Returns From Previous Years

You can file your original 2018, 2019 and 2020 income tax returns in the four-year period following the taxation year covered by the return .

If you did not file an income tax return for the 2018, 2019 or 2020 taxation year, and we sent you a notice of assessment for the year covered by the return, you cannot file an original return using authorized software. You have to mail the return to us.

What Happens If A Deceased Person Owes Taxes

If a deceased person owes taxes, any outstanding tax returns will need to be prepared and filed and any final tax payments will need to be made. This includes both federal and state tax payments, and it also includes not only the tax year in which the person died, but also any previous years in which the deceased did not pay their taxes. If a loved one experienced a prolonged illness, for example, they may not have prioritized tax filing. In that case, you may need to ensure that all outstanding tax returns are filed and any owed balance is paid.

Be aware that not just anyone can file taxes for a deceased person. If you are a surviving spouse of a deceased person and you have previously filed taxes as married filing jointly, you can maintain that filing status for the tax year in which your spouse passed away and include both of your income, deductions and credits in the filing.

If the deceased does not have a surviving spouse, a personal representative must take the responsibility of filing any outstanding taxes. This personal representative is generally the person responsible for the deceaseds property, such as an executor or administrator. You might be the personal representative for a deceased parent, for example.

How To Amend Your Prior

If it turns out that you made an error on your nonresident alien tax return, you can easily fix it! Simply, follow the steps in the article above.

A tax return can be considered incorrect for many reasons. And while making a mistake is not such a big deal, its crucial to file an amended tax return, where appropriate.

Read Also: Are There Tax Credits For Solar Panels

Help Filing Your Past Due Return

For filing help, call or for TTY/TDD.

If you need wage and income information to help prepare a past due return, complete Form 4506-T, Request for Transcript of Tax Return, and check the box on line 8. You can also contact your employer or payer of income.

If you need information from a prior year tax return, use Get Transcript to request a return or account transcript.

Get our online tax forms and instructions to file your past due return, or order them by calling 800-TAX-FORM or for TTY/TDD.

If you are experiencing difficulty preparing your return, you may be eligible for assistance through the Volunteer Income Tax Assistance or the Tax Counseling for the Elderly programs. See Free Tax Preparation for Qualifying Taxpayers for more information.

Benefits Of Using Infreefile Are:

- Faster refunds: A paper-filed return can take up to 8 weeks versus up to 2-3 weeks for an electronically filed return.

- Confirmation: Youll receive confirmation that your return was received and accepted.

- 24/7 access: You can access INfreefile at any time, day or night.

- Easy to use: All INfreefile options are user-friendly and include step-by-step instructions.

- Fewer errors: Electronically filed returns have a 2% error rate, compared to a 20% error rate for paper-filed returns.

- More efficient: You can prepare and file your federal and state tax returns at the same time.

- Convenient:INfreefile provides the added convenience of direct deposit for refunds and direct debit for payment of taxes owed.

Free File partners are online tax preparation companies that offer what is called the IRS Free File program, which provides free electronic tax preparation and filing of federal tax returns at no cost to qualifying taxpayers . Not all companies that participate in the IRS Free File program offer free state filings. Those vendors who participate in INfreefile must meet Indianas software certification requirements to ensure an accurate product.

The IRS and DOR do not endorse any individual partner company. The links below will take the user to sites provided by the vendor and are not maintained or controlled by DOR. Any other links used to access vendor websites may result in fees or charges. Please review each vendors offerings, including limitations and exclusions, carefully.

Read Also: When Do I Have To File My Taxes By

Efile For A Fee Other Available Efile Options

If you don’t qualify for free electronic filing, please visit the listing of the approved software productsto determine which software product will meet your filing needs.

- Be sure the product that you select supports the forms you want to file

- If the product that you select does not offer payment options, you can use our website to pay your taxes online

To find out if you qualify to use free software, review the eFile for Free options listed above.

File Your Taxes For Free

We are currently closed for the season. Please check back in early 2023 to see where well be operating our free tax preparation sites. We look forward to seeing you next season!

