What To Do With The 1099

A 1099-NEC form is used to report amounts paid to non-employees . Non-employees receive a form each year at the same time as employees receive W-2 formsthat is, at the end of Januaryso the information can be included in the recipient’s income tax return.

Payers are required to give a 1099-NEC form to non-employees only when the total income during the year was $600 or more. If you had income under $600 from that payer, you won’t receive a 1099-NEC form, but you still must include the income amount on your tax return.

If you are doing your own tax return using a tax software program, you will be asked if you have any 1099 income. At this point, you can include the information from the form you received.

If you are having a tax preparer do your personal return, give the form to your preparer along with your other documents.

How To File 1099 Taxes

Filing your taxes at the end of the year starts with preparing your taxes throughout the year. When you are self-employed, you can expect to file a 1040 tax for quarterly.

I know, another tax form. It sounds complicated, but it really isnt. A 1040 tax for is just simply an estimate for how much you think you will make a year based on what you made quarterly. You pay your quarterly amount based on that.

There are due dates for these payments, and you can be penalized if you dont pay them in time. Due dates are as followed:

- 1st Quarter Due April 15th

- 2nd Quarter Due June 15th

- 3rd Quarter Due September 15th

- 4th Quarter Due January 15th

Tax Season 202: What To Expect If You Made Money Via Paypal Cash App Or Venmo This Year

Expect a 1099-K for any earnings over $600 that came through digital payment apps.

Courtney Johnston

Editor

Courtney Johnston is an editor for CNET Money, where she manages the team’s editorial calendar, and focuses on taxes, student debt and loans. Passionate about financial literacy and inclusion, she has prior experience as a freelance journalist covering investing, policy and real estate. A New Jersey native, she currently resides in Indianapolis, but continues to pine for East Coast pizza and bagels.

If you started a side hustle, freelanced or worked as a contractor in 2022, and received payments through digital apps like PayPal, Cash App, Zelle or Venmo, the IRS will know about it.

While self-employed individuals are always required to report their earnings when filing their tax returns, this new regulation requires digital payment apps to report earnings over $600 to the IRS via tax form 1099-K. Individuals will then receive a copy of their 1099-K in late January or February.

How does this new rule impact your taxes? We’ll walk you through what’s changed and debunk a few myths along the way.

