Can You File Taxes Without A W

The short answer is yes. You can file taxes without a W-2. But its not ideal because even if you dont have your W-2, youll still need the information it contains to fill out your tax return.

Some of the information youll need is easy enough to obtain, like your employers name and address, while other details are much trickier to get hold of, such as information about the taxes withheld. Fortunately, there are a few solutions.

How To File Taxes Without W2 Or 1099

In filing taxes, youre probably aware of the W2 and the 1099 forms. Apart from these two, there are other ways to file taxes without these two tax forms.

Generally, filing your federal income tax is classified depending on the type of employment you have. For common-law employees or those employed under traditional employer-employee relationships, they use Form W-2. Freelancers usually report their income using the appropriate Form 1099, whether its 1099-NEC or 1099-MISC for miscellaneous income.

However, there are unfortunate events where you misplace these important IRS tax forms, or if the employer was not able to furnish you with a copy of these documents. Whether its a missing form or an unissued one, there are still things you can do to comply with applicable tax law and pay taxes correctly.

Can You Get A W

If February 1 has come and gone, you should take charge and attempt to get your W-2 from your employer. Speak to the company leadership and find out if they will provide W-2s to all employees. Also verify the address they have on file for you. Is it possible you moved after your employment ended and the company doesnt have your old address?

Even if the company is no longer in business, it can usually arrange for W-2s to be sent from its former payroll provider.

If you are unable to get in touch with someone at the company, or if it refuses to provide W-2s, what is your next step? Many individuals will attempt to get their information directly from the companys former payroll provider. But for security reasons, payroll companies are not allowed to discuss employee information with anyone who is not an authorized contact on the account.

Recommended Reading: What Is The Deadline For Taxes This Year

When Should You Contact The Irs About A Missing W

If you havent received your W-2 or a copy of it by the end of February, you should call the IRS at 829-1040 to get a substitute W-2. The IRS will need your:

-

Name, address, Social Security number, and phone number

-

Employers name, address, and phone number

-

Employment dates

-

An estimate of wages and federal income tax withheld in 2017use a final pay stub for these amounts

The IRS will use your information to send a letter to your employer on your behalf to obtain your W-2 form.

Can I Access My W

You can access your W2 online sometimes, but usually only if your employer has made it available to you. It’s a good idea to thoroughly check your employer’s website if you haven’t heard from them. If there’s an employee login portal , you might find your W2 somewhere inside. However, not all employers will offer this information online.Even if you can’t access your W2 online, you can still e-file your taxes, which is often easier than filling out the paperwork by hand. If you haven’t found your W2 on your employer’s website,

Also Check: How Do I Find My Tax Id

Let Primepay Handle Your Forms W

Tired of handling Forms W-2 on your own? PrimePay prepares Forms W-2 for all our clients. We ship them directly to you to distribute. They are self-sealed so all you have to do is put on postage and mail them out, or hand them out if the employees are physically located there.

Click here to learn more or fill out the form below.

Editor’s Note: This post was originally published in 2011 and has been updated for freshness, accuracy, and comprehensiveness.

Disclaimer: Please note that this is not all inclusive. Our guidance is designed only to give general information on the issues actually covered. It is not intended to be a comprehensive summary of all laws which may be applicable to your situation, treat exhaustively the subjects covered, provide legal advice, or render a legal opinion. Consult your own legal advisor regarding specific application of the information to your own plan.

About PrimePay Experts

Need A Loan Get One In 3 Simple Steps

If you are considering applying for a personal loan, just follow these 3 simple steps.

Apply

Apply online for the loan amount you need. Submit the required documentation and provide your best possible application. Stronger applications get better loan offers.

Accept

If your application meets the eligibility criteria, the lender will contact you with regard to your application. Provide any additional information if required. Soon youll have your loan offer. Some lenders send a promissory note with your loan offer. Sign and return that note if you wish to accept the loan offer.

