What Is Irs Free File

The IRS Free File Program is a public-private partnership between the IRS and many tax preparation and filing software industry leaders who provide their brand-name products for free. It provides two ways for taxpayers to prepare and file their federal income tax online for free:

- Traditional IRS Free File provides free online tax preparation and filing options on IRS partner sites. Our partners are online tax preparation companies that develop and deliver this service at no cost to qualifying taxpayers. Please note, only taxpayers whose adjusted gross income is $72,000 or less qualify for any IRS Free File partner offers.

- Free File Fillable Forms are electronic federal tax forms you can fill out and file online for free. If you choose this option, you should know how to prepare your own tax return. Please note, it is the only IRS Free File option available for taxpayers whose income is greater than $72,000.

Find what you need to get started, your protections and security, available forms and more about IRS Free File below.

About IRS Free File Partnership with Online Tax Preparation Companies

The IRS does not endorse any individual partner company.

- A copy of last year’s tax return in order to access your Adjusted Gross Income

- Valid Social Security numbers for yourself, your spouse, and any dependent, if applicable

Income and Receipts

Other income

ACA Filers

File Electronically

Contact Information

Information Safety

Prior-Year Returns

Is Filing Itr Compulsory For All Indians

Income Tax rules dictate that if you earn more than the limit that is exempted from being taxed by the Government, you are compulsorily required to file your tax return according to the tax slabs for each year. Filing your ITR post the due date may attract a penalty and also become a deterrent in getting a loan or visa approved in the future.

Filing Income Tax Return is a compulsory or everyone, with a few exceptions:

1. For individuals below 60 years of age with gross total income of less than Rs 2.5 lakhs , do not require filling an ITR.

2. In case of resident senior citizens , this limit is Rs.3 lakh and Rs.5 lakh for super senior citizens resident in India.

3. Senior Citizens aged 75 years and above with only pension income and interest income are not required to file return of income.

The due date for filing your income tax returns is 30th December 2021. As we know, the government has introduced a new portal for income tax return filing. For taxpayers, the major concern is income tax return filing on the new Income Tax Portal. Many taxpayers are finding it confusing. However, the new Income Tax Portal is very easy and convenient to use.

Currently, there are different to file your income tax returns on the new Income Tax Portal.

