I Havent Filed Taxes In A While How Can I Receive This Benefit

You may be eligible for Child Tax Credit payments even if you have not filed taxes recently. Not everyone is required to file taxes.

This year, Americans were only required to file taxes if they earned $24,800 as a married couple, $18,650 as a Head of Household, or $12,400 as a single filer. If you had total income in 2020 below those levels, you can sign up to receive monthly Child Tax Credit payments using simple tool for non-filers developed by the non-profit Code for America.

If you believe that your income in 2020 means you were required to file taxes, its not too late. In addition to missing out on monthly Child Tax Credit payments in 2021, a failure to file in 2020 could mean losing out on other tax benefits or a refund you were owed. For help filing a past due return, visit the IRS website.

Were There With Support If Youre Raising A Grandchild

More and more grandparents are finding themselves raising their grandchildren. Social Security will pay benefits to grandchildren when the grandparent retires, becomes disabled, or dies, if certain conditions are met. Generally, the biological parents of the child must be deceased or disabled, or the grandparent must legally adopt the grandchild.

To receive this benefit, your grandchild must have begun living with you before age 18 and received at least one half of his or her support from you for the year before the month you became entitled to retirement or disability insurance benefits, or died. Also, the natural parent of the child must not be making regular contributions to his or her support.

If your grandchild was born during the one-year period, you must have lived with and provided at least one-half of the child’s support for substantially the entire period from the date of birth to the month you became entitled to benefits.

Your grandchild may qualify for benefits under these circumstances, even if he or she is a step-grandchild. However, if you and your spouse are already receiving benefits, you would need to adopt the child for them to qualify for benefits.

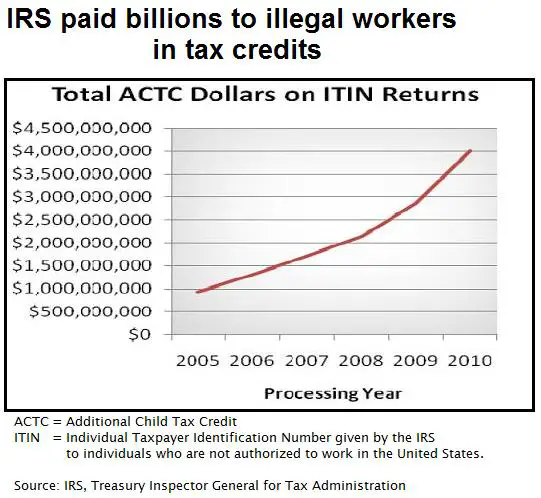

Filing Taxes Without A Social Security Number

The Form 1040 requires that a taxpayer enter their Social Security number at the top of the tax return. That obviously poses a problem for undocumented workers who are required to file returns but are seemingly prohibited from doing so because they arent eligible for SSNs.

Some non-citizens can apply for and receive Social Security numbers, however. Non-citizens might be temporarily authorized to work through Deferred Action for Childhood Arrivals or temporary protected status . Non-citizens might also have access to work visas.

These SSNs are only valid for a limited authorized time, but that technically means the non-citizens are not undocumented.

Read Also: How Do I Find My Business Tax Id Number

How Do I Apply For An Itin

If you want to file a tax return but cannot obtain a valid SSN, you must complete IRS Form W-7, Application for IRS Individual Taxpayer Identification Number. Form W-7 must be submitted to the IRS with a completed tax return and documents verifying identity and foreign status. You will need original documents or certified copies from the issuing agencies. The instructions for Form W-7 describe which documents are acceptable.

Parents or guardians may complete and sign a Form W-7 for a dependent under age 18 if the dependent is unable to do so, and must check the parent or guardians box in the signature area of the application. Dependents age 18 and older and spouses must complete and sign their own Forms W-7.

You can use this checklist to help prepare your application.

There are three ways you can complete the ITIN application:

Replacement Card For A Foreign Born Us Child

You can replace your child’s Social Security card for free if it is lost or stolen. However you may not need to get a replacement card, knowing your childâs Social Security number is what’s important. You are limited to three replacement cards in a year and 10 during a lifetime. Legal name changes do not count toward these limits. Also, you may not be affected by these limits if you can prove you need the card to prevent a significant hardship.

Important

You must present original documents or copies certified by the agency that issued them. We cannot accept photocopies or notarized copies. All documents must be current . We cannot accept a receipt showing you applied for the document.

Don’t Miss: How To Get Past Tax Returns

Replacement Card For A Us Born Child

You can replace your child’s Social Security card for free if it is lost or stolen. You are limited to three replacement cards in a year and 10 during a lifetime. Legal name changes and other exceptions do not count toward these limits. For example, changes in immigration status that require card updates may not count toward these limits. Also, you may not be affected by these limits if you can prove you need the card to prevent a significant hardship.

