The Type Of Taxable Income Matters

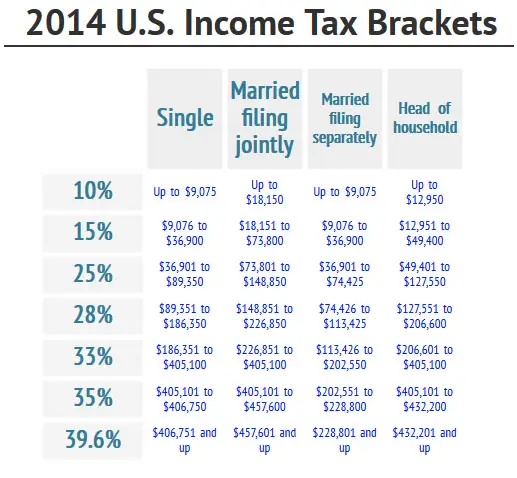

Tax brackets rely on using your taxable income to determine your federal income tax bill. However, not all income is treated the same for tax purposes. Income you earn from your job gets taxed through the tax brackets used on ordinary income. Long-term capital gains, on the other hand, are taxed at a rate between 0% and 20%, depending on your income level. Regardless of what type of income you make or the marginal tax bracket youre in, your goal should be to get your effective tax rate as low as possible. Past tax brackets:

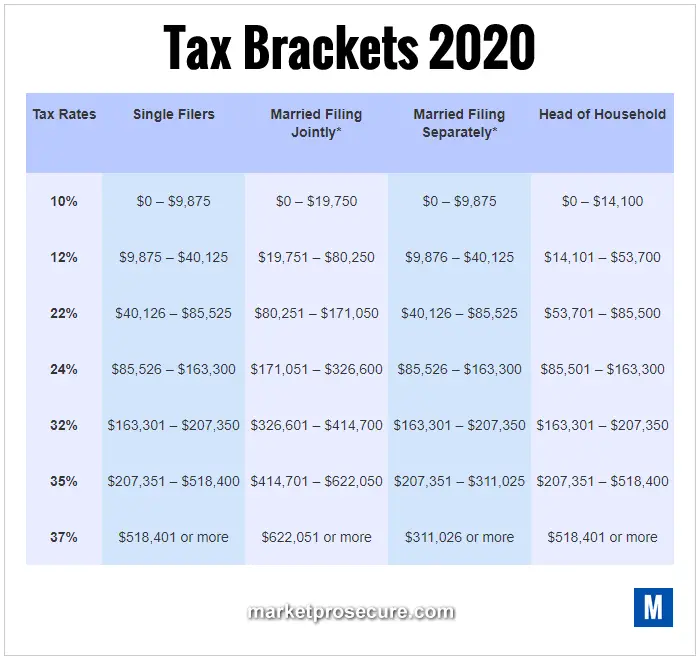

2020 Tax Brackets

| $311,026 or more | $518,401 or more |

Knowing your tax bracket and your effective tax rate can be the first steps to lowering your taxable income and lowering your tax.

If you need help determining your tax bracket, visit TurboTaxs Tax Bracket Calculator. Simply provide your filing status and taxable income to estimate your tax bracket.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

History Of Federal Tax Brackets

Tax brackets have existed in the U.S. tax code since the inception of the very first income tax, when the Union government passed the Revenue Act of 1861 to help fund its war against the Confederacy. A second revenue act in 1862 established the first two tax brackets: 3% for annual incomes from $600 to $10,000, and 5% on incomes above $10,000. The original four filing statuses were single, married filing jointly, married filing separately, and head of household, though rates were the same regardless of tax status.

In 1872, Congress rescinded the income tax. It didnt reappear until the 16th Amendment to the U.S. Constitutionwhich established Congress right to levy a federal income taxwas ratified in 1913. That same year, Congress enacted a 1% income tax for individuals earning more than $3,000 a year and couples earning more than $4,000, with a graduated surtax of 1% to 7% on incomes from $20,000 and up.

Over the years, the number of tax brackets has fluctuated. When the federal income tax began in 1913, there were seven tax brackets. In 1918, the number mushroomed to 56 brackets, ranging from 6% to 77%. In 1944, the top rate hit 91%. But it was brought back down to 70% in 1964 by then-President Lyndon B. Johnson. In 1981, then-President Ronald Reagan initially brought the top rate down to 50%.