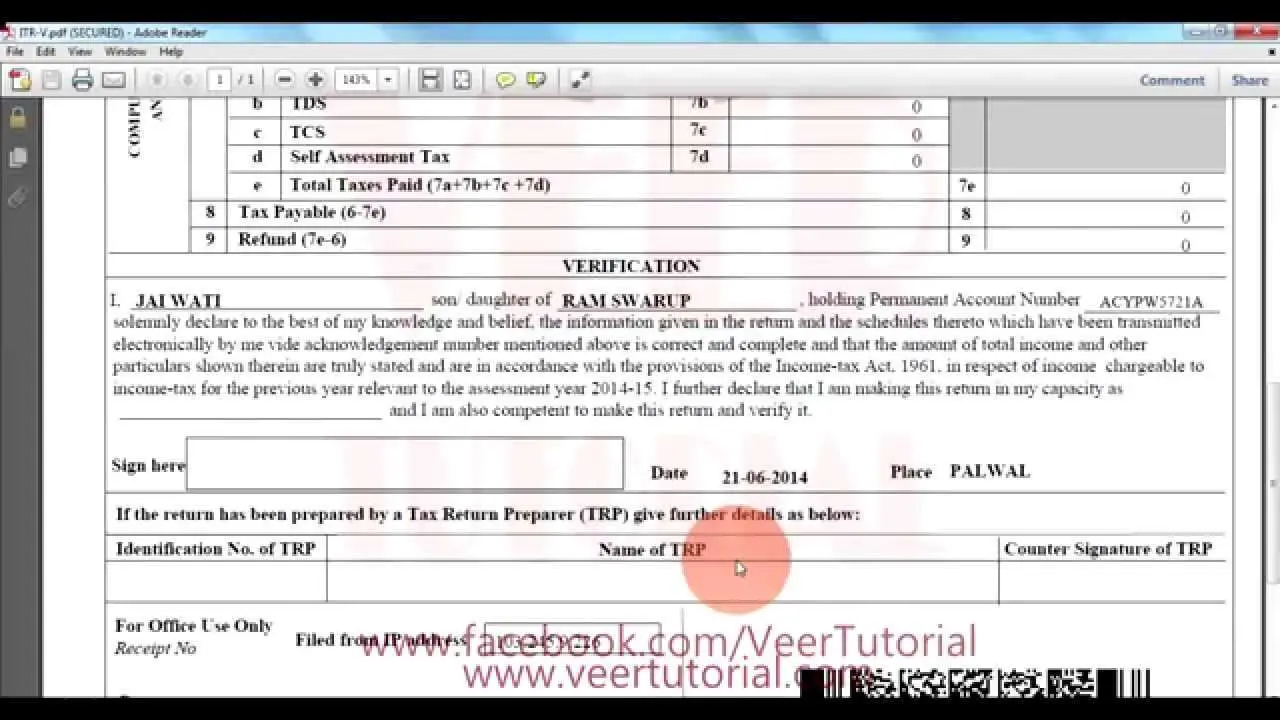

Verify Income Tax Return Form And Submit It

- Once you have added and calculated all required fields, you should now verify your identity.

- Your name and registration number shall already be populated

- Enter the verification pin that was given to you at the time of registration and click on Verify Pin tab

- Once you are given the details, you can now file income tax returns by clicking on the Submit tab

This was a comprehensive guide on how to file income tax returns in Pakistan. Did you find our step-by-step guide on how to file your income tax returns helpful? You can also take a look at the benefits of a tax filer against a non-filer. For more updates on laws and taxes, stay tuned to the best real estate and property blog in Pakistan. We also welcome comments and suggestions, so feel free to send in your queries at [email protected]

Read Also: Doordash Quarterly Taxes

Json Utility Introduced By The It Department For Ay 2021

Tax filing for the AY 2021-22 has started since the new financial year has begun. Taxpayers must file their ITR for the FY 2020-21 by 31 July 2021. The CBDT has issued the relevant ITR forms for the assessment year. The Java and Excel versions have been discontinued by the IT Department from this year. The CBDT has introduced a new facility called the JSON and has released a guide on how to use the new software. Only the ITR-1 and ITR-4 come with the offline utility.

6 April 2021

When Can I File My 2021 Tax Return Canada

When is the earliest you can al tax returns electronically is February 21, 2022. Tax obligations for the 2020 year should be completed on Wednesday, April 30, 2022 in the U.S. As long as your other arrangements have not been finalized with Revenue Canada, any amount owing becomes due on this date. Interest will begin accruing after this time.

Recommended Reading: How To Calculate Sales Tax Backwards From Total

Can I Contact The Irs For Additional Help With My Taxes

While you could try calling the IRS to check your status, the agency’s live phone assistance is extremely limited. You shouldn’t file a second tax return or contact the IRS about the status of your return.

The IRS is directing people to the Let Us Help You page on its website for more information. It also advises taxpayers to get in-person help at Taxpayer Assistance Centers. You can contact your local IRS office or call to make an appointment: 844-545-5640. You can also contact the Taxpayer Advocate Service if you’re eligible for assistance by calling them: 877-777-4778.

Though the chances of getting live assistance are slim, the IRS says you should only call the agency directly if it’s been 21 days or more since you filed your taxes online, or if the Where’s My Refund tool tells you to contact the IRS. You can call 800-829-1040 or 800-829-8374 during regular business hours.

You May Face A Delay If You Claim These Tax Credits

There are a couple of issues that could cause delays, even if you do everything correctly.

The IRS notes that it can’t issue a refund that involves the Earned Income Tax Credit or the Child Tax Credit before mid-February. “The law provides this additional time to help the IRS stop fraudulent refunds from being issued,” the agency said this week.

That means if you file as soon as possible on January 24, you still might not receive a refund within the 21-day time frame if your tax return involves either of those tax credits. In fact, the IRS is informing those who claim these credits that they will most likely receive their refunds in early March, assuming they filed their returns on January 24 or close to that date.

The reason relates to a 2015 law that slows refunds for people who claim these credits, which was designed as a measure to combat fraudsters who rely on identity theft to grab taxpayer’s refunds.