Important

You must present original documents or copies certified by the agency that issued them. We cannot accept photocopies or notarized copies. All documents must be current . We cannot accept a receipt showing you applied for the document.

Do I Need A Social Security Number For My Baby To File My Taxes

Do you need a Social Security card for a newborn? And if so, how does a baby get a Social Security number?

While the Tax Cuts and Jobs Act got rid of exemptions, a new baby improves your tax filing status still. Specifically, you can save money in the form of tax credits as you’ll have another dependent. However, the Internal Revenue Service states that you can claim your child as a dependent only when you provide the baby’s Social Security number on your tax return.

Read More:Claiming Dependents for Your Taxes

Also Check: What Expenses Are Tax Deductible For Self Employed

Why Would An Undocumented Immigrant Pay Taxes

Though there are many undocumented immigrants who are paid under the table for their work and do not pay taxes on their income, many others do pay in the hope that it will someday help them become citizens. Much of the evidence for this motivation is anecdotal, but various attempts at comprehensive immigration reform legislation over the last decade, including the Gang of Eight bill S.744, have included provisions like good moral character and paying back taxes as requirements for obtaining legalization. A provable history of paying taxes is seen as one way to show good faith, should such a bill ever pass.

Tax Return Options When Social Security Numbers Are Delayed

Update for the 2021 Tax Year : Recent changes to the Child Tax Credit supersede the guidance previously outlined below. Adoptive parents who are waiting on a social security number for their child should speak with a tax expert about filing an extension rather than filing with an ATIN, in order to be able to claim the Child Tax Credit. If you file with an ATIN, you cannot claim the CTC, and you cannot go back and amend the filing. Learn more in our interview with Becky Wilmoth, adoption tax expert.

Today was the extended deadline for filing federal 2019 taxes, and NCFA has learned in the last few days that many adoptive families experienced difficulty claiming their recently adopted child as a dependent and/or claiming the Adoption Tax Credit for which they are eligible due to processing delays caused by COVID-19. The reason? They were either waiting for a certified birth certificate from state officials or for the Social Security Administration to process their application for their childs Social Security number. Both processes experienced delays as state and federal offices were closed, had reduced operating hours, or employees were unable to work due to concerns about employee safety. Under normal conditions, it takes approximately two weeks to receive a Social Security number if all required documentation is submitted at time of application but many could not get the Certificate in time or the Card could not be issued in time for the tax return to be filed.

Recommended Reading: Do I File Taxes On Ssi

Child Tax Credit For Non

Americans have struggled during the pandemic, especially people with kids. The Child Tax Credit is here to help.

The deadline to sign up for monthly Child Tax Credit payments is November 15. The Administration collaborated with a non-profit, Code for America, who has created a non-filer sign-up tool that is easy to use on a mobile phone and also available in Spanish.

Heres a link to the Code for America non-filer sign-up tool:

Most families are already signed up! If youve filed tax returns for 2019 or 2020, or if you signed up with the Non-Filer tool last year to receive a stimulus check from the Internal Revenue Service, you will get the monthly Child Tax Credit automatically. You do not need to sign up or take any action.

If you arent already signed up, you can still sign up to get the Child Tax Credit. You wont lose your benefits if you do. These payments do not count as income for any family. So, signing up wont affect your eligibility for other federal benefits like SNAP and WIC.

You are also eligible to apply for the Recovery Rebate Credit, also known as stimulus payments, as part of this process.

Heres a list of things you will need to complete the process.

- Social Security Social Security numbers for your children and Social Security Numbers for you and your spouse

- A reliable mailing address

- E-mail address or phone number

- Your bank account information .

Heres a link to the Code for America non-filer sign-up tool:

Were There When They Get Their First Job

Once your child starts working and throughout their career, employers will verify their Social Security number to help reduce fraud and improve the accuracy of their earnings records.

Employers collect FICA, or Federal Insurance Contributions Act withholdings, and report earnings electronically. This is how we verify earnings and is how your child earns Social Security retirement, disability, and survivors coverage.

Once they turn 18, they can open a mySocial Security account and watch their personal earnings and future benefits grow over time.

Read Also: When Do You Have To File Taxes 2020

Ask The Taxgirl: Social Security Numbers For Dependents

Taxpayer asks:

I have a child that moved in with me from Canada in July and I do not have a social security number for him how do I go about claiming him on my taxes?

taxgirl says:

You generally need a Social Security Number to claim a dependent on your federal income tax return.