Recommended Reading: How Much Is Sales Tax In Louisiana

Filing Requirements For Issuers Of Forms 1099

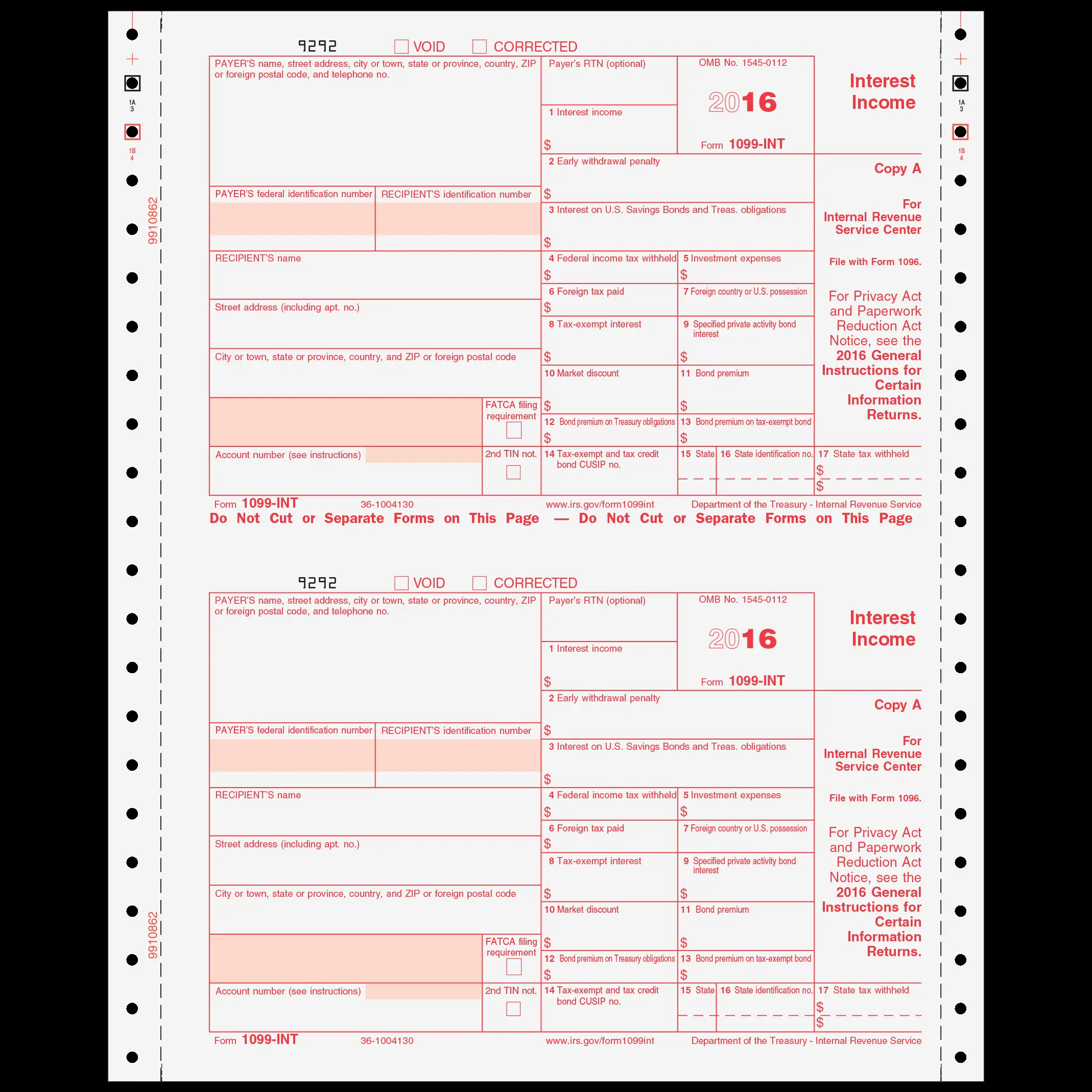

You must file an annual report of interest, dividends, and other income taxable under Chapter 62 of the Massachusetts General Laws if you issued any of the following:

- Form 1099-INT or Form 1099-DIV

- Form 1099-MISC or Form 1099-NEC

- Any other forms in the 1099 series.

Note: the forms listed above are federal IRS forms, and are not administered by the MA DOR. Visit the IRS for a complete list of 1099 forms and instructions.

Annual reports must be filed directly with DOR even if the transmitter participates in the IRS Combined Federal/State Filing Program . For filing instructions, see the Submitting your annual report section on this page.

Generally, Form 1099 Reports for Massachusetts follow the federal guidelines in IRS Publication 1220. Modifications to the Form 1099 specifications in IRS Publication 1220 are required for Massachusetts municipal bond interest as explained below.

Note: DOR and the IRS have different filing requirements for Form 1099-K.

- Effective for the 2022 calendar year, the IRS filing requirement for Form 1099-K will be changed from gross payments exceeding $20,000 and more than 200 transactions to gross payments exceeding $600 regardless of the number of transactions.

- The Massachusetts filing requirement for Form 1099-K remains at gross payments of $600 or more, regardless of the number of transactions.

How Bench Can Help

Whether you receive a 1099-NEC or need to issue one to a contractor, having clear, accurate, and up-to-date books are essential when itâs time to file your taxes. Your Bench bookkeeper can provide detailed year-end financial statements, including a 1099-specific report, that make tax filing a breeze.

In January, your Bench-provided 1099 report tells you:

- Who you need to file 1099 NECs for

- How much you paid each person and what they were paid for, including the transactions associated with those payments

Weâll even let you know whether you need to file an NEC or MISC form for that 1099. Learn more.

