Evasion Of Customs Duty

Customs duties are an important source of revenue in developing countries. Importers attempt to evade customs duty by under-invoicing and misdeclaration of quantity and product-description. When there is ad valorem import duty, the tax base can be reduced through under-invoicing. Misdeclaration of quantity is more relevant for products with specific duty. Production description is changed to match a H. S. Code commensurate with a lower rate of duty.

When Is A Verbal Agreement Legally Binding

For any contract to be binding, there are four major elements which need to be in place. The crucial elements of a contract are as follows:

Therefore, an oral agreement has legal validity if all of these elements are present. However, verbal contracts can be difficult to enforce in a court of law. In the next section, we take a look at how oral agreements hold up in court.

Contact A Tax Professional Today To Avoid Paying Your Independent Contractor Taxes

Completing your yearly taxes can be frustrating and a little scary, but it doesnât have to be. If you take the time to examine your possible deductions, keep track of your expenses and business income in detail, and remember to take a deep breath, youâll be just fine.

If you donât trust yourself, the best thing to do is to ask the experts and turn to a tax-focused program for assistance with your taxes. With professional help, youâll improve your chances of lowering what you owe and avoiding an audit by the IRS during tax time.

Are you ready to stop stressing about your freelance or independent contractor finances? With its seamless, integrated, and automated tax software, Bonsai could be the solution youâve been searching for. From expense tracking and income reporting to estimated tax planning and much more, taxes will be a breeze!

Start using our accounting software for freelancers for free today and enjoy peace of mind when tax season rolls around. Our app sends you filing deadline reminders, estimate taxes and discovers tax write-offs automatically so you can avoid paying taxes. Try a 14 day free trial today.

Also Check: Is The Stimulus Check Taxed

Use A Health Savings Account

Employees with a high-deductible health insurance plan can use a health savings account to reduce taxes. As with a 401, HSA contributions by payroll deduction are excluded from the employees taxable income an individuals direct contributions to an HSA are 100% tax-deductible from their income.

For 2021, the maximum deductible contribution level is $3,600 for an individual and $7,200 for a family.In 2022, those maximums rise to $3,650 for individuals and $7,300 for families. These funds can then grow without the requirement to pay tax on the earnings. An extra tax benefit of an HSA is that when used to pay for qualified medical expenses, withdrawals arent taxed, either.

Why Do Millionaires Not Pay Taxes

Because of years of repeated budget cuts, the Internal Revenue Service rarely has the staff or internal resources to engage in the costly, labor-intensive auditing process necessary to compel the largest corporations and wealthiest individuals to actually pay what they owe the IRS and any associated penalties and interest.

Also Check: How Much Can You Give Tax Free

Internet And Phone Expenses

Everyone does business online or by phone these days, making for a perfect tax deduction for those who are self-employed.

All youâll have to do is determine what percentage of time you use your phone and internet for business purposes. Then, figure out how much youâre paying for that amount of time. This number is your internet and cell phone deduction.

Example: You log 2,000 hours of computer use in a year. 500 of these hours were used for your business. This means ¼ of your internet expenses are deductible.

If you spend $50 each month on internet service , you can take $600 and multiply it by .25. After calculating, youâll discover that you can write off $150 of your internet expenses for the year.

Minimize Your Tax Burden

The importance of tax planning cannot be overstated. When it comes to paying the appropriate amount of tax, billionaires have a team to help them and so should you! A businesss success depends not just upon its structural soundness but also on how well they take care of all aspects of the business. Youre a small business owner with big dreams. You want to grow your company and live the life you choose. Planning for your future success is the first step in creating a plan to help you and those around you live well. Tax planning should be considered high on any list of priorities, as it can save money by legally minimizing taxes owed.

You should always be paying the taxes that you are legally obligated to pay, but its possible to avoid overpaying! Find a trustworthy advisor who can help create strategies for meeting your goals.

Don’t Miss: How Does The Irs Tax Bitcoin

Find The Right Home For Your Funds

Use your 401s and IRAs for investments that throw off short-term capital gains or interest income, which are taxed as ordinary income. This means taxable bond funds, high-yielding dividend stock funds, and actively managed funds that trade frequently. Then use taxable accounts for buy-and-hold equity funds that trade infrequently, such as index funds, and muni bond funds. Being smart about asset location can save up to 0.75 points a year in returns, says Vanguard senior investment strategist Joel Dickson.

