What Type Of Llc License Is Required For My Business

The type of LLC license required for your business depends on the state where you plan to operate. Generally, you’ll need to apply for a special permit or certificate from the state and federal governments. The paperwork involved may vary based on your industry and whether or not there are any local regulations governing it.

Additionally, certain businesses may require professional licensing depending on where you are located. This may include businesses like attorneys, doctors, or contractors. You should contact the appropriate state and local authorities to determine what licenses or permits are necessary for your business.

Choose The Correct Filing Status

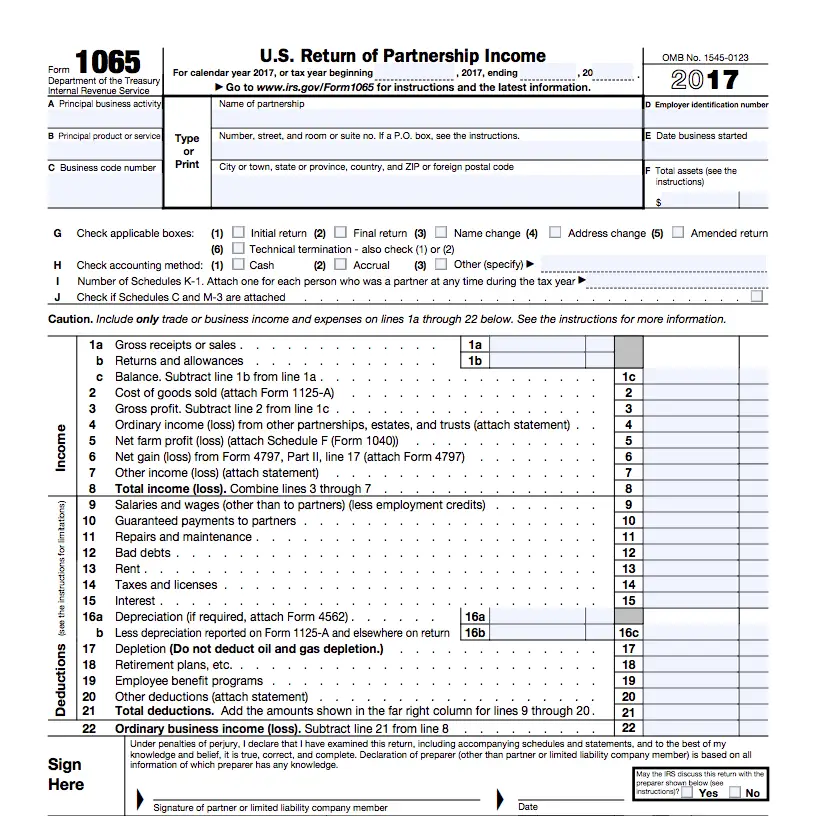

The type of tax filing status you choose will depend on the style of LLC you own. Single-member LLCs are usually treated as sole proprietorships for taxation purposes, while multi-member LLCs can be taxed as partnerships or S corporations. Depending on your business structure and income levels, choosing one of these options could save you money in taxes.

Can I Pay Myself A Salary As A Sole Proprietor

Learning how to pay yourself as a business owner is an important factor to consider when setting up a business as a sole proprietor.

While business owners cannot pay themselves an employee salary, they can pay themselves distributions from their business profits as long draws or dividends. The amount of these payments can vary, depending on the businesss financial situation and the owners personal needs.

Image: Depositphotos

Also Check: What Is The Current Capital Gains Tax Rate

Choose A Registered Agent

When registering your business, youll also be required to appoint a registered agent . A registered agent receives legal documents and certain official correspondence and official documents on behalf of your limited liability company. That can include paperwork such as tax notices or state compliance documents.

In most states, the registered agent must be available in person at a designated registered office during regular business hours so they can receive notices in person. The registered office must be a physical address in your state. Most states allow you to designate yourself, another resident of your state, or a registered agent service like ours to serve as your agent.

Deadlines For Quarterly Taxes

If you anticipate owing $1,000 or more on annual taxes, you are required to pay estimated taxes quarterly and file a tax return annually. This includes freelancers and many other sole proprietors.

Estimated quarterly taxes are due on the following dates:

Usually, April 15 is both the date your estimated taxes for the previous quarter are due and the day your annual tax-filing paperwork is due.

Also Check: Are Pre Paid Funeral Expenses Tax Deductible

How To File Taxes For An Llc

Written by Tyler Davis CPA, updated on November 29, 2021April 9, 2022

Limited liability companies provide greater flexibility for the taxation of your business.

You can choose to use the default federal tax classification for your business structure, such as sole proprietorship or partnership. Or elect to be taxed under another status.

In this guide, we break down the taxation rules and policies on federal and state levels and explain how to file taxes for your LLCs.

Different Types Of Business Taxes

When tax season comes, its important to understand your options for filing business taxes. IRS requirements for small business taxes can be more or less complex, depending on the type of business entity. For example, LLC taxes are usually quite simple, while dealing with S Corp taxes can be more complicated and requires a specialized S Corp tax return. However, filing as an S Corporation could save you tax dollars. Meanwhile, if your company is a C Corporation, you need to pay C Corp tax rates on any qualifying corporate profits.

