How To Pay Estimated Taxes

Taxpayers can pay online, by phone or by mail. The Electronic Federal Tax Payment System and IRS Direct Pay are two easy ways to pay. Alternatively, taxpayers can schedule electronic funds withdrawal for up to four estimated tax payments at the time that they electronically file their Form 1040.

Taxpayers can make payments more often than quarterly. They just need to pay each periods total by the end of the quarter. Visit IRS.gov/payments for payment information.

What Is The Percentage Of Federal Income Tax Withheld

As an employer, you withhold income tax on behalf of your employees and then remit those taxes quarterly to federal, state, and local tax authorities.

To calculate how much of your employeeâs federal income tax to withhold, youâll need a copy of their Form W-4, as well as your employeeâs gross pay.

Your next step is to determine the method you want to use to calculate withholding. Most employers have two options: the Wage Bracket Method or the Percentage Method. While not exactly simple, the wage bracket method is the more straightforward approach to calculating payroll tax.

Overview Of Vermont Taxes

Vermont has a progressive state income tax system with four brackets. The states top income tax rate of 8.75% is one of the highest in the nation. No Vermont cities have local income taxes.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

You May Like: How Do 1099 File Taxes

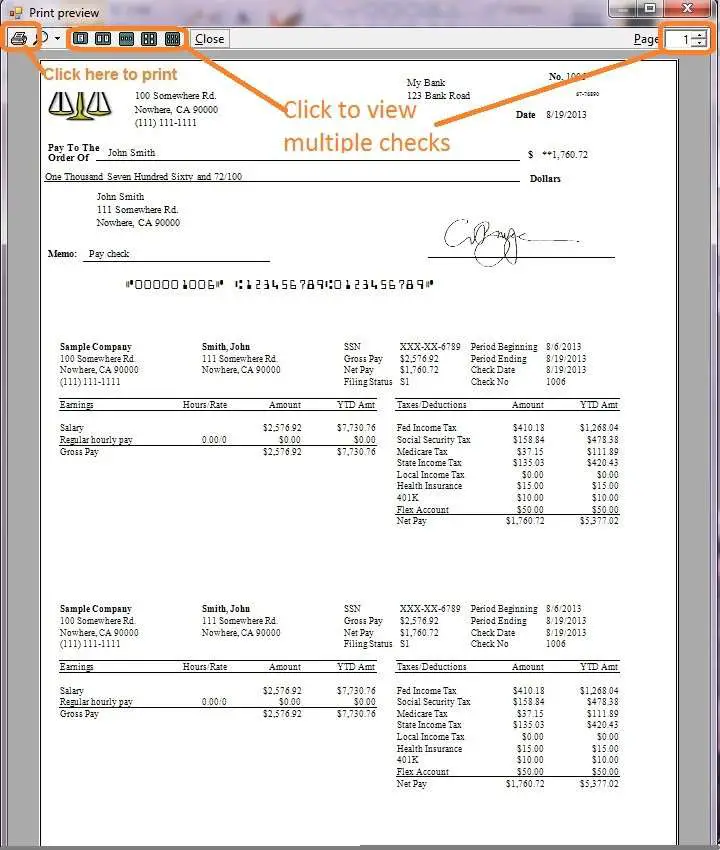

An Example Of An Employee Pay Stub

In the case of the employee above, the weekly pay stub would look like this:

| Employee Pay Stub |

|---|

You must make deposits with the IRS of the taxes withheld from employees’ pay for federal income taxes, FICA taxes, and the amounts you owe as an employer. Specifically, after each payroll, you must:

- Pay the federal income tax withholding from all employees

- Pay the FICA tax withholding from all employees, and

- Pay your half of the FICA tax for all employees.

Depending on the size of your payroll, you must make deposits monthly or semi-weekly.

You must also file a quarterly report on Form 941 showing the amounts you owe and how much you have paid.

How To Calculate Taxes Taken Out Of A Paycheck

Calculations, however, are just one piece of the larger paycheck picture.

You May Like: Do You Pay Taxes On Life Insurance Payment

Penalties Related To Estimated Taxes

If a taxpayer underpaid their taxes they may have to pay a penalty. This applies whether they paid through withholding or through estimated tax payments. A penalty may also apply for late estimated tax payments even if someone is due a refund when they file their tax return.