Trust This: How Wealthy Families Pass Billions To Heirs While Avoiding Taxes

The holes in the estate tax, we found, are even more remarkable. There are well-worn ways to make sure Uncle Sam doesnt get his cut of a fortune being passed on to heirs, and the most common is through a trust. How common no one can say, but we found evidence that at least half of the nations 100 richest individuals had used estate-tax-dodging trusts. In another story,we followed three century-old dynasties down through the generations, showing how they used trusts to avoid taxes, so that a fortune could pass all the way from the original early 20th century tycoon to, for example, the great-great-granddaughter who recently collected $210 million before her 19th birthday.

Help Us Report on Taxes and the Ultrawealthy

Do you have expertise in tax law, accounting or wealth management? Do you have tips to share? Heres how to get in touch. We are looking for both specific tips and broader expertise.

I may know something related to your investigation.We take privacy seriously.

Recommended Reading: How Much Do Business Owners Pay In Taxes

Legal Ways To Reduce Your Tax Bill Even Further

Property tax is generally a percentage of the value, so there are a few ways to reduce it below that amount. Instead, if you dont have more than $20k in personal property, take advantage of exemptions like vehicle , retirement accounts , and life insurance .

Your home might be your biggest asset and most expensive tax bill, but real estate has some of its tax savings, if youre married and filing jointly with a combined income under $142k, you qualify for certain write-offs.

Think Your Taxes Are Too High Change The Tax Laws

Sometimes, it pays to fight for a new tax break. For the billionaires who contributed millions to Republican politicians, the payoff came in the form of Trumps big, beautiful tax cut for passthrough businesses. We found the change sent $1 billion in tax savings in a single year to just 82 ultrawealthy households. Some business owners also boosted their savings with a trick: They slashed their own salaries and categorized the money instead as passthrough income.

Don’t Miss: How Do I Get My Pin Number To File Taxes

Can I Refund A Steam Game After 14 Days

Valve will, upon request via help.steampowered.com, issue a refund for any title that is requested within 14 days of purchase and has been played for less than 2 hours. Even if you fall outside of the refund rules weve described, you can submit a request and well take a look at it.

Avoid Having Important Economic Interests In Any Country

Most legislations discussing tax residency specify as a requisite for being considered a tax resident, apart from the 183 days rule, having important economic interests in the country.

What does this mean?

Basically, if the majority of your wealth, businesses or money sources are bound to a country, you are supposed to have a strong link to that country.

Similarly, if your husband, wife or underage children are tax residents in a country, that country can decide that you are a tax resident there too.

Thus, make sure to sever all ties to your home country.

If you have a partner, this is an important decision that you must make together.

Also, if you have dependent children they will probably have to join you too.

Although not mandatory, its also recommended not having real estate or other important properties in your home country either. Nothing that could be used against you by your tax office.

Also Check: When Is The Last Day To Pay Taxes

How The Average American Can Reduce Their Taxable Income And Pay No Taxes

So, lets get to the point! Can the average American pay no taxes? Indeed, some taxpayers, even those with investment income over $100,000, could pay zero tax. But regardless of your income or net worth, its financially prudent to take any available tax deductions and credits you qualify for.

John: 23 Year Old Recent College Grad

In the first example we have John, a 23-year-old who wants to keep his tax bill at zero. John just finished college and recently started full time employment at an entry level salary of $30,000. He managed to live frugally while in school and is willing to maintain the college student lifestyle for a few more years. Fortunately for him, he studied finance in college and knows the power of compounding investment returns. He knows that investment contributions made while he is in his twenties will grow for decades to come, thereby securing a safe retirement.

