How To Calculate Capital Gains Tax After Selling An Investment Property

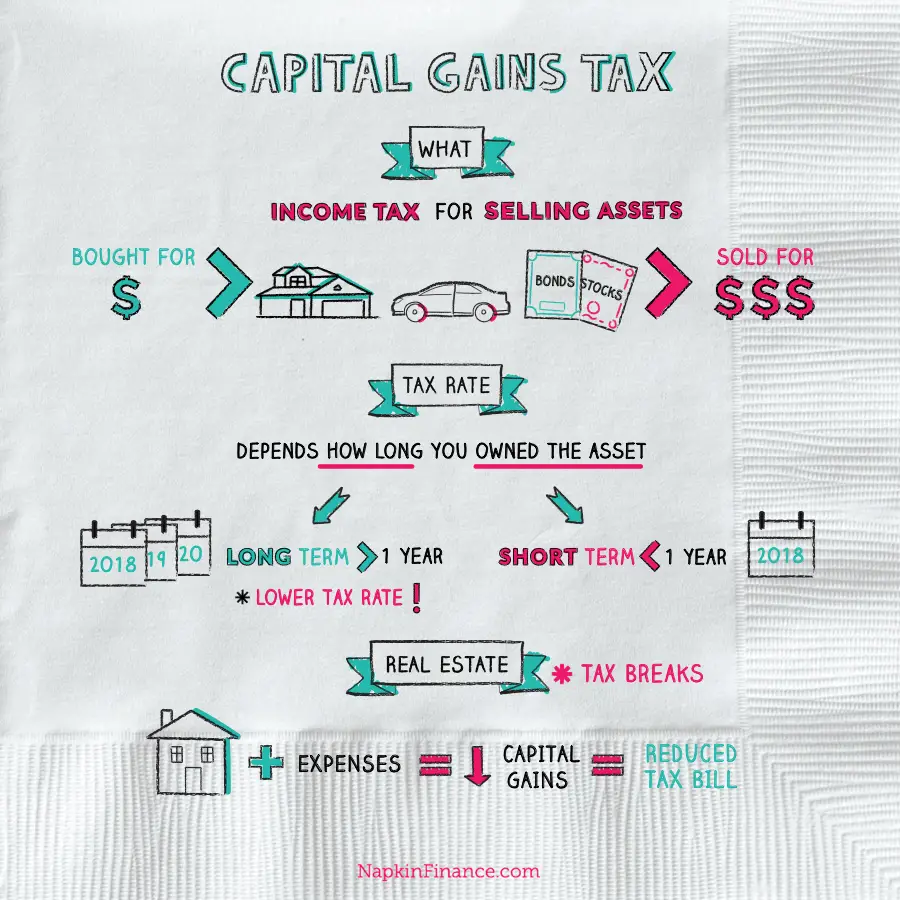

Capital gains taxes are applied to any proceeds derived from your real property investments. How much youll owe depends on how long you held the asset before selling and your income tax bracket for the tax year.

Below well take a closer look at how to calculate capital gains taxes — and how to defer them if youre facing a significant tax burden.

