Tax Accountants For Independent Contractors In Roseville And Sacramento Ca

Complying with tax laws can be tricky, particularly if this is your first time operating a sole proprietorship or working as an independent contractor. If you are self-employed, make sure you have small business accounting support from a skilled and experienced tax professional.

Cook CPA Group works with independent contractors in all types of industries throughout the Sacramento and Roseville, CA areas. For a free consultation about taxes for independent contractors in California, contact our Sacramento CPA firm online, or call our law offices today at 432-2218.

Consulting Services

Pay Quarterly Estimated Tax Payments

If you expect to owe more than $1,000 in annual taxes as an independent contractor, the IRS requires you to either pay quarterly estimated tax payments or pay an underpayment penalty fee during tax season . You can use Form 1040-ES to calculate and pay your estimated taxes to state and federal governments, based on your adjusted gross income.

The deadlines to pay estimates are generally April 15, June 15, September 15, and January 15, unless those days fall on a weekend or federal holiday .

Self Employment Income Tax Preparation Checklist

The 1099 tax checklist includes:

- Record of all the income received.

- Record of all business expenses

- Draft estimated quarterly taxes.

- File annual tax return.

- Congrats yourself for fulfilling your tax responsibilities well.

Always remember that every taxpayer should honestly pay his/her taxes. You should never withhold taxes. Paying taxes is your duty towards your country. If you need any advice for tax payment, contact a tax professional.

Have more admin than you know what to do with?

Tame your admin inbox with an Indy account. Use smart templates and clever tools to manage your proposals, contracts, invoices, payments, and files all in one place.

You May Like: How Much Is Lottery Tax

How Are Independent Contractors Taxed

Independent contractor taxes are based on the Internal Revenue Services self-employment tax rates. Therefore, businesses that hire self-employed contractors do not have to withhold taxes from wages.

If you earn $400 or more per year, you must file a Form 1040, Schedule SE, and Schedule C.

Anindependent contractor must also pay self-employment tax quarterly. These contribute to Social Security and Medicare. However, unlike employees whose employers hold taxes, contractors must use their taxes to cover these expenses.

You can report quarterly estimates on a Form 1040-ES, Estimated Tax for Individuals.

A freelancer can submit Form 1099-NEC and Form 1040, Schedule C, to the IRS at the end of the year. This will account for their total tax liability it will also entitle them to any refund from estimated taxes they paid earlier in the year.

Businesses that hire contractors do not pay any taxes on their behalf, and they do not file taxes for them. Therefore, the freelancer must keep accurate financial records to file appropriately.

Tax Deductions For Independent Contractors

You can reduce your business income by taking deductions for business expenses. To be deductible, these expenses must be for the purpose of making a profit. They must also be ordinary and necessary .

See the list of allowable expense deductions on Schedule C. Here are some important deductions you may be able to take, depending on your business situation.

“Cost of goods sold” is a separate calculation on Schedule C for materials, labor, shipping, and other costs for producing products for resale.

Home business costs are for the space you use as a home office or for other business uses. You can only deduct the space you use regularly and exclusively . This deduction is calculated on IRS Form 8829 for actual expenses or Schedule C using a simplified method for smaller spaces.

Business driving expenses are deductible in your independent contractor business. If you use a vehicle for both business and personal driving, you can only deduct business use, using either actual expenses or a standard mileage rate that changes every year. Report these expenses on Schedule C.

If your business owns major assets, like a car, a building, furniture, or equipment, you can deduct the costs over several years. This process, called “depreciation,” is a non-cash deduction that is reported separately. Use IRS Form 4562 to calculate depreciation and report it on Schedule C.

You May Like: When Do Llc File Taxes

Will I Have To Pay Someone Else To Do My Taxes

You might be able to use one of these online business tax preparation services if you have a simple business tax return, with no employees or product inventory.

However, if you choose to do the work yourself, or just want to better manage your business in general, here are some of the best accounting apps for your bookkeeping and tax calculation needs.

