Failure To Pay Penalty

A failure to pay penalty applies if you dont pay the tax you report on a tax return by the due date or an approved extended due date. The penalty is calculated as a percentage of the taxes you didnt pay: 0.5% of your unpaid taxes for each month the balance goes unpaid.

The maximum penalty the IRS can charge is 25% of your unpaid taxes. The IRS charges interest on the penalty here, too.

If you have to pay both a failure to file penalty and a failure to pay penalty in the same month, the IRS reduces the amount you owe. The combined penalty comes out to 5% for each month or part of a month your return was late.

For example, instead of hitting you with a 5% failure to file penalty for a month, the IRS will charge a 4.5% failure to file penalty and a 0.5% failure to pay penalty, for a total of 5% of your unpaid taxes.

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Getting Started With Your State Income Taxes

Whether you e-File or file by paper, planning ahead will help you avoid problems and delays with your income taxes.

First: View the Individual Income Filing Requirements to determine if you should file a North Carolina individual income tax return.

Second: determine your federal adjusted gross income, which is the starting point for your State individual income tax return. You determine that figure by completing a federal income tax return. Visit the Internal Revenue Service webpage to help you get started with your federal return.

Once you have determined that you should file, review these tips to give you a head start on your State income taxes:

Remember: Please don’t file photocopies of tax forms. That could delay the processing of your return or cause errors that would require you to file an amended return.

Don’t Miss: Where Can I Get 1040 Tax Forms

We Provide Qualified Tax Support

E-files online tax preparation tools are designed to take the guesswork out of e-filing your taxes. Our program works to guide you through the complicated filing process with ease, helping to prepare your return correctly and if a refund is due, put you on your way to receiving it. Should a tax question arise, we are always here help and are proud to offer qualified online tax support to all users.

If youve ever tried calling the IRS during the tax season, you probably know that telephone hold times at peak periods can be hours long. Our dedicated support team enables customers to get their questions answered just minutes after a question is sent, even during peak times. Simply send us a help request from within your account and our experts will begin working on your problem and get you an answer as quickly as possible. Prefer to call us? We also provide full telephone support to all taxpayers filing with our Deluxe or Premium software.

Also Check: How To Avoid Taxes On Lump Sum Payout

Many Taxpayers Can File Their State And Federal Tax Returns For Free

IRS Tax Tip 2021-10, February 1, 2021

As taxpayers get ready to file their federal tax returns, most will also be thinking about preparing their state taxes. There’s some good news for filers wanting to save money. Eligible taxpayers can file their federal and, in many cases, their state taxes at no cost.

Taxpayers whose adjusted gross income was $72,000 or less in 2019 can file their 2020 federal taxes for free using IRS Free File. Many of them can also do their state taxes at no charge. They do so through Free File offered by the IRS.

Don’t Miss: When Are Estimated Taxes Due 2021

Extension To File Your Tax Return

If you cant file your federal income tax return by the due date, you may be able to get a six-month extension from the Internal Revenue Service . This does not grant you more time to pay your taxes. To avoid possible penalties, estimate and pay the taxes you owe by the tax deadline of April 19, 2022, if you live in Maine or Massachusetts or April 18, 2022, for the rest of the country.

Welcome To Maine Fastfile

Maine Revenue Services solution to fast and secure tax filing. The Maine Fastfile service provides three options:

Modernized e-File e-File using tax preparation softwareThis service is offered through the IRS and provides one stop processing of federal and state returns. This is the do it yourself option through the purchase of tax preparation software either over-the-counter or online, prepare your own return and press send to e-file. Your return is sent through safe and secure channels, not via e-mail. Prices do vary so shop around .

OR e-File through a paid tax professional

Find a tax professional you trust to prepare and e-file your return. Nearly all tax preparers use e-file now and many are now required by law to e-file. But its still a good idea to tell your tax preparer you want the advantages of e-file your refund in half the time, or if you owe, more payment options.

Maine i-File i-File free for Maine taxpayersThis service is available for filing your individual income tax return including the Maine property tax fairness credit. The advantages of Maine i-File are:

Certain restrictions apply. See the directions page of the i-File application for more information.

Read Also: When Will I Get My Federal Tax Refund

Don’t Miss: How To Opt Out Of The Child Tax Credit

Why Is Turbotax Charging Me

If you make less than $36,000 a year and TurboTax is telling you it costs money to file, you are probably using the wrong version of TurboTax. Dont worry, there is a way to access the truly free version.

As ProPublica reported last year, TurboTax purposefully hid its Free File product and directed taxpayers to a version where many had to pay, which is called the TurboTax Free Edition. If you clicked on this FREE Guaranteed option, you could input a lot of your information, only to be told toward the end of the process that you need to pay.

You can access TurboTaxs Free File version here. This version is offered through the Free File agreement.

