Donate To The Correct Places

Unfortunately, its not quite as easy as giving your old clothes to someone you know whos in need. You can only get a tax deduction by donating to a tax-exempt organization like GreenDrop charity partners . Specifically, youll need to donate to organizations that are registered with the IRS as a 501 tax-exempt organization. You can easily get this information by looking on the IRS website or by calling the organization directly.

What Is The Fair Market Value

The fair market value is the price a property, business, or other assets would sell for in an open market. Considering both buyer and seller have reasonable knowledge of the asset and are under no pressure of selling or buying. In other words, it is the value of donated items.

There are four factors that can help to determine the fair market value of your donation:

- Cost or selling price

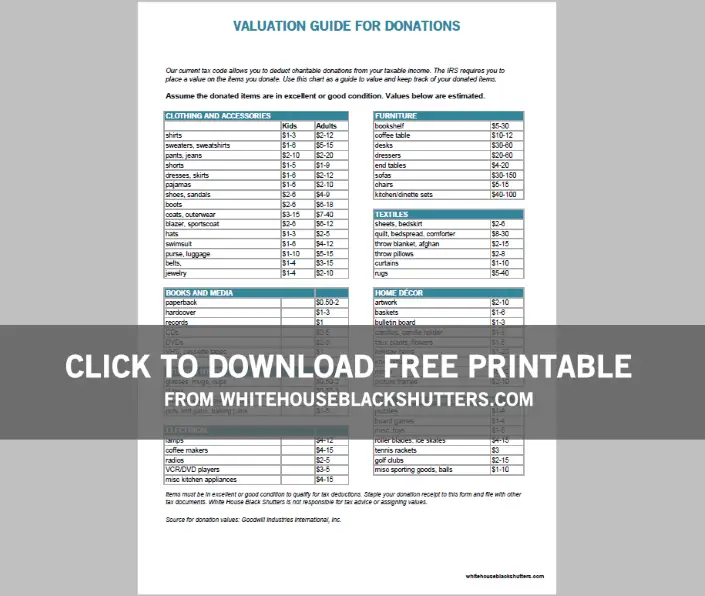

Goodwill also provides a âValue Guideâ offering average prices for items in good condition.

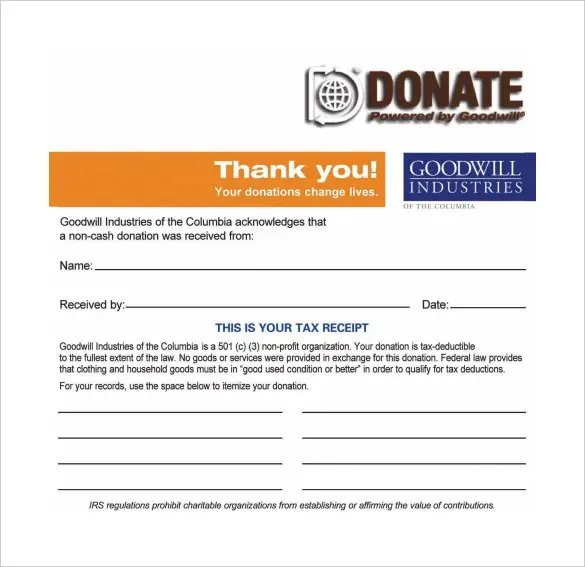

Completing Your Tax Paperwork

Recommended Reading: How To File Federal Tax Return

Can You Take Charitable Donations Without Itemizing In 2021

Deduction for individuals who dont itemize Usually taxpayers who take the standard deduction cannot deduct their charitable contributions. These taxpayers, including married individuals filing separate returns, can claim a deduction of up to $300 for cash contributions to qualifying charities during 2021.

How To Itemize Clothing Donations For Taxes

- October 02, 2020 by Tony Mers

Giving back to your community is one of the more fulfilling things you can do in your life. If that wasnt enough, there are other reasons to donate your old items as well. If done correctly, your donations can provide deductions on your next years taxes, something we can all enjoy. Given how common donating clothes is and how much is usually donated at one time, GreenDrop has made this guide to help you itemize your donations correctly to get the right refund. This guide on how to itemize clothing donations for taxes will help you be prepared for tax season with everything in hand.

Also Check: What Is Tax Liabilities On W2

How To Donate To Goodwill For Tax Deductions

How to Get Tax Deductions on Goodwill Donations.

- 1. Learn about the difference between itemized and standard deductions for Goodwill donations. Goodwill donations can only get you a deduction on your …

- 2. Record your donation items before donating them. Good record-keeping is important for maximizing your deduction. If you simply throw an assortment …

- 3. Donate items that are in good condition. Both Goodwill and the IRS require that you donate clothes or items that are in good condition or better.

- 4. Take photographs of anything of high value that you are donating. It’s a wise idea to take extra care to document any high-value donations you make …

What Are The Requirements

For amounts of a minimum of $250 and up to $500, you need a written acknowledgment like a receipt for taxes, donation statement, or letter from the charity.