If you are in need of immediate assistance, please contact the IRS. Contact information for the IRS can be found here:

If you were a tax client in 2022 and need assistance from a Free Tax team member, please contact us at .

Also Check: How Much Income To File Tax Return

Can I Still Get A Refund From Filing Back Taxes

If the IRS owed you a tax refund any year, you need to file your return within three years of the original due date or you forfeit your refund. If you had filed for a tax extension that year, your due date was likely October 15.

The three-year deadline also applies to individuals who would have gotten a refund only because of certain tax credits, like the earned income tax credit.

If you need to file a tax return for multiple years, the IRS may also withhold all of your refunds until you file all of your back taxes.

Read more: Will I get a tax refund this year?

Why File A Tax Return

Taxpayers are required by law to file an income tax return for any year in which a filing requirement exists.

There are numerous practical reasons to file tax returns. Important programs like federal aid to higher education require applicants to submit copies of tax returns to qualify for loans. Lending institutions also may require copies of filed returns for buying a home or financing a business.

And the filing of tax returns can have a tremendous impact on your future. A persons lifetime earnings as reported to the IRS and the Social Security Administration are the basis for Social Security retirement and disability benefits as well as Medicare. Reported income is also the source for state benefits such as unemployment compensation and industrial insurance.

Recommended Reading: Can I Still File My Taxes After The Deadline

All You Need To Know Is Yourself

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Read Also: Raffle Tickets Tax Deductible

When To File An Amended Tax Return

- you filed by mistake with the incorrect tax filing status

- you learned you forgot to claim a credit or a tax deduction you are entitled to

- you must either remove or add a dependent

- you neglected to include taxable income on your tax return.

- you found out that you claimed a cost, deduction, or credit for which you were not entitled.

Just bear in mind that the IRS restricts the period of time you have to file an amended return in order to get a refund to:

- Within three years following the initial filing deadline, or

- within two years after paying the tax owed for that year, whichever comes first.

If youre outside of that time frame, you wont be able to get a refund by changing your return.

Also Check: Is Money From Plasma Donation Taxable

Also Check: Which Ira Is After Tax

If You Owe More Than You Can Pay

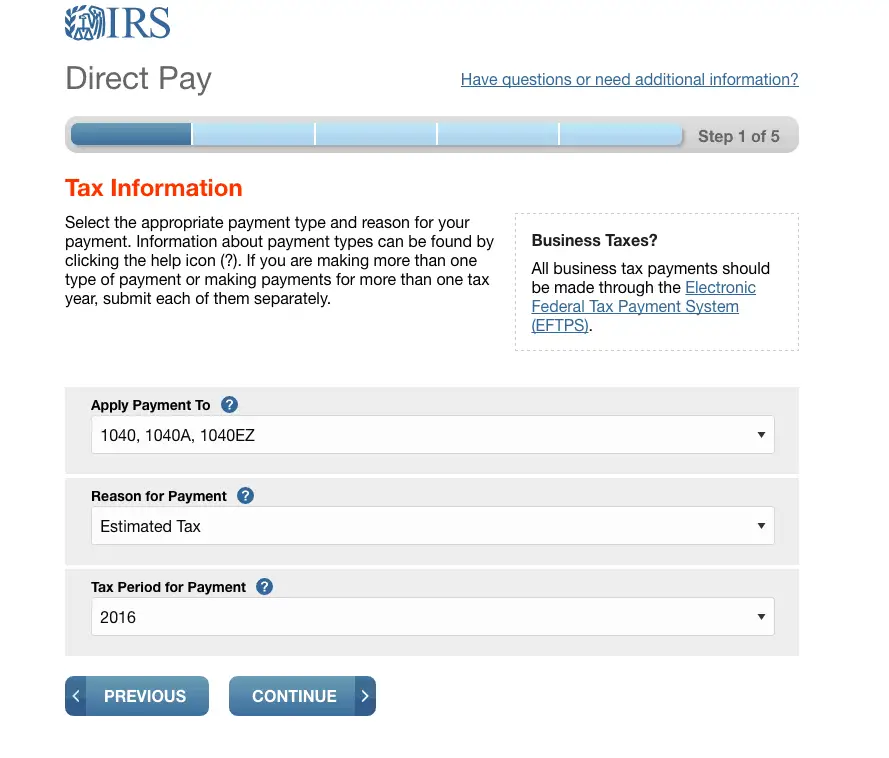

If you cannot pay what you owe, you can request an additional 60-120 days to pay your account in full through the Online Payment Agreement application or by calling no user fee will be charged. If you need more time to pay, you can request an installment agreement or you may qualify for an offer in compromise.

