Disaster Victims Can Amend Return To Deduct Losses

If you’re the victim of a hurricane, wildfire or other natural disaster, you might be able to file an amended tax return to claim a casualty loss deduction for the tax year before the disaster. Alternatively, you can claim the loss in the year of the disaster. You should select whichever tax year is more favorable to you. However, the loss must be attributable to a federally declared disaster that occurred in an area warranting public and/or individual assistance. Otherwise, this special rule doesn’t apply.

If you decide to claim the loss for the year before the disaster, you must file your amended tax return no later than six months after the due date for filing your original return for the year in which the loss took place. So, for example, if the disaster occurred in 2021, and you want to claim your loss on your 2020 return, you should have filed an amended 2020 return by October 15, 2022.

Also note that a personal casualty and theft loss deduction is generally subject to a $100-per-casualty limit. It also can’t exceed 10% of your adjusted gross income, and you have to itemize to claim it.

File A Superseding Return If The Filing Deadline Hasn’t Passed

What if you filed your tax return but discover a mistake the very next day? If the filing deadline, including extensions, hasn’t passed, then you don’t want to file an amended tax return. Instead, you can file a “superseding return.” Basically, if you file a second return before the filing deadline, the second return “supersedes” the first return and is treated as the original return.

Say, for example, you filed a 2021 return in February 2022 and, instead of getting a refund, elected to apply your overpayment against your 2022 tax liability. But then you lost your job in March and wanted to get your refund this year. If you filed a superseding return before the , you’ll receive the refund in 2022. It might take a while before the IRS is able to process your superseding return, since they’re behind on tackling paper returns. But this is an example of how, depending upon when you file your superseding return, you may not necessarily have to wait until the next year to benefit from the overpayment.

Take Note: Previously, you could only file a superseding return on a paper Form 1040. But the IRS recently changed that. As of June 2022, a new electronic checkbox has been added to certain tax forms to show that a superseding return is being filed electronically.

What Is An Amended Tax Return

An amended return is an IRS form that can be used to fix information on an annual tax return youve already filed. You must submit your amendment either within three years from the date you filed the original return or two years from when you paid taxes owed from the returnwhichever is later.

About 3 million amended returns are filed each year, according to IRS data.

You should use an amended tax return only to correct your filing status, income, deductions, credits or tax liability. Theres no need to amend a return for any mathematical or clerical errors.

Don’t Miss: Will My Property Tax Increase If I Refinance

Watch For New Laws Applied Retroactively

If there are any retroactive tax laws enacted that include new or expanded tax breaks, you’ll want to check your previous tax returns to see if you can take advantage of the new law or laws. If a new or expanded tax break that benefits you materializes later in the year, submit your Form 1040-X as soon as possible to get a refund for some of the taxes you already paid.

Stay Tuned: Congress triggers a lot of amended returns when it passes a “tax extenders” bill. The term “tax extenders” refers to a collection of tax breaks that keep expiring but are then retroactively extended by Congress for another year or two. This cycle has repeated itself over and over again for years. The Inflation Reduction Act of 2022 extended a couple of tax credits for individuals that expired in 2021, but that shouldn’t generate the need to file an amended tax return because the law didn’t change anything for tax years before 2022.

Otherwise, as of press time, other tax breaks for ordinary Americans that expired at the end of 2021 have not yet been extended for the 2022 tax year or beyond . However, if a tax extenders bill is enacted after you file your 2022 tax return, make sure you file an amended return if you qualify for any of the extended tax breaks.

What Do You Do If You Havent Filed Your Taxes In 10 Years

If you dont file and pay taxes, the IRS has no time limit on collecting taxes, penalties, and interest for each year you did not file. Its only after you file your taxes that the IRS has a 10-year time limit to collect monies owed. State tax agencies have their own rule and many have more time to collect.