What Is An Independent Contractor According To The Irs

Independent contractor is the term used by the IRS to designate a type of worker who contracts their services to a business. They are more like business partners or vendors than actual employees. Independent contractors don’t receive company benefits, and you don’t need to withhold payroll taxes from their compensation.

Read Also: Who Can Claim Education Tax Credit

Your Tax Liability As An Independent Contractor

With a federal tax code thatâs literally thousands of pages and can be considered an evergreen document due to the frequency of its revisions, itâs easy to be uncertain of exactly what you need to do to comply with the law.

If you work on a platform, you may get some assistance with sales tax if you sell things or local taxes. But generally speaking youâll want to get familiar with what youâre paying and to whom each tax year.

Are Independent Contractors Sole Proprietors

For income tax purposes, you’re probably considered a sole proprietor if you’re an independent contractor. A sole proprietor is the sole owner of a business that isn’t a partnership or a corporation.

The designation of sole proprietor is the default form of small business. You dont have to pay to register your business with your state, but you might want to register your business trade name with your locality or the U.S. Patent & Trademark Office .

You May Like: How Much Tax Do You Pay On Social Security

Tip #: Keep Track Of Your Business Expenses

Apart from some larger tax write-offs we mentioned above, you can deduct a variety of smaller business expenses which can add up quickly and sneakily.

Thats why its essential to keep meticulous records of all your business costs together with receipts so that you can easily add them up come tax season.

These can be anything from your internet and phone bills to workday meals.

File Form 1040 And Appropriate Schedules

Independent contractors use Form 1040 to report and pay their small business taxes. Sole proprietorships and single-member LLCs report business income on Schedule C.

Report your business deductions in part two of Form 1040 Schedule C. Image source: Author

Have your accounting software open as you file your business taxes. Tax software can help you identify additional business tax deductions reported in part two of Schedule C.

Also Check: What States Do Not Tax Your Pension Or Social Security

The Freelancer Tax Preparation Checklist

Here is our 1099 taxes checklist.

- Maintain records of all income received

- Keep track of business expenses

- Plan to make estimated tax payments if necessary

- File annual tax return

- Pat yourself on the back for a job well done after completing all of your tax forms!

Always keep in mind that each taxpayer has a unique set of circumstances. If you have questions or need advice about your specific situation during tax time reach out to your tax professional.

Serina Griffin, EA

Serina is an enrolled agent who enjoys helping individuals and businesses optimize their tax and realize their goals. When she’s not thinking about tax she enjoys cooking, spending time with friends and hiking in the Pacific Northwest.

Find write-offs.

How Does A 1099 Contractor Get Paid

Independent contractors get paid in all the normal ways that are available to regular employees or businesses. Some may receive payment electronically on a project basis while others may contract their services on an hourly basis. There are also more formal arrangements where there is an agreement in place for services to be provided on an on-going basis for a period of time.

