How To Calculate And Pay Self

You’re considered to be self-employed if you own a business that isn’t a corporation. You must pay self-employment taxes based on the net income of your business.

Self-employment taxes are paid to the Social Security Administration for Social Security and Medicare eligibility. If this tax sounds familiar, it’s because it’s essentially the same as Social Security and Medicare taxes for employees, just with a different name.

You pay these taxes on your personal tax return, along with the income tax liability for your business. Self-employment taxes are not withheld from your income as a business owner. You must figure the amount of the tax and keep track during the year.

You may also need to pay estimated taxes to cover the amount of business income tax and self-employment tax you’ll need to pay with your tax return.

Tax Returns And Combining Multiple Sources Of Income

While we know that many self-employed borrowers have tax returns that do not accurately reflect their income, some self-employed borrowers may have a co-borrower on the loan that is not self-employed, or they have may a traditional job alongside their own business.

In these cases we have options to combine income sources and use tax returns, if needed. Were able to combine 1099s, personal bank statements, business bank statements, and W-2s to calculate your total income and qualify you!

The Saving Grace Of 1099s

The thought of having to pay back your taxes at the end of the year or quarterly instead of receiving a return can be frustrating. A lot of people rely on that big check come February, but there is a saving grace.

When you file a 1099, you will also file a Schedule C. A schedule c is a tax form that goes over all of the money you had to pay for your business expenses throughout the year.

If youre a writer for example, you could claim new equipment like a laptop, a new keyboard, flying to a conference, taking your clients out for lunch. Anything that is considered ordinary and necessary by the IRS.

As long as you arent trying to claim things that arent actually important to your line of business, you can claim it and reduce the amount that you will owe at the end of the year!

Read Also: Is Property Tax Included In Mortgage

When Are My Taxes Due If I’m Self

You might not have to pay anticipated taxes if you completed the IRS W-4 form, which instructs your employer how much to deduct from each paycheck. But if you don’t have a W-4 salary, you should probably be aware of projected tax obligations.

The IRS states that in general, you must make anticipated tax payments if your employment type falls into one of the following categories and you anticipate owing $1,000 or more in taxes when your return is filed:

- Independent contractor or freelancer

- S corporation shareholder

The 15th day of April, June, September, and January of each year is often when estimated taxes are paid. If the 15th falls on a legal holiday or a weekend, that is one significant exception. In that situation, you have until the following workday to file your return.

Estimated tax deadlines:

What Are The Penalties If I Don’t Pay My Estimated Taxes

It’s a good idea to post a calendar reminder as the quarterly deadline approaches to avoid paying a late penalty. You may be charged a penalty if:

- If you owe more than $1,000 in taxes after subtracting withholdings and credits.

- If you paid less than 90% of the tax for the current year through estimated taxes.

The penalty could be waived in some situations. If you want to delve further into estimated tax penalties and conditions of a waiver, see the instructions in IRS form 2210.

Also Check: How Do I Pay My Quarterly Taxes Online

When Do I Have To Pay Freelance Taxes

According to the IRS, you should pay taxes quarterly if you expect to owe at least $1,000 in taxes this year.3 Since taxes from your freelance income arent being withheld throughout the year, theres a good chance youll need to estimate your taxes for the upcoming year and pay the IRS on a quarterly basis.

So, how do you know if you need to do this or not?

Thats a great question. If youre only making a couple thousand dollars or less freelancing each year, you can probably skip estimated tax payments and just report your freelance income when you file your tax return.

But if its looking like youll owe $1,000 or more in taxes, Form 1040-ES can help you ballpark how much youll make during the year and then determine your estimated taxes based on your projections.

If you underpay your estimated taxthese are estimates, after allyoull have to pay the remaining taxes when you file your annual tax return. On the other hand, if you overpay your estimated tax, youll receive the excess amount back in the form of a tax refund.

How Do I Know If I Need To File A 1099

Any time you make over $400 in a year from self-employment, you are required to report your income. Once you make over $600 in a year from a client, that client is required to send you a 1099 form.

If you are a freelance writer, self-employed teacher, or tutor, web designer, entrepreneur, or in any other self-employed position, you will need to file a 1099. This even applies to you if you are an independent contractor.

