Considerations You Need To Understand

Here are some additional points you should understand before submitting an offer.

- Submitting an OIC does not automatically suspend the collection of a warrant.

- Submitting an offer does not change the time you have to respond to an assessment.

- The statutory period for collections is suspended while the offer is pending and for a year afterward.

- You must file all tax returns and pay all tax owed for five years after the offer is accepted.

- If you qualify for any refunds or credits, the state applies those amounts to your taxes owed. That applies to the calendar year that you submit the offer and to any years prior to the offer.

- You may have to provide a collateral agreement to the state. A collateral agreement is where you agree to pay more than the offer if you come into extra money. For example, if your income goes up in the next few years, you agree to pay some of that money to the state.

- If you submit an OIC for trust taxes on behalf of a business, responsible individuals part of the business may still be personally liable. Trust taxes are withholding taxes that were withheld from an employees paycheck but not paid to the state. They also include sales taxes which are held in trust by the business on behalf of the consumer and remitted to the state.

- If the tax bill is more than $100,000, a New York Supreme Court judge needs to approve the OIC.

Business Return General Information

Important resources for Corporate filers can be found .

Due Dates for New York Business Returns

Corporations

- Original returns: April 15, or same as IRS, or for fiscal year filers the 15th day of the fourth month following the close of the year.

- Returns on Extension: Corporations can file for a six month extension by filing Form CT-5 by the due date of the return. Two additional three month extensions can also be filed.

S-Corporations

- Original returns: March 15, or same as IRS, or for fiscal year filers the 15th day of the third month following the close of the year.

- Returns on Extension: S Corporations can file for an automatic six month extension by filing Form CT-5.4 by the due date of the return.

Partnerships

- Original returns: March 15, or same as IRS, or for fiscal year filers the 15th day of the third month following the close of the year.

- Returns on Extension: Partnerships can file for an automatic six month extension by filing Form IT-370-PF by the due date of the return.

Fiduciary

- Original returns: April 15, or same as IRS, or for fiscal year filers the 15th day of the fourth month following the close of the year.

- Returns on Extension: Fiduciaries can file for an automatic six month extension by filing Form IT-370-PF by the due date of the return.

Business Extensions

Extension requests can be filed through TaxSlayer Pro as well as online at the Department of Taxation and Finance website here.

Amended Business Returns

Sourcing Sales Tax: Understanding Which Tax Rate To Apply

In some states, sales tax rates, rules, and regulations are based on the location of the seller and the origin of the sale . In others, sales tax is based on the location of the buyer and the destination of the sale .

New York generally uses destination-based sourcing. In New York, the sales tax rate is generally determined by the point of delivery, which is where ownership and/or possession of the item is transferred by the seller to the purchaser. For services, the rate is based on where the service is delivered, or where the property on which the service is performed is delivered.

For additional information, see the New York Department of Taxation and Finance.

You May Like: Why File For An Extension On Taxes

What Is My Domicile

The terms domicile and residence are often used synonymously, but for New York State income tax purposes, the two terms have distinctly different meanings.

In general, your domicile is your permanent and primary residence that you intend to return to and/or remain in after being away .

Residence means a place of abode. An individual may have several residencese.g., houses, apartments, condos, and/or other places to live or physical dwellings in which they resideand some may be in different states.

However, while you may have multiple residences, you can only have one domicile. An individual may live in a certain residence for a temporary period of time, which could be an extended period of time, but if its not the place they ultimately attach themselves to and intend to return to, its still not their domicile.

Furthermore, your New York domicile does not change until you can demonstrate with clear and convincing evidence that you have abandoned your New York domicile and established a new domicile outside New York State. This means shifting the focus of your life to the new location. It is not enough simply to file a certificate of domicile or register to vote in the new location. All aspects of a persons life are considered in determining whether a persons domicile has changed.

