The Due Date For Filing A Proprietorships Income Tax Return

In case of an audit under the Income Tax Act of 1961 and any international transactions, the due date for a proprietorships tax return is subject to change.

- Tax returns must be filed by July 31 for businesses that dont require an audit.

- Tax returns for proprietorships that need to be audited must be filed by September 30.

- Tax returns must be filed by November 30 by proprietorships that have transacted business internationally or with specific domestic entities.

Even though operating a business or profession as a sole proprietor is the most basic business organization, it is still required to adhere to tax laws and submit income tax returns on or before the specified due date. There are numerous advantages to submitting an ITR in India. Because of this, you should not avoid filing your ITR on purpose, as this could lead to notices and penalties.

If you are a sole proprietorship, then also filing a tax is very essential. Hence, this is where you would need expert advise such that of Vakilsearch who can be of great help here.

Also, Read:

A proprietorship must pay taxes like any other incorporated entity, such as a partnership or a corporation. Ownership is treated as an individual in the legal sense, and its income tax returns must be filed similarly to the proprietors. Therefore, the laws governing the proprietors income taxpayers also apply to the company.

A persons taxable income is zero if they are 80 years old or older and earn less than Rs 5 lakh per year.

How To Check Itr Status Online

Once you have filed your income tax returns and verified it, the status of your tax return is ‘Verified’. After the processing is complete, the status becomes ‘ITR Processed’.

If you wish to know which stage your tax return is after filing it and want to check your ITR status online, here’s how you can do it in easy steps.

Without login credentials

You can click on the ITR status tab on the extreme left of the e-filing website.

You are then directed to a new page where you have to fill in your PAN number, ITR acknowledgement number and the captcha code.

Once this is done, the status of your filing will be displayed on the screen.

Login to the e-filing website.

From the dropdown menu, select income tax returns and assessment year

Once this is done, the status of your filing will be displayed on the screen.

Keeping the Income Tax Department informed about your income and taxability will keep you on the right side of the law and prevent any blocks in your financial competency. Now that you know whether or not you compulsorily have to file your ITR, you need to ensure that you complete the process before the deadline every year.

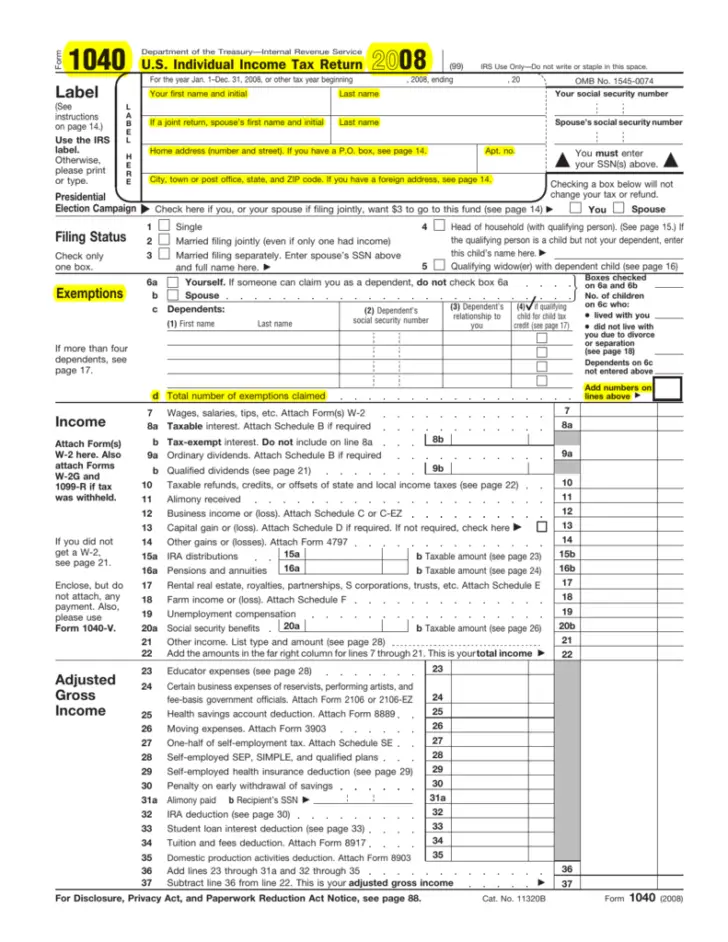

What Happens If I File My Taxes After October 15th

You’re supposed to pay at least 90% of your tax liability by the regular filing deadline. You may owe a late-filing penalty. The IRS can also sock you with a late-filing penalty of 5% of the amount due for every month or partial month your tax return is late. The maximum penalty is 25% of the amount due.