Federal Income Tax Brackets And Rates

In 2023, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows . There are seven federal income tax rates in 2023: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. The top income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $693,750 for married couples filing jointly.

| Tax Rate |

|---|

You May Like: How To Claim Inheritance Money On Taxes

How To Get Into A Lower Tax Bracket And Pay A Lower Federal Income Tax Rate

Your marginal tax rate is the tax rate you would pay on one more dollar of taxable income. This typically equates to your tax bracket.For example, if you’re a single filer with $30,000 of taxable income, you would be in the 12% tax bracket. If your taxable income went up by $1, you would pay 12% on that extra dollar too.If you had $41,000 of taxable income, however, most of it would still fall within the 12% bracket, but the last few hundred dollars would land in the 22% tax bracket. Your marginal tax rate would be 22%.

Explained: Tax Calculator Components

1. Assessment Year: This means a period of 12 months immediately succeeding the year of which income is being taxed/ assessed.

2. Salary:

a. HRA: House Rent Allowance is an allowance provided by an employer to an employee to cover the house rent expenditure. HRA is exempt subject to conditions and limits specified in the tax laws.

b. Leave Travel Assistance: LTA is an allowance provided by an employer to an employee for expenses incurred on travel within the country but does not include expenses incurred on boarding lodging etc. Exemption is available twice in a block of 4 calendar years. The quantum of expenditure allowed is subject to conditions specified under tax laws.

c. National Pension System: NPS is a defined contribution based pension scheme regulated by Pension Fund Regulatory and Development Authority . The NPS Corporate model allows employers and employees to contribute a certain portion of employees salary to NPS. The employer contribution is added to the salary income of the employee. However, the employee is eligible to claim deduction of the employer contribution under section 80CCD to an extent of 10% of the salary. The employee is eligible to claim his contribution as deduction under section 80C and is also eligible to an additional deduction under section 80CCD amounting to Rs 50,000/-. However, the additional deduction can only be availed if the overall limit of Rs 1,50,000/- specified under section 80CCE is exhausted.

3. House Property

You May Like: How To Avoid Taxes On Rmd

How To Determine Your Tax Bracket

As mentioned above, determining your tax bracket hinges on two things: filing status and taxable income. Here are some useful details:

The IRS recognizes five different filing statuses:

- Single Filing Unmarried, legally separated and divorced individuals all qualify all single.

- A married couple agrees to combine income and deduct the allowable expenses.

- A married couple files separate tax returns to keep an individual income lower. This is beneficial in certain situations like repaying student loans under an income-driven repayment plan.

- Head of Household Unmarried individuals who paid more than half the cost of keeping up a home for the year and have a qualifying person living with them in their home for more than half the year.

- Qualifying Widow A widow can file jointly in the year of their spouses death. A qualifying widow has a dependent child and can use the joint tax rates and the highest deduction amount for the next two years after their spouses death.

How Federal Tax Brackets Work

Tax brackets are not as intuitive as they seem because most taxpayers have to look at more than one bracket to know their effective tax rate.

Instead of looking at what tax bracket you fall in based on your income, determine how many individual tax brackets you overlap based on your gross income.

Figuring that out is easier in practice:

- Example one: Say youre a single individual who earned $40,000 of taxable income in the 2021 tax year. Technically, youd be aligned in the 12% tax bracket, but your income wouldnt be levied a 12% rate across the board. Instead, you would follow the tax bracket up on the scale, paying 10% on the first $9,950 of your income and then 12% on the next chunk of your income between $9,951 and $40,525. Because you dont make above $40,525, none of your income would be hit at the 22% rate.

That often amounts into Americans being charged a rate thats smaller than their individual federal income tax bracket, known as their effective tax rate.

- Example two: Say youre a single individual in 2021 who earned $70,000 of taxable income. You would pay 10% on the first $9,950 of your earnings then 12% on the chunk of earnings from $9,951 to $40,525 , then 22% on the remaining income

- Your total tax bill would be $11,148.50. Divide that by your earnings of $70,000 and you get an effective tax rate of roughly 16%, which is lower than the 22% bracket youre in.

Recommended Reading: Does Doordash Tax You

Read Also: How Much Percent Does Tax Take Out

Tax Rates Vs Tax Brackets

Tax brackets and tax rates are both used to calculate the total taxes owed. However, while they appear to be similar, they are, in fact, distinctly different from each other.