Filing a business tax return is part of the annual requirements for managing your small business taxes. Just like your personal tax return, the IRS expects your business to file a business tax return even if your business does not owe taxes.

Here are a few key points to keep in mind when filing business taxes, depending on your choice of business entity:

You May Like: What Is The Best Tax Software

How To File Taxes For An Llc With No Income

by Ryan Lasker |Updated Aug. 5, 2022 – First published on May 18, 2022

After you hit the pause button on your business, it might seem counterintuitive to file a business tax return. Its not required in every case, but you should expect to file your LLC taxes every year that your business exists, even if you have little to no business activity.

Estimate Your Federal Self

In most cases, LLC owners are subject to paying federal self-employment taxes, which cover your FICA and Medicare contributions.

If you plan on drawing a salary from your LLC , youll have to pay self-employment taxes on this income.

However, owners who are not active in the LLC those who have merely invested money but dont provide services or make management decisions for the LLC may be exempt from paying self-employment taxes on their share of the profits.

- Federal Unemployment Tax

- Social Security

- Medicare

For 2021, the social security tax rate is 6.2% for wages with a maximum wage of $142,800. Federal Unemployment tax is paid directly by the employer and uses only the employers funds .

These rates vary depending on how much the employee makes. Not all employers are subject to FUTA. Please consult with a tax professional or payroll provider for additional information.

Read Also: How Much Is Tax In Ct

Annual Report License And Permit Renewals

- Corporations, limited liability companies, and limited partnerships must file an annual report. Profit corporations, nonprofit corporations, limited liability companies, and limited partnerships file their annual reports with the Secretary of State and all services are available online at www.sos.wa.gov/corps.

- Your states business license may have state or city endorsements that are renewed annually. Many specialty licenses, permits, local licenses, and professional licenses also require annual renewal. Keep track of your renewal dates to ensure your licenses are current and to avoid extra fees. You may need to check with the individual state agency where the permit was issued.

- Renewal of contractor registration is required every two years, and cost $113.40. You renew your registration with L& I. L& I also renews specialty licenses related to trades .

- Health provider license and facility renewals.

- If you are now doing business in cities and towns where you werent licensed previously, you will need to get additional local licenses. Doing business can include sales, delivery, installation, or service. Contact the cities or towns for further information.

Programar Una Cita Para Un Agente Registrado

Antes de poder solicitar la formación de su LLC en Connecticut, necesitará un agente registrado en Connecticut. Los agentes de registro son las personas designadas legalmente por la empresa que reciben avisos y demandas del gobierno.

La ley estatal requiere que cada LLC tenga un representante registrado. El Secretario de Estado de Connecticut – División de Grabación Comercial designa al agente registrado.

Nuestro servicio de agente registrado es confiable y cumple con este requisito. Usted obtiene:

Read Also: Which States Are Tax Free

The Steps Needed To Create An Llc

The Employer ID number will be used to identify your business on any forms sent to the IRS, including W-2’s and 1099’s. Even if you never hire additional employees, you must obtain this important number.

You’ll also need to register your LLC in its state of residency. This often involves contacting the Secretary of State’s office and, depending on your state of residency, filing a Certificate of Organization.

Before you begin to form a hybrid business structure, such as an LLC, you must first understand how to file taxes for a partnership LLC.

Calculate Your Tax Deductions

Paying taxes is painful, but tax deductions can soften the blow. What you can deduct depends on the type of business you run, though there are a few deductions nearly every business owner can claim every year. For more information, read through IRS Publication 535. It details business deductions and explains how to calculate them.

Don’t Miss: Do You Pay Taxes On Stocks

How To File Taxes For Your Llc: Step

Most small business owners get intimidated by different tax obligations. But the truth is, even non-accountants can easily survive the tax seasons.

What you need to do is get equipped with an accounting app and follow along with the next steps.

Heres how to file taxes for your LLC:

Who Needs A Federal Tax Id

The IRS requires most business entities to use a federal tax ID corporations, partnerships, most LLCs, and some sole proprietorships. A federal tax ID offers other benefits, even when it isn’t required by the IRS. For instance, it can help protect against identity theft, and it’s often a prerequisite for opening a business bank account.

Don’t Miss: How Can You Find Out If Someone Filed Their Taxes

How Zenbusiness Can Help

If youre ready to create your LLC, ZenBusiness can help youget started today for $0 with our business formation services. Weve done thousands of business filings and have an extensive suite of services that will eliminate much of the stress of creating an LLC. In addition, we provide you with all the tools and resources necessary to streamline the process so you can focus on your business.

Disclaimer: The content on this page is for informational purposes only, and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

How To File Llc Taxes

If your business is organized as an LLC, it may be taxed as a sole proprietorship, a partnership, or a corporation, and you may be responsible for self-employment taxes in addition to federal and state income tax.

Ready to start your business?

From a tax standpoint, limited liability companies are like hermit crabs. With no tax classification of their own, they inhabit the tax homes of other types of businesses, and they can choose and change the way they are taxed.