Recommended Reading: When Can You File For Taxes 2021

Why Did I Receive A Form 1099

The Internal Revenue Service requires the Department to issue Form 1099-INT to taxpayers that received interest of $600 or more on refunds paid during the tax year. While the IRS does not require the Department to issue Form 1099-INT to taxpayers receiving refund interest of less than $600, all interest received on refunds is taxable and must be included in federal adjusted gross income.

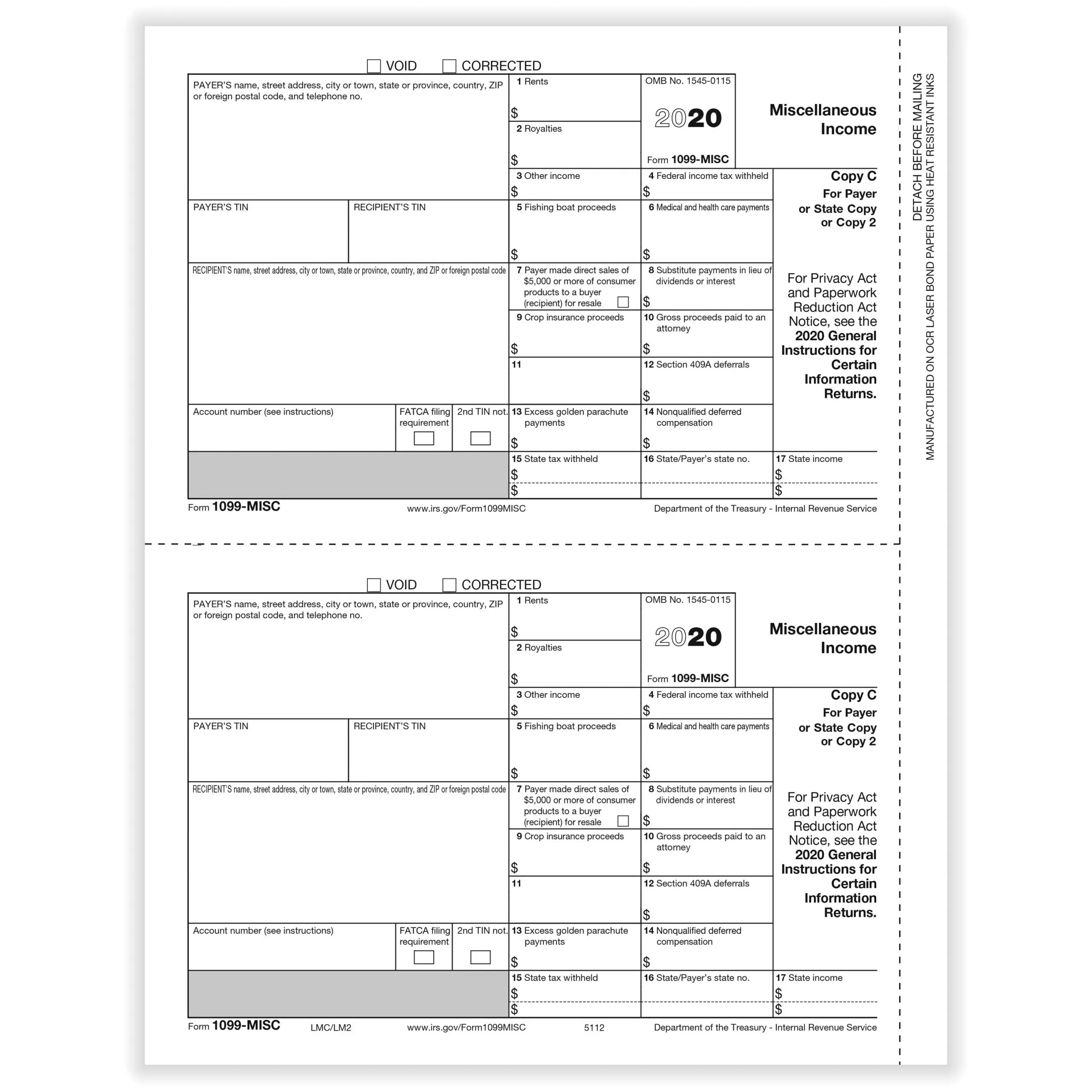

Entering Multiple 1099 Forms

if you received 1099-MISC forms from several payers, you will need to enter each one separately in your tax software. If you have just one business, all 1099-MISC forms are collected and added to your business tax schedule for that business. If you have several businesses, be sure each 1099 form is connected to the right business.

Don’t Miss: How Much To Do Taxes At H& r Block

Troubleshooting Your Wag Taxes

Should you run into issues filing your taxes or using the app as a pet caregiver, there are several resources you can check out:

- The Wag! support center for pet caregivers, which features a searchable database of blog posts and guides

- Wag! Support, which you can contact at

- The r/WagWalkers subreddit, which has plenty of useful threads on app quirks and changes, payment, and more. Plus, itâs a great place to connect with other caregivers

And, of course, thereâs the Keeper app, where a dedicated team of tax assistants can help you navigate write-offs and file faster than Pete sprints to a spoonful of peanut butter. Just to clarify, thatâs really fast.

Chloe Bryan

Chloe is a staff writer at Keeper and a writer, editor, and journalist. She previously reported on internet culture and lifestyle trends for Mashable, where she also led the shopping section. In her free time, she enjoys reading and writing poetry, traveling, watching the Mets, and hanging out with her dog Pete.

Find write-offs.

Paying Taxes As A 1099 Worker

As a 1099 earner, youâll have to deal with self-employment tax, which is basically just how you pay FICA taxes. The combined tax rate is 15.3%. Normally, the 15.3% rate is split half-and-half between employers and employees. But since independent contractors donât have separate employers, theyâre on the hook for the full amount. If youâd like more details on why things work this way, check out our beginnerâs guide to self-employment tax.

