Members Of The Military

If youre stationed outside the United States or Puerto Rico on May 1, you have until to file your return and pay any taxes you owe.Enclose a statement explaining that you were out of the country, and write Overseas Rule on the top of your return and on the envelope.

Combat ZoneIf youre serving in a combat zone, you receive the same filing and payment extensions allowed by the IRS, plus an additional 15 days, or a 1-year extension from the original due date. If you claim this extension, write Combat Zone on the top of your return and on the envelope. For more information, see Tax Bulletin 05-5. Extensions also apply to the spouses of military members who are serving in combat zones.Military Deployment Outside the United States Combat or NoncombatIf youre deployed to military service outside the U.S., youre allowed a 90-day filing extension following the completion of deployment. If youre using this extension, write Overseas Noncombat on the top of your return and the envelope.Note: If youre deployed in combat service, you can use whichever extension is more beneficial for you .

File Your Virginia Return For Free

Made $73,000 or less in 2021? Use Free File

If you made $73,000 or less in 2021, you qualify to file both your federal and state return through free, easy to use tax preparation software.

Are you a member of the military? Try MilTax

MilTax is an approved tax preparation software that provides free tax services for members of the military.

Free Fillable Forms: The software provider that previously supported our free fillable forms no longer offers them for individual income tax filing. Please consider one of our other filing options for your 2021 Virginia income tax return.

Virginia State Tax Extension

Filing an Extension in Virginia

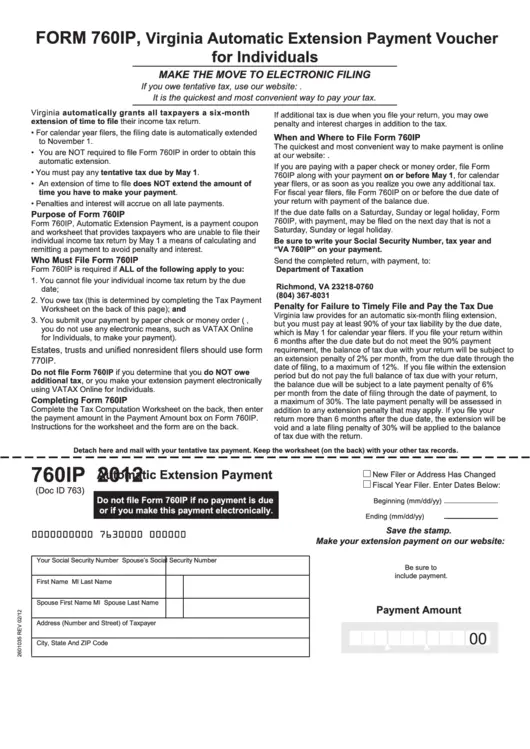

The Virginia Department of Taxation automatically grants all taxpayers a six-month extension of time to file their income tax return until November 1, 2022. No application for extension is required, however, any tentative tax due must be paid by the original due date of the return, May 1, 2022. Any tax due must be paid using , Automatic Extension Payment. Do not file Form 760IP if you determine that you do not owe additional tax or make your extension payment electronically or by other means.

To avoid penalties and interest, the balance due on a Virginia return must be paid by the original due date of the return. The automatic extension does not extend the time to pay your taxes. For returns that are extended, there is an extension penalty if 90% of the tax liability is not paid by the original due date. There is also a late payment penalty if the full balance due is not paid by the extended due date. There is a late filing penalty assessed on balance due returns filed after the due date or extended due date that will apply as if no extension had been granted. Interest is charged on any tax due and/or penalties.

An extension to file your return is not an extension of time to pay your taxes, and avoids a late filing penalty.

If You Owe

If you owe taxes, payment must be made by April 15, 2022. To avoid penalties, West Virginia requires that 90% of the total tax liability be paid by April 15, 2022.

Pay Online

Pay by Phone

Pay by Mail

START NOW!

Read Also: Do You Have To Report Roth Ira On Taxes

How To File For An Extension Of State Taxes

OVERVIEW

While the IRS requires you to file Form 4868 to request a tax extension, each state has its own requirements for obtaining a similar extension.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

While the IRS requires you to file Form 4868 in order to request a tax extension, each state has its own requirements for obtaining a similar extension. Some states such as California offer automatic extensions to all taxpayers, while other states require you to file a specific form by the original due date of the return. Here are some tips to help walk you through what you need to do when filing state taxes in your area:

Other Penalties & Fees

Penalties for fraud and failure to fileIn addition to the penalties above, Virginia law provides for civil and criminal penalties in cases involving fraud and failure to file. The civil penalty for filing a false or fraudulent return, or for failing or refusing to file a return with intent to evade the tax, is 100% of the correct tax. In addition, criminal penalties of imprisonment for up to one year or a fine of up to $2,500, or both, can apply in cases of fraud and failure to file.Returned payment feeIf your financial institution does not honor your payment to us, we may charge a fee of $35 . This fee is in addition to any other penalty or interest charged.