Since John has roommates that split the rent and utilities, John feels comfortable living on $1,300 per month total out of his $2,500 monthly paycheck. John participates in his employers 401k plan by contributing $1,000 per month. This leaves $200 from each paycheck to cover Social Security and Medicare tax withholding.

| 23 Year Old Single Person, No Children |

|---|

| Annual Salary |

A World Traveler Deducts A $50000 Trip

If you dream about traveling around the world and writing off the cost it might be possible. Tax preparer Jerry Lewin told CNN Money about a client of his who took a multiyear trip around the world with stops in Italy, France and Greece and the client wanted to write off the entire $50,000 cost of the trip. In the end, the client was able to write it off because he published a book about his travels and even though it was published by a very small publisher and only sold 20 copies, it counted as a business expense.

Read Also: When Are My Taxes Coming

Move Outside Of The United States

One of the fastest and easiest ways to reduce your income tax is to live outside the United States the vast majority of the time. This is called the Physical Presence test of the Foreign Earned Income Exclusion . This test has been well covered and its a very common tax strategy for most expats.

According to the IRS, if you reside outside of the United States at least 330 days out of 365, you can exempt $101,300 of income from your annual taxes. The beauty of this strategy is that you can leave the US any time you want. Im always telling you to get off your tuckus and go move today. Well, you can! And if you move you can start claiming benefits ostensibly 34 days back. Plus, even if youre like me and you never go to the US, you theoretically get one month in the US.

The one thing to be aware of is that the exemption specifically refers to time spent in a foreign country or countries. Its not just about being out of the United States 330 days, its about being in a foreign country or countries. What difference does that make? What it comes down to is that international waters and air spaces do not count.

For example, recently the guy who was working on a yacht discovered that his time outside the US didnt qualify him for the FEIE. International waters do not count so once he passed 35 days in international waters he lost the exemption even if he never went to the US.

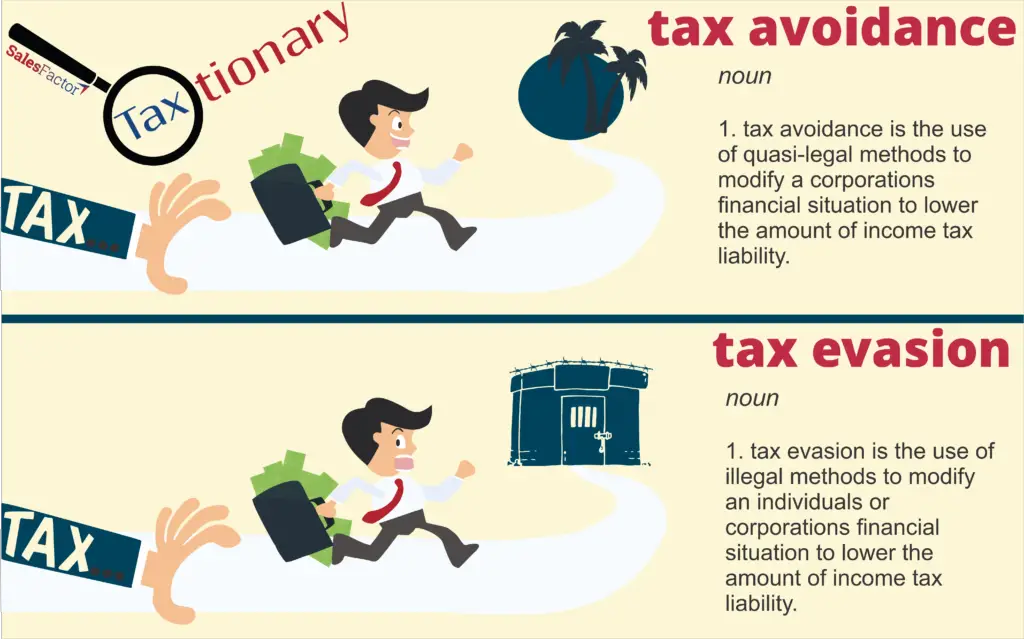

What Is Tax Avoidance

The term tax avoidance refers to the use of legal methods to minimize the amount of income tax owed by an individual or a business. This is generally accomplished by claiming as many deductions and credits as are allowable. It may also be achieved by prioritizing investments that have tax advantages, such as buying tax-free municipal bonds. Tax avoidance is not the same as tax evasion, which relies on illegal methods such as underreporting income and falsifying deductions.

