Federal Top Income Tax Rate

| Year | |

|---|---|

| 2011 | 35.00% |

When it comes to tax withholdings, employees face a trade-off between bigger paychecks and a smaller tax bill. It’s important to note that while past versions of the W-4 allowed you to claim allowances, the current version doesn’t. Additionally, it removes the option to claim personal and/or dependency exemptions. Instead, filers are required to enter annual dollar amounts for things such as total annual taxable wages, non-wage income and itemized and other deductions. The new version also includes a five-step process for indicating additional income, entering dollar amounts, claiming dependents and entering personal information.

One way to manage your tax bill is by adjusting your withholdings. The downside to maximizing each paycheck is that you might end up with a bigger tax bill if, come April, you haven’t had enough withheld to cover your tax liability for the year. That would mean that instead of getting a tax refund, you would owe money.

If the idea of a big one-off bill from the IRS scares you, then you can err on the side of caution and adjust your withholding. Each of your paychecks may be smaller, but youre more likely to get a tax refund and less likely to have tax liability when you fill out your tax return.

Six: Calculate Social Security And Medicare Deductions

You must withhold FICA taxes from employee paychecks.

Be sure you are using the correct amount of gross pay for this calculation. This article on Social Security wages explains what wages to take out for this calculation.

The calculation for FICA withholding is simple.

| FICA Taxes – Who Pays What? | |

|---|---|

| FICA Taxes | Employee Pays |

| 0.9% on gross pay over $200,000 | 0% |

Withhold half of the total from the employee’s paycheck.

For the employee above, with $1,500 in weekly pay, the calculation is $1,500 x 7.65% for a total of $114.75.

Be careful not to deduct too much Social Security tax from high-income employees, since Social Security is capped each year, with the maximum amount being set by the Social Security Administration.

You will also need to consider the additional Medicare tax deduction due by higher-income employees, which begins when the employee reaches a $200,000 in earnings for the year. The additional tax is 0.9% of the gross pay based on the employee’s W-4 status. No additional tax is due from the employer.

Most states impose income taxes on employee salaries and wages. You will have to do some research to determine the amounts of these deductions and how to send them to the appropriate state/local taxing authority.

Your responsibilities as an employer for deducting, paying, and reporting these taxes are discussed in this article.

Calculating Your Social Security Income Taxes

After provisional income, the second major factor in calculating taxable Social Security income is filing status.

If you are single or married filing separately, regardless of whether you lived with your spouse:

Halve your Social Security income.

Add it to your total other income.

If your total combined income for the year after the above calculation is $25,000 to $34,000, you may owe taxes on up to 50% of your Social Security income.

If your combined total income is above $34,000, up to 85% of your Social Security income may be taxable.

If you are married filing jointly:

Take half of your Social Security income.

Take half of your spouses Social Security income.

Add both of the above figures to your combined total income.

If you and your spouses total combined income after the above calculation is between $32,000 and $44,000, you may owe taxes on up to 50% of your Social Security income.

If the total annual income is above $44,000, up to 85% of your Social Security income may be taxable.

You can also use the IRS worksheet from Publication 915 to calculate how much of your Social Security benefit is taxable. This worksheet is also in the instructions on Form 1040 and 1040-SR.

You May Like: How Does Doordash Do Taxes

Social Security Benefit Taxes By State

Aside from federal tax rates, the way Social Security is taxed also varies by state. Only 13 states tax Social Security benefits: Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont and West Virginia. The chart below shows how different states handle Social Security taxes.

|

Taxation |

|---|

|

AK, FL, NV, SD, TX, WA, WY |

Reduce Your Taxes With Credits And Deductions

You may be able to reduce the amount of tax your business pays by taking advantage of targeted tax breaks, including both tax credits and deductions.

For tax deductions, you can choose to either itemize your deductions or take one standard deduction .

If you donât have many deductions to claim, youâll probably want to claim the standard deduction.

If youâve got lots of deductions, youâll probably want to itemize. To claim every deduction you possibly can, check out The Big List of Small Business Tax Deductions.

To see what tax credits you might qualify for, check out The Big List of U.S. Small Business Tax Credits.