Read Also: Can You Collect Unemployment And Social Security

Also Check: Do You Have To File Taxes If Your On Ssdi

Interest And Penalties On Tax Amendments

Although the IRS encourages taxpayers to amend a tax return when the original does not accurately report the correct tax, you are still liable for interest and penalties if the amended return requires an additional payment of tax.

- Monthly interest will also accrue on the tax you underreported between the original filing date and the date you file the amendment.

- Additionally, the IRS may impose a late-payment penalty that accrues concurrently with interest.

- However, if you can provide reasonable cause, the IRS has discretionary authority to waive all interest and penalties.

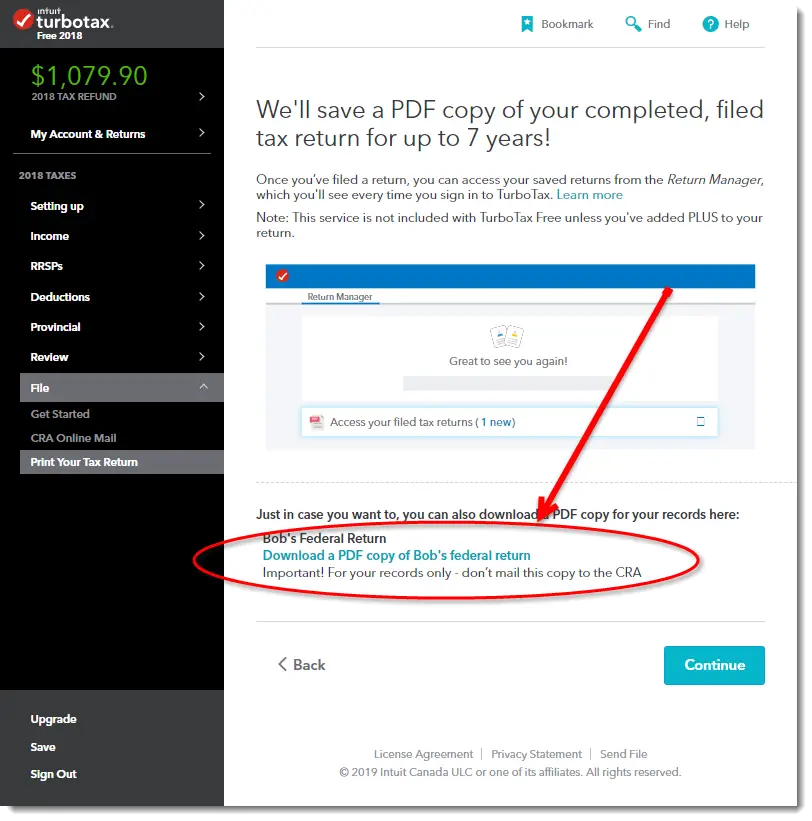

Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted.File your own taxes with confidence using TurboTax. Just answer simple questions, and well guide you through filing your taxes with confidence.Whichever way you choose, get your maximum refund guaranteed.

Form 1040x Can Be Harder To Prepare

Thats because it requires you to list all the changes that have been made to the return, including any changes that the IRS may have made when it processed the original return, or through an audit, adjustment, or notice.

Basically, you must properly report three items:

- The original return including any changes

- The changes with an explanation

- What the return would look like based on all the changes

For many people, completing the original return was difficult enough.

Thats why many people use a tax pro to file amended returns, even if they normally prepare their own returns.

Also Check: Why Are My Property Taxes So High

Where Is My Amended Tax Return

To track an amended tax return, you can use the Wheres My Amended Return? tool on the IRS website starting three weeks after you filed your amendment, or you can try calling the agency at 866-464-2050.

When you enter your information into the online tool, it will indicate whether your amended return has been received, adjusted or completed.

The system updates each day, usually at night.

How To File An Amended Tax Return With The Irs In 5 Simple Steps

Filing an amended tax return requires that you fill out Internal Revenue Service Form 1040X and submit it to the IRS. The tax code is complex and with recent changes, its common for small business owners to make mistakes on their income tax returns. If you make a mistake on a tax return or you receive new information that requires an amendment, such as learning that you qualify for certain tax credits or deductions, you can file an amended tax return to provide the federal government with new information about your income taxes.

