State Taxes May Not Automatically Be Withheld From Unemployment Benefits

While federal taxes are usually withheld automatically, state taxes may not be.

Some states may tax unemployment benefits on the state level, while others may not, Savage said. You should check with your state to see if the amounts are taxable, and remit estimated payments ahead of time or set aside funds to pay the taxes if/when they come due.

According to the Tax Foundation, of the 41 states that have income tax, five states completely exempt unemployment benefits from tax California, New Jersey, Oregon, Pennsylvania and Virginia.

Read Also: Unemployment Ticket Checker

Start Saving As Soon As Possible

If the bill isn’t too big, you may be able to simply save up enough money before the April 18 due date to pay the bill. The most efficient way of doing this is to set up a savings plan for yourself where you automatically put aside a small amount each week from your checking to your savings account.

Employer Payment Deferment Under Relief Act Ended For Calendar Year 2021

Payment deferment under the RELIEF Act ended on December 31, 2021, for calendar year 2021. Under the state RELIEF Act, contributory and reimbursable employers could elect to defer their unemployment insurance payments for the first three quarters of calendar year 2021. Contributory and reimbursable employers who deferred payments for calendar year 2021 are required to pay the outstanding payments by the due dates described below.

For Contributory Employers :

- Deferment of payments for Quarter 1, Quarter 2, and Quarter 3 of calendar year 2021 ended on December 31, 2021.

- All outstanding payments for Quarter 1, Quarter 2, and Quarter 3 of calendar year 2021 which were deferred under the RELIEF Act are due by January 31, 2022.

- Failure to pay outstanding contributions/taxes by January 31, 2022, will impact and reduce a contributory employers FUTA tax credit. This will result in an increase in the amount owed in federal unemployment insurance tax.

- Note : Under the RELIEF Act, contributory employers with fewer than 50 employees can defer payments for Quarter 1, Quarter 2, and Quarter 3 of calendar year 2022 until January 31, 2023.

For Reimbursable Employers :

If you have any questions, please call the Employer Call Center at 410-949-0033.

Read Also: Do You Have To Pay Taxes On Disability

Reporting Unemployment Income For Taxes

Your stateâs unemployment agency will report the amount of your benefits on Form 1099-G. The IRS gets a copy, and so do you. The form will also show any taxes you had withheld.

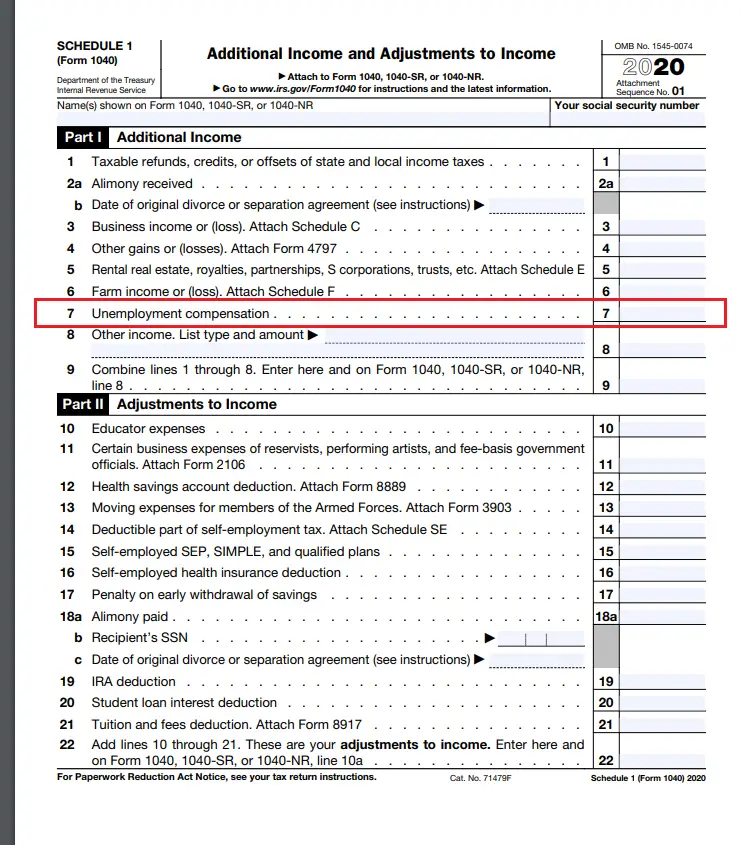

You must report these amounts on line 7 of the 2020 Schedule 1, then total all your sources of additional income in Part I of the schedule and transfer the number to line 8 of the 2020 Form 1040.

