If I Owe Child Support Will Mytax Return Be Applied Tomychild Supportarrears

-

Maybe.Federal law and regulationsdetermine when federal payments are intercepted and applied to child support arrears.

-

IfTANFhas been received for your child,thetotalamount of past due supportonall ofyourchild support cases must be at least $150

-

IfTANFhasnotbeenreceivedfor your child,thetotalamount of past due supportonall ofyour child support casesmust be at least $500

Donât Miss: Whoâs Eligible For 3rd Stimulus Check

When Will I Receive The Money

Press briefings have indicated 3 weeks if the IRS is able to do direct deposit. Paper checks will inevitably take longer, especially for those residing abroad.

After the payment is paid, the IRS will mail a letter to the taxpayers last known address within 15 days. The letter will provide information on how the payment was made and how to report any failure to receive the payment. If unsure if it is legitimate, please visit IRS.gov first.

The IRS just released a tool to check payment status . Importantly if the IRS has your information on file, you cannot update the direct deposit info. Update: the direct deposit information can only be updated via filing the 2020 tax return. Get My Payment tool no longer offers the option to update bank details.

- Check payment status

- Confirm payment type: direct deposit or check

- Enter bank account information for direct deposit if direct deposit information is not on file and payment has not yet been mailed.

Should I File My 2020 Taxes Now

The IRS already began issuing stimulus payments based on your latest filed tax return between 2018 and 2019. If you are required to file a tax return and havent filed your 2020 taxes, you may want to consider filing since you may be eligible for a tax refund. Last tax season about 72% of taxpayers received a tax refund and the average tax refund was close to $3,000.

Read Also: How To Avoid Paying Capital Gains Tax On Inherited Property

Return An Erroneous Payment

If you received the Golden State Stimulus payment and believe this is an error, please review the eligibility qualifications above to verify this is an erroneous payment. Once verified, follow the instructions that correspond to the payment received:

Direct deposits:

Paper checks that have not been cashed:

ATTN: Golden State Stimulus FundFranchise Tax Board

Paper checks that have been cashed:

ATTN: Golden State Stimulus FundFranchise Tax BoardRancho Cordova, CA 95741-3070

You May Like: Does Turbotax Do Local Taxes

If I Owe Child Support Will I Be Notified That My Tax Return Is Going To Be Applied To My Child Support Arrears

-

Yes.You were sent a noticewhenyour case wasinitiallysubmitted for federal tax refund offset.The federal government shouldsend an offset notice toyouwhenyour stimulus rebate paymenthasactuallybeenintercepted. The noticewill tell youthatyourtax returnhas been applied toyour child support debtand to contactthe Child Support Divisionifyoubelieve this was done in error.

Read Also: When Is The Cutoff Date To File Taxes

Child Tax Credit For Non

Americans have struggled during the pandemic, especially people with kids. The Child Tax Credit is here to help.

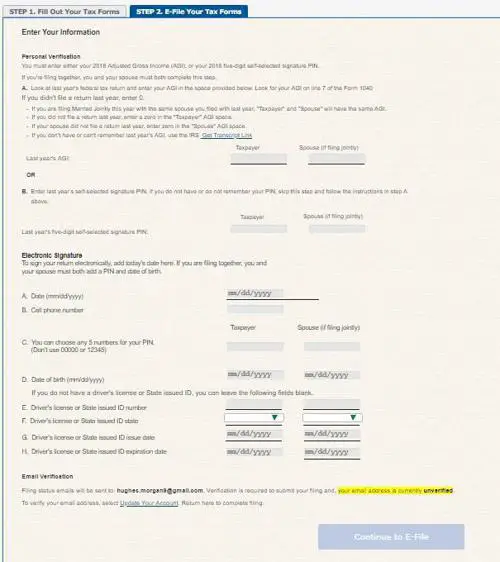

The deadline to sign up for monthly Child Tax Credit payments is November 15. The Administration collaborated with a non-profit, Code for America, who has created a non-filer sign-up tool that is easy to use on a mobile phone and also available in Spanish.

Heres a link to the Code for America non-filer sign-up tool:

Most families are already signed up! If youve filed tax returns for 2019 or 2020, or if you signed up with the Non-Filer tool last year to receive a stimulus check from the Internal Revenue Service, you will get the monthly Child Tax Credit automatically. You do not need to sign up or take any action.

