Failure To Collect Utah Sales Tax

If you meet the criteria for collecting sales tax and choose not to, youll be held responsible for the tax due, plus applicable penalties and interest.

Its extremely important to set up tax collection at the point of sale its near impossible to collect sales tax from customers after a transaction is complete.

How To Collect Sales Tax In Utah

If the seller has an in state location in the state of Utah, they are legally required to collect sales tax at the rate of the their own location, where the sale was made, as Utah is an origin based sales tax state.If the seller’s location is out of state, and the seller has tax nexus, then the state of Utah requires you to collect the base rate in Utah, which is 4.7%.

How Can I File A Utah State Tax Return

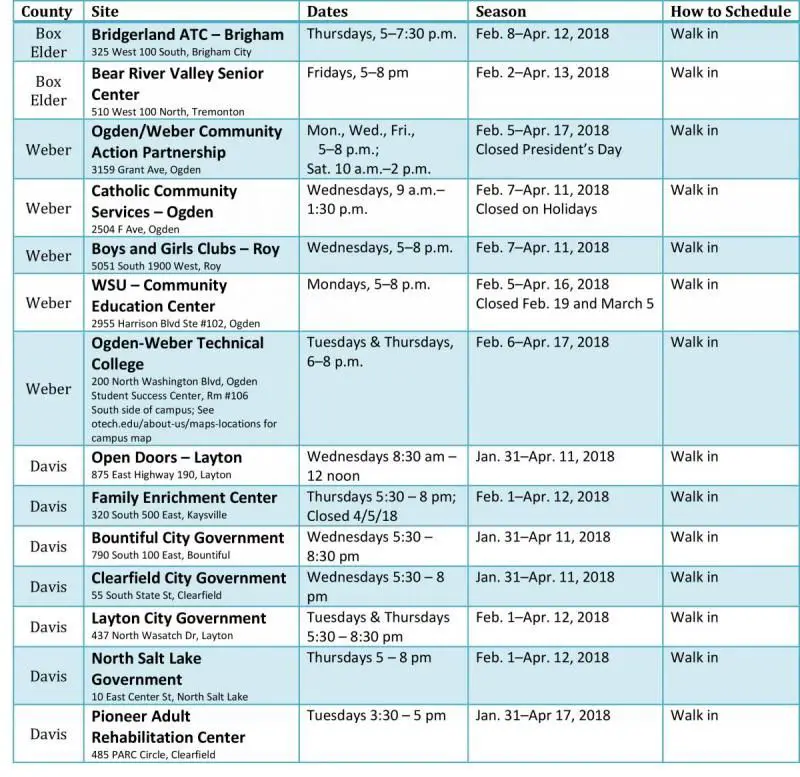

Theeasiest and fastest way to file your Utah state tax is to do it electronically.The Utah State Tax Commission hosts a website TAP where you can fileyour return and make any payments online. If you earn $66,000 or less, you canprepare and file your Utah state tax return for free through the Utah TaxHelp portal.And if you make less than $56,000,you may also qualify for free online or in-person tax preparationassistance.

You can also e-file your federal and Utah state tax returns via software providers listed on the state commission site. Check for any fees and other charges.

Ifyou prefer the comfortable feel of pen and paper, you can file your tax returnby mail. Youll need to download and print Form TC-40 and other tax forms. Alternatively, to request paper copies tobe mailed to you, email the Utah State Tax Commission at [email protected] orcall 1-801-297-6700 or 1-800-662-4335 ext.6700 .

Mail your state return to the Utah State Tax Commission at one of these addresses.

If you need to send a tax payment and want to send your return by U.S. mail:

210 N. 1950 West, Salt Lake City, UT 84134-0266

If you expect a refund or dont need to include a payment, and want to send your return by U.S. mail:

210 N. 1950 West, Salt Lake City, UT 84134-0260

If you want to send your return by express mail, FedEx, UPS or another company:

210 N. 1950 West, Salt Lake City, UT 84116

Recommended Reading: Does New Mexico Have State Income Tax

Prepayment Requirements For Filing Extension

You must prepay by the original due date:

- 90 percent of your 2021 tax due

- 100 percent of your 2020 tax liability or

- 90 percent of your 2021 tax due if you did not have a Utah tax liability in 2020 or if this is your first year filing.

