How To Get Started With Your Own Tax Business

The first thing you will need is a solid foundation of tax knowledge. Surgent Income Tax School offers tax courses online, 24/7. So you can get started right away!

After just one 48-hour Comprehensive Tax Course, you will be able to prepare tax returns for most individual U.S. taxpayers. This tax course can be completed in just weeks! If you want to be able to prepare tax returns for small businesses, then you will also want to take the 30-hour Small Business I Tax Course.

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Tax Brackets Declined Versus 2018 Numbers

The 2019 tax brackets provided better rates for most Canadians compared to 2018 numbers. Taxes in 2019 declined in all brackets while the percentages stayed the same.

Due to those thresholds increases, the tax burden was less for self-employed business owners. To take advantage of the systems in place and legally minimize your share of tax when filing at tax season , its important to review the process.

Don’t Miss: Is Plasma Money Taxable

Fact : Most Businesses Are Pass

Of the 26 million businesses in 2014, 95 percent were pass-throughs, while only 5 percent were C-corporations .1 C-corporations, which include most publicly traded businesses, pay taxes at the corporate level. As a result, the income of C-corporations is potentially taxed twice: once at the corporate level and again when the profits are distributed to shareholders via dividends or capital gains . Organizing as a C-corporation affords the owner limited liability and facilitates complex financing such as selling shares to the public. In contrast, pass-throughs do not pay the corporate tax. Instead, their profits are passed through to their owners individual tax returns and taxed at the individual rate.

While they are not pass-throughs, many closely-held C corporations in which the owners are also managers share certain similarities with pass-throughs and, in practice, the income of their owners is often taxed much like that of sole proprietors. Owner/managers of closely-held C corporations often pay themselves wages, which are deductible from corporate-level tax, in lieu of dividends, which are not. This way, they maintain the limited liability and legal benefits of incorporation, but avoid the two levels of corporate tax by receiving their income as wages. As a result, the taxes they face are more similar to general partners or sole proprietors than to, say, publicly-traded C corporations.

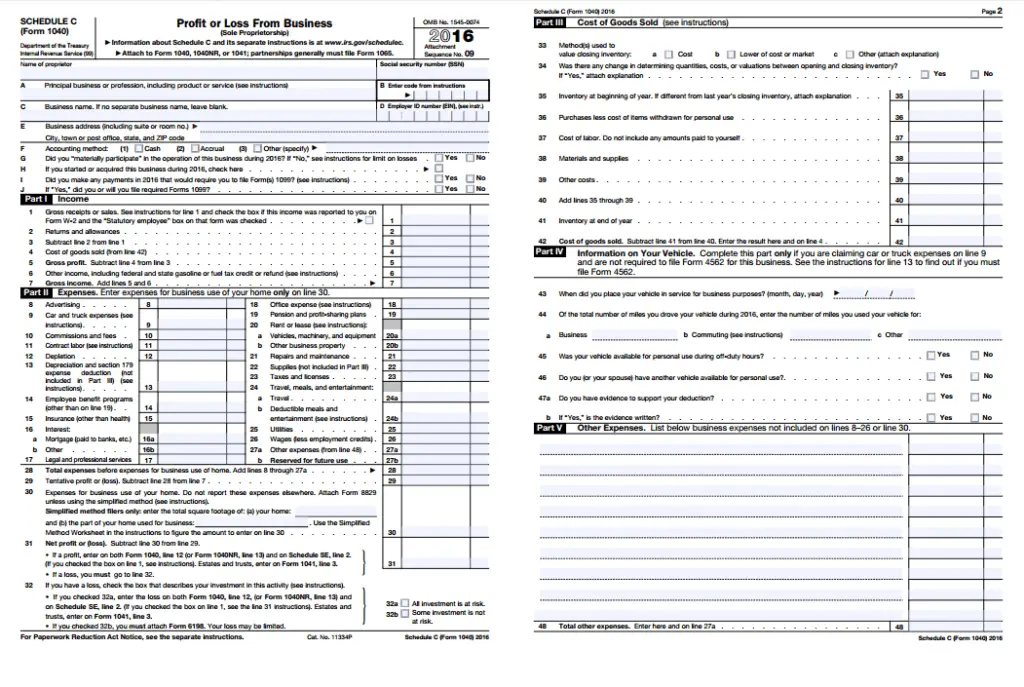

How To File Federal Income Taxes For Small Businesses

OVERVIEW

Depending on your business type, there are different ways to prepare and file your taxes.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

When its time to file a federal income tax return for your small business, there are various ways you can do it, depending on whether you run the business as a sole proprietorship or use a legal entity such as an LLC or corporation.

Each type of entity requires a different tax form on which you report your business income and expenses. Regardless of the form you use, you generally calculate your taxable business income in similar ways.

TurboTax has two products to serve business ownersTurboTax Home & Business is designed for sole proprietors and 1099 contractors, while TurboTax Business helps you prepare taxes for corporations, partnerships and LLCs.

