Irs Rules Regarding Your Age

As the table above indicates, individuals younger than age 65 must file if they make certain amounts. The earnings threshold amounts go up a bit for individuals 65 and up.

For married couples that file separate tax returns, the earnings target is based on the age of the older spouse.

In most situations, your age for tax purposes depends on how old you were on the last day of the year. But when it comes to determining whether you have to file a return, the IRS says that if you turned 65 on New Years Day, you are considered to be 65 at the end of the previous tax year. The one-day grace period allows you to use the higher-income thresholds to determine whether you must file a tax return.

How To File Your Taxes Online For Free

Anyone with simple tax returns can file their taxes for free. Here are some optionsand how to use them.

For the past six years, Milagros Melendez, a 72-year-old retired home-care worker, has filed her taxes digitally with the help of volunteer tax professionals in an immigrant-assistance program.

The program, called the Volunteer Income Tax Assistance , is just one of many free tax filing options available to consumers.

For Melendez, who lives in a predominantly Latino neighborhood in Northern Manhattan, the free service offers peace of mind. Her tax preparation is performed by volunteers who speak Spanish and who must take and pass tax-law training that meets or exceeds Internal Revenue Service standards.

Ive never dedicated myself to learning about taxes, it just wasnt my area of expertise, she says.

Plus, now that shes retired and on a fixed income, using the free tax prep service eliminates a financial burden. Before, she would go to her neighborhood tax preparation service, a travel agency, which, she says, charged her around $125.

And since the service files her taxes digitally, the time for processing and delivery of any refund is expedited.

With that in mind, here are some options to consider.

File A Digital Return Yourself For Free

Anyone who wants to file their own taxes digitally can do so for free using the IRS Free File System. If you earn $73,000 or more, it allows you to download a digital version of the 1040 tax form that you can fill out yourself and file digitally to the IRS, free of charge. No need to go to the Post Office to get the paper version.

But be prepared: Though the digital version performs some basic calculations, youll have to do the rest of the math yourself. And at this income level, youre not eligible for free tax help.

Also, check with your state tax office to see if it has any free digital services.

Important RemindersIts easiest for simple returns. While there are many free digital forms available to download, most taxpayers will only need a 1040, which is straightforward if youre reporting a simple tax return composed mainly of income, without itemized deductions.

Youll need to create a new Free File Fillable Forms account, even If you used the program in previous years. This account is separate from your irs.gov account, which you dont need to update.

How to Find ItGo to the Free File webpage on the irs.gov website and click the Use Free File Fillable Forms button. > > Review the information on the page and, when ready, click on the Start Free File Fillable Forms button. > > This will bring you to a page where youll be given even more important information to review.

Don’t Miss: How Much Is Sales Tax In Kansas

There Are 2 Ways To Prepare And File Your Taxes

Americans have two basic options when it comes to filing their taxes:

1. Do it yourself with tax software or through the IRS website. The IRS does not charge to file taxes. If you’re well-versed in tax law you can or request the paper forms in the mail. However, the IRS encourages online filing and directs taxpayers with incomes up to $73,000 to its free filing portal, which lists 10 qualified tax preparers that offer free services .

For people with incomes north of $73,000, you can still find free filing options if you have straightforward income. A more complex situation like self-employment or complicated investments means you’ll likely have to pay an online tax preparer, which can range from $25 to $100 or more for federal and state filing.

2. Hire a tax preparer to do it for you. The only professionals qualified to help you are tax lawyers, CPAs, and enrolled IRS agents. You can search for appropriately credentialed preparers at taxprepareregistry.com.

Preparers generally start at around $100 and vary depending on where you live and how complex your taxes are, and accountants might very well charge at least twice that, with similar variations in price according to location and complexity. According to a survey from the National Association of Tax Professionals, the average charge for preparing and filing a tax return is $216.

Extension To File Your Tax Return

If you cant file your federal income tax return by the due date, you may be able to get a six-month extension from the Internal Revenue Service . This does not grant you more time to pay your taxes. To avoid possible penalties, estimate and pay the taxes you owe by the tax deadline of April 19, 2022, if you live in Maine or Massachusetts or April 18, 2022, for the rest of the country.