If you do not have a Social Security Number for your dependent, and your dependent qualifies for a Social Security Number, you need to file a form SS5, Application for a Social Security Card , with the Social Security Administration . According to the IRS, it usually takes about two weeks to get the SSN once you’ve submitted all of the information. Since it’s so early in the tax season, you ought to be able to get the SSN in time to file your tax return timely. If you don’t have the SSN by April 15, you can always request an extension of time to file your return.

If your dependent does not qualify for an SSN, you may be able to apply for an individual taxpayer identification number for your dependent. To do this, use federal form W7, Application for IRS Individual Taxpayer Identification Number . You’ll file the form W7 with the Internal Revenue Service note this is different from the SS5 which is filed with the Social Security Administration.

Hopefully, one of those options will work for you.

Be sure to read my disclaimer Remember, I’m a lawyer and we love disclaimers. But you know who loves them more? My malpractice carrier. Consider yourself warned.

To Get The Expanded Child Tax Credit

- File your taxes, even if you dont file them normally. This will tell the IRS where to send your payment and how many children you take care of. Also, if you dont file, you might miss out on other tax credits.

- To self-file or make an appointment for free tax preparation help, visit GetTheTaxFacts.org.

Recommended Reading: When Are Personal Taxes Due 2021

Who Can Get A Social Security Number

A Social Security number serves many purposes. Itâs used as an identification number by your employer when reporting federal and state income and payroll taxes withheld, for instance. Itâs also used to open a bank account with a U.S. financial institution, apply for federal loans or certain types of public assistance, enroll in Medicare and to get a driverâs license.

Having a Social Security Number is also essential for establishing a credit score in the U.S. Without a SSN, it can be challenging to build credit and take out loans if you need them for major purchases.

If you, your spouse or a dependent qualify for an SSN, you should file Form SS5, Application for a Social Security Card, with the Social Security Administration .

According to the SSA, generally only non-citizens authorized to work in the U.S. by the Department of Homeland Security can get a Social Security number. To do this, you can either apply for a SSN in your home country before coming to the U.S. or visit a Social Security office in person.

If you choose to take care of this process in your home country, youâll need to file for a SSN when filing your application for an immigrant visa with the U.S. Department of State.

If visiting a Social Security office in person, youâll need to show documentation to prove your identity and work-authorized immigration status. This documentation might include:

Corrected Card For A Foreign Born Us Citizen Adult

If you legally change your name because of marriage, divorce, court order, or any other reason, you need to tell Social Security so that you can get a corrected card. If you are working, you also need to tell your employer. If you do not tell us when your name changes, it may:

- Prevent your wages from being posted correctly to your Social Security record, which may lower the amount of your future Social Security benefits.

- Cause delays when you file your taxes.

Important

You must present original documents or copies certified by the agency that issued them. We cannot accept photocopies or notarized copies. All documents must be current . We cannot accept a receipt showing you applied for the document.

We may use one document for two purposes. For example, we may use your U.S. passport as proof of both citizenship and identity.

Recommended Reading: How To File Taxes For Free On Turbotax

Resident And Nonresident Aliens

How you claim a non-citizen spouse on your tax return depends on your spouse’s residency status. Your spouse will be either a “resident alien” or a “nonresident alien.” Usually, for a non-citizen to qualify as a resident alien they need to meet one of two tests:

- The non-citizen has a “green card,” which is authorization from the federal government to live and work in the United States permanently. The IRS refers to this as the “green card test.”

- The non-citizen was in the United States for at least 31 days of the year, and at least 183 days during the three-year period that includes the current year and the two years immediately before that. The IRS calls this the “substantial presence test.” Learn more about how to properly count those 183 days with TurboTax’s Tax Tips for Resident and Non-Resident Aliens.

Anyone who doesn’t qualify as a resident alien is considered a nonresident alien.

Replacement Card For A Noncitizen Child

You can replace your child’s Social Security card for free if it is lost or stolen. You are limited to three replacement cards in a year and 10 during a lifetime. Legal name changes and other exceptions do not count toward these limits. For example, changes in immigration status that require card updates may not count toward these limits. Also, you may not be affected by these limits if you can prove you need the card to prevent a significant hardship.

In general, only noncitizens who have permission to work from the Department of Homeland Security can apply for a Social Security number. If your child does not have permission to work but needs a Social Security number for other purposes, see “If your child does not have permission to work” for further information.

Important

You must present original documents or copies certified by the agency that issued them. We cannot accept photocopies or notarized copies. All documents must be current . We cannot accept a receipt showing you applied for the document.

Don’t Miss: When Can I File My 2020 Tax Return