These topics show you how to file an amended tax return:

NOTE: FreshBooks Support team members are not certified income tax or accounting professionals and cannot provide advice in these areas, outside of supporting questions about FreshBooks. If you need income tax advice, please contact an accountant in your area.

You May Like: How Do You Avoid Capital Gains Tax

Amended Returns Must Be Filed By Paper For The Following Reasons:

Can I File My Amended Return Electronically

If you need to amend your 2019, 2020 and 2021 Forms 1040 or 1040-SR you can now file Form 1040-X, Amended U.S. Individual Income Tax Return electronically using available tax software products.

Additionally, Tax Year 2021 Form 1040-NR Amended and Tax Year 2021 Form 1040-SS/PR Corrected returns can now be filed electronically.

Recommended Reading: Can You File Previous Years Taxes Online

Keep An Eye On The Calendar

Generally, the IRS audits only returns from the previous three tax years though there are major exceptions. So although it might be tempting to wait and see if the IRS will catch you in an error, it might be cheaper to fess up sooner rather than later.

The IRS charges interest and penalties on outstanding tax liabilities going all the way back to the original due date of the tax payment. So the longer you wait to fix a mistake, the more expensive that mistake can get.

Coronavirus Relief Fund Grants

Learn about the taxability of grants funded by the CARES Act Coronavirus Relief Fund, including grants awarded by the Massachusetts Growth Capital Corporation , the Commonwealth, or municipalities.

My business received a grant awarded by the MGCC, or another Commonwealth or municipal grant funded by the CARES Act Coronavirus Relief Fund. Is this grant taxable income?

Yes. Federal law requires that grants to businesses be included in gross income. The IRS has specifically stated that if governments use CARES Act Coronavirus Relief Fund payments to establish grant programs to support business, businesses receiving such grants must include the grant amount in their federal gross income. Because these grants are taxable under federal law, they are also taxable under Massachusetts law.

Can I deduct business expenses paid with grants awarded by the MGCC, or with other Commonwealth or municipal grants funded by the CARES Act Coronavirus Relief Fund?

Yes. Whether you are subject to the personal income tax or the corporate excise, if your expenses are deductible on your federal return, they are also deductible on your Massachusetts return.

Debt Relief Subsidies Paid by the Small Business Administration

I report my business income on a personal income tax return. My business received a loan qualifying for debt relief subsidies paid by the Small Business Administration pursuant to Section 1112 of the CARES Act. Are these debt relief subsidies taxable income?

Recommended Reading: Did The Tax Deadline Get Extended

Reasons To File A Tax Amendment

The IRS allows you to file an amended return only to

- correct your filing status,

- cure any errors you make in claiming dependents,

- increase or decrease the amount of income you originally reported, and

- add or eliminate any deduction or credit.

If the original return includes mathematical errors that affect your tax liability, you should provide the IRS with sufficient time from the original filing date to fix the error. Generally, the IRS can detect and correct math errors on tax returns within a reasonable amount of time.

The IRS will notify you of any change it makes to your tax return. If additional changes are still necessary after receiving notice, only then should you amend the tax return.

Amending Your Tax Return

A valid tax return amendment requires you to complete IRS Form 1040-X. The two-page form requires you to update the amounts that differ from what you reported on the first tax return. The form also provides space for you to draft a short note to the IRS explaining why you are amending the return.

However, if the error relates to information you initially reported on a schedule or attachment to the tax return, you have to update that schedule and attach it to the 1040-X.

For example, if you initially underestimated your capital losses because you omitted some stock transactions , you must prepare a new Schedule D and file it with the 1040-X.