How Do I File Back Tax Returns

You can use TaxSlayer to file a return for up to three years after it is due. So for example, in 2022, you can file back taxes for years 2018, 2019, and 2020.

Simply log into your account or create a new account to begin. Then click on the Prior Years tab in the middle of the My Account page. Select the year you wish to create and click Start a New Tax Return. From there, youll enter the income and expense information for the year you are filing.

Once your return is complete, you will need to print out and mail in the paper copies of your forms. This is because the IRS does not support filing prior year returns electronically. The mailing address for the IRS can be found herebased on the state where you live.

When you file back taxes with TaxSlayer, you get all the correct forms and instructions for the specific year you are completing.

Don’t Miss: What Is Tax Liability Zero

Filing Your Own Return

You can use commercial software to complete your income tax return and file it online using the integrated NetFile Québec feature.

When you file your income tax return online, do not send us any paper copies of the return.

Important

When you file your return online, you get a confirmation message containing a reference number. Make sure you get one after filing.

End of note

You can file your 2021 income tax return as of February 21, 2022.

A File Taxes Online With Tax Software

If youve used tax software in the past, you already know how to prepare and file taxes online. Many major tax software providers offer access to human preparers, too.

TurboTax, H& R Block, TaxAct and TaxSlayer, for example, all offer software packages or support options that come with on-demand, on-screen or online access to human tax pros who can answer questions, review your return and even file taxes online for you.

The IRS Free File program can get you free online tax preparation software from several tax-prep companies, including major brands. You must have less than $72,000 of adjusted gross income to qualify.

You May Like: Does Doordash Tax Your Earnings

You May Like: Can I File Bankruptcy On State Taxes Owed

How To File Your Taxes Online For Free

Anyone with simple tax returns can file their taxes for free. Here are some optionsand how to use them.

For the past six years, Milagros Melendez, a 72-year-old retired home-care worker, has filed her taxes digitally with the help of volunteer tax professionals in an immigrant-assistance program.

The program, called the Volunteer Income Tax Assistance , is just one of many free tax filing options available to consumers.

For Melendez, who lives in a predominantly Latino neighborhood in Northern Manhattan, the free service offers peace of mind. Her tax preparation is performed by volunteers who speak Spanish and who must take and pass tax-law training that meets or exceeds Internal Revenue Service standards.

Ive never dedicated myself to learning about taxes, it just wasnt my area of expertise, she says.

Plus, now that shes retired and on a fixed income, using the free tax prep service eliminates a financial burden. Before, she would go to her neighborhood tax preparation service, a travel agency, which, she says, charged her around $125.

And since the service files her taxes digitally, the time for processing and delivery of any refund is expedited.

With that in mind, here are some options to consider.

Irs Free File Program

Many Americans are eligible to file their taxes for free through the IRS Free File program, which is a public-private partnership between the agency and the Free File Alliance, a group of tax preparation companies with online software such as TaxAct, FreeTaxUSA and others.

In 2020, 4.2 million Americans used the Free File program for their 2019 taxes, according to the IRS. While that was a nearly 50% increase from the previous year, more could still use the program.

If your annual gross income in 2021 was less than or equal to $73,000, you can use one of the Free File software programs to submit federal taxes free of cost. In addition, some products will also let you file your state taxes for free. The software generally includes step-by-step instructions and help for filers.

This year it may be especially important for Americans to use the service, as it will help them file electronically. The IRS has recommended that people file online and receive any refunds through direct deposit this year to avoid delays.

To use the program, you must go through the IRS site not directly to a tax preparer. The program opened Jan. 14.

There are also free basic tax preparation services offered through the IRS Volunteer Income Tax Assistance and Tax Counseling for the Elderly programs, called VITA and TCE, respectively.