This tax flexibility is one of the things that make LLCs so appealing for small business owners. But if youre just starting out, the LLC tax filing process can seem confusing.

LLCs can choose to be taxed like sole proprietorships, partnerships or corporations. Its important to understand the differences between them because the way your business is taxed can affect both your total tax bill and your obligation to pay self-employment tax.

Also Check: What If I File My Taxes 1 Day Late

Running Your Business In Bellevue

At the core of any successful business is a focus on creating value, effectively leading people to do quality work and managing the work to optimize costs. Because small business is closer to the customer, they are more sensitive and responsive to market changes. Because they tend to solve value problems, not cost problems they tend to be more innovative.

-

Taxes

Businesses pay several different kinds of taxes, including income tax and property tax. Taxes for businesses can be federal, state, and local. There are also different types of taxes depending on various business activities, like selling taxable products or services, using equipment, owning business property, being self-employed versus having employees.

Single Member Limited Liability Companies

A Limited Liability Company is an entity created by state statute. Depending on elections made by the LLC and the number of members, the IRS will treat an LLC either as a corporation, partnership, or as part of the owner’s tax return . A domestic LLC with at least two members is classified as a partnership for federal income tax purposes unless it files Form 8832 and elects to be treated as a corporation. For income tax purposes, an LLC with only one member is treated as an entity disregarded as separate from its owner, unless it files Form 8832 and affirmatively elects to be treated as a corporation. However, for purposes of employment tax and certain excise taxes, an LLC with only one member is still considered a separate entity.

Read Also: Do You Have To Pay Taxes On Disability

What You Get From The Call

A personalized walkthrough with a small business expertWe will get to know your business, show you how Bench works, and get you set up, quick.Full access to all features of the Bench platformYou’ll see first-hand how intuitive reports and real human bookkeepers take the stress out of tedious financial admin.A free month of bookkeepingWe will do one prior month of your bookkeeping in one business day, and prepare a set of financial statements for you to keep.

How To File Business Taxes For An Llc

CONTENTS

As a small business owner, you may be wondering how to file taxes for an LLC. You’re not alone!

The process of filing taxes for an LLC can seem quite confusing at first, but it’s actually simpler than you might think.

There are a few different ways that tax options for LLCs can benefit your business, no matter if you’re a small business owner or you’re going big.

In this blog post, we’ll cover how to file taxes as well as how this option is especially appealing to entrepreneurs who don’t want the hassle of paying personal income taxes too!

You May Like: What Investments Are Tax Free

When Should A Sole Proprietor Become An Llc

If youve already started operating as a sole proprietor, you may be asking, At what point do I need an LLC? When weighing the choice between operating as a sole proprietor versus an LLC, many begin as sole proprietors due to the lower costs and simplicity of getting started. However, after experiencing suitable growth, they often become LLCs.

Operating as a sole proprietor is a simple way to operate when you first begin your business. However, a sole proprietorship provides no personal liability protection for the owner, meaning that the business and the owner are the same legal entity. If someone sues the business, theyre suing the owner and could go after their personal savings, home, car, etc.

For that reason, the longer youre in business as a sole proprietor, the longer your personal assets are at risk. Those risks increase as the business grows. Starting an LLC can shield you from the legal liabilities and debts of the business.

Employment Tax And Certain Excise Tax Requirements

In August, 2007, final regulations PDF were issued requiring disregarded LLCs to be treated as the taxpayer for certain excise taxes accruing on or after January 1, 2008 and employment taxes accruing on or after January 1, 2009. Single-member disregarded LLCs will continue to be disregarded for other federal tax purposes.

A single-member LLC that is classified as a disregarded entity for income tax purposes is treated as a separate entity for purposes of employment tax and certain excise taxes. For wages paid after January 1, 2009, the single-member LLC is required to use its name and employer identification number for reporting and payment of employment taxes. A single-member LLC is also required to use its name and EIN to register for excise tax activities on Form 637 pay and report excise taxes reported on Forms 720, 730, 2290, and 11-C and claim any refunds, credits and payments on Form 8849. See employment and excise tax returns for more information.

Don’t Miss: How Self Employed File Taxes

What Is A Sole Proprietor

If you are considering becoming a business owner, one option to consider is being a sole proprietor. Being a sole proprietor allows you to be your own boss by controlling the operations of your own small business and enables you to benefit from all of its profits.

This type of business has very few start-up costs and operational hurdles. If that sounds appealing, then lets dive into what it means to become a sole proprietor.

What About Tax Deductions When Youre Taxed Like A Sole Proprietor

Youre entitled to the same tax deductions as any other business entity. This includes expenses like equipment, mileage, travel, rent, office supplies, software, and more.

In addition to regular business deductions, you may be able to take the pass-through tax deduction that went into effect in 2018 as well. If you qualify, you might be able to deduct up to 20% of the net income you earn from your LLC from your income taxes. This effectively reduces your income tax rate on your LLC profits by up to 20%.

Lets say that your top tax rate is 22% and you qualify for the 20% pass-through deduction. In this case, youll pay tax on your LLC income at just 17.6%. Everyone loves a good tax break!

Also Check: How Can Tax Identity Theft Occur