You May Like: What’s The Sales Tax In New York

Completing Income Tax Return

To complete online Income Tax Return a person must complete the Return of Income form and Wealth Statement form.

To facilitate the taxpayers, video tutorials on are provided. Furthermore, Knowledge Base portal provides step by step written and video guides on filing Income Tax Return and Wealth Statement.

Successful submission of Income Tax Return and Wealth Statement in Iris is confirmed when both the forms have moved from the Draft folder to Completed Task.

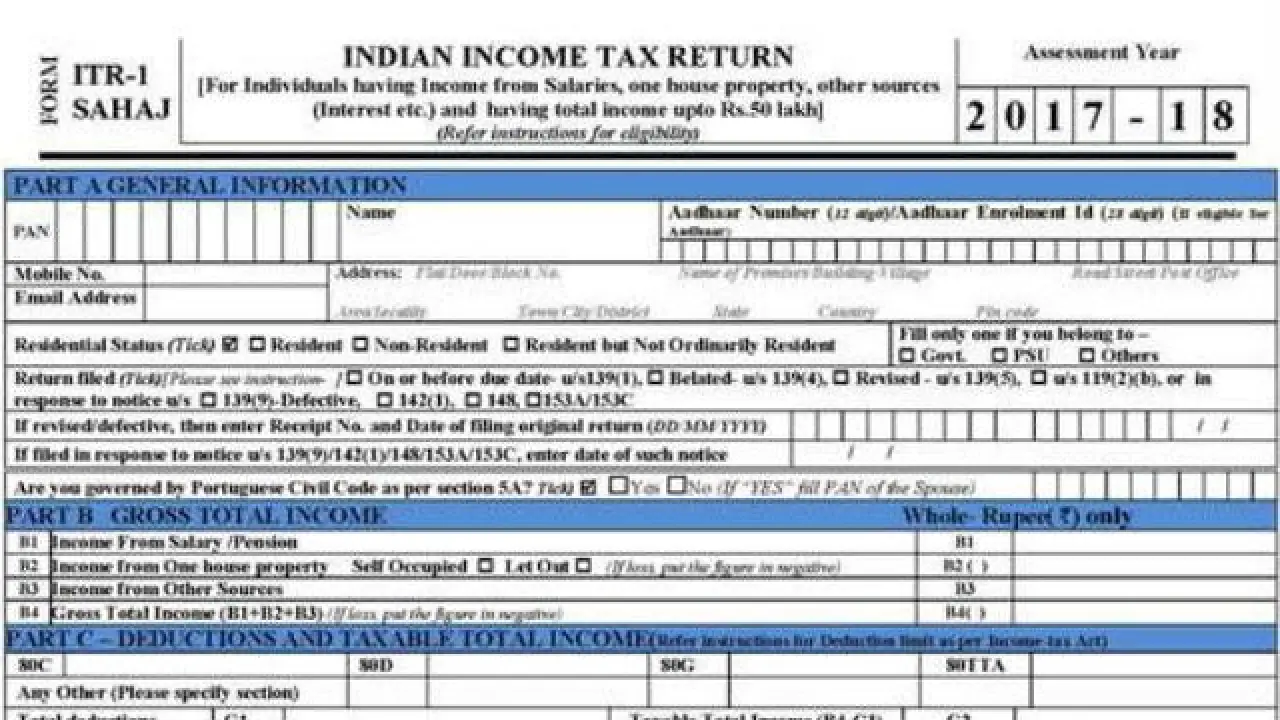

How To File A Tax Return In India As A Sole Proprietor

To electronically file a proprietorship tax return, follow these steps:

- PAN cards are the first step in the process. The IRS mails this card to every one of its customers. The cardholder needs a PAN card to pay taxes.

- Taxes must be paid and tax returns filed using the proprietors PAN if there is no separate legal organization.

- The e-filing portal requires that you first register if you have previously registered, you must log in using your PAN.

- In the e-filing menu, select Income Tax Return.

- On this page, you must make the following selections: Prepare and submit in the submission mode for the year of assessment ITR form Type of filing

- Press the Enter key to continue. Youll need to enter all the required information on this new page.

- There will be some information that must be provided and others that depend on their relevance.

- Select a verification method after filling out all the required fields. There are two electronic options and one physical option for filing. By selecting e-verify, you can have your filing verified immediately after you submit it. Within the next 120 days, you can re-verify your information using e-verification. To proceed manually, select I dont want to e-verify.

- Preview and Submit will appear in a drop-down list. You can preview the return before submitting it to check for any errors or issues.