A tax rate is a percentage at which income is taxed, while each tax bracket is a range of income with a different tax rate, such as 10%, 12%, or 22%, referred to as the marginal rate. Most taxpayersall except those who fall squarely into the minimum brackethave income that is taxed progressively, meaning that their income is subject to multiple rates beyond the nominal rate of their tax bracket.

A taxpayers tax bracket does not necessarily reflect the percentage of their income that they will pay in taxes. The term for this is the effective tax rate.

Tax brackets are adjusted each year for inflation, using the Consumer Price Index .

What Is A Federal Allowance

A federal withholding allowance refers to information that is on the W-4 form for tax years before 2020. You generally fill out a W-4 when you start a new job or experience a life change, like having a child. Your W-4 helps your employer understand how much tax to withhold from your paycheck. Before 2020, the number of personal allowances you took helped determine the amount your employer withheld the more allowances you claimed, the less tax your employer would withhold. But the IRS changed the W-4 starting with the 2020 tax year. The new form eliminates personal allowances.Learn more about the new W-4.

You May Like: How To Get Stimulus Check 2021 Without Filing Taxes

Don’t Miss: Can I File My Business And Personal Taxes Separately

Earned Vs Unearned Income

Why the difference between the regular income tax and the tax on long-term capital gains at the federal level? It comes down to the difference between earned and unearned income. In the eyes of the IRS, these two forms of income are different and deserve different tax treatment.

Earned income is what you make from your job. Whether you own your own business or work part-time at the coffee shop down the street, the money you make is earned income.

Unearned income comes from interest, dividends and capital gains. Its money that you make from other money. Even if youre actively day trading on your laptop, the income you make from your investments is considered passive. So in this case, unearned doesnt mean you dont deserve that money. It simply denotes that you earned it in a different way than through a typical salary.

The question of how to tax unearned income has become a political issue. Some say it should be taxed at a rate higher than the earned income tax rate, because it is money that people make without working, not from the sweat of their brow. Others think the rate should be even lower than it is, so as to encourage the investment that helps drive the economy.

Recommended Reading: What Can I Write Off On My Taxes For Instacart

Contribution Exceptionnelle Sur Les Hauts Revenus

In addition to the basic rates of income tax those fortunate few with a taxable income of upwards of 250,000 pa are liable for a special tax called contribution exceptionnelle sur les hauts revenus.

This tax is at the rate of 3% on income up to 500,000, and at the rate of 4% on income above 500,000.

The tax is imposed on net income, after determination of the tax liability under the standard scale rates.

You May Like: How Do I Find My Business Tax Id Number

What Are The Federal Tax Brackets For 2022

The top tax rate is 37% for individual single taxpayers with incomes greater than $539,900 . The other rates are:

- 35%, for incomes over $215,950

- 32% for incomes over $170,050

- 24% for incomes over $89,075

- 22% for incomes over $41,775

- 12% for incomes over $10,275

The lowest rate for the 2022 tax year is 10% for single individuals with incomes of $10,275 or less .

Irs Tax Bracket Rate For Single Head Of Household Married Couples Filing Jointly

Lets look at some of the main tax brackets for each major filing group. Youll get a rough idea of which tax bracket youre likely to fall into. Take note that your tax bracket is defined by your adjusted gross income, rather than your salary on its own.

With recent changes under the Tax Cuts and Jobs Act , five of the seven tax brackets have changed.

If you are a single taxpayer, the IRS tax brackets for the upcoming tax filing season are as follows:

- $9,525 or under means youll be taxed at 12%.

- Up to $38,700, and youll be taxed at a rate of $952.50, in addition to a 12% tax rate of your income that falls solely in this threshold.

- Up to $82,500, and youll see a tax rate of 22%. This is $4,453 on top of this.

- Up to $157,500 is a rate of 24%. But thats $14,089.50, on top of that.

- Anything up to $200,000 is a rate of 32%, plus $32,089.50.

Top rate taxpayers who go over $200,000 will enter the final two brackets, which are 35% and 37%, respectively. If you earn more than $500,000, expect to pay a tremendous amount in addition. For these taxpayers, we recommend they seek specialized advice.

For married couples filing jointly, the tax brackets are the same, but the amounts differ. can earn around double that of a single taxpayer and continue to remain in the same tax bracket.

For example, the lowest tax bracket has a range of between $0 and $19,050, which is more than double what a single taxpayer is entitled to.