But for now, think of self-employment tax as those double-pop popsicles. It can be split between two people, but it comes in a single package. Thereâs no way to avoid paying for both sticks even if itâs just you.

Luckily, only your net earnings are subject to self employment taxes. Thatâs your gross income minus your business write-offs.

Don’t Miss: What Is The Tax Rate In Tennessee

If You Have Income But No 1099

All income must be reported to the IRS and taxes must be paid on all income. The payee may have forgotten to prepare and submit a 1099-MISC form for the income paid to you. Most likely, the payee may not have paid you $600 or more in a calendar year, in which case, no 1099-MISC must be filed with the IRS and provided to the worker.

What Is The Difference Between A 1099 And A W2

A 1099 form shows non-employment income, such as income earned by freelancers and independent contractors. On the other hand, a W-2 shows the annual wages or employment income that a taxpayer earned from a particular employer during the tax year. Unlike a 1099, a W-2 shows the taxes withheld by the employer from the employee’s salary throughout the year.

Don’t Miss: How To Figure Out Tax Deductions From Paycheck

Do I Have To Pay Taxes As A 1099 Employee

Yes, you are responsible for paying your own taxes. Your client will not withhold federal or state taxes like they will for W-2 employees.

If your pay is $600 or more, you should receive Form 1099-MISC to report your income to the IRS from your client. Use the form to calculate your gross income on Schedule C.

Outside of the 1099-MISC, you may need to file your estimated taxes quarterly if you will pay more than $1,000 in taxes for the fiscal year.

All 1099 employees pay a 15.3% self-employment tax. There are two parts to this tax: 12.4% goes to Social Security and 2.9% goes to Medicare. Its your responsibility to set aside money to cover these costs as clients arent required to withhold these taxes from your paycheck.

Visit the IRSs Self Employed Tax Center to learn more about taxes as a 1099 employee. If youre unsure whether you owe taxes or should file a 1099-MISC, its probably a good idea to speak with a tax professional.

