the IRS Free File providers website. Then, you must create an account at the IRS Free File providers website accessed via Irs.gov to prepare and file your return. Please note that an account created at the same providers commercial tax preparation website does NOT work with IRS Free File: you MUST access the providers Free File site as instructed above.

Paid Tax Preparation Help

To be sure, some people may still want to pay for help in filing their taxes because they don’t qualify for a free program or don’t want to spend the time to do their own taxes. There are many online software programs that help people file for a fee, and have products serving a wide range of tax scenarios at different price points.

If you have a more complicated return, such as you itemize deductions, are a sole proprietor with income or run a small business, you may want to get help via a software program or hire an accountant or other tax expert to help you file.

Recommended Reading: Tsc-ind Ct

Free Tax Return Help For Eligible Taxpayers

Find out if you qualify for the following free tax return preparation services:

-

Volunteer Income Tax Assistance – VITA offers free tax help to people who generally make $57,000 or less, people with disabilities, and taxpayers with limited English. IRS-certified volunteers explain tax credits and prepare a basic tax return with electronic filing.

-

Tax Counseling for the Elderly – TCE focuses on questions about pensions and retirement-related issues. It offers free tax help to all taxpayers, particularly to those who are 60 years old or older.

Due to the COVID-19 pandemic, many VITA and TCE offices are closed. Use the VITA/TCE locator tool to find an open office near you. To learn more about the services of VITA and TCE and what you should bring to your appointment, use the VITA/TCE checklist.

You’re Filing A More Accurate Tax Return

Accuracy is a big deal with tax returns, and e-filing does improve tax filing accuracy. That’s because e-filed returns are handled via programmed software that is built to uncover mistakes and not inaccuracies in real time. Plus, new-age tax software helps taxpayers do a better job of filling out their returns accurately. Data shows that e-filed tax returns are more accurate that paper-based returns.

Also Check: What Does H& r Block Charge

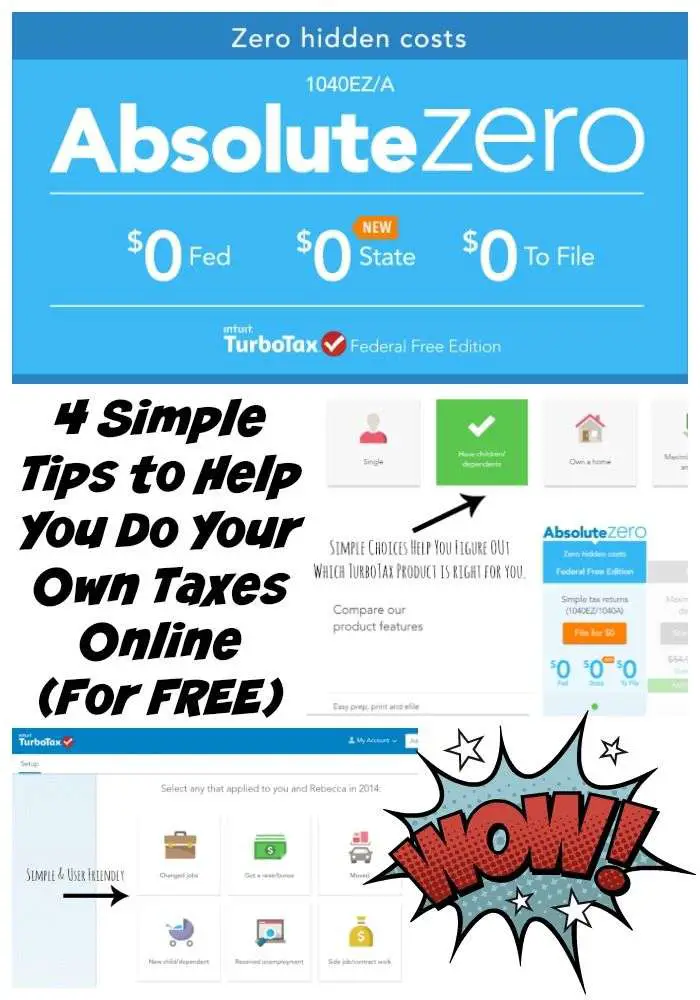

How To File Taxes Online

This article was co-authored by Cassandra Lenfert, CPA, CFP®. Cassandra Lenfert is a Certified Public Accountant and a Certified Financial Planner in Colorado. She has over 13 years of tax, accounting, and personal finance experience. She received her BA in Accounting from the University of Southern Indiana in 2006.There are 8 references cited in this article, which can be found at the bottom of the page. This article has been viewed 47,220 times.

You can easily prepare your income taxes online using an income tax service. Filing online saves time and money. Prepare, print, and e-file your federal and state income taxes online to get a fast tax refund.

