Calculate Employee Tax Withholdings

Once you know an employees gross pay and the number of allowances from their W-4, you can start figuring out how much you need to withhold to cover their taxes. In most states, youll need to withhold for both federal and state taxes and FICA taxes from each paycheck.

In our example, we will look at a Florida employee who claims a single marital status and two dependents on their W-4. The employee earns a $50,000 annual salary and is paid twice per month . Her gross pay per period is $2,083.33.

How To Calculate Withholding Tax: A Simple Payroll Guide For Small Business

Small businesses need to calculate withholding tax to know how much money they should take from employee paychecks to send to the Internal Revenue Service to cover tax payments.

Employers calculate withholding tax by referring to an employees Form W-4 and the IRSs income tax withholding table to determine how much federal income taxes they should withhold from the employees salary or wages.

There are two main methods small businesses can use to calculate federal withholding tax: the wage bracket method and the percentage method.

To calculate withholding tax, youll need the following information:

- Your employees W-4 forms

- The IRS income tax withholding tables and tax calculator for the current year

Small business owners should learn how to calculate withholding taxes to make sure employees are being taxed at the correct rate.

These topics take you through how to calculate withholding tax:

In this article, well cover:

NOTE: FreshBooks Support team members are not certified income tax or accounting professionals and cannot provide advice in these areas, outside of supporting questions about FreshBooks. If you need income tax advice please contact an accountant in your area.

How Can You Reduce Your Federal Income Tax Liabilities

One of the key ways to reduce your federal income tax liabilities is by undertaking careful planning. This involves making sure that you are claiming all the deductions for which you qualify. In fact, you can also file a new W-4 with your employer to adjust your payroll tax exemption.

Thus, 15 strategies that you can implement to reduce your federal income tax liabilities are:

Recommended Reading: How Long Should You Keep Tax Returns

Lets Review Our Example Using The 2020 W

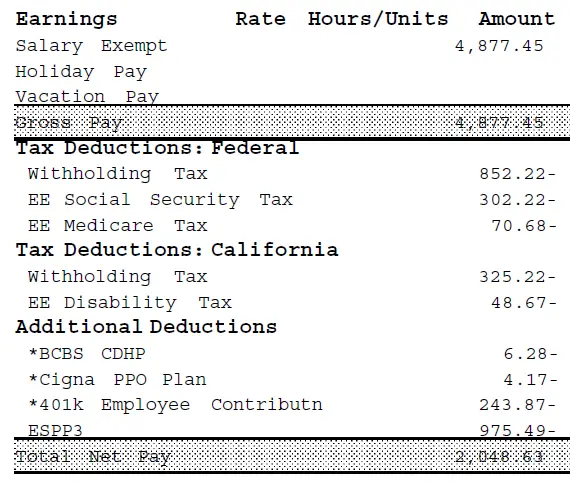

- Our employee earns $50,000 a year, or $2,083.33 of gross pay per semi-monthly pay period.

- Our employees federal income tax withholding is $12.29 using the new W-4.

- Social Security tax is $129.17, and Medicare tax is $30.21. The total combined FICA tax is $159.38.

- Since our employee lives in Florida, there is no state income tax withholding.

- There were no deductions or expense reimbursements.

- Thus, our employees net pay is $1,911.66.

From time to time, there may be other things youll need to add or deduct from your employees paychecks. When these items are added and subtracted, the rest of the basic math outlined above stays the same.

How Is Federal Withholding Calculated

Federal withholding, also known as payroll withholding tax, is a tax on income that is withheld from your wages. Here’s how it is calculated.

*information provided by IRS data

These free resources should not be taken as tax or legal advice. Content provided is intended as general information. Tax regulations and laws change and the impact of laws can vary. Consult a tax advisor, CPA or lawyer for guidance on your specific situation.

Read Also: Do You Have To Pay Taxes On Inheritance Money

How To Calculate Your Federal Income Tax Withholding

The following guidance pertains to wages paid on and after January 1, 2021.

