Protect Yourself From Tax

Tax ID theft occurs when someone steals your personal information to file a tax return using your personal data. Usually, the fraudulent tax filer will use your Social Security number to file your return in order to collect a refund. To protect yourself from tax ID theft, you can obtain a six-digit Identity Protection PIN from the IRS. IP PINs are known only to you and the IRS so the IRS is able to confirm your identity when you file your return. Learn more about how the IP PIN works and how to apply.

Get A Transcript Of A Tax Return

A transcript is a computer printout of your return information. Sometimes a transcript is an acceptable substitute for an exact copy of your tax return. You may need a transcript when preparing your taxes. They are often used to verify income and tax filing status when applying for loans and government benefits.

Dont Miss: When Are Va State Taxes Due

Extension To File Your Tax Return

If you cant file your federal income tax return by the due date, you may be able to get a six-month extension from the Internal Revenue Service . This does not grant you more time to pay your taxes. To avoid possible penalties, estimate and pay the taxes you owe by the tax deadline of April 19, 2022, if you live in Maine or Massachusetts or April 18, 2022, for the rest of the country.

Recommended Reading: Where To File Federal Tax Return In California

What Customers Are Saying:

I really was impressed with the prompt response. Your expert was not only a tax expert, but a people expert!!! Her genuine and caring attitude came across in her response

T.G.WMatteson, IL

I WON!!! I just wanted you to know that your original answer gave me the courage and confidence to go into yesterdays audit ready to fight.

BonnieChesnee, SC

Great service. Answered my complex tax question in detail and provided a lot of additional useful information for my specific situation.

JohnMinneapolis, MN

Excellent information, very quick reply. The experts really take the time to address your questions, it is well worth the fee, for the peace of mind they can provide you with.

OrvilleHesperia, California

Wonderful service, prompt, efficient, and accurate. Couldnt have asked for more. I cannot thank you enough for your help.

This expert is wonderful. They truly know what they are talking about, and they actually care about you. They really helped put my nerves at ease. Thank you so much!!!!

AlexLos Angeles, CA

Thank you for all your help. It is nice to know that this service is here for people like myself, who need answers fast and are not sure who to consult.

GPHesperia, CA

Belated Income Tax Return

- As per section 139 of the income-tax act, 1961, if any individual fails to file the income tax returns within the due date, he can file a belated return with the penalty prescribed by the income tax department.

- This belated return can be filed at any time before the end of the corresponding assessment year or before the completion of assessment by the tax authorities whichever is earlier. This scheme has been made applicable from the assessment year of 2017-2018. i.e from the financial year of 2016-17.

- This can be explained further with an example: the income tax return due date for the fiscal year 2017-2018 was 31 July 2018 and 30 September 2018. If a taxpayer fails to file the ITR on time for any reason, he has the option of filing a belated tax return before the end of the corresponding assessment year, i.e. before 31 March 2019.

You May Like: How Much Tax Do You Pay On Social Security

Benefits Of Using Infreefile Are:

- Faster refunds: A paper-filed return can take up to 8 weeks versus up to 2-3 weeks for an electronically filed return.

- Confirmation: Youll receive confirmation that your return was received and accepted.

- 24/7 access: You can access INfreefile at any time, day or night.

- Easy to use: All INfreefile options are user-friendly and include step-by-step instructions.

- Fewer errors: Electronically filed returns have a 2% error rate, compared to a 20% error rate for paper-filed returns.

- More efficient: You can prepare and file your federal and state tax returns at the same time.

- Convenient:INfreefile provides the added convenience of direct deposit for refunds and direct debit for payment of taxes owed.

Free File partners are online tax preparation companies that offer what is called the IRS Free File program, which provides free electronic tax preparation and filing of federal tax returns at no cost to qualifying taxpayers . Not all companies that participate in the IRS Free File program offer free state filings. Those vendors who participate in INfreefile must meet Indianas software certification requirements to ensure an accurate product.

The IRS and DOR do not endorse any individual partner company. The links below will take the user to sites provided by the vendor and are not maintained or controlled by DOR. Any other links used to access vendor websites may result in fees or charges. Please review each vendors offerings, including limitations and exclusions, carefully.

Minimize Penalties And Interest

The IRS can penalize you if you dont file a return or pay any tax you owe by the deadline. Generally, the penalty for not filing is more than the penalty for not paying. You may also be charged interest on any unpaid tax balance.

Filing your back taxes and paying anything you owe may help limit the amount of interest and penalties youre subject to for missing the deadline.

Also Check: How Are Annuity Payments Taxed

Recommended Reading: When Are Va State Taxes Due

What Are Back Taxes

Back taxes refer to an outstanding federal or state tax liability from a prior year. Federal income tax returns are typically due each year on April 15 for the prior year. You may request an extension to file your taxes, which gives you another six months to file your return. However, even if your extension is approved, you must still pay your tax bill by the required due date. This is generally on April 15 for most individual tax filers.

How To Efile Your Business Tax Return

Electronically filing your business tax returns is secure, can save you time, and reduces errors. Learn how to start the process today.