With reporting by the Associated Press.

Also Check: Irs Gov Cp63

Individual Income Tax Filing

Filing electronically, and requesting direct deposit if youre expecting a refund, is the fastest, safest, and easiest way to file your return.

Free Fillable Forms: The software provider that previously supported our free fillable forms no longer offers them for individual income tax filing. Please consider one of our other filing options for your 2021 Virginia income tax return.

Prepare The Required Documents

Before you log in to myTax Portal, make sure you have these documents ready:

- Singpass/SFA

- Form IR8A -for-employment-income” rel=”nofollow”> Auto-Inclusion Scheme)

- Particulars of your dependants for new relief claims

- Details of rental income from your property and other income, if any

- Business registration number/partnership tax reference number .

Recommended Reading: Opi Plasma Center

Is The Irs Accepting E Filed Returns

The IRS will accept tax returns prepared by its Free File partners on January 24. Tax returns are to be processed by the IRS over several weeks. Prior tax filings can also be made at least 24 hours in advance by tax software companies. Tax payment for the fourth quarter of 2022 is due on January 18. The Tax Season in 2022 begins on January 24th at the IRS.

Extension To File Your Tax Return

If you cant file your federal income tax return by the due date, you may be able to get a six-month extension from the Internal Revenue Service . This does not grant you more time to pay your taxes. To avoid possible penalties, estimate and pay the taxes you owe by the tax deadline of May 17, 2021.

Read Also: Pastyeartax Com Review

What If I Do Not File

In case you do not file, the Income tax Department will send you a notice asking you to file your return and may ask you to pay a penalty for not filing your income tax return. You will not be given your refund. If you are found to owe the government taxes, the interest on the base tax keeps adding up till you pay.

If you are found to owe the government taxes money, then the interest keeps adding up till you pay. A penalty may also be levied.

A new section 234F has been inserted in Income Tax Act, 1961 with effect from Assessment Year 2018-19 . Under this section, fee is levied if the Income-tax return is not filed within due date. Earlier penalty for delay in filing of return was levied at the discretion of Assessing Officer. But now, the same is payable before filing of Income-tax return.

New Rule For Exemption From Income Tax Returns For Senior Citizens Aged 75 And Above

The Finance Minister of India, Nirmala Sitharaman announced Income Tax relaxation for the Senior Citizens in the Union Budget 2021. The new rule says that the Senior Citizens of the age of 75 years and above won’t have to file Income Tax Returns for the fiscal year 2021-22 if the following conditions are met: The senior citizen is of age 75 years or more and is a resident of India. The senior citizen has only pension and interest earned on it as a source of income. The bank is one of the specified banks in the list provided by the Central Government in the Union Budget of 2021. The senior citizen has to provide a declaration form to the bank specified by the Central Government

7 September 2021

Also Check: Is Doordash Taxed

How To File Income Tax Returns Electronically In Canada

The Canada Revenue Agency processes more than 25 million tax returns each year and almost two-thirds of these returns are filed electronically.

That number is poised to grow as telephone filing for simple returns is no longer an option. The CRA also has encouraged taxpayers the move away from using paper forms.