The economic impact payment or stimulus checks that you might have received are not considered to be unemployment compensation. You do not have to pay taxes on this money.

Claimant And Employer Contact Information

The Division of Unemployment Insuranceâs website and call centers are currently experiencing an unprecedented volume of users due to COVID-19. This may result in longer than usual wait times. We apologize for any inconvenience and thank you for your patience during these uncertain times.

Please be assured that Maryland does not have a waiting week like many other states do. No matter when or how they file, Marylanders become eligible for benefits starting the day after they separated from employment. Your payment will be backdated to the date you became unemployed, not when your claim was processed. If you are determined to be eligible, you will be paid for all benefits due.

Recommended Reading: How To Check Income Tax Return Status

Am I Allowed To Skip A Required Minimum Distribution For 2021

Under the CARES Act, required minimum distributions for 2020 were waived. However, RMD is back on for 2021.

If you dont take a RMD you might get a penalty of 50% of the shortfall, on top of whatever taxes are due on the original amount.

RMDs are based on the balance in your traditional IRAs, 401s and other retirement-savings plans as of Dec. 31, 2020, and an IRS life-expectancy factor based on your age.

The SECURE Act, passed in late 2019, raised the age to start taking the required withdrawals to 72. For 2022, the IRS released new tables for all three life expectancy tables affecting RMD.

Josh Rivera

Dont Miss: How Do You Qualify For Unemployment In Tennessee

Who Is Liable To Pay Unemployment Taxes

Liability depends on the type and nature of the business, the number of workers employed, and the amount of wages paid.

Employers who are liable to pay unemployment taxes include the following:

- An employing unit that is liable under the Federal Unemployment Tax Act and has at least one employee in Tennessee regardless of the number of weeks employed or amount of payroll..

- An employing unit that pays $1,500 or more in total gross wages in a calendar quarter, or has at least one employee during twenty different weeks in the current or preceding calendar year regardless of the wages. The employee does not have to be the same person for twenty weeks. It is not relevant if the employee is full-time or part-time.

- An employer who has acquired all or part of the business of another employer who was already liable.

- An employing unit that is a non-profit organization as described under section 501 of the IRS code and has four or more employees during each of 20 weeks in the current or preceding calendar year. Officers of a nonprofit corporation are counted even if such officers do not receive remuneration for their services from the nonprofit corporation.

- An employing unit that volunteers to become liable even though they do not currently meet the required criteria.

- All state and local government units and political subdivisions.

- An employing unit that paid cash wages of $1,000 or more in any calendar quarter of the current or preceding calendar year for domestic services.

Recommended Reading: How Do I Figure Out My Tax Bracket

Do You Owe Taxes On Unemployment Benefits

Yes, unemployment checks are taxable income. If you received unemployment benefits in 2021, you will owe income taxes on that amount. Your benefits may even raise you into a higher income tax bracket, though you shouldn’t worry too much about getting into a higher tax bracket.

People who file for unemployment have the option to have income taxes withheld from their unemployment checks, and many do. If you elected to do this, you have little to worry about.

What if you didn’t choose to have income taxes withheld from your unemployment checks? Don’t panic. If you were employed during much of the year, you may simply see a reduced tax return or a very small tax bill when you file.

Are Unemployment Benefits Tax

Eric is a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

Receiving unemployment benefits is no different from earning a paycheck when it comes to income taxes, at least under normal circumstances when the U.S. isnt struggling with a pandemic. Unemployment income is considered taxable income and must be reported on your tax return. It is included in your taxable income for the tax year.