How to file Schedule C for 1099-MISC

Heres a brief rundown of how to fill out Schedule C:

The Irs Won’t Tax Money You Send To Family And Friends

Rumors have circulated that the IRS was cracking down on money sent through third-party payment apps to family and friends, but that isn’t true. Personal transactions involving gifts, favors or reimbursements are not considered taxable. Some examples of nontaxable transactions include:

- Money received from a family member as a holiday or birthday gift

- Money received from a friend covering their portion of a restaurant bill

- Money received from your roommate or partner for their share of the rent and utilities

Payments that will be reported on your 1099-K must be flagged as payments for goods or services from the vendor. When you select “sending money to family or friends” it won’t show up on your tax form. So that money from your roommate for her half of the restaurant bill is safe.

If you do receive a 1099-K for money that was sent from a family member or friend, reach out to the payment processing company to get this transaction corrected.

Don’t Miss: How Do I File My City Taxes

What Do I Need To File My 1099

A big part of learning how to file 1099 taxes, is learning what things you will need in order to file them.

Aside from just your 1099 forms and your W-2 forms , you will need to have a few other things to get you through filing taxes.

You need to have ready all of your important documents such as your social security card. You will also want to have any receipts for expenses that are business related.

You will also want to bring along your 1040 tax forms, as well as any other tax forms you have received from any other source of income throughout the year. Like social security benefits, student loans, real estate, etc

If you have all of these required things with you when you go to file your taxes, you will be able to get through it smoothly.

Why Did I Receive A 1099

You probably received a 1099-NEC form because you worked for someone during the past year but not as an employee. For example, if you got paid as a freelancer or contractor, the person you worked for is required to keep track of these payments and give you a 1099-NEC form showing the total you received during the year.

Read Also: How Much Tax Is Taken Off Paycheck

Where Will You See Your 1099 Form

Once your 1099 form is available â which should be around January 31 â youâll be able to see it in the Wag! Pet Caregiver app, according to the Wag! help center.

1099 forms are generally sent out via snail mail, but if youâd prefer to receive yours digitally, you can opt in on the Stripe dashboard on the Wag! Pet Caregiver app.