In general, taxpayers dont have to pay a penalty if they meet any of these conditions:

- They owe less than $1,000 in tax with their tax return.

- Throughout the year, they paid the smaller of these two amounts:

- at least 90 percent of the tax for the current year

- 100 percent of the tax shown on their tax return for the prior year this can increase to 110 percent based on adjusted gross income

To see if they owe a penalty, taxpayers should use Form 2210.

The IRS may waive the penalty if someone underpaid because of unusual circumstances and not willful neglect. Examples include:

- casualty, disaster or another unusual situation.

- an individual retired after reaching age 62 during a tax year when estimated tax payments applied.

- an individual became disabled during a tax year when estimated tax payments applied.

There are special rules for underpayment for farmers and fishermen. Publication 505 has more information.

United States Federal Paycheck Calculation

All residents and citizens in the USA are subjected to income taxes. Residents and citizens are taxed on worldwide income , while nonresidents are taxed only on income within the jurisdiction.

A tax year is different for the federal and state. A federal tax year is the 12-months period beginning October 01 and ending September 30 the following year. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. The state tax year is also 12 months but it differs from state to state. Some states follow the federal tax year, some states start on July 01 and end on Jun 30.

Similar to the tax year, federal income tax rates are different from state income tax rates. Federal taxes are progressive , while states have either a progressive tax system or a flat tax rate on all income.

The income tax rate varies from state to state. There are 8 states which dont have income tax and 1 state that has no wage income tax.

It is also worth noting that the recent Tax Cuts and Jobs Act of 2017 made several significant changes to the individual income tax across the board. If you want to understand the changes in detail, refer to this Investopedia article.

Don’t Miss: How Do I Know What Form I Filed For Taxes

Calculating Your Tax Refund

Whether or not you get a tax refund depends on the amount of taxes you paid during the year. This is because they were withheld from your paycheck. However, it also depends on your tax liability and whether or not you received any refundable tax credits.

When you file your tax return, if the amount of taxes you owe is less than the amount that was withheld from your paycheck during the course of the year, you will receive a refund for the difference. This is the most common reason people receive a tax refund.

If you paid no taxes during the year and owe no taxes, but are eligible for one or more refundable tax credits, you will also receive a refund equal to the refundable amount of the credits.

Understanding Your Tax Refund Results

Our tax return calculator will estimate your refund and account for which credits are refundable and which are nonrefundable. Because tax rules change from year to year, your tax refund might change even if your salary and deductions dont change. In other words, you might get different results for the 2021 tax year than you did for 2020. If your income changes or you change something about the way you do your taxes, its a good idea to take another look at our tax return calculator. For example, you might’ve decided to itemize your deductions rather than taking the standard deduction, or you could’ve adjusted the tax withholding for your paychecks at some point during the year. You can also use our free income tax calculator to figure out your total tax liability.

Using these calculators should provide a close estimate of your expected refund or liability, but it may vary a bit from what you ultimately pay or receive. Doing your taxes through a tax software or an accountant will ultimately be the only way to see your true tax refund and liability.

Read Also: Does The Irs Forgive Back Taxes

Federal Insurance Contributions Act

Also known as paycheck tax or payroll tax, these taxes are taken from your paycheck directly and are used to fund social security and medicare.

For example, in the tax year 2020 Social Security tax is 6.2% for employee and 1.45% for Medicare tax.If your monthly paycheck is $6000, $372 goes to Social Security and $87 goes to Medicare, leaving you with $6000 $372 $87 = $5541

Social Security

How To Increase A Take Home Paycheck

Salary Increase

The easiest way to achieve a salary increase may be to simply ask for a raise, promotion, or bonus. However, this is assuming that a salary increase is deserved. For instance, an employee is in a legitimate position to ask for a raise or bonus if their performance exceeded original expectations, or if the company’s performance has noticeably improved, due in part to the employee’s input. If internal salary increases are not possible, which is common, try searching for another job. In the current job climate, the highest pay increases during a career generally happen while transitioning from one company to another. For more information about or to do calculations involving salary, please visit the Salary Calculator.

Reevaluate Payroll Deductions

Sometimes, it is possible to find avenues to lower the costs of certain expenses such as life, medical, dental, or long-term disability insurance. For instance, someone who is healthy with no major diseases or injuries can reconsider whether the most expensive top-of-the-line health insurance is necessary. In addition, each spouse’s company may have health insurance coverage for the entire family it would be wise to compare the offerings of each health insurance plan and choose the preferred plan.