- Following the e-verify option, you can use EVC OTP to verify the filing. The EVC/OTP must be entered within 60 seconds to be confirmed.

Recommended Reading: How To Calculate Pay After Taxes

Download Itr Utility From Income Tax Portal

Visit the site www.incometax.gov.in and click on Downloads from the top menu bar.

Choose the assessment year and download the offline utility software, i.e. Microsoft Excel or Java, or JSON utility based on your preference. The excel and java utility are discontinued by the income tax department from AY 2020-21

How To File Income Tax Returns For Individual

Every year, many people in Pakistan file income tax returns. According to the law, every taxpayer must file an income tax return. Failing to file an income tax return or failing to do so accurately and in time can lead to penalties and interest. This post will help you file income tax returns for an individual in Pakistan and help you understand the process of filing an income tax return.

Recommended Reading: How Much Tax Is Taken From My Paycheck

Do I Need To Report Exempt Dividend Income From Shares/mutual Funds In Itr Form 1

Until 31 March 2020, dividends from Indian companies were exempt from tax for individual taxpayers. From 1 April 2020 onwards, dividend income is taxable. Hence, for all dividends received after April 1, 2020, you will have to report the same under the head Income from Other Sources.

Don’t miss out!

Filing An Amended Return

If you file your income tax return and later become aware of any changes you must make to income, deductions, or credits, you must file an amended Louisiana return. To file a paper amended return:

- Mail an amended return that includes a payment to the following address: Louisiana Department of Revenue

Read Also: How To Calculate Tax In Texas

Eligibility For Itr E

For all individuals who earn an income that falls within the taxable limit, it is compulsory to file taxes. Individuals can find out if they have a taxable income and calculate their tax liability online for free by using an Income Tax calculator. Anyone who is required to pay taxes can make use of income tax online filing.It is compulsory to file your taxes under the following circumstances:

- If you are an individual whose annual income exceeds the below-mentioned exemption limit:

| Particulars | |

|---|---|

| Individuals over 80 years | 5,00,000 |

- If you have spent more than 2 lakhs on travel to a foreign country, be it yourself or for another individual

- If you have deposited more than 1 crore in one or more current accounts with any bank

- If you have paid an electricity bill of more than lakh on one single bill in the financial year

- If you have income from foreign countries, assets in foreign countries, or have signing authority in any account outside India

- If your gross total income before claiming exemptions on capital gains from section 54 is more than the basic exemption limit

- Companies have to file income tax irrespective of whether they earn a profit or a loss.

Employees Qualified For Substituted Filing

Substituted filing means employers file ITRs on behalf of their employees. Under the TRAIN law , an employee is exempted from filing an annual ITR if these two requirements are met:

- The employee received purely compensation income, regardless of amount, from only one employer in the Philippines within the taxable year.

- The employer has withheld the income tax correctly and filed the BIR Form 2316 .

Under the substituted filing system, the BIR Form 2316 with the âreceivedâ stamp by the BIR is considered the employeeâs substitute ITR.

Recommended Reading: What Percentage Of My Income Goes To Taxes

Reasons You May Need To Complete An Individual Income Tax Return

If you:

- are filing a return for someone who died if there’s a requirement to file a return for this year

- received untaxed income in the previous tax year which you didnt tell us about

- received income as a shareholder in a company, or as a beneficiary of a trust in the previous tax year

- received interest or dividends from a partnership, look-through company, trust or estate

- have an overdue income tax return for the previous year

- registered for GST – unless you’re an

- registered as an employer – unless you’re an IR56 taxpayer, or your only employee is a nanny or private domestic worker, or you received individualised funding for payments to a disabled person or Ministry of Health funded family care

- use the AIM method to work out your provisional tax

- changed your balance date partway through the year

- have a non-standard .

You can check to see if you need to complete an individual tax return.

Nonresident Athlete Individual Income Tax

A nonresident individual who is a member of the following associations is considered a professional athlete and is required to electronically file a Louisiana income tax return, IT-540B reporting all income earned from Louisiana sources:

- Professional Golfers Association of America or the PGA Tour, Inc.

- National Football League

- East Coast Hockey League

- Pacific Coast League

Income from Louisiana sources include compensation for the services rendered as a professional athlete and all income from other Louisiana sources, such as endorsements, royalties, and promotional advertising. The calculation of income from compensation is based on a ratio obtained from the number of Louisiana Duty Days over the total number of Duty Days. Duty Days is defined as the number of days that the individual participated as an athlete from the official preseason training through the last game in which the individual competes or is scheduled to compete.