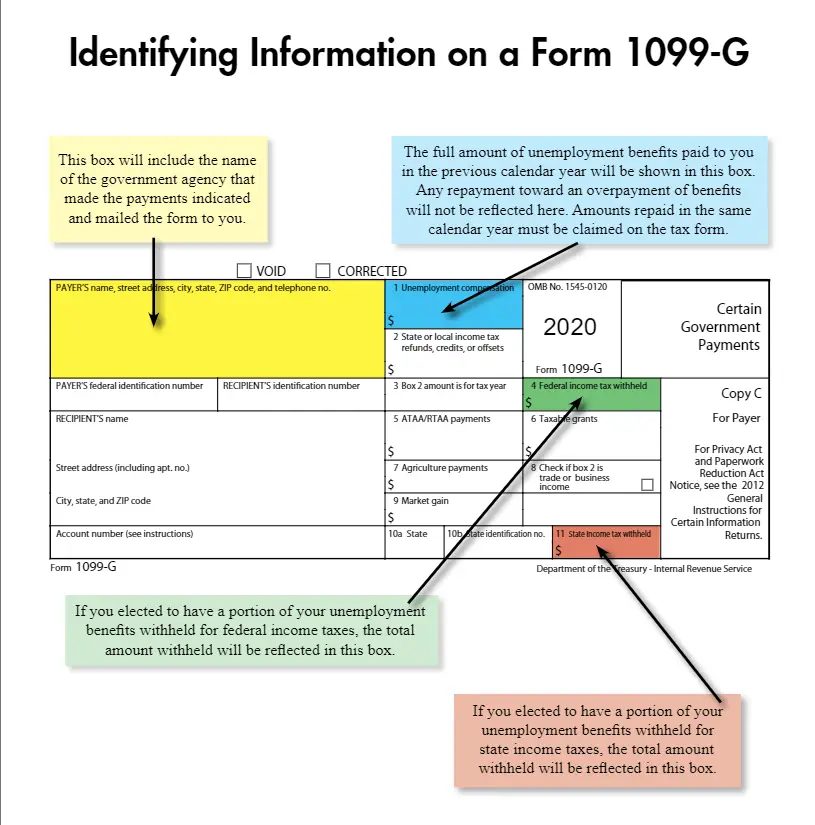

Forms And Backup Withholding

In certain circumstances, income reported on a Form 1099 may be subject to backup withholding. The payers of the income will do the following if backup withholding applies:

- Show the tax withheld on Form 1099, and

- Withhold tax at a rate of 24%, if any of these apply:

- You dont provide the payer with your tax identification number, like your Social Security number .

- The taxpayer identification number you provide is incorrect.

- The IRS notifies the payer that youve been underreporting interest or dividends.

- You havent certified that youre exempt from backup withholding.

You May Like: Do You Have To Pay Taxes On Inheritance Money

S To Submitting Your Companys 1099

Submit Copy B To The Independent Contractor

Once your Form 1099-NEC is complete, send Copy B to all of your independent contractors no later than January 31.

You can download and print a version of Copy B from the IRS website and send it to your independent contractor. This process is explained in further detail on the first page of Form 1099-NEC.

Read Also: How To Get Out Of Paying School Taxes

Will I Be In A Different Tax Bracket After Getting Married

This depends largely on the income that both you and your spouse earn. You may move to a different income tax bracket once married and filing a joint income tax return.

You may ask your tax professional whether it is worthwhile to calculate your taxes both jointly and separately to determine the most favorable status. Filing separately, however, is rarely beneficial when you calculate the impact on both spouses. Typically, filing jointly lowers a couples combined tax liability. This typically happens when a high-income taxpayer marries a person with less or no income. The high-income spouse moves into a lower income tax bracket when filing jointly.

Download The Stride App

While tackling 1099 taxes seems complicated, it doesnt have to be. Weve made a free app that helps independent workers like you easily keep track of mileage and expenses throughout the year. This means that when tax time rolls around, you arent scrambling to find receipts or making risky assumptions about mileage. Have an accountant? They will love you for using it! the Stride app and start using it today.

Disclaimer: The information contained in this Guide is not offered as legal or tax advice. The U.S. federal income tax discussion included in this Guide is for general information purposes only and is not a complete analysis or discussion of all potential tax consequences that may be relevant to a particular individual. In light of the foregoing, each individual should consult with and seek advice from such individuals own tax advisor with respect to the tax consequences discussed herein. Any information contained in this Guide is not intended to be used, and cannot be used, for purposes of avoiding penalties imposed under the U.S. Internal Revenue Code of 1986, as amended.

Don’t Miss: How Do I Check If I Owe Maryland State Taxes

Dont File 1099s For Contractors Hired Through Freelance Marketplaces

Freelance marketplaces like Upwork or Fiverr donât provide tax documents. Whyâs that? Because theyâre technically payment settlement entities. Businesses do not need to provide 1099-NEC forms to workers they hire on these platforms.

If youâre a freelancer that finds work on these platforms, you will a form 1099-k if you earn more than $20,000 and have 200 transactions. Otherwise you can find all the information you need for tax filing in your account.

What Should I Do If I Received Interest On A Refund From The Department But Did Not Receive Form 1099

Interest received on your refund is taxable and must be included in federal adjusted gross income regardless of the amount. The amount of interest paid on your refund is reported on the refund check. If you did not keep a record of the amount of refund interest received, you should contact the Department, at 1-877-252-3052 to determine the amount of refund interest received during the tax year. Include the amount of refund interest received in the calculation of your federal adjusted gross income.

Read Also: Why Appeal Property Tax Assessment