If you arent already signed up, you can still sign up to get the Child Tax Credit. You wont lose your benefits if you do. These payments do not count as income for any family. So, signing up wont affect your eligibility for other federal benefits like SNAP and WIC.

You are also eligible to apply for the Recovery Rebate Credit, also known as stimulus payments, as part of this process.

Heres a list of things you will need to complete the process.

- Social Security Social Security numbers for your children and Social Security Numbers for you and your spouse

- A reliable mailing address

- E-mail address or phone number

- Your bank account information .

Heres a link to the Code for America non-filer sign-up tool:

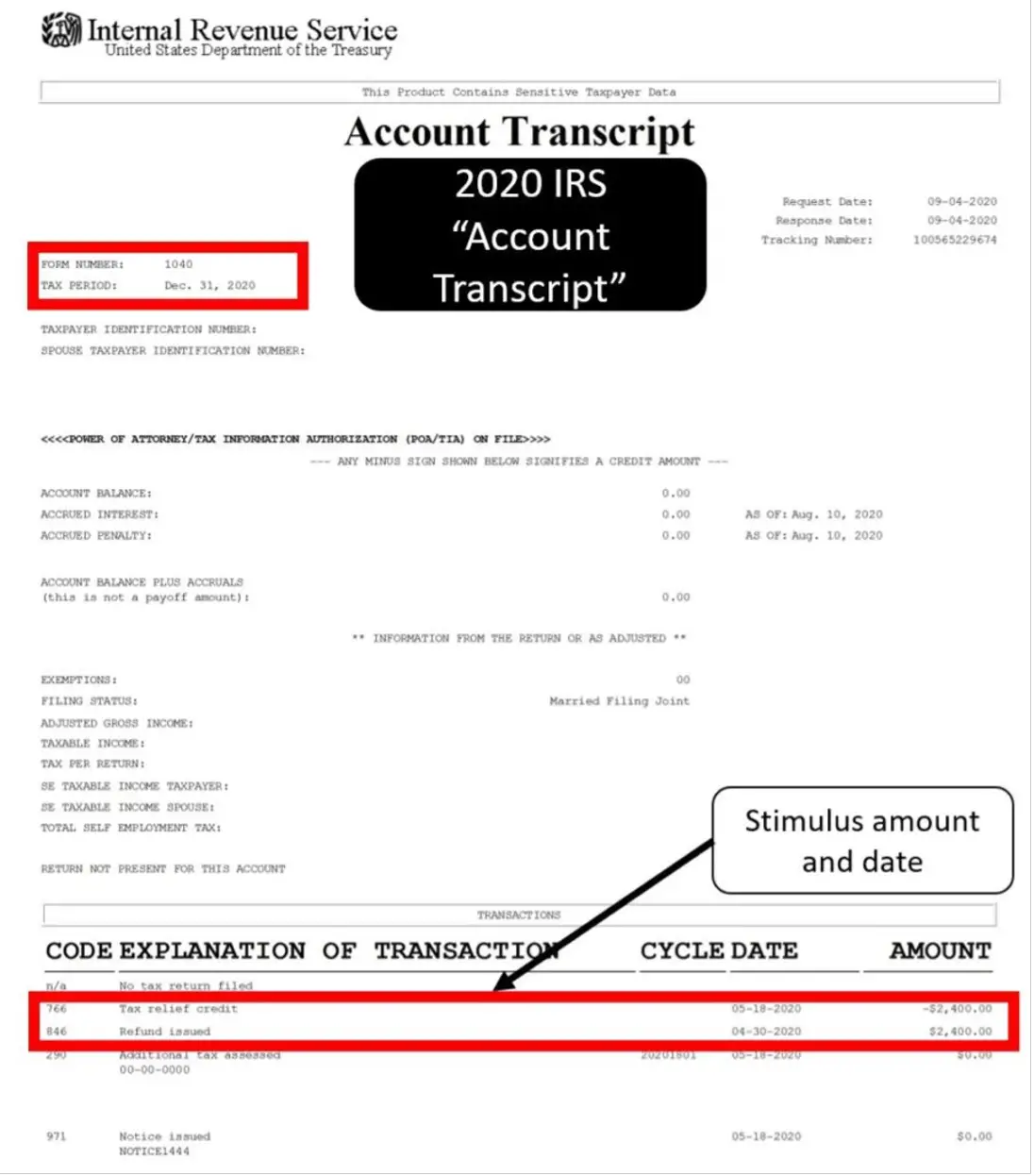

Irs Letter 6475 Notice 1444

Youll need to know the total amount of your third stimulus check payment and any plus up payments actually paid to claim the recovery rebate tax credit on your 2021 tax return. You can get this information from a few different sources. First, you should have received Notice 1444-C from the IRS shortly after receiving your third stimulus payment. If you received a joint payment with your spouse, the notice shows the total amount of the payment. If youre married but file separate 2021 tax returns, each spouse must enter half of the payment amount shown on Notice 1444-C. People who received a plus-up payment should have received a separate Notice 1444-C after your payment was sent. Save Notice 1444-C with your other tax records.

The IRS is also mailed Letter 6475 in January. This letter confirms the total amount of the third stimulus check and any plus-up payments you received for the 2021 tax year. Again, if you received a joint payment with your spouse, the letter shows the total amount of payments. If you file separate 2021 tax returns, each spouse must enter half of the amount shown on Letter 6475. Save this letter, too.

Read Also: Can I Pay Property Tax Online

If I Sign Up For The Child Tax Credit Will It Affect My Other Government Benefits

No. Receiving Child Tax Credit payments will not change the amount you receive in other Federal benefits like unemployment insurance, Medicaid, SNAP, SSI, TANF, WIC, Section 8, SSDI or Public Housing. The Child Tax Credit is not considered income for any family. So, these programs do not view tax credits as income.

What If I Dont Have A Bank Account

If you dont have a bank account, checks will be mailed to your address.

If you wish to open a bank account, visit the Federal Deposit Insurance Corporation for information on opening an account online.

Reloadable prepaid debit cards or mobile payment apps with routing and account numbers may also be an option.