Open a Flexible Spending Account

Work Overtime

Cash Out PTO

Temporarily Pause 401 Contributions

Don’t Miss: What Tax Forms Do C Corporations File

Penalty For Underpayment Of Estimated Tax

If you didnt pay enough tax throughout the year, either through withholding or by making estimated tax payments, you may have to pay a penalty for underpayment of estimated tax. Generally, most taxpayers will avoid this penalty if they owe less than $1,000 in tax after subtracting their withholdings and credits, or if they paid at least 90% of the tax for the current year, or 100% of the tax shown on the return for the prior year, whichever is smaller. There are special rules for farmers, fishermen, and certain higher income taxpayers. Please refer to Publication 505, Tax Withholding and Estimated Tax, for additional information.

However, if your income is received unevenly during the year, you may be able to avoid or lower the penalty by annualizing your income and making unequal payments. Use Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts , to see if you owe a penalty for underpaying your estimated tax. Please refer to the Form 1040 and 1040-SR Instructions or Form 1120 Instructions PDF, for where to report the estimated tax penalty on your return.

The penalty may also be waived if:

Contribution Effects On Your Paycheck

An employer-sponsored retirement savings account could be one of your best tools for creating a secure retirement. It provides two important advantages:

-

All contributions and earnings are tax-deferred. You only pay taxes on contributions and earnings when the money is withdrawn.

-

Many employers provide matching contributions to your account, which can range from 0% to 100% of your contributions.

Use this calculator to see how increasing your contributions to a 401 can affect your paycheck as well as your retirement savings.

This calculator uses the latest withholding schedules, rules and rates .

Also Check: When Do We Get Our Taxes Back 2021

How You Can Affect Your Vermont Paycheck

You cant escape your income taxes, but you can take steps to change how much of your income taxes you pay each paycheck. One of the simplest ways to do this is by adjusting your withholdings when you file your W-4. If you want even more control over your tax withholding, you can also specify a dollar amount for your employer to withhold. For example, if you want your employer to withhold an additional $20 from each paycheck, you can write $20 on the appropriate line of your W-4. While that might mean smaller paychecks now, this practice could save you money come tax time.

Besides manually switching up your withholdings, you can also impact your paycheck by lowering your overall taxable income. You can do this by contributing to pre-tax retirement accounts, like a 401, or to a Health Savings Account or Flexible Spending Account . This means smaller paychecks, but because the contributions go in pre-tax, you wind up keeping more of your money.

Summary Of Payroll Taxes

Since your business and your employee are both taxpayers, there are two types of payroll taxes: ones that come out of your own pocket and ones that you collect from employee paychecks and remit to the federal government.

Payroll taxes that come out of your pocket:

-

FICA tax: contributions to Social Security and healthcare programs . This cost is shared by employer and employee. The employer portion is 6.2% for Social Security and 1.45% for Medicare, and youâll collect and remit the same amount from your employees.

-

FUTA tax: contributions to unemployment insurance. The total amount is 6.0%. However, most states have a 5.4% credit, meaning most employers only pay 0.6%.

Weâll cover both of these in more detail later on.

Payroll taxes that you collect and remit:

-

Federal income taxes

Weâll cover each of these in detail, beginning with federal income tax withholding.

Don’t Miss: What Is The Income Tax Rate In California

State And Local Income Taxes

Many states, as well as some cities and counties, have their own income taxes. These are collected in addition to the federal income tax. States that have a state income tax require that you file a separate state tax return, as they have their own rules. If you’re curious about a particular states tax system and rules, visit one of our state tax pages.

How You Can Affect Your New York Paycheck

If you find yourself always paying a big tax bill in April, take a look at your W-4. One option that you have is to ask your employer to withhold an additional dollar amount from your paychecks. For example, you can have an extra $25 in taxes taken out of each paycheck by writing that amount on the corresponding line of your W-4. This paycheck calculator will help you determine how much your additional withholding should be.