Misplacing A Sales Tax Exemption/resale Certificate

New York sales tax exemption and resale certificates are worth far more than the paper theyre written on. If youre audited and cannot validate an exempt transaction, the New York Department of Taxation and Finance may hold you responsible for the uncollected sales tax. In some cases, late fees and interest will be applied and can result in large, unexpected bills.

Also Check: How To Pay My State Taxes Online

Wages Subject To Contribution

Remuneration includes every form of compensation you pay to covered employees, including:

- The value of meals and lodging

- Other types of non-cash compensation

Employers are required to pay Unemployment Insurance contributions on remuneration paid to each employee in a calendar year up to the UI wage base. On January 1, 2014, several provisions of the recent UI reform legislation will go into effect. These provisions affect the UI wage base. The UI wage base will adjust January 1st of each year as follows:

- Year 2013 and prior $8,500

- Year 2014 – $10,300

- Year 2025 – $12,800

- Year 2026 – $13,000

- After 2026, the wage base is permanently adjusted on January 1 of each year to 16% of the state average annual wage, rounded up to the nearest $100. The state average annual wage is established no later than May 31 of each year. The average annual wage cannot be reduced from the prior-year level.

Also included in the calculation of the UI wage base are wages paid:

- To an employee reported to another state during a calendar year

Employers who share the services of a single employee must report and pay the contributions on their share of the employee’s earnings. Each is liable for contributions up to the annual UI wage base. If the employers are financially related, they pay contributions only up to the annual UI wage base of total annual earnings.

Late Sales Tax Filing Penalties And Interest

Filing a New York sales tax return late may result in a late filing penalty as well as interest on any outstanding tax due. For more information, refer to our section on penalties and interest.

In the event a New York sales tax filing deadline was missed due to circumstances beyond your control , the New York Department of Taxation and Finance may grant you an extension. However, you may be asked to provide evidence supporting your claim.

Hopefully you dont need to worry about this section because youre filing and remitting New York sales tax on time and without incident. However, in the real world, mistakes happen.

If you miss a sales tax filing deadline, follow the saying, better late than never, and file your return as soon as possible. Failure to file returns and remit collected tax on time may result in penalties and interest charges, and the longer you wait to file, the greater the penalty and the greater the interest.

Don’t Miss: How To Pay Illinois State Taxes

How To File State And Federal Taxes For Free In New York

A calculator and tax books

ALBANY, N.Y. – There are eight tax services that participate in the IRSs Free File program allowing people who make up to $73,000 to e-file their taxes for free. Depending on where in the country people live, if they are planning to file state taxes, not all the eight programs allow people to file both federal and state taxes.

Three options exist for New Yorkers who file federal and state returns: OnLine Taxes , TaxAct, and FreeTaxUSA, according to the Internal Revenue Service and the New York State Department of Tax and Finance . Still, each of the services has its own limitations. Below are the guidelines for each:

| Service | |||

| Yes, if AGI criterion is met. | Yes | ||

| Up to $65K | Up to 56-years-old | Yes, if AGI criterion is met. | Yes |

| Yes, if AGI criterion is met. | Yes |

The NYSDTF said tax season opens on January 24 but companies offering free tax services could make software available as early as Jan. 14. They have a list of documents New Yorkers will need to file their taxes online and videos to help people choose the service thats right for them.

Copyright 2023 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed.

Whats The Difference Between Filing As Resident Vs Nonresident

As a resident, you pay state tax on all your income no matter where it is earned. As a nonresident, you only pay tax on New York source income, which includes earnings from work performed in New York State, and income from real property located in the state. If you are a nonresident, you are not liable for New York City personal income tax, but may be subject to Yonkers nonresident earning tax if your income is sourced to the city of Yonkers.