When You Have To Pay Capital Gains Tax

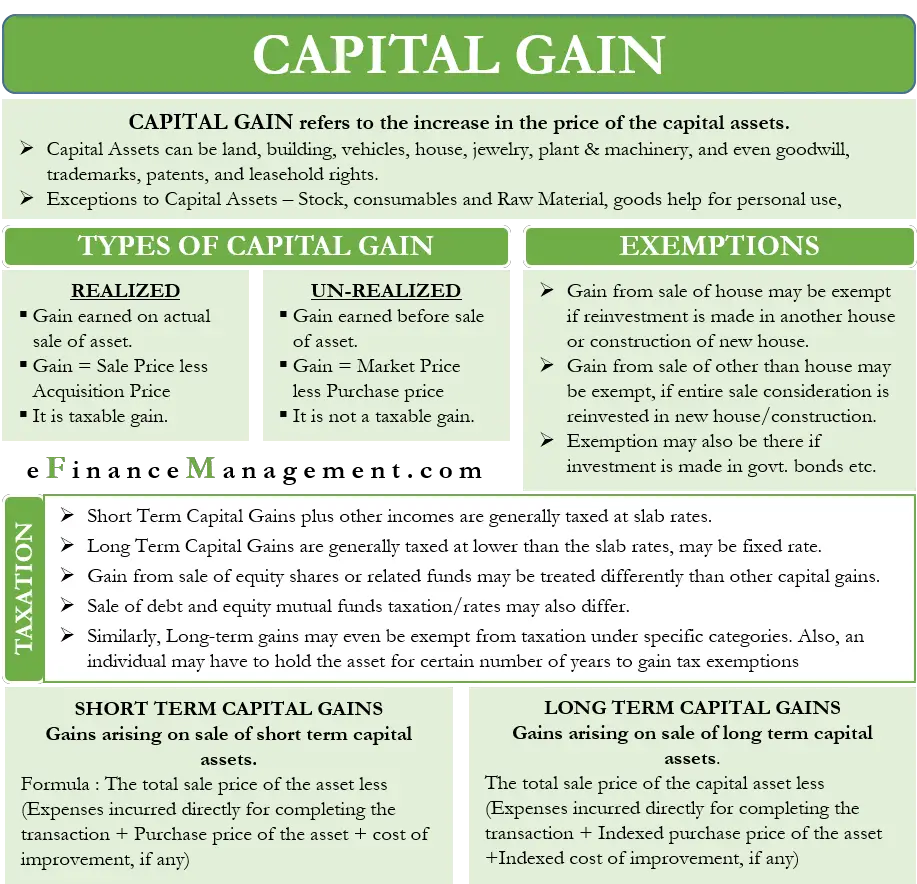

Anytime you sell a capital asset for more than you paid for it, you’ve realized a capital gain. If you sell a capital asset for less than what you paid, you’ve realized a loss and may be able to deduct it from your taxes.

Assets such as stocks that gain value but remain in your possession aren’t taxed as long as you continue to hold on to them. Once you sell the asset, you’ve realized the gain and you’ll need to report your gain or loss to the IRS and may be required to pay capital gains tax.

How To Minimize Capital Gains Tax

Now that you see how expensive capital gains taxes can be, you might be wondering if there are some ways you can minimize the taxes. Here are some suggestions to make the most of your assets and lessen taxes:

1. Hold onto the asset

Unless you need money right away from an asset sale, try to hold onto the asset for a year or longer. This will qualify you for a short-term capital gains rate and allow you to pay less overall taxes.

2. Exclude home sales

You can exclude your home if you have used it as your main residence for two years in the last five years. You also cant use another home for the same two-year period. This allows you to exclude up to $250,000 if youre single and $500,000 if you are married and filing jointly.

3. Carry losses over

If your net capital loss is more than what you can deduct in one year, the IRS allows you to carry the excess into the following year.

4. Rebalance with dividends

Instead of reinvesting in new dividends, you can rebalance the ones you have by putting the money into other underperforming investments. Many people choose to rebalance by selling securities that are doing well, and then they can put that money into other dividends that are underperforming.

This allows you to avoid selling investments that are doing well. Holding onto investments that are doing well means you have the potential to make more money in the future. It also allows you to avoid capital gains that could have come from the sale.

5. Consider a robo advisor

You May Like: Does Wyoming Have State Income Tax

Importance Of Capital Gain Tax In Us Economy

The capital gain tax rate for shares in the US raises revenue for the government, but it also discourages investment . Changes in the tax rate are accompanied by forecasts of how the change will affect both outcomes of the proposal. Increasing the tax rate would make it more difficult for people to invest in assets, but it would raise more money for the government at the same time.

The fact that the United States competes with other countries for capital is another economic effect that could cause actual receipts to differ from those predicted. Changes in the capital gains tax rate could encourage more foreign investment and boost the US economy.

How To Figure Out Your Short

Capital gains tax can apply to short-term or long-term capital gain. This section will break down the differences between short-term and long-term capital gain taxes to help you figure out how these terms apply to your assets and affect your tax rate.