Also Check: How Much Third Stimulus Check

You May Like: Are Traditional Ira Contributions Tax Deductible

What Is A Recovery Rebate Credit

The IRS has lots of different rules, regulations and terms that make things confusing for filers, but pay no attention to the man behind the curtain: The Recovery Rebate Credit is simply just another name for your stimulus check. And if you were one of the lucky Americans who received two EIPs with no problems, you technically just received an advance of that Recovery Rebate Credit.

Americans can claim that credit by filling out a new, special section on their 2020 Form 1040 or 1040-SR if theyre a senior. That also goes for taxpayers who normally dont have to file a tax return, according to the IRS.

But rest assured: Receiving a stimulus check wont come back to bite you. The IRS says that the credit will only increase the amount you receive as a tax refund or decrease the amount you owe, rather than subtract from the refund youre entitled to. Your stimulus check also isnt considered taxable income.

What Do I Do With Letter 6475

Hold onto it until you or your tax preparer are ready to file your 2021 federal return, then use the amount shown on your Recovery Rebate Worksheet to determine if any credit applies.

Having the wrong amount on your return could trigger a manual review,according to the H& R Block website, which could delay a refund for weeks.

Read Also: Irs.gov Stimulus Check Deceased Person

You May Like: How Are Qualified Dividends Taxed

How Do I Know If Im Eligible For More Stimulus Money

All stimulus check payments ended on December 31, 2021. Most Americans received their full payments, but there are a few reasons why you may not have received as much as you are eligible for: If you had a baby or added qualifying children to your family in 2021, youre due another $1,400 for each additional kid.

Likewise, if your income dropped considerably last year, you could also be owed more money.

If you believe that you are eligible for more stimulus money than you received in 2021, the best tax software will calculate your recovery rebate credit automatically and include the amount of additional money on line 30 of your IRS Form 1040.

If you want to calculate your potential recovery rebate credit yourself, use the Recovery Rebate Credit Worksheet as directed in the IRS instructions for Form 1040.

Read Also: How To Estimate Payroll Taxes For Small Business

Enter $1 For Your Income If You Didnt Earn Anything

If you earned money for the year youre filing for, report that amount. Since your earnings were low enough that you werent required to file a tax return for the year, you shouldnt worry about owing income tax.