Don’t Miss: Where’s My Refund Ga

Tax Query: How To File Itr For The Deceased

I lost my brother to Covid-19 in May 2021. Do we need to file income tax returns on his behalf for the last financial year? Advance tax was deducted from his salary during April 2021 and May 2021 for bonus received in April 2021 and projected annual income. Is it possible to claim excess tax paid?

A. R. Chintha

As per the provisions of Section 139 of the Income-tax Act, 1961 , every person whose total taxable income during the previous year exceeds the maximum amount which is not chargeable to income-tax 250,000 for FY 2020-21 and FY 2021-22) is required to file income tax return. As per the provisions of Section 159 of the Act, where a person dies, his / her legal representatives shall be liable to pay any tax liability due, on behalf of the deceased and are deemed to be assessed to tax on behalf of deceased. Accordingly, the legal representative shall also be eligible to file the income tax return on behalf of a deceased person. In order to do so, the legal heir would be required to register as the Representative assessee of the deceased through his/her e-filing profile.

Below are the steps to register as a legal representative:

· Legal heir will have to log in to his/her income tax e-filing account.

· Click on Authorised Partners on the home page

· Select Register as Representative Assessee

· Click on Lets get started and create New request

· Select the category as Deceased in the category of assessee who you want to represent and Continue

M.Ramanathan

How To Pay Small Business Taxes

Most small businesses are required to pay estimated taxes quarterly, rather than annually.

Submitting your payment to the IRS is a breeze: just fill out form 1040-ES and mail it along with a check to the IRS office closest to you.

You can also pay estimated taxes online online or by phone via the IRS Payments Gateway.

Recommended Reading: How To Appeal Property Taxes Cook County

Income Tax Filing Tips For Online Businesses

If you earn money online, either as your full-time income, part-time income or occasional income, the Canada Revenue Agency requires you to report your earnings at tax time.

At TurboTax, we want you to stay out of tax trouble, so were going to teach, educate or enlighten you as to how to correctly complete your personal income tax return and understand the deductions you are eligible for.

Like Working With People And Computers Tax Preparation Is A Great Business For You

Tax preparation is a great home-based business for many types of people. If you are someone who enjoys working with people and computers, this could be for you!

Stay-at-home parents and early retirees find this to be a wonderful complement to their lives. It enables you to still have your holidays and summers free to be with the kids or grandkids, it allows you to travel, etc.

Retired military people looking for a second career can establish a business that allows them to work for as many years as they want.

Military spouses looking for a portable career that you can take with you and grow regardless of where you are.

Financial services professionals can add tax preparation expertise to their available services, offering more value to their clients.

Also Check: Do You Have To Do Taxes For Doordash

Myth #: Tax Preparation Is For Numbers People

Its amazing how many people think that tax preparation is all about the numbers, but thats not all. Tax preparation is actually a people business. So, if you enjoy working with people, you could do very well in the tax business. Its about building relationships and trust.

Yes, it is extremely important that you have the knowledge to prepare taxes accurately. But the experience that your clients have during the tax preparation process and after is just as important. When you are dealing with a clients financial information it becomes very personal. Your client trusts you to take good care of him/her and hopes you have their best interests in mind. Your client is looking for guidance and has come to you because they see you as an expert in the tax industry. You could prepare a clients tax return perfectly but if you dont provide personal service, they may not be back. Relationships are paramount!

Make Sure To Claim All Revenue Reported To The Irs

The IRS knows everything. They get copies of all of the 1099 forms you get to compare the revenue you declared with the reports they have internally. So you need to ensure that the revenue you report is the same as the one on your 1099s.

If you fail to do so, they will definitely not like it, and youll find yourself in a tricky situation. You dont want to leave out any source of income from the year because the IRS will find out.

Also Check: How To Get Tax Preparer License

Are My Business And Personal Taxes Due At The Same Time

Your business and personal taxes arent always due at the same time. While your personal taxes are always due well, except for 2020 on April 15, your business tax return follows a different schedule.

Business returns are generally due on the 15th day three months after the end of your fiscal year. For instance, calendar-year businesses file taxes by March 15.

Most small businesses should file their personal and business tax returns together. Self-employment tax software will help with both your business and personal tax returns.

Which Turbotax Is Best For Your Business

While all TurboTax products allow you to report self-employment income, TurboTax Self Employed Online is the best choice for doing and filing your income tax if youre a sole proprietor, member of a partnership, or otherwise self-employed. However, if you feel a bit overwhelmed, consider TurboTax Live Assist & Review Self Employed and get unlimited help and advice as you do your taxes, plus a final review before you file.

*TurboTax Live Full Service is not available in Quebec

Read Also: Have My Taxes Been Accepted

Tax Definitions And Terms

Here are the key definitions and business examples youll need for all of your tax questions with more information available in the below links.

A business number is a series of nine digits that the Canada Reserve Agency uses to identify your business in communications with the federal government. Businesses with at least one employee typically need to register for a business number.

A corporation key is a password assigned by the CRA. You can use this to access the Online Filing Centre, which processes your businesss tax information.