Recommended Reading: How Do I Pay My State Taxes In Missouri

Monitor Your Tax Status

Register for an account with the Georgia Tax Center and you can sign up to receive notifications when any activity takes place on your account. These notifications help you monitor your tax status and help combat fraudulent activity.

After filing, use Where’s My Refund? to track the status of your refund.

Determine Whether The Deceaseds Tax Records Are Current

Before filing taxes for a deceased person, check to see how many outstanding tax returns they might owe. If that information is not in their personal records, the IRS has a guide to help you through the process of requesting previous-year tax information for a deceased person, including sending the IRS a death certificate and proof of your relationship to the deceased.

Its worth noting that you may be responsible for filing two years worth of tax returns on behalf of the deceased person even if their taxes were previously up to date. If the deceased passed away in the first part of the year, for example, they might owe taxes on the previous year as well as the portion of the current year in which they were alive.

Dont Miss: Reverse Ein Search

Don’t Miss: How To Maximize Tax Return

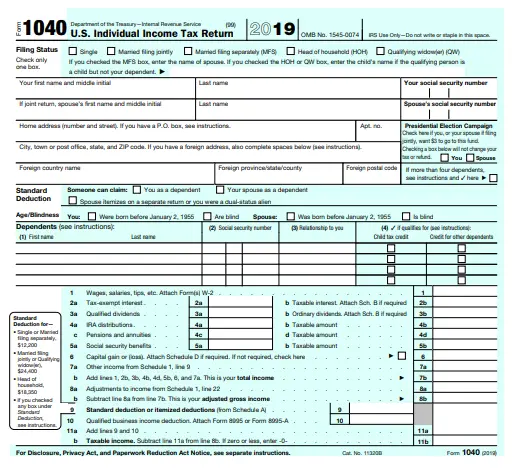

Complete The Right Tax Forms

IRS forms change from year to year, so you need to make sure you use the forms for the tax year you need to file. If you use online tax software to file a return, make sure you select the correct year in the software.

If youâre filing without the help of software, you can and instructions for completing those forms at IRS.gov.

You can also work with a professional tax preparer if you donât feel comfortable filling out the forms on your own.

City Of Detroit Income Tax E

City of Detroit tax returns for 2015, 2016 and 2017 including amended 2017 tax returns will be accepted during the 2018 processing year.

Michigan, along with many other state revenue agencies, is requesting additional information in an effort to combat stolen-identity tax fraud to protect you and your tax refund. If you have a drivers license or state issued identification card, please provide the requested information from it. Your return will not be rejected if you do not have a drivers license or state-issued identification. Providing the information could help process your return more quickly. View more information regarding identity theft.

E-file is a safe, fast, and easy way to file your tax return. This filing option is now available for City of Detroit Individual Income Tax Returns.

E-File with Commercial Tax Software Do it yourself. Buy tax preparation software either over-the-counter or online, and prepare your own return.

E-File through a Paid Tax Preparer Find a tax professional you trust to prepare and e-file your return. Most tax preparers use e-file and many are required to do so. To find an e-file provider in your area, search the IRS Authorized e-file Provider Locator.

Wheres My RefundE-Service is the quickest way to check the status of your refund. Please allow 14 days before checking the status of your e-filed return.

If submitting payment by mail, send a completed form 5122 City Income Tax e-File payment voucher , with payment to:

You May Like: How Do You Do Your Own Taxes Online

File State Federal And Local Taxes

Once you have collected the appropriate information, its time to fill out the various tax forms and file taxes on behalf of the deceased. Depending on where the deceased lived and the type of work they did, you may need to file state, federal, local and/or business taxes on their behalf.

Filing taxes for a deceased person can be as simple as completing a married filing jointly form as a surviving spouse, or it can be much more complicated. If you have any questions about the process at any point, consult a CPA or tax professional.

You should also consider the deceased persons effect on your own taxes. Surviving spouses are entitled to their own tax benefits, such as special tax rates. If you are filing taxes on behalf of a deceased person who was also your dependent, youll be able to claim the dependent on your tax return during the year of their death, even if they died early in the year.