You may prepay through withholding , payments applied from previous year refunds, credits and credit carryovers, or payments made by the tax due date using form TC-546, Individual Income Tax Prepayment Coupon, or at tap.utah.gov. Interest is assessed on unpaid tax from the original filing due date until the tax is paid in full. Penalties may also apply.

Using A Third Party To File Returns

To save time and avoid costly errors, many businesses outsource their sales and use tax filing to an accountant, bookkeeper, or sales tax automation company like Avalara. This is a normal business practice that can save business owners time and help them steer clear of costly mistakes due to inexperience and a lack of deep knowledge about Missouri sales tax code.

Avalara Returns for Small Business is an affordable third-party solution that helps business owners simplify the sales tax returns process and stay focused on growing their business. Learn how automating the sales tax returns process could help your business. See our offer to try Returns for Small Business free for up to 60 days. Terms and conditions apply.

Also Check: How Can I Track My Taxes

Misplacing A Sales Tax Exemption/resale Certificate

Utah sales tax exemption and resale certificates are worth far more than the paper theyre written on. If youre audited and cannot validate an exempt transaction, the Utah State Tax Commission may hold you responsible for the uncollected sales tax. In some cases, late fees and interest will be applied and can result in large, unexpected bills.

Utah State Tax Extension

Filing an Extension in Utah

The Utah State Tax Commission does not require that you file for an extension. Utah grants an automatic six-month extension of time to file until October 15, 2022. However, to avoid penalties, Utah requires that you pay at least 90% of your total 2019 tax liability or 100% of your prior year tax liability and the balance with the filing of your return.

If You Owe

An extension to file your return is not an extension of time to pay your taxes. If you do not pay the tax due by the original due date, you will owe interest and penalty on any balance due.

Find out if you owe using the simple Tax Payment Worksheet on .

Pay Online

Pay your taxes online at Utahs Taxpayer Access Point.

You can also pay online at Official Payments Corporation . Visa, MasterCard, Discover Network, and American Express credit and debit cards, and other forms of payment, such as Bill Me Later® are accepted. To make a debit card payment you can use a MasterCard or Visa Debit Card or any debit card with Nyce, Pulse or Star logos.

There is a convenience fee for this service which is paid directly to the company. The amount of the fee is based on the amount of your payment.

Pay by Phone

Pay your taxes by phone by calling Official Payments toll-free at 1-800-272-9829. This automated service is available 24 hours, 7 days a week. At the end of your call you will be given a confirmation number. Save this as proof of payment for your records.

Pay by Mail

If You Do Not Owe

START NOW!

Also Check: How To Not Pay Capital Gains Tax On Real Estate

Need More Tax Guidance

Whether you make an appointment with one of our knowledgeable tax pros or choose one of our online tax filing products, you can count on H& R Block to help you get the support you need when it comes to filing taxes.

Need to check the status of your federal refund? Visit our Wheres My Refund page to find out how soon youll receive your federal refund.

Related Topics

Donating household goods to your favorite charity? Learn the ins and outs of deducting noncash charitable contributions on your taxes with the experts at H& R Block.

Free Federal And State Tax Filing Sources

There are many free filing options available, even for taxpayers with higher incomes. Choose any of these for more information:

- TAP Taxpayer Access Point at tap.utah.gov: The Utah State Tax Commissions free online filing and payment system.

- Earn it. Keep it. Save it at utahtaxhelp.org: Provides free tax help.

- My Free Taxes at myfreetaxes.com: Sponsored by H& R Block and The United Way.

- The FreeFile Alliance at freefilealliance.org: Partnered with the IRS to help taxpayers e-file.

- : A service of the IRS.

Don’t Miss: Is Heloc Interest Tax Deductible

Extensions Of Time To File

This is NOT an extension of time to pay your taxes it is an extension to file your return.

You get an automatic extension of up to six months to file your return. You do not need to file an extension form, but we will assess penalties if you have not met the prepayment requirements .