You May Like: How To File Taxes Working For Doordash

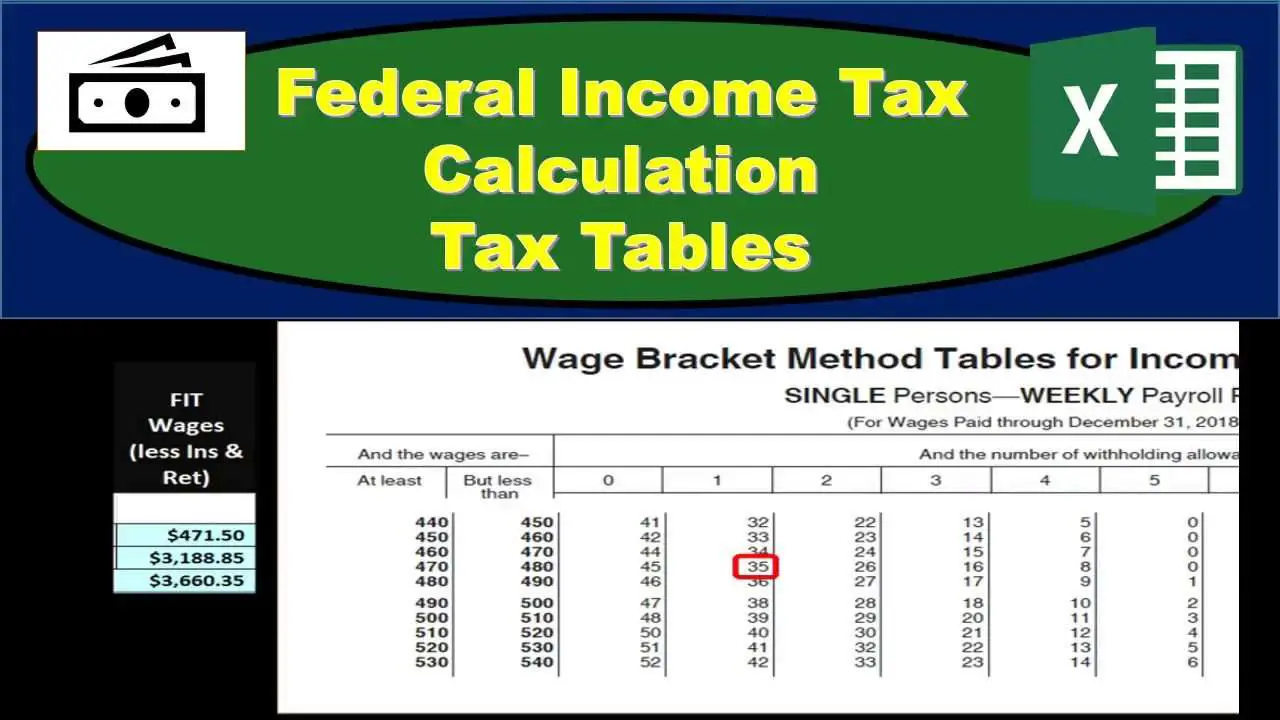

How Much You Owe

After you figure out your taxable income, you can determine how much you owe by using the tax tables included in the Form 1040 Instructions. Though these tables look complicated at first glance, theyre actually quite straightforward. You simply look up your income, find the column with your filing status , and the intersection of those two figures is your tax.

For simplicitys sake, the tax tables list income in $50 chunks. The tables only go up to $99,999, so if your income is $100,000 or higher, you must use a separate worksheet to calculate your tax.

To illustrate, lets say your taxable income is $41,049. Using the tables, youd go to the 41,000 section and find the row applicable to incomes between $41,000 and $41,050. Then, you can easily find the tax you owe:

- $4,816 for single filers

- $4,528 for married couples filing jointly

- $4,816 for married couples filing separately

- $4,641 for heads of household

Australian Income Tax Calculator

Employment income: Employment income frequency

Enter an income to view the result

The estimated tax on your taxable income is0

| Your income after tax & Medicare levy: |

|---|

| Your marginal tax rate: |

This means for an annual income of you pay:

| No tax on income between $1 – $18,200 | $0 |

| 19c for every dollar between $18,201 – | 0 |

| 32.5c for every dollar between – | 0 |

| 37c for every dollar between – $180,000 | 0 |

| c for every dollar over $180,000 | 0 |

- The rates are for Australian residents.

- Your marginal tax rate does not include the Medicare levy, which is calculated separately.

- The Medicare levy is calculated as 2% of taxable income for most taxpayers. The Medicare levy in this calculator is based on individual rates and does not take into account family income or dependent children.

- The calculations do not include the Medicare Levy Surcharge , an additional levy on individuals and families with higher incomes who do not have private health insurance.

- These calculations do not take into account any tax rebates or tax offsets you may be entitled to.

- For the 2016-17 financial year, the marginal tax rate for incomes over $180,000 includes the Temporary Budget Repair Levy of 2%.

- In most cases, your employer will deduct the income tax from your wages and pay it to the ATO.

- 2020-2021 pre-budget reflects the tax rates prior to those announced in the Budget in October 2020.