Another way to manipulate the size of your paycheck – and save on taxes in the process – is to increase your contributions to employer-sponsored retirement accounts like a 401 or 403. The money you put into these accounts is taken out of your paycheck prior to its taxation. By putting money away for retirement, you are actually lowering your current taxable income, which can help you save in taxes right now. Another option is to put money in a spending account like a health savings account or a flexible spending account if your employer offers them. The money you put in these accounts is also taken from your paycheck before taxes, and you can use those pre-tax dollars to pay for medical-related expenses like copays or certain prescriptions. Just keep in mind that only $500 in an FSA will roll over from year to year. If you contribute more than that and then dont use it, you’re out of luck.

Recommended Reading: What Refinance Costs Are Tax Deductible

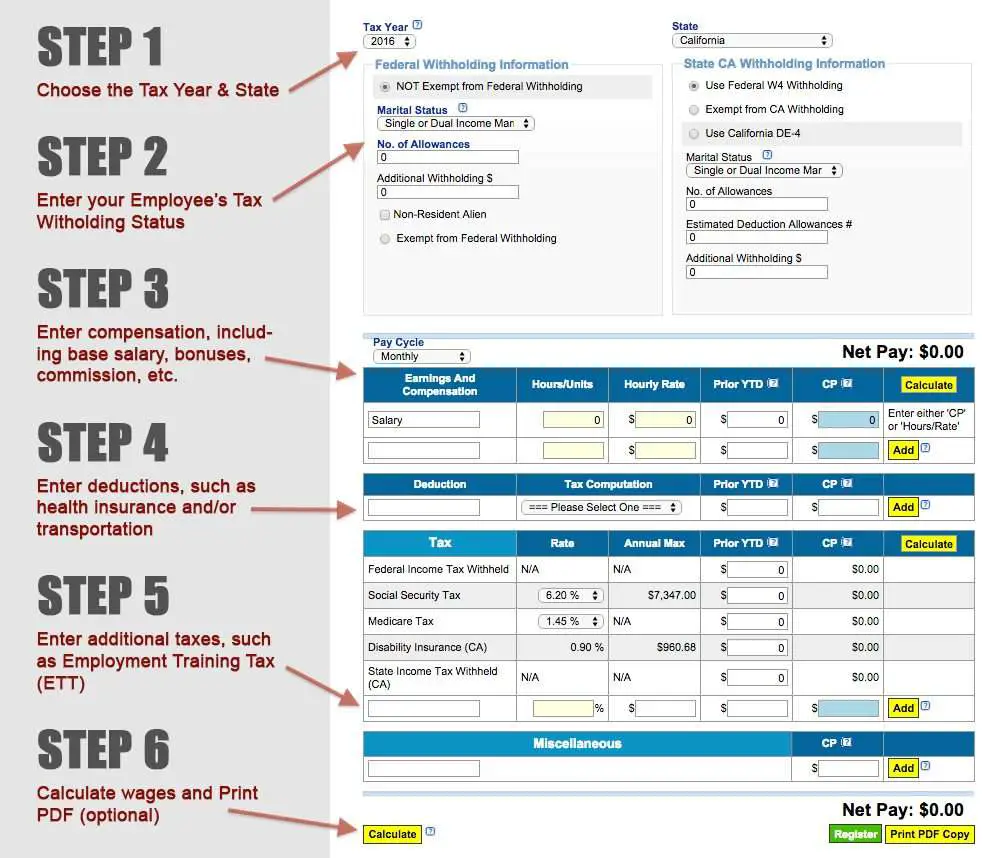

S For Calculating Payroll Taxes

If you aren’t eager to run the above calculations by hand, we can’t blame you. Luckily, you have a few more options than just a spreadsheet and some deeply confusing IRS tax tables:

- With payroll tax calculators, you enter your employee’s gross pay and allowances to calculate the total tax withholding amount. Some calculators let you enter your state to autofill the correct income tax rate for your area.

- With self-service payroll software, you still calculate and remit your employees’ taxes, but the software stores your information and offers built-in tools to make tax calculations a little easier.

- With full-service payroll software, the software calculates and remits payroll taxes for you.

- With an outsourced payroll company, another company handles all the ins and outs of your payroll taxes, including remitting taxes on your behalf and sending employees their W-2 forms at the end of the year.

Federal Payroll Tax Rates

The steps our calculator uses to figure out each employees paycheck are pretty simple, but there are a lot of them. Heres how it works, and what tax rates youll need to apply.

Recommended Reading: How To Pay Sales Tax For Small Business