Also Check: When You File Taxes Is It For The Previous Year

The Ultra Wealth Effect

Our first story unraveled how billionaires like Elon Musk, Warren Buffett and Jeff Bezos were able to amass some of the largest fortunes in history while paying remarkably little tax relative to their immense wealth. They did it in part by avoiding selling off their vast holdings of stock. The U.S. system taxes income. Selling stock generates income, so they avoid income as the system defines it. Meanwhile, billionaires can tap into their wealth by borrowing against it. And borrowing isnt taxable.

How To Evade Tax

A person may dodge income tax by purposefully filing a tax return that includes incomplete or erroneous information. They could hide information about their income or assets . Or they may dishonestly claim deductions or claim larger deductions than they are entitled to.

Contents

Read Also: How To Get Tax Info From Unemployment

Financial Advisor Bristol And Pension Advisor Clifton

Frazer James Financial Advisers is an Independent Financial Advisor based in Clifton, Bristol.

About us: Frazer James Financial Advisers is a financial advisor, based in Clifton, Bristol. As an independent financial adviser, were able to provide independent and unbiased financial advice. We provide independent financial advice, pension advice, investment advice, inheritance tax planning and insurance advice.

If you would like to speak to a Financial Advisor, we offer an Initial Financial Consultation without cost or commitment. Meetings are held either at our offices, by video or by telephone. Our telephone number is 0117 990 2602.

Here Are Some Of The Most Common Ways Employers Try To Avoid Paying Employment Taxes

All businesses that hire employees are required to pay employment taxes to the IRS. These consist of two separate taxes:

- a 12.4% Social Security tax up to an annual employee wage ceiling, and

- a 2.9% Medicare tax on all employee wages .

Employers are required to withhold half of the Social Security and Medicare taxes from their employees’ paychecks and pay the other half out of their own pockets. The money is supposed to be sent to the IRS or an authorized financial institution, usually monthly or semi-weekly. Employers must report employment taxes withheld from their employees on Form 941, Employer’s Quarterly Federal Tax Return.

Unfortunately, some employers attempt to evade their employment tax responsibilities. There are many reasons for this. Some cash-starved businesses try to use the IRS as a bankthey withhold the employment taxes from their employee’s paychecks and then “borrow” the money for a short with the intent to pay it back later. Others simply take the money with no plan ever to repay it. Some employers are misguided “tax protesters” who mistakenly believe that all federal taxes are unconstitutional.

Employment tax evasion schemes can take many forms. The IRS says that some of the more common include pyramiding, misclassifying workers as independent contractors, paying employees in cash, filing false payroll tax returns, or failing to file payroll tax returns.

Also Check: How To Report 1099 K Income On Tax Return

How Can You Legally Evade Taxes

A person may dodge income tax by purposefully filing a tax return that includes incomplete or erroneous information. They could hide information about their income or assets . Or they may dishonestly claim deductions or claim larger deductions than they are entitled to.

Claiming Deductions Minimizes Taxable Income

To reduce your taxable income, you must be aware of what is deductible and what isn’t. You also need to know the special rules that apply to certain types of deductions, such as

In many cases, a business owner can deduct benefits that would be considered nondeductible personal expenses for an employee.

Examples would be business use of a computer or business use of the family car. Don’t overlook the possibility of purchasing health insurance, investing for your retirement, or providing perks like a company car through your business.

Warning

Know the rules regarding which expenses are deductible and make sure to document them properly. Over-exuberant payment of personal expenses from business funds is a red flag for audits and may be considered proof of tax fraud.

Consider the big picture when claiming deductions. Claiming certain types of deductions can have a tax impact in later years.

One example is electing to expense the entire cost of a business asset in the year of purchase. While this will lower your tax liability for the current year, you will not be able to claim depreciation deductions in the future. If you anticipate your business income increasing in the future, you may want to scale back the current deduction so that you can claim depreciation deductions in future years.

Tax credits shave dollars off your tax bill

Work smart

Aim for lowest possible marginal tax rate

These include:

Control the tax year for income and deductions

Warning

Warning

Recommended Reading: Does Washington Have Income Tax