Repay

The loan then gets disbursed into your U.S. bank account within a reasonable number of days . Now you need to set up your repayment method. You can choose an autopay method online to help you pay on time every month.

About Stilt

Stilt provides loans to international students and working professionals in the U.S. at rates lower than any other lender. Stilt is committed to helping immigrants build a better financial future.

We take a holistic underwriting approach to determine your interest rates and make sure you get the lowest rate possible.

Learn what others are saying about us on , Yelp, and or visit us at . If you have any questions, send us an email at

You May Like: How Much To Do Taxes At H& r Block

Is It Legal To File Without W

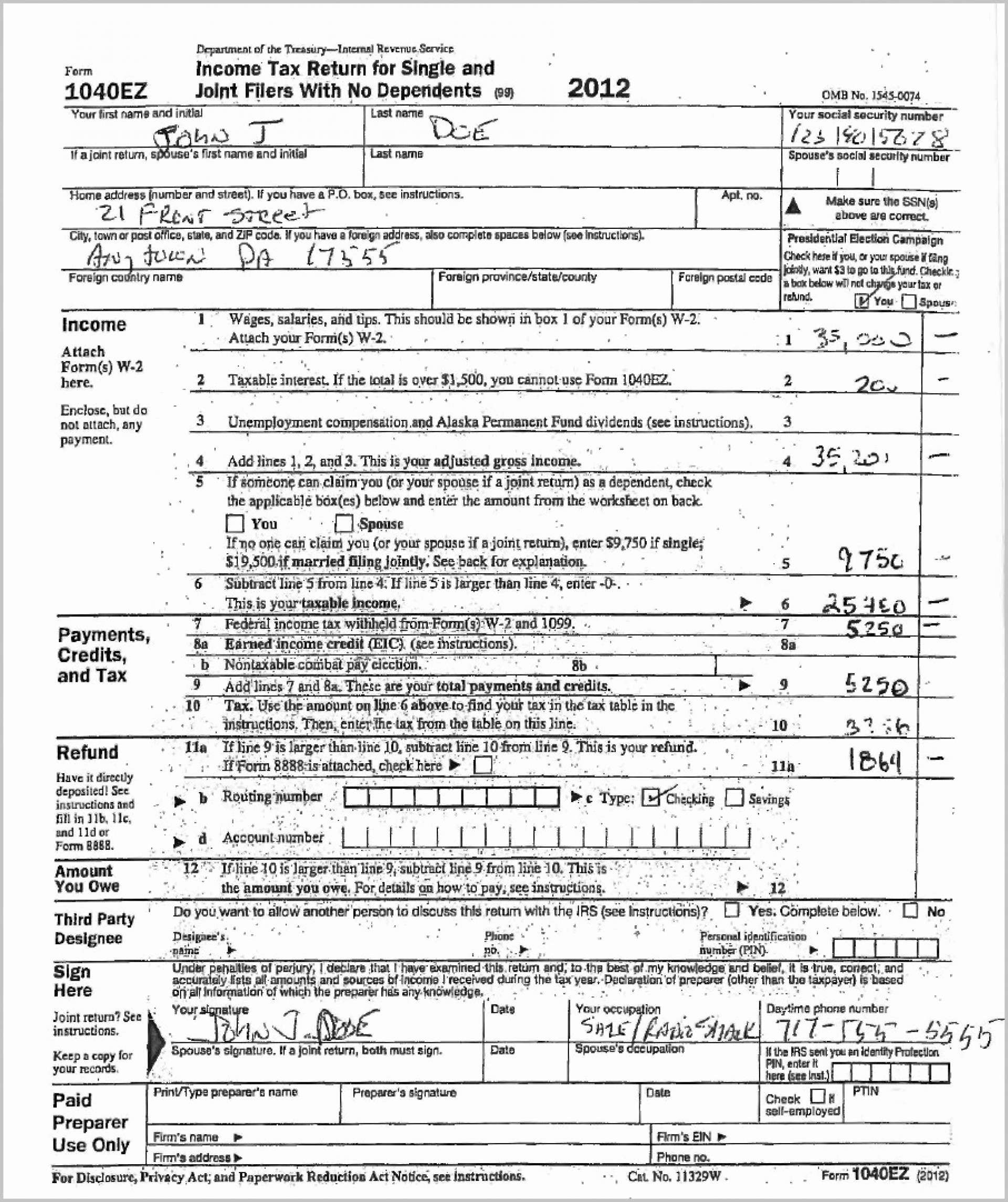

Technically, you could still file your taxes legally without the W-2 form as long as you’re filing electronically. However, if you’re going to do so correctly, there’s a bunch of information from your W-2 you’ll need nonetheless, such as:

- Any separate local income taxes withheld

- Medicare tax withheld

- Your complete wages, including other compensation like tips

- Social security tax withheld

- Social security tips and wages

- Identification number of your employer

- Federal income tax withheld from your income

- State income tax withheld

- Name and address of your employer

So, if youre filing your taxes electronically, you wont need an actual copy of your W-2 form. However, its where youd find all of the information weve listed above. And even if you have that info, we advise you to keep your W-2 somewhere secure you never know if youre going to have to produce it for the authorities in the future due to an audit or a background check.

Bear in mind that your employer is supposed to file your W-2 with the SSA by the end of every January, and then the SSA is supposed to share this with the Internal Revenue Service . Therefore, if the data you enter differs from the numbers that your employer reported, it’s perfectly possible you might get audited.

Still, these are just contingencies in case you really can’t find your W-2. The safest way to ensure you’re filing consistent and accurate info is to directly take the numbers off your W-2 sheet.

Check With Your Tax Preparer

In many cases, your tax preparer may actually be able to access a copy of your W-2. H& R Block, for example, has a free W-2 Early Access service. The service is easy to use and in just three steps, you could have an electronic copy of your W-2.