Recommended Reading: Where To Find Tax Forms

How To File Your Taxes For Free

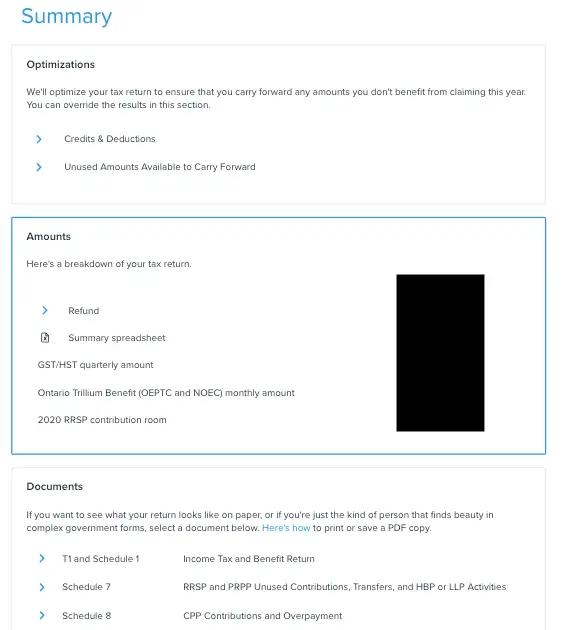

At this point, youve probably decided youre going to file your taxes online yourself. Great choice! Now you have a couple of options. One being to file your taxes online for free using IRS Free File. With this tool, the IRS works with online tax preparation services to help you fill out your information and file your return online. Its a free program, so its not as intuitive as a paid tax software program, but it wont cost you any money.

IRS Free File has 2 options bases on your income:

File Electronically In Just Minutes And Save Time

We know that filing your taxes can sometimes be unpleasant. That is why our helpful online tax preparation program works with you to make the filling process as pain-free as possible. Many filers can use our online tax software to electronically file their taxes in less than 15 minutes.

To use the E-file software, a visitor simply needs to create a free account , enter their taxpayer information, income figures, then any deductions they may have, and our software will calculate and prepare the return. Once a user has completed preparing their return they will be provided the option of either e-filing or printing and mailing. It’s as simple as that.

Also Check: How To Efile Just State Taxes

Consider Your Gross Income Thresholds

Most taxpayers are eligible to take the standard deduction. The standard tax deduction amounts that youâre eligible for are primarily determined by your age and filing status. These amounts are set by the government before the tax filing season and generally increase for inflation each year.

The standard deduction, along with other available deductions, reduces your income to determine how much of your income is taxable. As long as you donât have a type of income that requires you to file a return for other reasons, like self-employment income, generally you donât need to file a return as long as your income is less than your standard deduction.

For example, in 2021, you donât need to file a tax return if all of the following are true for you:

- Donât have any special circumstances that require you to file

- Earn less than $12,550

Recommended Reading: Do Dependents Need To File Taxes

Are There Other Factors That Will Complicate My Tax Return

Multiple streams of income arent the only things that can make your tax filing process more complex. If you own property, have investments, or can claim dependents, those things will all change your tax return.

Additionally, if any of the following situations apply to you, youll definitely want to work with a tax professional:

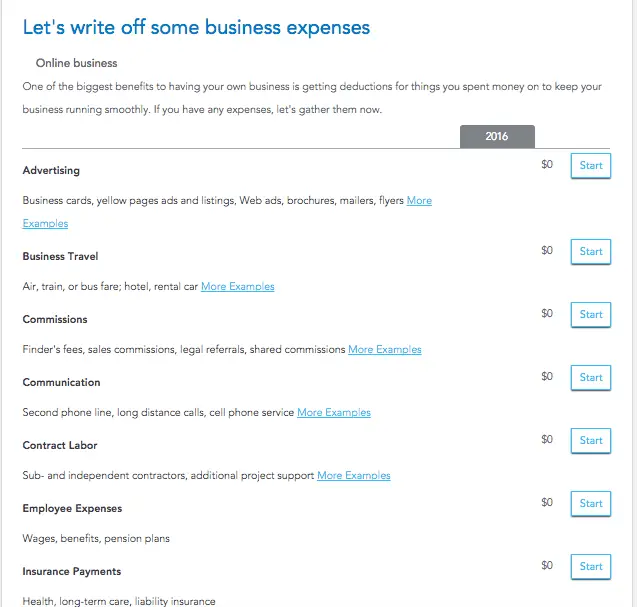

- You own your own business or are self-employed: If youre a business owner or self-employed individual, your taxes will automatically be much more complicated. There are also little known write-offs that could save you money if you work with a tax professional.

Plus, online filing services charge much higher rates for self-employed individuals and business owners, so its probably more cost effective to hire a tax accountant anyway.

Read Also: What Is The Sales Tax Rate In Utah

Recommended Reading: What Is Wotc Tax Credit

Review And File Your Taxes

Once youve crunched all the numbers and filled in all your forms, review everything. Go over your entire process from start to finish and double-check each line item for complete accuracy. This could be tedious, but its vitally important as errors can lead to costly penalties.

As you prepare your return, keep the filing deadline in mind and plan well in advance to make sure you meet it. For 2022, the filing deadline is April 18 for most U.S. residents. Those who live in Maine or Massachusetts get an extra day, as April 18 is a state holiday .

Shutterstock

Keep An Eye On Your Income

You need to file a tax return if you meet or surpass certain levels of income during the year. If youre employed, look at your pay stub for the year to date incomeand if you have more than one job, be sure to add up your income from all your employers. Remember to include income from other sources, too, such as money you make on rental property, anything you sell, investments or interest.

You May Like: Can You File Taxes With Last Pay Stub

Amended Income Tax Returns

You can file an amended 2018, 2019, 2020 or 2021 income tax return as of February 21, 2022.

Important

For an income tax return for a year prior to 2018, the request for an adjustment must be made using form TP-1.R-V,Request for an Adjustment to an Income Tax Return, which you must send by mail.

End of note

What Is An Electronic Filing Identification Number

An electronic filing identification number is a number assigned by the IRS to preparers who are approved for the federal and state e-file program.

Once issued, an EFIN does not expire. However, if you change your Employer Identification Number or the name of your firm, you will have to either get a new one or update it through the online portal.

Its important to note: everybody who prepares taxes needs a PTIN. However, only your firm needs an EFIN. One per firm or per physical location is usually required.

To put even more simply: you need a PTIN to prepare and an EFIN to e-file.

Recommended Reading: How Much Is Tax In Alabama

Do You Even Have To File Taxes

Whether you have to file a tax return this year depends on your income, tax filing status, age and other factors. It also depends on whether someone else can claim you as a tax dependent.

Even if you dont have to file taxes, you might want to do it anyway: You might qualify for a tax break that could generate a refund. So give tax filing some serious consideration if:

-

You qualify for certain tax credits.

What Does A Tax Preparer Need To Prepare Tax Returns

Tax preparers need to efficiently and securely access and manage confidential information for their clients. As a result, most preparers look for software to manage their workflow effectively and efficiently.

Tax software should help preparers in the following ways:

- Learn. You cant know everything. There will always be knowledge gaps and questions from clients that you didnt anticipate. Professional tax software should increase your know-how, the ability to fill knowledge gaps with trusted and meaningful information for your daily work. Something to unstuck you when you dont know how to proceed.

- Research. Every client is different. And that means every answer you provide will need to be tailored to their specific questions and concerns. A tax research software solution can help get the answers when you need to go deeper and retrieve more information.

- Operate. Tax preparation requires a significant amount of day-to-day organization. You need tools to do the work and produce all the necessary forms. From document management solutions to e-filing assistance, tax software should make your operational duties easier, more productive, to do your job with confidence every time.