Irs Free File Opens Today Do Taxes Online For Free

IR-2020-06, January 10, 2020

WASHINGTON Most taxpayers can get an early start on their federal tax returns as IRS Free File featuring brand-name online tax providers opens today at IRS.gov/freefile for the 2020 tax filing season.

Taxpayers whose adjusted gross income was $69,000 or less in 2019 covering most people can do their taxes now, and the Free File provider will submit the return once the IRS officially opens the 2020 tax filing season on January 27 and starts processing tax returns.

“Free File online products offer free federal tax return preparation, free electronic filing and free direct deposit of refunds to help get your money faster,” said Chuck Rettig, IRS Commissioner. “The IRS has worked to improve the program for this year, and we encourage taxpayers to visit IRS.gov, and consider using the Free File option to get a head start on tax season.”

For 2020, the Free File partners are: 1040Now, Inc., ezTaxReturn.com , FileYourTaxes.com, Free tax Returns.com, H& R Block, Intuit, On-Line Taxes, Inc., Tax ACT, TaxHawk, Inc. and TaxSlayer .

Since its 2003 debut, Free File has served nearly 57 million taxpayers, saving an estimated $1.7 billion calculated using a conservative $30 tax preparation fee. Free File is a public-private partnership between the Internal Revenue Service and Free File Inc. , a consortium of tax software providers who make their Free File products available at IRS.gov/FreeFile.

Read Also: How To Buy Tax Lien Properties In California

About Free File Fillable Forms

Free File Fillable Forms are electronic federal tax forms you can fill out and file online for free, enabling you to:

- Choose the income tax form you need

- Enter your tax information online

- Electronically sign and file your return

- Print your return for recordkeeping

If you choose Free File Fillable Forms as your Free File option, you should be comfortable doing your own taxes. Limitations with Free File Fillable Forms include:

- It won’t give you guidance about which forms to use or help with your tax situation

- It only performs basic calculations and doesn’t provide extensive error checking

- It will only file your federal return for the current tax year

- No state tax return option is available

- You can’t make changes once your return is accepted

Free File Fillable Forms is the only IRS Free File option available for taxpayers whose income is greater than $72,000. Taxpayers whose income is $72,000 or less qualify for IRS Free File partner offers, which can guide you through the preparation and filing of your tax return, and may include state tax filing.

Q: What Are Credit Karma Tax Security Practices

- We use 128-bit or higher encryption to protect the transmission of your data to our site

- We maintain physical, electronic and procedural safeguards of taxpayer information that comply with applicable law and federal standards

- We have a dedicated on-site security team, plus independent third-parties who regularly assess our site for vulnerabilities

- We require a phone number and text SMS or voice/call verification when using Credit Karma Tax®

- We support Two-Factor Authentication with the Google Authenticator app

Also Check: How Much Does H& r Block Charge To Do Taxes

What Happens If You Don’t File Taxes

If you don’t owe anything, you may not need to file taxes. However, if you owe taxes and don’t pay them by filing returns, then the IRS will try to collect the money in other ways like garnishing your wages. Even if you don’t owe taxes, you won’t be able to collect any refunds if you don’t file, so it’s almost always a good idea to file whether you “need” to or not.

Nyc Free Tax Prep Service Options

The filing deadline was May 17, 2021. However, you can still file your 2020 tax return for free with NYC Free Tax Prep if you meet income requirements. NYC Free Tax Prep providers can help you claim important tax credits including the Child Tax Credit. More sites will be added, please check this webpage often. Note: If you owe the government money, be aware that late filing and/or late payment penalties may apply. Please click or press the enter key on a service option to learn more. You can also use our guide to find which NYC Free Tax Prep service is best for you. For all options, make sure to review checklist of documents you need to file your taxes. IMPORTANT: In Person Tax Prep and Drop-off Service have limited capacity. Use Virtual Tax Prep or Self-Prep with Help to save time.

Virtual Tax Prep

Virtual Tax Prep is a safe and reliable online tax prep service. An IRS certified Volunteer Income Tax Assistance /Tax Counseling for the Elderly volunteer preparer will:

- help you file your 2020 tax return during a 60-90 minute virtual call

- use a secure digital system to manage your tax documents

- answer your tax questions.

The following information is for virtual appointments only. Please do not arrive in person.

Self-Prep with Help

Self-Prep with Help is a safe and reliable online tax prep service. Do your own taxes with easy-to-use tax filing software but contact a volunteer preparer for help when needed.

Recommended Reading: Michigan.gov/collectionseservice

How Tax Brackets Work

How much tax you must pay begins with your total or “gross” income from all sources. You can then claim any deductions to which you’re entitled. These subtract from your gross income to arrive at your taxable income.