Recommended Reading: Payable Com Doordash

Adjusted Gross Pay For Social Security Wages

When you determine the gross wages, you need now to calculate adjusted gross income from pay stub. You may need to pay closer attention to these calculations. Before calculating the income tax and FICA withholding, there are some payments to employees you must remove. Notably, the type of payments excluded in Social Security wages may differ from those removed from the federal income tax.

You can check IRS Publication 15 pages 3842 to see the complete list of payments to employees. Youll also be able to tell which ones are included in the Social Security wages and which ones are subject to income tax withholding by the federal government.

What Are Withholding Allowances

Withholding allowances were exemptions that employees used to use to claim from federal income tax, using Form W-4. Withholding allowances were used to determine an employees withholding tax amount on their paychecks. The more allowances an employee choose to claim, the less federal tax their employer deducted from their pay.

Withholding allowances are no longer used on the 2020 W-4 form.

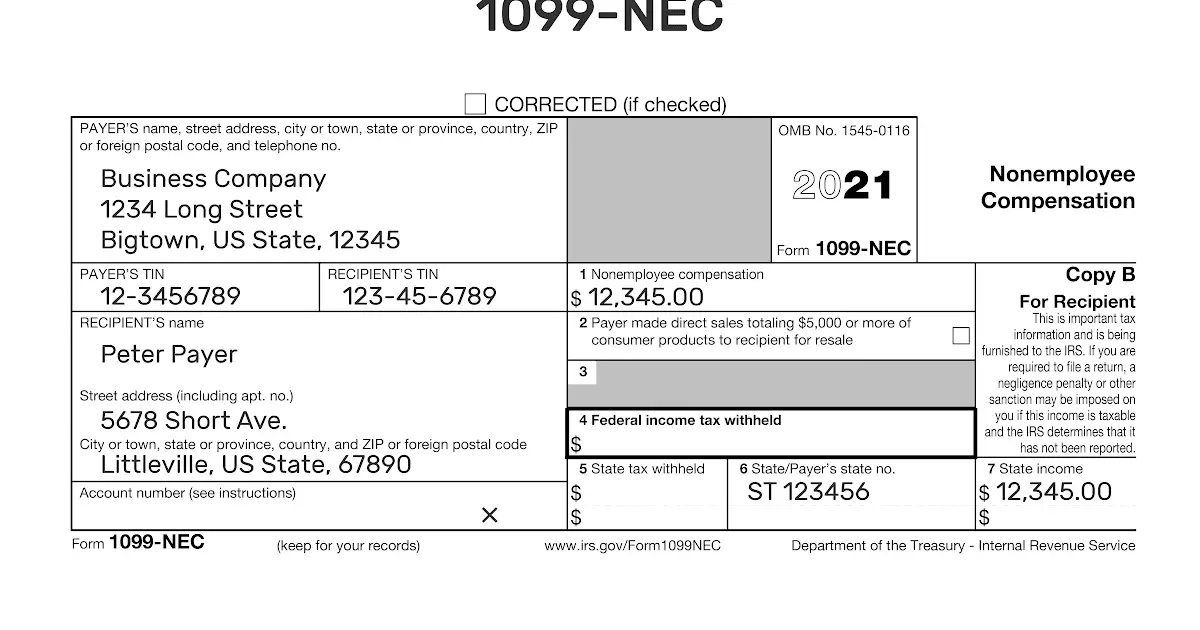

You May Like: Does Doordash Give You A 1099

How To Figure Out Your Tax Rate If Youre Not A C Corp

If your business is not a C corporation, that means itâs a flow-through entity, meaning youâll pay the taxes yourself, instead of the business paying them.

Your tax rate will depend on the amount of the businessâ taxable income and your tax filing status.

If youâre single and:

| Your total taxable income is: | Your taxes are: |

|---|

| $164,709.50 plus 37% of any income you made above $612,350 |

State And Local Income Taxes

Many states, as well as some cities and counties, have their own income taxes. These are collected in addition to the federal income tax. States that have a state income tax require that you file a separate state tax return, as they have their own rules. If you’re curious about a particular states tax system and rules, visit one of our state tax pages.

Read Also: Tax Id Reverse Lookup

An Example Makes This Clearer

Letâs look at an example to see how a hypothetical flow-through entity would determine the amount of federal income tax it owes based on these tax tables. Suppose Wallyâs Widgets ends up with taxable income of $300,000 in 2018, and that Wally files a joint tax return with his wife, Wendy.

Wallyâs tax owed would be:

$28,765 + 24% of the amount over $168,400 .

The calculation: $28,765 + $31,584 = $60,349 total tax due for our friend Wally.