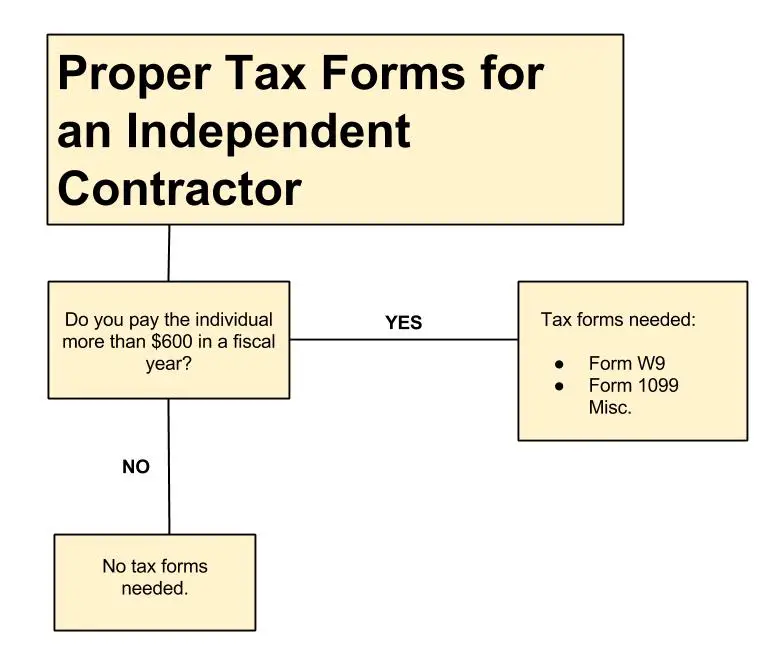

Are you a podcast host or a speaker? Have you provided a service or delivered a program for a school district or private organization. If so, you may have been asked to complete a Form W-9. Form W-9 is used to collect your taxpayer information so that organizations can maintain accurate records and report any payments made to you in a given year on Form 1099.Many contractors donât have a designated pay day in the same way an employee would. In some cases they may be paid upon completion of a product or service which for some independent contractors may be daily. Payday every day is a concept I can get behind! The main takeaway when it comes to payment, a freelancer has no tax of any kind withheld. Weâll explore exactly which independent contractor taxes you need to be on the lookout for later in the guide.

Also Check: How Much Is The Penalty For Filing Taxes Late

Estimating An Independent Contractors Federal Tax Liability

Figuring out exactly how much you owe in taxes can be challengingespecially if youre new to working as an independent contractor. Its not as simple as setting aside a specific percentage of your incomesay 25% or 30%because the amount youll ultimately owe depends on your tax bracket and the deductions and tax credits you may be eligible for.

Plus, your estimated taxes need to cover both federal income taxes and self-employment taxes: the independent contractors version of Social Security and Medicare taxes.

Select The Scenario That Applies To You:

- I am an independent contractor or in business for myselfIf you are a business owner or contractor who provides services to other businesses, then you are generally considered self-employed. For more information on your tax obligations if you are self-employed , see our Self-Employed Individuals Tax Center.

- I hire or contract with individuals to provide services to my businessIf you are a business owner hiring or contracting with other individuals to provide services, then you must determine whether the individuals providing services are employees or independent contractors. Follow the rest of this page to find out more about this topic and what your responsibilities are.

You May Like: What Is The Deadline To File Your Tax Return

A Guide On How To Pay Independent Contractor Taxes

Whether you work as an independent contractor or self-employed individual in blogging, tutoring, plumbing, or dog walking, you bring a unique set of skills to the world of work. Along with your unique knowledge and expertise, however, comes a distinctive pathway when it comes to navigating tax season and tax year. Unlike traditional employees whose employers withhold employment taxes for things such as Social Security and Medicare, a self-employed individual is required to sort through those numbers, percentages, and paperwork themselves.

Taking charge of your self-employment tax requirements can be a daunting task for even the most skilled professionals. That’s why we’ve put together a guide to simplify the business tax burden process and help you steer clear of any blunders when it comes time to file. Keep reading to learn how you can pay taxes as a contractor like a pro.

Independent Contractor Sole Proprietor And Self

- The term “independent contractor” describes how the person works and how much control the worker has over their work. The independent contractor isn’t controlled by an employer as an employee is.

- Independent contractors are considered self-employed, because they are in business for themselves.

- The term “sole proprietor” is a tax designation. It’s how a single owner of a business that is not a corporation pays taxes.

Also Check: How Is Capital Gains Tax Calculated On Sale Of Property

Set Up Dedicated Bank Accounts

The best way to stay on top of your income and expenses is to have at least 3 separate bank accounts:

With the first and second, you can easily separate your personal and business expenses. This will also help you with record-keeping.

The savings account can come in handy for allocating funds for taxes in advance, instead of waiting for the tax season.