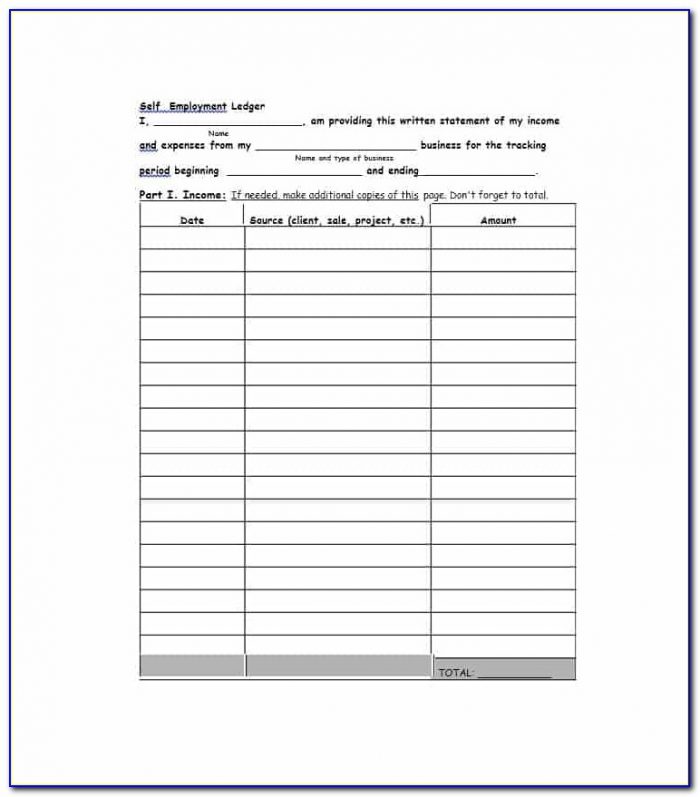

When you are self-employed, you dont have an employer to send off your taxes each pay period to the government for you. So, it is your responsibility to keep track of your income.

Also Check: How To Track Your Income Tax Check

Calculating Your Freelance Tax Bill

Remember that work I made you do in steps 2 and 3? Now you get to use it! To estimate your SE tax, you need to find your net income. This is your income after subtracting business expenses. For example, letâs say you earn $10,000 in gross income and have $5,000 in business expenses. Your net income would be $5,000. Youâll owe SE tax on this $5,000, not the full $10,000. So your SE tax would be $765 . If youâd like to use a shortcut here, Keeper Tax offers a free 1099 tax calculator that can do this calculation for you. Simply input your information:

And voila! An accurate estimate of what youâll owe for your self-employment tax, federal income taxes, and state income taxes

Fair Market Value For Your Assets

You might transfer your personal assets to your business.

If you are operating a sole proprietorship, this is a reasonably simple process. The Income Tax Act requires that you transfer these assets to the business at their fair market value . This means that we consider you to have sold the assets at a price equal to their FMV at that time. If this amount is greater than your original purchase price, you must report the difference as a capital gain on your income tax and benefit return.

Your business will show a purchase of these assets, with a cost equal to the FMV at the time of the transfer. This is the value that you will add to the capital cost allowance schedule for income tax purposes.

For income tax purposes, when you transfer the property to a Canadian partnership or a Canadian corporation, you can transfer the property for an elected amount. This amount may be different from the FMV, as long as you meet certain conditions. The elected amount then becomes your proceeds for the property transferred, as well as the cost of the property to the corporation or partnership.

The rules regarding these transfers of property are technical. They allow you to change your business type from a sole proprietorship to a corporation or a partnership, or from a partnership to a corporation, on a tax-free basis.

You May Like: What States Do Not Tax Your Pension Or Social Security

Know Your Tax Obligations

All self-employed persons must report the income earned from their business operations as business income, and not as salary. The business income is part of the total personal income which is taxed at individual income tax rates.

You are a self-employed person when you earn a living by carrying on a trade, business, profession or vocation. Generally, sole-proprietors and partners registered with the Accounting and Corporate Regulatory Authority are self-employed.

To check whether you are a self-employed person, please refer to Am I a Self-Employed Person.

Make Your Payments On Time

The IRS imposes four payment deadlines throughout the year. If you earn all of your income through self-employment, its more likely you will have to make four payments than an employee who has insufficient withholding. As a general rule, you dont have to make your first estimated tax payment until you earn sufficient income that is taxable.