First, you’ll need to search for your employer in the database using either his name, the company’s name or the employer’s Federal Employer Identification Number . Second, you’ll need to follow the prompts to request a copy of your W-2. Third, you’ll need to pick up the W-2 from your nearest H& R Block storefront.

Note: Should your employer not have uploaded the W-2 in the database at the time of your search, you can put in a request to be notified by email when he or she does finally add it.

Read More:How to Find Your Employer Identification Number

You May Like: How Much Tax Return Will I Get

How Do I File Taxes If I Get Paid Cash

If you are an employee, you report your cash payments for services on Form 1040, line 7 as wages. The IRS requires all employers to send a Form W-2 to every employee. However, because you are paid in cash, it is possible that your employer will not issue you a Form W-2.

Try To Get Another Copy Of Your Form 1099

If you havenât received your 1099 in your mail or have misplaced it, chances are the issuer has a copy of it. You can simply reach out to them and request a copy of it. You must ensure that you request a copy of the same 1099 form you lost or misplaced. This is because if you are issued a new 1099, the IRS will perceive that as another income you have earned and it will require you to declare it.

Also Check: What Is The Tax On Capital Gains For Property

Do I Need To File A Tax Return

You may not have to file a federal income tax return if your income is below a certain amount. But, you must file a tax return to claim a refundable tax credit or a refund for withheld income tax. Find out if you have to file a tax return.

How To Report Foreign Income Without A W2

Individuals who qualify as U.S. citizens, resident aliens, or nonresident aliens working abroad for a foreign employer generally are not required to withhold Social Security or Medicare taxes. But lets say you work for an American employer with a foreign subsidiary instead. In this case, the employer can require that Social Security and Medicare taxes be withheld from the employees of the foreign subsidiary.

U.S. citizens, resident aliens, and nonresident aliens employed in the United States but working for a foreign employer continue to be subject to Social Security and Medicare withholding taxes. However, persons employed in the United States for a foreign employer may be exempt from social security and Medicare tax withholding if a concentration agreement is in effect.