Short-Term Capital Gains Taxes

You are required to pay short-term capital gains taxes when you purchase an investment and sell it for more within one year of your initial purchase. In other words, you need to pay short-term capital gains taxes whenever you sell an investment after not much time. In general, short-term capital gains tax rates can be more than the tax rates for long-term capital gains to help incentivize investors to hold onto their investments for longer periods.

Your income tax rate, which is based on your household income, determines how much you are allowed to be taxed on short-term capital gains. You will have to add your short-term capital gains to your income before determining your tax rate rather than determining your tax rate with just your income. The increased taxable income due to short-term capital gains could transition you to a higher tax bracket, which you should consider before deciding whether to sell an investment and realize your gains.

Long-Term Capital Gains Taxes

On the opposite end of the spectrum, long-term capital gains tax applies to paying taxes on profits for investments. Youve held those investments for over one year in this case.

Recommended Reading: Do Your Taxes Online Free

Capital Gains Tax Rate 2021

If you are filing your taxes as a single person, your capital gains tax rates in 2021 are as follows:

-

If your income was between $0 and $40,000: 0%

-

If your income was between $40,000 and $445,850: 15%

-

If your income was $445,850 or more: 20%

If you are filing your taxes as married, filing jointly, your capital gains tax rates are as follows:

-

If your income was between $0 and $80,800: 0%

-

If your income was between $80,801 and $501,600: 15%

-

If your income was $501,600 or more: 20%

If you are filing your taxes as the head of household, your capital gains tax rates are as follows:

-

If your income was between $0 and $54,100: 0%

-

If your income was between $54,100 and $473,750: 15%

-

If your income was $473,750 or more: 20%

Last but not least, if you are filing your taxes as married, but filing separately, then your capital gains tax rates are as follows:

-

If your income was between $0 and $40,400: 0%

-

If your income was between $40,400 and $250,800: 15%

-

If your income was $250,801 or more: 20%

Which Assets Qualify For Capital Gains Treatment

Capital gains taxes apply to what are known as capital assets. Examples of capital assets include:

- Real property used in your trade or business as rental property

Also excluded from capital gains treatment are certain self-created intangibles, such as:

- Literary, musical, or artistic compositions

- Letters, memoranda, or similar property

- A patent, invention, model, design , or secret formula

The Tax Cuts and Jobs Act, passed in December 2017, excludes patents, inventions, models, designs , and any secret formulas sold after Dec. 31, 2017, from being treated as capital assets for capital gain/capital loss tax purposes.

Also Check: What Is The Deadline For Filing Taxes In 2021

How To Reflect The Sale Of Your Home In Your Tax Return

In the Capital Gain/Loss section of the opening wizard, indicate that you disposed of an asset this will open the Capital Gain/Loss section of your tax return.

If the property you sold was your primary residence , tick the Yes block in the section which asks this question. SARS will then apply the R 2 million primary residence exclusion to the capital gain on assessment.If the property sold was not your primary residence , tick the No block in the section which asks this question. The primary residence exclusion will not be applied to this transaction when youre assessed.If the property sold was not your primary residence for the full amount of time that you owned it, you need to report the details of the property sale as two separate transactions . Do this by indicating in the opening wizard that two disposals happened. This will open up two capital gains/loss sections so that you can capture the details of each separately.

For example 3, lets look in more detail at how Paul would capture his disposal in his tax return.

He must indicate in the opening wizard that he made two disposals.

Disposal 1:

Proceeds: 5/8 x R 4 000 000 = R 2 500 000Base Cost: 5/8 x R 2 900 000 = R 1 812 500Gain: R2 500 000 R1 812 500 = R687 500

SARS will apply the R 2 million primary residence exclusion on assessment so that capital gains tax will be zero.