State Income Tax Withholding

If you live in a state with a state income tax requirement, the employer will withhold the same from your paycheck. Again, Form W-4 will determine the amount. If you owe income tax to more than one state, you must request your employer to withhold taxes for the other states as well. Alternatively, you can also ask the employer to withhold more taxes or make estimated payments to cover the difference.

These are the likely state tax scenarios you can face depending on where you live:

-

No state withholding at all

-

Several state withholdings for your home state and other states where you work

Don’t Miss: Buying Tax Liens In California

Introduction To Income Tax In Excel

A user can calculate n number of things in MS Excel in a few steps one of them is the calculation of the Income Tax. There are two ways of income tax deduction from the incomes if a user is working in some company, they will deduct all income-related taxes from the users salary where the user needs to declare the income tax himself.

Excel functions, formula, charts, formatting creating excel dashboard & others

How To Calculate Tax Liability From Taxable Income

Your taxable income minus your tax deductions equals your gross tax liability. Gross tax liability minus any tax credits youâre eligible for equals your total income tax liability.

But before you can start crunching numbers, you need to understand your entity type. That will affect how you calculate your taxes.

Recommended Reading: Does Doordash Tax You

Identify All Your Taxable Income

Taxable income, particularly for businesses and corporations, is often complex and layered. Most companies have options regarding how they track and categorize their taxable income, particularly in regards to depreciation on their profits. It’s advisable to consult a professional tax expert, like a CPA or tax attorney, to help identify all taxable income expenses for your organization.

How To Figure Out Your Tax Rate If Youre A C Corp

The Tax Cuts and Jobs Act greatly simplified tax calculations for C corporations by replacing the graduated corporate tax rate schedule that included eight different tax rate brackets with a flat 21% tax rate.

In other words, if you own a C corporation, no matter how much taxable income your business has, your income tax rate will be 21%.

Read Also: How To File Taxes As A Doordash Driver

Bottom Line On Tax Returns

An accurate income tax return estimator can keep you from banking on a refund thats bigger in your mind than the real refund that hits your bank account. It can also give you a heads-up if youre likely to owe money. Unless youre a tax accountant or someone who follows tax law changes closely, its easy to be surprised by changes in your refund from year to year. Use the tool ahead of time so you arent already spending money you may never see. You can also run the numbers through a tax refund calculator earlier in the year to see if you want or need to make any changes to the tax withholdings from your paycheck.

How Effective Tax Rate Is Calculated From Income Statements

The effective tax rate is the percentage of income paid in taxes by a corporation or individual. It relates to the companys overall tax rate rather than its .

Effective tax rate typically applies to federal income taxes and doesnt take into account state and local income taxes, sales taxes, property taxes, or other types of taxes that an individual might pay. The effective tax rate calculation is a useful metric for benchmarking the effective tax rates of two or more entities.

Read Also: Do You Have To Pay Taxes On Plasma Donations

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

The Federal Income Tax

The federal personal income tax that is administered by the Internal Revenue Service is the largest source of revenue for the U.S. federal government. Nearly all working Americans are required to file a tax return with the IRS each year. In addition to this, most people pay taxes throughout the year in the form of payroll taxes that are withheld from their paychecks.

Income taxes in the U.S. are calculated based on tax rates that range from 10% to 37%. Taxpayers can lower their tax burden and the amount of taxes they owe by claiming deductions and credits.

A financial advisor can help you understand how taxes fit into your overall financial goals. Financial advisors can also help with investing and financial plans, including retirement, homeownership, insurance and more, to make sure you are preparing for the future.

You May Like: Do You Get A 1099 From Doordash

Is Any Part Of My Business’s Income Tax Deductible

Tax deductions vary from the federal to the state level and from individual state to individual state. Federal income taxes are non-deductible. However, some states do allow specific income tax deductions. There are a variety of factors that impact whether or not you can deduct some or all of your taxable income on your state tax return, so it’s best to consult with a tax professional on what your options are.

Local Income Tax Withholding

Cities and local communities may also have an income tax, and your employer will withhold these taxes as well. The rules and rates vary from one local community to another. Knowing if your paycheck includes withheld local taxes is crucial to avoid unpleasant surprises when the time for filing your taxes come.

Local income tax is taxed per jurisdiction. If you work or live in a city or community that levies the tax, then your wages will be taxed.

Recommended Reading: Where Can I Amend My Taxes For Free

Total Estimated 2021 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

How To Calculate Taxes Taken Out Of A Paycheck

Calculations, however, are just one piece of the larger paycheck picture.

Recommended Reading: Www.1040paytax.com