It must include the name and address of the organization, a description of the property donated, the original cost, and the fair market value of the property at the time of the donation.

To claim a deduction for a non-cash contribution that goes from $500 up to $5,000 you must also complete the IRS Form 8283. This form requires additional information like the means of acquisition

In addition to all of the above, non-cash contributions that go over $5,000 you must present a qualified appraisal of the property donated, issued by a qualified appraiser.

Also Check: How To Reduce Income Tax

How To Place A Value On Your Donation

The IRS requires donors to determine the value of their donations for tax purposes. The value is not the original purchase price, but the estimated resale value or replacement cost in its current condition.

To help you determine those values, we have created a valuation guide that lists price ranges for common donation items.

However, the rules governing valuation, substantiation, recordkeeping and reporting are complex. We suggest you visit the following IRS links to download IRS Publication 526 and IRS Publication 561 and/or consult a tax advisor.

Claim A Tax Deduction

Your monetary donations and donations of clothing and household goods that are in good condition or better are entitled to a tax deduction, according to Federal law. The Internal Revenue Service requires that all charitable donations be itemized and valued.

Use the list of average prices below as a guide for determining the value of your donation. Values are approximate and are based on items in good condition.

Its a good idea to check with your accountant or read up on the rules before you file you return. Here are some handy IRS tips for deducting charitable donations.

When you bring items to one of our donation locations, you may fill out a paper donation form. The form is required if you are donating computers and other technology equipment so that we can comply with state reporting requirements. Thanks for taking the time to fill it out!

Recommended Reading: Why Do I Owe State Taxes

Can I Claim Donations To Goodwill On My Taxes

Use the slider to estimate the fair market value of an item. Donation Value. $1 $200. $50. Price. $10.00 – $20.00. Fair Market Value. Below is a donation value guide of what items generally sell for at Goodwill locations. To determine the fair market value of an item not on this list, use 30% of the items original price.

Could You Make Money Selling Clothes On Ebay

I probably could have made more money selling my clothes on eBay. I didnt sell any of my clothes online because I didnt want the overhead of having to post the items individually, answer questions, and deal with different customers.

I itemize my taxes each year and just wanted to go with the tax deduction. If I had more time and didnt have so much other stuff I was selling online, then I would definitely sell each item one by one on Craigslist or eBay.

Don’t Miss: How Much Do Corporations Pay In Taxes

Find The Correct Valuation

Speaking of finding the price of the item as it is now, that is an essential step that youll need to undertake if you want to report your donations correctly. If you can find a valuation guide for the item you are considering donating online, that is perfect. If not, youll need to do some of your own research. The items dont have to be exactly the same, but search for similar items in places like eBay, or in thrift stores or consignment stores. Make sure you keep a record of where you found these prices as well as the date of when you found the valuation.

What Is Fair Market Value

Fair market value is that property would sell for on the open market. In other words, it is the value of your donation. It is the price that would be agreed on between a willing buyer and a willing seller, with neither being required to act, and not having reasonable knowledge of the relevant facts.

Also Check: What’s The Penalty For Doing Taxes Late

Donation Calculator & Tax Guide

Donation Calculator

The Donation Impact Calculator is a great way to see how your donations support your Goodwills programs and services. Simply select the types of clothing, household and/or electronic items donated, and instantly see how that translates into hours of programs and services provided to people in the community. You can then follow a link to read how an individual benefited from that service or program.

Click this link to get started: donate.goodwill.org/

Taxes and Your Donations

When you drop off your donations at Goodwill, youll receive a receipt from a donation attendant. Hang on to this receipt at the end of the year, you can claim a tax deduction for clothing and household items that are in good condition.

The U.S. Internal Revenue Service requires you to value your donation when filing your return. To get started, , which features estimates for the most commonly donated items.

Donation Calculator

The Donation Impact Calculator is a great way to see how your donations support your Goodwills programs and services. Simply select the types of clothing, household and/or electronic items donated, and instantly see how that translates into hours of programs and services provided to people in the community. You can then follow a link to read how an individual benefited from that service or program.

Click this link to get strated: donate.goodwill.org/

Taxes and Your Donations

What Is A Qualified Charitable Organization

A qualified charitable organization is a nonprofit organization that qualifies for tax-exempt status according to the U.S. Treasury. Qualified charitable organizations include groups operated exclusively for religious, charitable, scientific, literary, or educational purposes, or the prevention of cruelty to animals or children, or the development of amateur sports. As mentioned above, only donations that are made to a qualified charitable organization are tax-deductible. For example, lets say, you donated $10,000 to political parties. Although this is a great way to get involved in politics and your community, donations to political organizations or candidates are not tax-deductible.

Recommended Reading: Do I Pay Tax On Selling My House

How Strong Is A Verbal Agreement In Court

Most business professionals are wary of entering into contracts orally because they can difficult to enforce in the face of the law.