Don’t Miss: When Is Sales Tax Due In Ny

Choose Between Standard And Itemized Deductions

Deductions are super important to think about since they can lower your taxable income, potentially giving you a bigger refund or a lower tax bill. As you file your taxes, youll have two options: You can take the standard deduction or itemize your deductions. Below are the forms you will have to complete with your online tax filing.

- Form 1040: If you have a 9-to-5 job and will be receiving a W-2, you may be able to takethe standard deduction. For 2021, the standard deduction for individuals is $12,550 and $25,100 for married people filing jointly. If you use this standard deduction, you cant itemize deductions as well. Instead, youll take the standard deduction and fill out aForm 1040and submit it with your tax return.

- Form 1040 with schedules:If youve had a big life change , this may bump you into a different financial situation where youll need to take itemized deductions instead of the standard deduction. If this is the case, you may need to fill out one or more of the new schedules in addition to the Form 1040. For example, if you have capital gains, unemployment compensation, gambling winnings, or any deductions to claim , you may want to fill out Schedule 1.

- Home mortgage interest

- Home office and other associated deductions

- Educator expenses

- Child care expenses

Returns From Previous Years

You can file your original 2018, 2019 and 2020 income tax returns in the four-year period following the taxation year covered by the return .

If you did not file an income tax return for the 2018, 2019 or 2020 taxation year, and we sent you a notice of assessment for the year covered by the return, you cannot file an original return using authorized software. You have to mail the return to us.

Don’t Miss: How Long Will The Child Tax Credit Last

Free Versions Of Online Tax Software

Many of the big tax preparation companies will bring in customers with the offer of free filing, says Curtis. But beware of the upsell.

We at Forbes Advisor reviewed four of the top online tax software platforms, and our top free pick for simple tax returns is Cash App Taxes where you can file both your federal and state taxes for free. The service includes several forms, including self-employment, as part of their free package.

Unlike Cash App Taxes, some online tax software providers offer limited form options. Often, if the return requires any additional forms like a Schedule A or C, that costs extra. In many cases the federal return might be free, but a state return will have an additional cost.

When youre choosing a free product, read the fine print. Most of these products come with limitations that may exclude your specific situation, including your income and the forms you need to file. Also, consider the complexity of your taxes: If you think youll need professional help while filing, some tax software companies offer CPA assistancebut youll likely have to pay for it.

Read more: The Best Tax Software of 2022

Tips For Itemizing Tax Deductions

The IRS maintains a complete list of tax deductions and tax credits. Note that deductions and credits are not the same. Deductions reduce your taxable income, while credits reduce the amount of tax you owe. Tax credits are more valuable, but they are also rarer and narrower in scope.

Each individual taxpayer will qualify for different deductions, depending on their circumstances. The most common deductions apply to taxes you paid to state and local authorities, property taxes, and qualified medical expenses. You can also deduct charitable contributions and the mortgage interest you paid on up to two properties you own.

Shutterstock

Also Check: When Do Llc File Taxes

An Irs Free Filing Program Could Work But Will Take Time

Tax preparation companies argue that free online filing through the IRS wouldn’t necessarily be a win for taxpayers.

“Taxpayers see an inherent conflict of interest in having the IRS be the tax collector, investigator, auditor, enforcer and now preparer,” said Rick Heineman, vice president of corporate communications at Intuit, as part of a longer statement given to ProPublica.

Although for-profit tax preparers have a clear financial incentive to take this position, it is worth questioning whether the IRS would be incentivized under a free filing system to maximize refunds for filers using its system.

“There are certainly political figures who would say it’s like a fox guarding the henhouse,” says Borst. “But the IRS will of its own accord point out if a customer misses a deduction. And if under a new system the IRS is missing obvious deductions, H& R Block and TurboTax will be able to say, ‘They didn’t get you this, and we did.'”

For millions of Americans with straightforward tax situations, a free filing program could be a massive benefit. Between 41% and 48% of all returns could be pre-populated based on taxpayers’ previous filings and current-year financial documents from employers, according to recent research published by the National Bureau of Economic Research.

But don’t expect to have the option to file your taxes by the next time you file, or even the year after that.

“Something like this will likely require further appropriation,” says Cordasco.