A deferred tax is a current tax payment that you push into the future, often through an investment or retirement account. Inflation and payment control are the main benefits of these taxes.

Excise duty is a tax charged on certain Canadian products, such as wine, spirits, and tobacco. These products incur excise duty at the point of manufacture before they are sold to customers.

A fiscal pardon is a type of tax amnesty that allows you to rectify any unpaid, unfiled, or unreported taxes from previous years without fear of large fines or criminal penalties. To take advantage of this tax pardon program, you must apply with the CRA.

An inclusion rate is the rate that the CRA uses to determine taxable capital gains and allowable capital losses. This helps you figure out how the profit or loss from the sale of property fits into your tax return.

Can A Small Business Get A Tax Refund

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

A common business accounting question that tax practitioners often hear from small-business clients is Why doesnt my business get a tax refund? Taxpayers, in general, receive a refund only when they have paid more tax than was due on their return. The same is essentially true of businesses.

However, just like there are different types of taxpayers, there are different types of businesses, and this has an impact on a small businesss tax refund eligibility. Generally, C-corporations are the only type of business entity eligible for a tax refund. Your business also might receive a tax refund if it overpays on payroll or sales taxes. Here are the factors to consider.

Recommended Reading: Where’s My Refund Ga State Taxes

How Do I Keep My Business And Personal Taxes Separate

As a business owner, its as hard to separate your business and personal taxes. Its just as hard to keep your personal and business lives apart.

C corporations are the only business type where your companys earnings dont flow through to your personal tax return. Still, most small businesses shouldnt become C corps because the structure creates double taxation so shareholders may be taxed twice on the same earnings. C corporations must also have a board of directors and follow a host of other legal requirements.

Filing Your Business Income Tax Return: A 7 Step Guide For Self

By | March 1, 2013

How do you file a business tax return? How is it different from a typical return and how do you know what forms to use?

Filing your first business income tax return can be confusing, so we have created this 7-step guide to help. Remember: we can only provide a general overview of the topic and requirements may vary depending on your individual situation. I always recommend seeking professional advice to help address the needs of each individual situation and to optimize your personal tax situation.

With that being said, here is an overview of the steps you need to take to report business income on your personal income tax return.

Step 1: Are you running a sole proprietorship, partnership or corporation?

The type of business you operate determines what tax form you need to fill out. If you are a sole proprietor or are in a business partnership, you report business income on your personal tax return by filling out Form T2125: Statement of Business or Professional Activities. If your business is a corporation, you will need to fill out T2. This article addresses the use of Form T2125.

In a sole proprietorship, the person and the business are the same entity, so if you have earned money outside of regular employment, you are a sole proprietor, even if you did not register your business. Partnerships are similar, except there are stricter rules for registering the business in each province.

Step 2: Two options for filing your tax return

You May Like: How Do I Get My Pin For My Taxes

Free File Fillable Forms

With Free File Fillable Forms, youâre essentially filling out electronic versions of paper tax forms. You do it through the IRS website. They handle basic calculations, but donât do any error checking. Itâs up to you to make sure you fill in everything correctly.

How it works

Once you create a Free File Fillable Forms account with the IRS, you can log on to select and fill out the relevant forms for your business. After filling out the main part of your return, youâll need to select which income documents youâre includingâW2s or Form 1099s, for instanceâand then enter information from them.

Free Fillable Forms automatically estimates how much youâll receive as a tax refundâor how much youâll have to pay. You can pay your taxesâor get your refundâby entering your bank info, and receiving a direct electronic funds transfer from the IRS.

Finally, you digitally sign your return, and submit it to the IRS. You have the option of printing off a copy for your records.

Is it worth it?

Free File Fillable Forms only works for the current tax yearâso you canât use them to file back taxes. And itâs only for filing federal taxes, not state.

Using Free File Fillable Forms only makes sense if youâre already experienced and comfortable with filing your own business taxes by handâand if those taxes arenât too complex. If you check all the above, and you donât want to do your taxes with a pencil, then the Free File Fillable Forms are a great choice.

Fill Out Any Required Forms Or Information

Most taxes come with associated forms you need to complete.

For instance, income tax forms will have you put in your gross sales from your business, list any allowed deductions from your income, and then do the math to come up with taxable income and total tax due.

Sales tax forms, on the other hand, might only include your total receipts and then apply the percentage of the tax to the entire amount.

Increasingly, tax authorities are using online electronic filing to submit tax forms of various kinds. In some cases, you’ll have to use an online filing method, while other tax collection processes give you the choice of a paper or electronic filing. Some people use tax software for filing business taxes.

Don’t Miss: Amended Tax Return Online Free

Do You Have To File A T2 Corporate Tax Return

The tax return you are required to file depends on whether your business is incorporated. If it is, you are required to file a T2 corporate tax return for the business, in additional to a T1 personal tax return. You must file both because a corporation is considered a separate legal entity with the ability to own property and enter into binding contracts in its own name.

Any business losses you incur cannot be deducted against your taxable income on your T1. However, non-capital losses from your corporation may be carried back three years or carried forward 20 years to offset business income earned in those years.