Additions To State Taxes

Common state additions to federal taxable income include:

- Bonus depreciation

- Interest on municipal bonds from other states

- Moving expenses

- Pennsylvania

- Utah

However, most states have tax brackets just like the federal government, with tax rates that increase as income rises.;Youll have to use a table to calculate your tax in these states.

Most tax preparation software offers interactive calculators for free.

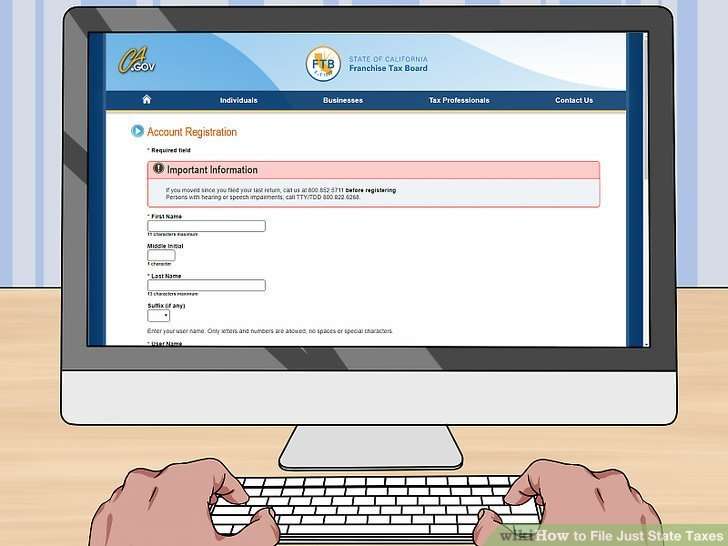

Basics To Know About Filing State Taxes For Free

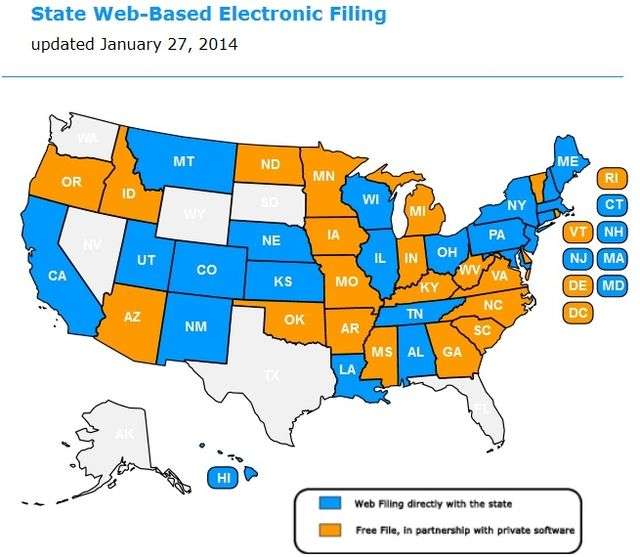

Some states allow taxpayers to e-file state returns for free directly through a state website. Others participate in state-level versions of the Free File Alliance.

The Free File Alliance is a group of tax-preparation and tax-filing software vendors and online filing services that has agreed to make free versions of its paid products available to eligible taxpayers. To use Free File software, taxpayers must have an adjusted gross income of $66,000 or less. Additionally, participating vendors may have lower AGI limits or additional limitations based on age, military status or other factors.

Currently, 23 states participate in the Free File Alliance. does not participate in the Free File Alliance. Its always free to prepare and file federal and single-state income tax returns with Credit Karma Tax®, regardless of adjusted gross income. But a free Credit Karma account is necessary in order to use the service.

If I’m Getting A Tax Refund When Can I Expect To Receive It

E-filing will deliver your tax refund much faster than traditional mail. Taxpayers using TurboTax and electing to have their refunds deposited directly into their bank accounts will get their fastest refunds possible.

Refunds from tax returns filed on paper can take up to six weeks, depending on the time of year you file your tax return.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. Whether you have a simple or complex tax situation, we’ve got you covered. Feel confident doing your own taxes.