Totalization agreements are agreements between two countries that specify to which country certain taxes, such as Social Security and Medicare taxes, are paid, all governed by the foreign employers tax laws.

Read Also: How To Figure Out Tax Id Number

Can My Tax Service Get My W

Some tax services are able to obtain your W-2 for you electronically before you would receive yours in the mail, or in the event you lost yours. The availability of your W-2 through such services does depend on whether your employer has filed your W-2 yet or not, so it may still take until the end of January to get your W-2 this way.

Not all W-2s will necessarily be available through these services, however, and often if they are, its because your company already provides you with a means to electronically access your W-2 form.

What Happens If I Cant Get A W

If you are unable to obtain a W-2, either because your employer refuses to provide one or because the document does not arrive, you should contact the IRS. You will get them to call your employer for a solution if you do this.

However, if this does not resolve the issue, you can still file your income taxes by completing Form 4852.

Recommended Reading: How Much Of Paycheck Goes To Taxes

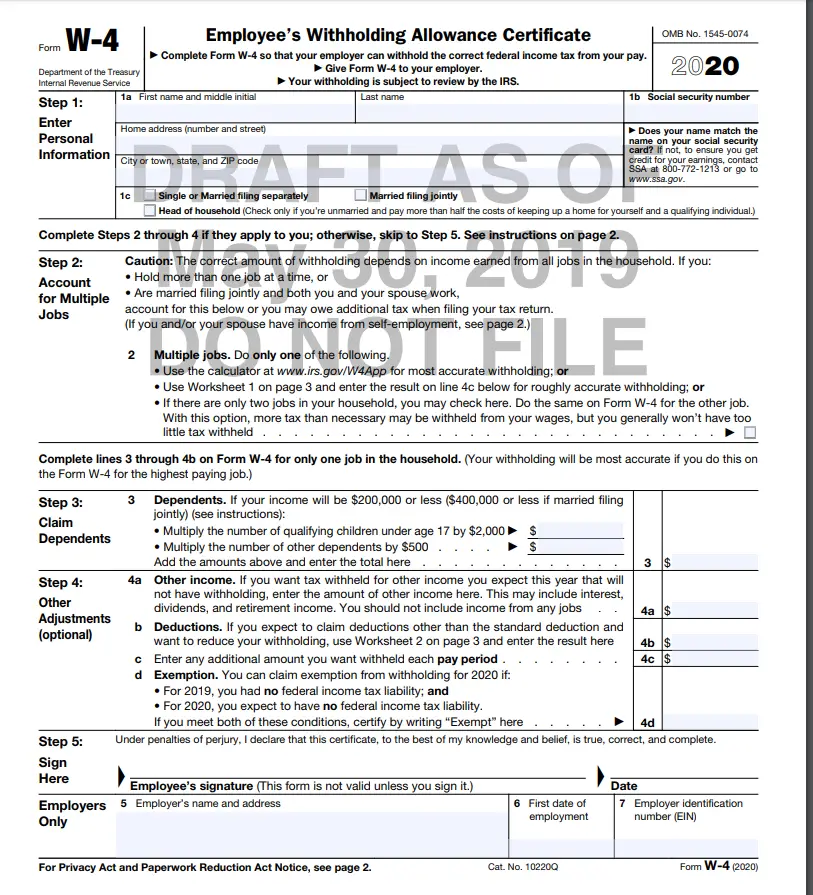

Refresher: What Is Form W

Form W-2 is an IRS reporting document that details the amount of compensation paid to an employee for the year, including federal and state income, Social Security, and Medicare taxes that were withheld. The official IRS formincludes six copies:

- Copy B for the employee to file with their federal tax return

- Copy C for the employees records

- Copy D for the employers records

- Copy 1 to file with State, City, or Local Tax Departments

- Copy 2 for the employee to file with their state, city, or local tax return

Every employer must file a Form W-2also called a Wage and Tax Statementfor each employee from whom income, Social Security, or Medicare taxes were withheld in the previous year.