Don’t Miss: How To Get Tax Exempt Status

File Your Amended Return Before It’s Too Late

Generally, you must file an amended tax return within three years from the date you filed your original return or within two years from the date you paid any tax due, whichever is later. If you filed your original return before the due date , it’s considered filed on the due date. There are a number of special due-date rules for amended returns that are based on changes related to bad debts, foreign tax credits, net operating losses, natural disasters, service or injury in a combat zone, and a few other situationsâcheck the instructions for Form 1040-X for details.

Don’t file your amended tax return too quickly, though. If you’re due a refund on your original return, wait until you actually receive the refund before filing an amended return for that tax year.

Extra Refunds For Taxpayers In Community Property States

Taxpayers who received UI and who live in community property states also may be seeing magic money from the IRS appearing in their bank accounts. This was due to late guidance that created another automatic adjustment. UI is considered community income in community property states. That means if one spouse on a joint return received $25,000 in UI and the other spouse received less than the exclusion amount each taxpayer was allowed to exclude a full $10,200. Depending on the couples effective tax rate, the savings could be from a little over $1,000 to a few thousand dollars! Again, the IRS is automatically adjusting returns but it is prudent if you filed a joint return in a community property state and received over $10,200 in UI to review your direct deposits and ensure that you got the benefit of the maximum exclusion amount available to you . Again, patience is recommended, but an amended return could be indicated.

Read Also: How Are Qualified Dividends Taxed 2020

Backgroundarpas Unemployment Exclusion Provisions

The American Rescue Plan Act of 2021 , which wasnt signed into law until March 11, provides that, for taxpayers whose 2020 modified adjusted gross income is less than $150,000, the first $10,200 of unemployment compensation received in 2020 is not included in the taxpayers 2020 gross income. In the case of a joint return, the first $10,200 per spouse is not included in gross income. , as amended by ARPA Sec. 9042)

American Rescue Plan Act Of 2021

In an effort to align with the American Rescue Plan Act of 2021 , which excludes up to $10,200 in unemployment compensation per taxpayer paid in 2020, the IRS is sending refunds to affected taxpayers. The $10,200 is the maximum amount that can be excluded when calculating taxable income it is not the amount of refunds.

- In addition to a refund, taxpayers affected will receive letters from the IRS, generally within 30 days of the adjustment to their federal tax return.

More information from the IRS can be found here: IRS sending more than 2.8 million refunds to those who already paid taxes on 2020 unemployment compensation

Don’t Miss: How Do I Get Child Tax Credit

When To File An Amended Tax Return

There are times when you should amend your return and times when you shouldn’t. Here are some common situations that call for an amendment:

- You realized you missed out on claiming a tax deduction or credit.

- You accidentally claimed the wrong tax filing status.

- You need to add or remove a dependent.

- You forgot to claim taxable income on your tax return.

- You realize you claimed an expense, deduction or credit that you weren’t eligible to claim.

You usually don’t need to file an amended return if you discover math or clerical errors on a recently filed tax return. The IRS will often correct those types of mistakes on its own and, if necessary, send you a bill for the additional tax due or a refund if the error was in your favor.

Before filing an amended return, make sure the IRS has already processed the tax return you need to amend. That way, it will be less likely that the IRS will get your original return and amended return mixed up. If you’ve already received your tax refund, then you know the IRS has already processed your return.

Just keep in mind that the IRS limits the amount of time you have to file an amended return to claim a refund to:

- Within three years from the original filing deadline, or

- Within two years of paying the tax due for that year, if that date is later.

If you’re outside of that window, you typically can’t claim a refund by amending your return.

Need Help With Your Taxes

- Code for Americas Get Your Refund website: Visit Get Your Refund to connect with an IRS-certified volunteer who will help you file your taxes. First, you will upload your tax documents online. Then, an IRS-certified volunteer will call you to discuss, prepare, and review your tax return for filing.

- Volunteer Income Tax Assistance and Tax-Aide sites: VITA and Tax-Aide sites are IRS-sponsored programs that provide free tax preparation for those who earn less than about $56,000.

The deadline to file your taxes this year is April 18, 2021.

Don’t Miss: How Much Is Inheritance Tax In Indiana