Read Also: How Much Does Tax Take

Freefile Program For Individual Income Tax

The State of Arkansas is a member of the Free File Alliance.

The Free File Alliance is a group of software providers working with the State of Arkansas and the IRS to donate free tax preparation for taxpayers. ;

What this means to Taxpayers is that if you meet the qualifying criteria, you can prepare and efile your tax return for FREE.;

eFile Online Providers

The following companies provide preparation and electronic filing services for both Arkansas and Federal individual income taxes. The services these companies offer allow taxpayers to prepare their tax returns with their personal computer, giving them the option of filing their returns electronically or printing paper tax returns for mailing. These companies have asked the Department of Finance and Administration to provide links to their websites, and we have done so as an accommodation to our taxpayers.

The State of Arkansas does not specifically endorse or recommend any of these sites. It is your choice as to whether to employ the service of any of these companies. If you have any specific questions concerning the prices or services offered, contact the appropriate company listed below. All website links open in new windows.;

Online Taxes at OLT.com would like to offer free federal and free state online tax preparation and e-filing if your Federal Adjusted Gross Income is between $16,000 and $72,000 regardless of age.;

Activity Duty Military with adjusted gross income of $72,000 or less will also qualify.

Calculating Your Amount Due

You can reduce your state tax liability by any state tax credits that you qualify for.;State credits can vary widely, but many states have their own versions of child tax credits and earned income credits.;

Most tax credits can only reduce your tax liability to zero. They’re treated as payment toward any tax you owe.

Some credits are refundable. Any leftover credit after eliminating your tax debt would be sent to you as a tax refund.

You May Like: How To Pay Taxes For Free

Get A Discount On Software

Tax software providers might offer free state filing for U.S. military members and reservists, or for taxpayers with very simple returns. Certain conditions typically apply for a taxpayer to receive free tax filing.

For example, TaxSlayer has free options for both state and federal returns, but only for basic 1040 returns, and you only get one free state filing. TurboTax will permit free state tax filing, and it can handle slightly more services such as W-2 income, Earned Income Tax Credit , and some dividends and interest payments . H&R Block permits free state tax filing for taxpayers with simple returns, and it covers W-2, 1099, and EITC situations.

Even if your state offers free e-filing directly, these services may be a more convenient option for those who qualify. The software will automatically populate your state form with data from your federal form, saving you time and effort.

Finally, Credit Karma Tax offers free state filing and accepts many different forms, including W-2s, 1095s, 1098s, 1099s, and much more. However, Credit Karma Tax only works with 40 states . If you don’t live in one of the states covered by this service, you’ll have to find a different way to file your state returns.

If you need more sophisticated tax software, consider these paid options.

Can I File My State Taxes For Free

That depends. You can file a state tax return for free with TaxSlayer if you qualify for TaxSlayer Simply Free.

Simply Free is available to you if your taxable income is less than $100,000, you dont claim dependents, your status is single or married filing jointly, and your income only comes from wages, salaries, tips, taxable interest of $1,500 or less and/or unemployment compensation. You must also claim the standard deduction.;;

If your tax situation is slightly more complex and you dont meet the requirements above, you can file your federal and state returns with TaxSlayer Classic instead for less than the other guys.

Also Check: Where Can I Find My Agi On My Tax Return

How Can I File Only My State Taxes Through Turbotax But Not My Federal Tax Return

If you did not file a federal return with TurboTax, you are not able to e-file just the state in TurboTax since it pulls information from the federal return. So if you;have filed federal with another tax preparer, you can do one of the two options listed below.;

NOTE:;If you have already filed your federal return with TurboTax, you can just log back in and go to;File;tab and file your state return. The federal return must already be accepted by IRS in order to e-file the state return.;

Irs Free File Program Delivered By Taxslayer

- 72k AGI or Less and Age 51 years old or younger

- OR qualify for EITC

Website URL;

Intuit TurboTax is proud to sponsor IRS Free File Program delivered by TurboTax, donating free Federal and State tax returns nationwide for:

Taxpayers with Adjusted Gross Income of $39,000 or less

Active Duty Military with Adjusted Gross Income of $72,000 or less

Taxpayers eligible for the Earned Income Tax Credit

Accuracy & Simplicity: Download your W2 and transfer prior year TurboTax data

Qualified taxpayers can prepare and e-file their federal and state return online for FREE, with America’s #1 best-selling tax preparation product year after year.”