You May Like: Do You Have To Pay Taxes On Workers Comp

What This Means For Your Federal Taxes:

- The deadline to file federal taxes is now July 15, 2020.

- Those who owe on their federal taxes will have until July 15, 2020 to pay.

- Eligibility includes anyone who owes up to $1 million.

- This applies to all individual returns including self-employed individuals.

- This also applies to any entity that is not a C-Corporation, such as trusts or estates.

- Taxpayers do not need to file any additional forms or call the IRS to qualify for this relief. It will be automatically provided to all qualifying taxpayers.

- Filers who do not owe money to the IRS and are due a refund are not penalized if they file after the deadline of July 15, 2020.

- Taxpayers have a three year window of opportunity to claim a refund. If taxpayers do not file a return within three years, this money becomes property of the U.S. Treasury. The deadline to file a 2016 tax return has been extended. Taxpayers are required to properly address, mail and ensure the return is postmarked by the July 15, 2020 deadline.

Irs Electronic Free File For Federal Returns

You may qualify to electronically file your federal return for free by using IRS Free File Some of the companies participating in the IRS Free File service will file your Maryland return electronically for free as well. No matter what company you select, you can always return to file your Maryland tax return for free online, using our iFile or bFile services. Keep in mind that your Maryland return begins with your federal adjusted gross income, so you must prepare your federal return first before you can prepare your Maryland return.

Generally, you are required to file a Maryland income tax return if:

- You are or were a Maryland resident

- You are required to file a federal income tax return and

- Your Maryland gross income equals or exceeds the level listed below for your filing status. The filing levels also apply to nonresident taxpayers who are required to file a Maryland return.

Even if you are not required to file a federal return, you may be required to file a Maryland return if your Maryland addition modifications added to your gross income exceed the filing requirement for your filing status. Dependent taxpayers must take into account both their additions to and subtractions from income to determine their gross income.

For more information, see the instructions in the and nonresident tax booklet.

Filing Requirements for 2021 Tax Year

|

Filing Status |

|

| One spouse 65 or older | $ 26,450 |

| $ 26,450 |

Your income tax return is due July 15, 2022.

Don’t Miss: When Will We Get Our Tax Return

Filing Information For Individual Income Tax

Whether you file electronically using our free iFile service, hire a professional preparer, have us prepare it for free, or complete a paper return, filing a Maryland tax return is easy.

For those in a hurry, some quick links to everything you need to know about…

Follow the links to sort out all the details quickly and make filing your tax return painless!

Virginia State Taxpayers Extension

- No application for an extension is required.

- You must pay at least 90% of your tax due by the original due date using a voucher, Form 760IP.

- If you file your return within the extension date, and you did not pay at least 90% of your tax due, you will be subject to an extension penalty of 2% per month. The extension penalty is applied to the balance of the tax that was due in accordance with the due date through the date the return is filed. The maximum extension penalty is 12%.

- If you file more than six-months after the original due date, the extension will not apply, and you will be subject to the late filing penalty of 6% of the tax due per month or part of a month, not to exceed 30%.

- Interest will be charged on the tax due amount, even if you meet the 90% payment requirement for returns with an automatic six-month extension.

Recommended Reading: Should I Efile My Taxes

Get An Extension When You Make A Payment

You can also get an extension by paying all or part of your estimated income tax due and indicate that the payment is for an extension using Direct Pay, the Electronic Federal Tax Payment System , or a . This way you wont have to file a separate extension form and you will receive a confirmation number for your records.

Individual Income Tax Filing Due Dates

- Typically, most people must file their tax return by May 1.

- Fiscal year filers: Returns are due the 15th day of the 4th month after the close of your fiscal year.

If the due date falls on a Saturday, Sunday, or holiday, you have until the next business day to file with no penalty.

Filing Extensions

Can’t file by the deadline? Virginia allows an automatic 6-month extension to file your return . No application is required. You still need to pay any taxes owed on time to avoid additional penalties and interest. Make an extension payment.

Also Check: Can You File Business Taxes Separate From Personal

Can I File My Return For Free

For certain people, yes.

If you made $73,000 or less in 2021, you qualify to file both your federal and state return using free tax preparation software. A list of options for free filing is available on Virginia Tax’s website.

Members of the military can use MilTax for free tax services.

For those looking for free fillable forms, the Virginia Department of Taxation said the software provider no longer offers them for individual income tax filing. People will have to use other filing options.