But what about a head of household?

Don’t Miss: When Do Taxes Need To Be Filed 2021

Understanding Marginal Tax Rate

Historically, taxpayers are subdivided into seven tax brackets and spread across four households. The marginal tax rate system increases as an individuals income moves higher in the tax bracket scale. It means that a lower taxable dollar earning will be charged at a lower marginal tax rate.

As the taxable income increases to the next tax bracket, it is charged at a higher rate. The rate increases progressively until the last dollars highest marginal tax rate.

Taxable Income Practical Example

Lets say Johns total income per annum is $75,000. However, he places a claim for individual deductions like retirement contributions, Health Saving Accounts , and student loan interest.

His taxable income will be the income after the refundable deductions. If the total deductions amounted to $12,000, his taxable income will be $63,000 .

How To Calculate Federal Tax Credits

Unlike adjustments and deductions, which apply to your income, tax credits apply to your tax liability, which means the amount of tax that you owe.

For example, if you calculate that you have tax liability of $1,000 based on your taxable income and your tax bracket, and you are eligible for a tax credit of $200, that would reduce your liability to $800. In other words, you would only owe $800 to the federal government.

Tax credits are only awarded in certain circumstances, however. Some credits are refundable, which means you can receive payment for them even if you dont owe any income tax. By contrast, nonrefundable tax credits can reduce your liability no lower than zero. The list below describes the most common federal income tax credits.

- The Earned Income Tax Credit is a refundable credit for taxpayers with income below a certain level. The 2021 credit can be up to $6,728 for taxpayers with three or more children, or lower amounts for taxpayers with two, one or no children.

- The Child and Dependent Care Credit is a nonrefundable credit of up to $4,000 or $8,000 related to childcare expenses incurred while working or looking for work.

- The Adoption Credit is a nonrefundable credit equal to certain expenses related to the adoption of a child.

- The American Opportunity Tax Credit is a partially refundable credit of up to $2,500 per year for enrollment fees, tuition, course materials and other qualified expenses for your first four years of post-secondary education.

Recommended Reading: Is Summer Camp Tax Deductible

Progressive Vs Flat Tax Rates

You might have heard common arguments about progressive tax rates versus flat tax rates. Some states use a flat tax for state income taxes, so its good to understand the difference

With a flat tax, everyone pays the same tax rate regardless of their income. If you live on an income below $30,000 per year, you would pay the same percentage of your income in taxes as someone who makes $300,000 per year . If the flat tax rate is 5%, for example, 5% of your income would go to taxes at all income levels.

Under a progressive tax system, which we use for Federal taxes, those with a higher income pay a higher percentage of their income. This system taxes new income at a higher rate but doesnt go back and raise your tax rate on income earned earlier in the year.

Tax Brackets And Tax Rates

Single

| If taxable income is over: | but not over: |

| 10% of the amount over $0 | |

| $9,875 | $988 plus 12% of the amount over $9,875 |

| $40,125 | $4,618 plus 22% of the amount over $40,125 |

| $85,525 | $14,606 plus 24% of the amount over $85,525 |

| $163,300 | $33,272 plus 32% of the amount over $163,300 |

| $207,350 | $47,368 plus 35% of the amount over $207,350 |

| $518,400 | $156,235 plus 37% of the amount over $518,400 |

| If taxable income is over: | but not over: |

| 10% of the amount over $0 | |

| $19,750 | $1,975 plus 12% of the amount over $19,750 |

| $80,250 | $9,235 plus 22% of the amount over $80,250 |

| $171,050 | $29,211 plus 24% of the amount over $171,050 |

| $326,600 | $66,543 plus 32% of the amount over $326,600 |

| $414,700 | $94,735 plus 35% of the amount over $414,700 |

| $622,050 | $167,308 plus 37 % of the amount over $622,050 |

| If taxable income is over: | but not over: |

| 10% of the amount over $0 | |

| $9,875 | $988 plus 12% of the amount over $9,875 |

| $40,125 | $4,618 plus 22% of the amount over $40,126 |

| $85,525 | $14,605 plus 24% of the amount over $85,525 |

| $163,300 | $33,271 plus 32% of the amount over $163,300 |

| $207,350 | $47,367 plus 35% of the amount over $207,350 |

| $311,025 | $83,654 plus 37% of the amount over $311,025 |

Head of Household

You May Like: When Can I File My Taxes