Disposal 2:

Proceeds: 3/8 x R 4 000 000 = R 1 500 000Base Cost: 3/8 x R 2 900 000 = R 1 087 500Gain: R 1 500 000 R 1 087 500 = R 412 500

How Much Is Capital Gains Tax In Real Estate

Calculating capital gains tax in real estate can be complex. The tax rate depends on several factors:

- how long youve owned the house

- if the house was your primary residence, a secondary residence or an investment property

Note: The tax is only assessed on the profit itself. If you purchased a house five years ago for $150,000 and sold it today for $225,000, your profit would be $75,000. You would need to report the home sale and potentially pay a capital gains tax on the $75,000 profit.

For the 2022 tax year, for example, if your taxable income is between $41,676 $459,750 as a single filer, and $83,351 $517,200 for married filing jointly, you would pay 15 percent on the $75,000 profit, or $11,250.

However, the IRS gives home sellers multiple ways to avoid or reduce their capital gains taxes, primarily if the property theyre selling is a primary residence. You can exempt a certain amount of the profit up to $250,000 or $500,000, depending on your filing status from the tax, if you meet certain conditions. Details on this below.

Read Also: How To Get Tax Info From Unemployment

Capital Gains On Futures Contracts

Many kinds of futures contracts on equities and commodities are not traditional capital assets either. Rather, these are section 1256 contracts and are marked-to-market at the end of each calendar year. For these, a 60/40 rule applies, 60% of gains are treated as long-term and 40% as short-term regardless of how long an asset is held. Do note that different rules apply for taxpayers that are filing as a professional trader.

Most individual investors don’t trade futures. However, do note that you can end up with a section 1256 tax treatment from investing in certain exchange-traded funds. An ETF that holds commodity futures such as grains or metals may end up being taxed in this way rather than being subject to usual tax rates on capital assets.

Max Out Your Ira/401k

Investors that are worried about getting crushed by taxes should consider ways to decrease their taxable income. One of the most common ways to do that is by contributing to your retirement accounts. Maxing out an IRA or 401k allows investors to keep their money safe reduce how much of their income can be taxed.

You May Like: What Home Improvements Are Tax Deductible 2020

Exceptions To Capital Gains Tax Rates

As the chart above shows, the typical maximum capital gains tax rate is 20%. However, there are several exceptions to those capital gains tax rate rules. Here are the three primary ones:

- If you sell section 1250 real property , a portion of the gain may be taxed at a maximum of 25%.

- If you sell collectibles , your capital gains tax rate is a maximum of 28%.

- If your taxable gains come from selling qualified small business stock your capital gains tax rate is a maximum of 28%.

There are many exceptions to capital gains made on owner-occupied homes.

All homeowners are eligible for a $250,000 capital gains exemption following the sale of their home, as long as that home has been used as their primary residence for at least two out of the last five years. That eligible amount doubles for married couples filing a joint tax return. This means that a couple could be exempt from up to $500,000 in capital gains from the sale of their property, as long as they lived in the home for the required period of time.

For example, letâs say an investor sells a single-family residential rental property for a $200,000 capital gain, and then purchases a new single-family residential rental property for at least $200,000. Thanks to the 1031 Like-Kind Exchange rule, they would not be required to pay capital gains taxes on that $200,000 gain from the original sale in that tax year.

Long Term Capital Gain

Taxes on long-term capital gains are less than ordinary income, but how much you pay depends on your taxable income. Depending on your annual taxable income, youll pay either 0%, 15%, or 20% on the sale of most assets or investments that have been held for more than a year.

Its important to keep in mind that the holding periodthe period of time you owned the asset before selling itshould be counted only when you sold it, not when you purchased it. For instance, if you purchased an asset on February 1, 2020, you would have reached the one-year mark of ownership on February 1, 2021.

2022 Long-Term Capital Gains Tax Rates

| Tax filing status | ||

|---|---|---|

| Taxable income of up to $41,675 | $41,675 to $459,750 | |

| Taxable income of up to $83,350 | $83,350 to $517,200 | |

| Taxable income of up to $41,675 | $41,675 to $258,600 | |

| Taxable income of up to $55,800 | $55,800 to $488,500 | Over $488,500 |

Also Check: Can I File My Taxes Without My Social Security Card

Capital Gains Tax Calculation

Total Capital GainTotal Capital GainTaxable Capital GainTaxable Capital GainCapital Gain Tax

Olivia is a student living in Ontario and her taxable income for 2019 is $30,000. She bought stocks at the beginning of 2019 using $100,000 of inheritance and sold these stocks at the end of the year for $107,020. How much does Olivia pay in capital gains tax?