TurboTaxs misleading advertising and website design directed users to more expensive versions of the software, even if they qualified to file for free. After our stories published, some people demanded and got refunds. Intuit, the maker of TurboTax, faces several investigations and lawsuits because of this. The company has denied wrongdoing.

Following ProPublicas reporting, the IRS announced an update to its agreement with the tax-preparation companies. Among other things, the update bars the companies from hiding their Free File offerings from Google search results. It also makes it so each company has to name their Free File service the same way using the format: IRS Free File Program delivered by .

Read Also: How Long Should We Keep Tax Records

What You Need To Fileand When

If you are a non-resident for tax purposes who received income in the U.S. during the last calendar year, you must file a tax return with the U.S. government. In addition to filing a federal tax return, you will likely need to file a return on the state level, as well.

Federal Tax Return

Federal taxes are those paid to the U.S. central government Internal Revenue Service . OIA pays for software licenses for our international population to use a special non-resident tax filing software for their federal returns only.

State Tax Return

In addition to a federal tax return, many will also have to file a State of Illinois income tax return. If you resided and/or worked in more than one U.S. state during the past calendar year, you may have to file tax returns in all of the states in which you resided or worked. You should check the state revenue website of the other state where you lived and worked to figure out your tax filing obligations. There will be a fee to use Sprintax to file a state tax return as the code provided by OIA only covers the federal return.

Don’t Miss: How Do I Find My Business Tax Id Number

How Do Social Security Benefits Impact Filing Requirements

Now that you know your gross income is a primary factor in whether you have to file taxes, you may be wondering how Social Security benefits factor in.

In some cases, you wont need to pay taxes on your Social Security, but it all comes down to your combined income.

Combined income includes:

-

Half of your Social Security income

-

Your tax-exempt interest

Youll need to pay taxes if your combined income is greater than $25,000 as an individual or greater than $32,000 if married filing jointly. However, you wont pay taxes on more than 85% of your Social Security benefits. How much of your Social Security income is subject to tax will depend on your combined income.

If youre filing as an individual and your income is between $25,000 and $34,000, 50% of your benefits are taxed0. If your income exceeds $34,000, 85% of your benefits are taxed.

If youre filing a joint return, 50% of your benefits are taxed if your income is between $32,000 and $44,000. If your income exceeds $44,000, 85% of your benefits are taxed.

For each year you receive Social Security, you should receive a Form SSA-1099 from the Social Security Administration. This form is for tax-filing purposes and outlines how much you received in Social Security benefits for the year.

Consequences Of Not Filing

State tax penalties can be just as harsh as those imposed by the IRS. In the most severe cases, the state can even prosecute you for a crime if it believes that your failure to file tax returns was part of a fraudulent scheme. Just like other crimes, the punishment can include time in jail.

However, the majority of taxpayers who don’t file their state returns are only subject to penalties, interest and other fees in addition to the amount of tax due. And since your account is charged on a monthly basis, the longer you wait, the more you’ll pay. Some states can even put liens on your property, seize your assets, garnish wages and intercept a federal tax refund if too much time passes without any tax return or tax payment.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

Also Check: Where Can I Get Taxes Done For Free

The Legality Of Filing Without Your W

If you file electronically, you will have no problem filling your taxes without having your W-2. However, you still need the information from the W-2 in order to accurately do your taxes. Some of the things you will need are:

- Medicare tips and wages

- Withheld Medicare tax

- Any withheld local income taxes

Although it is not necessary to submit a W-2 copy when you file electronically, you will have to enter the information found on this form. It is still very important to make sure your W-2 stays in a safe place because you may need it at some point. For instance, it may be required for background checks, for an audit, or other similar situations.

Keep in mind that you will have to produce the W-2 and other documents in case of an audit. They will allow you to show evidence of your income, as well as withholding. If you are unable to show that you entered those numbers in good faith, you may end up dealing with legal problems.

The employer is the one who should file the W-2 form with the Social Security Administration. This has to be done before the end of January. Also, the information will be shared by the SSA with the IRS. This is how they will be able to tell whether you and your employer reported different numbers, in which case an audit will take place.

Heres A Few Things For Taxpayers To Know About Filing State Tax Returns Through Free File

- Most people make less than the $72,000 income limit. So, most people can use Free File.

- Generally, taxpayers must complete their federal tax return before they can begin their state taxes.

- More than 20 states have a state Free File program patterned after the federal partnership. This means many taxpayers are eligible for free federal and free state online tax preparation.

- The states with a Free File program are Arkansas, Arizona, Georgia, Idaho, Indiana, Iowa, Kentucky, Massachusetts, Michigan, Minnesota, Missouri, Mississippi, Montana, New York, North Carolina, North Dakota, Oregon, Rhode Island, South Carolina, Vermont, Virginia and West Virginia, plus the District of Columbia.