1. Calculate your Federal Taxable Gross: Gross Pay minus any Pre-TaxReductions for Federal Income Tax Withholding*

2. Using your Federal Taxable Gross from the previous step, calculate your Federal Income Tax Withholding using either of the following resources from the IRS:

- Worksheet 1 on page 5 of IRS Publication 15-T , as well as the Percentage Method tables on page 6.

- The Tax Withholding Assistant Excel spreadsheet refer to the Income Tax Withholding Assistant for Employers page on irs.gov. When using this tool, be sure to use your Federal Withholding Taxable Wages dollar amount and notyour Gross Wages dollar amount.

You may find it helpful to refer to Form W-4 as you use either of the above resources.

*Pre-tax reductions for federal income tax withholding include retirement contributions , state deferred compensation, pre-tax VIP, pre-tax medical insurance, pre-tax dependent care , pre-tax Health Savings Account , pre-tax Medical Flexible Spending Arrangement , pre-tax Limited Purpose Flexible Spending Arrangement , and pre-tax parking.

What Are Withholding Allowances

Withholding allowances were exemptions that employees used to use to claim from federal income tax, using Form W-4. Withholding allowances were used to determine an employees withholding tax amount on their paychecks. The more allowances an employee chooses to claim, the less federal tax their employer deducted from their pay.

Don’t Miss: How To File Ca State Taxes For Free

Add On Any Expense Reimbursements

If your employee paid for any company expenses out of their own pocket, they expect to be reimbursed. Employers can either pay reimbursements separately from payroll or combine it with payroll.

Remember that expense reimbursements are not part of gross wages, and thus not subject to tax withholding. Any expenses you reimburse to employees should be made in full and added on to net pay at the end of your calculation.

How To Use The Percentage Method Withholding Tables With Pre

Employers must withhold federal income taxes from their employeesâ pay every pay period. The IRS provides several methods employers can use to fulfill this duty. The percentage method of withholding is most commonly used by employers with an automated payroll system and third-party payroll service providers. The percentage method withholding tables and worksheets are issued before the end of each calendar year for employers to use in the following year. They are published in .

You May Like: How To Pay Nc Taxes Online

Recommended Reading: How To Pay Taxes As An Independent Contractor

How To Calculate Payroll Taxes: Step

If youre a small business owner trying to figure out how to calculate payroll, youre not alone. Over six million small businesses in the U.S. are in the same boat as you. They all have fires to put out, employees to pay, futures to plan, and little to no time to grapple with the IRS tax code.

The good news is that although the tax code may seem complicated, once you figure out what tax filings are required and learn how to do the math, the process is fairly straightforward. With that being said, calculating payroll taxes correctly is critical not only to your employees but also to your accountant and Uncle Sam. Thats why we decided to write this in-depth guide on how to calculate payroll taxes, step by step.

You should be able to find all the answers to your payroll questions here, but if you hit a wall or simply want to take payroll taxes off of your to-do list, we also offer a simple payroll service that does the heavy lifting for you. And we publish OnPay customer reviews if you want to hear what businesses have to say about working with us.

Calculating Your Tax Refund

Whether or not you get a tax refund depends on the amount of taxes you paid during the year. This is because they were withheld from your paycheck. However, it also depends on your tax liability and whether or not you received any refundable tax credits.

When you file your tax return, if the amount of taxes you owe is less than the amount that was withheld from your paycheck during the course of the year, you will receive a refund for the difference. This is the most common reason people receive a tax refund.

If you paid no taxes during the year and owe no taxes, but are eligible for one or more refundable tax credits, you will also receive a refund equal to the refundable amount of the credits.

You May Like: How Much To Do Taxes At H& r Block

Taxation And Tax Liabilities

For an individual or a business, the tax liability is calculated based on the current tax laws. This involves multiplying the tax base by the tax rate.

One thing to keep in mind is that the income that is subjected to federal income tax includes earnings, gains on sales of a home or other asset, and other taxable events. Also this income may also be subjected to state as well as local taxes.

Finally, the amount of tax liability that you calculate is reduced by items such as credits, deductions, and estimated tax payments, made to reach your total tax liability.