Oliviaâs trading fees were $20, so her proceeds of disposition less outlays and expenses is $107,000. Oliviaâs total capital gain is $7,000. Since the inclusion rate is 50%, her taxable capital gain is $3,500. This would bring her to a taxable income of $33,500. Olivia is in the lowest income tax bracket, so she will pay 15% in federal income tax and 5.05% in provincial income tax for a total of 20.05% as her income tax rate. Therefore, her capital gain tax will be $702.

What Is The Capital Gains Tax

The capital gains tax is a federal tax levied against any profit on the sale of capital assets. It is levied separately from income tax on normal wages.

Most taxpayers are already paying federal taxes on their wages, typically through automatic withholdings from their paycheck. However, if they are also making money by trading stock, thatâs additional income and, from the government’s perspective, should be taxed accordingly.

This means that if someone buys a stock, then later sells it for a profit, theyâll be expected to pay taxes on that profit â or the difference between what they paid and what they sold that capital asset for.

The capital gains tax is designed to catch taxable events that would otherwise be excluded from typical federal income tax.

Capital assets are items that, if sold for a profit, will trigger a capital gains taxable event. Examples of these types of assets include:

- Various securities, such as shares of stocks and mutual funds

- Real estate property, such as land or a home

- Vehicles and machinery

- Trademarks and patents held

- Collectibles and art

Nearly anything that is of significant value to investors, and can be sold for more than it was bought for, is considered a capital asset.

Also Check: What Address Do I Send My Tax Return To

Capital Gains Tax Rates In 2021

You can expect these capital gains tax rates for the taxes filed in April 2022 or October 2022 if you have an extension.

-

0% Tax rate: $0 to $40,400 for singles, $0 to $80,800 for married filing jointly, $0 to $40,400 for married filing separately, $0 to $54,100 for head of household

-

15% Tax rate: $40, 401 t0 $445, 850 for singles, $80, 801 to $501,600 for married filing jointly, $40,401 to $250,800 for married filing separately, and $0 t0 $54,100 for head of household.

-

20% tax rate: $445,851 or more for singles, $501,601 or more for married filing jointly, $250,801 or more for married filing separately, and $473,751 or more for head of household.

Capital Gains Tax Rates In 2022

These are the capital gain taxes you can expect to pay in April 2023:

-

0% tax rate: $0 to $41,675 for singles, $0 to $83,350 for married filing jointly, $0 to $41,675 for married filing separately, $0 to $55,800 for head of household.

-

15% tax rate: $41,676 to $459,750 for singles, $83,351 to $517,200 for married filing jointly, $41, 676 to $258,600 for married filing jointly, and $55,801 to $488,500 for head of household

-

20% tax rate: $459,751 or more for singles, $517,201 or more for married filing jointly, $258,601 for married filing separately, and $488,501 or more for head of household.

Read Also: How To File Taxes With An Itin Number

What Is A Principal Residence

Your principal residence is where you and your family normally live in Canada during the year. You must own or jointly own the home. However, in some cases, a vacation property that you own and only you and close relatives use may be considered as your principal residence as long as you donât earn any rental income from it. You donât even have to live in the residence for the whole year. However, you can only claim one home as a principal residence in any calendar year for your family unit .

Your principal residence can be any number of different property types according to the Canada Revenue Agency. It can be a house, a duplex, a condo, a cottage, a cabin, a mobile home, a trailer or a houseboat. You can generally only have half a hectare of land on which your residence sits. However, there are exceptions to this. For instance, if the municipality you bought your property in has a minimum lot size that is already greater than half a hectare, then you may prove the increased lot size is solely for enjoyment purposes.