Request A Copy Of Previously Filed Tax Returns

To request a copy of a Maryland tax return you filed previously, send us a completed Form 129 by mail or by fax. Please include your name, address, Social Security number, the tax year you are requesting and your signature. If you are requesting a copy of a joint return, include the information for both taxpayers and their signatures.

Mailing address:

You May Like: Where Can I File My Taxes

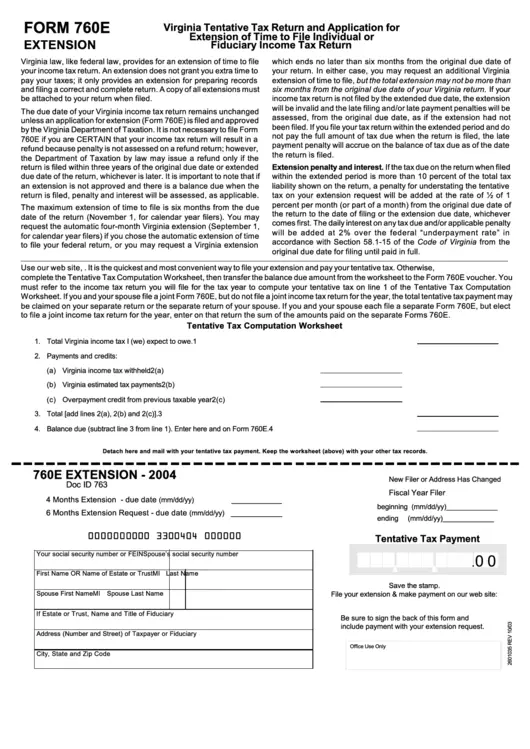

Virginia Individual Income Tax Returns Are Due By May 1 Unless You Are A Fiscal Year Filer If You Cannot File On Time You Can Get A Virginia Tax Extension

A Virginia income tax extension will give you 6 extra months to file your return, moving the filing deadline to November 1 . There is no paper form or Virginia extension application to submit. However, at least 90% of your Virginia tax liability must be paid by the original deadline of your return or penalties will apply.

To make a Virginia extension payment, use Form 760IP . State extension payments can be made by paper check or money order using Form 760IP, or electronically via VATAX Online Services for Individuals:

NOTE: You do not need to file Form 760IP if you owe zero state income tax in this case, you will automatically receive a Virginia tax extension. Additionally, do not file Form 760IP if you make your Virginia extension payment electronically.

For more information, please visit the Virginia Department of Taxation website: www.tax.virginia.gov

How To File And Pay

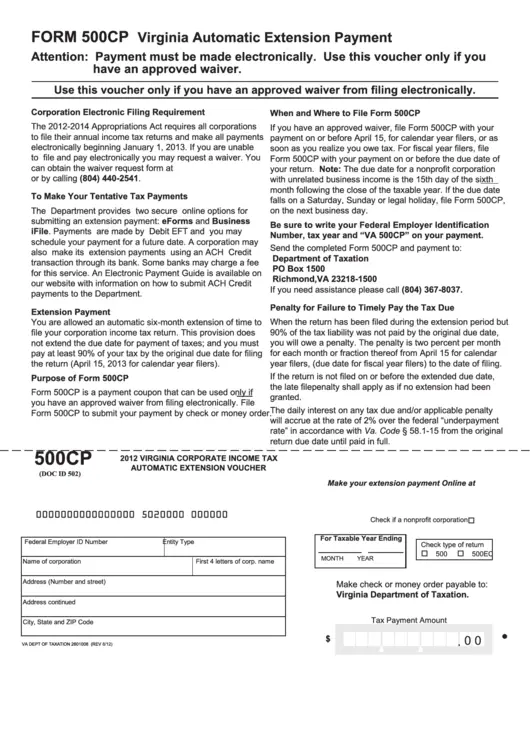

Annual income tax return

- All corporations can file their annual income tax return and pay any tax due using approved software products.

- Certain Virginia corporations, with 100% of their business in Virginia and federal taxable income of $40,000 or less for the taxable year, may qualify to electronically file a short version of the return for free using eForms. If tax is due, you can pay using your bank account information. See eForm 500EZ for complete eligibility requirements and instructions.

Note: Taxpayers who submit eForm 500EZ are not required to submit a copy of their federal return. Please maintain a copy of your federal return with your records and do not mail a copy to Virginia Tax.

Also Check: When Do We Get Our Taxes Back 2021

Filing Your Tax Return

General assistance for individuals by telephone: 804-367-8031 or by fax 804-254-6113 . The Department’s Customer Service Walk-In Center is open Monday – Friday, 8:30 a.m. – 4:30 p.m. from January 30 to late May 2017.