You May Like: How To Register For Tax Id

Efile For A Fee Other Available Efile Options

If you don’t qualify for free electronic filing,;please visit the listing of;the approved software products to determine which software product;will meet your filing needs.;

- Be sure the product that you select supports the forms you want to file

- If the product that you select does not offer payment options, you can use our website to pay your taxes online

To find out if you qualify to use free software,;review the eFile for Free;options listed above.

Worst Option: Get The Paper Forms And Mail Them In

Yes, it sounds pretty archaic, but if you really want to file your state return for free and dont qualify for the options listed above, this might not be a bad option. If you have already completed the federal form online, it should be pretty easy to fill out the state return. You can get the forms from your local library or you can print them off at your states Department of Revenue website.

Read Also: What Tax Return Does An Llc File

How Will I Know That The Irs Has Received My Tax Return

Ever worry that your return might get lost in the mail? E-filing lets you rest easy. When you send a return by mail, you have no way of knowing if the IRS received your return unless you pay extra for certified mail with a return receipt. It could take weeks for you to get that receipt.

But if you file electronically, the IRS notifies you by email within 48 hours that it has received your return. And if the IRS detects any errors, it will send an error code that TurboTax will translate into a text message telling you what the problem is, how to fix it, and how to retransmit your return.

Adjusting Your Federal To State Income

Begin making adjustments after you’ve entered the information from your federal return onto your state income tax return. You must reconcile the differences between your federal taxable income and your state taxable income.;

Some of these adjustments will be additions. They’re usually add-backs of any federal tax deductions that you might have taken that aren’t allowed on your state return.

They might also be income items that are tax-exempt for federal purposes but are taxed at the state level.;

Other adjustments will be subtractions. These are usually income items that are taxable under federal tax law but are tax-exempt under state tax law.;Some of these subtractions can also be state-specific deductions.;

The number of adjustments you’ll make on your state tax return will depend on the extent to which your state conforms to and follows the federal tax code.

Don’t Miss: How To Find Out Your Tax Rate

Whats The First Thing I Should Do When Looking For A House

The first thing you should do before searching for rental homes is decide on an ideal budget. Consider how much of your income goes towards bills and what you have left over at the end of each month. Also, remember that when first moving in, you will need to account for at least a deposit and first months rent.

Faqs About State Tax Software

If you live in a state that doesn’t have state income tax, you might not have to file a state return. Congrats! Here are the states without any income tax. Note: New Hampshire and Tennessee do tax certain interest and dividend income and other activities.

- Alaska

- Wyoming

Yes. Use this state tax software to e-file right from your computer. An additional fee for e-filing applies, and you can’t e-file in a state that doesn’t have income tax. Note: New Hampshire doesnt allow e-filing for state returns.

Yes. For most states, you can file nonresident and part-year resident state returns using H&R Blocks State tax software. We support e-filing part-year and/or nonresident returns for:

- Arizona

- Wisconson;

Absolutely! You can e-file up to three state returns for the same filer. Any additional state returns must be printed and mailed.

Yes, you can file a state return by itself after you’ve completed your federal return. Just make sure you already have the federal software downloaded and installed. To buy your state’s program, choose your state from the drop-down menu above, then install it to access it from the federal software.

You May Like: How To Figure Out Tax Percentage

Other Free State Income Tax Filing Websites

3. MyFreeTaxes.com;;This is a not-for-profit with funding from the Walmart Foundation, The United Way and H&R block and they offer free state and federal tax returns if you meet the criteria.