If an oral contract is brought in front of a court of law, there is increased risk of one party lying about the initial terms of the agreement. This is problematic for the court, as there’s no unbiased way to conclude the case often, this will result in the case being disregarded. Moreover, it can be difficult to outline contract defects if it’s not in writing.

That being said, there are plenty of situations where enforceable contracts do not need to be written or spoken, they’re simply implied. For instance, when you buy milk from a store, you give something in exchange for something else and enter into an implied contract, in this case – money is exchanged for goods.

Goodwill Hacks You May Not Know About

There are three hacks I recently became aware of after listening to this guest on FIRE DRILL PODCAST.

Don’t Miss: Is The Tax Assessment The Value Of The Property

What Records Should You Keep For Qualified Charitable Contributions

You’ll have to keep records for your donations. Here’s what’s acceptable to the IRS:

- Bank statements

Just like keeping receipts for business write-offs, hoarding paper copies of your donation records isn’t actually necessary. Digital proof, like a credit card statement that says “Greenpeace,” is totally fine.

Just make sure your documentation shows the following information, whether it’s paper or digital:

- The organization you donated to

Donations over certain limits have special requirements for recordkeeping. Letâs dive into those next.

Is It Worth Claiming Charitable Donations

How much do I need to give to charity to make a difference on my taxes? Charitable contributions can only reduce your tax bill if you choose to itemize your taxes. Generally youd itemize when the combined total of your anticipated deductionsincluding charitable giftsadd up to more than the standard deduction.

Recommended Reading: Do You Have To Pay Taxes On Pandemic Unemployment

How Much Can You Donate To Goodwill For Tax Purposes

How much of my donation is eligible for the tax credit? The limits are $400 for individuals and $800 for married couples filing jointly. However, smaller donations are allowed.

- How much can you donate to the Salvation Army or Goodwill in one year? In any single tax year, youre allowed to deduct charitable donations totaling up to 50% of your adjusted gross income . If you donate more than that, the IRS will allow you to carry over these donations for up to 5 subsequent tax years.

How Do I Claim Donations To Goodwill On My Taxes

Goodwill donations can only get you a deduction on your Federal income taxes if you itemize them. When you file your taxes, you can choose to either take a standard deduction, which is based on your age, marital status, and income, or an itemized deduction, which takes all of your deductible activity into account.

Don’t Miss: How To File Quarterly Taxes For Business

What Is Tax Deductible

How much can you deduct for the gently used goods you donate to Goodwill? The IRS allows you to deduct fair market value for gently-used items. The quality of the item when new and its age must be considered

The IRS requires an item to be in good condition or better to take a deduction. Our donation value guide displays prices ranging from good to like-new. For more information on how to take a deduction, scroll to the bottom of this page for a how-to video.

To determine the fair market value of an item not on this list below, use this calculator or 30% of the items original price.

Do You Get Money For Donating Clothes To Goodwill

There is no monetary compensation for donating clothes to Goodwill however, the satisfaction of knowing that you are helping others in need is its own reward. Every clothing donation made to Goodwill helps to create job training and placement opportunities for people in your community who face barriers to employment.

Recycling unwanted clothing can be a powerful way to reduce waste and pollution while also assisting those in need. Goodwill does not receive any money from donations however, if you itemize deductions, your clothes donations may be deductible. Clothing, footwear, accessories, and small items are some of the simplest items to donate. Goodwill donation centers accept gently used clothing for recycling. Goodwill aids people in overcoming obstacles to develop skills, find jobs, and improve their careers. When you file your taxes, you can claim donations as a deduction for charitable contributions. When you donate clothing to Goodwill, you may be eligible for a larger tax break.

Goodwill is the only place to exchange or sell gently used and new clothing for men, women, and children. In addition to handbags, shoes, linens, small toys, and other items, it accepts donations. Non-cash contributions may still be deducted as a tax deduction for taxpayers. If you donate noncash property, you may be able to deduct the fair market value of it from your taxable income.

Don’t Miss: What Happens If You File Taxes One Day Late

How To Calculate The Value Of Donated Clothes

How to value your clothing donations if you donate to a charity? Well, some important points that you can refer to how to value your clothing donations are to look for fair market value, look at online valuation guides, or look at previous sales of similar items.

To find the fair market value of your clothes, you can find out the price that buyers are willing to pay for the items you are donating. In addition, you must not give more than the fair market value of your donation. Providing fair market value for used items can also be tricky. The point is you need to give a reasonable price, a price that is neither too high nor too low.

You can determine fair market value yourself and the IRS recommends that you consider all relevant factors. Things that you can consider are the cost of clothes or the selling price of the clothes and expert opinions.

The online assessment guide can also help you if you have questions about how to value your clothing donations. Several well-known non-profit organizations have created value guides for clothing such as goodwill. Moreover, tax software can help you provide assessments such as TaxCut from H& R Block and TurboTax from Intuit, which can give donors an estimated value of clothing based on the condition of each item.