Streamlining your business processes should always be on your radar. One of the easier ways to do that is to file your business tax returns electronically. Also known as e-filing, completing your tax returns electronically can expedite the filing process, reduce errors, and eliminate your need to track down paper documents in years to come.

Recommended Reading: How To Apply For Sales Tax Exemption In Georgia

Welcome To Maine Fastfile

Maine Revenue Services solution to fast and secure tax filing. The Maine Fastfile service provides three options:

Modernized e-File e-File using tax preparation softwareThis service is offered through the IRS and provides one stop processing of federal and state returns. This is the do it yourself option through the purchase of tax preparation software either over-the-counter or online, prepare your own return and press send to e-file. Your return is sent through safe and secure channels, not via e-mail. Prices do vary so shop around .

OR e-File through a paid tax professional

Find a tax professional you trust to prepare and e-file your return. Nearly all tax preparers use e-file now and many are now required by law to e-file. But it’s still a good idea to tell your tax preparer you want the advantages of e-file your refund in half the time, or if you owe, more payment options.

Maine i-File i-File free for Maine taxpayersThis service is available for filing your individual income tax return including the Maine property tax fairness credit. The advantages of Maine i-File are:

Certain restrictions apply. See the directions page of the i-File application for more information.

Free Electronic Filing For Individuals

The Arizona Department of Revenue will follow the Internal Revenue Service announcement regarding the start of the electronic filing season. Because Arizona electronic income tax returns are processed and accepted through the IRS first, Arizonas electronic filing system for individual income tax returns is dependent upon the IRS’ launch date. Remember, the starting point of the Arizona individual income tax return is the Federal Adjusted Gross Income.

Taxpayers can begin filing individual income tax returns through Free File partners and individual income tax returns will be sent to the IRS once electronic filing season opens. Tax software companies also are accepting tax filings in advance of the IRS’ launch date.

Please refer to the E-File Service page for details on the e-filing process.

Read Also: How Long Can You Go Without Filing Your Taxes

The Canada Revenue Agency

We permit only approved participants to electronically file income tax returns.

Personal and financial information must be transmitted to us in an encrypted format. Encryption is a way of encoding information before it is transmitted over the Internet. This ensures that no unauthorized party can alter or view the data.

We also ensure that all personal and financial information is stored securely in our computers. We use state-of-the-art encryption technology and sophisticated security techniques to protect this site at all times.

We have made every possible effort to ensure the safety and integrity of transactions on our Web site. However, the Internet is a public network and, as a result, is outside our control.

Income Tax Filing Due Date And Penalty

The last date to file ITR for taxpayers whose accounts need to be audited is .

Similarly, professionals with turnovers of Rs. 50 lakhs also require a tax audit.

In case you miss the due date and file your return after the due date, then you will have to pay:

- A late fee of Rs. 5000 under section 234F

Editors note: If you have yet to get a business website, now is the time. Put your business online in less than 10 minutes with Online Starter Bundle.

Also Check: Can You File Llc Taxes Online

Next Steps: Plan Ahead For Next Year

Filing accurate tax returns by the filing deadline and paying all the tax you owe on time goes a long way to help you avoid problems with the IRS. Dont wait to clear up your back taxes before getting a jump start on this years tax return.

Start a file for all your tax documents, such as income statements from your employer, interest statements from your bank or receipts for deductible expenses you hope to itemize. Having everything in one place will be helpful when its time to prepare your return.

You can use the IRS Tax Withholding Estimator to help ensure youre having the right amount of tax withheld from your paycheck. If you have too little withheld throughout the year, you could face a tax bill when you file next year. And if you withhold more than necessary, you could get a refund next year.

What Efiling Options Are Available

In order to eFile your tax return, you need to make use of the IRS’s FreeFile program, a suite of income tax software, or a paid tax preparer who is authorized to submit e-Filed returns to the IRS.

There are dozens of popular software suites and filing services available – which one you choose should depend on your yearly income and the complexity of your tax return. Here are some of the most popular options available for preparing and e-filing your federal or state tax returns.

Also Check: How Many Undocumented Immigrants Pay Taxes

Why Is Turbotax Charging Me

If you make less than $36,000 a year and TurboTax is telling you it costs money to file, you are probably using the wrong version of TurboTax. Dont worry, there is a way to access the truly free version.

As ProPublica reported last year, TurboTax purposefully hid its Free File product and directed taxpayers to a version where many had to pay, which is called the TurboTax Free Edition. If you clicked on this FREE Guaranteed option, you could input a lot of your information, only to be told toward the end of the process that you need to pay.

You can access TurboTaxs Free File version here. This version is offered through the Free File agreement.

TurboTaxs misleading advertising and website design directed users to more expensive versions of the software, even if they qualified to file for free. After our stories published, some people demanded and got refunds. Intuit, the maker of TurboTax, faces several investigations and lawsuits because of this. The company has denied wrongdoing.

Following ProPublicas reporting, the IRS announced an update to its agreement with the tax-preparation companies. Among other things, the update bars the companies from hiding their Free File offerings from Google search results. It also makes it so each company has to name their Free File service the same way using the format: IRS Free File Program delivered by .