- IRS Free File partners feature online products, some in Spanish. They offer most or some state tax returns for free as well. Some of them may charge so its important for taxpayers to explore their free options.

- Free File partners will charge a fee for state tax return preparation unless their offer says upfront the taxpayer can file both federal and state returns for free. Taxpayers who want to use one of the state Free File program products should go to their state tax agencys Free File page.

- Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming dont have an income tax. So, IRS Free File for a federal return may be the only tax product people in those states need.

Don’t Miss: Why Does It Cost So Much To File Taxes

What Customers Are Saying:

I really was impressed with the prompt response. Your expert was not only a tax expert, but a people expert!!! Her genuine and caring attitude came across in her response…

T.G.WMatteson, IL

I WON!!! I just wanted you to know that your original answer gave me the courage and confidence to go into yesterday’s audit ready to fight.

BonnieChesnee, SC

Great service. Answered my complex tax question in detail and provided a lot of additional useful information for my specific situation.

JohnMinneapolis, MN

Excellent information, very quick reply. The experts really take the time to address your questions, it is well worth the fee, for the peace of mind they can provide you with.

OrvilleHesperia, California

Wonderful service, prompt, efficient, and accurate. Couldn’t have asked for more. I cannot thank you enough for your help.

Mary C.Freshfield, Liverpool, UK

This expert is wonderful. They truly know what they are talking about, and they actually care about you. They really helped put my nerves at ease. Thank you so much!!!!

AlexLos Angeles, CA

Thank you for all your help. It is nice to know that this service is here for people like myself, who need answers fast and are not sure who to consult.

GPHesperia, CA

You May Know About Ways To File Your Federal Income Tax Return For Free But What About Filing State Taxes For Free