Read Also: How Much Can You Make Before Social Security Is Taxed

Use An Online Tax Preparation Service For Easier Tax Filing

Every step in the tax preparation processâfrom computing your tax due and filling out to filing tax returnsâis tedious and complicated. For self-employed and mixed-income taxpayers, this can eat away precious time and energy they could have otherwise used for growing their business or improving their skills.

Fortunately, you donât have to do everything by yourself. Browser-based platforms and mobile apps for tax filing are now available for taxpayers to use on their computers or smartphones.

These online tax preparation services help in filing ITRs by automating the process, saving a busy taxpayerâs time, and yes, sanity. This way, self-employed persons can focus on running and growing their businesses.

Among the most well-known online tax filing platforms today are Taxumo, Moneygment app, JuanTax, and Tax Whiz app.

Generally, hereâs how an online tax filing service works: You encode your income, expenses, and other relevant tax data on the platform, and it automatically fills out the tax return, computes the tax due, and files your ITR for you. The online platform also enables the scanning and uploading of receipts, bills, invoices, and other supporting documents for easier tracking of business expenses.

For the convenience they provide, online tax preparation services charge a fee ranging from Php 100 to Php 5,000 per transaction, depending on the package youâre availing.

How Can I File My Income Tax Return Online 2022

Go to incometax.gov.in/iec/foportal. Create an account or log in with your existing details. Download the appropriate ITR form. Fill up all the information correctly. Gather all requisite documents for verification. Then, follow the steps from Steps to Follow for E-Filing ITR Online to file your taxes.

You May Like: How To Check If The Irs Received My Tax Return

Why Filing A Tax Return In India Is Important

The Income Tax Act 1961, obligates certain eligible persons to file their income tax returns once a year. Filing of Income Tax Return legitimize your earnings and investments whereas non-filing means that you have not disclosed your eligible income which is required to be disclosed as per law, which becomes your Black Money. Also, by filing your Income Tax Return you can get an income tax refund, if you have paid excessive taxes to the government. Further, your Income Tax Return plays a crucial role in the time of applying for loans, credit cards, etc.

Requesting An Extension Of Time For Filing A Return

Revised Statute 47:103 allows a six-month extension of time to file the individual income tax return to be granted on request. The extension request must be made before the state tax filing due date, which is May 15th for calendar year filers or the 15th day of the fifth month after the close of a fiscal year.

The five options for requesting an extension are as follows:

An extension does not allow an extension of time to pay the tax due. Payments received after the return due date will be charged interest and late payment penalty.

You May Like: What Is Medicare Tax Used For

Is It Mandatory To File Income Tax Return In India

Yes, it is compulsory to file income tax returns . Not filing returns will not only attract penalties but can also hamper your chances of getting a loan, or a visa for travel purposes or property registration. As per the Income Tax Act, below are entities or firms that require mandatory filing of ITRs in India:

The Due Date For Filing Itr For Individual Taxpayers

Generally, the last date to file an income tax return for individual taxpayers is July 31st in the subsequent financial year. For example, the due date to file an ITR for FY 2019-2020 was July 31st, 2020.

However, this date is subject to extension as and when deemed suitable by the Central Board of Taxes . For instance, although the last date to file ITR was July 31st, 2020, for FY 2019-2020, it was extended to December 31st, 2020.

Have you missed out on the due date to file your income tax return? Do not fret. Allow us to explain how to file ITR for salaried employees after the due date:

1) File a belated return

You can still file your income tax return after the due date, which is known as a belated return. Filing a belated return is essentially the same as filing an ITR before the due date. The primary difference while filing a belated return is that while filing the applicable ITR form, you must select Return Filed under Section 139.

2) Pay a late filing fee or penalty

The downside to filing an income tax return after the due date is that it attracts a penalty. Therefore, you are liable to pay a late filing fee under Section 234F of the Income Tax Act, the amount of which is variable.

The table below highlights the amount of penalty generally payable by different categories of taxpayers:

However, when filing a return after the deadline, you shall lose certain deductions and set-offs on carrying forward losses as prescribed under Section 139.

Also Check: Can I Request An Extension To File My Taxes

Why Should You File Itr

Filing income tax returns comes with several advantages, which we will be discussing later in this piece. However, the foremost reason why you should be filing ITR is it is mandatory for individuals with incomes exceeding the taxable limit.

You can refer to the following table to know about the different exemption limits for individuals of different ages.

|

Above 80 years |

5 lakhs |

Since we are talking about non-salaried applicants here, lets focus on the tax filing mandates for income sources like an organisation. If you are wondering how to file an income tax return for a non-profit organisation or a firm/company, know that it is mandatory to file ITR in such cases regardless of profit or loss.

Similarly, knowing how to file a non-resident tax return is essential.