However, what you must note here is that if your tax liability is unpaid, then you will accrue fees, charges, and interest over time.

Withholding Income Tax From Your Social Security Benefits

You can ask us to withhold federal taxes from your Social Security benefit payment when you first apply.

If you are already receiving benefits or if you want to change or stop your withholding, youll need a Form W-4V from the Internal Revenue Service .

You can or call the IRS toll-free at 1-800-829-3676 and ask for Form W-4V, Voluntary Withholding Request.

When you complete the form, you will need to select the percentage of your monthly benefit amount you want withheld. You can have 7, 10, 12 or 22 percent of your monthly benefit withheld for taxes.

Only these percentages can be withheld. Flat dollar amounts are not accepted.

Sign the form and return it to your local Social Security office by mail or in person.

You May Like: Do I Have To File Taxes On Unemployment Benefits

How To Check Withholding

- Use the instructions in Publication 505, Tax Withholding and Estimated Tax.Taxpayers with more complex situations may need to use Publication 505 instead of the Tax Withholding Estimator. This includes employees who owe, the alternative minimum tax or tax on unearned income from dependents. It can also help those who receive non-wage income such as dividends, capital gains, rents and royalties. The publication includes worksheets and examples to guide taxpayers through these special situations.

What Are Federal Income Tax Liabilities

Federal income tax is a tax imposed by the United States federal government on the income of individuals, corporations, trusts, and other legal entities. Income tax is calculated based on taxable income, which is adjusted gross income plus certain deductions and exemptions.

Taxpayers are required to file a federal income tax return each year to report their income, deductions, exemptions, and other pertinent information. Tax liability is the amount of money an individual or business owes in taxes to the federal government.

Tax liability is determined by subtracting any credits or deductions from the taxpayers total taxable income. Taxpayers can reduce their tax liability by taking advantage of deductions, credits, and other available tax breaks.

Taxpayers with a higher income may be subject to higher tax brackets and owe more in taxes. Taxpayers can also lower their federal income tax liabilities by contributing to retirement accounts, such as a 401, IRA, or other tax-advantaged plans.

Additionally, taxpayers may be able to offset some of their federal income tax liability by claiming certain credits, such as the Earned Income Tax Credit or the Child Tax Credit. Taxpayers may also be able to reduce their tax liability by making charitable donations.

Lastly, taxpayers may be able to reduce their federal income tax liability by consulting with a qualified tax professional.

Don’t Miss: When Can You File For Taxes 2021

Tax Withholding: How To Get It Right

Note: August 2019 this Fact Sheet has been updated to reflect changes to the Withholding Tool.

FS-2019-4, March 2019

The federal income tax is a pay-as-you-go tax. Taxpayers pay the tax as they earn or receive income during the year. Taxpayers can avoid a surprise at tax time by checking their withholding amount. The IRS urges everyone to do a Paycheck Checkup in 2019, even if they did one in 2018. This includes anyone who receives a pension or annuity. Heres what to know about withholding and why checking it is important.