See instructions for line 41. All extension returns must be filed by Oct. 17, 2022.

Information On Filing Utah Taxes

With annual tax revenue close to $6 billion, Utah is close to the nation’s median range. The state’s income tax rate is 5%. This is slightly below the national average. Any partial-year resident, resident or nonresident earning income in UT must file an annual Utah income tax return.

Tax forms must be e-filed or postmarked by April 15, the same filing deadline as federal income tax. For extended returns, the deadline is October 15.

You May Like: Where To File Quarterly Taxes

How Am I Taxed In The Us

When you start a job in the U.S., youll fill out a W-4 Form so your employer can estimate what income should be withheld from your wages for tax purposes. This is then paid directly to the U.S. Treasury on your behalf. At the end of the tax year, you must verify that youve paid the correct amount of tax by filing your tax return.

Registration In Other States

If you will be doing business in states other than Utah, you may need to register your LLC in some or all of those states. Whether you’re required to register will depend on the specific states involved: each state has its own rules for what constitutes doing business and whether registration is necessary. Often activities such as having a physical presence in a state, hiring employees in a state, or soliciting business in a state will be considered doing business for registration purposes. Registration usually involves obtaining a certificate of authority or similar document.

For more information on the requirements for forming and operating an LLC in Utah, see Nolo’s article, 50-State Guide to Forming an LLC, and other articles on LLCs in the LLC section of the Nolo website.

Don’t Miss: Can You File Taxes Online

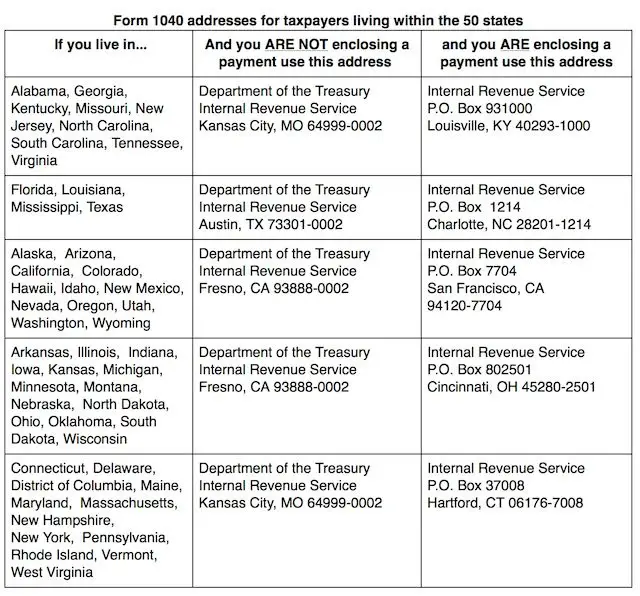

Do You Mail Your State And Federal Tax Return To The Same Place

Do not mail the federal and state returns together in the same envelope! They do not go to the same place. When you print out your returns there should be instructions that tell you where to mail them. When you mail a tax return, you need to attach any documents showing tax withheld, such as your W-2s or any 1099s.

Options For Filing State Taxes

More information on filing taxes with the State of Utah can be found here. Please note that you may use Sprintax to file your Utah state tax return for an additional fee.

State Tax Filing Options:

Option 1: If you worked in multiple states or would like to have your state tax return prepared for you, Sprintax can prepare state returns for a fee.

Option 2: If you would like to prepare your own Utah state tax return for free, you can do so at Utahs Taxpayer Access Point. If you choose to prepare your own state return outside of Sprintax, make sure that in Sprintax on page Step 6, State Taxes. We have reviewed your information and found that you need to file the following tax items that you uncheck Utah. If unselected, Sprintax software should be free at checkout, after entering your Sprintax code. Here is a guide to assist you in filing your own state taxes:

Don’t Miss: What States Have The Lowest Sales Tax

What If I Owe And Cant Pay

Ifyou cant pay your Utah state tax by the annual deadline, you can request apayment plan from the Utah State Tax Commission. But you should pay as much asyou can by the due date in order to minimize interest and penalties.