Decide How Youll File

You have several options for filing taxes:

- You can use Free File, which is free, to file your federal individual tax returns

- You may be entitled to file for free through the Volunteer Income Tax Assistance program

- You could use an accountant or a qualified tax-preparation specialist to prepare and file your returns

- You could reach out to an IRS approved Modernized eFile provider

- You can print out all the forms and use the paper-and-pen approach to complete and file your returns

Check the IRS website for each of these options before you decide which one is best for you. For instance, Free File is only available for filers with an income of $66,000 or below, while VITA is only available to persons with disabilities or those who make $55,000 or less.

If you are computer-savvy and able to navigate your way through online tools, and your business structure isnt overly complex, then e-filing or using tax software for self-employed might be a good choice. If, however, you have complex filing requirements, then it might be worthwhile using a professional tax service to help you with your filing.

Here are some additional tips from the IRS to help you choose a tax return preparer.

Don’t Miss: How To Estimate My Tax Liability

How Does An Independent Contractor Pay Taxes

Things get a little more complicated with your taxes when youre an independent contractor. Youll have additional forms to file and youll need to file estimated taxes regularly. There are four main differences between filing taxes as an employee and filing taxes as an independent contractor. These include:

-

Reporting self-employment income and deductions on Schedule C.

-

Paying self-employment tax on Schedule SE.

-

Paying quarterly estimated taxes.

-

Receiving form 1099-MISC rather than a W-2.

Estimated Payments And Calculating Your Taxes

Estimated payments are required for individuals, including sole proprietors only if you expect to owe $1000 or more when your return is filed.

Schedule SE or form 1040-ES is used to figure and pay estimated tax. However, the easiest way to file quarterly taxes is electronically. There are options through the IRS website , EFTPS (Electronic Federal Tax Payment System or IRS2go app. There are tools available to help you figure out exactly how much you should expect to pay like Keeperâs estimated tax payment calculator.

If you think youâll owe tax and you also have W-2 income you can choose to adjust your withholdings to cover the overage. If you earn all of your income as an independent contractor, don’t expect a tax refund. You’ll be expected to owe and you may want to make quarterly estimated payments. Quarterly tax payments allow you to pay as you go as the tax system was designed and can help to avoid a large unexpected tax bill when you file your return.

When are quarterly estimated tax payments due? Well, quarterly tax payments are due on a schedule set by the IRS. Those dates are April 15, July 15, September 15 and January 15.

Also Check: How Are Lump Sum Pensions Taxed

Making Quarterly Tax Payments

If youre expected to owe $1,000 or more in taxes for the year, you have to make quarterly tax payments.

These quarterly tax payments are estimated, i.e. you need to make a calculated guess on how much you will owe, either based on your current income stream or your previous years tax obligations.

To calculate the quarterly amount you need to pay, you can use Estimated Tax Worksheet Form 1040-ES.

The four tax payments are due in the following months:

Of course, you wont know the exact amount youre due until you file the personal tax return at the end of the year so be careful with your estimates.

If you miss a quarterly payment or underestimate the amount, you may face penalties.

NOTE: The above are your federal tax obligations, but make sure not to neglect your state taxes as well.

How Much Tax Do You Pay When Your’e Self

Letâs start with the portion of independent contractor taxes collected by the IRS. These are known as federal taxes and to keep things simple, there are two parts. Thereâs the portion that would have shown up on your W-2 pay stubs as FICA, which is collected for the purpose of making contributions to Social Security tax and Medicare taxes. For employees, they pay half and the employer pays half. However, if you get paid and donât have any taxes withheld, the IRS classifies you as self-employed. You must be aware of how much tax you need to pay on 1099 income.

You see, you are responsible to pay the full amount of self-employment tax which is 15.3%. Fortunately, youâre allowed a tax deduction for ½ of it when you file your tax return.

Next, thereâs the Federal income tax. The US follows a progressive tax system where people earning more money are responsible to pay a higher percentage of their income in taxes. The amount you pay will be based on which tax bracket you fall into after you subtract deductions from your total business income. For 2020, there are seven 1099 tax brackets and the tax rate range from 10% to 37%.

To quickly see how much youâll owe at the end of the year, use Keeperâs self-employment income tax calculator.

State and local tax

Read Also: How To Mail Tax Return