The federal government uses a progressive tax system, which means that the higher your taxable income, the higher your effective tax rate will be. These rates are determined by tax brackets.

For example, youre in the 24% tax bracket for tax year 2020 if you were single and your taxable income was between $85,525 and $163,300. But only the portion of your income above $85,525 will be charged at that 24% rate. The IRS adjusts these taxable income amounts annually for inflation. These taxable income thresholds increase to $86,375 and $164,925 for the 24% tax bracket in tax year 2021, the return you’ll file in 2022.

Why You Have To File A Tax Return

You’ll be asked to complete Form W-4 for your employer when you begin a new job. The information you enter on this form determines how much in the way of taxes will be withheld from your pay. The decisions you make when you set up your payroll withholding by completing this form can easily result in under or over-paying your taxes. Payroll withholding usually isnt exactly right.

The IRS introduced a revised Form W-4 for the 2020 tax year. Its much easier to complete, guiding you through the process with various questions and eliminating the complicated allowances that once had to be figured out.

The IRS recommends updating your W-4 and withholding requirements whenever you experience a life event that could affect your tax obligation, such as marriage, the birth of a child, or receiving unexpected sources of income.

Youre required to file a tax return every year to come up with a final tally of your tax situation. The process determines whether you owe taxes beyond what youve already paid, or whether youre owed a refund of the taxes that have been withheld. Your tax return is normally due on or near of the year following the tax year.

The Biden Administration made an exception to this rule for tax year 2020, the return you’ll file in 2021. The filing deadline has been extended from April 15 to May 17, 2021, in response to the ongoing pandemic.

Recommended Reading: Www Michigan Gov Collectionseservice

When Are Taxes Due

The IRS began accepting 2020 income tax returns on Feb. 12. The deadline for those returns is on May 17 this year.

The editorial content on this page is based solely on objective, independent assessments by our writers and is not influenced by advertising or partnerships. It has not been provided or commissioned by any third party. However, we may receive compensation when you click on links to products or services offered by our partners.

Best Tax Relief Companies For Tax Debt Help Your Browser Indicates If You’ve Visited This Link

If you’re struggling with IRS tax debt, there are a variety of tax relief companies that can help significantly reduce or even eliminate your tax debt altogether. The best tax relief services have experienced tax attorneys that understand tax law and how to negotiate with the IRS on your behalf for a reduced settlement.

SFGate

Recommended Reading: How Much Does H & R Block Charge For Taxes

Free File: Everyone Can File An Extension For Free

The following companies partner with the IRS Free File Program, so that you can e-file your tax filing extension for free. Please be aware that filing an extension gives you time to e-file your federal tax return. If you have a balance due, the deadline to pay is still May 17, 2021. However, if you want to file your taxes now with free, easy to use software use the IRS Free File Program.

Can I File My Taxes Online For Free

In Canada, TurboTax makes it simple for anyone with any tax situation to file their taxes for free. These are just a few of the tax situations you could have and use TurboTax Free to file your taxes with the CRA:

- Youre working for an employer and/or are self employed

- Youre a student looking to claim tuition, education, and textbook amounts

- You were unemployed for part or all of 2020, including if you claimed CERB

- Your tax situation was impacted by COVID-19, including if you had to work from home and want to claim related expenses

- You have dependants and want to ensure you claim all related credits and deductions

- Youre retired and receive a pension

- You have medical expenses to claim, including amounts related to COVID-19

- Its your first time filing your taxes in Canada

There are a few situations where youll need to print and mail your return instead of filing online using NETFILE. Dont worry though, you can still enter all your tax info online and well guide you through the process of mailing your return to the CRA.

You May Like: Efstatus Taxact Com Login

How Do I Get Help Filing My Taxes Online

If at any point you have a question about your taxes or the software, you can browse answers on our online help forum 24/7, or post a question for our online community of users and experts. While youre filing you may realize that youre looking for more guidance or help with your taxes. In that case you can upgrade to a different TurboTax Online product at any time without losing any of the data youre already entered.

Need more help? TurboTax Live Assist & Review gives you unlimited tax advice from one of our tax experts as you do your taxes, plus a final review before you file to make sure you didnt miss anything. Or if you want to hand off your taxes to one of our experts, TurboTax Live Full Service allows you to simply upload your documents and our experts will complete and file your return for you.

How Filing Online Impacts Your Tax Refund

Filing your taxes online is instantaneous, unlike mailing a paper tax return which takes time to reach the IRS.

Submit your forms online and youll get a notification from the IRS saying that they successfully received it, or an error occurred. If the IRS owes you a tax refund, you can have this direct-deposited into your bank account, or they will mail you a check. The former is quicker and eliminates the risk of your money getting lost in the mail.

Also Check: How Does H And R Block Charge