And if you didnt earn income? Youd put $1, Allec said. Dont worry. Youre not going to owe taxes on that dollar.

Also Check: Where To Send Kentucky State Tax Return

If You Didnt Get The Full Economic Impact Payment You May Be Eligible To Claim The Recovery Rebate Credit

If you didnt get any payments or got less than the full amounts, you may qualify for the credit, even if you dont normally file taxes. See Recovery Rebate Credit for more information.

The tool is closed and it will not be available for other payments including the second Economic Impact Payment or the Recovery Rebate Credit. Economic Impact Payments were an advance payment of the Recovery Rebate Credit. You may be eligible to claim the credit by filing a 2020 1040 or 1040-SR for free using the IRS Free File program. These free tax software programs can be used by people who are not normally required to file tax returns but are eligible to claim the credit.

If you submitted your information using this tool by November 21, 2020 or by mail for the first Economic Impact Payment, IRS will use that information to send you the second Economic Impact Payment, if youre eligible.

You can check your payment status with Get My Payment. Go to IRS.gov Coronavirus Tax Relief and Economic Impact Payments for more information.

Will You Suspend Monthly Payments For Payment Plans

Existing payment plans

If you currently cant comply with the terms of an existing installment agreement , you may request to skip your payments. You can request to skip payments online or by phone at 689-4776.

For court-ordered debt installment agreements, you can request to skip payments online by logging into your court-ordered debt account or by phone at 916-845-4064.

New payment plans

You can apply for a payment plan if youre unable to fully pay your state taxes . If you have court-ordered debt, you can also apply for a payment plan. You can apply online, by phone, or mail. For more information:

Recommended Reading: Can I Still File My Taxes 2021

College Tax Credit : What Is The Income Limit For American Opportunity Tax Credit

Another important tax break for families with a child or dependent who is currently studying in collage is the American Opportunity Tax Credit .

It isnt available for all, as it is designed to help those families who need the support, but it can see those who qualify claim a maximum credit of 2,500 dollars per year per eligible student. If the AOTC reduces the amount of tax owed to zero, eligible students can have 40 percent of any remaining amount of the credit refunded, but up to 1,000 dollars.

It is also explained in the IRS documentation that the amount of the credit is 100 percent of the first 2,000 dollars of qualified education expenses paid for each eligible student and 25 percent of the next 2,000 dollars of qualified education expenses paid for that student.

What If I Am Married To Someone Who Owes Child Support Will My Tax Return Be Applied To The Child Support Arrears They May Owe

-

Yes,unless you are eligible for relief. If youdo not owe child support butyouare married tosomeonewhoowes child support,you may need to file an Injured Spouse Claim and Allocation -Form 8379

-

In some instances, the IRS offsets a portion of the payment sent to a spouse who filed an injured spouse claim if it has been offset by the non-injured spouses past-due child support. The FAQ on the IRS stimulus FAQ www.irs.gov/coronavirus/economic-impact-payment-information-center website states: The IRS is aware that in some instances a portion of the payment sent to a spouse who filed an injured spouse claim with his or her 2019 tax return has been offset by the non-injured spouses past-due child support. The IRS is working with the Bureau of the Fiscal Service and the U.S. Department of Health and Human Services, Office of Child Support Enforcement, to resolve this issue as quickly as possible. If you filed an injured spouse claim with your return and are impacted by this issue, you do not need to take any action. The injured spouse will receive their unpaid half of the total payment when the issue is resolved.

You May Like: Where Can I Drop Off My Taxes

Recovery Rebate Credit Topic A: Claiming The Recovery Rebate Credit If You Arent Required To File A 2020 Tax Return

These updated FAQs were released to the public in Fact Sheet 2022-26PDF, April 13, 2022.

If you didn’t get the full first and second Economic Impact Payments, you may be eligible to claim the 2020 Recovery Rebate Credit and need to file a 2020 tax return to claim it.

Q A1. I used the Non-Filers: Enter Payment Info Here tool in 2020 and dont usually file a tax return. How can I claim a 2020 Recovery Rebate Credit?

A1. If you’re eligible you must file a 2020 tax return to claim the 2020 Recovery Rebate Credit, even if you usually dont file a tax return.