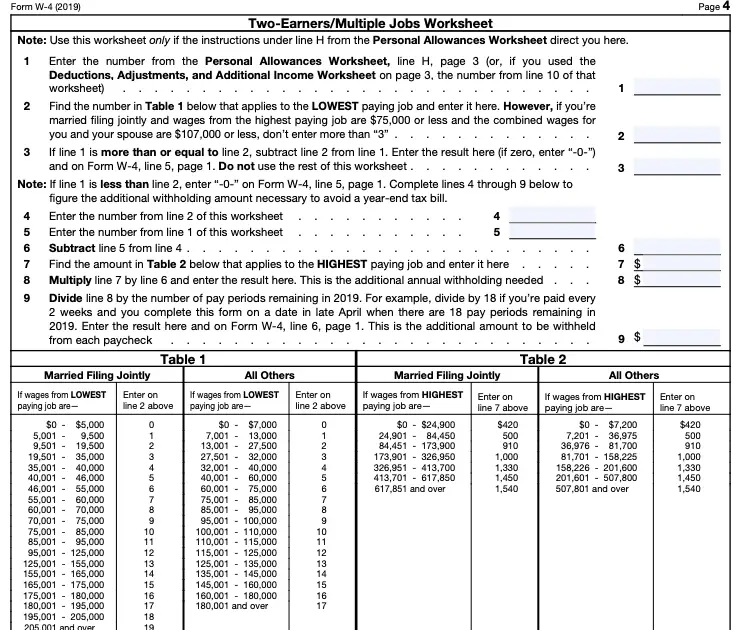

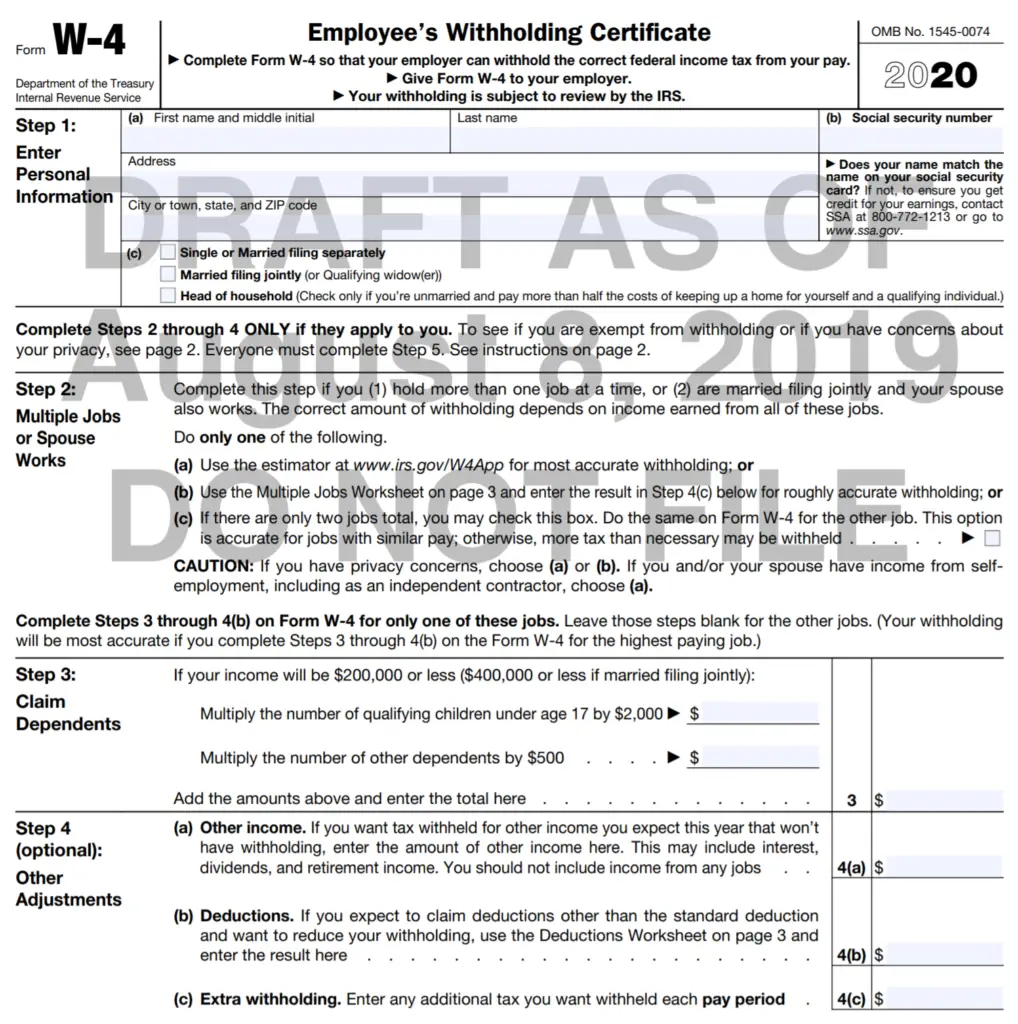

Understanding The New W

Remember the first day of your job? Dont worry. We dont either. A new job is a blur of new names and spaces. But at some point, you probably filled out a W-4 form to help your employer figure out how much taxes to withhold from each paycheck.