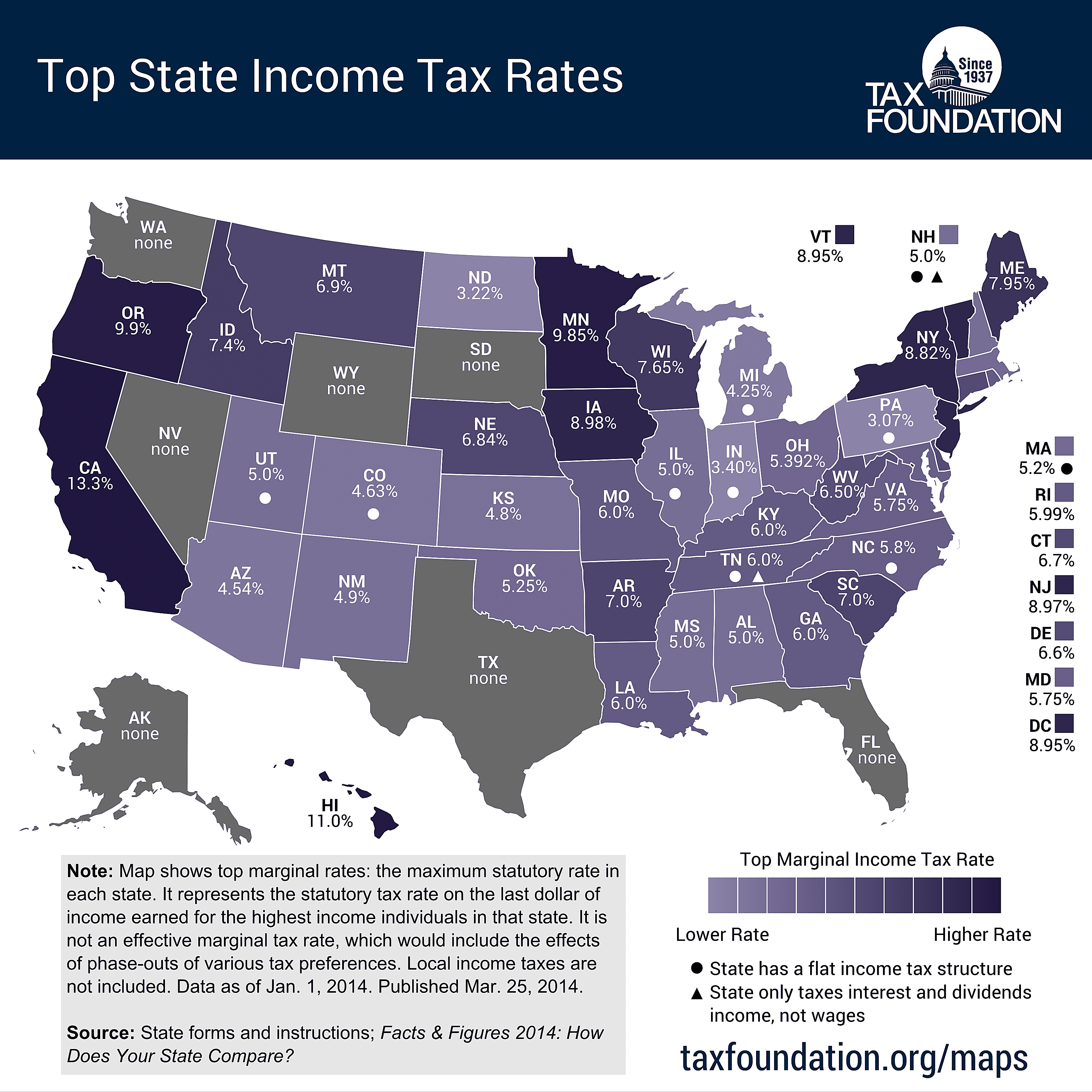

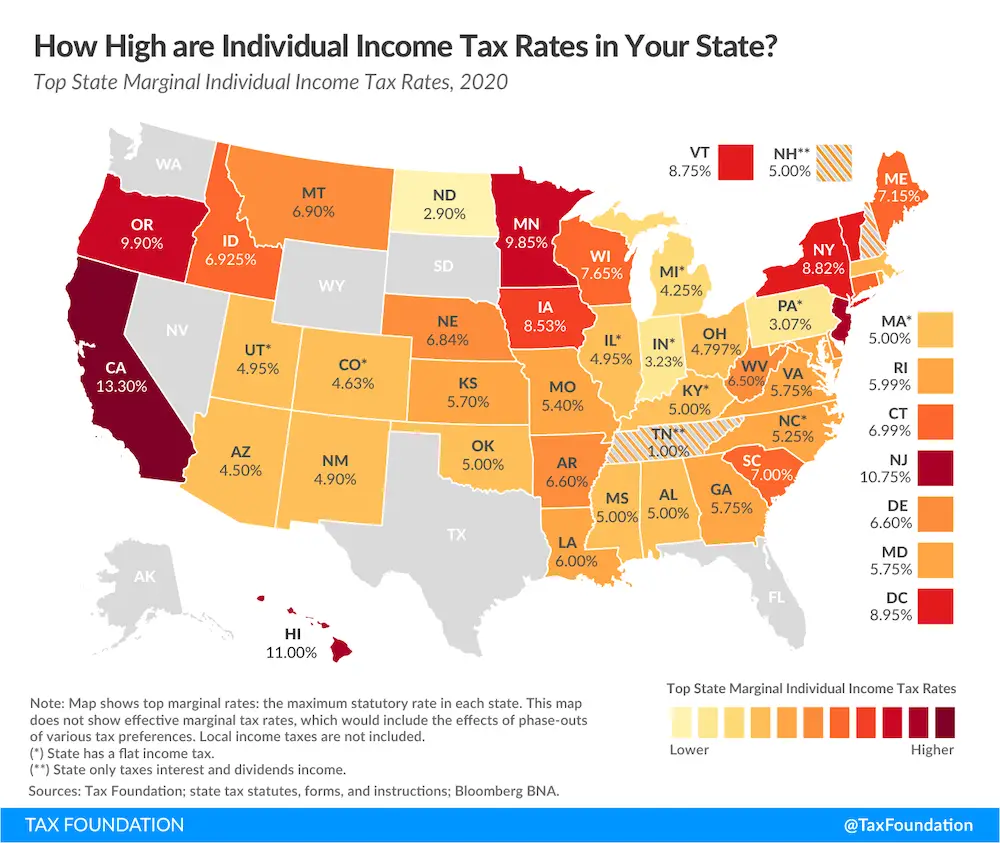

In 43 states and the District of Columbia, Americans have to pay some sort of state-level income tax as well as federal income tax. If you live in a state with a state-level income tax, you may dread the idea of paying someone to complete yet another tax return for you.

If so, youll be happy to know that its possible to file state taxes without paying for it. Heres what you should know about filing your state taxes for free.

Recommended Reading: How Do Tax Write Offs Work For Llc

Protect Yourself From Tax

Tax ID theft occurs when someone steals your personal information to file a tax return using your personal data. Usually, the fraudulent tax filer will use your Social Security number to file your return in order to collect a refund. To protect yourself from tax ID theft, you can obtain a six-digit Identity Protection PIN from the IRS. IP PINs are known only to you and the IRS so the IRS is able to confirm your identity when you file your return. Learn more about how the IP PIN works and how to apply.

Need More Time About Tax Filing Extensions

You may find that you need additional time to file your taxes. This might be because you are waiting for an ITIN approval or missing some of your necessary documents. If you need additional time to file your federal return, you can file for an Automatic Extension of Time to File Your U.S. Tax Return. You should submit the extension form before the deadline listed above. More information can be found on the IRS link above.

You May Like: How To Get Stimulus Check On Tax Return