While the federal government tweaked this rule in 2020 in response to COVID-19, those who collected unemployment income in 2021 should expect to pay the full taxes on those benefits. As of Nov. 29, 2021, the federal government and the Internal Revenue Service did not say that the rule would be tweaked again.

Heres what to know about paying taxes on unemployment benefits in tax year 2021, the return youll file in 2022.

Recommended Reading: How To File For Unemployment In Tennessee

Also Check: Can You Pay Your State Taxes Online

Some States Will Require An Amended Return To Get The Tax Break

In several states, some additional legwork may be required to get the unemployment tax break at the state level. âNow states are saying youâre going to need to formally amend your individual state return if you want to take advantage of the exclusion that we retroactively adopted,â Grzes says.

West Virginia, New Mexico, and Louisiana are among the states that have agreed to follow the federal unemployment tax break, but they are requiring eligible residents to file amended returns to get it. Other states, like Massachusetts, are allowing residents to take the unemployment tax break without having to file an amended return.

âEvery state is different,â Grzes says. âThatâs one of the challenges.â To find out how your state plans to tax unemployment benefits, visit its tax agencyâs website for details.

Heres How The $10200 Unemployment Tax Break Works

- President Joe Biden signed the American Rescue Plan Act of 2021 on Thursday.

- The $1.9 trillion Covid relief bill gives a tax break on unemployment benefits received last year. The measure allows each person to exclude up to $10,200 in aid from federal tax.

- The IRS issued instructions Friday for workers who havenât yet filed their taxes. Americans who got jobless benefits in 2020 and already filed their taxes shouldnât yet file an amended return.

In this article

Millions of Americans who collected unemployment benefits last year got a new tax break from the American Rescue Plan.

Hereâs how it works.

Recommended Reading: When Are Income Tax Returns Due

How To Pay Federal Income Taxes On Unemployment Benefits

Perhaps the easiest way to pay taxes on unemployment compensation is to have federal income taxes withheld from your weekly payments. To have federal income taxes withheld, file Form W-4V with your states unemployment office to instruct them to withhold taxes.

If you request tax withholding, the state will withhold 10% of each paymentno other amounts or percentages are allowed.

Another option is to make estimated quarterly payments by mailing a check with Form 1040-ES or making a payment online via IRS Direct Pay. However, this option is fairly high maintenance compared to having tax withheld from your unemployment benefits.

First, you need to estimate the amount youll owe using your tax software or the worksheet accompanying Form 1040-ES. Then you need to make four quarterly payments, generally due April 15, June 15, September 15, and January 15 of the following year.

The final option is to wait until you file your tax return to see how much youll owe. However, this option can be risky because it can leave you with a large tax bill and underpayment penalties in April.

Unemployment Insurance Is A Federal

Program parameters come from both federal statute and guidance and state statute and rules.

The federal government paid for many unemployment programs used during the pandemic in 2020 and 2021 including:

- Pandemic Unemployment Assistance

- Pandemic Unemployment Compensation

- Lost Wages Assistance

- Extended Benefits

Every state has a UI trust fund

States deposit employer tax dollars in individual UI trust funds for paying future benefits.

- ESD produces Washingtons UI trust fund forecast report three times per year.

- Find current and archived reports on ESD’s labor market page for the trust fund.

Employers pay two types of taxes: state and federal

- SUTA taxes fund benefit payments for claimants. Theyre deposited in the states UI trust fund.

- FUTA taxes are administered at the federal level. Theyre used for oversight of state unemployment programs. During times of high unemployment, states may borrow from FUTA funds, helping provide benefits to locally unemployed people.

State Unemployment Taxes

An employees wages are taxable up to an amount called the taxable wage base, authorized in RCW 50.24.010. This taxable wage base is $62,500 in 2022, increasing from $56,500 in 2021.

Experience tax currently capped at 5.4% )

Flat social tax currently capped at 0.50%

The total of the experience tax and the social tax cant exceed 6%.