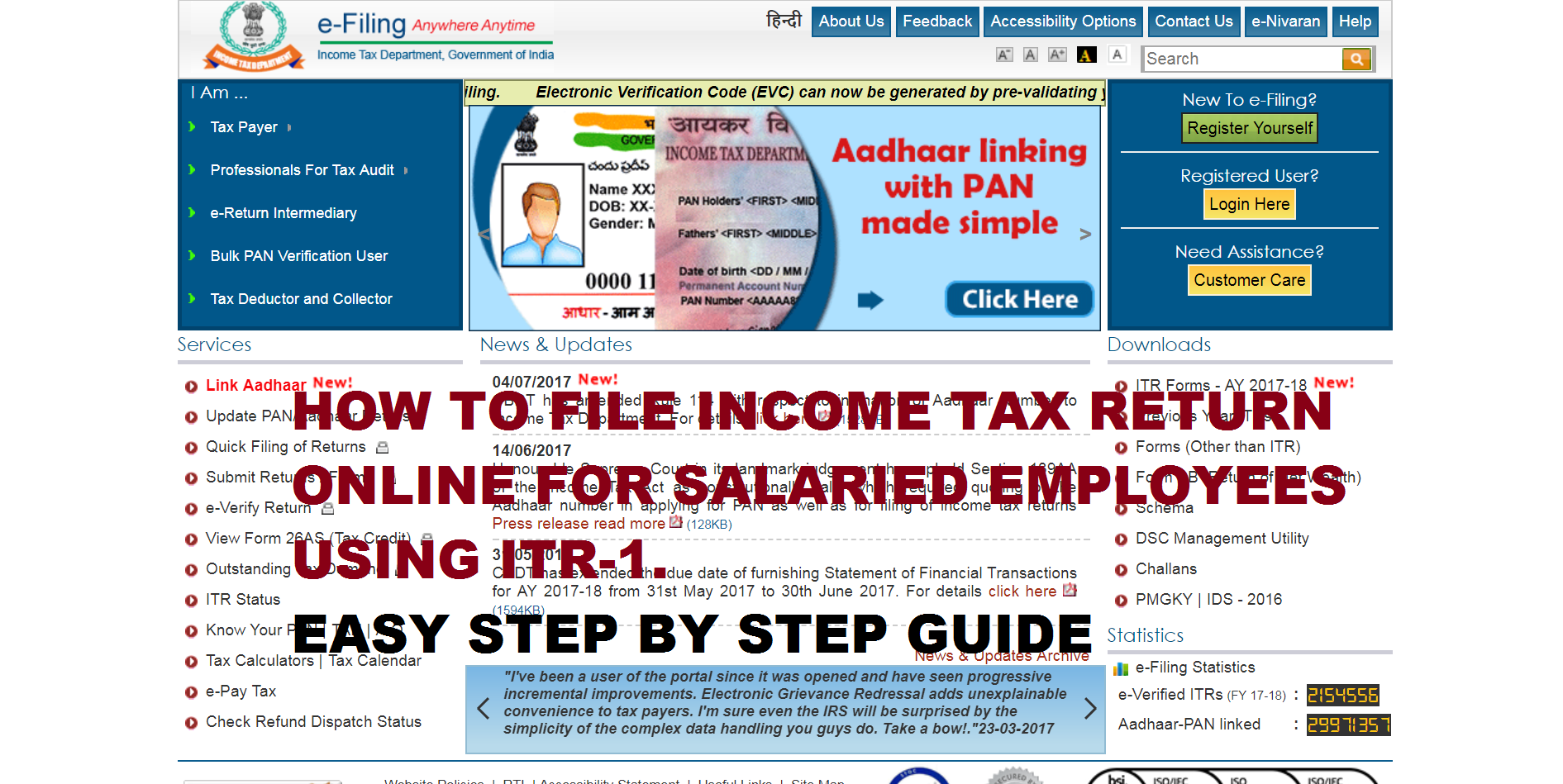

Advantages Of Filing Itr Online

Filing your ITR online comes with several benefits. Let’s have a look at them-

- Prompt processing- The acknowledgement generated for filing your ITR is quick. You also get refunds faster than when you file your returns on paper.

- Higher accuracy- The filing software is built-in with validations, and seamless electronic connectivity minimises chances of errors to a great extent. Paper filing cannot identify these errors. Moreover, when the data is being transferred from paper filing to the electronic system, the person entering such data may also make an error.

- Ease of access- E-filing can be done anytime and from anywhere as it is online and offline. So, you can also do it from the comfort of your home.

- Confidential- The online filing offers better safety and security as your data is inaccessible to other people.

- History- You can easily access your older records while filing a return. This data is kept secure.

- Proof of receipt- You get a confirmation of filing instantly, and it is also sent to you via mail on your registered mail ID.

- Easy fund transfer- You get the option to file now and pay later. You can also choose the day when your taxes will be debited from your account.

These are some of the benefits you must know after learning how to submit income tax returns online.

Recommended Reading: Paying Taxes On Doordash

Filing Your Tax Return

What you need to know about filing your personal income tax and benefit return.

Get help this tax season with the Ontario Child Care Tax Credit and the Low-Income Workers Tax Credit.

Save your receipts for the new Seniors’ Home Safety Tax Credit in 2021, which you can apply for during the 2022 tax season.