The first payment deadline covers income you earn between Jan. 1 and March 31. If you are employed during this period and have sufficient amounts withheld from your paycheck, you need not make an estimated payment for this period. However, if you start earning income as an independent contractor during the second period of April 1 through May 31, then your first payment may be due by the second deadline.

Read Also: How Do I Dispute My Property Taxes

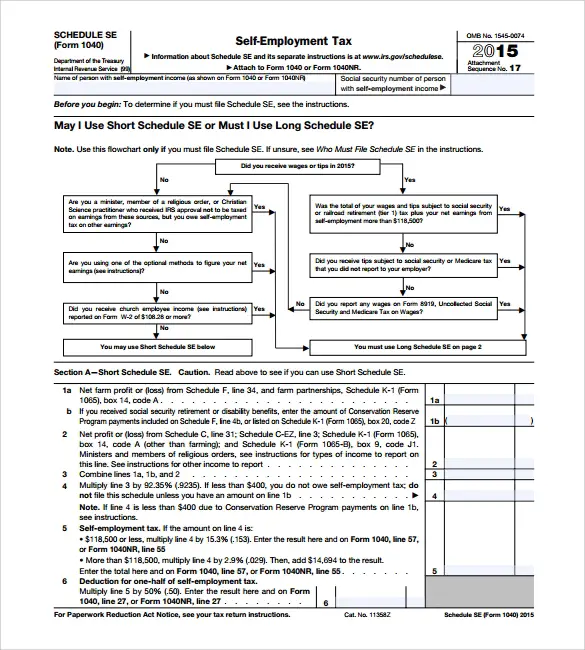

Calculate The Minimum Estimated Tax Payment To Make

If you determine that you need to make estimated tax payments, then you should obtain Form 1040-ES to calculate the amount of each payment. If you use tax preparation software, such as TurboTax, it will generate the form based on the information you provide. Essentially, the form calculates your payments using an estimate of your taxable income for the year.

Estimating your taxable income requires you to reduce your gross income by all deductions you anticipate claiming, and to reduce the amount of tax you will owe by the tax credits you are eligible for.

Track All Business Mileage

Whether you take the standard mileage deduction or your expenses for gas, oil, and other actual expenses, you must have good records to deduct vehicle expenses.

Your records must include mileage driven, the purpose, and the date. Count every trip to the post office and client meeting those miles add up!

Read Also: How To Find Out If You Owe State Taxes

Publications And Subscriptions Deduction

The cost of specialized magazines, journals, and books directly related to your business is tax deductible as supplies and materials.

A daily newspaper, for example, would not be specific enough to be considered a business expense. A subscription to Nations Restaurant News would be tax deductible if you are a restaurant owner, and Nathan Myhrvolds several-hundred-dollar Modernist Cuisine boxed set would be a legitimate book purchase for a self-employed, high-end personal chef.

What Are The Tax Changes This Year

- The Section 179 deduction allows taxpayers to deduct all or part of assets purchased and placed in service in a business for the year. The deduction increases to $1,080,000 worth of assets placed in service. The types of assets allowed to be claimed, or expensed, under this method has increased as well.

- You may also claim a special depreciation of 100% of the value of the property you placed in service during the year. This is different from the Section 179 deduction but does increase your allowed deduction of tangible property.

- Up to 100% of medical insurance costs you pay for yourself, your spouse, and your dependents may be deductible as an adjustment to income on Form 1040, US Individual Income Tax Return. The deduction is subtracted directly from your total income and applies whether or not you itemize. If you purchase your health insurance through the Marketplace, you may have to adjust your deduction for your Premium Tax Credit.

- Business tax credits can reduce your tax liability. There is a credit for providing access to the disabled and a work opportunity credit for providing work for members of groups with special employment needs or higher unemployment rates.

Don’t Miss: How Much Is Sales Tax In Louisiana

Can I Avoid Paying Estimated Taxes

Probably not without incurring those penalties. Some classes of workers — particularly those whose income is exceptionally modest, inconsistent or seasonal — are exempt from having to make quarterly payments to Uncle Sam, however:

- If your net earnings were $400 or less for the quarter, you don’t have to pay estimated taxes — but you still have to file a tax return even if no taxes are due.