Solvency tax currently capped is waived

Federal Unemployment Taxes

Recommended Reading: Do I Pay Taxes On Social Security Income

Guide To Unemployment And Taxes

OVERVIEW

The IRS considers unemployment compensation to be taxable income that you’ll need to report on your federal tax return. State unemployment divisions issue an IRS Form 1099-G to each individual who receives unemployment benefits during the year.

|

Key Takeaways The IRS and some states consider unemployment compensation to be taxable income, that you are required to report on your federal tax return. Box 1 of Form 1099-G Certain Government Payments, from you state unemployment agency shows the amount of compensation to report. Keep this form with your tax records. Report your unemployment compensation on Schedule 1 of your federal tax return in the Additional Income section and carry the information to your main Form 1040. If you choose to have income tax withheld from your benefits, the total federal tax withheld will appear in Box 4 of Form 1099-G, and the state tax withheld will appear in Box 11. |

If you received unemployment benefits this year, you can expect to receive a Form 1099-G Certain Government Payments that lists the total amount of compensation you received. The IRS considers unemployment compensation to be taxable incomeand requires that it be report on your federal tax return. Some states also count unemployment benefits as taxable income.

No Matter How You File Block Has Your Back

Also Check: How To File Your Taxes Online For Free

Which States Dont Tax Unemployment Benefits

Whether you have to pay state income taxes on your unemployment benefits depends on where you live. Some states donât have income taxes or treat unemployment benefits differently from other types of income.

- Seven states donât have any income taxes: Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming.

- Two states only have income taxes for investment income: New Hampshire and Tennessee.

- Six states exempt unemployment benefits from income taxes: Alabama, California, Montana, New Jersey, Pennsylvania and Virginia.

- Two states may only tax a portion of your unemployment benefits: Indiana and Wisconsin.

In other states, your unemployment benefits may be treated as regular income and taxed at the same income tax rates. Some cities and counties may also have a local income tax that applies to unemployment benefits.

These Are The States That Will Either Mail Or Electronically Deliver Yourform 1099

Florida

You can access your Form 1099-G through your Reemployment Assistance account inbox. The fastest way to receive your 1099-G Form is by selecting electronic as your preferred method for correspondence. Go to My 1099-G in the main menu to view Form 1099-G from the last five years.

Illinois

Access yourForm 1099-Gonline by logging into your account atides.illinois.gov. If you havent already, you will need to create an .

Indiana

Access yourForm 1099-Gonline by logging into your account atin.gov. Go to your Correspondence page in your Uplink account.

To reduce your wait time and receive your 1099G via email, or using the MD Unemployment for Claimants mobile app.

Michigan

If you did not select electronic as your delivery preference by January 9th, 2021, you will automatically be mailed a paper copy of your Form 1099-G.

To view or download your Form 1099-G,

o sign into your MiWAM account ando click on I Want To, theno 1099-G then choose the tax year.

To change your preference, log into MiWAM.

o Under Account Alerts, click Request a delivery preference for Form 1099-G and thenselect the tax year.

Mississippi

To access yourForm 1099-Gonline, log into your account and follow the instructions sent by email on where you can view and print yourForm 1099-G.

North Carolina

Division of Employment SecurityP.O. Box 25903Raleigh, NC 27611-5903

Utah

Read Also: How To File Last Years Taxes Turbotax

Chat With A Live Agent

Claimants can conveniently chat online with a live agent to receive help with their unemployment insurance inquiries. To chat with a live agent, please select the blue Chat with us button at the bottom right of the homepage and then type “speak with an agent.” For live agent hours, see the Claimant Contact Information webpage.

Claimants can also chat with Labors Virtual Assistant Dayne, which can provide immediate answers to common inquiries or direct claimants to relevant resources about filing a new claim, extending benefits, receiving benefit payments, and more. The Virtual Assistant is available 24/7. The Virtual Assistant has handled more than 18.8 million messages and 3.1 million conversations, with an average of 10,400 conversations daily.