When is my tax return due?

The due date for your Virginia income tax return is May 1. If the due date falls on a Saturday, Sunday or legal holiday, you may file your return on the next business day. The United States Postal Service postmark is used to verify the date your return is mailed. If you are living or traveling outside the United States on May 1, you have until July 1 to file your return.An automatic six-month filing extension is allowed for individual income tax filers. No paper application or online application for extension is required. But, the extension provisions do not apply to payment of any tax that may be due with the return. To avoid penalties, filers must pay at least 90% of their final tax liability by the original due date for filing the return.

Where do I mail my forms?

You may send your Virginia income tax return to the Department of Taxation or the city or county where you lived on January 1, 2017. To mail your income tax return directly to the Department of Taxation use::

- Refund Returns: Virginia Department of Taxation, P.O. Box 1498, Richmond, VA 23218-1498

- Tax Due Returns: Virginia Department of Taxation, P.O. Box 760, Richmond, VA 23218-0760

Refunds

Missed The Filing Deadline

Virginia grants an automatic 6-month extension to file your individual income tax return. However, the extension does not apply to paying any taxes you owe.

If you missed the deadline, and owe taxes, you should pay as much as you can as soon as possible to reduce additional penalties and interest.

Your options:

- If you havent filed your return, you should file and pay as soon as possible.

- If youre still not ready to file your return, make an extension payment online using the eForm 760IP or by check. If paying by check, be sure to include the 760IP voucher with your payment. To determine how much to pay, use the worksheet on the back of the Virginia Automatic Extension Payment Voucher for Individuals .

- If you filed your return on time, but didnt pay the taxes you owed, you should pay as much as you can now to reduce penalties and interest later. You have a number of payment options, both online and by check. If paying by check, be sure to include the 760-PMT voucher with your payment.

In all cases, you should pay as much as you can to reduce the amount of penalty and interest youll owe.

If you cant pay the full amount that you owe, well send you a bill to collect the remaining amount due, along with any penalty and interest. Once you have a bill, you can call to set up a payment plan.

Don’t Miss: Who Must File An Income Tax Return

State Filing Deadlines For 2021 State Individual Income Tax Returns

Below is a listing of the filing deadlines for Tax Year 2021 state individual income tax returns:

Alabama, Arizona, Arkansas, California, Colorado, Connecticut, District of Columbia, Georgia, Idaho, Illinois, Indiana, Kansas, Kentucky, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, New Jersey, New Mexico , New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina , Utah, Vermont, West Virginia, Wisconsin

Maine, Massachusetts

Hawaii

May 2, 2022 is the filing deadline for the following States:

Delaware, Iowa, New Mexico , South Carolina , Virginia

May 15, 2022 is the filing deadline for the following State:

Louisiana

File With Approved Tax Preparation Software

If you don’t qualify for free online filing options, you can still file your return electronically with the help of commercial tax preparation software. View approved software options.

To file on paper, see Forms and Paper Filing below. If you do choose to file on paper, please note that, due to COVID-19 workplace protocols and mail delays, it will take longer for us to process your return.

Recommended Reading: Does Turbotax File Federal And State Taxes

Currently Not Accepting Donations

Due to storage space being at capacity, the library is unbale to accept book or material donations at this time. Learn more…

| TAX FORM UPDATE: We have received the 1040/1040-SR booklets and instructions. Copies are available on a cart in the library’s vestibule as you enter the building. The library is now an AARP Tax Assistance site! Appointment required. Learn more… |

What This Means For Your Virginia State Taxes:

- The deadline to file state taxes for the state of Virginia remains May 1, 2020.

- Those who owe on their state taxes will have until June 1, 2020 to make a full payment of the amount they owe.

- Any income tax payments due between April 1 and June 1 can be paid as late as June 1 without penalty.

- All households automatically get an extension until November 1 to file a state tax return.

- This year all late penalties will be waived, provided you pay 90% of what you owe.

- Virginia law prevents the Department of Taxation from waiving interest. The governor is proposing a change to this law when the General Assembly returns on April 22, to waive interest until June 1.

- For more information from the state of Virginia, go here.

While many of United Ways Volunteer Income Tax Assistance sites have been shut down due to COVID-19, we are committed to offering free tax preparation services through our VITA program in a way that accessible, safe and in accordance with public health recommendations. We will share more information as soon as it is available.

Meanwhile, we also offer direct access to multiple free software programs that allow individuals and families to file their own taxes online. Visit yourunitedway.org/tax/online-tax-prep for more information.

For the latest updates and information, visit yourunitedway.org/tax or contact .

You May Like: How To Find Tax Refund From Last Year