You will need the amount of all first and second Economic Impact Payments to calculate the 2020 Recovery Rebate Credit. You can find the amounts you received in your IRS Online Account.

Tax year 2020 returns can be filed electronically only by paid or volunteer tax return preparers. If you prepare a prior year tax return yourself, you must print, sign and mail your return. There are various types of tax return preparers, including certified public accountants, enrolled agents, attorneys, and others who can assist you in filing your return. For more information about these and other return preparers who might be right for you, visit Need someone to prepare your tax return? on IRS.gov/filing.

The safest and fastest way to get a tax refund is to use direct deposit.

The safest and fastest way to get a tax refund is with direct deposit.

DO NOT file an amended tax return.

When Will I Get The Recovery Rebate Credit

You will most likely get the Recovery Rebate Credit as part of your tax refunds. If you electronically file your tax return, you will likely receive your refund within 3 weeks. If you mail your return, it can take at least 8 weeks to receive your refund.

Claiming the Recovery Rebate Credit will not delay your tax refund. However, if you dont claim the correct amount of the Recovery Rebate Credit, your refund may be delayed while the IRS corrects the error on your return. The IRS will send you a notice of any changes made to your return.

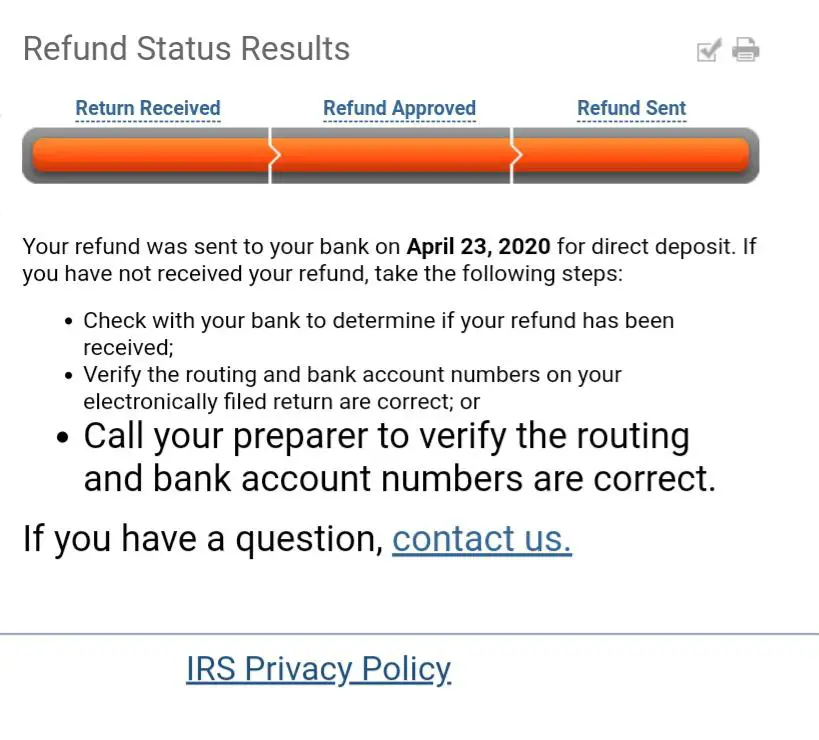

You can check on the status of your refund using the IRS Check My Refund Status tool.

Don’t Miss: What Time Is Tax Deadline

How Do I Update My Direct Deposit Information With The Irs To Receive My Stimulus Check

The IRS wont have your direct deposit information if you didnt provide it on your 2018 or 2019 tax returns, but you can use the IRS Get My Payment tool to check your payment status and confirm your payment type . If the IRS already has your direct deposit information and IRS Get My Payment tool shows your payment as pending or processed, you cannot use the tool to change your direct deposit information.

How To File A Simple Tax Return In 5 Steps

You can easily file a tax return in just a few minutes that gives the IRS the information it needs to get you your payment .

Youre just going to have to provide some basic info, and its stuff you know, said Logan Allec, a CPA and owner of the personal finance site Money Done Right. Your name, your dependents names, your address, your Social Security number.

The one piece of information you might not know off the top of your head: the Social Security numbers of your dependents.

As long as you have all that information, youre ready to get started. Heres what to do.

Read Also: How Much Do You Have To Make To Pay Taxes