4. On-Line Taxes; This one is pretty simple. You have to have an adjusted gross income within a certain range. If you dont qualify both returns cost $7.95. They are a little bit different than many of the other places in that they offer free customer service with a toll-free number, e-mail, and live tax help. They also allow you to view the forms before;paying.

Ways To File Your State Income Tax Online For Free

It isnt too difficult to find a place to file your federal tax return for free, but finding a service to file your state return for free is another story.

So if you are asking where can I file my state taxes for free? you are in for good news!

I did a little digging and found a few options to consider . . . .

Don’t Miss: What Can I Write Off On My Taxes For Instacart

Will My Tax Return Data Be Kept Confidential

Yes. You’ve got no worries about data falling into the wrong hands or being misused because the IRS, the states and tax preparers are under the same rules of confidentiality for e-filed returns as they are for paper returns. They may not reveal or discuss any information contained in your return unless you authorize them to do so. Tax software developers also must operate under these rules, and they must protect customer confidentiality during the e-filing process. To ensure the integrity of your electronically filed tax return, always use only proven, high-quality e-filing software.

You May Know About Ways To File Your Federal Income Tax Return For Free But What About Filing State Taxes For Free

In 43 states and the District of Columbia, Americans have to pay some sort of state-level income tax as well as federal income tax. If you live in a state with a state-level income tax, you may dread the idea of paying someone to complete yet another tax return for you.

If so, youll be happy to know that its possible to file state taxes without paying for it. Heres what you should know about filing your state taxes for free.

Don’t Miss: Can I Pay Quarterly Taxes Online

Filing A State Return

TaxACT’s state modules are not standalone applications. They require the federal software to run.TaxACT allows you to prepare your state return, but first you need to prepare your federal return. All the data that flows to the state return originates from the federal return. The State Q&A interview section then prompts you for additional information that is specific to your state. Depending on your state, your filing options may be limited if you have already filed your federal return . If you are in a “Piggy Back” state , you will be required to print and mail your return if not submitting it along with the Federal return. For all other states you can electronically file by selecting State Only when going through the filing steps.

State Only Filing: To file only your state return, click on the blue Filing tab and select E-File My Return. Select the state-only return you wish to submit and then complete the filing steps.

If you do not see the option to file only your state return when going through the filing steps, please follow the instructions below:

Welcome To Maine Fastfile

Maine Revenue Services solution to fast and secure tax filing.; The Maine Fastfile service provides three options:

Modernized e-File; e-File using tax preparation softwareThis service is offered through the IRS and provides one stop processing of federal and state returns.; This is the do it yourself option through the purchase of;tax preparation software;either over-the-counter or online, prepare your own return and press send to e-file.; Your return is sent through safe and secure channels, not via e-mail. Prices do vary so shop around .

OR; e-File through a paid tax professional

Find a tax professional you trust to prepare and e-file your return. Nearly all tax preparers use e-file now and many are now required by law to e-file. But it’s still a good idea to tell your tax preparer you want the advantages of e-file your refund in half the time, or if you owe, more payment options.

Maine i-File; i-File free for Maine taxpayersThis service is available for filing your individual income tax return;;including the Maine property tax fairness credit.; The advantages of Maine i-File are:

Certain restrictions apply. See the directions page of the;i-File application;for more information.

Recommended Reading: Where To Find Real Estate Taxes Paid

Do I Have To File A State Tax Return

If you live in Alaska, Florida, Nevada, South Dakota, Texas, Washington, or Wyoming, your state does not impose an income tax, meaning you do not have to file a tax return for that state. New Hampshire and Tennessee do not have income tax either, but they do tax dividend and interest income, so you may have to file a return for those states.

All other states have income tax, but the rates and;filing requirements;vary from state to state. for Check;your;states department of revenue or taxation website;to find out if you should;file a state return this year.;;

See more state and local tax informationhere.

Do you live in one state and work in another? Heres what you need to know about filing your state taxes.

The information in this article is up to date through tax year 2021 .;;