The Legality Of Filing Without Your W

If you file electronically, you will have no problem filling your taxes without having your W-2. However, you still need the information from the W-2 in order to accurately do your taxes. Some of the things you will need are:

- Medicare tips and wages

- Withheld Medicare tax

- Any withheld local income taxes

Although it is not necessary to submit a W-2 copy when you file electronically, you will have to enter the information found on this form. It is still very important to make sure your W-2 stays in a safe place because you may need it at some point. For instance, it may be required for background checks, for an audit, or other similar situations.

Keep in mind that you will have to produce the W-2 and other documents in case of an audit. They will allow you to show evidence of your income, as well as withholding. If you are unable to show that you entered those numbers in good faith, you may end up dealing with legal problems.

The employer is the one who should file the W-2 form with the Social Security Administration. This has to be done before the end of January. Also, the information will be shared by the SSA with the IRS. This is how they will be able to tell whether you and your employer reported different numbers, in which case an audit will take place.

Read Also: Did The Tax Deadline Get Extended

File Electronically In Just Minutes And Save Time

We know that filing your taxes can sometimes be unpleasant. That is why our helpful online tax preparation program works with you to make the filling process as pain-free as possible. Many filers can use our online tax software to electronically file their taxes in less than 15 minutes.

To use the E-file software, a visitor simply needs to create a free account , enter their taxpayer information, income figures, then any deductions they may have, and our software will calculate and prepare the return. Once a user has completed preparing their return they will be provided the option of either e-filing or printing and mailing. It’s as simple as that.

Need More Time About Tax Filing Extensions

You may find that you need additional time to file your taxes. This might be because you are waiting for an ITIN approval or missing some of your necessary documents. If you need additional time to file your federal return, you can file for an Automatic Extension of Time to File Your U.S. Tax Return. You should submit the extension form before the deadline listed above. More information can be found on the IRS link above.

Read Also: What Is The Difference Between Estate Tax And Inheritance Tax

Understand How Your Taxes Are Determined

The government decides how much tax you owe by dividing your taxable income into chunks also known as tax brackets and each chunk gets taxed at the corresponding tax rate. The beauty of this is that no matter which bracket youre in, you wont pay that tax rate on your entire income.

The progressive tax system in the United States means that people with higher taxable incomes are subject to higher federal income tax rates, and people with lower taxable incomes are subject to lower federal income tax rates.

Can I Still File My 2016 Taxes And Get A Refund

To collect refunds for tax year 2016, taxpayers must file their 2016 tax returns with the IRS no later than this year’s extended tax due date of July 15, 2020. The IRS estimates the midpoint for the potential refunds for 2016 to be $861 that is, half of the refunds are more than $861 and half are less.

You May Like: How To File Taxes When You Moved States

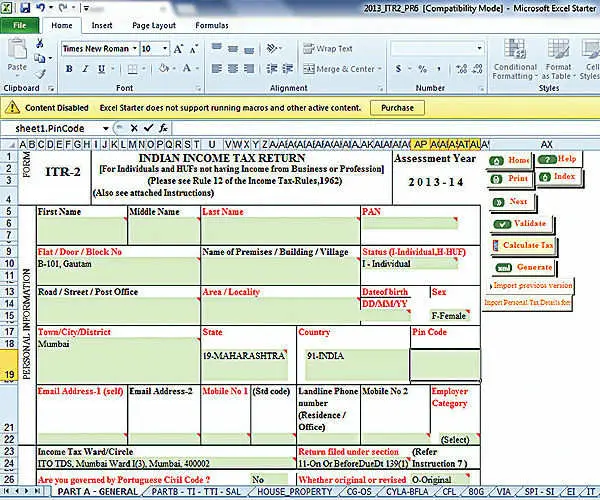

Income Tax Return Filing: Here’s How To E

3 min read.Livemint

- Sahaj is needed to be filed by taxpayers who have income up to 50 lakh and who receive income from salary, one house property / other sources . Notably, the ITR filing for the fiscal FT22 having assessment year 2022-23 is due on July 31, 2022.

| Listen to this article |

About seven income tax return forms are available for various categories of taxpayers to file before the due date of a financial year. The ITR-1 is one of the simpler forms and caters to a large number of small and medium taxpayers. Sahaj is needed to be filed by taxpayers who have income up to 50 lakh and who receive income from salary, one house property / other sources . Notably, the ITR filing for the fiscal FT22 having assessment year 2022-23 is due on July 31, 2022.

According to the Income Tax department website, the pre-filling and filing of the ITR-1 service are available to registered users on the e-Filing portal. This service enables individual taxpayers to file ITR-1 online through the e-Filing portal.

Kerala doctors neat handwriting goes viral

For filing ITR-1 forms, a taxpayer needs to have a registered user ID and password. Also, their status of Permanent Account Number should be active. Other important details are – PAN is linked with Aadhaar, pre-validate at least one bank account and nominate it for refund, and valid mobile number linked with Aadhaar/e-filing portal/bank account/NSDL/CDSL.

Step 3: Select Assessment Year as 2021 22 and click Continue.