You may be eligible for tax credits and benefits to help you with living costs.

Why Should You File

Many think that filing tax returns is optional and therefore dismiss it as unnecessary and burdensome. Filing tax returns is an annual event and is a moral and social duty of every responsible citizen.

Filing returns is a sign that you are responsible

The government mandates that individuals who earn a specified amount of annual income must file a tax return. Failure to pay income tax and file the income tax return will invite penalties from the Income Tax Department.

Those who earn less than the prescribed level of income can file their income tax return voluntarily.

Your loan or credit card company may want to see your income tax return

If you plan to apply for a home loan in future it is a good idea to maintain a steady record of filing income tax returns as the home loan company will most likely insist on it as a proof of steady income. In fact, you may even consider filing your spouses returns if you want to apply for a loan as a co-borrower. Even a credit card company may insist on proof of income tax return before issuing a credit card.

Financial institutions may insist on seeing your returns over the past few years before transacting with you. In fact, the government may make it mandatory for them to do so, thereby indirectly nudging individuals to file returns regularly even when its voluntary.

If you want to claim adjustment against past losses, a return is necessary

Filing income tax returns may prove useful in case of revised returns

Read Also: H& r Block Form 5498

Can I View My Submitted Tax Return Online

Tax transcripts can be downloaded from the IRS online for taxpayers. Go online to view the AGI promptly using Get Transcript Online. Make sure that the only entry relating to adjusted gross income is included in the Tax Return Transcript. Visit Get Transcript By Mail or call 800 908 979 to retrieve your transcript.

Log In To Mytax Portal

Log in to myTax Portal with your Singpass/SFA. Click on “Individuals” > “File Income Tax Return” to start. This electronic tax form may take about 5-10 minutes to complete. Please clear your cache before and after filing.

There are software requirements for accessing myTax Portal. Please refer to the operating systems and browsers that are supported.

Your session will expire if you leave it idle for more than 20 minutes. When this happens, you have to log in to the portal again.

If you need help during e-Filing, please click on the icon < > , known as ‘i-help’.

Also Check: Csl Plasma Taxes

Filing Individual Income Tax Return Online

Any alien with a valid resident certificate and ARC No. issued by the National Immigration Agency may file an individual income tax return online for the year 2020 from May 1st, 2021 to May 31st, 2021. After downloading the electronic tax-filing program at , taxpayers can log into the system via an Alien Citizen Digital Certificate, Registered National Health Insurance Card with password, a Financial Certification Authority , or by entering the ARC No. and Passport/Resident/Permit No. as specified on the ARC as of January 31st, 2021, and follow the instructions given in the program to file income tax returns online. If any document is required for filing, taxpayers shall submit it in person or send it by post before June 10th, 2021.

Can I File My First Tax Return Online Canada

File online using only your social security number, date of birth, income tax information, and access to NETFILE software or website application. On your return, include all the amounts for your various financial documents and receipts. Visit cea.com for more information. The auto-fill function can be found at ntu-www.

Recommended Reading: Is Plasma Donation Taxable

Getting Refunds Within 21 Days Of Filing

If all goes well, though, taxpayers who e-file can receive their refunds via direct deposit as quickly as one week after filing based on previous years’ processing time, according to trade publication CPA Advisor.

It’s important to note that processing time typically slows down as the tax season gets underway and the IRS handles more returns, the publication added.

In the meantime, tax experts say there are some steps that taxpayers can take to help ensure a quick tax refund, which is even more important this year given that the IRS is starting with a backlog. National Taxpayer Advocate Erin M. Collins issued a report to Congress in January that warned she is “deeply concerned about the upcoming filing season” given the backlog, among other issues.

“The first thing you know if you are going to cook a meal, you have to have the kitchen cleaned up from the last meal,” said Mark W. Everson, vice chairman at Alliantgroup and former Commissioner of the IRS. “It just snowballs into a terrible situation.”

Delays in processing tax returns count as one of the agency’s most pressing problems, Collins said in her report, which described an agency in crisis.

Americans are hearing the message: Potential IRS processing delays ranked second among the three top concerns of people who are expecting a refund from the IRS this year, according to a Bankrate.com poll of almost 2,500 people released February 22.