You can set up a payment plan by going to the states TAP website, calling the commission at 1-801-297-7703 or 1-800-662-4335 ext. 7703, or filling out Form TC-804 and sending it to the Utah State Tax Commission. Your plan request will be considered only after your return is processed. Beware, though: As long as you have an unpaid tax balance, you can incur penalties and interest, and the state may even file a lien to secure the debt.

Filing Tax Returns In 2022

While International Student & Scholar Services advises students and scholars on many topics, tax preparation is not one of them. ISSS advisors are not tax professionals and cannot assist with advising on tax preparation. Similarly, the Financial Wellness Center at the University does not provide tax advising to non-residents for tax purposes .

Because of the limited resources for non-residents for tax purposes, ISSS partners with a company called Sprintax, a company that specializes non-resident tax preparation. Sprintax is a paid service however, ISSS has purchased access codes to help offset the cost.

Don’t Miss: How To Find Out Your Tax Id Number

Utah Filing Due Date: Ut Individual Income Tax Returns Are Due By April 15 In Most Years Or By The 15th Day Of The 4th Month Following The End Of The Taxable Year

Extended Deadline with Utah Tax Extension: Utah offers a 6-month extension, which moves the individual filing deadline from April 15 to October 15 .

Utah Tax Extension Form: The Utah tax extension is automatic. That means there is no official application or written request to submit as long as you owe zero state tax. Utahs extension form, Form TC-546, should only be used if you need to make an extension payment for your Utah income tax. Do not use Form TC-546 if you have no Utah tax liability or if youre due a Utah tax refund.

Utah Extension Payment Requirement: A tax extension gives you extra time to file. It does not give you more time to pay your Utah income tax. All state tax payments are due by the original deadline of the return . Any UT tax that hasnt been paid by the proper due date will be subject to interest and penalties. To obtain a Utah extension, you must fulfill one of the following prepayment requirements :

Pay 90% of your current Utah tax balance, or Pay 100% of your Utah tax liability for the previous year

You can make a Utah extension payment with Form TC-546, or pay electronically through Utahs Taxpayer Access Point : tap.tax.utah.gov/TaxExpress

Deadlines To Claim A Refund Or Credit

To qualify for a refund or credit, you must file a return within:

- three years from the original return due date , or

- two years from the payment date.

For amended returns, you must file a claim for refund or credit within:

- two years after you had to file an amended Utah return based on changes to your federal return made by the IRS, or

- three years from the original due date of the return of a loss year to report a net operating loss carryback.

This website is provided for general guidance only. It does not contain all tax laws or rules.

For security reasons, TAP and other e-services are not available in most countries outside the United States.Please contact us at 801-297-2200 or for more information.

Recommended Reading: How To Get Tax Refund

Your Utah Sales Tax Filing Frequency & Due Dates

Your business’s sales tax return must be filed by the last day of the month following reporting period.For a list of this year’s actual due dates, see our calendar of Utah sales tax filing due dates.

Please note that if you file your Utah sales taxes by mail, it may take significantly longer to process your returns and payments.

Simplify Utah sales tax compliance! We provide sales tax rate databases for businesses who manage their own sales taxes, and can also connect you with firms that can completely automate the sales tax calculation and filing process.

Prepayment Of Utah Income Taxes

There is no form for requesting an extension in Utah. Taxpayers should send a copy of their federal extension with their extended Utah return by October 15. Extensions do not grant extra time to pay tax due. If taxpayers owe money, it must be paid by April 15 to avoid penalties. To file Utah taxes later but mail a payment on time, use Form TC-546. Mail it with payment to the State Tax Commission at:

210 North 1950 West Salt Lake City, UT 84134-0266 Mail forms with payment to: 210 North 1950 West Salt Lake City, UT 84134-0266

Track a UT tax refund online at . To check the status of a refund by phone or for inquiries about amendments and other issues, call 801-297-2200.

If an error is found on a return, file an amended Form TC-40. Submit the amended return with a copy of the federal return to State Tax Commission at the address:

210 North 1950 West

You May Like: How To Figure Out 1099 Taxes