- If you were a US citizen or resident alien for all of last year, your total tax was zero and you didn’t have to file an income tax return.

- If your income fluctuates drastically throughout the year , you may be able to lower or eliminate your estimated tax payments with an annualized income installment method. Refer to the IRS’s 2-7 worksheet to see if you qualify.

Is It Easy To Do Your Own Taxes

More than 43.6 million Americans prepared and e-filed their own income tax returns in 2013, up 4 percent from the year before, according to the IRS. In addition to being more affordable than a storefront or accountant, online and mobile solutions have made doing your own taxes exceptionally easy and fast.

You May Like: Is It Hard To Do My Own Taxes

Is A C Corporation Eligible For The Qualified Business Income Deduction

No. According to the Internal Revenue Service , income earned through a C corporation or by providing services as an employee is not eligible for the deduction. A C corporation files a Form 1120: U.S. Corporation Income Tax Return, and it is not eligible for the deduction.

You also cannot deduct any portion of wages paid to you by an employer and reported on a Form W-2: Wage and Tax Statement. Independent contractors and pass-through businesses are eligible for the deduction. They report their percentage of business income on a Schedule C: Profit or Loss from Business that accompanies the Form 1040: U.S. Individual Tax Return.

Manage Your Cash Flow

Many self-employed people earn a good living. But even if your overall annual income is strong, the flow of money is not always regular. It can be weeks or even months between pay cheques.

To help with your cash flow, only make larger purchases once you’ve paid yourself and covered regular bills. Keep some money aside for the unexpected.

Being self-employed means you won’t have the benefit of paid holidays or sick leave. It’s up to you to put money aside. Regularly saving a little extra will help you manage during quiet periods, as well as funding a well-deserved break.

See business.gov.au for tips on managing your business finances.

Recommended Reading: What Is The Employer Portion Of Payroll Taxes

What Are Estimated Taxes

If you earn or receive income that isn’t subject to federal withholding taxes throughout the year — side hustle earnings or income from a rental property, for example — you’ll pay as you go with estimated taxes. Estimated tax is a quarterly payment based on your income for the period. Essentially, estimated tax allows you to prepay a portion of your income tax every few months to avoid paying a lump sum on Tax Day.

Understand How To Estimate Quarterly Taxes

Freelancers who expect to owe at least $1,000 in taxes are required to pay estimated taxes quarterly. Refer to your prior years tax return to gauge how much you should be paying quarterly.

If this is your first year as a freelancer, you may not be able to estimate your tax payments accurately. If you miscalculate by either underpaying or overpaying your estimated taxes the IRS will issue a correction when you file your annual tax return. You will either be asked to pay for any missing taxes or issued a tax refund for any excess amount you paid.

The IRS wants to see that youve paid 90% of your taxes or the equivalent of 100% of last years tax bill by December, said Wade Schlosser, founder and CEO of Solvable. Otherwise, youll have to pay an estimated tax penalty.

Visit the IRS estimated tax information page to find updated estimated tax due dates. According to Schlosser, if you dont pay your estimated quarterly taxes, you wont get a bill or notification from the IRS, but you will have to pay a penalty when you file your taxes. The IRS provides tools such as the 1040-ES worksheet to help approximate your annual income and determine your estimated tax payments.

If youre a married freelancer, consider having your spouse increase their withholding taxes to help defray your tax bill, Schlosser advised.

You May Like: When Is The Irs Sending Out Tax Returns

Who Pays My Tax When Self Employed

Asked by: Danyka Mann

As a self-employed individual, generally you are required to file an annual return and pay estimated tax quarterly. Self-employed individuals generally must pay self-employment tax as well as income tax. SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves.

How To Recover A Lost Tin/tin Card

Forgetting what your TIN is can be a hassle, especially since youre only given one TIN for your whole life, and youre not allowed to just re-register.

After making a plan to make sure you dont misplace your TIN again, here are some ways you can recover your lost TIN.

Whichever method you choose to recover your TIN, remember that its your responsibility to protect your TIN from being lost or from being stolen by people who might use your identity for their own purposes.

Don’t Miss: How To Find Out How Much Taxes I Owe