For a list of what does and does not constitute New York source income, plus other information, see:

- Tax Bulletin TB-IT-615, New York Source Income of Nonresident Individuals, Estates, and Trusts, and Part-Year Resident Individuals and Trusts

- Tax Bulletin TB-IT-620, New York Source Income-Sole Proprietorships and Partnerships

- IT-203-I, Instructions for Form IT-203 Nonresident and Part-Year Resident Income Tax Return

- TSB-M-18I, Definition of New York Source Income of Nonresident Expanded

- TSB-M-18I, Nonresident Partners Treatment of Gain or Loss on Certain Sales or Transfers of a Partnership or Membership Interest

- TSB-M-15C, I, Impact of New York State Corporate Tax Reform on New York S Corporations and their Nonresident and Part-Year Resident Shareholders

- TSB-M-10I, Income Received by a Nonresident Related to a Business, Trade, Profession, or Occupation Previously Carried on Within New York State

- TSB-M-09I, Amendment to the Definition of New York Source Income of a Nonresident Individual

Recommended Reading: What Federal Tax Forms Do I Need

Log In And Create A Sprintax Account

Do not file your 2021 tax return until you have all of your income statements! Some students and scholars get both a W-2 and a 1042-S. depending on the type of income. The 1042-S is generally issued in the first two weeks of March.When you log in through the Columbia Portal below with your UNI and password, it will take you to the Sprintax/Columbia page where you need to create a Sprintax account with a new username and password.

The Corporation Franchise Tax

Franchise taxesâor, as theyâre known in some states, privilege taxesâare taxes that you pay for the privilege of doing business in that particular state.

New Yorkâs corporate franchise tax applies to both C and S corporations. To calculate and pay it, you must fill out and file Form CT-3, your New York corporate tax return.

For many businesses, this tax ends up being somewhere around 6.5% of their business income earned in New York. But calculating your exact New York State corporation taxes can take some work.

First, you have to calculate three different amounts:

The final amount that you pay is equal to whichever of these amounts is the greatest.

You May Like: How To Reduce Federal Taxes

New York Tax Deductions

Income tax deductions are expenses that can be deducted from your gross pre-tax income. Using deductions is an excellent way to reduce your New York income tax and maximize your refund, so be sure to research deductions that you mey be able to claim on your Federal and New York tax returns. For details on specific deductions available in New York, see the list of New York income tax deductions.

Will Tax Refunds Be Bigger In 2023

In November 2022, the IRS warned that tax refunds issued in 2023 may be smaller. This is because taxpayers won’t be receiving any Economic Impact Payments as they did in the past.

Taxpayers will also have to submit Form 1099-K for third-party transactions that exceed $600. In the past, 1099-Ks were only issued for transactions if the number of transactions exceeded 200 for the year and the aggregate amount of these transactions exceeded $20,000.

The IRS also stated that if a taxpayer doesnt itemize and take the standard deduction, they wont be allowed to deduct charitable contributions. This year, the IRS raised the standard deduction for all categories of taxpayers. They are as follows:

- Single or married filing separately, $12,950

- Head of household, $19,400

Read Also: How To Get Your Property Taxes Lowered In Texas

Sales Tax Considerations For Out

If you have sales tax nexus in New York, youre required to register with the New York Department of Taxation and Finance and to charge, collect, and remit the appropriate tax to the state. Out-of-state sellers with no physical presence in a state may establish sales tax nexus in the following ways:

- Affiliate nexus: Having ties to businesses or affiliates in New York. This includes, but isnt limited to, the design and development of tangible personal property sold by the remote retailer, or solicitation of sales of goods on behalf of the retailer. More details on affiliate nexus in New York.

- : Having an agreement to reward a person in New York for directly or indirectly referring potential purchasers of goods through an internet link, website, or otherwise, and:

- The total cumulative sales price from such referrals is more than $10,000 during the preceding four quarterly sales tax periods.

Filing When Your Business Has Collected No Sales Tax

Once you have a New York Sales Tax Certificate of Authority, youre required to file returns at the completion of each assigned collection period regardless of whether any sales tax was collected. When no sales tax was collected, you must file a “zero return.

Failure to submit a zero return can result in penalties and interest charges.