Form W-3Transmittal of Wage and Tax Statementsshould also be included when filing Form W-2. This summary form shows the totals of all W-2s for a particular employer, including wages paid and taxes withheld.

Penalties For Not Reporting 1099 Income

As discussed earlier, the IRS also receives your 1099 form. The form typically comes in triplicate. One copy for the issuer, another for the taxpayer, and the last one is for the IRS.

So, if you receive a Form 1099-MISC that reports your miscellaneous income, you can be sure that the IRS also has that information. The same applies if you receive a Form 1099-NEC. You should still report cash income without a 1099 by law.

You will incur the wrath of the IRS in the form of penalties if you do not include your miscellaneous income and any other taxable income on your tax return.

For late payments, the IRS will impose a 1099 late filing penalty of 0.5 per cent, per month, for every month that the late taxes remain unpaid, capped at 25%.

You also run the risk of understating your tax liability if you do not report your income. This forces the IRS to impose an accuracy-related penalty. This is equal to 20% of your underpayment. In severe cases, penalties for not filing a 1099 could include criminal charges for tax evasion which comes with serious jail time.

Also Check: What Are Tax Lien Properties

Defend Against Future Audits

An audit is the last thing you want to happen to you.

When it comes to inspecting old tax returns, the IRS follows a statute of limitations. In general, they can only go back three years if you make sure to accurately disclose your information. However, for the current year, it all begins when you file your tax return.

Failure to file your tax return puts you at danger of an audit by the IRS. As a result, the IRS advises that even if you do not intend to file, you must keep all necessary financial records.

Otherwise, you risk encountering major issues, which can quickly become uncomfortable.

Can Turbotax Find My W

TurboTax does not have your W-2. They would only have a local form for data that you either entered from your W-2 or downloaded from your employer. You would need to get a copy from your employer. You can get a wage and income transcript from the IRS which shows data from Forms W-2 and other information returns.

Recommended Reading: How Soon Do I Have To Pay My Taxes

How Do I File Form 4852

Even though you can find the form online, you cant submit it to the IRS electronically so youll have to print out the form, fill it out, and mail it to the IRS along with everything else. And to fill it out, youll need to have:

- A detailed explanation of how you attempted to obtain the proper W-2 form from your employer

- Your employers address and name

- A statement that explains how you came up with the data you entered

- The estimated wages and withheld taxes that you would otherwise have listed on the W-2

Remember this: the information you enter on form 4852 is supposed to be a good faith estimate. However, if you obtain information that suggests this data wasnt correct later, youre still supposed to file your amended tax return with the newly acquired information.

When Should I Receive My W

If you are eligible for a W-2, the IRS requires that your employer send it to you by January 31. If your employer fails to do so, they could face penalties.

The January 31 deadline refers to when your employer must send you your W-2. It may arrive a little later, typically in the first week of February.

Read Also: What Is The Tax Percentage Taken Out Of My Paycheck

How To Fill Out Form 4852

The IRS does not accept online submissions of 4852, so you will need to print and mail the required forms to the IRS. To fill out this form, you will need to enter the following:

- Estimated numbers for all wages earned and taxes withheld that would have been listed on your W-2

- A statement explaining how you came up with those numbers

- Your employers name and address

- An explanation of how you tried to obtain your W-2 from your employer

The information you enter on this form can be a good faith estimate, but if you later obtain information suggesting your numbers werent correct, you are required to file an amended return with updated information.

Can I Look Up My W

With more than 100 million W-2s available online, finding yours may be very easy by using the TurboTax or H& R Block W2 finder to access yours. TurboTax and H& R Block are both online tax preparation companies that have a free W2 search and import function enabling you to find your W2 online quickly.

Don’t Miss: Will Rav4 Prime Qualify For Tax Credit