The official government title for a W-4 is Employees Withholding Certificate, which sounds kind of fancy. But its not. You wont hang this certificate in a place of honor next to the one you got for second place in a hot dog eating contest.

The W-4 is divided into five, fairly easy steps that will give your employer the info they need to calculate your withholding. Leave it to the government to label a five-step form with the number four!

- Step 1: Youll enter some basic personal information herename, address, Social Security number and filing status . Everyone has to fill out this step, but you only have to fill out steps 24 if they apply to you.

- Step 2: If you have more than one job, or youre married filing jointly and your spouse also works, fill out this step. You can use the IRStax withholding estimator or the worksheet on the form to calculate how much additional tax youll need to withhold from your paycheck.

The IRS introduced a new W-4 form in 2020. If youve been at your job for a while, you dont have to fill out a new W-4 form. But it could be a good idea to check it anyway because the new form should help you get your tax withholding closer to where it needs to be.

Don’t Miss: What Items Do You Need To File Taxes

How To Calculate Federal Tax Withholding

This article was co-authored by Cassandra Lenfert, CPA, CFP®. Cassandra Lenfert is a Certified Public Accountant and a Certified Financial Planner in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.There are 9 references cited in this article, which can be found at the bottom of the page. This article has been viewed 136,634 times.

Calculating federal tax withholding can be surprisingly frustrating even though it’s something the majority of people have to do regularly. Luckily, with the right guidance, this yearly ritual doesn’t have to be a source of stress: each tax has its own set of laws and regulations associated with it, which are clearly outlined by the IRS. Learn how to calculate your federal tax withholding today to save yourself time and energy for years to come.

How To Calculate Your Paid Family And Medical Leave Withholding

To calculate the amount of Paid Family Medical Leave withheld from your paycheck, multiply your gross wages by .6%. You pay 73.22% of that 0.6%.

Note that premiums are capped at the 2022 Social Security Wage Base of $147,000 the maximum premium paid for PFML is $649.32.

You can also visit the Premiums Calculator page on the Washington State Paid Family and Medical Leave website for more information.

Also Check: Can Home Improvement Be Tax Deductible

Read Also: How Can I Avoid Paying Taxes On Retirement Income

How To Calculate Your Medical Aid Withholding

The following guidance pertains to hours worked on and after January 1, 2022.

To calculate the amount of Medical Aid withheld from your paycheck, multiply the number of hours worked by the following rates:

Note: The sum of all 3 figures is limited to the maximum deduction of $9.16.

Employer Contribution is determined by multiplying .2487 by the number of hours worked, up to a maximum of 80 hours. The maximum contribution possible is $19.89.

What Are The Components Of Federal Income Tax Liabilities

Before you can calculate your federal tax liabilities , some of the information that you must know are:

- Gross Income: This is the total income earned from all sources before deductions and exemptions.

- Deductions: These are the allowable deductions that reduce a taxpayer’s taxable income.

- Exemptions: These are the amounts that are exempt from taxation, such as personal exemptions, dependents, and certain credits.

- Taxable Income: This is the amount left after deductions and exemptions are taken into account.

- Tax Brackets:Tax brackets are the various income levels at which different tax rates are applied.

- Tax Rate: This is the rate at which taxes are applied to taxable income.

- Tax Credits: These are the amounts that reduce the amount of taxes owed.

Thus, the four main components of federal income tax liabilities are:

Don’t Miss: Are Church Donations Tax Deductible In 2020

Federal Income Tax: 1099 Employees

Independent contractors, unlike W-2 employees, will not have any federal tax deducted from their pay. This means that because they are not considered employees, they are responsible for their own federal payroll taxes .

Both 1099 workers and W-2 employees must pay FICA taxes for Social Security and Medicare. But, whereas W-2 employees split the combined FICA tax rate of 15.3% with their employers, 1099 workers are responsible for the entire amount.

The IRS mandates employers to send 1099 forms to workers who are paid more than $600 during a tax year.

A financial advisor can help you understand how taxes fit into your overall financial goals. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.