Don’t Miss: Where Is The Cheapest Place To Get Taxes Done

Remember To File For S Corporation Status

âS corporation is a special federal tax statusâ granted by the IRS. A corporation meeting the qualifications can get it by successfully filing IRS Form 2553. If youâve done this, many states will recognize your S corporation status when you file your state taxes. New York State however, will not.

Even if you have successfully filed a Form 2553 with the IRS, you must file another separate form with New York State to be considered a New York S corporation: Form CT-6 .

If you fail to file a CT-6, you will be taxed like a traditional C corporation, which pays a slightly higher New York franchise tax than S corporations do and misses out on the other tax advantages of S corps.

Further reading:S Corps vs C Corps: Advantages and Disadvantages

Business Return Electronic Filing Information

Business Electronic Filing Mandate – If a tax return preparer prepared at least one authorized tax document for more than 10 different taxpayers during the previous calendar year and will use tax software to prepare one or more authorized tax documents in the current calendar year, or were previously mandated to e-file, the preparer is subject to the e-file mandate. The mandate applies to both original returns and amended returns.

This mandate applies to Corporation, Partnership, and S Corporation returns, and there is no opt-out provision. Tax preparers are subject to a $50 penalty for each tax document that is not filed electronically unless it is due to reasonable cause and not due to willful neglect. Reasonable cause will be considered on a case by case basis.

E-File Registration Requirements – Electronic return originators authorized by the IRS to e-file federal corporation tax documents are also authorized to e-file corporation tax documents with New York State . NYSDTF does not require EROs to apply to their program, or to provide copies of their IRS acceptance letters to NYS.

Tax Years That Can Be E-Filed Current year and 2 prior years

Read Also: Do You Pay Federal Taxes On Unemployment

If You Had Us Income During 2020 You May Need To File A State Tax Return

State taxes may have different residency guidelines than US taxes. For a fee, you can use Sprintax to file your state taxes. There are two easy ways to access Sprintax:

You may need to file for every state you lived and/or worked in for 2020. Remember, you cannot electronically file your tax return if youre using Sprintax and filing as a nonresident for US tax purposes.

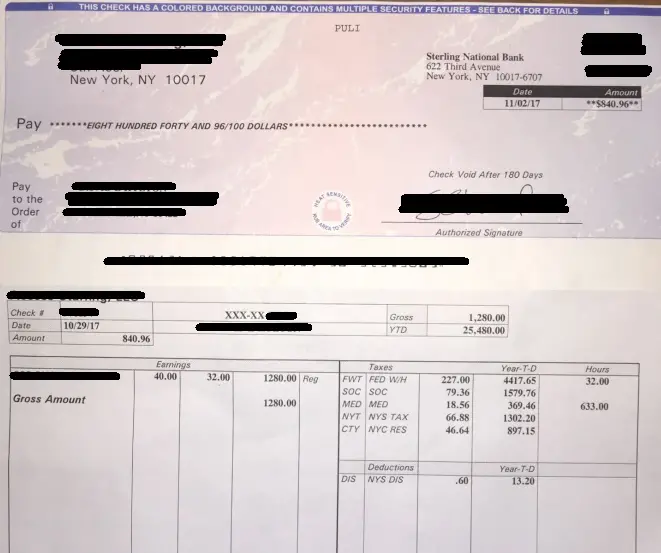

NEW YORK STATE and CITY TAX

You must file a NY Tax Return if:

- You are a NY resident and you filed a US tax form for 2020 or

- You had NY income greater than $4,000 in 2020 or

- You want a refund of NY State or City taxes withheld from your paycheck in excess of what you actually owed.

NEW JERSEY STATE TAX

- International students, professors and scholars are considered non-residents for NJ state tax purposes unless they had a permanent home in NJ.

- Make sure to confirm your own tax residency to determine your tax filing status NJ state.

- Use the appropriate NJ tax form:

- Either NJ resident tax form NJ-1040

- or NJ nonresident tax form NJ-1040NR.